Do the ongoing surge in gold and oil prices and slide in the dollar signal a resurgence of inflation?

Gold climbed over $830 an ounce this week,

|

while oil held its ground at $96 a barrel:

|

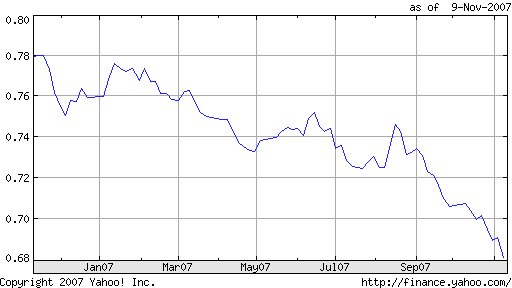

The dollar fell to 0.68 euros, setting a new all-time low each day:

|

Each of these developments means a decrease in the purchasing value of a dollar– a dollar will buy you significantly less gold, less oil, and fewer euros than it would have in September. It is thus natural to wonder if the three developments might be related manifestations of a single phenomenon, namely, a resurgence of inflation.

It is important to remember first the scale of these figures. Gold is up 24% and oil 34% since the beginning of September, while the dollar has only slid 7%. The price of gold and oil has gone up substantially for everybody in the world, regardless of the currency used to buy them. You would have had to surrender 61 pounds of coffee to get a barrel of oil in September. Today you’d need 79 pounds of coffee to get that oil. The explanation of that fact should have little to do with the value of the dollar or inflation.

Granted there is a direct implication of rising oil prices for inflation in the sense that a dollar now buys less than it did. But if 4% of your income is spent on oil and the oil price goes up 34%, your cost of living has only gone up by 1.4%. Imports overall would represent a higher fraction of spending than energy alone, but the prices of imported goods will likely increase by significantly less than the amount of the dollar depreciation. So certainly there are implications of the movements in oil prices and the dollar for the overall inflation numbers that we’ll be seeing in the next few months, and when translated into an annual rate, these numbers are big enough to be noticed. But the actual inflation picture must be an order of magnitude smaller than that conveyed by oil, gold, or the dollar alone.

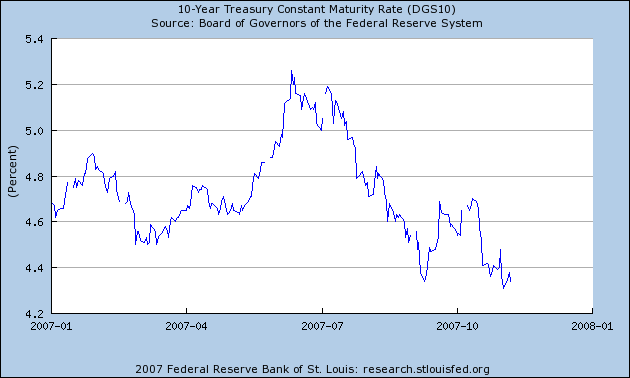

Is there a case that these three markets might be regarded as early harbingers of broader increases in the dollar prices of other goods and services that are yet to come? Certainly inflationary expectations could be a factor driving all three markets. But I would expect a broad inflation fear to show up first in long-term nominal interest rates, and these have in fact been sinking lower over the last few months.

|

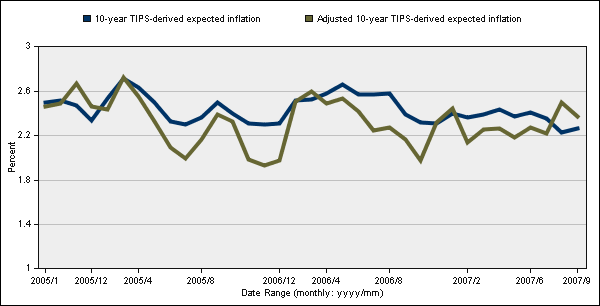

Consider also the Treasury Inflation Protected Securities, whose coupon and principal are both guaranteed to rise with the consumer price index. The nominal yield minus the TIPS yield should reflect investors’ concerns about future CPI inflation. This gap has in fact been declining over the last two months.

|

I am therefore inclined to interpret the increase in the relative price of oil and gold as driven by real rather than nominal events. In the case of oil, the stagnation of global production strikes me as far more important than anything done by the U.S. Federal Reserve. Geopolitical tensions in places such as Pakistan, Iran, and Iraq could lead to further disruptions in world oil supplies and are likely a factor in gold’s run-up as well, as would be ongoing concerns about financial instability in the U.S.

