As the Fed drops interest rates, I’ve been trying to sort out all the channels that monetary policy will affect output, and which ones are likely to be short circuited this time around.

Paul Krugman observes that changing interest rates might not work on housing when the stock of housing is out of line with the fundamentals. Robert Reich says bank asset portfolios are too risky to allow expanded lending in response to increases in money base. Thomas Palley argues contractual rigidities (resets in adjustable rate mortgages) reduce the impact of interest rate changes. Another line of argument can be summarized by the following question: after the dot.com boom and the housing boom, what other sector can monetary policy influence?

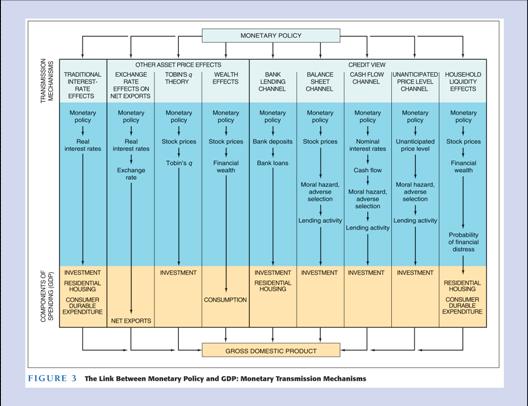

When I face a welter of arguments, all of which have some plausibility, I do what a typical teacher does — reach for a textbook. In particular, I’m going to look for guidance in Figure 3 in Chapter 23 from Mishkin’s textbook.

Source: Chapter 23, Frederic Mishkin, Economics of Money, Banking and Financial Markets (8/e).

The first column is what I would call the neoclassical channel. A reduced nominal interest rate, in the presence of nominal price rigidities, results in a lower real interest rate. This changes the optimal stock of capital, resulting (with adjustment costs) in higher investment until the new optimal capital stock (either business or housing) is achieved. This approach is applied here, in the context of housing.

The second channel is the expenditure switching channel that I’ve examined previously here and here. That is, a depreciated exchange rate induces greater exports and less imports.

The third channel — the q-theory approach — could equally be viewed as a neoclassical approach, depending upon the formulation. I would say the emphasis is different, viewing the incentive to invest from the ratio of the market price versus book price of physical capital as the driving force. A lower nominal (and hence real) interest rate drives up the present value of the stream of returns to a unit of capital, and hence stock prices. I think of this approach as the quintessential approach to modeling monetary policy impacts upon investment for firms that do not face pecking order financing heirarchies arising from asymmetric information (i.e., large firms with lots of cash flow); see one survey here.

Wealth effects, arising from monetary policy affecting the valuation of the components of wealth, is the fourth channel. This, too, I think of as fairly uncontroversial. The figure traces the channel as going through stock prices, but I think recent experience could trace the channel as going through housing as well.

I think the channels under the “credit view” are the ones that bear deeper examination in the current episode, when thinking about how effective monetary policy is going to be. In particular, the bank lending channel is going to be much more circumscribed this time around. Usually, as the Fed engages in open market operations, banks have an incentive to lend in order to get rid of non-interest-bearing excess reserves. However, as bank capital has been hit hard by write-downs of CDOs, banks are experiencing a capital crunch, such that lending cannot be expanded, given capital requirements. This is a very cursory explanation, but there’s been plenty of discussion of this point in the wake of Jan Hatzius’s note. (Here’s the credit crunch in commercial real estate, via CR)

Even if the bank lending channel is short circuited, the balance sheet and cash flow channels could still be operative. Lower interest rates raise firm net worth thereby reducing adverse selection problem faced by banks. Lower interest rate payments also increase cash flow, making it easier to determine whether firms and households (think ARMs; see also Jim’s post) can pay their bills. This in turn also reduces adverse selection and moral hazard problems.

