If the Fed thinks that recent commodity price moves have nothing to do with their own actions, perhaps they should think again.

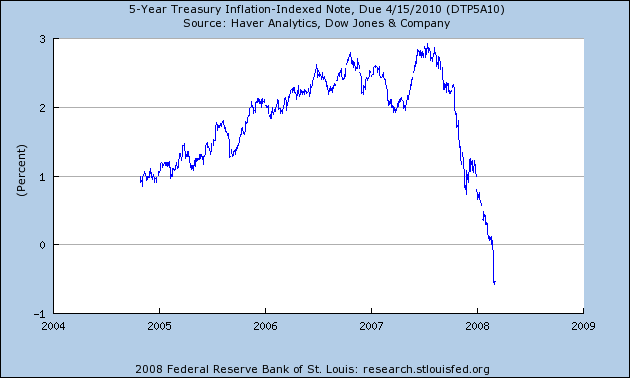

The yield on the 2-year Treasury fell yesterday to 1.5%. It’s impossible to imagine that the average inflation rate over the next two years could be less than 2%, meaning that the real interest rate– the nominal rate minus expected inflation– has become unambiguously negative. Greg Mankiw is impressed that when you plot the implied real yield on the Treasury inflation indexed security maturing in 2010, you indeed get a graph of the real interest rate that has recently become quite negative. If there is no inflation over the next two years, you’d actually pay more in dollars to buy this security than you will receive back in coupons and principal. With inflation, you may make a nominal gain, but you’re guaranteed to end up with less than you started in real terms.

|

Apart from the evidence of your lying eyes, does economic theory allow the possibility of a negative real interest rate? The answer, in an economy in which there is only a single consumption good that can be costlessly stored, is no. In such a world, you would never park your capital in the form of a Treasury asset that cost you one potato today and repaid you 0.99 potato next year, when you had available an opportunity instead to put a potato in your cupboard today and still have a perfectly good potato next year.

| aluminum | 29.2 |

| barley | 7.5 |

| cocoa | 25.9 |

| coffee | 23.5 |

| copper | 26.3 |

| corn | 21.2 |

| cotton | 32.0 |

| gold | 17.4 |

| lead | 32.7 |

| oats | 33.8 |

| oil | 6.8 |

| silver | 37.8 |

| tin | 15.5 |

| wheat | 32.7 |

| zinc | 20.5 |

As Greg points out, in the actual U.S. economy we of course have thousands of goods and services, many of which cannot be stored at all, and most potatoes don’t actually fare that well if you leave them in your cupboard for a year. But some items certainly can be stored pretty easily, and it is quite striking that the list of goods that are most readily stored is precisely the list of items whose price has been bid up most spectacularly since the real interest rate turned negative. The accompanying table displays the nominal price change over the last two months in the prices of the main commodities I could get my hands on through Webstract. Note these are the actual changes since January 1– to quote these at an annual rate you’d multiply by about 6.

Can the real interest rate be negative in a world where some but not all goods can be stored costlessly? Consider for illustration an economy with two goods, immortal potatoes and transient haircuts, with both items currently selling for $1 and both given equal weights in the CPI. If you put $2 into a 1-year TIPS with a real interest rate of -1% in that world, next year you’d have the ability to purchase 0.99 potatoes and 0.99 haircuts.

Why buy the TIPS when you could simply save the $2 in the form of 2 potatoes and still have those same 2 potatoes a year from now? If nothing else changes, and 2 potatoes were still worth 2 haircuts a year from now, everybody would want to do just that. If we were in long-run equilibrium before the real rate went negative, in response to a negative real interest rate, everybody would want to buy potatoes today as an investment vehicle. The price of potatoes today would have to be bid up to a point above the long-run equilibrium so that from here, potato prices are expected to rise less quickly than the price of hair cuts. Your 2 potatoes might be worth 2 haircuts today, but if they’re only worth 1.96 haircuts next year, you might be just indifferent between an investment in TIPS or physically storing the commodity.

Now the real world is admittedly more complicated. Playing commodities is the farthest thing from a risk-free investment, and the calculation is more along the following lines. There is a downside risk from investing in commodities, and that downside risk grows the farther relative commodity prices move above their long-run equilibrium values. But the lower the real return available on assets such as Treasuries, the more investors are willing to face those risks, with negative real rates just producing an extreme version of that calculation. This of course is just a variant of Jeff Frankel’s claim that interest rates are a prime driver of commodity prices.

I’m also willing to believe that there are a number of investors plunging into commodities today who don’t know what they’re doing. The economic fundamentals warrant a temporary increase in the relative price of commodities, for the reasons just given. Some less sophisticated investors see the surging commodity prices and jump on the bandwagon, thinking they’re going to continue to go only up. To the extent that this is part of what’s going on in the current market, it is just one more reason why commodity prices have responded as sharply as they did to negative real interest rates.

