The White House today cited the 2006 Treasury Report in its “Pro Growth Tax Policy” information sheet. From the website:

…

3. Benefits of Making the Tax Cuts Permanent

The 2001 and 2003 tax cuts are currently scheduled to expire at the end of 2010. This scheduled expiration limits their beneficial impact on the economy, particularly with regard to decisions that pay off over long periods of time (for example, education or long-term investments). Making the tax cuts permanent can substantially improve economic performance. However, the long-run effects of extending the tax cuts depend on how the tax cuts are financed.

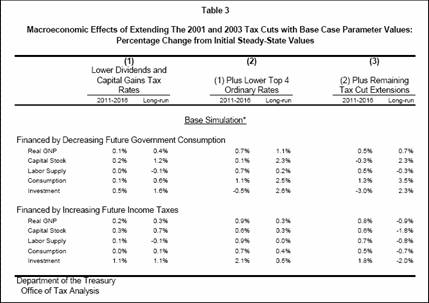

This point is illustrated in a 2006 study by the Treasury Department, which examines the long-run macroeconomic impact of making the tax cuts permanent. This study assumes that the tax cuts are financed by additional government borrowing through 2016. After 2016, two scenarios are considered. In the first scenario, government spending is reduced after 2016 to maintain a constant debt-to-GNP ratio. In the second scenario, income tax rates are raised across-the-board after 2016 to maintain a constant debt-to-GNP ratio. Treasury finds that in the first scenario, the capital stock increases by 2.3%, and long-run GNP increases by 0.7%. In terms of today’s $14 trillion economy, this would amount to almost $100 billion per year in additional output, or $329 per capita. In the second scenario, long-run GNP falls by 0.9%.

Not all of the tax cuts have the same impact on output. Treasury also estimates that extending only the dividend and capital gains rate cuts would raise long-run GNP by 0.4% (assuming they are offset by spending reductions). If the top four ordinary income tax rates were made permanent as well, long-run output would increase by 1.1%. Adding the remaining tax cuts (including the child tax credit, marriage penalty relief, and the 10% bracket rate) would lower the impact on long-run output to 0.7%. These remaining provisions lower long-run output because they increase take-home pay without a reduction in marginal tax rates. The increase in take-home pay allows individuals to reduce their labor supply.

[Emphasis added — mdc]

Since the Bush Administration has done such an admirable job at restraining spending, I think it’s useful to recall what I wrote about this report almost two years ago, in “A Dynamic Analysis of Permanent Extension of the President’s Tax Relief”:

The press account surrounding the Mid Session Review (MSR) (page 3-4) noted the preferred estimate of GNP response to the President’s tax proposals: real GNP might be 0.7 percent higher than steady state baseline. The Treasury’s Office of Tax Analysis has just released the underlying analysis.

There are, of course, a variety of estimates which differ depending upon assumptions regarding the time horizon, parameter values, and most importantly, whether the tax cuts are accomodated by reductions in future government spending or increases in future income taxes. The report admirably lays out the range of results for many configurations. Some are laid out in Table 3. The 0.7 percent deviation from baseline cited in the 2007 MSR is in the top right hand corner element, under “Financed by Decreasing Future Government Spending” (recent history has not been too supportive of this possibility, though). This estimate is for the case where capital gains and dividend tax rates are reduced, reduce top 4 ordinary rates, and make permanent 2001 and 2003 tax reductions.

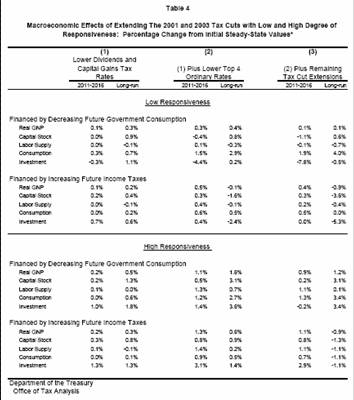

Of course, the astute reader will note that if taxes are raised in the future to finance the tax cut, then GNP will eventually be 0.9 percent lower than steady state baseline. Table 4 indicates that — for the future government spending reduction case — low and high responsiveness parameters lead to increases in GNP of between 0.1 and 1.2 percent relative to initial steady state, respectively. 0.7 percent is approximately in the mid-point of the range bracketed by these two estimates. The future tax increase estimate is unchanged across parameter value configurations.s

Table 4 from Office of Tax Analysis, “A Dynamic Analysis of Permanent Extension of the President’s Tax Relief,” U.S. Treasury, July 25, 2006.

