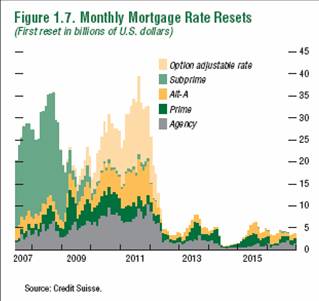

Remember this graph?

Figure 1.7: from IMF’s September Global Financial Stability Report.

At the time (October 21, 2007), some observers were arguing that (i) the mortgage crisis was containable, and (ii) unlikely to cause a recession.

One comment, responding to another reader’s predictions, went as follows: “In other words, you are predicting a fall of 50% in value [in valuations of residential housing]…Nonsense.”

Well, it’s now time to flash forward 16 months, and look back at what has happened in the intervening time, and to see what the markets are predicting.

Figure 2: Case-Shiller 10 city price index, (red triangles), CME futures prices, 21 Sep 08 (green circle), and CME futures prices, 25 Feb 09. Source: Standard and Poors’

[xls], ino.com, St. Louis FRED II, NBER, and author’s calculations.

As of December, the CS 10 city index is 33.3% below peak (2006M06) in log terms. Taking into account inflation (CPI-all), the CS 10 index is 38% below peak.

CME futures indicate 46.6% decline relative to peak by 2010M11 (in logs, nominal). Pretty close to 50% in my book.

Hence, in considering whether to intervene to modify mortgages, it seems to me that one has to trade off concerns of moral hazard against the collateral damage on the financial sector, taking into account the dire straits the housing market is in [1], and how many asset backed securities depend on housing values.

The observant reader will note that the trajectory of house prices implied by futures has shifted downward since September 2008, in Figure 2. My guess is that if expectations about unemployment rates in the future prove too optimistic, we might see further downward revisions in expected (by the futures markets) house prices, putting further stress on the financial sector.

If the final resting place is a 47% decline, and 33% of it has already happened (not counting inflation in either case), then that means there is a 21% further decline from present (Dec 2008) levels.

There should be no government meddling in mortgages. Any scheme to prop up people who foolishly bough beyond what they could afford, is merely robbing renters and first-time buyers today. Why is it better to keep person A in a home they cannot afford, rather than let person B, who is a renter and prospective first-time buyer, from buying at a better price? The latter would be more stimulative.

The downward revision in Sept 2008 vs. Feb 2009 projections is relatively minor. It comes back to my point that these revisions are shrinking in severity, and so the bottoming process is well underway (in the economy, not housing prices).

Housing prices in CA will be in the doldrums until 2013 or later, and deservedly so.

Was the concern over the Credit Suisse graph that the resets would trigger defaults in a rising interest rate environment? I know some (perhaps many) non-conforming loans enticed borrows with ‘teaser rates’ that would rise no matter the prevailing rate. Option arms look to be the next challenge. These just reset to a yearly float, right?

In terms of Case-Shiller, Calculated Risk has a regular review of price-to-rent and price-to-income. Both seem to indicate there is still more room to the downside.

Menzie: “Hence, in considering whether to intervene to modify mortgages, it seems to me that one has to trade off concerns of moral hazard against the collateral damage on the financial sector, taking into account the dire straits the housing market is in [1], and how many asset backed securities depend on housing values.”

I recognize you’re just stating the problem of the trade-off between moral hazard and systemic financial contagion…but how would we quantify this to come up with an optimal solution? I don’t the answer, I’m wondering if someone else would know.

The original poster was dealing in regular percentages, not log terms. A decrease of 50% is a decrease of about 0.7 in log terms, rather than the 0.47 that the futures imply.

Resetting mortgages is less of a problem than a year ago because of the decline in rates.

GK is correct. Using cheap money and relaxed lending standards to levitate home prices that are falling due to cheap money and lax lending standards is frankly the definition of insanity: doing the same thing but expecting a different result.

Let’s shift the focus to good banks, prudent borrowers, renters and savers. Their interests should come first. As Shakespeare warned, never a borrower nor a lender be. To hell with the “credit economy” and the misery it hath wrought.

Step 1: make invalid all naked CDS.

Step 2: leave the troubled banks with their troubled borrowers and shut them down when their regulatory capital drops below FDIC requirements.

Step 3: do nothing to assist borrowers, other than easing the use of bankruptcy to discharge debt

Step 4: while the debt is being liquidated (a couple of years), policy changes are needed to encourage domestic savings, balanced trade and energy innovation.

A decline more than offset by job losses and the declining value of the house (time to look at which houses rather than the median composite maybe)…

A timely post Menzie with the stress tests about to be unfurled by Mandrake the Magician (CR has his doubts about Timmy) …not to mention the dissolving Commercial real estate picture. I can see why Ben is nervous

Given cost-of-capital considerations, it would appear prudent to wait until 2015 before buying anything.