To the extent that there is a monetary explanation for the recent behavior of oil, gold, and the dollar, I would attribute it not to inflation fears per se, but rather to the lowering of U.S. short-term interest rates, which make the dollar a less attractive place to hold capital and can make commodity speculation more profitable.

But insofar as these relative price movements do themselves have undeniable direct inflationary consequences, they are hardly developments that the Federal Reserve is free to ignore. The fact that long-term inflation expectations have been slow to move up in response to recent events has been an asset for the Fed so far. But if those expectations do start to move up, that same sluggishness will become a significant problem as the Fed looks for some way to bring them back down.

Technorati Tags: macroeconomics,

Federal Reserve,

interest rates,

inflation,

commodities,

oil,

oil prices,

gold,

exchange rates,

dollar

What you seem to ignore is that both crude and gold turned up essentially simultaneously at almost exactly the moment that the Bernanke Fed began its inflation creating tap dance in mid August.

No my friend, I fear that the markets have just taken the measure of Mr. Bernanke and found him to be a clear and present danger, a danger of a sort that we have not faced for close to three decades. The largest money runners no longer listen to what the Fed says but only watch what it does. When I asked one South African player (whom some of you may know) for his reaction to this week’s contradictory statements from Fed spokesmen his response (in part) was, “listen, laugh and lay on leverage.” Cute, but telling.

When the money runners rapidly move to protect wealth it is seldom wise to stand in front of them.

And with Ben Bernanke sitting in the big chair it is the protection of wealth from being inflated away that is job one. That job is being done rapidly, as the crude and gold charts above so indicate.

With respect to the “signalling ability” of ten year T paper, well, it seems that much of that ability was lost when the PBC and other central banks became the big buyers and holders.

Listen, laugh and lay on leverage.

And pray.

I think the question is really, how low does the dollar have to go before the Chinese break their peg and will they do so before the Saudis price oil in some other currency?

Interesting that medical, education and real-estate (even post mortgage crisis) have also skyrocketed.

Suppose (for the sake of arguement) CPI was completely bogus, and the real inflation rate was much higher. What would the end-game look like?

It would be intersting to compare monopoly-style business that have more pricing power to other businesses that would try to combat inflation by raising efficiency.

JDH: After reading economic blogs for a while, Ive come to think of inflation as a monetary phenomenon. And if that is true, then I dont see how the increased price of oil and/or gold can be inflationary. If the monetary supply remains the same, increased energy costs mean more money circulating into energy, or less energy purchased, and presumably deflationary pressures in other segments of the economy. I dont have enough background here, but Im no longer a believer that increased energy costs are inflationarywhat matters is the feds response, e.g. if the fed tries to inflate away recessionary pressures that may result from higher energy costs.

Joseph: Similar to my above comment, Im not sure whether I see a movement away from dollars as significant. Currencies are traded on the world market. Oil can be priced in any currency. I just dont see this as an issue. Unless we experience hyperinflation, it seems to me that Saudis can take dollars from oil and convert to whatever they want. Only in the case of hyperinflation when they lose value between the time they take those dollars and convert. We arent anywhere near that can I cant imagine we will be.

JDH,

I agree with you on oil and the dollar.

Gold looks more speculative, not so much based on “real factors.” Are we suffering problems in gold production? Certainly there is a lot of worrying about international tensions, as well as fear of inflation out there globally, all of which pushes gold up.

But the last time gold went up this high (still not up that high in real terms, not close), it fell rather sharply some time later, although silver fell harder and more suddenly (and sooner), although I could be mistaken.

Oil fell sharply in 1986, but that was because the Saudis, suffering internal budgetary pressure, finally tired of propping up the price above $30 per barrel while both Iran and Iraq were chronically and massively cheating on their OPEC quotas in order to buy weapons for their then increasingly long war with each other. The Saudis finally got sick of it, opened up their taps, and the price fell to $9 barrel by around July, 1986, causing then-VP George H.W. Bush to fly suddenly to Riyadh to beg then King Fahd to scale back a bit to save the behinds of all the Texas realtor folks who were suddenly falling into deep doo doo. He did push the price back of oil back up into the teens, but US taxpayers still got to pay out about $100 billion to cover all those depositers who would have gone down otherwise in the great S&L crisis, whose epicenter was Texas, starting that summer in 1986.

