Or, “Oceania has always been at war with Eastasia”. The speculation regarding imminent military action rises. What are the fiscal implications of a large scale missile campaign? What would be the repercussions of likely Iranian responses (including closing off the Straits of Hormuz)?

Source: The Economist.

Articles in The Economist, Financial Times, and Business Week all have raised the prospect that the Bush Administration is contemplating launching combined air- and missile strikes against targets in Iran, irrespective of what compromises Tehran might be willing to make (after all as noted by the Christian Science Monitor, in 2003, Dick Cheney scuttled an agreement that conformed roughly to the current demands of the Administration).

In my mind, this raises a series of questions regarding economic consequences. In order to reduce the dimensionality of the problem, I restrict the range of actions below that of 1000 sorties and/or substantial commitment of ground forces. (In another example of opportunity cost, the latter is clearly off the table, unless we move to full mobilization, given the prior commitment of 130,000 troops plus planned 21,500 troops to the Iraq theater.)

Cordesman and Al-Rodhan outline several options: (i) Demonstrative, Coercive, or Deterrent Strikes, (ii) Limited U.S. attacks, (iii) Major US attacks on Iranian CBRN and major missile targets and (iv) Major US attacks on military and related civilian targets. Option (iii) is described thus:

- 200-600 cruise missiles and strike sorties; would have to be at least a matching number of

escorts, enablers, and refuelers. Period of attacks could extend from 3 to 10 days.

- Hit all suspect facilities for nuclear, missile, BW, and related C4IBM.

- Knock out key surface-to-air missile sites and radars for future freedom of action

- Would need to combine B-2s, carrier-based aircraft and sea-launched cruise missiles, and used of land base(s) in Gulf for staging, refueling, and recovery.

- Threaten to strike extensively at Iranian capabilities for asymmetric warfare and to threaten tanker traffic, facilities in the Gulf, and neighboring states.

- At least 7-10 days to fully execute and validate.

- Goal would be at least 70-80% of most costly and major facilities critically damaged or destroyed.

- Hit at all high value targets recognized by IAEA and EU3 to show credibility to Iran, minimize international criticism, but also possible sites as well.

- Strike at all known new sites and activities to show Iran cannot secretly proceed with, or expand its efforts, unless hold back some targets as hostages to the future.

- Impact over time would probably be crippling, but Iran might still covertly assemble some nuclear device and could not halt Iranian biological weapons effort.

- Hitting hard and underground targets could easily require multiple strikes during mission, and follow-on restrikes to be effective.

- Battle damage would be a significant problem, particularly for large buildings and underground facilities.

- Size and effectiveness would depend very heavily on the quality of US intelligence and suitability of given ordnance, as well as the time the US sought to inflict a given effect.

- Much of Iran’s technology base would still survive; the same would be true of many equipment items, even in facilities hit with strikes. Some impact, if any, on pool of scientists and experts.

- Iranian response in terms of proliferation could vary sharply and unpredictably: Deter and delay vs. mobilize and provoke.

- A truly serious strike may be enough of a deterrent to change Iranian behavior, particularly if coupled to the threat of follow on strikes in the future. It still, however, could as easily

produce only a cosmetic Iranian change in behavior at best. Iran might still disperse its program even more, and shift to multiple, small, deep underground facilities.

- Might well provoke Iran to implement (more) active biological warfare program.

- An oil embargo might be serious.

- Iranian government could probably not prevent some elements in Iranian forces and intelligence from seeking to use Iraq, Afghanistan, support of terrorism, and Hezbollah to hit

back at the US and its allies if it tried; it probably would not try.

- International reaction would be a serious problem, but the US might well face same level of political problems as if it had launched a small strike on Iranian facilities.

It strikes me that the direct fiscal implications, on top of the 0.8 percentage points of GDP already dedicated to operations in the Iraq theater of operations, would probably not be too great, as long as the war does not escalate to option (iv), which involves among other things:

- 1000-2,500 cruise missiles and strike sorties

- Hit all suspect facilities for nuclear, missile, BW, and C4IBM, and potentially “technology

base” targets including universities, dual use facilities.

- Either strike extensively at Iranian capabilities for asymmetric warfare and to threaten tanker traffic, facilities in the Gulf, and neighboring states or threaten to do so if Iran should deploy

for such action.