Don’t forget that Baby Boomers are no longer buyers, but are becoming sellers/downsizers.

Wrong! Wrong! Wrong! House prices DO NOT go down. It’s a great time to buy. They are not making any more land. Mortgage rates are at all time lows. Population is growing.

Aghhh. Cognitive dissonance…aghhhhhhhh1

The key to housing is house prices to income and house prices to rents. You can’t have an economy where only the top 3% of people can afford their houses. So the drop was entirely foreseeable, as is the continuing drop. It’s gravity, not policy. The sooner the housing market bottoms, the sooner a sustained recovery can begin.

Menzie wrote:

Hence, in considering whether to intervene to modify mortgages, it seems to me that one has to trade off concerns of moral hazard against the collateral damage on the financial sector,…

Bailouts give us both moral hazard and damage to the financial sector.

Assuming that subprime MBS’s and their CDO offspring have been written down by now, have the Alt-A and Option-Arm variants been written down to levels consistent with both CME projected C-S and depths of the recession? This Q (along with the infamous CDS overhang) seems to be the elephant in the room on bank solvency.

The administration’s parameterization of cash flow projections for its stress test may cover the possibilities: 2 yr horizon for the test, during which period the resets occur; additional 20% C-S decline; & 10% unemployment in 2010 as worst case. (I may not have these details nailed, but they’re approximately true from new reports.)

All tea leaves (Obama’s speech [“..and more may be needed”], Bernanke’s testimony, and Geithner’s convertible preferred program) point to supplying whatever it takes in capital to the banks, using the stress test, which addresses the Q above, to determine the initial additional infusion.

Don’t forget — futures contracts are biased forecasts at best, due to the risk-premiums embedded in the contract price. The CME contracts are highly illiquid and, given ongoing concerns about housing, the risk-premium is likely quite large (although difficult to measure, given the lack of long-term trading history)… thus, the 46% decline “implied” by the end of 2010 is a mixture of expectations and risk-premia — the actual decline could be quite a bit less, or the bottom sooner (unless fundamentals deteriorate to a much greater degree than currently expected).

I feel some cognitive dissonance between the negative second derivative of the Case Shiller line and the forecasts … if the stock market, for example, is at 1997 levels, why would it be impossible for the housing market to return to those levels. Future earnings prospects for both companies and individuals look pretty bleak at the moment.

GK, get them out. Give a tax break for money used to pay off principal for a while. People with cash and income will buy people out their mortgages.

Losses from the peak will be closer to 80% in the subdivisions creating middle class slums,high crime,vacant housing and bad banks. The U.S. economy driven for years by excess credit distribution and speculation has little to offer the average worker other then road resurfacing projects and military sponsored trips to far away location to kill local villagers.

The changes necessary to revive the housing market or even create a bottom have nothing to do with interest rates on mortgages rather a economic redo, no the average American will not be buying new F150 trucks or 300K homes.

My guess is that if expectations about unemployment rates in the future prove too optimistic, we might see further downward revisions in expected (by the futures markets) house prices, putting further stress on the financial sector.

because prof. chinn is more circumspect than, say, rich berger was in october 2007, he won’t suggest what i foolishly will. better yet, i’ll hide under the rubric of “stress testing”.

we know from past experience that unemployment peaks some quarters after actual economic recovery begins. economic recovery is likely some ways off still — even bernanke, beholden to incantation, now admits 2010 only if there are no more shocks, which with the generous presumption of a six-month window of visibility is as good as saying he doesn’t know when — as this has clearly become a balance sheet recession replete with much-dreaded and long-anticipated consumer retrenchment. even in further shocks are averted — unlikely, as i can rattle off five that seem quite possible if not probable — that retrenchment is unlikely to slow at least until consumer confidence gets out of the gutter.

given these things, and given further that job losses interact with negative equity to drive foreclosures — we are looking at a sustained period of high foreclosure activity for several quarters to come, and well beyond the 1q2010 indicated by the futures curve. this would be true even if neg-am alt-a’s were not about the recast early in droves on the basis of their LTV triggers over the next four to six quarters. and if that is so, the current consensus view (such as there may be one) is probably underestimating the damage which will be measured by any number of macroeconomic indicators.

if there’s anything i’ve (and many of you, i suspect, have) learned in the markets, its that the predictive value of futures curves are near nil. prices therein reflect the hedging needs of market participants, not a crystal ball. (my favorite recent example was the forward oil curve, stubborn all the way through the great crash of 2008.)

so call it a “stress test” if you like — i’ll call it the probable reality: downward revisions in the future house price curve are a mortal lock. the house value decline is if anything going to exceed the target offered by jm back in october 2007, perhaps (with a shock or two) generously.

