Not a good month for the domestic automakers.

Domestically manufactured cars sold at the same pace in June as in the same month last year. Given the long-run declining trend, that may be as good as we might hope for in the current environment.

|

However, domestic light trucks were down 10% from the previous year.

|

Some news reports played this story as the ongoing success of imports over domestics, spurred by sales incentives from Japanese automakers. There is certainly some truth to that perspective:

|

However, with domestic light truck sales down nearly 60,000 units and truck imports up just over 10,000, it’s more accurate to describe this as a drop in big-vehicle sales overall. GM reported a

23 percent drop in Chevrolet full-sized pickups and 60 percent decline in their TrailBlazer SUV. High gas prices and a weak construction sector look like a more important part of the June story than sales incentives from the Japanese automakers.

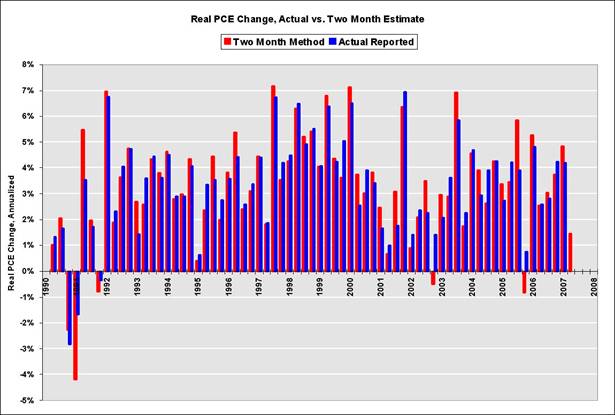

Elsewhere, Calculated Risk has estimated second-quarter growth of personal consumption expenditures on the basis of the first two months currently available. That doesn’t give a perfect forecast, but suggests pretty convincingly we’re going to see a weaker contribution of consumption to 2007:Q2 GDP growth than we had in the first quarter. The ailing domestic auto sales and other June sales indicators give further confirmation of significantly weaker second-quarter consumption growth.

|

Dave Altig is cheered by the June ISM report and is looking ahead to a better second half of the year. But the quarter just ended is unlikely to be a good one.

Technorati Tags: macroeconomics,

autos,

auto+sales

The BEA SAAR rate is 15.6 m for a 2nd quarter average of 16.01 m as compared to 16.56 m for the first quarter. this gives a 2nd Q SAAR growth rate of -12.7% for real auto sales — remember this will be divided between PCE, government purchases and business capital spending.

PS don’t forget medium and heavy truck sales have also collapsed since the start of the year. In May they were 0.345 M versus 0.596 M in December.

They are almost back to the 0.297 M low in Dec. 2002.

I take that a Chevy Aveo made in Korea is domestic in these statistics and a Honda Accord made in Marysville Ohio is foreign.

Spencer, can you point me to the BEA SAAR link?

Sorry, I get the data through Haver Analytics,

so I do not have a link for you.

Here is the BEA data. The BEA provides the SAAR rates for autos (line 4) and trucks (line 16) separately – but I’m not getting exactly the numbers Spencer is quoting.

Haver Analytics is probably estimating June from the data released this week.

Best Wishes and Happy 4th!

Thank you s- and CR.

Jim, your observation on Q2 PCE is right on….looks like PCE will make only a weak contribution to Q2 GDP. I suspect many forecasters are paring back Q2 GDP estimates. One thing we should remember is that automotive production is the key to GDP, not sales. Here if automakers’ built to schedule in June (June data not yet available) then assemblies in Q2 would come in at a 11.230 mln rate, up from 10.582 mln in Q1-07. This should be worth somethng close to a 1% Q2 contribution to GDP. The weakness in June sales seems to be an artifact of poor GM truck sales, which some blame on very aggressive incentives by Toyota on it’s large truck, and weak fleet sales. The weak fleet sales might be strategic in nature to make the industry appear to be in a more dire situation going into the UAW negotiations. Also the seeming strong Q2 production might also be strategic to build inventories to strengthen bargianing position vis-a-vis the UAW.

On a seasonally adjusted basis the auto I/S ratio is rising. Is GM deliberately building inventories in anticipation of a strike?

Fat Man, “domestic” refers to anything produced in North America, regardless of the brand of

the model. Therefore, the Honda built in Ohio is a domestic while the

Chevy manufacturered in Korea would be an imported model.

I notice we have not heard from the GM dealer in quite a while; nor from MovieGuy. Some of us predicted this quite clearly a year or so ago – the days of SUVs for everyman are clearly over.

Trailblazer sales are down 60%? That may not entirely be because of gas prices. The model is now 6 years old without a revision of any kind.

Clearly, this is an orphaned model that GM is building until it just kills the model entirely.

Until then, let the incentives flow. Would you take a Trailblazer with $4000 on the hood? $5000?

Does anyone have a feel for world sales of autos? How is the US doing on a relative basis?

Dickf –Sales in Asia — excl. Japan — are soaring while sales in Japan and Europe are sluggish.

Note that there has been no growth in US sales since 2000 — seven years.

Thanks spencer. Could you just help me one more time. Do the soaring sales in Japan (the East)simply offset the slump in sales in Europe and North America? What I am asking is has there been a change in consumption of simply a change in mix, the East buying more of their domestic cars and less European and American cars?

Dick — I am not an expert and do not have the data.

But my general impression is that it is the newly emerging countries where demand is growing very rapidly and for the most part it is being filled my a newly developing domestic auto industry.

Within Europe you are seeing a very significant shift of production from the old west to the east where labor is much cheaper and where demand growth is stronger.

The US suffers from excess capacity as does most of the western world–Japan and Western Europe.

In the US we have more registered light vehicles then drivers.