Note a similar diversity of effects is recounted in the CBO’s analysis, How CBO Analyzed the Macroeconomic Effects of the President’s Budget, July 2003, (Table 9), cited in my previous post on this subject. (By the way, the “Division on Dynamic Analysis” is in the President’s budget proposal for FY2007.)…

Parting shot: It is important to understand that there is no welfare calculation undertaken, despite the fact that under certain conditions, GNP is higher than under baseline. That is because undertaking a welfare analysis would require taking a stand on the utility associated with government spending on goods and services. So even if one were to take the Treasury’s high end estimate for the long run steady state effect, the answer to the question of whether tax cuts are desirable depends upon the utility associated with spending on civil servant wages, bridges, and body armor.

I say “Let Bush be Bush” and allow the legislation underpinning the Bush tax cuts (remember, the budget scoring running up to passage was based upon expiration of the tax cuts) be implemented as passed.

Menzie says, “assuming they [tax cuts] are offset by spending reductions”

Menzie, a raspberry for saving the comment about “welfare” to the end and for not spelling out what that means in non-technical language. The procedure used amounts to a hidden assumption that nothing that government does has any value. While I suppose it’s always possible that the Administration could make cuts from the graft it provides to its cronies or that the Congress could eliminate earmarks for evangelizing on the public nickel, it’s almost certain that cuts will come from activities that do have an economic value: schools or Coast Guardsmen or park rangers or whatever. Cut them and we are all wounded, as we have been wounded and wounded again for almost 30 years.

This is unfortunately a hidden assumption that permeates a lot of economic writing today.

The CBO analysis, strangely, does not attempt to calculate the effect keeping the cuts and the spending and letting the debt get bigger. The closest estimate would be to combine the scenario of cuts with reduced spending with other studies of increased deficit spending. History shows that deficits have little negative effect on the economy and growth would still be well above baseline even with the increased debt.

The scenario of increasing taxes later only confirms the obvious conclusion that it is best to keep tax rates flat across time.

Why do some economist (Nobel Laureate William Vickrey and L. Randal Wray, prof. of economics at U. of Kansas are a couple that come to mind) say that govt deficits are an economic necessity? Yet many economist (and politicians) say govt deficits are evil? It would appear history is on the side if Vickrey and Wray. Over the last several decades the stock market (and presumable the economy) has performed much better when the public debt to gdp ratio has been ABOVE 40%. The 1970s and the last several years the ratio (and I am talking about the public debt not total debt) was below 40% and the economy and stock market have underperformed.

I do not advocate more govt spending. I want to eliminate wasteful spending as much as the next guy. But increasing taxes (or letting tax cuts expire) for the sake of deficit reduction goes against what history tells us.

I think some tax cuts for the middle class including rebates for energy improvements is in order. As for the deficits the tax cuts may generate, I would suggest reading some of Vickrey or Wray’s work.

Dr Chinn: The hyperlink to your earlier post labeled with the string:

“A Dynamic Analysis of Permanent Extension of the President’s Tax Relief”

in the second unindented paragraph, seems to point back to this article, rather than the previous post.

I say “Let Bush be Bush” and allow the legislation underpinning the Bush tax cuts (remember, the budget scoring running up to passage was based upon expiration of the tax cuts) be implemented as passed.

That’s an awful big tax increase in a very short amount of time.

Would there be a Y2K-like runnup to the date that the tax increases kick in? Take all your capital gains, income, and, yes, death in the year before the increase?

Talk of spending cuts by Menzie and the other libs is pretty funny. Most government spending is on entitlements. Any of you support, say, Dubya’s Socialist Insecurity reform?

Do you support McCain’s health care plan, which is totally brilliant by making employer paid insurance a taxable benefit?

How about extending McCain’s health insurance plan to Medicare? Seniors could get the $5000 tax exclusion just like everybody else, but anything above and beyond that is taxable?

Via the Adam Smith Institute:

“Need” now means wanting someone else’s money.

“Greed” means wanting to keep your own.

“Compassion” is when a politician arranges the transfer.

———————

For the oppressors, what is worthwhile is to have more – always more – even at the cost of the oppressed having less or having nothing.