- Would require a major portion of total US global assets. Need to combine B-2s, other bombers, and carrier-based aircraft and sea-launched cruise missiles. Would need land base(s) in Gulf for staging, refueling, and recovery. Staging out of Diego Garcia would be highly desirable.

- Would probably take several weeks to two months to fully execute and validate. …

Even assuming we remain at option (iii) levels of operations, getting a handle on expenditures is difficult without greater knowledge of the mix of cruise-missile strikes versus aircraft sorties. For instance, a Tomohawk SLCM costs (depending upon the vintage of production, and whether expressed in current or constant dollars) about 2.3 million dollars in 2002 (see page 15, [1]). The costs of munitions would then be no more 1.4 billion dollars (1400 = 2.3 x 600 x 1.14, where 2.3 is per unit cost, 600 is maximal units expended, and 1.14 is adjustment for inflation using headline CPI). Shifting the mix of munitions expended toward smart bombs and other precision guided munitions would require aircraft sorties that would then incur other costs. The net effect on the costs of an air campaign is unclear to me.

Some insight might also be gained from inspecting other short term air campaigns. In Operation Deliberate Force, NATO forces conducted 3515 sorties over Bosnia in August-September 1995. The United States conducted approximately 70% of the total number of sorties (2318). The mix of weapons employed was heavily tilted toward laser guided munitions, with only a few Tomohawk missiles (13) fired. Despite this, CBO estimated the three week campaign cost $600 million in incremental costs at that time. Adjusting by the headline CPI, that would translate into about $795 million in current (end-2006) dollars. Of course, given that many of the proposed targets are hardened, it is likely that much more specialized (and hence more expensive) munitions might be used, thus jacking up the total cost. In addition, the Iranians might be able to inflict damage upon U.S. aircraft or naval forces. Such outcomes would further raise total costs.

However, given that we are expending between 9 to 10 billion dollars per month in Iraq (solely on combat operations, and not including RESET costs), the direct impact via fiscal stimulus is probably small; similarly, assuming away supply bottlenecks, inflationary effects would also be small.

The more important macroeconomic effects would probably come from repercussions from U.S. action. The likely outcomes associated with Scenario (iii) include attempts at an embargo, and/or moves to close off the Straits of Hormuz.

Standard and Poor’s has run some simulations to assess the impact on the U.S. and world economy arising from a shutoff of Iranian oil or closing the Straits of Hormuz.

…

Having survived higher energy prices relatively unscathed so far, the U.S. economy is more sensitive to costlier oil now than it was a year ago. Inflation, even excluding energy, has accelerated, leading the Federal Reserve to raise interest rates 425 basis points in response. Consumers are already spending more than they earn. And Standard & Poor’s expects the economy to slow down to 2.5% growth in gross domestic product in 2007 from an estimated 3.5% in 2006.

UNCERTAINTY PREVAILS. The falloff in U.S. growth means it takes a smaller shock to cause a recession than it did a year ago. Continued strong world oil demand, with usage in both China and Europe accelerating, will continue to put rising pressure on oil supplies despite a U.S. slowdown, thus raising the odds of an oil price surge causing a U.S. recession.

Whether the current Mideast conflict causes a recession depends mostly on how big the impact on oil supplies and prices becomes. This is still highly uncertain. At Standard & Poor’s, we continue to believe that the most likely outcome is that cooler heads will eventually prevail and that oil prices will drop back from current peaks. (Of course, there are other, non-military factors—like hurricanes or production disruptions on the order of BP’s [BP] Aug. 6 closure of its Prudhoe Bay field in Alaska—that could have an effect as well [see BusinessWeek.com, 8/7/06, BP’s Pipeline Trouble].)

The range of worse outcomes, unfortunately, is almost unlimited. We’ve looked at four scenarios, but even worse cases, or combinations of the problems below, are also possible:

1. Conflict containedOur base case assumes that the fighting is limited to Israel, Gaza, and Lebanon. There is no impact on oil supplies, and prices drop slowly from current levels, which have a risk premium built into them. Oil falls below $70 per barrel by yearend and to $60 per barrel by the end of 2008. The world economy continues to expand, with the U.S. slowing to 2.5% growth in 2007 from 3.5% in 2005 and 2006 but with Europe speeding up this year and Asia remaining solid. Headline inflation rates drop because of the decline in oil prices.

