This is a potentially huge story that is not being adequately investigated by the financial press.

The future of world oil depends critically on what happens in Saudi Arabia. The country’s importance comes not just because it accounts for more than 10% of global production, but moreover from the fact that it produces almost a quarter of the oil globally available for export. Furthermore, nearly a third of the increase in global production by 2010 that is assumed in the EIA’s reference case forecast is supposed to come from Saudi Arabia.

And the Saudis are once again in the news this week. From last Monday’s Wall Street Journal (subscription required):

The world oil market is in “much, much better health and balance” now and, if trends hold, there will be no need for further production cuts or increases in supply when members of the Organization of Petroleum Exporting Countries meet next month, Saudi Arabian Oil Minister Ali Naimi said yesterday.

In an interview, Mr. Naimi said the kingdom’s production is now 8.5 million to 8.6 million barrels a day, confirming its reduction by one million barrels a day from its output about six months ago.

The reduction is part of a push by OPEC to shrink stockpiles of oil that climbed sharply last year as demand growth stumbled. The U.S. benchmark crude price fell through the turn of the year to a 20-month low in mid-January of $49.90 a barrel. It has since rebounded to settle Friday at $59.89 a barrel….

Data sources: Jan 04 through Nov 06:

EIA;

Dec 06 and Jan 07: estimates from

Platts;

Feb 07: latest

statement from Ali Naimi.

“If you are asking me are we going to take additional cuts or increase supply, I do not know,” said Mr. Naimi, the oil cartel’s de facto leader. “But, most probably if the trend is like what it is like today, with the market getting in much, much better health and balance, there may not be any reason to change.” He added that the situation can still change: “I would not be surprised to see different figures and a different situation on the 15th of March. That is the benefit of getting together with 12 other oil ministers to review the data.”

Saudi Arabia’s one-million-barrel-a-day reduction, reported in The Wall Street Journal last month, is nearly double what it agreed to under two OPEC output cuts hammered out by the cartel at meetings in Doha, Qatar, in October and in Abuja, Nigeria, in December.

The Wall Street Journal’s assumption that these production cuts represent a deliberate effort by the Saudis to stabilize the price is a reasonable one to make. But one problem with that hypothesis is that the trajectory followed by prices really doesn’t jibe with the story:

|

That price doesn’t look to me like it’s being stabilized by the Saudis or by anybody else. In particular, the cuts in Saudi production began in October 2005, when oil was selling for $62 a barrel, and those cuts continued as oil rose to a new high over $75 last summer.

For that matter, the Saudi production numbers themselves don’t look to me like they’re under the precise control of anybody. Up through the first half of 2005, the Saudis hit 9.5 mbd or 9.6 mbd month after month. I interpreted the stability of those numbers as signaling that the Saudis could hit any target they wanted, and they happened to be picking 9.5 or 9.6. By contrast, the erratic path since is much harder to view as the outcome of some careful manipulations.

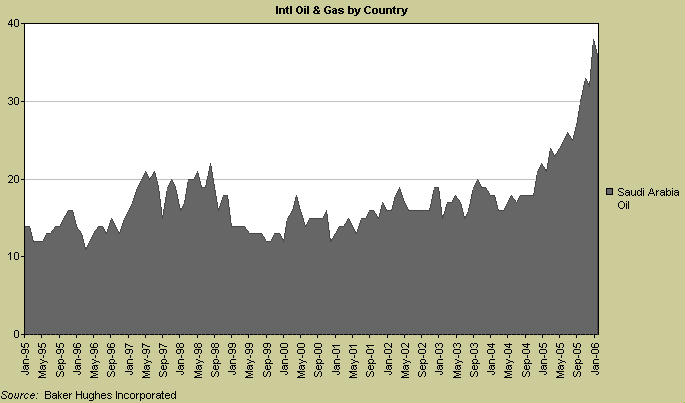

We do know that concomitant with this decrease in Saudi production has been a huge increase in the effort they’re making to find and produce new oil, as evidenced by the number of oil rigs the Saudis are employing:

|

We also know that the decrease in production has coincided with a deterioration in the quality of oil that the Saudis are trying to sell and develop. For example, there was this story from Reuters last summer:

China will extend a 50,000 barrel per day (bpd) cut in Saudi crude oil imports into July and August after some refiners struggled to cope with new higher-sulphur supplies, industry officials said.

China contracted to buy 500,000 bpd of Saudi crude in 2006, but cut that back by 10 percent in the second quarter after refiners ill-equipped to handle the kingdom’s mainly heavy-sour oil were forced to slow production after running the grades, the officials said.

As another example, an important part of the Saudi’s new production plans evidently involve the Manifa oilfield, which the Saudis had discovered in 1957, but up to now had decided not to try to develop because existing refineries were unable to process its high-sulfur oil [1],

[2].

There’s some fascinating speculation as to what this all means at the

Peak Oil News & Message Boards in a discussion thread that’s now been running for a year and a half. Here are the two possibilities that I find most plausible.

