From Bloomberg, an anodyne to happy talk:

Treasury Sales May Rise 50 Percent as Deficit Suddenly Swells

By Elizabeth Stanton

Oct. 15 (Bloomberg) — Sales of Treasuries may increase for the first time since 2004 as the U.S. federal budget deficit expands, jeopardizing the biggest bond rally in five years.

Government auctions of bills, notes and bonds in the fiscal year that started this month may rise more than 50 percent to $220 billion, according to UBS Securities LLC, one of the 21 primary dealers that underwrite Treasury auctions. The first decline in corporate tax revenue since 2003 increased the shortfall by 12 percent to $162.8 billion for the year ended in September, from $144.8 billion in the 12 months through April.

With the Federal Reserve cutting interest rates to keep the economy from falling into recession and inflation slowing, an increase in net sales would mar an otherwise bullish outlook for U.S. government debt, which has returned 4.3 percent this year, Merrill Lynch & Co. index data show. Less than six months ago, Treasury officials credited a shrinking deficit for allowing them to eliminate sales of three-year notes.

“Unless the economy turns on a dime and starts to show strength again, we’re going to be looking at increased Treasury issuance beginning with bills later this year and spreading out across all Treasuries beginning in the first quarter,” said William O’Donnell, head of U.S. government bond strategy at Zurich-based UBS AG’s securities unit in Stamford, Connecticut.

UBS, whose economists are ranked the best on Wall Street in the latest poll by Institutional Investor magazine, forecasts a $225 billion deficit in fiscal 2008.

Deficit Forecasts

The difference for fiscal 2007 was the smallest in five years as tax revenue increased and spending rose at the slowest pace of George W. Bush’s presidency.

The improvement may be short-lived. The average estimate of UBS, Barclays Capital Inc., Banc of America Securities LLC, RBS Greenwich Capital Markets Inc. and Wrightson ICAP is for the shortfall to widen to $196 billion this fiscal year. All are primary dealers, except Wrightson, a Jersey City, New Jersey- based research firm specializing in Treasury finance.

The Concord Coalition, an Arlington, Virginia-based nonpartisan group that advocates a balanced budget, said it expects the deficit will continue to grow, exceeding $500 billion by 2013, if tax cuts slated to expire in 2010 are extended and spending increases at its historical rate.

“All else being equal, greater supply should lead to higher yields,” said Michael Pond, an interest-rate strategist in New York at Barclays, the securities unit of London-based Barclays Plc. The firm anticipates spending to exceed revenue by $200 billion this year.

‘Higher Yields’

Selling Treasuries is the government’s main way of funding the gap. The yield on the benchmark 10-year note due in 2017 rose 5 basis points, or 0.05 percentage point, to 4.68 percent last week, according to bond broker Cantor Fitzgerald LP in New York. The price of the 4 3/4 percent security due in August 2017 fell 11/32, or $3.44 per $1,000 face amount, to 100 16/32.

A National Bureau of Economic Research study in 2005 found that a 1 percentage point increase in the deficit as a share of gross domestic product, lasting for three years, adds 0.40 percentage point to 0.50 percentage point to 10-year note yields.

The deficit shrank to 1.1 percent of GDP in April and widened to 1.2 percent in September, according to Louis Crandall, the chief economist at Wrightson. The midpoint of Crandall’s forecasts for fiscal 2008 is $200 billion, or 1.4 percent of estimated GDP over the period.

“With that framework they will probably need to raise note sizes for the first time in some years by the end of the fiscal year,” Crandall said.

Reduced Sales

The government reduced sales of Treasury securities to about $142 billion in fiscal 2007 from a peak of $379.5 billion in fiscal 2004. The supply of marketable government debt rose 3.5 percent last year, the smallest increase since 1997.

Treasury bills, securities maturing in less than a year, were cut the most. Fewer bills were sold in fiscal 2005 and 2006 than matured, shrinking the supply by a $50 billion. The government decided in May to discontinue sales of three-year notes in part because officials said they wanted to “rebuild” issuance of bills.

The government retired $147 billion of the securities during the third quarter of fiscal 2007, helping to fuel a rally that pushed the yield on three-month securities to a 14-month low of 4.5 percent on June 18. That was less than a week after the 10-year note’s yield rose to a five-year high of 5.32 percent.

…

Three months ago, Stanley forecast a fiscal 2008 gap of $140 billion. It now appears likely to be about $180 billion, he said.

Net Borrowing

Net borrowing during the last three months of the fiscal year totaled about $116 billion, compared with the Treasury Department’s July 30 forecast of $73 billion. The agency is scheduled to forecast borrowing estimates for the current and following quarters on Oct. 29.

