The new conventional wisdom is that the return foreigners obtain on U.S. assets is less than the return U.S. residents obtain on foreign assets. And that this means that the U.S. can build up a bigger foreign debt than traditional analyses; I’ve been skeptical [1], [2]. Now, we have more reason to ask how robust is the finding of a durable earnings differential in favor of U.S. investors?

A new preliminary paper (updated link 5/5) by Stephanie E. Curcuru (Fed), Tomas Dvorak (Union College) and Frank Warnock (Darden/UVA), in “The Stability of Large External Imbalances: The Role of Returns Differentials” argues to the contrary, at least for bonds and equities.

Were the U.S. to persistently earn substantially more on its foreign investments (“U.S. claims”) than foreigners earn on their U.S. investments (“U.S. liabilities”), the likelihood that the current environment of sizeable global imbalances will evolve in a benign manner increases. However, utilizing data on the actual foreign equity and bond portfolios of U.S. investors and the U.S.

equity and bond portfolios of foreign investors, we find that the returns differential of U.S. claims over U.S. liabilities is essentially zero. Moreover, were it not for the poor timing of investors from developed countries, who tend to shift their U.S. portfolios toward (or away from) equities prior to the subsequent underperformance (or strong performance) of equities, the returns

differential would be even lower. Thus, in the context of equity and bond portfolios we find no evidence that the U.S. can count on earning more on its claims than it pays on its liabilities.

How is it that Curcuru et al. obtain such different results from Gourinchas and Rey? From the introduction.

We analyze the returns differential in a manner that differs from previous analysis in at least two ways. First, we use information from actual bond and equity portfolios. Specifically, we

utilize data on the country and asset class composition of U.S. portfolio claims and liabilities. By matching precise country and asset class weights to corresponding total market returns (and by

being careful with the currency composition by asset class and country), we are able to obtain accurate estimates of the returns differential. Using data on bilateral positions also has the

advantage of allowing us to distinguish differentials vis-a-vis developed from those vis-a-vis developing countries.

The second way our study differs is methodological. Ascertaining the extent of the America’s privileged status in having a positive returns differential vis-a-vis the rest of the world

is essentially an exercise in performance evaluation. Therefore, we utilize portfolio performance evaluation techniques inspired by Grinblatt and Titman (1993). Specifically, we decompose the

return differential into its three components: composition, return, and timing effects. The first two — the composition and return effects — capture average characteristics of U.S. claims and liabilities. The composition effect would be positive were U.S. claims on foreigners weighted toward asset classes with higher average returns. The return effect would be positive were U.S. investors to earn higher average returns within each asset class. The third effect, timing, is driven by reallocations across different asset classes. The timing effect captures investment skill as given by the covariance between current weights and subsequent returns. A positive covariance between current asset weights — themselves the outcome of a buy-and-hold strategy or active trading — and subsequent asset returns would mean that portfolios were correctly positioned to capture subsequent returns. If portfolio weights and subsequent returns covary more positively in

U.S. claims than in U.S. liabilities, U.S. investors display more skill abroad than foreign investors in the U.S. and the timing effect would be positive.

Our findings can be easily summarized: Overall, we find no returns differential. For our sample (January 1994 through December 2005), the returns differential is 5.6 basis points per month but statistically insignificant. Were we to end the sample a year earlier (end-2004), the returns differential would be negative. In either case the differential is statistically indecipherable from zero.

…

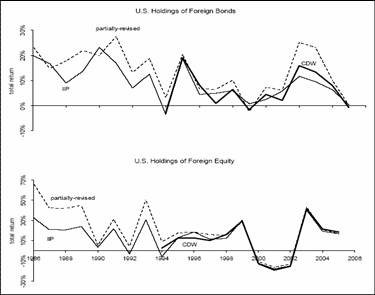

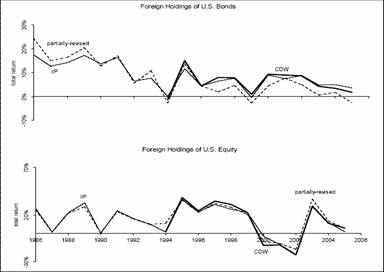

These returns are depicted in Figures 3 and 4 from the paper.

Figure 3: US holdings of foreign portfolio assets. Source: Curcuru et al. (2007).