For them, to be is to have and to be the class of the “haves”.

Paulo Freire, Pedagogy of the Oppressed

TDM says, “The CBO analysis, strangely, does not attempt to calculate the effect keeping the cuts and the spending and letting the debt get bigger.”

If it did, it would almost certainly show that growth would be harmed. To believe that we can spend more and tax less is freelunchenomics, not economics.

Economics predicts that it matters what we spend the money on. If we spend the money on things that add to national productivity, then we can spend in the present and recoup the gain in the future.

History has shown that this is rarely achieved. Since 1980, unchecked deficit spending led to a massive accumulation of debt which burdens present growth. However, there are limited cases in which deficit spending can pay for itself. In general: improving infrastructure, raising the quality of human capital (education, health), investment in technology, improved security from crime… all of these things can pay for themselves.

Losing wars, not so much.

Losing wars, not so much.

Now you’re just being an ***.

I appologize to Menzie and JDH if that crosses the line. Censor if necessary. But it had to be said.

This war is in no way lost. Regime change was achieved. Islamism was taken on at its source and defeated (Menzie still hasn’t written his obligatory “graph the death rate” post since the surge really started to work this year).

All that is left is to build the pro-western Democracy in the heart of the middle east that the world so desperately needs.

Easier said than done. But to think, at this point, that the $1T spent so far was wasted on a “lost war” is just wrong, wrong, wrong.

To say the $1T has been well spent, one would also have to be deranged. That amounts to $40,000 per person in Iraq — every man, woman and child — where the per capita income is about $2000 per year. To think what we could have done for those people besides killing hundreds of thousands of innocents and turning world opinion against the U.S.

“This war is in no way lost.”

That is total BS. For OVER 5 years now you haven’t defeated a backward country of 24 Million, even with explosive deficits and over Four Thousand dead Americans and how many Iraqis?

Maybe you need a history lesson to figure that it took less time to defeat Germany and Japan.

So what is your definition of “winning”? More torture maybe? Another coalition of the willing since all the members of the last one have pulled out?

“All that is left is to build the pro-western Democracy”

Can you explain why this is such a wonderful thing? You didn’t like the results of the elections in Lebanon or Palestine?

Regime change? So invading and occupying sovereign nations becuase you don’t like the leadership is OK? No, its criminal.

Yes, the war was lost before it started. All that is left is cleaning up the mess.

That is total BS. For OVER 5 years now you haven’t defeated a backward country of 24 Million, even with explosive deficits and over Four Thousand dead Americans and how many Iraqis?

Actually, the war was over pretty quickly. The Iraq army was defeated by a small number of Marines.

It is the occupation that has not gone well. It has taken the US Military some time to come to terms with how to fight an insurgency.

Is Lebanon an example of the failure of democracy? I thought the results there were generally good, but Syrian meddling is the problem. Hezbollah has power because of the Syrians, not democracy.

Charles wrote:

Economics predicts that it matters what we spend the money on. If we spend the money on things that add to national productivity, then we can spend in the present and recoup the gain in the future.

Your comment is absolutely correct but your implication is wrong. You imply that government spending will give us gain in the future, but there is very limited gain from government expense.

What you have to realized is that government is actually a business cost, it is the cost of enforcing compliance. But the problem with government is that it does not allow competition and so the cost of most government spending is naturally higher than it would be in a competitive environment. Government is a monopoly by definition.

The Constitutional Convention did a pretty good job of limiting government, but over the years, especially since FDR’s Alphabet Soup, government has injected itself into areas where it is extremely inefficiently and costly.

Since 1980, unchecked deficit spending led to a massive accumulation of debt which burdens present growth. However, there are limited cases in which deficit spending can pay for itself. In general: improving infrastructure, raising the quality of human capital (education, health), investment in technology, improved security from crime… all of these things can pay for themselves.

Here you phrased it exactly right. Unchecked deficit spending has been the problem. If you look at government revenue you see that during periods of supply side tax cuts revenues increase significantly. The cause of the deficits has been on the spending side.

You also need to understand that none of the items in your list pay for themselves. They are all a cost. The question is whether it is better to have this done by the government or by the free market. Let’s look at them one by one.

improving infrastructure – I assume that this means such things as road and bridges and such. Actually infrastructure is better when it is done by business. This is easy to understand if you think about it. When business makes its income from infrastructure (toll bridges, etc.) it makes sure that the infrastructure is repaired and functional. Here is the business has a problem with the infrastructure it loses money so the incentive is to keep the infrastructure functional.

