Our local newspaper, the San Diego Union Tribune, has a big article this morning on the housing market. Among other things, this features some thoughts from yours truly and a foray into multimedia publishing.

< |

The main points I made will be familiar to regular readers of Econbrowser:

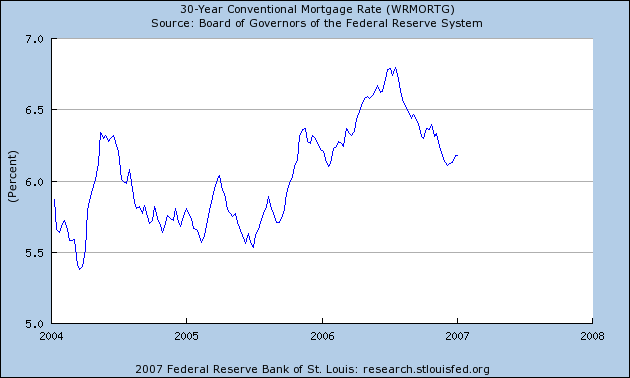

- The prime driver of both the earlier housing boom and the current housing downturn has been interest rates.

- The decline in the 30-year mortgage rate from 6.80% in July to 6.18% last week should help arrest the current housing slide, and there are some indications that, as far as home sales are concerned, the worst may now be behind us.

- Even if home sales have indeed stabilized, the inventory of unsold homes means that hard times will persist for homebuilders. Falling construction spending and employment will continue to exert a drag on the national and local economies for a significant period.

- The main downside from here is whether foreclosures on subprime loans and a new market psychology based on fears of price depreciation might introduce some new unfavorable dynamics.

|

On that last point, the fact that the Union Tribune is now running prominent stories like this one may be a signal that a broad recognition is now settling in on the magnitude of what is going on, and with it the widespread recognition that the era of big price appreciation has come to an end. The next few months will probably prove critical in determining how much those changing perceptions might influence what happens from here.

Unlike my typical interview, in which I yak for 30 minutes and they use a 30-second bite, the entire interviews with me and four others can be downloaded as audio files. If interested, go here and click on your favorite mug.

Technorati Tags: macroeconomics,

housing

Professor, you have mentioned that you believe the prime driver of the housing boom has been the drop in mortgage rates form 2002 to 2005 but over a longer period of time there is very little evidence that previous drops in mortgage rates have been responsible for housing booms.

You often display charts that start with data in the 1950s and 1960s. Here is a chart of median sales price growth from the 1970s.

http://bigpicture.typepad.com/comments/2006/05/real_estate_dat.html

And here is a chart of mortgage rates from the 1970s. http://mortgage-x.com/trends.htm

(Scroll down to see the chart)

Based on the information I have seen if you compare mortgage rates with housing price growth there is very little correlation.

What is different this time?

Gavin, I don’t think I’d characterize it as very little historical correlation. In my latest research paper on this topic, I used data from 1988 through 2006, and found a t-statistic relating home sales to changes in the mortgage rate of -5.6.

It’s true that if you go back to the 1970s, a key determinant of nominal interest rates back then was inflation, and for that earlier data, you’d want to specify the relation a bit differently. But over the last two decades, I believe the relation is quite strong.

Note also I’m talking about the effect of mortgage rates on the number of homes sold, not on the median price of homes sold.

Even if there is a strong correlation between home sales and mortgage rates it is not evident that it would carry over to house prices. If interest rates fall encouraging people to buy homes, it would also encourage builders to supply more homes. So, it is not obvious that a drop in interest rates would cause a rise in home prices. And as I have said before historical data does not show a correlation between mortgage rates and home prices.

Now Edward Glaeser at Harvard does claim that this time is different and new restrictions on building that were not present in the 1970s are driving up house prices. But according to the census bureau the number of new single-family homes for sale is at a record.

Close to home I am sure the Professor must be aware that in San Diego downtown surely a supply constrained market builders have been able to increase supply so much as to cause a drop in condo prices.

Gavin,

Consider that a home owner can afford to buy a more expensive home at a lower interest rate. Much of the housing boom was from home owners trading up. Anecdotally that is exactly what my daughter did in Las Vegas. She now has a larger home in a better area for almost the same payment. This tends to drive up the price of homes due to increased demands at all price levels.

There is also an element of inflation but it is interest rates that directed the inflated dollars into housing.

DickF: I have no problem explaining the increase in home prices because of the decrease in REAL mortgage rates. A simple home price model similar to the dividend discount model for stocks demonstrates the price you are willing to pay for a home should depend on real interest rates.

The problem is explaining why prices should rise when NOMINAL mortgage rates fall Are buyers suffering from inflation illusion? Are credit constraints relaxed because of lower nominal rates?

Do you have any academic paper explaining this phenomenon?

Also, in the past home prices have increased in the past (1970s) even when nominal rates were rising and similarly prices have fallen or stayed flat (early 1990s) when nominal rates were falling. See the links I posted above.

The Realtor MLS website during mid-November thru the first week in January shows that there was a big (probably seasonal) drop in single family homes inventory for LA, Boston and Westchester County. This gauge is very accurate for predicting new house inventory in the same month. So the NAHB survey and the Govt survey on permits and starts should be quite good for the month of December.

My goodness what a cute mug…I’m shaving my beard off tonight!

This was an surprisingly good interview (see Menzie wasn’t so lucky) as you say with a reasonable interviewer.

But I must say James, I am a few shades darker on the overall picture. It comes down to mostly interest rates for you and I think this under-estimates the affordability issue from the standpoint of the huge house price tag vs stagnant wages (discard those recent reports of 5% increase –they are merely temporary surges, possibly even janitorial ones, that won’t bite into those flabbergastingly high house prices). Yes, I cannot be cajoled off my darker picture by your winsome face.

But the razor’s coming out tonight…ladies beware.

Fine, informative interview, Professor. I look forward to hearing your comments at the Jan. 26 conference at USD.

On that last point, the fact that the Union Tribune is now running prominent stories like this one may be a signal that a broad recognition is now settling in on the magnitude of what is going on, and with it the widespread recognition that the era of big price appreciation has come to an end. The next few months will probably prove critical in determining how much those changing perceptions might influence what happens from here.

JDH,

This is an excellent point. The next big move will be other than housing because housing is getting all the press right now. When the press finds a subject you can usually be assured that it has run its course.

Also your bullet points on housing are spot on. I would only say that the slight change in interest rates are not enough to spark a housing recovery but as you note probably indicates a pause in the fall.

Thanks.