Part of the run in gold, I think, has been a global “flight to safety”. In the good old days when we had a big, liquid, reliable currency (the DM), the deutschemark would go off on a run at times like this. Right now, if you’re a global investor and worried about systemic shocks and the outlook in the U.S., where do you hide? Gold might seem like a decent currency substitute.

In the U.S., I think “flight to safety” is also why the ten year treasury yield has declined from the low 5’s in mid-Summer into the low 4’s presently. The mortgage debacle has spread into a broadly based credit crisis and fear and panic gets people fleeing into safe fixed income paper.

But they’re not scared of inflation. So Inflationists either have to argue conspiracy theories (the gov’t is cooking the inflation statistics AND gullible fixed income investors have bought the story hook, line and sinker) or that consensus fixed income investors have gone totally insane and are gobbling up 10 year gov’t bonds and pushing yields down even as true inflation expectations rise – though of course that doesn’t show up in TIPS spreads either. More of Dick Cheney’s work, presumably.

Question: Is comparing gold and oil prices kind of an apples and oranges thing? The uses for the two items are very different. I’ve rarely heard of people buying oil in order to hedge against inflation (though it’d be funny if they did), and I’m not 100% sure, but I don’t believe that the demand for gold increases as a country becomes more industrialized.

But most goods and services are transported by oil driven means. And, of course, oil is also used in the production of many goods.

So, as oil rises, the oil-cost portion of production costs is also increasing.

Won’t this cause across-the-board inflation at some point?

JDH wrote:

But insofar as these relative price movements do themselves have undeniable direct inflationary consequences, they are hardly developments that the Federal Reserve is free to ignore. The fact that long-term inflation expectations have been slow to move up in response to recent events has been an asset for the Fed so far. But if those expectations do start to move up, that same sluggishness will become a significant problem as the Fed looks for some way to bring them back down.

The most important paragraph professor! Thanks.

Concerning long term interest rates we must understand that they are based on long term averages. The inflation that is being injected into the economy now will not become manifest for 4 or 5 years. That means that the FED could reverse its inflationary stance and instead deflate. Concerning interest rates this would average with the current inflation and as a result the CPI could remain relatively low. Long term interest rates are measuring the average long term anticipated inflation. For the next year or so that is still a question though the current trend is inflation.

What bothers me about the FED’s monetary roller coaster is that it injects inflationary mistakes into the economy and then jerks the economy into a deflation in an attempt to correct the inflation. The result is inflationary and deflationary problems existing at the same time. I believe that the real estate problems and oil prices are a manifestations of their inflationary mistakes. They will probably soon begin a deflationary policy and we will begin to see the manifestation of deflationary problems such as the squeezing of profit margins and an increase in bankruptcy of marginal businesses (especially start up businesses). The FED has been able to manipulate the statistics to reduce the number of recognized recessions but I am not sure that has been good for the longer prosperity of our economy. If you have one hand in the freezer and another in boiling water so that you average 75 degrees I doubt you would consider yourself as comfortable as your total environment being at room temperature.

General Specific, the rise in oil and gold do not cause inflation, they are a manifestations of inflation. Gold and oil are relatively “pure” commodities and so respond to monetary mistakes more quickly than other goods and services. They are indicators not causes.

Consider the deflation that gold signaled beganing around 1996. The talking heads did not see it manifest until around 1999-2000, but the deflation was in full swing by then as indicated by both the price of gold and oil. What is important about the professor’s comment I quoted above is that by the time the FED indicators begin to tell them to do something about inflation it will have been running for a number of years. Turning the economy is like driving an ocean liner, it has a huge turning radius.

Is there a way to investigate how much the political entities, China and Japan Inc.’s together with the Oil oligopoly, have a strangle hold in the 10yr T-bills? Inflation expectation may be artificially low, if the proportional amount of the overall T-bills held by these entities is large?

Let’s talk about inflation, shall we?

I’m a computer geek and hacker. I get the Fry’s flier in the paper every week, and I keep track of prices for a lot of items.

Computer memory prices have completely collapsed. What would have cost you $200 last year is now about $40.

Memory is in all kinds of electronic items: iPods, TiVos, whatever.

That’s some insane deflation there!

CPU prices are down a lot too. You can build low end PCs for less than $200 without any trouble whatsoever, as long as you’re comfortable running some variant of Linux.

In fact, the biggest impediment to cheap PCs is having to pay the “Microsoft Tax”. Licenses of XP and Vista are more than half the cost of low end PCs.