Figure 4: Foreign holdings of US portfolio assets. Source: Curcuru et al. (2007).

It is important to recall that these findings do not overturn the results pertaining to FDI (see the CBO report), although the authors express some skepticism about this differential as well. All this sugests that what differential exists might only pertain to a small segment of cross-border of assets and liabilities.

All this leads me to reinforce my view that we can’t let policy go on automatic pilot — the current account deficit remains a threat to economic stability.

Technorati Tags: exorbitant privilege,

exchange rate,

current account deficit,

net income,

dark matter

And at the bottom line, is it not the case that the investment income flow part of the current account turned decisively negative last year? After all, that was the argument for dark matter all along, wasn’t it, that while the US had this nominally enormous foreign debt, that debt was not generating as much of an outflow of income as the assets, dark or otherwise, were generating as inflow offsetting that into the US? Now that this particular peculiar phenomenon appears to have come to an end, is this not effectively the end of the dark matter story as something serious?

“For our sample (January 1994 through December 2005), the returns differential is 5.6 basis points per month but statistically insignificant.”

5.6 basis points per month compounds to almost 7% a year. if a 7% return is not statistically signicicant, then neither is this paper.

“For our sample (January 1994 through December 2005), the returns differential is 5.6 basis points per month but statistically insignificant.”

5.6 basis points per month compounds to almost 7% a year. if a 7% return is not statistically significant, then neither is this paper.

Perhaps you need to read it more carefully. What they mean is that if they change the period slightly, the return becomes negative. This is why this, otherwise large, return, is “statistically insignificant”. Change the period under consideration slightly, and the return disappears. It’s like saying that the market going up 0.1% in a day compounds to 44% yearly return. True, but irrelevant.

In addition, 5.6 basis points compound to 0.7 (0.674) percent, not 7% a year.

Small Investor Chronicles

While I recover from the phrase “the new conventional wisdom” (not that the old conventional wisdom needed this upgrade or that “conventional” needed to be shown unconventional disrespect by say, “radical” or “wisdom” trashed entirely with say the modest “thinking” or slightly less modest, “intelligence estimates” or the slightly less militaristic, “views”), and ponder the time sensitive nature of this so colorful Dark Matter, I wonder whether this issue would not be better tied down to some specific industries from which this investment differential obtains.

Tend to side with Menzie here:

…what differential exists might only pertain to a small segment of cross-border of assets and liabilities.

but also that a case study of GM China and Toyota US might shed some light.

In the spirit of letting a thousand flowers bloom, I’ll note a contrasting view by John Kitchen, in his revised Sharecroppers or Shrewd Capitalists? paper (forthcoming, if I can do some advertising, in Review of International Economics).

Retract statistically insignificant comment. Sorry, I dropped a decimal place.

What I am interested in is how does the last decade’s globalization affect this all. What happens to trade balance when an American company manufactures product in China, sells it in Germany, and keeps the profit? This must adversely affect the trade balance, but is it a bad thing? Unsustainable? What about selling the same product in the US, where most added value and all the profits are generated?

I would be interested in our gracious hosts’ take on this.

Small Investor Chronicles

Thanks to Menzie for the reference to the Sharecroppers/Shrewd Capitalists paper …

I’m trying to figure out exactly how it’s all fitting together — that is, the results of Curcuru, Dvorak and Warnock (CDW) with the observed historical relationships shown by BEA.

The CDW results are for the total returns to bonds and corporate equities. I think those would show up in the BEA numbers both in the income flows and also in the price valuation adjustments to the stock values. But it’s not clear how much of the historical “exorbitant privilege” ultimately is explained by their results. As Menzie points out, the differential returns to direct investment assets are a big part of the story. In addition, the capital gains/price valuation adjustments have only been a small part historically (although large in the last 2 years), and the BEA data indicate that the relative effective rates of return for income on bonds and corporate equities haven’t been much of the explanation.

“Other” valuation effects have been an important part, and I’m curious about the observation in the CDW paper about the poor timing of foreign investors for their investments and whether that might actually fit with part of an explanation for the “other” valuation effects.

The BEA data indicate that the bulk of the observed exorbitant privilege effects have been from FDI differentials and from “other” valuation effects, and that the bond and equity relationship has been a smaller part of that explanation. An important part, yes, but a larger part beyond that remains …