The first possibility is that the Saudis could still pump 10 mbd or more today if they wanted to, but they are cutting back production and exploring like mad because they put an extremely high value on having 2-3 mbd of excess capacity. If so, the recent price behavior suggests that the reason they would seek such capacity is not because they want to stabilize the price, but because it puts them in an incredibly powerful negotiating position. For example, the ability at any time to flood the market could be used at an opportune moment to undercut expensive alternatives such as oil sands that require an oil price over $50.

The second and more natural interpretation is even more disturbing: the mighty

Ghawar oil field is already in decline, and the Saudis don’t want anyone to know.

Now this would be a simple enough hypothesis for anyone to test, if the Saudis published field-by-field numbers for production and water cut. But instead, those numbers are a closely guarded secret, leaving people like me simply to guess as to what the truth might be.

But, if you’ll indulge me in a bit of cloak-and-daggerism, there are others who must know. This data cannot be something that would be that difficult for American or Russian intelligence operatives to collect. So, I find myself wondering the following– suppose that someone in the CIA knew for a fact that Ghawar was in decline– what would we be observing out of Washington? The ramifications are so enormous, many, many decision-makers would surely need to be informed. It’s hard for me to imagine that something so widely disseminated could remain a secret in Washington. According to this reasoning, perhaps we should read the fact that the story hasn’t yet been leaked as an indication that it hasn’t yet happened.

Unless the spooks don’t understand the full implications of the facts they are sitting on. Perhaps not unlike the Wall Street Journal.

Technorati Tags: oil,

oil prices,

Saudi Arabia,

peak oil,

Ghawar

Hey, I love me a conspiracy theory. But why in that scenario do the big cuts postdate the price drops?

Why would the Saudis want to undercut the oil sands?

Just as I was starting to think that the threat of peak oil might be less serious than I had previously believed, JDH reveals that he spends some of his valuable time reading the peakoil.com message boards!

I’d better go work on my survival shelter and vegetable garden …

You state an oil sands price of $50. I have read, including Canadian government, that the oil could be priced at about $25. Would appreciate your source.

The graphs seem to tell the story as you have laid it out. Peak oil theory applies not just to global production but to each field. Therefore, the Ghawar oil field, if in decline, would still hold 50% of the recoverable oil, based on its age a very reasonable assumption.

Also recall the days only a few years ago when the Saudi’s had a few million barrels of oil surplus capacity. Economic growth seem to have dealt with those surpluses quite handily.

US election cycle.

This is an eye-opener for me. Great piecing together of the EIA and Platts data and WSJ statement. Enlightening (and frightening!) links, too. Not good news — once it gets out — for the fragile (actually, receding) U.S. economy.

I find myself these days not so eager to assert that an interesting piece of information “cannot be something that would be that difficult for American … intelligence operatives to collect”.

wogie1, I didn’t mean to jump quite so casually into the debate on the break-even point for oil sands. Here’s another source for the $50/barrel number, though I don’t particularly advocate that number over some other. I was only trying to point out that there are a series of high-cost competitors to the Saudis out there, of which oil sands is one, which companies might make big investments only to find the rug pulled out from under them.

Stephen Gordon, the argument would have to rely on the assumption that the Saudis earn monopoly profits, and that these profits are higher if potential competitors can be dissuaded from making large fixed investments simply because of the threat that is implied by 2-3 mbd excess capacity.

Once you take into account the huge cost overruns for the Ft McMurray oil sands projects (that are still growing wider), the $50 breaking point is clearly unrealistic. You can’t make a profit at your assumed level when you double/triple costs constructing the damned infrastructure.

China has simply changed suppliers from Saudi to Kazakhstan due to the opening of the first pipeline.

When fully operational 400000bbl per day will be piped.

The East Siberia-Pacific Ocean pipeline from Russia with capacity of 1.6 million bbl per day of which 605000bbl per day will transit to China will reduce middle east imports by an equivalent amount.

Similar pipelines for gas are under preliminary infrastruture construction(pumpstations and power plants).

No peak oil worries here just part of the SCO energy agreement and JV investment strategy by the chinese.

The Russian has forecast oil to drop 2008-2014 as new projects come on stream.The low 40’s is the idicator range.

How much of the recent price increase is due to the reported sharp decline in production out of Mexico’s Cantarall field, supposedly on the order of 25% or more in the last few months?

Matthew Simmons (Twighlight in the Desert) has been banging the drum on this for years.

And he has found the smoking gun. A report by Seymour Hersh, based on 2 Congressional Hearings in 1974 and 1979, that Aramco (then part owned by US oil companies) maximised Gawar production using waterflooding, because they feared nationalisation (which eventually happened). Even in the late 1970s, even after My Lai, Sy Hersh could cause trouble.

The Congressional Hearings testimony is closed under executive privilege until at least 2019 I believe.

Gawar is half of Saudi production. If it has peaked, as all oil fields do, then we live in a different world than the one of our current mental model.

Or are they preparing for the war with Iran?

that someone in the CIA knew for a fact that Ghawar was in decline– what would we be observing out of Washington?

This administration would probably act upon that information the same way they acted on the report entitled “bin Laden Determined to Attack the U.S.”