So, here’s my question: what is more important to the overall inflation rate? $100 oil or $40 memory (2 x 1GB DDR2 667).

Maybe the Perfessor is having market impact today!!

Oil is off smartly to $94, and Gold is down over 4% to under $800 on what’s being called, “the rout of the risk averse” . . . . . .

“So, here’s my question: what is more important to the overall inflation rate? $100 oil or $40 memory (2 x 1GB DDR2 667).”

I say neither. I’m still of the opinion that inflation is a monetary phenomenon. Period.

buzzcut: oil or memory? How about food, rent/housing, medical care/drug costs, electricity, heating and water. After that, it’s all luxury to various degrees, IMO.

How about food, rent/housing, medical care/drug costs, electricity, heating and water.

No doubt, those are important things.

But how do cheap computers effect the prices of those things?

Computer server prices are based on the component prices of the things that go into servers. As I said, those component prices are in freefall.

What do cheap servers or computers allow you to do?

Shop at home, certainly. I don’t burn gas when I browse at Amazon rather than going to the mall.

Drug research and oil exploration are all computationally intensive. Cheap computers all help there.

I’m still of the opinion that inflation is a monetary phenomenon.

Could you say that again?

I think that Milton Friedman is rolling over in his grave, being quoted approvingly by General Specific.

Okay. Inflation is a monetary phenomenon. How would one know if the money supply is expanding in this interconected world. Whose money supply?

Thank you for putting so many pieces of the puzzle together. The status of inflation and the two commodities in question was certainly begging for discussion and this did nicely.

I wish I was as sanguine about the Fed as you though.

While this sentiment…

But insofar as these relative price movements do themselves have undeniable direct inflationary consequences, they are hardly developments that the Federal Reserve is free to ignore.

might be reasonable at other points in time with other circumstances, considering how freely the Fed ignores so many other inflationary signals, I’m not sure it’s appropriate.

He didn’t get the nickname “Helicopter Ben” for his pilot skills.

coffee17 …

Yes, inflate the cost of survival goods and deflate the cost of luxuries (esp. electronic toys).

An economy tailor made for “loyal Bushies.”

Or, as RBC might aver, “sounds good to me!”

Buzzcut,

Thanks for appreciating the deflationary forces of technology.

All semiconductor and magnetic storage products depreciate at a rate of 20-40% a year, depending on the dynamics of that particular subsector.

This leads to deflation in the prices of PCs, flat-screen TVs, iPods, Broadband connections, cellphones, new electronic systems that go into cars (what was in $100,000 cars in 2000 is in $25,000 cars today), game consoles, home networking equipment, hard drives, etc.

As these become a bigger piece of the consumer spending basket, they necessarily offset inflation elsewhere (but do cause real-estate to rise, due to the additional disposable income people now have).

Read this superb article titled “The Impact of Computing” to appreciate this concept more deeply.

the monthly TIPS spread chart is a little deceiving; a look at daily moves provides a different impression: inflation expectations are still relatively low, but they have been on the rise in recent weeks…

http://www.clevelandfed.org/research/inflation/TIPS/index.cfm?state1=1&state2=&state3=&state4=&startDate=01/01/2005&endDate=11/12/2007&freq=daily

link

JDH,

Does supply and demand also apply to long term Treasury Securities? Is the yield falling (price increasing) because the U.S. govt is not supplying enough debt (aka Treasury Securities) for demand? Treasury Securities are a liquid asset for the public. I know this goes against the conventional wisdom that govt debt is bad (unless you are in the same camp with Abba Lerner or William Vickrey). I don’t buy the argument that bigger deficits increase interest rates or weaken the dollar (the 1980s for example). Is it possible the govt is wrongly using monetary policy when it should be using fiscal policy (resulting in falling dollar, high gold and oil prices and falling Treasury yields)?

Thanks for the link, GK.

Trying to address esb’s comment regarding inflating “survival goods” vs. deflating “luxuries”, the point to grasp is that oil is a declining share of the economy. Silicon is an increasing share, as computer power is applied to more and more processes.

For example, I recently leased a new Saab. There are on the order of 15 computers in the thing, everything from the navigation to the memory seats to the rear park assist.

Saabs have an extremely powerful engine computer, by engine computer standards. That’s an example of how silicon replaces oil. The car gets better mileage because it has a powerful computer controling the engine.

Where might silicon really replace oil? More and more driving fuctions are being automated. Automated cruise controls, which use radar to maintain closing distance between vehicles, is the best example. Some automated cruise controls can drive for you in traffic. All you need to do is steer!