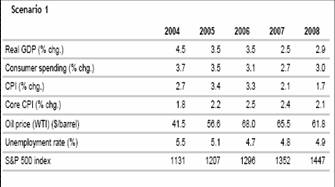

Scenario 1 from David Wyss, “The Future of Oil: Four Scenarios,” Business Week, August 8, 2006.

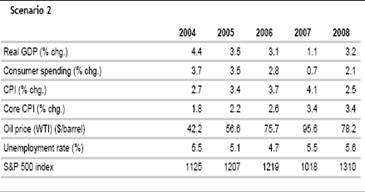

2. Iran shuts its taps

In the second scenario, Iran stops exporting oil. This could be in response to a strike on its nuclear facilities, a retaliation against the West for supporting Israel, or internal disruption in Iran. In any case, Iran takes its 2.7 million barrels of oil exports off the market. World oil prices soar, probably to above $100 per barrel temporarily but settling near $95 per barrel. Near the end of next year, oil prices begin to decline, presumably as Iran returns to world markets, and fall back to $66 per barrel by the end of 2008.

This scenario’s impact on the U.S. is substantial, with a near-recession starting in the fourth quarter and continuing through mid-2007. Higher oil prices take 1.8% off the level of real GDP by the third quarter of next year and add 3.3% to the level of the consumer price index a year later.

The impact on the euro zone economies is smaller than in U.S., with real GDP cut by a maximum of 1.0% and the CPI up 2.0%. The Japanese price effect is similar to Europe’s, but GDP is cut 1.2% because of the greater reliance on oil and on imports.

Scenario 2 from David Wyss, “The Future of Oil: Four Scenarios,” Business Week, August 8, 2006.

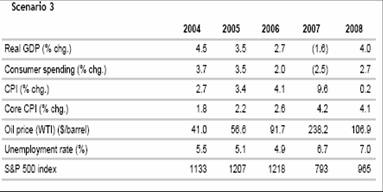

3. The Gulf goes dry

In this scenario, Iran closes the Strait of Hormuz to oil tankers. Oil prices spike sharply. World oil supplies would be cut by about 20%. World strategic petroleum reserves are tapped extensively, but even so, oil prices rise to $250 per barrel. The world economy moves into recession, on the order of the 1980-1982 downturn. The U.S. is the hardest hit of the major economies, with real GDP dropping 5.2% below the baseline in late 2007, implying a major recession, and the unemployment rate reaching 7%. Consumer price inflation hits 10% next year as oil prices soar. The impact on Europe is smaller, but because the Continent started with weaker growth, the recession is just as big. Japan has a recession of similar size.

Both in terms of the price effect and the supply impact, the models are being pushed well outside their historical range, and the dislocations could be even more painful than this projection implies. This is by no means a worst-case scenario but closer to a best case given the closure of the Strait. We think (and certainly hope) this is an unlikely scenario.

Scenario 3 from David Wyss, “The Future of Oil: Four Scenarios,” Business Week, August 8, 2006.

To place things in perspective, a one-year 5% decrease of output relative to baseline translates into approximately $675 billion worth of lost output.

I agree that the Scenario 3 predicate of closing off the Straits of Hormuz fully is unlikely. Still, the assessment from Cordesman and al-Rodhan of Iranian capabilities in this regard is sobering:

The Iranian surface navy is highly vulnerable, but Iran could position land-based antiship missile where it could strike at tanker traffic, and mobile firing elements using systems like the HY-2/C-201 Silkworm or Seerseeker (Raad) have ranges of 90 to 100-

kilometers and have proved difficult to detect and kill in the past.

Iran is reported to have the capability to make or assemble such missiles, modify and upgrade them, have

roughly 100 systems in stock, and have 8-10 mobile missile launchers. These are reported to be deployed near the Strait of Hormuz, but may actually be in a number of different locations.

Iran also has three relatively effective Kilo-class submarines, which can use long-range wire guided torpedoes or release mines. (Reports Iran has advanced “bottom” mines with sensors that release and activate them as they sense ships passing overhead are uncertain.)

The naval branch of the IRGC is reported to have up to 20,000 men. They operate 10 Hudong missile patrol boats with C-801K (42-120 kilometers) and C-802 (42-120 kilometers) sea-skimming anti-ship missiles.92 The Iranian air force has airborne variants of these systems.