I would suggest that we are seeing a “cob-web” or for the technicians a “pennant” pattern for oil prices. That would still be consistent with your thesis.

Ahh, what is this thing called “the price of oil?”. Brad Setser has a go at it here.

Problem with links? Try Brad Setser here:

http://www.rgemonitor.com/blog/setser/175297

Kit wrote: Or are they preparing for the war with Iran?

Wouldn’t Saudi Arabia bring oil prices down to prepare for a “war with Iran”?

One of the large oil projects in Alberta has $28 as a price point where it becomes profitable to develop the sands.

JDH:

I totally agree; your comments echo observations of mine from a few months ago. I think the Saudi fields have hit the tipping point.

The global ramifications are historical. Makes you go “hmmm” regarding the GSCI rigging as well.

One typical argument against this kind of thing is that if this were true, so many people would know about it that many of them would want to take advantage of this inside information by betting on oil price increases. It would be an almost risk-free way to make incredible fortunes. But this trading activity would itself move the price up. If well-placed insiders knew that there was a major crisis coming, we should see substantially higher prices than we do.

Sure, the gov already knows about Gawar – that’s why we’re in Iraq (it sure wasn’t WMD. Because of the Saudi fall-off, we have to jump into the ME with both feet and start pushing folks around to prove we still run things, and to make sure we get our share of what’s left. The untidiness in Iraq is a minor issue as Cheney likes to say: “its not the point.” The run-up in oil was probably due to the news getting out – the speculators just happened to run the price up a bit higher that what it would have been normally.

Why is inflation ignored in this discussion?

This issue is highly monetary. The Saudis are trying to determine the proper price/production of oil relative to the current value of the dollar. They understand that a price/bbl in the mid to high 50s will prevent competition from alternative sources (oil sand, shale oil, other) while maximizing Saudi profits. They are using production to keep the price in this range.

Understand that the major influence on the cost of Saudi oil right is dollar inflation, and that the Saudis do not measure inflation like the US press. They could care less how much Americans pay for their products. For them it is the only stable international medium of exchange, gold.

If the current direction of the dollar v Euro continues I expect more pressure for oil to be valued in euros. Right now the Saudis are attempting to manage the monetary gyrations with changes in production. If exchange rate parity continues to deteriorate we could see such a shift.

Then consider if oil becomes valued in euros it is highly likely that the Yuan peg would move from the dollar to the Euro.

MANDATORY RENEWABLE ENERGY THE ENERGY EVOLUTION R13

In order to insure energy and economic independence as well as better economic growth without being blackmailed by foreign countries, our country, the United States of Americas Utilization of Energy Sources must change.

“Energy drives our entire economy. We must protect it. “Let’s face it, without energy the whole economy and economic society we have set up would come to a halt. So you want to have control over such an important resource that you need for your society and your economy.” The American way of life is not negotiable.

Our continued dependence on fossil fuels could and will lead to catastrophic consequences.

The federal, state and local government should implement a mandatory renewable energy installation program for residential and commercial property on new construction and remodeling projects with the use of energy efficient material, mechanical systems, appliances, lighting, retrofits etc. The source of energy must be by renewable energy such as Solar-Photovoltaic, Geothermal, Wind, Biofuels, Ocean-Tidal, Hydrogen-Fuel Cell etc. This includes the utilizing of water from lakes, rivers and oceans to circulate in cooling towers to produce air conditioning and the utilization of proper landscaping to reduce energy consumption. (Sales tax on renewable energy products and energy efficiency should be reduced or eliminated)

The implementation of mandatory renewable energy could be done on a gradual scale over the next 10 years. At the end of the 10 year period all construction and energy use in the structures throughout the United States must be 100% powered by renewable energy. (This can be done by amending building code)

In addition, the governments must impose laws, rules and regulations whereby the utility companies must comply with a fair NET METERING (the buying of excess generation from the consumer at market price), including the promotion of research and production of renewable energy technology with various long term incentives and grants. The various foundations in existence should be used to contribute to this cause.

A mandatory time table should also be established for the automobile industry to gradually produce an automobile powered by renewable energy. The American automobile industry is surely capable of accomplishing this task. As an inducement to buy hybrid automobiles (sales tax should be reduced or eliminated on American manufactured automobiles).

This is a way to expedite our energy independence and economic growth. (This will also create a substantial amount of new jobs). It will take maximum effort and a relentless pursuit of the private, commercial and industrial government sectors commitment to renewable energy energy generation (wind, solar, hydro, biofuels, geothermal, energy storage (fuel cells, advance batteries), energy infrastructure (management, transmission) and energy efficiency (lighting, sensors, automation, conservation) (rainwater harvesting, water conservation) (energy and natural resources conservation) in order to achieve our energy independence.

“To succeed, you have to believe in something with such a passion that it becomes a reality.”

Jay Draiman, Energy Consultant

Northridge, CA. 91325

Feb. 19, 2007

P.S. I have a very deep belief in America’s capabilities. Within the next 10 years we can accomplish our energy independence, if we as a nation truly set our goals to accomplish this.

