Yesterday’s dollar plunge unnerved markets. What’s the likelihood of a sustained, drastic decline?

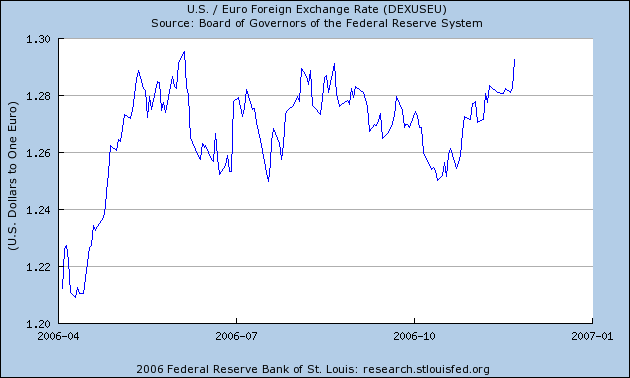

Figure 1: USD/EUR daily exchange rate, up to 24 November 2006. Source: St. Louis Fed FRED.

One of the enduring oddities of the international economy is the willingness of foreign investors — both private, official, and quasi-state — to hold dollar assets despite the very low returns on such assets, even when comparing in common currency terms. It is this anomaly that Krugman disucusses in an academic paper asessening the possibility of a dollar crisis.

“Concerns about a dollar crisis can be divided into two questions: Will there be a plunge in the dollar? Will this plunge have nasty macroeconomic consequences?

The answer to the first question depends on whether there is investor myopia, a failure to take into account the requirement that the dollar eventually fall enough to stabilize U.S. external debt at a feasible level. Although it’s always dangerous to secondguess

markets, the data do seem to suggest such myopia: it’s hard to reconcile the willingness of investors to hold dollar assets with a very small premium in real interest rates with the apparent necessity for fairly rapid dollar decline to contain growing foreign

debt. The various rationales and rationalizations for the U.S. current account deficit that have been advanced in recent years don’t seem to help us avoid the conclusion that investors aren’t taking the need for future dollar decline into account. So it seems likely that there will be a Wile E. Coyote moment when investors realize

that the dollar’s value doesn’t make sense, and that value plunges.”

The presumption that there is investor myopia means that median measures of exchange rate expectations might provide very inaccurate indicators of what will happen in the future. Right now, typical forecasts are for gradual dollar depreciation — 8 percent over the next twelve months (in log terms) from November 17th, according to DeutscheBank. The USD/EUR rate is forecasted to depreciate by 5.3 percent. In contrast, the Economist reports JP Morgan forecast of zero USD/EUR depreciation over the next year from November 23rd.

Investor myopia might explain — or at least is consistent with — the finding that uncovered interest parity (UIP) doesn’t hold. Indeed, the failure of UIP is one reason why the “carry trade” is so profitable [see Mike Rosenberg’s (Bloomberg) discussion of the long standing nature of carry trade profitability at the end of this chapter]. Of course, in a portfolio balance model common currency returns need not be equalized. But the extent to which the rate of return on USD denominated assets is less than those on other assets is too large to be rationalized by standard portfolio balance models.

On the second question posed, Krugman is much more sanguine. Since balance sheet effects are not relevant(or more accurately, work to the benefit of the US via valuation effects), the dollar decline should have a net positive effect on aggregate demand via expenditure switching. This view is buttressed by the empirical work of Croke et al. (2005) as well as Freund and Warnock (2005).

He is a little less optimistic about avoiding a slump if the current strength of the dollar is due to investor myopia, and housing prices exceed those consistent with rationality and the transversality condition (for instance, if there is a bubble). A downward revision in both the relative market-to-book price (i.e., “q“) of housing as well as the value of the dollar might induce a slump if the lags in adjustment to the exchange rate are longer than those to housing prices. My own view is that is likely to be the case.

Indeed, the lags to exchange rate changes are more likely to be longer, the harder it is to move capital and labor to the export sector. After the battering taken by the tradable sector over the past decade, I worry.

Technorati Tags: dollar,

exchange rate,

portfolio balance model,

hard landing

A dollar plunge doesn’t achieve much in terms of rebalancing if it’s still against EUR, CHF, GBP, CAD, AUD, and perhaps JPY.

I want to see it move more against RMB, KRW, TWD, and the currencies of GCC countries. Otherwise, I’m afraid that it’s same old, same old.

Look at the trade balance vs manufacturing workforce rate graph here:

http://news.goldseek.com/GoldSeek/1164228539.php

Krugman’s benign consequence of dollar collapse seems to base on the implicit assumption of supply plasticity of US industry. But is that valid? For example, agriculture output is limited by land, water and supply of labor. With dollar plunge, demand for US farm products from abroad could sky rocket. But it is not easy for US to expand its farm output, thus unless domestic demand for the farm products dramatically shrink what we have will be inflation of food prices.