They have additional C-14 high speed catamarans which each have C-701 anti-ship missiles, and additional North Korean missile boats. They operate some 50 additional patrol boats, including 40 Bohammar Marine boats. Many are so small they are difficult to detect with ship-borne radars. These can be armed with recoilless rifles, RPGs and

small arms to attack or harass ships in are near the Gulf and raid or attack offshore facilities. They can conduct suicide attacks, or release floating mines covertly in shipping lanes or near key facilities. Iran can use any commercial ship to release free-floating

mines for the same purpose.

Iran made claims in the spring of 2006 that it was testing more advanced weapons for such forces. These included a sonar-evading underwater missile (torpedo?) that IRGC Rear Admiral Ali Fadavi claimed no enemy warship could detect, and “no warship could escape because of its high velocity.” Iran also claimed to be testing a new missile called the Kowsar with a very large warhead and extremely high speed to attack “big ships and submarines” that it claimed could evade radar and anti-missile missiles. While such tests may have been real, Iran has made so many grossly exaggerated claims about its weapons developments in the past, that it seems they were designed more to try to deter US military action and/or reassure the Iranian public than serious real-world capabilities.

In any case, Iran could not close the Strait of Hormuz, or halt tanker traffic, and its

submarines and much of its IRGC forces would probably be destroyed in a matter of days if they become operational. It could, however, conduct a series of raids to threaten and disrupt Gulf traffic, and/or strike at offshore and shore facilities in the Southern Gulf, or at Iraqi oil facilities in the Gulf. Even sporadic random strikes would create a high risk premium and potential panic in oil markets. Iran could potentially destabilize part of Afghanistan, and use Hezbollah and Syria to threaten Israel.

So one might avoid the Scenario 3 outcome, which entails serious economic dislocation in the United States. However, even if the Cordesman-al Rodhan option (i) is undertaken, political risk associated with limited missile strikes might elevate oil prices to levels indicated in Wyss’s Scenario 2. And of course, preventing escalation of limited strikes into more widespread conflict would require nimble and nuanced diplomacy of the sort that we have not seen in ample abundance of late.

As an aside, the implied impact of GDP with respect to a 10% increase in oil prices is somewhat less than is cited in Jim Hamilton’s survey.

In sum, the expected value of the costs associated with military action in Iran would likely dwarf the direct fiscal and nonpecuniary costs that we have already incurred in Iraq.

Technorati Tags: Iran, Straits of Hormuz,

oil prices,

recession, inflation.

I suspect their unemployment figures are a bit low, in the Scenario 4 case.

A rise of oil prices, even briefly, to say $95 is going to have a huge impact on consumer spending. Worse for the US than Europe, because the percentage impact on gasoline prices is so much greater (probably $4/gal gasoline?) as gasoline is not so highly taxed. Americans who are driving fuel inefficient cars are going to be stuck with enormous millstones around their neck.

Put it another way, households will spend on groceries, gas, heating and light, and on healthcare. Anything else they can defer, they will.

The flow through into restaurants, retail and wholesale trades (WalMart!), and other discretionary elements of consumer and business behaviour would be huge– airlines in particular, as well as hotels. Businesses just don’t allow their employees to fly, or spend money, with that much uncertainty out there.

The knock on effect on Wall Street would be huge.

State and local governments would trim spending as their tax bases fall. This happened in 2001 as well.

Certainly at the $250 price level, even on a spike, all bets are off. Many industries would just shut down and go into hibernation mode. Chemicals and plastics, any kind of discretionary consumer spending etc.

I would expect to see unemployment north of 10% in the US, and similar rises in Europe. When that happens, those still employed will stop spending.

At which point, all the questions about creditworthiness and financial stability come into light.

You are concentrating on the US side’s regrets matrix.

The US side positive effects matrix is virtually zero.

The bombing campaign needed to produce any potentially real effect on is not on the table.

Strategic bombing is an illusion.

The Iranian facilities will be rebuilt in weeks and at less cost than the politically correct bombing campaign.

The Iranians, knowing this, will likely reduce the price of their oil to make the money to perform the small rebuilding needed to get back on track.

