Typically, people think of the euro as the most likely competitor to the dollar. And maybe it is in the long run (see these posts [1], [2], and this paper). But in the short term, maybe it’s the British pound.

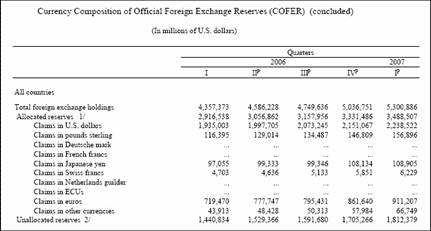

Here’s the table from the latest IMF COFER release:

Some interpretation from IDEAglobal (July 5):

…There are three pincipal take away points: 1) The dollar’s share of official FX reserves around the world has fallen as a percentage of overall reserves. … 2) EUR denominated reserves have grown at a faster pace than USD denominated reserves, but only very marginally when adjusted for currency movements. 3) The GBP continues to be the main beneficiary of reserve diversification (in percentage terms).

The foreign exchange reserves of the world’s central banks continued to grow at a rapid pace in Q1 2007 of 5.2% q/q and 21.7% y/y. US dollars now represent 64.2% of official reserves around the world. This compares to 64.6% in Q4 2006 and 66.4% in Q1 2007. EUR denominated reserves increased to 26.1% in Q1 2007 from 25.9% in Q4 2006 and 24.7% in Q1 2006. GBP denominated reserves also rose, increasing to 4.5% in Q1 2007 from 4.4% in Q4 2006 and 4.0% in Q1 2006. On the other hand, JPY denominated holdings declined to 3.1% in Q1 2007 from 3.3% in Q4 2006, which was unchanged from the 3.3% in Q1 2006. However, the dollar’s slide as a percentage of overall reserves is not due to central bank selling of USD denominated assets. In fact, central banks purchased $87.5 bln in USD denominated assets in Q1 2007. This is far greater than the $49.6 bln of euros and the $10.1 bln of GBP purchased during the same time period. The dollar’s relative decline is explained by its depreciation and by the slightly faster pace of EUR denominated (and other currencies) purchases in percentage terms.

Of course, the caveat is that there is a tremendous question mark in the form of unallocated reserves…

Technorati Tags: dollar,

reserve accumulation,

euro,

British pound

Minzie,

A great observation. The dollar became the world currency during WWI because the US was the only country to maintain a stable currency tied to gold. McAdoo and others saw that if they could keep the dollar honest they could replace the pound as the world currency and they did just that.

But the pound or any other currency from a large economy could easily push the dollar from it position as the world currency. With all currencies of the world floating a country that linked its currency to gold would quickly become the world currency.

Remember during the 1970s that the Swiss because the worlds bankers because they resisted leaving the gold standard. The problem the Swiss had was that their economy was not large enough to handle the role of the world’s banker. Their entire nation would have had to become a bank. Even today the Swiss banks are perhaps the strongest in the world.

Consider that those who see competition from another currency look at the stability of the currency, and those countries who hold reserves hold those currencies that give them the greatest probability of maintaining value. Whether the euro, pound, yuan, or some other, the currency that first returns to a gold anchor would quickly become the world currency.

Thanks for bringing this to light, Professor.

Makes sense, DF.

Any sense what the composition of the unallocated reserves is? 30-35% unallocated is huge.

DickF:Any pegging of exchange rates involves making a trade-off between anti-inflation credibility and hence utility as a reserve currency, and the loss of monetary policy autonomy, in a world characterized by high capital mobility. The experience of Britain’s return to gold in the inter-war years should provide a cautionary note to those inclined toward pegging to gold.

jg: I think the consensus is that most of the unallocated reserves is in USD. I don’t know what the guesses are for unallocated reserves in general, but for China, it’s thought that 70% of reserves are in USD.

Menzie wrote:

The experience of Britain’s return to gold in the inter-war years should provide a cautionary note to those inclined toward pegging to gold.

Menzie,

If a currency were pegged to gold at a seriously low exchange rate, as the UK did in the interwar period and as the US did after the Civil war, you would be absolutely correct and such a mistake would be foolish, but if a monetary authority linked its currency to gold at its existing market price and announced that it would use its powers in open market transactions to maintain that market price of gold it would quickly become the world’s reserve currency.

The gold standard seems dated.

Why not peg to a kW of electricity?

If it has to be a physical commodity, oil.

Rename the pound “the barrel”.

Name,

I can see that you have not thought much about a standard for our currency, as opposed to a fiat currency based on a hope and a promise from our government – and you should know how much that is worth.

There are reasons that gold was chosen by the market as the commodity of choice in valuing currency. I won’t mention all but consider one. Most of the gold that was around at the time of the birth of Christ is still around. Can you say that for a kw of electricity or a bbl of oil?