It seems to me the higher long-term interest rates that are likely to flow from a falling $ will be a very powerful negative.

They should look at it on an exchange-weighted basis. The Canadian Dollar and the Mexican Peso are pretty important too.

Emmanuel and jim miller: I agree that what would be helpful is a broad-based dollar decline; to the extent that a decline against other convertible currencies heightens the costs of holding massive amounts of dollar assets, the decline might spur faster diversification of reserves. However, even if the drop is primarily against the euro, that still will have an effect. See Lane and Milesi-Ferretti’s paper on the subject.

By the way, a plot of the trade weighted exchange rate is here.

Laurent Guerby: I agree that the strong dollar, which has induced a deteriorated trade balance, has probably depressed manufacturing sector output and employment. But even without the trade balance, employment probably would have fallen given rapid productivity growth.

HZ: I’m sure there’s some elasticity of supply. Given enough time, the U.S. economy is flexible enough to move factors of production to the traded sector (manufacturing, agriculture, financial and technical services). But the adjustment process may be more difficult than necessary if it takes place over a very short period of time.

algernon: I agree that theoretically interest rates should rise in response to an anticipated dollar depreciation. However, empirically, this does not seem to have been the case (as documented in of Croke et al. (2005) as well as Freund and Warnock (2005).

Today’s Dollar-Falling Post – Dollar 40% Too High?

Over at Brad DeLong’s Semi-Daily Journal: Fair and Balanced Almost Every Day: The Dollar Looks 40% too High, and Long Treasury Yields Look 200 Basis Points too Low,…Menzie Chinn worries about the possibility of a dollar crash:One of the enduring…

Menzie:

I don’t doubt US manufacturing has elasticity, given enough time lag, but commodity has other constraints? You can’t grow land nor water. What is the wage necessary to attract people back to agricutural labor? And if dollar lose value against peso, cross-border trafficing in labor will also lessen? I understand that service/wage is the main contributing factor to inflation, but if energy and food prices go up to a new plateau because of dollar drop that certainly put upward pressure on wages? And Fed response to that could drive economy into recession. Does Krugman paper give this mode of outcome enough weight?

Reason to Worry about a US Slump

Menzie Chinn at Econbrowser seems pessimistic about the outlook for the US economy:

What happens if several countries (e.g. China, Mexico) suddenly decide to convert, say, 65% of their “foreign reserve dollars” to, say, EU currency and/or gold?

G Anton, we have had foreign investment in our central banks bonds since Alexander Hamilton and the First National Bank of the United States. Hamilton welcomed the investment because it funded our growth.

There are two things wrong with the gloom and doom idea of countries suddenly sending dollars back to the US. One they would take huge losses as the dollar declined, and it is doubtful that the decline would last because with such an event the FED would sell bonds to sop up the liquidity. Secondly, what would they exchange their dollars for? If they took their own currency in exchange once again they would realize a loss and they would then either have to put the currency in a vault or into a lesser currency.

I know there are a lot of people spreading this myth, but it is just not a realistic.

The decline in the dollar is very simple. As long as the FED leaves the interest rates artificially inflated there will be problems with business. This creates a shortage of goods and services relative to the money supply.

If the FED continues to do nothing the dollar will continue to slowly lose value, though in time so will other currencies so the differential may be less between currencies than in real value. But if the FED decides to increase interest rates, look out. They will create another surge in inflation and the dollar will fall over the edge.

In my eyes, the extent of the currency concerns lies in the hands of our diplomatic relations with those countries who have the power to diminish our economy with one or two decisions. In the event that the dollar loses so much value that it subsequently loses the universal presence it has will the depreciation value then have a profound effect on our economy. In short, if OPEC, China or Japan decide to cash in the dollar for the Euro, I think we would be in serious trouble. However, I think the catalyst behind an event like this would have to be an extreme downturn in our economic standing…one that would unprecedented measures.

Chris wrote:In my eyes, the extent of the currency concerns lies in the hands of our diplomatic relations with those countries who have the power to diminish our economy with one or two decisions.

Chris,

What is the economic mechanism that allows foreign countries to determine the value of the dollar? If you believe it is the repatriation of dollars to the US how does that happen?

I think if you begin to think in terms of mechanism rather than pop politics you might have a different opinion.

Another point is that the euro is not large enough to become the world’s reserve currency. Right now the US is the 500 lb. gorilla.

HZ: I don’t know what the price elasticity of ag exports is. But in any case, agricultural goods only account for about 6 percent of total exports, so is unlikely to be central in the adjustment process.

G. Anton and Chris: I think it unlikely there will be a rapid shift to other currencies in the near future. However, bad enough macro policies pursued in the U.S. combined with more rapid than expected economic integration in Europe could prove a challenge over a longer term, and make in other countries’ interests to diversify out of the dollar. See this paper for more on the subject.