But wouldn’t it be nice if instead of reasoning by “suppose that” and “what if”, economists could resolve our disagreements like real scientists with controlled experiments? I have a modest suggestion along these lines.

With the Fed’s target interest rate currently at 3.0%, a 1.5% two-year nominal Treasury yield implies that the market is expecting the Fed to cut rates a whole lot more and in a big hurry. Is 75 the new 25? asks Greg Ip– we used to expect 25 basis points each meeting, now it seems to be 75.

So the Fed would clearly shock the markets by only bringing the rate down 25 basis points this month, to a new target of 2.75%. If Frankel is correct, we’d see an immediate plunge in commodity prices across the board. If we didn’t see that price response, then the outcome of the experiment would have proved that the Fed is right in claiming that the recent commodity price moves have nothing to do with the FOMC.

So how about it, Ben? Wouldn’t it be fun to collect a little high-quality data here? In the name of science?

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

commodity prices,

interest rates,

fed funds rate,

inflation,

Bernanke

Great suggestion, Professor. May BB take you up on it.

T’would be a wonderful experiment; however, Dr. B might end up mimicking the infamous doctor who pronounced the operation a great success but unfortunately the patient died.

Look at the spike in spreads between munys and treasuries or gov’t agencies and treasuries and/or the continuing meltdown in mortgage defaults, and it’s pretty obvious to me that putting commodities on a monetary diet to pull their prices back in line could produce some unsavory unintended consequences for a major financial institution or two.

As I write this at 11:10 EDT, the huge short-covering rally this morning in financial stocks is steadily losing steam – maybe because word of the proposed Hamilton/Bernanke experiment’s got out? – or more likely because the Fed’s too-small actions this morning combined with Fisher’s stingy monetary comments in Paris have suggested to the market’s that the Fed’s still comfortably behind the curve.

Here are some pictures that indicate an unsustainable boom in commodity prices.

According to some formulae..the recession probability is only 7%. (with a blue smiling face on this websites home page)

Worlds richest man said last week..that commonsense tells him that recession is already here.

I have asked this Q before, why are economic models so far off reality ?

When hoarding stuff is better than hoarding money, people will hoard stuff.

Hoarding stuff will have its costs. They will be paid by people who go hungry, starve and freeze.

Yeah, the market will sort it out, if its a bubble it will go bust. It will not bring back the dead, or undo the physiological damage (especially infants) caused by undernourishment.

Who cares? All rise, and bow to the market.

There must be a diabolical bent to people who devise policies that result in hoarding of stuff

Dr. Dan,

(1) The face is frowning, not smiling, and the blue frowning face is the maximal bearish indicator we allow. It has been in effect since Jan 4.

(2) The 7.7% probability refers to the status of the economy in 2007:Q3.

I am not sure I understand, 2007: q3 ?

Why do we call it a probability ? Hasn’t the “event” already happened ?

Would a soul be interested in the probability of the economy in 2007:Q3 when 2008 is alrerady underway

Dr. Dan,

No indeed, we typically aren’t at all sure about these events until much later. For example, no one is really sure whether the U.S. economy is currently in a recession. We’ll have a better and better fix on that as we accumulate more and higher-quality data. It’s completely appropriate statistically to describe our uncertainty about something that’s “already happened” in terms of a probability, as the links provided explain in detail.

The NBER waited until July 2003 before announcing that the recession ended in November 2001. I expect to render a verdict more quickly than that, but more slowly than you may wish. One of the key things I wait for is data revisions.

It hardly seems plausible that a very slight real negative interest rate could cause the dramatic run up in commodities. It seems likely that it could start it, at which point “Some less sophisticated investors see the surging commodity prices and jump on the bandwagon, thinking they’re going to continue to go only up.”

And so we have the same story over and over again (the Asian crisis, dot.com bubble, housing bubble, commodities…). It seems like we need a way to diffuse the herd, because it’s stampeding from one market to the next completely perverting the market until there is no semblance of reality.

These are the biggest unilateral transfers of wealth I have ever seen. A zero sum game. Like a pyramid scheme the first ones in get a little bit of wealth from everyone else. Every time you fill up your car a little wealth is being transferred from you to a commodity speculator. In the end, the market it left in ruin and the herd moves on to the next market.

No wealth or economic gain has been created: just a unilateral transfer.

Here is the real experiment.

The spokesman comes out of the FOMC meeting and reads the following, no more, no less, “the current rapid inflation in essential raw materials and commodities is absolutely unacceptable to the FOMC, and will be resisted vigorously with all tools available.” No changes in rates are announced.

The inflationary breakout will have been ended with a single sentence and those who have been gambling in commodities will then and immediately be introducted to one of my favorite expressions, “lock liimit down.”

Oh, and as for the unintended consequence, well, lets just say that the fictitious wealth that has been created since January and is “hiding” in commodities will be extinguished.

