From IDEAGlobal, FX Alert, August 21:

MONEY MARKET DISLOCATION WORSE THAN IN 1998

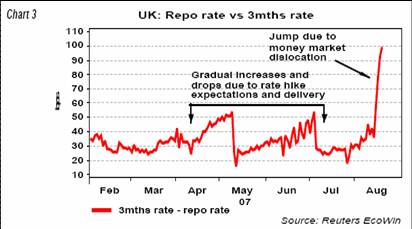

The spread between the 3 months cash rate and

the policy rate in the US, Eurozone and UK has

jumped during this period of financial turbulence

more than it did on the occasion of the Russian

default/LTCM debacle in 1998. A similar pattern

can be observed also for the spread between O/N

rate and the policy rate. This is due to the

dislocation observed in the money markets around

the world originated by the liquidity crisis caused

by the very restrained conditions in the commercial

paper market.

…

While this is not news to almost anyone reading the financial press, I wasn’t aware of how severe the situation is outside of the US and the euro zone. The text continues.

The most serious situation is in the UK,

where the 3mths – repo rate spread has

widened by 50bps to 100bps in the current

environment (please see Chart 3), practically

equivalent to two BoE 25bps rate hikes in terms of

market squeeze. In 1998, the same spread

remained in the 15/35bps area during the crisis

(was negative after the CBs interventions).

…

Brunello Rosa

Here’s one picture that summarizes the UK situation.

Chart 3 from IDEAGlobal, FX Alert, August 21.

So, don’t be fooled by sidewise trending in equity indices…and buckle your seat belt!

Technorati Tags: financial crisis,

LTCM,

money markets.

thanks

a few doubting thomases will be fixed with that simple graph

rgds pcm

Oddly enough, the worst of the financial firestorm may be hitting in Germany of all places, where the abuses of “asset-backed” conduits and SIVs were apparently greater than anywhere else:

http://ftalphaville.ft.com/blog/2007/08/22/6752/the-critical-state-of-german-banks/

This wondrous quote comes from an article overnight in The Guardian:

Alexander Stuhlmann, chief executive of Germany’s WestLB bank, said the problems in the US housing market were making it difficult for German banks to get credit lines from their foreign partners. He told reporters that German banks were in a “not uncritical situation”.

I took two years of German in college, and I’m imagining what “a not uncritical situation” sounds like auf Deutsch?

“a not uncritical situation” is in german

“eine nicht unkritische Situation”…

br

g. from germany

@Anarchus: Well in German it’s “nicht unkritische Situation”.

(FTD)

Back to Econbrowser: I wrote about the spike in the spread between Fed Funds and 3-month-bills yesterday in my (in German only) blog and I am puzzled too.

Bye egghat

Menzie,

Thanks for this update. You are not alone in not being aware how serious the situation is overseas. I think many were caught off guard last week, certainly the FED was.

Where can you find up today price to earnings ratios? – there’s a very good correlation between rises or falls in the p/e ratio and in the level of the index as a whole.

Closer to home, I talked to a friend of mine, who happens to be the senior currency buyer for a Dow Jones listed company. He told me that his company was unable to lay off a 1.5 billion dollar, well collateralized offering of receivables. The fact that this company is sitting on a lot of cash, tells me that no one is buying commercial asset-backed paper. I’m saying good-bye to my money markets and saying hello to non-taxable auction rate securities.

I doubt that the larger situation is actually worse in Germany than in the US. I think they are disclosing problems faster and treating them with due gravity, while we in the US are being given the mushroom treatment, perhaps with the idea that if failures are distributed over a longer period of time, the shock will be less severe. But, yes, it is going to be a bumpy ride.

So, is this a black swan event a la Taleb? Has their been any way to make any money on those several days in a row “25% standard deviation moves” that the Goldman Sachs fund made last week? Presumably somebody can (or could) make a pile on these spreads, if they forecast them right and the proper “black swan” puts were not already oversold.

BTW, for all the talk of the Fed being caught flat-footed, I would note that last fall NY Fed prez, Timothy Geithner, gave a speech in which he warned that the explosion of derivatives, both in kind and in quantity (a 50% increase in forex ones alone in the first half of 2006) was putting the Fed in a much more difficult situation than they faced in 1998. The complexity of the situation was much more severe, and he was quite open that they were unable to figure out what was going on, much to their own unhappiness, in sharp contrast with 1998.

So, maybe the Fed was caught flat-footed (although I think the discount rate cut was a rather smooth move), but the Fed knew that it was going to get caught flat-footed, and it appears that at least some people there had been losing sleep over the situation for quite some time.