Nonetheless, I disagree with Dick‘s assertion that because there is no other viable reserve currency, the dollar cannot drop precipitously in value (by precipitously, I mean say 40 percent in two years, as it did in the mid-1980s). Exchange rates are determined by relative supply and demand for an asset, and that is a function of current and expected future macro fundamentals. If dollar assets were to look less attractive due to lower returns, then the dollar could lose value, and in a fast way (as is true with all asset prices, which represent the present discounted value of future fundamentals).

Menzie — methinks the ft leader writers doth read econbrowser; check out their leader today.

RE: Anonymous:

I don’t believe there is one economic mechanism that determines the value of the dollar on a global level. It’s obviously more of a culmination of the overall anticipated environment of our economic well being.

Although I do believe that it is the “mechanism” that warrants primary concern, my point was that in the event of a complete dollar downfall brought on by fiscal mechanics there could be justification for other countries to reconsider what they are investing their money into. This would create a snowball effect (much like those shown in other currency disasters) that would take our economy for a ride.

RE: menzie chinn

I couldn’t have said it better myself!!

Chris,

Sorry, I was anonymous. I still don’t have the hang of posting.

I think you misunderstood me. You said, “the extent of the currency concerns lies in the hands of our diplomatic relations with those countries who have the power to diminish our economy.” If that is true what is the mechanism. I am not asking you to give the mechanism for all foreign relation actions, only the one you attribute as changing the value of the dollar. If you can’t explain the mechanism perhaps you should rethink your post.

Dick,

The diplomatic related mechanism that I was pertaining to lies in the economic decisions of those countries that hold debt in the form of our currency. In the event (which might be unlikely in the near future, but certainly plausible within the next decade) that Japan or China wanted to cash in our debt for a currency that has more stability, our dollar valuation would drop immensely.

I do agree with your current 500 lb gorilla status that the dollar has, but that can only last for so long. With the euro gaining so much strength with such a short existence, I think it has the chance of posing a serious threat to replacing the dollar. This, of course, is assuming that combining the EU is not going to end up in a economic/political disaster eventually (which would be a bold hypothesis).

“What is the economic mechanism that allows foreign countries to determine the value of the dollar? If you believe it is the repatriation of dollars to the US how does that happen?”

With a command economy like China the mechanism to influence it could be quite strong:

They make a decree, and harshly enforced, that all long-term trade contracts with nations outside of North & South America must be denominated in euros, pounds, or the trading partner’s local currency. And then they dissuade hedging of such against dollar.

It wouldn’t control the dollar exactly but it would have an influence.

The dollars crisis and commodities boom are all control by the chinese. By keeping the RMB down, technology know how will be transfer to china. Giving the US consumers cheap chinese make products is like giving them drug to get addicted and making interest rate and inflation down so that they spent more and making the US debt much greater , destroying manufacturing base of USA.

In the mean time secretly buying Gold and silver through third countries when selling china make products to them so hedge against USD. As we know US has the world largest fiancial centers, by pulling the plug in supporting the USD ,the stock and bond market will collapse the most and destroying large part of US economy but not the chinese as their stock market still very small and the chinese are good at enduring these short term pain and reduce dollars losses as they buy gold and siliver to hedge against. Who is so stupid to support a over value USD? It will eventually emerge as winner in this economic war as chinese know military they cannot win USA in 20 years time.

In the mean time, chinese study and working in USA fiancial sector (hedge fund) will be ask to come back to short the commodities as they have insider information when china will cool down it economy and accumulated the necessary natural resources (especially Oil) when the prices is low and long it when china going to increase it import as china is still a centrally planned goverment state.

The EU money will not be affected as china see it as ally in this economic war and future market for new demand.

The ans is when will china dumped USD and other countries and hedge funds followed to protect their foreign reserves.

This is Just a Joke from the Future Shanghai.

I am going to write a paper on budget deficit and would appreciate any comments or suggestions.

If it becomes more attractive to invest in say the Euro and given we have a very low savings rate wouldn’t that cause a lot of problems for our economy?

How does a stock head south? First a few sellers sell big blocks, hit others’ stop prices and eventually triggers enough scares that nobody wants to be the last one holding the bags so eventually everybody sells and follows a typical overreaction. That’s how a market in panic mode works.

In my opinion, a few things are sure: Everybody wants to diversify out of the USD. BUT no one wants to trigger the panic by selling too much. AND no one wants to lose money. BUT if the selling pressure is strong enough, no one will want to be the bagholder.

Bottom line: everyone’s screwed to a certain extent. To which extent is the question and will depend how the events unfold.

Hence, it is VERY possible that the dollar would plunge, just like it could simply slowly drift down. Bottom line is, the market place will decide, and none of us can predict what the market’s mood will be.