And so each of you has to ask yourself (a la Clint Eastwood) one question, do you think that the FOMC actually wants that fictitious wealth to be extinguished … “well do ya, punk?”

You are describing crack up boom inflation behavior.

Inflation works as long as the housewife thinks: I need a new frying pan badly. But prices are too high today; I shall wait until they drop again. It comes to an abrupt end when people discover that the inflation will continue, that it causes the rise in prices, and that therefore prices will skyrocket infinitely. The critical stage begins when the housewife thinks: I dont need a new frying pan today; I may need one in a year or two. But Ill buy it today because it will be much more expensive later. Then the catastrophic end of the inflation is close. In its last stage the housewife thinks: I dont need another table; I shall never need one. But its wiser to buy a table than keep these scraps of paper that the government calls money, one minute longer.

– Ludwig von Mises- Theory of Money and Credit

Maybe these guys at the Fed aren’t as stupid as they look, JDH. The usual response to dealing with inflation is to buy…(wait for it)…. real estate.

If they can get a good enough inflation scare going, they may be able to start moving houses again.

At this point there is zero danger of real rates turning positive. The FED is intent on allowing the price level to increase until real estate prices stabilize and rebound.

Obviously this isn’t lost on commodity traders. Its a free pass for them to hoard commodities.

Is that a real Mises quote on JDHs blog. I can’t believe it.

Professor Hamilton,

Wondering how you think the Fed’s new announcement regarding stepping up TAF and 28 day repos will affect the overall Fed balance sheet. Will they step up the pace of long term bond redemption to counterbalance?

Here is the link.

http://federalreserve.gov/newsevents/press/monetary/20080307a.htm

jp, I would have no doubt whatever that the incresed TAF will be neutralized with offsetting redemptions of securities. As I’ve said before, there’s no point in using the TAF to affect changes in the liabilities side of the Fed’s balance sheet (i.e., creating traditional liquidity), because that could have been done perfectly well instead with open market purchases. The purpose of the TAF is to alter the composition of the Fed’s assets without changing their total volume.

JP

The sterilized the 28 day REPO buy selling Treasury Bills back to the street.

http://www.ny.frb.org/markets/pomo/display/index.cfm

Thanks for the answers JDH and Fullcarry. Right on the mark.

Sorry for being off topic, but one last question. Can you recommend a good Monetary Economics textbook? I am looking for something university level, but without too much math. Something that encapsulates current economic thought on the subject – nothing out of the mainstream.

commodity money

The subprime crisis represents massive unpunished malfeasance by financial intermediaries managing US dollars. This discourages people from using US dollars as money.

In 2008 January, the fed drove real dollar interest rates negative – only slightly n…

“Apart from the evidence of your lying eyes, does economic theory allow the possibility of a negative real interest rate? ”

No one else seems to have commented on some top notch comedy amongst the usual top notch econ. I think these guys would approve ..

http://www.youtube.com/watch?v=6Etj2hkvC9w

Another very interesting post! An interesting feature of TIPS is that it is possible for the observed yield on TIPS to be negative, while the ex-post real holding period return is positive. This is due to the 2-3 month lag in the calculation of the inflation adjustment to principal. For example, the inflation adjustments for March are being calculated based on the CPI from Dec to Jan. The adjustments for April, will be calculated based on the CPI from Jan to Feb.

http://www.publicdebt.treas.gov/of/releases/2008/of032008cpi.pdf

This effect, although modest given current data, may push the yield negative on shorter maturity TIPS if recent increases in the CPI have been large enough.

Yields on some TIPS also went negative briefly in 2004 http://research.stlouisfed.org/fred2/series/DTP10J07?cid=82

There’s a Pulitzer Prize waiting out there for the journalist who does an in-depth study of how investment funds are distorting all commodity markets: fuel, metals, food. There isn’t enough difference between supply and demand to warrant the kinds of rocketing price increases that have occured in all commodities. You can’t blame corn ethanol for everything.

This is the same kind of investment money that went into the dot-com boom and the mortgage bubble. It’s looking for big returns and hedging on a falling dollar. A lot of these people, even highly paid fund managers, don’t know what they’re doing.

Any fool can make money on a rising market. But when the panic comes, and come it will, prices will crash across the board, across all markets, all over the world.

Yeah, fred, I’m seeing a lot of anger on boards around the world centered on American ethanol production. Sorry, folks, you can’t blame all your problems on using some feed corn to make alcohol. What’s next–prosecute Anheuser-Bush for their crimes against humanity for converting rice to beer? Or Jim Beam for using wheat? Or vodka makers for, well, anything that’s used for vodka but is used to get drunk instead?

Apparently this El Nio year and a hungry world population have helped drive up prices, as has oil, but if we want to incorrectly assign blame to its most ridiculous end, let’s blame house flippers for famine in Africa. Hey…it could be true, right?