I happen to believe that we can do it. In another crisis–the one in 1942–President Franklin D. Roosevelt said this country would build 60,000 [50,000] military aircraft. By 1943, production in that program had reached 125,000 aircraft annually. They did it then. We can do it now.

“the way we produce and use energy must fundamentally change.”

The American people resilience and determination to retain the way of life is unconquerable and we as a nation will succeed in this endeavor of Energy Independence.

The Oil Companies should be required to invest a substantial percentage of their profit in renewable energy R&D and implementation. Those who do not will be panelized by the public at large by boy cutting their products.

Solar energy is the source of all energy on the earth (excepting volcanic geothermal). Wind, wave and fossil fuels all get their energy from the sun. Fossil fuels are only a battery which will eventually run out. The sooner we can exploit all forms of Solar energy (cost effectively or not against dubiously cheap FFs) the better off we will all be. If the battery runs out first, the survivors will all be living like in the 18th century again.

Every new home built should come with a solar package. A 1.5 kW per bedroom is a good rule of thumb. The formula 1.5 X’s 5 hrs per day X’s 30 days will produce about 225 kWh per bedroom monthly. This peak production period will offset 17 to 2

4 cents per kWh with a potential of $160 per month or about $60,000 over the 30-year mortgage period for a three-bedroom home. It is economically feasible at the current energy price and the interest portion of the loan is deductible. Why not?

Title 24 has been mandated forcing developers to build energy efficient homes. Their bull-headedness put them in that position and now they see that Title 24 works with little added cost. Solar should also be mandated and if the developer designs a home that solar is impossible to do then they should pay an equivalent mitigation fee allowing others to put solar on in place of their negligence. (Installation should be paid performance based).

Installation of renewable energy and its performance should be paid to the installer and manufacturer based on “performance based” (that means they are held accountable for the performance of the product – that includes the automobile industry). This will gain the trust and confidence of the end-user to proceed with such a project; it will also prove to the public that it is a viable avenue of energy conservation.

Installing a renewable energy system on your home or business increases the value of the property and provides a marketing advantage.

Nations of the world should unite and join together in a cohesive effort to develop and implement MANDATORY RENEWABLE ENERGY for the sake of humankind and future generations.

The head of the U.S. government’s renewable energy lab said Monday (Feb. 5) that the federal government is doing “embarrassingly few things” to foster renewable energy, leaving leadership to the states at a time of opportunity to change the nation’s energy future. “I see little happening at the federal level. Much more needs to happen.” What’s needed, he said, is a change of our national mind set. Instead of viewing the hurdles that still face renewable sources and setting national energy goals with those hurdles in mind, we should set ambitious national renewable energy goals and set about overcoming the hurdles to meet them. We have an opportunity, an opportunity we can take advantage of or an opportunity we can squander and let go,”

solar energy – the direct conversion of sunlight with solar cells, either into electricity or hydrogen, faces cost hurdles independent of their intrinsic efficiency. Ways must be found to lower production costs and design better conversion and storage systems.

FEDERAL BUILDINGS WITH SOLAR ENERGY Renewable Energy

All government buildings, Federal, State, County, City etc. should be mandated to be energy efficient and must use renewable energy on all new structures and structures that are been remodeled/upgraded.

“The goverment should serve as an example to its citizens”

Jay Draiman

Northridge, CA 91325

Email: renewableenergy2@msn.com

It seems pretty clear to me what the reaction in Washington would be. First, you’d have Dick Cheney saying things like:

“For the world as a whole, oil companies are expected to keep finding and developing enough oil to offset our seventy one million plus barrel a day of oil depletion, but also to meet new demand. By some estimates there will be an average of two per cent annual growth in global oil demand over the years ahead along with conservatively a three per cent natural decline in production from existing reserves. That means by 2010 we will need on the order of an additional fifty million barrels a day. So where is the oil going to come from? Governments and the national oil companies are obviously in control of about ninety per cent of the assets. Oil remains fundamentally a government business. While many regions of the world offer greet oil opportunities, the Middle East with two thirds of the world’s oil and the lowest cost, is still where the prize ultimately lies, even though companies are anxious for greeter access there, progress continues to be slow.” (From a speech at the London Institute of Petroleum Autumn lunch in 1999 when he was Chairman of Halliburton.) You’d then invade Iraq, and have the president speaking about hydrogen and ethanol every chance he gets. They know, oh, they know.

haven’t we already seen the reaction from washington? i suppose this gsci business was all nonsense….

The Saudis have also starting putting some chips on the table concerning the Iraqi Sunnis, apparently lending a hand to our efforts in Iraq.

The trends do seem consistent with Ghawar peak and the intent to stay a player in geopolitical affairs, especially within the region. A Saudi without oil to sell is what, exactly?

Putin’s recent swaggering also is consistent with the theory of Saudi peak. Russia now has a stronger hand.

The question is now, can the production capacity be maintained or restored with all those busy rigs? They do have minor new prospects and they can try harder with known fields. I suspect that they can plateau at roughly the same flow rates for a few years longer but at substantially reduced profit margins. It would certainly be in their security interests to stay Uncle Sam’s good buddy.