The household liquidity effects channel sounds a lot like the wealth effect channel. But in this liqidity channel presupposes that a substantial number of households are liquidity constrained. In other words, one could imagine households reducing consumption due to wealth declining, or households reducing consumption because they can’t borrow at a given instant, even if the present value of their stream of income minus consumption is positive.

Finally, the second to last channel — the unanticipated price channel effect — is a channel nobody is pointing to. That’s because repeated exploitation of this channel would imply erosion of hard-won monetary credibility over the past decades. But that doesn’t mean that this channel won’t be operative.

Unanticipated price increases can have an impact because firms have debt denominated in nominal terms, while firm assets often take the form of physical capital. Of course, while firms with net (nominal) debt may gain, creditors may lose. The impact on overall investment spending will depend upon the patterns of net debt, and the investment propensities of the firms.

(Digression: where does the current intra-financial sector logjam [1] show up in this diagram? I don’t think it does, explicitly. However, to the extent that all financial institutions are less likely to lend to each other, I presume they will tend to hold more excess reserves, and thus lend less (i.e., the lending channel is further diminished). Greater uncertainty about the long term prospects of major banks should also make it more difficult to raise new capital, exacerbating the capital crunch.)

What is the (policy) upshot of this discussion? In answer to the question of which sector can fulfill the role previously filled by housing, I would say the only candidate is net exports. The decline in the Fed Funds rate has led to a depreciation of the dollar. In the future, net exports will be higher than they otherwise would be. However, the behavior of net exports, unlike other components of aggregate demand, depends substantially on what happens in other economies. If policy rates decline in the UK, the euro area, and elsewhere, additional declines of the dollar might not occur. (And as I’ve pointed out before, if rest-of-world GDP growth declines (as seems likely [2]), then net exports might decline even with a weakened dollar).

I think the main point is that the decreases in interest rates, working through the traditional channels, will have a positive impact on components of aggregate demand. With respect to the credit view channels, the impact on lending is going to be quite muted, I think, given the supply of credit is likely to be limited. In fact, I suspect monetary policy will only be mitigating the negative effects of slowing growth and a reduction of perceived asset values working their way through the system.

So while I conclude that it’s wrong to look for a sector that monetary policy can rely upon to “save” the economy, in order to justify expansionary monetary policy, it seems to me that expansionary monetary policy will serve to offset these negative influences.

Technorati Tags: recession,

credit view,

monetary policy,

bank lending, capital crunch,

credit crunch.

Naive questions of an empirical nature follow.

1. Money supply growth should be slowing or going temporarily negative in the context of this credit crisis, no cierto?

2. Will builds in the monetary base be sufficient to reduce money supply softening or simply off-set it somewhat in the near-term?

Menzie, assuming the dollar continues to drop, how important a role will import substitution play?

Here is my depressing personal housing indicator of the day:

The house across the street from me is part of the “Walk Away” phenomenon. Alledgedly, the bank paid someone to winterize it, but I guess they didn’t turn off the water. Last night there was a huge puddle in the street. My wife called me this afternoon to tell me that water was coming from the house across the street. Public works came to shut off the water, but they said that the house was trashed.

Okay, Menzie, how does the “Walking Away” phenomenon play out? Monetary policy doesn’t fix all the houses literally destroyed by fraudulent loans and other mischief.

This is a half million dollar house, and would be worth millions if it were in New York or LA. Now its uninhabitable.

A. lowering interest rates, & B. channeling savings into investment, are not synonymous. The commercial banks IMPOUND SAVINGS by out-bidding financial intermediaries for loan-funds.

But if savings were transferred to financial intermediaries (from the CBs), the commercial banks, the financial intermediaires, & the economy would all benefit (just like in 1966).

I don’t understand. Why does the U.S. always pursue a political solution rather than an economic one?

Today’s Links: The Grinding Gears of the Economy

The GDP numbers came out yesterday. For a breakdown, including the inflation component, go here. For the announcement from the BEA go here. The Fed also cut rates by 50bps. Here is the Journal’s story.