When government builds infrastructure repairs are a cost and politicians have many other things they would rather spend on than infrastructure repair. Politicians gain more from building a new bridge and naming it after themselves than insuring that the old bridge named after someone else doesn’t fall down.

raising the quality of human capital (education, health) – Once again the government does this very poorly. Consider that children who are home schooled or in private schools do better than those in state schools with much less cost.

We have a similar situation with health care. Government money in health care is spent on the most politically expedient health concerns not the most needed. Comparing government spending on diseases that cause the greatest number of deaths is a good illustration. The political diseases such as AIDS get much more than those that are the primary cause of the death of children for example.

investment in technology – Again government does an awful job on this. A very small number of people in government spend enormous amounts of money on their pet projects. In the business world you do not have the luxury of spending on failed technology because you must prove the technology to stay in business. In government when your pet technology fails you just appropriate more money; you pour more money down the same rat hole.

improved security from crime – This and the courts are where the cost of government is most beneficial. The government is best enforcing contractual agreements. The government does a bad job of preventing crime but generally a good job of catching and prosecuting criminals. This is where the coercive nature of government is actually a benefit.

In discussing tax cuts/increases and spending consider the Warner/Lieberman Bill currently in Senate committee. Right now this is the largest tax increase in the history of our country. It would impose a tax of more than $0.50 on each gallon of gasoline.

Lieberman claims that this is a market solution to global warming because it increases the cost of energy but actually it is just more income for government. Didn’t we just have to endure the Senate claiming the oil companies are making huge profits at the expense of our citizens? Well the government takes in over twice as much from the oil companies as they make and now it wants more? A real market solution would be to just let people use as much as they want at whatever price the market will bear. That is when you get the innovations. But Congress does not want a solution. They want control and taxes and spending means control.

Can you please comment on this….Buy one get one free housing….Is this the beginning or end ??

http://www.usnews.com/blogs/the-home-front/2008/6/3/buy-a-home-get-one-free.html

Banker, I think it’s mostly to get publicity (and it’s working), as I commented to a reporter when this story was carried in a local paper. He used another quote of mine for the story, though.

Buzzcut,

This might not be the place but I agree with you.

For 5% of our annual budget we have a real effort to improve an important region of the world that needs improving.

Robert Bell: Thanks much — I’ve corrected that mistake now.

Buzzcut says, “This war is in no way lost. Regime change was achieved. Islamism was taken on at its source and defeated…”

Sadly, Buzzcut, this sentence reveals exactly how little you understood of the war aims (real and fictional), measuring them, and how they might be achieved.

Prior to the invasion, Iraq was a secular state. Like his role model, Josef Stalin, Saddam suppressed Islam because he believed it would undercut his power. He was an opponent of al Qaida. Prior to the war, there was an al Qaida camp– in Kurdistan, in territory outside of Saddam’s control. Al Qaida’s real source is Saudi Arabia (note that 15 of the 19 hijackers were Saudi, while none were Iraqi).

Therefore, to say that “Islamism was taken on at its source” is a profoundly ignorant statement.

Al Qaida’s real primary war aim is probably to damage the western economy. Using a quarter of a million dollars for the WTC attacks, they managed to get us to waste $3T in Iraq alone. From their standpoint, the war has been a tremendous success.

A secondary and related war aim is probably to mire the US in foreign lands, creating resentments and amplifying anti-Americanism, just as the USSR was mired in Afghanistan, bringing recruits to al Qaida. This war aim has succeeded.

A third war aim is to fracture the western alliance. They have succeeded brilliantly in this. Since lies were used to start the Iraq war, countries that should be our allies do not trust us. The new Ozzie PM just said so, quite bluntly. Japan is debating whether to continue to fuel our ships. These are very dangerous developments.

As another poster has pointed out, the Iraq war has gone on longer than World War II.

You might want to look up the phrase “Pyrrhic victory.”

Buzzcut also says, “All that is left is to build the pro-western Democracy in the heart of the middle east…”

Again, total historical ignorance. Turkey is a functioning democracy. Iran was a functioning democracy until we destroyed it. Lebanon was… well, Lebanon. Sort of a democracy, sort of an oligarchy, sort of a theocracy. And, thanks to our equipping the Israelis to launch an attack against it and losing, slipping into anti-Westernism.