I think even scenario #1, where oil supplies are not interfered, will make an immediate collapse into recession. The reason is, the leveraged derivatives players will rush into the exits and jam there. The current balance is very fragile and the sharp decline in the markets will kill the consumer & business confidence. After all, what makes people to borrow and spend is the confidence. When confidence drops, people stop spending and banks stop lending.

I don’t believe the CSM article, quoting the BBC and State Department officials. I don’t think any of those sources are sufficiently reliable considering their hard bias against the Bush administration. I don’t think the Iranian offer was credible, considering their expressed interests in the destruction of Israel and their long-term and recent actions in support of Hizbollah in Lebanon.

Absent continuation of their war against the West, what prevents Iran from collapsing?

Dr. Chinn–you seem to have a military-industrial complex going in your last few posts! Are you working on defense-related policy matters in your current research? Not that I’m complaining; keep up the interesting work..and don’t forget to Fire Your Guns.

We should never have gone to war in consideration of Israel’s right wing. We should never ever do so again.

Kristol, Ladeen, Krauthammer, Feith, Perle, Wolfowitz, Brooks, … need be called to account for our invading Iraq at their bidding, insistence. They should keep their mouths shut about Iran.

The problem with all of this is that the Pentagon seems to believe that Iraqis and Iranians are incapable of proactive strategic or even tactical thinking and action.

But then, oops, down came a mosque in February, 2005 and all hell broke loose.

So when a Revolutionary Guard unit runs a false flag assasination of Sistani (faux US uniforms, black SUVs, US weapons left at the scene…you know, the whole package) and every US soldier becomes a target of every Shia (including in the supposedly stable south) it will be just another deer-in-the-headlights moment for Condi, Dick, and George.

america has immense firepower, and no where is safe for the iranian soldier – except, possibly, on the move, in iraq or kuwait.

what are the rules of engagement ? do iranians have to stand still under a rain of nuclear bombs ? would it be cowardly to get out of the country before n day ?

I see ken gives that entourage (Kristol, Ladeen, Krauthammer, Feith, Perle, Wolfowitz, Brooks,…)[the software] a lot more respect than I do. I’d be more interested in the military interests, those spokesmen, lobbyists, congressional/senatorial contacts, major shareholders [the hardware].

OTOH, Coverage of Carter and his book promotion tell me that the media has this very pro-Israeli bias.

Um, does this include the economic effects of other nations deciding we are a predatory pariah and refusing to do business with us anymore?

What happens to the logistics supply line to Kuwait and Iraq if the Iranians are able to choke the Straits? What happens to our bases in the region if the Iranians threaten Qatar and Bahrain? What happens the next time the Iranians fly a civilian airplane near our ships in the Gulf? What happens to our troops garrinsoned inside the Green Zone? The Iranians have a lot of options.

Now we all know Rummy’s a genius or he might have known Saddam didn’t but if Saddam had of he could of entrapped the US forces and it could still happen.

“Threaten to strike extensively at Iranian capabilities for asymmetric warfare…”

Do people actually get paid for this nonsense? Asymmetric warfare by its nature cannot be effectively addressed by bombing campaigns. We seemed to think aerial attacks solve everything. We should expect some sort of asymmetric response and it may be substantial. One would expect Iranian government-backed efforts to be more effective than those of a very small group like Al Qaeda. Of course, it’s difficult to estimate the economic effects of asymmetric warfare.

Or, “Oceania has always been at war with Eastasia”.

Right, because Bush Administration rhetoric has been so pro-Iranian in the past and pretended that Iran was an ally that this would be a dramatic change worthy of 1984. Fine enough post, but can you try not to butcher your literary metaphors while doing it?

John Thacker: I meant something else by that quote, namely that certain elements seem to always want an enemy of some sort; almost anybody will suffice. And some elements are willing to distort information and intelligence to keep the Nation in a state of perpetual war. But I agree that applying that quote to Iraq/Saddam Hussein would have been even more appropriate than to Iran. For verification, see this photo.

Professor Chinn,

Without wishing to either seem grovelling or brown-nosing, and unfortunately not having the time to digest this post right now, posts like this are the reason why Econbrowser is the very best of all the economics blogs on the markets.

Professor Hamilton and yourself do your readers the courtesy of only ever dealing in numbers.