It looks like a rate cut there may be needed more than one here and then the Fed could just follow.

Related article, from

Reuters yesterday. If this is what it looks like when the best-rated assets are being unloaded, what will it look like when the lower quality assets are sold?

Do we really think the FED was “blindsided” by all this? The FED has unlimited access to all the information from its own BLS data and other institutuions, this site and other sites who have warned of this dislocation many in detail. The FED and the goverment have seen it coming and allowed it to happen. What is the alternative? that the FED is incompetent? I dont know about you guys but if they guys who “know” everhthing because they invented the game get caught flatfooted does not inspire a lot of confidence. Of course all you need to do is do a little background check on the FED and its auspicious begginings to understand that there is more to it than meets the eye.

CT – all you have to do is go back and read what the Fed and FOMC were saying 6-9 months ago about prospects for the housing industry bottoming and the subprime crisis being contained to know that they’ve been consistently behind the curve since the game started late last year . . . . . as a conspiracy theorist you COULD argue that they weren’t saying what they believed, but the shifts in their FOMC voting actions were consistent with what they were saying at the time.

The only conclusion I can draw is that they got caught flat-footed. Others may disagree.

Glad that you are on the ‘doom and gloom’ bandwagon, now, Professor! It is going to be an ‘exciting’ ride.

Anarchus,

You (and some others) are right to point out that the FED was aware of a problem months ago but they were looking in the rear view mirror, as you say “behind the curve.” That is why they were caught flat-footed. They knew something was happening because they kept seeing the shadow behind them but the didn’t see it in front of them when they ran into full force.

As Conspiracy Theroist says they have all the research available to anyone. But data means nothing when your theory doesn’t work out and you are confused by what you are seeing.

For the past year they have been talking more about not knowing what is going on than debating what should be done. They appear to be frozed to inaction by their conflicting analysis.

They do not generate much confidence when they are seeing and discussing the issues 6 months before they happen and still step into it.

the way to cook up subprime b rated mortgages into aaa rated investment tranches is to dilute and refine the local and personal into something global and general that can best be handled by computers. computers can very rapidly analyse the rise of the tide, or even the fall of the tide, but are beaten every time by the turn of the tide.

computers can also exhibit ‘swarm intelligence’ as shown by schools of fish or flocks of birds. as each individual reacts to the distance and direction of those closest to it, the whole swarm / flock / bank moves as if of one mind. so a single computer may be rational, but thousands of computers, interlinked by access to similar information, can panic.

when the ‘zombie corpses’ begin to float in on the tide of ‘toxic waste’ – the finger of blame is pointed all around.

but it is not bush, bernanke, greenspan, china, bankers, wall street, mortgage lenders . . . . who are to blame.

the phenomenon is a mass phenomenon. the feeding frenzy on certain assets and the panic flight which follows, are both results of investors, or computers, analysing markets (i e what other investors or computers are doing ) and thus creating the overall effect of ‘swarm intelligence.’

if common sense threatens to spoil the game – opacity and complexity can be relied upon to bamboozle it.

Menzie,

Great work as always. The dislocation is about to become an amputation by freight train…

http://naybob.blogspot.com/2007/08/act-ii-prologue.html

With $400 Billion in LBO & ABCP already trapped in the pipeline…

theres another $550 Billion or 50% of the existing CP market maturing in the next 90 days.

Thats almost $1 Trillion that better find takers at near full price.

Anything less will result in more BK’s and some commercial banks going under as well.

Shades of the utilities & investment trust pyramids of 1929.

All will be told in the next 90 to 120 days.

Or could it be “crisis, what crisis?” to quote the UK chancellor Dennis Healy from the 1970s. It seems to me its always easy to get blinded by the numbers in these cases, which invariably seem mind boggling. Might it be we’ve seen the worst of this disruption already? That the DJIA has bottomed out at around 12500, that with employment looking positive and the effects of the crash in residential investment out of the way, a falling dollar boosting exports, corporate profits robust, that in fact they’ll be a continuing and strengthening recovery in the second half?

But then again maybe I’m just blinded by the lights of the oncoming train?!

Anarchus,

A friend just reminded me. It is a good thing that the FED does not understand its data. If they had known that the economy would have grown as it has the past 5 years they surely would have done everything they could to prevent it, you know prevent the economy overheating and all.

August 22, 2007

Well, the press is certainly champing at the bit to announce a return to normalcy!

In the best news of the day HSBC Canada issued a press release that included the paragraph:

HSBC Investment Funds (Canada) Inc., manager of the HSBC Mutual Funds, and H…