People who don’t know the history and don’t understand the root of antagonisms make very poor decisions. That’s a perfect description of this Administration.

_______________

Dick, I thought we had agreed to enhance our relationship by ending it.

Lets say we remove the tax cuts and end up with a budget surplus. This would result in the money supply being reduced because the federal government would no longer be selling treasuries. Our economy is not flexible enough to handle a reduction in the money supply because of controls such as the minimum wage. This is why we are left with every expanding deficits at the federal level. We are forced to pay $500 billion a year on interest on our debt which is about 20% of all federal expenses. Could you image how much more wealthy we could be if we didnt have to waste this 20% every year? But we will never pay this debt down, and we will be paying more on interest forever in the future because if we paid down the debt, then are money supply would be reduced. We need to look to reform our system of money as debt.

Charles-

You never cease to amaze.

Your statement that Saddam was an opponent of Al Qaeda is demonstrably false. The 9/11 report provides evidence that there were contacts between Iraq and OBL from time to time including discussions of safe haven in Iraq. The real controversy is whether those contacts constituted an operational relationship.

Iraq may not have been the original source of Islamism, but AQ’s boys clearly considered it the main front once the war started. They appear to regret that now.

The war has not cost $3T. That’s Joe Stiglitz’ estimate of current and future costs – speculation.

No matter how many times you and your friends repeat it, we were not lied into war.

“Your statement that Saddam was an opponent of Al Qaeda is demonstrably false. The 9/11 report provides evidence that there were contacts between Iraq and OBL from time to time including discussions of safe haven in Iraq. ”

Excuse me?? Where do you get your news, Faux Nuze?

” we were not lied into war.”

Uh, yes we were as evidenced by the collapse of the “coalition of the willing”. Every government that lied along with Bush has collapsed, as fortunately, the republicans will this November in this country.

You need to turn off Hannity and watch some real news like Charles.

Rich Berger: We are way, way off topic, but I cannot let your comments go unchallenged. The assertion we were not lied into war flies in the face of those fourteen words in the State of the Union Address, the “mushroom cloud” metaphor, and aluminum tubes. And your paragrhaph:

speaks for itself — it is a front due to our actions. Moreover, I think it critical to make a distinction between Al Qaeda and Al Qaeda in Iraq. Conflating the two organizations is, in my opinion, highly misleading, and USG (at the nonpolitical levels) makes the distinction.

Bilmes and Stiglitz’s $3 trillion estimate is an estimate; we cite many estimates in the blogosphere, so we’re almost always “speculating”. It would be useful to say why you think the $3 trillion estimate is wrong. I myself would probably make different assumptions in making my estimates, but I could see my estimate being even higher, as well as lower. CBO says direct fiscal outlays will easily reach a trillion in a few years; is that mere speculation as well? By your definition, I think it is.

Charles wrote:

Dick, I thought we had agreed to enhance our relationship by ending it.

I don’t remember that but I am here to do my best to make people think. If you choose not to think that is fine. Simply don’t read my posts.

it is a front due to our actions

Okay. But is that bad? And was it unforseen?

They’re there, not here. It has drawn islamists like moths to a flame.

And the situation on the ground right now is that if you are an Islamist and go to Iraq, you’re going to be killed, and not as a suicide bomber/ martyr.

That kind of takes the gloss off the whole Al Qaeda thing.

CBO says direct fiscal outlays will easily reach a trillion in a few years; is that mere speculation as well?

Um, almost by definition it is. It’s a projection, an estimate. An educated guess.

I mean, Obama could get elected and pull out the troops on Feb 1st, 2009, right?

Menzie, I’m still waiting for an updated post from you on death rates. Haven’t gotten one in 6 months. What’s the deal with that?

Menzie –

I agree with you that a discussion of the Iraq war is pretty far afield when the initial post was dynamic scoring. However..

It is interesting that you mention the 14 (actually 16, assuming you mean the State of the Union). Bush was correct – http://www.factcheck.org/bushs_16_words_on_iraq_uranium.html

The fact that people still cling to Joe Wilson’s falsehoods astonishes me.

Rich Berger: These assertions had been removed by CIA review several times before in other speeches; they were repeatedly re-inserted by somebody. So, to paraphrase, I think the President “convinced himself” that he didn’t know of disagreement on this point within the intelligence community. By the way, what about aluminum tubes and the distinction between AQ and AQI and mushroom clouds?