Another perspective is to consider all the horrible problems the Saudis would have if it came out that Ghawar was peaking. Oil prices would likely climb steeply as people worried about future shortages. However Saudi production would stay relatively large for many years into the future. Ghawar took decades to peak and it will take decades to trail off.

With production relatively steady and new, much higher oil prices, the poor Saudis would have to suffer under enormous floods of dollars pouring into their banks. They would need to invest in new bulldozers to push around the mountains of greenbacks and new vaults to hold their jewels and gold coins. They would have to expedite their process of buying up assets overseas and spend even more money internally on elaborate projects such as we see in Dubai. The poor, poor Saudis would suffer under wealth such as even Croesus would envy. No wonder they are keeping this horrible secret.

The Saudi production cuts could make very good sense, using some pretty straightforward assumptions:

1) They really do fear demand destruction due to over supply more than any other economic force.

2) They assume that the price runup last year was due to the Israel-Hezbollah war, not due to supply imbalances (since inventories continued to climb throughout). This disruption would be assumed to be ‘transient’.

3) They really do believe that 1.8 million bpd of new oil supplies will come on stream from Angola, Brazil, Canada, Kazakhstan, and Russia this year

Reducing supply to try to keep a floor on the price after the hostilities ended was smart, and successful.

…Or, they hit their peak production rate, and are frantically scrambling to get near-term replacements on-line before the peak driving season this summer…:-)

Excellent and balanced piece, Jim. A lot of facts do not add up: quality of oil, number of rigs, etc.

There is no question that energy availability is on everyone’s mind.

I live in the boonies of Ontario…almost daily, along the trans-Canadian highway, a huge windmill passes by.

China is planning to build hundreds of coal plants.

If peak oil becomes a well-known and accepted reality, then I am not sure how the markets will react.

Some metals as well are becoming scarcer: platinum, copper, zinc, etc. Withut recycling and with continued growth, we may face shortages here as well.

We do live in interesting, albeit dangerous, times.

Inflation, caused by excess monetary growth, appears to be inflating the price of oil.

In the 80’s, the Saudi’s pulled the rug out from under oil shale development. They will do it again.

stormy

the history of shortages is that substitutes and new sources of production are found.

Home plumbing used to be all copper, now it is mostly plastic, I believe.

Similarly home wiring used to be all copper, but I believe modern houses have aluminium wiring.

The basic raw materials: silicon, alumina, timber etc. are not in short supply.

The problem is, inevitably, the supply and demand lag. In a world of environmental and political restrictions, it can take a long time to get a new mine into production. And learning to recycle your entire municipal waste is a challenge- changing our personal habits back to the 1930s, when our grandparents never threw anything away that had a future use or value, is hard.

On energy, we have conflicting agendas. One is to get more energy which does not come from Middle Eastern oil. But that almost inevitably means more coal- -either as a power station fuel, or as a future source of oil via coal-to-oil technology.

More coal means more CO2. More CO2 means more global warming: a problem of pressing urgency and possibly completely critical to the survival of our civilisation.

Coal is roughly 1/3rd of the CO2 we as a civilisation emit (could be up to 40%, if you include heating/cooking).

I am sure we have the technological expertise to tackle both problems. The US alone could produce 20% of its electricity from wind power– the Great Plains has some of the best wind resources in the world.

And we could drive plug in diesel electric hybrid vehicles, which can achieve 80mpg and above– Peugeot Citroen already has such a vehicle in operation (but say they cannot sell it at an economic price).

What I question is whether we have the political will to tackle the problem of global warming (for which we pay no price now, and only a price in the future and onto future generations) and to address the question of our energy supply security.

It would require sacrifices, and trade offs now. A new round of reactors are Darlington, for example– angering environmental groups. More expensive cars which are more fuel efficient, for another. More energy efficient homes which cost more to build (typically about 10% more, for a 50% increase in energy efficiency). R2000 homes have been around for 20 years, but how many Canadians have one?

A friend, who lives not far from the Niagara Escarpment, has a ground source heat pump. A big expenditure up front, with a 10-12 year payback and huge savings in CO2 emissions (the fact that it solves both the heating and air conditioning problem increases the savings). How many people are willing to make that kind of investment in their future?

Controlling CO2 emissions would require widespread agreement that global warming is a problem and that we have a moral imperative to do something about it, even at a cost to our own standard of living. Neither is anywhere near a political consensus– Margaret Thatcher’s concerns about global warming notwithstanding.

Tradeoffs now for future benefits is not something we are particularly good at, as a civilisation, and perhaps not as homo sapiens.

The assumption that Ghawar will slowly decline in production has been challenged by Matthew Simmons. His point seems to be that the water flood techniques used to keep production high also means that depletion, once it starts, is that much steeper.

Already, the well outputs are 40% injected water or more (forget the exact number and when it was dated.)

Perhaps some petroleum engineer could expound on that point.

As to windmills, don’t count on more than marginal contributions to our electrical supply. Our real options remain coal and nuclear. Coal can be quicker since restarting the nuclear infrastructure will take time.