It now auctions $18 billion of two-year notes and $13 billion of five-year notes every month, the smallest amounts since 2001. Two-year sales are down from a peak of $27 billion in 2003. Five-year notes shrank from $18 billion when their frequency was increased to monthly from quarterly in August 2003.

“We have finally hit a point where the next change in auction sizes is likely to be up rather than down,” Michael Cloherty, head of U.S. interest-rate strategy in New York at the securities unit of Bank of America, wrote in an Oct. 4 report. The firm revised its forecast for the fiscal 2008 deficit to about $175 billion from $120 billion in April.

…

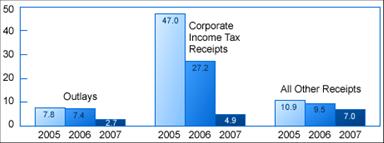

So, also say goodbye to that talk about the tax revenue surge (from CBO).

Figure 1: Growth rates, from CBO).

All this merely confirms what I noted in this post from August on the importance of focusing in on the full employment budget balance, and the implausibility of the budget outcomes the Administration had put forward.

Technorati Tags: budget deficit,

debt financing,

Treasury securities.

Obviously we just need more tax cuts! The old ones have just worn out.

Interesting post …it leaves me with a couple questions though:

1) Does this even include annual financing for the Iraq War? It’s common for the govt to try to hide things like this Enron style…

2) Since the dollar is continuing to slide shouldn’t this force higher interest rates also? Most purchasers are foreign countries after all and their currency is appreciating compared to the USD (except the Yen probably).

It really all depends on what the overall economy does. If the credit crunch was just a blip, we’ll go back on the flight path to $140B. If we go into recession, all bets are off.

Even if the deficit is $180B this year, that’s in the face of the 2003 tax cuts and Iraq war spending. Not bad if you ask me.

That article made me laugh. They glossed over the decline in the deficit for FYE 2007 and treated a prediction as if it had already happened. I wonder what their track record has been the last 4 years. Seems to me that the OMB and CBO, at least, have consistently underestimated revenue growth. Note also that they focus on corporate taxes, which are a relatively small piece of federal receipts.

Almost makes me think Al Hunt has a hand in the business news, not just slanting the political reports.

Buzzcut and Rich Berger get it. I also wondered about the intermingling of the “bond Market” and its price predictions and predictions on federal borrowing. At times it appeared to be saying because there are fewer Fed treasuries being offered that prices were going up. Well, Duhh!!!

The vast majority of ALL Fed Treasuries, public and intra-governmental, represent pensions. Where are the safe investments sources for that very large baby boomer generation now looking at moving their investments into safe investment vehicles?

BizLinks | 10.16.07

Risks Sparking Bailout Were Still in Shadows By Post-Enron Rules ($) Why lessons from the energy trader’s collapse didn’t shield us from the hidden effects of the mortgage meltdown. About That Oil Price — Yesterday’s $86-a-barrel close isn’…

180 isn’t good because it actually is much higher than that and going higher in the future sans the economy’s performance.

Yes, if the credit crunch was a blip (and all the median forecast is way off), then indeed revenues will likely continue to grow. Yes, the FY2007 deficit was relatively small, but that was then, this is now.

Rich Berger: OMB and CBO underpredicted revenue growth on the upswing; they’ll like overpredict on the downswing. That’s not a criticism — it’s an assessment of the forecasting enterprise in general. So if you believe in a slowdown in economic activity and profits, then you should be inclined toward thinking that the median estimate will over-predict revenues and under-predict expenditures (note that government outlays are countercyclical).

Be happy if we’re only at -$180B by this time next year. These numbers are based on projections of 2.9 percent growth in 2008 and 2.1 for 2007, and based on what Mr. Bernanke and Mr. Paulson and the realtors said today, I think they know that ain’t happening (or are they trying to goad investors into the stock market because they’ll cut rates even more? T’would be an interesting strategy with oil at $87+ and our dollar in the tank).

And with employment growth cut in half from over the last 4 months compared to the last 4 years of this expansion (90K/ month vs. 180K/month), where do you think all extra this revenue’s going to come from? The party’s over folks. It wasn’t very real for most people to begin with.

Oh wait, our fearless leader could ask to cut some of the $150B spending for the war to help our deficit, or he could roll back the tax cuts which have played themselves out (for the few lucky enough to benefit), and we’d be in a better spot……hahaha! That’s a joke son! Get it?