Since we are looking at the economic impact of highly improbable scenarios why not look at the most cost effective. We could pull one of our “Boomer” subs off the coast of Iran and within 20 minutes make the entire country into a sheet of glass. We could probably do this for under $2 Billion.

Completely unnecessary, there was never doubt to remove.

DickF: How can one tell how unlikely something is? I would’ve thought it incredibly unlikely that after the President’s Daily (intelligence) Briefing of August 6, 2001, he wouldn’t have taken some actions to heighten our defenses against al Qaeda. But see what happened….

Has anyone not considered that we could lose our forces in Iraq? The majority of the supplies for our fuel thirsty troops comes up the Persian Gulf. Their is a lot of oil in Iraq, but very little of it is refined. It is not even remotely implausible that this supply line could be cut for a period of time. One area that the Iranian Navy has made progress in is mine warfare: they manufacture non-magnetic, free-floating, and remote-controlled mines. It is believed that they have stocks Russian pressure, acoustic, magnetic mines, and possibly Chinese rocket-propelled rising mines. Mine warfare is one of the weakest capability areas (relative to the threat)of the US Navy. In Gulf War 1, we used the capabilities of the some of the small European navies to increase our capabilities and we still had the Tarawa heavily damaged by a WW1 tech. mine.

At the same time an uprising of Shiite militias, the Mahdi Army, the Badr Brigades, a possible general Shiite uprising and intervention by Irans Revolutionary Guards would cause a massive expenditure of supplies and fuel. Our troops are scattered all over Iraq fighting insurgents, and not positioned well for a fight with Iran.

It is also not clear that we have enough in theater munitions to deal regular Iranian munitions rolling over the border.

The German Sixth Army at Stalingrad was in some respects less isolated then our units in Iraq. Our air lift capabilities are much greater then the Luftwaffe’s, but so is our fuel demand load. To only view a potential war with Iran as one where we will be inflicting all the damage is a huge mistake.

“The German Sixth Army at Stalingrad was in some respects less isolated then our units in Iraq.”

The Germans lost 250K men at Stalingrad; all of Sixth army and part of the Fourth Panzer army. Why? Because they were TOTALLY isolated without any means of support or supply. They happened to be surrounded by nine Soviet armies. Inside the city they had no food, water, ammunition, or petrol.

Our troops are disciplined and well equipped; the US Air Force would be capable of providing support in a case such as this.

The insurgents, or whatever elements you envision, are not experienced in siege warfare. I seriously doubt that any anti-American elements, in that theater, could encircle and reduce a pocket of American forces to the point of surrender.

Though the idea might peak the interest of some on this board (especially those historically challenged like Sidney ‘Stalingrad’ Blumenthal), mentioning that our troops are in ANYWHERE near the situation that the Germans were in Stalingrad is flat out wrong.

Grz:

You have pointed out obvious differences between Stalingrad and the current situation. You also compare the current situation to the very final situation (fully surrounded with no support)in 1942. The current situation would be more analogous to the time frame just before the Russian counter offensive. I did not say that our troops would be surrounded in one large pocket, but that they would burn through a massive amount of supplies in open warfare type fighting.

The Germans were less isolated in the sense that they could walk back to Germany if they could find supplies and a way through all the Russians. I suppose that we would be able to walk back to Turkey, but that would be an unmitigated disaster.

The primary reason for comparing the two is to note that Stalingrad was a disaster (for the Germans) that did not need to occur. If we take into account the full nature of the problem, it is likely that a Stalingrad would not occur with Iran either. But it is not a scenario that seems to be much addressed.

Presuming that US firepower would prevent the tight encirclement that occurred in 1942, it is still not clear what our fuel thirsty units do when they run out of gas.

Very short sighted analysis. Inaction, weakness, pusilanimity, surrender never pays. By this method you can negotiate with yourself to retreat to the original thirteen colonies. Action has always a cost, and it is always apparently more expensive than inaction. Apparently.

jaim klein: Bombing is not always productive. Nor does opting not to bomb necessitate inaction. During the Cuban Missile Crisis, would immediate airstrikes have been your preferred option?

If this rogue regime drops any bombs ON Iran you can be sure our troops will be attacked by the hundreds of thousands of shia and sunni when they figure out fighting each other is counterproductive, and do you think china and russia will sit idly by as their financial interests are being attacked? vote for RON PAUL FOR PRESIDENT..