Reactions:

Barry Rithotlz- Q4 GDP: El Stink…

groucho: The answer depends upon when you time the beginning of the adjustment episode. The real broad dollar has only dropped 5.4% (in log terms) since July 2007. According to my estimates, the price elasticity of non-oil non-computer imports is only about 0.3. Nominal non-oil non-computer imports account for about {delete 20%} 80% of goods imports, and {delete 18%} 82% of total imports. That suggests to me that no more than $40 billion real dollars worth of import substitution will occur due to exchange rate changes experienced thus far. On the other hand, the income elasticity of imports is about 2, so slower growth will have a much bigger impact on imports.

Buzzcut: It’s clear that a lot of resources are going to be wasted in the depreciation of housing stock people cannot afford due to either insolvency or illiquidity. Lower interest rates will mean somewhat fewer foreclosures, working through the various channels outlined. I don’t mean to say that interest rate decreases will stop this process, merely that it will mitigate it.

E.Poole: Take a look at the money statistics at FRED. Latest statistics show negative M1 and M2 y/y growth.

Read this Arthur Laffer Supply Side article :

http://online.wsj.com/article/SB120122126173315299.html?mod=opinion_main_commentaries

Gosh. It sounds like I ought to purchase a copy of Mishkin’s book and wedge it in between “Time Series Analysis” and John Cochrane’s “Asset Pricing Theory”.

A little more gas makes the engine run faster, usually. But what you’ve got here is a thrown rod.

The S&P index of homebuilders was up 26.7% in Jan.

This clearly implies that the market expects the rate cuts to work.

Moreover, the S&P index of retailers was up 3.3%.

These are usually one of the first sectors to rebound in a new bull market and reinforce the point that the market expects a more or less normal economic rebound.

Robert Bell: Let me add to your list David Romer’s Advanced Macroeconomics, and N. Gregory Mankiw and David Romer, New Keynesian Economics (MIT Press).

Dr. Chinn’s presentation is interesting.

From my vantage point, monetary policy seems simpler than that. Whenever there is economic weakness, the Fed creates & makes available to lend fresh money that has never been saved. Thus distorting the perception of the cost of savings/capital, they certainly provide short-term stimulation to the eoconomy.

But who amongst us thinks that this sort of distortion of the price system improves long-run economic growth?

Regarding the net export channel: a rising dollar/yuan rate spread results in a carry trade between the two currencies. The result is rising capital inflows to China which are not entirely sterilized. This is a factor contributing to accelerating inflation in China. What is the solution? Revaluation. Imagine an adjustment of 30% to the Chinese Yuan (merely matching that of the Brazilian Real).

Unlike 2001, deep cuts in Fed Funds are occurring in an accelerating Chinese CPI environment. The monetary policies of the U.S. and ALL dollar reserve accumulators (not just China) are at cross purposes. How long can this go on without impacting exchange rates and BWII?

Yes, a reval from Asian and GCC countries would marginally help out next exports, but the impact on the prices of tradeable goods and U.S. interest rates would likely be the more important one.

Menzie Chen: Thank you for the FRED suggestion.

Context: I had just been forced to suffer the undue punishment of chicken-little, contradiction-maximizing gold nutsthat appeal to investor friends. [Commentaries on http://kitco.com/ should give the reader a flavour.]

You’d be surprised at how many folks in the capital markets see monetary phenomena in a completely different light from professional economists yet somehow manage to make good coin….

Here is a link to bar charts of key Canadian monetary aggregates: http://www.bank-banque-canada.ca/en/graphs/a1-table.html

As a basic understanding of the money creation process would indicate, major fluctuations in monetary aggregate growth rates are readily apparent.

I’m still curious if any stylized facts exist on how much monetary base creation would be required to offset a decline in M2 (or bigger). I understand the empirical difficulties and that I may be still taking Friedman too literally.

regards -Erik

Much obliged …

-RKB