Yet another way of analyzing the situation is to look at how oil producers should behave if they wanted to maximize the present value of their future income stream, as predicted/assumed by economic theory.

Hotelling worked it out in the 1930s. Oil producers should aim to adjust their production levels so that their profits increase gradually every year, at the prevailing interest rate. Today that might be 5-10%. Generally, to achieve these price increases, they need to gradually reduce production levels. The goal is to run out of oil just as the price rises so high that no one would have wanted to buy it anyway, as alternatives are cheaper.

This profit maximization strategy does not depend on the existence of a cartel. Each oil producer is individually motivated to follow this price curve. Of course most producers can’t set their own prices, only big swing producers like Saudi Arabia can do that. But the common motivation of all producers is to match this price curve, so we would predict that everyone will behave so as to achieve this goal, if they aim to maximize returns from their oil.

Now in practice, oil prices have not followed this theory. Oil has acted more like a renewable resource, as more has been discovered all the time. But now, oil discoveries are decreasing, so we may be moving into an oil end game where producers face the reality that they own a finite resource. This will make Hotelling’s analysis more relevant and may make his model more accurate as a prediction of oil producer behavior.

If so, we would expect to see the Saudis gradually reduce production so as to raise prices at this gradual rate of 5-10% per year. It’s difficult to discern a long-term price trend given the natural gyrations of oil markets, but Saudi behavior over the past few years is at least roughly consistent with this explanation. This model would predict that oil prices will rise gradually, and will be in the $80s around 2010. That is the optimal strategy for Saudi Arabia, assuming they have enough oil to make it work.

Nuclear Fussion. It is reality, but the government has been supressing it for years for the cartel’s.

We already have a clean burning, long lasting power source and we surpress it. Much like Cancer research for cures.

The U.S. is going to bomb Iran sometime in the next several weeks, and the Saudis are going to do their part to keep the world’s oil flowing.

The Saudis are cutting back on production now, so that they will have excess capacity to release when the bombs start falling.

The Iranians have figured this out–note that the Iranian oil minister has just called for ‘no more cuts’ at the next OPEC meeting in March. The last thing the Iranians want is more excess capacity, because it lessens the downside of their being attacked by the U.S.

Although I am not a petroleum engineer, I do know in general the slower an oil field is produced, the more efficient it is at extracting the petroleum.

Wells never extract all of the oil (in fact, a significant fraction remains in the ground, just as squeezing a sponge never gets all the water out). Attempting to pump too fast may lead to ‘bypassed’ oil as the water flood front starts to preferentially flow through natural fractures. So there *may* be good reasons for the production cuts.

[the amount left in the ground depends on a variety of factors including type of oil, type of reservoir, drive, and production history.]

“I find myself these days not so eager to assert that an interesting piece of information “cannot be something that would be that difficult for American … intelligence operatives to collect”.”

I agree. Wasn’t Valerie Plame our go to person on Saudi oil?

Joseph

You don’t like wind power. You’ve been banging on about it here and in other forums.

Yet you live in Texas? Which is the fastest growing wind state in the Union, and if ranked as a wind country in and of itself, would be something like number 10 (about 3,700MW I believe).

Wind has entered a period of exponential capacity growth. Worldwide, capacity is growing by 30-40% per annum, and would be growing faster if shortages in turbine production capacity could be overcome.

At the same time, the cost of wind power falls by about 18% for every doubling of sector size.

Now take nuclear. There are very few civilian reactors under construction anywhere on the planet. And even if the US does opt for new nukes, it will be 8-10 years before the first of those are in service.

By which time the current 12GW or so of wind capacity in the US could easily be 100GW of capacity (equivalent to about 40GW of nuclear capacity at a load factor of 30% for wind, and 85% for nukes).

In power grid terms, nukes and wind share a characteristic. They are not ‘despatchable’ ie they cannot be ‘fired up’ rapidly to meet demand.

So in that sense they don’t compete with each other.

There is no practical reason why the grids of the UK and US cannot get 20% of their electric power from wind. At the current rates of growth (doubling in size every 18 months) they would do so in no more than 20 years. Which is the level nuclear power has reached now in the US, and probably won’t change much between now and 2020– new build up to that point will only compensate for shutdowns of older units.

Beyond that 20% penetration requires significant developments in energy storage, or more pumped storage. The Australians are experimenting with vanadium ‘flow’ batteries.

Valued Thinker,

Your point about delay of new nukes is well-taken. Windmills can come on-line quicker. The first new nuclear power plant in the US will come on line 1st quarter, 2015. However, the US nuclear industry is already stretched to the limits now in manpower and physical inputs (heavy steel ingots and forgings) and will have to rebuild itself before it can deliver on the scale needed. But take away the tax incentives and production mandates, and shipment of windmills will stop tomorrow.

In a sense, wind and nuclear do not compete but for a reason you mistated in your post. Nuclear is base-loaded and wind is opportunistic. Kinda like farming vs. hunting/gathering. Nuclear is indeed dispatchable – we can turn the output down and back up at will and at a good clip. It is just that the economics of nuclear does not recommend it until one reach the market share seen in France or Taiwan where nukes have to load follow because they make up more than the minimum system load. In fact, last year I was testing the computer controls for load-following, frequency control, and remote system dispatch on a plant we’re building in Asia.