Honda has a system in England that steers for you on the highway. It keeps you in your lane. Combine that with active cruise control, and you’ve got an automated driving system.

Think about this: that automated driving system could be optimized to maximize mileage, even in traffic. Or it could be wirelessly networked, or whatever. Major mileage gains could be available through such a system.

Guys, guys, price decreases are not deflation. Deflation is a degredation of the value of the monetary unit. If technology makes something cheaper that is not deflation because it has not changed the value of the monetary unit, but the value of the commodity.

Dick, how would you know the difference?

To me, a price decrease is a price decrease. It would be hard to know WHY it decreased (technology vs. “decrease in the monetary unit”).

Dick, also, to better illustrate my question:

In the late 1800s, prices were decreasing. Were they decreasing because of monetary policy, or the industrial revolution?

Dick-

Seems to me that deflation is defined as a contraction in the volume of money in circulation, resulting in the erosion of price levels on goods… Inflation is the converse- an increase in the volume of money in circulation, resulting in the increase of price levels on goods.

Virtually all commodities and manufactured goods that require energy inputs for production, (food, plastics, metals, concrete, transportation…) are directly impacted by higher oil and gas prices. Higher prices (inflation) is inevitable.

It doesn’t require a rocket scientist to realize that the source of the inflation we’re experiencing is directly related to the exponential increase in U.S. dollar M3 since 1994. (The frightening increase in M3 is the primary reason why the government no longer reports it)… Bend over folks- 1983 style interest rates are right around the corner… There’s $13 trillion floating around out there… About one-third of it needs to be mopped-up while the Euro and soon the Renminbi become the preferred international trading currency.

If you long for a dollar that holds its value: Lobby your congressman to tax the hell out of imported oil and gas as well as subsidize domestic renewable energy; Encourage your acquaintances in small and medium sized business to get some ambition, and start marketing internationally; Make an effort in your personal life to preferentially purchase American manufactured goods and encourage your friends to do the same; Call a spade a spade, and publicly chastise the U.S. Treasury and the Federal Reserve for expanding the money supply too much, addicting the nation to short-term junk food (fiat money) rather than the more nutritious and sustainable variety that comes from a current account surplus.

I came across this link at FT.com and thought it might make an interesting debate for a future blog topic: http://blogs.ft.com/maverecon/

In particular, I suspect there are really implicit estimates for future affluence/retained_productivity that are revised downward when masses of people can’t pay their mortgage/rent.

These arguments are commonly made and seem flawed.

The price of 10yr Treasuries is completely distorted by demand from “non profit oriented entities” – thus the failure of long-term rates to rise is not meaningful. Comment?

Similarly, any analysis referring to TIPS. TIPS spreads are based upon the utterly ridiculous & fraudulent calculation of inflation by the government. Thus the post should read: “TIPS yield should reflect investors’ concerns about future CPI inflation (AS CALCULATED BY THE GOVERNMENT). REAL INFLATION could be, and is, significantly higher, but it irrelevant for the pricing of TIPS. Comment?

Paul, Mark, and others:

You’re right that foreign central banks have been big buyers of U.S. Treasuries. But what always matters is the marginal, not the average, investor, and the question is why would everybody else leave money on the table? I grant that there may have been some effect of the volume of foreign purchases on the 10-year nominal yield, but I think it is best to regard this to a first approximation as an effect on yields generally.

As for the inaccuracy of the CPI, surely it has a broad connection with what we’re talking about. You really believe we’re going to see a ferocious inflation over the next 10 years but the CPI is only going to rise at a 2.3% annual rate? What in your opinion is a better way to combine what happens to the price of oil, coffee, and computers?

General S.,

There is a school of inflation watching which relies on commodity prices in preference to most other things. Gold and oil are often lumped together because both are commodities. You are right that they serve very different economic functions and have very different implications for transmitting inflationary impulses. Gold can fairly be said to have no significant transmission effect, outside of any influence it may have on expectations. If you were to wander over the “The Big Picture” you could get a flavor of this school of thought. Nothing our host here could say would change the view at Big Picture.

Greenspan noted some years back a rule of thumb that is used within the Fed with regard to oil prices and their impact on economic performance. When growth is at or above trend, the biggest impact of higher oil prices tends to be inflation. When growth is below trend, the biggest impact tends to be to slow the economy further. It isn’t hard to see how relative pricing power serves to make this work.

