There’s been a debate whether investment rates in China are sustainable or not.

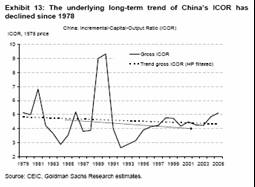

Goldman Sachs’ Hong Liang argues that incremental capital to output ratios have been trending downward, which — in conjunction with other rising measures of profitability — suggest no “over-investment” (thanks Brad Setser for bringing the paper to my attention). This issue is of particular interest because in the run-up to the East Asian crises, incremental capital to output ratios (ICORs) were rising.

Figure 1: Source: Hong Liang, “China’s Investment Strength is Sustainable,” Global Economics Paper No: 146, (Oct. 2006).

The incremental capital to output ratio is the change in output for a unit change in physical capital. Usually, increases in the ICOR are interpreted as decreases in the efficiency of capital. Since this coefficient is calculated without holding constant other factors of production, it is only a very imprecise measure of the (inverse) marginal product of labor. In any event, from this perspective, the current pace of (correctly measured) investment could continue indefinitely.

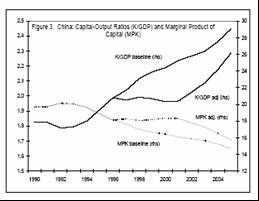

Interestingly, with somewhat similar pictures, a recent IMF working paper by Barnett and Brooks comes up with a different conclusion.

Figure 2: Source: Steven Barnett and Ray Brooks, “What’s Driving Investment in China?” IMF Working Paper WP/06/265, (Dec. 2006).

The Barnett/Brooks calculations focus on the capital-to-output ratio, rather than the arguably more standard ICOR. However, Barnett and Brooks compute a more relevant measure, the marginal product of capital (MPK) [although documentation of how they calculate the series is a little sparse]. The MPK is, conceptually, the partial differential of output with respect to a unit of capital, and is the theoretically relevant measure (this is what is set equal to the rental cost of capital when a firm optimizes). The MPK variable is trending downward using conventional depreciation rates, and trending downward after 2003 even if one assumes a one-off 10% obsolescence of State Owned Enterprise (SOE) capital in the 1990’s due to the accelerated pace of reforms.

Given these results, the authors conclude:

“Investment has grown rapidly in China in recent years, reaching more than 40 percent of GDP. Despite good progress on bank and enterprise reforms, weaknesses remain that could contribute to inefficient investment decisions. Manufacturing, infrastructure, and real estate

have been the drivers of fixed asset investment. Econometric analysis presented in the paper suggests that manufacturing investment is strongly correlated with firms’ liquidity, largely retained earnings. … A policy implication of these findings is that reducing liquidity in firms, for example by requiring state-owned enterprises to pay dividends to the government, and using monetary policy to reduce liquidity [and] increase real interest rates, would slow investment in manufacturing …”

Now, one might say that decreased investment is the last thing China needs, given the outsize current account balance to GDP ratio. [Remember CA == (T-G) + (S-I) ]. But I would argue that China needs to see a decline in both investment and saving, and getting investment behavior to be more akin to that in a run-of-the-mill developing countries is an important part of rebalancing the Chinese economy.

Technorati Tags: China,

investment,

incremental-capital-to-output ratio,

marginal product of capital

“But I would argue that China needs to see a decline in both investment and saving, and getting investment behavior to be more akin to that in a run-of-the-mill developing countries is an important part of rebalancing the Chinese economy.”

Menzie,

Are you saying that the Chinese government should take action to make this happen, or that you would not be alarmed if it did happen?

In an idealized free market, the interest rate acts to match investment & savings. A great benefit of this is that the structure of production is matched to the wants of consumers. Resources are well-allocated.

With Yuan supply growing ~18%/yr or ~8% faster than GDP, a lot of what is being lent for investment isn’t money that has been saved but created. Furthermore, one would expect state-owned banks to award loans at least somewhat politically rather than economically.

It seems likely to me that China is over-invested in production of export goods for which demand will fall when the US decides it just cannot borrow any more.

Following on from algernon, I would like to see more local demand in China, where only 38% of GDP is made up of consumption. You can only rely on exports for so much and it seems to me that domestic consumption would be necessary in continuing growth when a global economic slowdown comes, and surely it will.

For me, then, the question of whether China is overinvesting or not is very much contingent on where future demand lies for the output from investment, and I don’t have a crystal ball to give a definitive answer.

Algernon,

If the yuan supply is growing so fast why is it appreciating against the dollar? Is the dollar supply growing in excess of 18%?

Dick,

No. M2 has grown I think 4.8% in the last 12 months (5.9% in the last 3 mo.) But they don’t try to send any Yuan to us for real goods (on net), whereas we every day send them dollars for real goods. They are accumulating more $’s than they can use, & so unless they lend them back to us, they would be dumping them on the market such that the $ value would fall

Menzie — one issue. While reducing investment would help with the domestic rebalancing of the chinese economy (i.e. both helping to slow China’s torrid growth and shift the basis of growth so that rapid growth doesn’t reuqire an ever rising investment to GDP ratio) doesn’t it also potentially complicate global rebalancing, as it may be hard to get savings to fall faster than investment, so a fall in investment in the first instance might be associated with a larger savings and investment imbalance?