Menzie-

We’ll see. It does occur to me that your cited tendency to project rosy results on the downside could have been a major reason for the surplus projections in the waning moments of the Clinton administration. The actual surpluses were rather small – the projected surpluses were largely based on expectations which did not reflect the dawning recession.

Menzie, has anyone ever told you that you have a pessimistic bias?

I understand what you are saying, that there is a serious downside risk to the deficit if the economy is anything but “good”. Maybe “great”.

I just think that we all underestimate how much this economy operates on momentum. There will be growth tomorrow because there was growth yesterday. I’m not worried about the deficit at this time simply because growth, while positive, hasn’t exactly been stellar, yet the deficit keeps dropping. That’s momentum at work.

But maybe I just have an optimist bias.

or he could roll back the tax cuts which have played themselves out (for the few lucky enough to benefit), and we’d be in a better spot

What do you mean that the tax cuts have “played out”?

As long as I’m earning an income, the tax cuts are at work. The alternative is a tax increase, which results in me having less to spend and invest.

As of this second, the 10 year rate is 4.59%. Down 0.06% in a couple of hours. Go figure.

I would have guessed an incumbent bias.

This is not in reference to Menzie, who seems to call it straight.

A deficit of $180B at this stage of the economic cycle is not an accomplishment.… unless, of course, one considers being a Darwin Award nominee an accomplishment.

In 2000, we were expecting to have a $5T surplus by about now. Instead, we’ve added something like $3T to the debt. The war and recession are estimated as having contributed less than half of that, if memory serves. So, we’re talking about a $6T swing to the negative.

I have to agree somewhat with Charles. If you are comfortable with a $180 billion deficit 5 years into an expansion, you basically have to be comfortable with ever-expanding debt, never paying off the national debt. That strikes me as a very risky position.

On the other hand, believing in the 2000 projection of a $5T surplus by now seems like wishful thinking to me. That projection was made before the .com collapse. I have always thought that a large part of the economic growth of the late 90s was a mirage, just like the housing related growth of the last few years.

Charles-

Your numbers don’t add up. We were expecting a $5T surplus by now – that means that we were expecting surpluses of roughly $800 BN per year over 7 years? But Bush has contributed $3T in debt which would imply around $400BN deficits each an every year, which I do not believe has happened.

According to the last budget message delivered by that lovable lug WJC in Feb 2000, surpluses of approximately $160-215 BN per year were expected. Thats somewhere around 1.1 – 1.5 TN over seven years. What gives?

MattJ,

Why? In looking at one of the more recent charts, the last time the National Debt was at zero as a percent of GDP was 1860. So, in reality we are still paying down (not off) the Civil War. So, what risk?

MattJ-

Deficit in FYE2007 – 1.2% of GDP

Deficit in FYE1996 (five years into expansion) – 1.4% of GDP.

My take would be that as long as your overall economy is growing faster than your debt (and thus the debt to GDP ratio is going down), you can easily service that debt. No worries.

But what do I know, I have an incumbant bias. I’ll have to check Wikipedia to see what an incumbant bias is.

Rates are down to 4.55%. Down over a tenth of a point in half a day.

WHAT ABOUT THE DEFICIT?!? Don’t you stupid traders know that the deficit is going to be $180B this year?!? If we’re lucky!

I think the Indian stock market spooked some people into buying T-bills. Can you say “Flight to Safety”?

Rich Berger: Please see the top figure on page 21 of this CBO document from January 2002. You can see how much of a change in projected deficits came from economic factors relative to January 2001, when it was already apparent the economy was slowing.

Buzzcut: I don’t think anybody’s called me pessimistic to my face. However, people do say I’m skeptical, which I take to be a compliment. Social scientists should be skeptical, or else we’d believe in cold fusion and tax cuts that pay for themselves.

Menzie Chinn

What do think about last TIC data ?

Is it just a august momentum regarding liquidity crisis or a selling sign from big T-bonds olders ?

Maybe treasury will not remain a safe heaven in 2008.

Rich Berger says, “Your numbers don’t add up. We were expecting a $5T surplus by now – that means that we were expecting surpluses of roughly $800 BN per year over 7 years? But Bush has contributed $3T in debt which would imply around $400BN deficits each an every year, which I do not believe has happened.”

I specifically stated that these were rough numbers, Rich. Getting the exact figures takes time. But they aren’t far from what I said they would be.

Actual on-budget deficits for 2001-2006 have (http://www.cbo.gov/budget/data/historical.pdf) been: 32.4, 317.4, 538.4, 568.0, 493.6, and 434.5– about $2.4T in on-budget deficits in just six years (see table 1).