We should also probably distinguish between periods when high oil price resulted from supply interruption and periods when high oil price resulted from demand rising faster than supply, without interruption. Recession is a reliable result of oil supply interruption. Recession is not a reliable result of high prices alone.

Paul D great post on fradulent CPI and he ludicrous adjustments made. No there is no inflation – it is just above “trendline” everywhere but the US and that is with the dollar collapsing. I guess we just have to pat ourselves on the back for our “productivity” advantage. Another ludicsour proposition.

The Us Debt market being the deepest and most liquid is probably the biggest asset bubble going. Thre lesser evil I guess.

if everyone is going to protect their currency export advantage, how does that work itself out in the traditional game theoryu sense? This notion that nobody loses and everyone wins is equally proposterous.

Gold rally reflects both an inflation hedge and a flight to something real. A craving for something other than paper.

This things gets fixed only when the govt steps in and nbails the markets out and that will have grave consequences. When Empire fails.

Buzzcut

In the late 1800s, prices were decreasing. Were they decreasing because of monetary policy, or the industrial revolution?

The currency was anchored to gold in the 1800s so price decreases had to be primarily from increased production not inflation.

MarkS,

Inflation is more a function of monetary demand than money supply. I know that the monetarists including modern Austrians consider increases or decreases in money supply as inflation or deflation but the data often goes counter to this Quantity Theory of inflation.

Your best measure of inflation that has not yet become manifest is the price of gold because it is overwhelmingly monetary compared to other commodities. It is not perfect but it is what ahead of what ever is in 2nd place. Gold flying up to $850 and ounce is a serious indicator just as gold falling to $278 in 1998 signaled deflation (along with $10 oil).

I think it is very difficult to measure “inflation”. There are so many prices in the economy and any measurement has to focus on a subset, and adjust those prices for differences in quality over time. Any measure is going to involve quite a bit of guesswork. How do you distinguish between movements in relative prices (such as the current rise in oil price) and a general increase in the price level. Using oil and gold as indicators is flawed, too, because supply and demand in these markets distorts the price signal. Consumers can adjust their expenditures when on price goes up – an increase in one price does not have to be inflationary. I understand that there was inflation in Europe due to the increase in supply of gold when Spain was colonizing the New World. Do we want to claim that there has been no net inflation since 1980 because the price of gold now is roughly the same as it was back then?

Milton Friedman advocated a fixed rate of increase in the money supply primarily because he expected prices to fall with productivity gains and he wanted to keep prices relatively stable.

I am amused by sources such as Shadow Statistics, who apparently claim that prices are really rising at 8-10% per year. I think precise measurement of inflation is impossible. If someone told me that real inflation was as low as 1.5% per year or as high as 3.5% per year, I could buy it (after examining their evidence). But not 8-10%.

Dick-

I believe that deflation is defined as the erosion of price levels of goods due to the contraction of the volume of money. Inflation is the converse: Price levels increasing due to the expansion of money volume.

The exponential expansion of dollar-M3 since 1994 to nearly $13-trillion, clearly illustrates America’s profligancy. It also underlines the source of the dollar’s exchange rate erosion and why the FED has been warning of inflation since 2005.

There are of couse no free rides in economics. The last 40 years of Amerian current account deficits and the 6.6 Trillion dollars they represent amount to a hidden tax: The loss in value of all dollar denominated asets; The sale of American business overseas; And the eventual erosion of America’s industrial base and standard of living.

In Louis XVI’s France, a few economists (e.g. Turgot), realizing that the state finances were on a crash course, argued that, in order to preserve at least part of the status quo, the nobility had to relinquish some of their privileges (specifically, their exemption from paying all taxes). Their stark advice fell into deaf years and the economists ended up quickly losing their jobs.

On the other hand, most of that time’s economists, vying for the nobles’ favor and appointments, reassured them that things were working the way they were supposed to, and that there was no need to part with any of the practices that had been established by history. Their soothing advice was welcome by the nobles who, by following it, in a few years had parted with their lands or their heads.

Today, a few economists realize that the US dollar status as the international trade and reserve currency is inherently precarious, arising as it does from its voluntary acceptance by foreigners:

“It is the market that made the dollar into global money — and what the market giveth, the market can taketh away.”

“At present, Americans and non-Americans alike make and receive international payments in dollars because they have confidence that dollars will, relative to other transaction vehicles, retain their value well in future commercial transactions. It is hardly science fiction to imagine a tomorrow in which this is no longer the case.”