“getting investment behavior to be more akin to that in a run-of-the-mill developing countries”

Isn’t U.S. supposed to have a higher natural rate of growth that the rest of the developed economies? Could China also have a higher natural rate of growth based on its internal conditions? Point is, why compare with run-of-the-mill developing economies?

Brad Setser: Good point. I agree if investment falls while saving remains at high levels, the Chinese current account balance will rise even further, worsening global imbalances. But continued high investment with these distortions perpetuates the underlying problems of resource misallocation in the economy; and also sets up the re-accumulation of contingent liabilities in the form of nonperforming loans. So in my view, best if investment and saving both start responding to more market-oriented signals, in a way that presumably will lead to lower levels of both.

Dick: My view is that it would be best if the Chinese government were to deregulate and liberalize the economy; presumably removal of some of the distortions highlighted in the IMF working paper would induce a reduction in both investment and saving, although there are no guarantees. Heavy-handed dirigiste approaches might get the desired short run effect, while setting up perhaps bigger problems in the future.

In response to your query about why the CNY is appreciating against the USD given rapid money supply growth (my sources indicate 16.8% annualized growth in first 3 quarters of this year), I would just say that a monetarist approach to the balance of payments is probably not useful for a distorted economy like China’s.

HZ: You might be right. But a declining marginal productivity of capital is suggestive. In any case, the extremely high rates of (officially recorded) investment — far in excess of other observed rates — should at least make one wonder.

Menzie wrote:

In response to your query about why the CNY is appreciating against the USD given rapid money supply growth (my sources indicate 16.8% annualized growth in first 3 quarters of this year), I would just say that a monetarist approach to the balance of payments is probably not useful for a distorted economy like China’s.

Menzie,

I have been attempting to get someone to see that the growth in the supply of yuan is not depreciating their currency relative to other currencies because their economic growth is demanding this kind of increase in supply. I would postulate that one of the primary reasons the dollar is falling against other currencies is because the FED have depressed economic activity in the US.

FED monetary policy is counter cyclical and the situation with the yuan gives us hints as to why. What I mean is that FED policy that is supposed to be fighting inflation is actually causing inflation.

So Dick,

Are you implying that the Fed should print more money to fight inflation?

algernon,

No. The FED does not use the money supply in their attempt to control inflation. They use interest rates. There is a huge difference.

Ceteris paribus if the FED were to lower interest rates inflation would come down as business activity increased.

Dick,

They don’t decree those interest rates. They TEMPORARILY lower short-term interest rates by increasing the supply of money. What they target does not change the fact that the only weapon they have is the supply of money & credit.

The FED sets an interest rate by fiat. They then defend that interest rate by supplying all the currency that the market demands. In essence their interest rate scheme is meaningless because they sterilize any possible monetary affects – EXCEPT, by changing interest rates they change interest rates for business which can hamper investment and production. Any affect the FED has on inflation and deflation is due to its attacks against business, not its changes in money supply.

I wish they used the money supply to target inflation and deflation. It would be a small step forward toward stability. This is one thing Bernanke has said he will do.

Dear ersatz algernon,

They may arbitrarily set the federal funds rate, but they do so by supplying or withdrawing money from the banking system. The variable that they control that matters is the supply of money & credit.

I find it interesting that with the short-term rate unchanged, M2 crept up to a 5.9% annual rate of growth in the most recent quarter, implying that they really haven’t achieved neutrality yet. M2 growing twice as fast as GDP isn’t neutral.

The one thing the Fed can & should do is restrain money/credit growth so that we have very little price inflation. That would be success.

algernon,

Dear ersatz algernon

What can I say: I’m an idiot! 🙂

I think we both understand the FED system.

Our current bout with inflation came when the FED began to attack business. The FED was increasing the money supply to support their low interest rate and yet there was no indication of inflation. The FED made an arbitrary increase in the rates to fight some future inflation and the result was that marginal businesses were put under stress. This caused a change in monetary demand and we began to actually see inflation. So the FED, feeling justified in its prediction of inflation increased interest rates again and more businesses were put under stress and inflation grew. The FED was generating what it was claiming to fight.

The increase in the Ms has no meaning apart from monetary demand. M2 could be growing at 10% but demand could keep us from inflation.

I am not sure comparing increases in the Ms to GDP is meaningful since GDP is such a lagging indicator.

I do agree with you that it would be a better than the current system if the FED targeted price inflation, but even then it is less than optimal because there are times that prices should change naturally, consider the price of computers during the 1980s and 1990s for example.

I once invested in a China-based mutual fund. It never made any money, not because there was no money to be made but, because the profits never made it back to the investors.

IP theft, profit skimming and other forms of corruption are widespread problems in China. Protectionism, lax disclosure rules and, political corruption don’t help, either. Until these issues are taken care of, investors will pay a “stupid-tax” for thinking they’ll get rich from supporting someone else’s business.

If you’re there, you own the business and you defend your business from the government and your competition, yes, you can make a lot of money. Otherwise, beware the “stupid-tax”.

I agree with Menzie: China needs some time to economically cool off and mature its legal and market structures. The foray into communism and isolationism delayed economic development so China has to catch up on all of the hard lessons in corporate governance.