The results of the Wall Street Journal’s recent survey of forecasts were discussed in an article with the curious title “The Economy Is Clawing Back, but Not Much”.

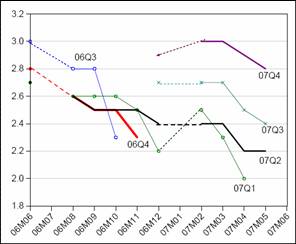

This title inspired me to look closer at the results, to see how the forecasters have been reading the tea leaves (for a previous take, using the Survey of Professional Forecasters, see this post). Figure 1 depicts the implied GDP (log) levels consistent with announced GDP levels known at the respective forecast dates.

Figure 1: Log real GDP (in Ch.’00, SAAR), 27 Oct ’06 release (blue), 31 Jan ’07 release (green), 27 Apr ’07 (teal); and implied forecasts from Wall Street Journal, Nov ’06 (red/square), Feb ’07 (black/triangle), May ’07 (purple/circle)revised 5/15 8pm . Sources: BEA NIPA via St. Louis Fed FREDII, WSJ forecasts, and author’s calculations.

First, it’s of interest to see that even as slower growth in 07Q1 become apparent, forecasters were largely maintaining the predicted 07Q4 growth rate [added 5/15 8pm] . raising their 07Q4 growth estimates, so that the April 2007 WSJ mean forecast implies the same level of GDP in 2007Q4 as the February 2007 forecast, despite the surprise in the advance 2007Q1 release. It’s almost as if there is a “law of conservation of predicted GDP” (which is of course consistent with previous observations about professional forecasts; see for instance what happened just before the last recession, [1], Figure 2).

Remarkably, even as predicted growth rates are reduced for each quarter, the predicted growth rates for each subsequent quarter are now uniformly higher. This second point is highlighted in Figure 2.

Figure 2: Real GDP growth (in Ch.’00, SAAR), forecasts from Wall Street Journal for 2006Q3 (blue), 2006Q4 (red), 2007Q1 (green), 2007Q2 (black), 2007Q3 (teal), 2007Q4 (purple) . Source: WSJ forecasts.

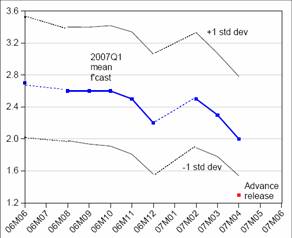

The third observation is that the advance release for 2007Q1, shown in Figure 3, was quite a surprise. The mean growth rate (in blue) predicted in early April was far above the actual rate released in late April. Indeed, the actual rate was more than one standard deviation below the mean prediction. (Figure 4, which shows the 2007Q4 forecasts over time, is presented for completeness’ sake.)

Figure 3: Real GDP growth (in Ch.’00, SAAR), forecasts from Wall Street Journal for 2007Q1 (blue), +/- one standard deviation (black), and advance release for 2007Q1 real GDP growth (red triangle). Source: BEA NIPA, WSJ forecasts and author’s calculations.

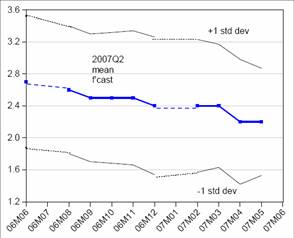

Figure 4: Real GDP growth (in Ch.’00, SAAR), forecasts from Wall Street Journal for 2007Q2 (blue), +/- one standard deviation (black). Source: WSJ forecasts and author’s calculations.

Who were the perennial optimists? At the top of the guesses for 2007Q1 in the March forecast were The Conference Board at 3.6%, Camilli Economics, LLC at 3.1% and Barclays Capital, Perna Associates, and Bear Stearns & Co. Inc. all at 3.0%. And for 2007Q2 in the May forecasts? Barclays Capital and First Trust Advisors, L.P. are at 3.0%, and The Conference Board at 2.9%. FedEx Corp., Moody’s Investors Service, Wrightson ICAP, Standard and Poor’s, and Mesirow Financial are all at 2.8%. High Frequency Economics is almost at the bottom, at 1% (only James F. Smith at Western Carolina University and Parsec Financial Management is more pessimistic, forecasting -1.4%).

By the way, it was Nariman Behravesh of Global Insight (running a pretty Keynesian model) that hit on the mark the advance GDP growth rate in the April survey — although after the release of the March trade figures, it may turn out that Ian Shepherdson at High Frequency Economics will prove most accurate (albeit insufficiently pessimistic; see here).

At the end of the day, most of these folks have a self-serving interest in being optimistic–especially the Wall Streeters. I put little, ahem, stock in these forecasts.

Then again, with the stock market rising with good news or bad, maybe just as “deficits don’t matter,” “economic slowdowns don’t matter,” either.