Wind is so undependable that one CAN NOT dispatch it. One could, of course, disconnect it but with zero marginal operating cost, that would be foolish given the sunk costs. In Texas, ERCOT (the grid operator) only credits wind with a

I wonder if what they’re really worried about is security.

The US has two carrier groups and what, 200,000ish troops in the vicinity? If we (and indeed the world) heard with any credibility that Saudi Oil was declining in any serious way, one wonders where those troops might be directed.

Joseph

I’m not a big worry about online nicks, but yours getting mine wrong suggests either 1). a desire to insult or mock 2). that you don’t read very carefully.

FWIW ‘Valuethinker’ means, no more or less, a preference for low price to book, price to earnings, price to sales, stocks.

Turning to your arguments.

That Kw of nuclear capacity costs 1850 according to the British nuclear industry estimates for a 3rd Gen reactor.

The same Kw of wind capacity costs you 650. So adjusting from load factors, the costs are close.

Now the nuclear number may fall due to economies of learning (repeated units), site economies, and possibly lower financing costs over time (at the moment, private capital markets will *not* finance new nuclear stations). But of course the same factors apply to wind.

The reason wind has to be subsidised is the same reason nuclear requires a subsidy, in fact the Bush 2005 Energy Act gives them the same subsidy– CO2 emission is not taxed or regulated.

In such an environment, no utility would build (at today’s gas prices) anything but new coal stations. Coal gets a free ride. Forget nuclear or wind.

And the history of nuclear power is one of 300-400% cost overruns. The cost estimates for each generation of nukes have always been way too generous.

The most successful nuclear programme, the French one, we don’t actually know the real costs: the French have buried them in their government accounting (they may not actually know them).

Now to the cost of waste disposal. The decommissioning liability for the UK nuclear industry is 70bn. That is being borne by the UK taxpayer. One would imagine the US industry has a similar cost awaiting it?

You are offly definite about the start date for the US nuclear reactor? Has the NRC licensed one? Have the site hearings gone through? Is concrete being poured?

Nukes are not despatchable in the sense the grid operator doesn’t count them, due to reliability issues. In fact, the power load characteristics of nuclear and wind are quite similar: sudden, unplanned shutdowns.

The MIT study said 6.8 cents/kwhr for new nukes. That was in 2003, as you note, it’s likely there has been a degree of price inflation. They argue why it might fall by 25% over time, on the other hand they note the industry doesn’t have a great handle on the causes of the cost inflation in the last ‘big build’ in the 70s.

I really did mean 20% of terrawatt hours– not capacity. That is a reasonable estimate of what the UK grid can take from wind, and not unjustified by the Danish experience.

The energy return from invested capital from wind looks very good over the life cycle of a wind farm. A good analogy is to a hydro electric station: high capital cost, very low operating cost. And there is a diversification effect in your generation portfolio (uncorrelated assets produce higher return for the same risk– the basis of modern finance theory) which lowers total cost (risk).

Agree with you re wind patterns and peak demand (although the reverse is true in the UK: when the wind is blowing hardest, we have our winter demand peak) *however* to the extent that the windfarms spread over different wind sub-regions, this is less of a problem.

I’m not particularly anti-nuke. It is expensive power, with big waste and proliferation issues, that happens to be very clean. The technology has always under performed and under delivered (a norm with complex technology). However given the race we are in against outside factors (global warming in particular), it has a place in a generation portfolio.

However so does wind. The US and UK have some of the best wind resources on the planet, we might as well go for it.

VT,

Sorry, but I have to pull some insider leverage here. At least two merchant nuclear power reactors are being financed in the US with non-recourse project loans and hedge fund equity at $50 per megawatt-hour forward PRICE. I know because I’m doing internal economic evaluations on a going project using just such terms. Plants in Amarillo, Texas, Fresno, California, and Boise, Idaho are being publicly considered under similar financing arrangements although I lack detailed insider perspective on those specific projects. I will attest that $2,000 a kW for nuclear is very conservative as of 2007 although the relatively long construction times do make them vulnerable to cost inflation.

I used the salutation “Valued Thinker” as a compliment to be taken literally, not as a “nick.” We’ve had several on-line exchanges in the past and I’ve always respected your opinion in spite of our disagreements.

As to the technology “under-performing,” our going-in assumptions in the 1960’s and 1970’s were for an ultimate 70 or 80% capacity factor. It took a few years of growing pains and the proper incentive structure, but the US nuclear industry and others have hit 90% quite consistently for over a decade now. I’d call that OVERperforming.

Send me your email via Professor Hamilton and I’ll provide the critical path summary of my project with your signed non-disclosure agreement. Steel is being ordered (cash up front) this month and non-safety-related site work will begin in the Fall with safety-related concrete pours TBD upon further regulatory rulemaking.