Buzzcut: Well, someday soon. I did run the numbers, and if you replicate my last graph, you’ll see that we are still 155 cumulative fatalities above the 2003-06 trendline.

What is equally of interest is the “burn rate” which keeps on escalating; while reduction in force levels in theater should put downward pressure on expenditures, rising fuel costs should put counter that tendency. Thanks for reminding me about this issue, especially since the long term costs imposed on the armed forces are becoming ever more apparent.

Oh, and I think your argument that our (costly) intervention in Iraq has reduced attacks elsewhere makes the implicit assumption that there is a fixed number of AQ and AQI; but at least one of the NIEs has made the point that this is not a tenable assumption.

Buzzcut: it is a front due to our actions

Okay. But is that bad? And was it unforseen?

They’re there, not here. It has drawn islamists like moths to a flame.

I am sure the Iraqis are grateful that you have made their country an Islamist killing ground for your selfish benefit. This is yet one more example of how this war has created more enemies than allies.

Rich Berger says, “No matter how many times you and your friends repeat it, we were not lied into war.”

Scott McClellan is no friend of mine, Rich. He was the guy who told all those lies and now he’s confessed.

There’s no accounting for the resistance of some people to facts. So, I am not going to try to convince you of anything. But for

the sake of those Republicans who read this and are amenable to reason, here are my answers.

1. It is true that $3T is Joe Stiglitz’s estimate of the costs of the Iraq War. You have produced no evidence that it is in error.

2. Rich Berger says “Your statement that Saddam was an opponent of Al Qaeda is demonstrably false. The 9/11 report

provides evidence that there were contacts between Iraq and OBL from time to time including discussions of safe haven in

Iraq.”

Rich, if you are going to obfuscate, it’s better to choose a topic where the source is not readily accessible.

From Chapter 2 of the 911 Report:

“The reports describe friendly contacts and indicate some common themes in both sides hatred of the United States. But to

date we have seen no evidence that these or the earlier contacts ever developed into a collaborative operational relationship.

Nor have we seen evidence indicating that Iraq cooperated with al Qaeda in developing or carrying out any attacks against the

United States.”

No collaborative operational relationship = no trust.

In fact, the United States had a much stronger relationship with Saddam Hussein, having provided him intelligence in the Iran-

Iraq War and having supplied him with weapons or their components– even components of WMD in the form of precursor

chemicals– for which we have the historical record of Donald Rumsfeld shaking hands with Saddam.

What contacts between Iraq and al Qaida that there never occurred at the top level, only at junior levels. Some of them were

hostile, as when bin Laden unleashed anti-Saddam operatives via Ansar al Islam. In all, the 911 Report lists about six contacts,

none of which led to anything.

Because the White House manipulated the report through Philip Zelikow, by introducing information obtained by torture, and by

exempting certain people from testifying publicly and under oath, there are also serious questions about even the minor contacts

that occurred at junior levels. What is not in question is Saddam’s

relationship to Islam:

“What will be the nature of Islamist politics in Iraq after Saddam Hussein? We are moving

into quite uncharted waters in examining this question. The ruthless character of the

Baath Party dictatorship absolutely dominated decades of Iraqi politics, canceling out

the normal workings of Iraqi politics, especially among Islamist groups, and forcing

their activities, if any, underground. Movements still represented today in other Arab

countries such as communists, liberals, and Islamists were barely in evidence in Iraq.”

Ruthless suppression is not what one does to friends.

As Menzie says, we are far from the topic. Enough.

Charles-

Thanks for substantiating my points.

Your pal,

Rich

Rich, I have been well-aware of the “points” you were trying to make from the beginning. They are neither insightful nor important.

The fact is that any ties of Iraq to al Qaida were tenuous and often hostile.

The fact is that the United States chose to invade a nation that had no significant Islamist presence due to ruthless repression by Saddam.

The fact is that as a result of that invasion, the United States has wasted an estimated $3T, killed and maimed hundreds of thousands of civilians, created massive anti-US sentiment, split the western alliance, amplified terrorism, and otherwise fulfilled Osama bin Laden’s wildest dreams.

If that’s what you call victory, you are welcome to do so. Just don’t expect to be taken seriously.