“The status of global money is not heaven-bestowed, and there is no way effectively to insure against the unwinding of global imbalances should China, with more than a trillion dollars of reserves, and other asset-rich central banks come to fear the unbearable lightness of their fiat holdings.”

Benn Steil, Director of International Economics at the Council on Foreign Relations, 2007

http://www.foreignaffairs.org/20070501faessay86308/benn-steil/the-end-of-national-currency.html

and

http://www.cato.org/pubs/journal/cj27n2/cj27n2-10.pdf

“Falling US interest rates would make the control of inflation even more difficult within the emerging world, eventually increasing the temptation to “go it alone” and leave the dollar to its own destiny. Might this lead to a dollar collapse, a loss of US monetary credibility and the end of an economic pax Americana?

Perhaps this is a fairy-tale too far. … The story unfolding … may finish happily ever after. But it might, instead, end up like one of those novels from my namesake, a horrific mixture of weak growth, sticky inflation and, ultimately, a loss of confidence in the dollar’s status as a reserve currency.”

Stephen King, managing director of economics at HSBC, 2007 Oct 1st

http://news.independent.co.uk/business/comment/article3015584.ece

What almost no economists realize is the extent to which life-as-Americans-know-it depends on the US dollar keeping, at least in part, its current privileged status, and the consequences that the complete loss thereof can bring about.

As Krugman said in his latest paper, the USD could have a “Wily E. Coyote moment”. And as he also said, the US in 2007 isnt Argentina in 2001. Only that, contrary to what he meant, the present situation of the US has far more downward potential than that of Argentina in 2001. This might be shocking for anyone familiar with the magnitude of the adjustment that Argentina underwent at that time, best illustrated by the fact that imports dropped from 20 billion USD in 2001 to 9 billion USD in 2002. Why and how could possibly the US face an even harder adjustment?

To understand why, we will use Jacques Rueff’s tailor metaphor as quoted by Steil (2007), after making a couple of observations to it. In the first place, it is just not true that dollars are of no use outside the US, at least today. Because today the dollar is regarded as valid tender for goods, services and property rights from _any_ country (and that use is precisely what props up its value), in order to pay for Saudi oil or Brazilian soybeans, China must have in hand and tender US dollars, not bonds or stocks. Secondly, and related to the above, to use the metaphor in a more realistic way, we need to include, along with Steil’s Chinese tailor, an Arabian shoemaker.

So, here we have a customer (the US) to whom a number of providers sell real things (suits, shoes) in exchange for IOU’s. (And by IOUs we mean US dollars themselves, not US bonds, because a fiat currency abroad is intrinsically a promise to the holder that he will be able to exchange it for goods, services or property rights from the issuing country. A bond is just a promise to get more promises.) The providers have been doing that for some time and by now have piled up a huge stack of IOUs, to the point of starting to worry whether they will ever be able to exchange the IOU’s for real things from the customer. And as they see that the customer is showing no sign of lowering the amount of IOU’s he issues per year (and much less stopping issuing them, and even less starting paying them out!), they can be reasonably expected to take action about the situation. What kind of action? Basically, stop selling anything to the customer until they have cashed out (exchanged for real things from the customer) at least a large part of their stacks of IOUs. Which in the real world is particularly important for the Arabian shoemaker because the product it sells (oil) comes from a finite, absolutely exhaustible endowment.

And this makes the first difference between the US in 2007 and Argentina in 2001. Even if some of the products the US sells to the world are absolutely essential (e.g. grains), there are enough dollars (and dollar-denominated debt) outside the US to pay for those products for an extremely long time. So the world can buy those products from the US without the need to sell anything to the US for that time. In contrast, there were no Argentinian pesos circulating outside Argentina in 2001 or anytime. Therefore, if someone wanted to buy Argentinian soybean or wheat, they had to tender the international means of payment (US dollars) for that.

The second difference lies in the respective quality of imports. In 2001 Argentina was an exporter of not only food, but also of oil and natural gas. So the drop in imports did not involve anything really essential for their daily lives. In contrast, today the US imports 59 % of their consumption of crude oil and petroleum products.

Bottom line: if paying for US exports becomes the only reason to hold dollars outside the US – as it should be in a fair international monetary system, BTW, i.e. one in which the dollar was not accorded “privileged” status – then there are way, way too many dollars (and US-issued dollar-denominated debt) outside the US. So many that their holders would be able to pay for US exports for a very, very long time without needing to sell anything to the US. And why wouldn’t they?