For the projections of surplus, there were significantly different opinions from OMB and CBO. However, OMB had a much better track record on predictions than CBO for the period 1995-2000 thanks to the leadership of Alice Rivlin. As of August 2001, this was the story:

OMB’s mid-session review of the federal government’s numbers projects a surplus of $173 billion for fiscal year 2002, lower than the $231 billion projected in April. Over the long-term, the 10-year budget projection from 2002 to 2011 is $3.1 trillion. That 10-year projection, however, stood at $5.6 trillion earlier this year, before the impact of the tax cut.

Granted, that surplus included the SS surplus. But from the CBO budget, the SS surplus is ca. $1T. Even if we pro-rate the remaining $4.6T (so that we can compare on-budget apples to apples) for 8 years of Bush, that $3.7T of surplus that has vanished and already $2.4T in deficits that have appeared.

I think you need to spend some time over these things. Our nation is in serious financial trouble, and it is largely due to punk supplysideism.

____

Buzzcut, if you look it up, “incumbent” contains no a’s. “Incumbent bias” refers to whether the occupant of the White House happens to belong to the same party as the person making an economic argument.

OMB and CBO underpredicted revenue growth on the upswing; they’ll like overpredict on the downswing. That’s not a criticism — it’s an assessment of the forecasting enterprise in general.

Indeed. They’re always off this way, which is why the happy talk is just as ridiculous as the same in 2000 and early 2001 when it was clear that a slowdown was going to happen, as you note. Kind of strange that no one’s figured out a good way to correct it.

The charts also point out that the corporate tax (and similarly, capital gains) are particularly volatile with the economy. I suppose that could say something about possible pitfalls in relying on such taxes.

Of course, even a $225 billion deficit for FY 2008 isn’t that large by historical standards. That’s still looking at 1.6-1.7% of GDP. More than predicted back in August by the CBO, certainly, though.

But debt held by the public as a percentage of GDP is actually going down this year. And it is around 36.5% now, right around where it was after FY2003 (and underneath that of FY99). For all the talk of debt, it’s not increasing nearly as fast as in the 80s, not least because defense spending as a percentage of GDP is still 4%, below any pre-1995 number since WWII. So the doom and gloom as far as the short term is exaggerated. (The long term outlook remains unsustainable, as it has.)

Charles-

Your new numbers aren’t any improvement over your original ones. For one, as you notice, you quote the deficits excluding the SS surplus, while the 5.6 TN surplus was based on the unified budget. The document that Menzie has cited (which I will be interested to read on the train this evening) indicates that the tax cut reduced the surplus by $1.3TN over 10 years. For argument’s sake I will accept that.

The country is not in a fiscal criss – I think John Thacker provides some evidence to that effect.

Menzie – thanks for the citation.

Thanks to all for a lively exchange. I re-start it in my newest post.

Thanks for hosting it!

Rich Berger says, “Your new numbers aren’t any improvement over your original ones. For one, as you notice, you quote the deficits excluding the SS surplus, while the 5.6 TN surplus was based on the unified budget. The document that Menzie has cited (which I will be interested to read on the train this evening) indicates that the tax cut reduced the surplus by $1.3TN over 10 years. For argument’s sake I will accept that.”

The Republican-run CBO has been a disaster, Rich. Their predictions have been embarrassing. I would only use them for historical data, never for projections.

Crippen’s testimony, for example, projects 2002-2011 “on-budget deficits that add up to $617 billion.” We already know that is horse apples. The diagram Menzie points to predicts a $100B surplus in 2006– that’s way off! And the reason that the figure on page 21 shows such a small change for 2002-2008 is because they are predicting massive surpluses for 2007-11.

As for using on-budget vs. including Social Security, the Bush tax policy has essentially no effect on Social Security. Therefore, whether one compares on-budget to on-budget or total to total is a second order correction.

And you’re forgetting the effects of the wild spending of the Republicans, which created new definitions of pork, not to mention the changes to debt service that the fall in revenues and the porking create. And then there’s “technical changes.”

I’m all too familiar with the phenomenon of people who don’t want to see. Please, continue to deny the growing fiscal crisis. The truth is very evident to anyone– ANYONE– who wants to look at the facts fairly.

Well, Charles, your last comment reminded me of the following observation:

How to win a case in court: If the law is on your side, pound on the law; if the facts are on your side, pound on the facts; if neither is on your side, pound on the table.

Keep pounding the table. I’m moving on.

Rates are down to 4.41% on the 10 year.

Recession wories dominate deficit worries, evidently.