I’m very skeptical of your cost numbers for wind. I think $2000/kW is a much more reasonable estimate of construction costs including transmission access costs. Costs are coming down but they will plateau at a non-trivial value. I see no reason to depend on increasing wind capacity factors about the current 25% as reported by EIA.

What has been consistently under-estimated or not reported are the O&M costs for wind. That is a huge reason by so many of the wwindmills in the Altamont Pass are now just junk abandoned in place.

As to waste disposal, the cost have been pumped-up in the US as part of a calculated political strategy. Recycling with actinide burning will result in dramatic cost savings.

I’ve no grudge against windmills if:

1) I don’t have to pay the premium,

2) adequate REAL capacity is built to keep my lights on, and

3) I don’t have to look at them or hear them.

Joseph

Thanks for the clarification.

$2000/kw for nuclear may be doable, but it’s a reach.

For various reasons I probably shouldn’t sign your NDA at this point, but thank you for the offer– I appreciate it.

On the O&M on wind, I think Altamount was very early technology. I agree that there will be (unpleasant surprises) on wind O&M, but again this is a very new industry, but with operating experience growing by 2-3,000 hrs/yr per unit, so learning is very fast. The Vesta turbines have had some problems, but I think the GE ones have been fine.

If one wants a ‘hidden’ cost for wind, it is the grid connect charge. Given where wind farms are, that is a serious problem for utilities. But like all such problems, I think it can be overcome.

As to plateauing of wind costs (economies of learning)– no sign yet, and to the extent that coal fired generation costs fell from 1900 to the mid 1960s (and are again falling now) there is hope for continued improvement, and a reason to think that it will occur (as it has in virtually every other energy technology). Double the size of installed capacity, and experience a 15-18% fall in costs– it’s a sustained relationship.

Agree that the Load Factor is crucial to the economics of nuclear power. Having lived through the Ontario Hydro CANDU debacle ($32bn writeoff by the taxpayer) I am sceptical of the more optimistic claims of the nuclear industry (although $10bn of that was pure political meddling). *but* the LFs you cite are consistent with the best current operators (albeit we will be building 3rd Gen reactors with a different technology).

The biggest saving the 3rd Gen will have over the 2nd Gen might well be simply the site costs, as most 3G reactors will be built on existing sites. Here the proposals are at Hinkley (Bristol Channel) and Sizewell (Suffolk on the East Coast, north east of London– the site of the only existing British PWR).

I’ll be fascinated to see merchant power operators building nukes. Again, the industry utility consensus is private capital won’t take on nuclear risk– you couldn’t float a bond backed by a nuclear project without government guarantees.

What I would assume they are doing is hedging against an existing asset (eg a distribution company) or against the forward power curve, but I wasn’t aware you could buy forward power contracts 15 years out. This is in essence what the Finns are doing, and it makes sense: line up a group of high electricity using industrial customers, and forward sell their power. I think the new Finnish 3rd Gen reactor is essentially a co-operative, owned by its big industrial consumers.

I agree that if it actually takes place, this will be a major step forward for the nuclear industry.

This weekend’s news is about a leveraged buy out of TXU by KKR/Blackstone. Which will kill any nuclear plans by TXU– no senior debt lender is going to finance that kind of risk in a highly leveraged structure.

My main point remains.

Reasonable men may differ. One uncontravertable fact is that the nuclear industry in the US is growing at its rate limit today. There is NO unutilized talent.

The TXU deal is news! Their proposal for 11 new coal plants was met with a storm of slings and arrows. My colleagues and I joked that this was a red herring to make a subsequent proposal for new nukes look good. When has KKR even built anything?

As to selling forward, check out NRG’s 10-K. They’ve sold their total ERCOT output forward several years and intend to continue. BTW, my project s getting 1% money for a quarter billion from an equipment supplier!

While there are some site development savings from using existing sites, the REAL savings comes in schedules due to reduced licensing and from reduced licensing and political risk. Many systems have to be independent by regulation.

There are substantial cost savings in the new generation of plants. They are measured in tons of steel and yards of concrete – that’s where the money is. However, the REAL impact will be regulatory certainty – retrofits and running engineering changes are a terrible waste.

For most jurisdictions, the property taxes paid by a nuke declines with time as the plant depreciates. The means that the money flowing into the local school district tapers off. Building a new nuke on the site means a fresh infusion of cash! Ergo, locals learn to love their nuclear plants and comunity support for new projects is vigorous.

Are you completely unaware of the military build-up the US has prepared to unleash upon Iran?

Iran exports about 3.5 million barrels of oil per day. If/when the U.S. attacks Iran, that shortfall will have to be made up somehow or it will cause an oil price shock. Therefore, at the behest of the Americans, the Saudis have cut back production so much so that, when the bombs start dropping, they will be able to release immediately an additional 3+ million barrels per day onto the world markets. To be able to do this, they had to first cut back by about a million barrels per day.

Dale, you figure the oil reserves in Saudi Arabia are like elasticized bladders? –that cuttin back now builds pressure which comes in handy later?

Or do you envisage huge swimming pools of reserve oil that, because it is in the swimming pools marked “non-production”, is not counted?

This site is so awesome! I love learning so much!