Clearly, if the US becomes the only country accepting dollars as payment for its exports, US imports would drop brutally. And the impact on US life would be brutal too.

If the US wants the dollar to retain, at least in part, its role as international trade and reserve currency, they can no longer follow a monetary policy focused only (or even mainly) on avoiding internal recessions, and must adopt one geared to preserving the purchasing power of the USD for international transactions by checking money supply growth. Unpleasant recessions may come as a result, but the alternative is much, much worse.

This issue is developed more extensively at

http://peaktimeviews.blogspot.com/2007/10/realistic-view-of-international.html

Re CPI, I like The Economist’s Big Mac index for the US. In April 2001 it stood at $2.54 while in July 2007 it was $3.41. That implies an effective annual inflation rate of 5% over the 6 years.

At least hamburgers don’t get “hedonic adjustments”.

I am not sold on the fact that a weak dollar is bad. A weak vs. strong dollar merely shifts the tradeoffs.

If weak currencies were undesirable, why would China be forcibly keeping its currency far lower than what it would freely trade at?

A weak dollar reduces the trade deficit, hence increasing GDP growth. Furthermore, it increases US employment, as outsourcing slows while insourcing from Canada and the EU grows.

I think the weak US dollar has some beneficial side-effects as well. It forces Americans to consume less oil, AND (more importantly) is forcing China to re-value its currency. China has no choice but to lessen the Yuan/Dollar peg, which then reduces China’s trade surplus with the US, thus increasing US GDP growth.

So I am not convinced it is all bad. Merely a different set of tradeoffs.

I would love to have someone explain to me how the US can “not export anything”, when 50% of earnings from companies on the S&P 500 are from foreign nations. It seems to me, that there a huge part of the trade deficit (aside from oil) is just accounting for the fact that Asian countries increasingly are the experts in manufacturing. Wouldn’t this by default give them a surplus just for the simple fact that the goods are actually manufactured there and aren’t going to come back overseas for a transaction? However, they tend not to invent/design the product, market the product or sell it, roles that take place over here. The fact that central banks hold dollar reserves tell you nothing about who owns what inside the country, just that a lot of money has been flowing to it. So how can 50% of S&P 500 earnings be foreign based and yet we still don’t export anything? A weak dollar isn’t going to bring manufacturing back. That requires years of investment and belief that things are going to remain the same before the investment even starts. This is not healthy for the world. Manufacturing countries should be very wary of having unstable currencies. It will blow up the lifeblood of their economies.

To heck with inflation expectations; look at those year-over-year increases in today’s PPI for finished goods (6.1%), intermediate goods (5.6%), and raw materials (25.7%). And, as you can clearly see, the upward year-over-year trend has been in place since February.

http://www.bls.gov/news.release/ppi.nr0.htm

I saw this on Big Picture this morning.

The Fed better quit cutting rates and better start fighting this incipient inflation.

The Big Picture does tend to look for the dark cloud, just like the relentlessly cheerful crew at Calculated Risk. If you want to pick and choose subsets of data, you can usually find some alarming stats – so what?

Yeah, you’re right, RB, I’ll just ignore BLS’ year-over-year price increases (nicely trending up since February) in wholesale prices. Must be a secret plant by the BP types.

Years of loose monetary policy are coming home to roost, sir.

Uh, PPI was up a modest .1% last month.

MarkS,

You simply cannot leave monetary demand out of your inflation equation. One of the reasons the dollar is sliding against other currencies is investors are beginning to value other economies as a better investment. You can keep the money supply absolutely constant and you will still have fluctuations in inflation and deflation depending on demand.

DickF-

I do agree that monetary demand in concert with money supply affects inflation/deflation:

I used the phrases volume of money and money volume to express the balance between money supply and aggregate demand (sales). In other words, when the volume of money increases, money supply rises relative to demand.

I just re-read your November 12, 2007 01:54 PM post: price decreases are not deflation. Deflation is a degradation of the value of the monetary unit. If technology makes something cheaper that is not deflation because it has not changed the value of the monetary unit, but the value of the commodity.

RealThink-

Words can not describe my admiration of your November 13, 2007 02:57 PM posting. You have concisely explained the serious dangers facing the US economy and banking system.

Hey Rich berger:

To paraphrase Stephen Colbert: “How can one be unbiased when the facts themselves are biased…?”