The credit crunch seems to be worsening, rather than lessening, and the conundrum seems to have disappeared.

Chart 2 from DB, GEP Nov. 12, 2007.

From Deutsch Bank’s Global Economic Perspectives of November 12th:

Chart 2 illustrates the development of tensions in the

credit market using credit default swaps for investment

and high yield European corporate bonds as measured by

the iTraxx Europe and iTraxx Europe crossover indices. As

in the money markets, tensions peaked in summer (with

high yield CDS spreads reaching 463bp on July 30) and

subsequently eased off. However, spreads have widened

again since mid-October.

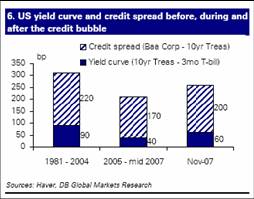

It seems that not only are credit spreads widening; so too are term spreads. This is shown in Chart 6.

Chart 6 from DB, GEP Nov. 12, 2007.

It might appear that the two phenomena are unrelated. But the DB article argues that while banks pursued off-balance sheet activities such as “rating transformation” (transmuting assets of one credit default risk category to another category by financial engineering), they moved away from reliance on maturity transformation and taking on credit risk. With the end of the structured credit market, and reorienting of banks’ operations, credit spreads and term spreads will reappear.

Interestingly, as Chart 6 illustrates, term and credit spreads are not back to where they were pre-2005. However, in terms of the latter, they’re close. And, as time on goes on, one might very well expect further curve steepening.

Figure 1: 10 year – 3 month spread; NBER defined recession shaded gray. Source: St. Louis Fed FRED II, NBER, and author’s calculations.

One digression/observation: the last time the 10 year – 3 month yield curve inverted (monthly average of daily data basis) and was not followed by a recession was over 30 40 years ago (1966M09-1967M01).

On the recession watch front, one of the more sophisticated analyses, by Willem Buiter in Maverecon, noted today that we should not be focusing on the size of the mortgage market, and the write downs of asset backed corporate paper associated with the sub prime market. He notes that these writedowns are on “inside assets”, so one bank’s loss is some other institution’s gain. Hence, there are big first-order distributional effects, but the net effects are second-order (although they could still be large in numerical terms).

That being said, his conclusions regarding the overall course of the credit shakeup are sobering:

The destruction of value and wealth thus far in the US as a result of the housing sector crisis is manageable. Its effects are mitigated and could well be more than offset by the strength of the export sector. However, the sub-prime crisis is but the tip of the credit risk mis-pricing iceberg. Unsecured consumer loans and car loans, and the large stock of ABS backed by credit card receivables, are waiting to join the credit risk-repricing party.

The single best thing that could happen would be for the true magnitude of the losses suffered by banks and other exposed parties to be revealed and put in the P&L. Until what happens, fear of getting stuck with the hot potato makes banks unnaturally unwilling to extend credit against the kind of collateral that they would not have thought about twice accepting at the beginning of the year.

Continued global economic growth and dollar weakness are a necessary condition for the US to avoid a serious slowdown, or even a recession. While both may continue to materialise, the risks to global growth are higher than generally recognised and rising.

[Late addition, Nov. 13, 5:40am Pacific]

Brad Setser discusses the prospects for the dollar here

Technorati Tags: subprime mortgages, housing market; credit crunch, credit spread; term spread, recession; rating transformation, asset backed corporate paper.

November 13, 2007

Menzie Chinn at Econbrowser has reviewed credit and term spreads:

He notes:

It might appear that the two phenomena are unrelated. But the DB article argues that while banks pursued off-balance sheet activities such as “rating transformation&#…

It seems rather obvious that the dollar will continue to fall in any case because the national saving rate of households is going up and will continue to do so. Increased savings should make the dollar go down, all things being equal. (Of course, in general, they aren’t.)

When home price appreciation was high, the savings rate declined, as it made sense under those circumstances to acquire assets in the form of homes. Without that, returning to savings makes sense.

Also, naturally, various macroeconomic theories have been saying that the dollar was overvalued for years.

the dollar was overvalued for years.

so the dollar is bound to go down. so gold is bound to go up. no marks for that – but if you can tell us, on the day, when the gold spike hits the top floor, and the dollar collapse hits bottom – why then you will be good. really good.

.

I cited the chart in my blog. Enjoyed seeing these unique charts.