The problem with mortgages isn’t the rate resets, nor the teaser rates, nor interest rates: the problem is *payment* resets, specifically the transition from interest-only payments to payments including principal amortization. This problem is most dramatic in the Pay-Option ARM products (Alt-A), but also applies in the subprime realm (short and medium term IOs) and the Prime realm (longer term IOs).

Many, many borrowers are/were keeping up with IO payments that are (now) approximately equivallent to fair rents on their house; many of these people put little (5%) or no equity into the house to begin with. The option ARM borrowers generally have negative equity even at the original appraisal price of the property.

Now that the mortgage payments have reset to include principal amortization — which is generally at a rate faster than 30 years, given the age of these mortgages — the payment is onerous even though the interest rates are very low: even buying the interest rate down to zero will not help these people. Consider an example from a recent article in the NYTimes: a woman with a $30k income is paying a mortgage that has an approximate $500k principal balance (implied by the numbers given in the article). While this person could afford to rent that house, there is no possible way she can afford to buy it, not even with a 40 year mortgage at zero interest.

Unfortunately, mortgage servicers and banks have no ability to transition borrowers into renters, which is what most of these people should be, if they want to stay in the house they mortgaged. And unfortunately no private entity has stepped up to create a wide-scale rental entity: the economics of single family detatched rentals are tough in a good market, let alone the current climate of crazy uncertainty on all fronts.

We — the investors, the banks, the borrowers, the government, the people — need a solution to this! Unfortunately, the current plan(s) do nothing to adress the problem, and bankruptcy cramdown is hardly a workable solution (do we really want to force borrowers through bankruptcy). And so, we continue to go sideways and downward, with no bottom in sight — though I’m quite sure one of the various arrangements of the deck chairs will be the right one.

Assuming that subprime MBS’s and their CDO offspring have been written down by now, have the Alt-A and Option-Arm variants been written down to levels consistent with both CME projected C-S and depths of the recession?

d4w, i don’t think we can even yet assume the former for most parties — it’s certainly not true of the whole loan portfolios, in any case. indeed it seems to me that’s a lot of what ongoing intermittent bad bank programming is all about, how to maintain unrealistic marks and/or offload securities anywhere near them.

I can tell you from personal experience that nothing encourages saving then seeing the value of your home fall from $475,000 to $300,000 in three years. Whooooooooopppppppppppeeeeeeeeeee.

On top of that folks IRAs, 401K and like plans have crashed and burned an additional 50% if they were left in stock, as most folks were still encouraging them to do until last September. (I may been burned on the house, but after August 2007 I saw that the value of Treasuries for capital preservation was cheap even at 1% interest, and a steal at 3%.) Nothing promotes saving more than seeing all your asset wealth to turn out to be a mirage.

The joke among us boomers is that they we still have about 30 years to go until we get to ninety and can retire.

The problem with moral hazard is application — timing and to whom it is intended for. Dismissing the principle when needed and applying it when not called for set forth the Great Depression. Moral hazard should have been in play by Greenspan and the free-marketeers, instead of suggesting the benefits of adjustable-rate-mortgages, during the bubble years. Now common good must trump moral hazard because of massive collateral damages. So many non-participants have and will be hurt by the Wall Street’s greed and certainly they are not the intended targets of the punishment.

Menzi-

I ran through the excercise of plotting the annual rate of change in the Case-Schiller National Home Price Index (NHPI) from Q1-2000 through Q4-2008. I then ran a 3rd degree polynomial regression (trendline) on the data. The Trendline had an R-squared value of 0.8239, and indicated a yearly rate of change for Q4-2008 of negative 30%…This regression indicates that the rate of home price devaluation is currently ACCELERATING when viewed at an eight year perspective. The CME futures data plotted in Figure 2 indicates that the rate of change should be decelerating. I would conclude that CME futures contracts are a poor proxy for likely future national home prices.

Thank you Gaius Marius! Your informed and cogent observations are much appreciated… I hope to read more of your wisdom in the future.

The “moral hazard” argument has passed its shelf life.

At the beginning of the slide, it could probably be safely surmised that the majority of foreclosures were caused by unwise borrowing. As the recession deepens and credit tightens, it is more likey that an increasing share of homeowners in trouble are victims of bad circumstances, not bad choices. Most of the borrowers who represent the moral hazard will have been flushed out well before the bottom of the decline.

When it comes to knowledge of economics I am not in the same world as most of the people that post here, but I do have a question to the people that talk down the cramdown.

How would having people booted from the place they call homes be the best option.

1. Wouldn’t that bring home prices in the surrounding area down even further. And since most people want to move eventually from the middle lower neighborhoods it would stop it since people won’t want to buy a house for $80k when they can buy a forclosed home or a HUD home for $30-40k.

2. Most the people in these forclosed homes will have to file for bankrupcy anyway since most don’t have just mortgage woes. Credit Card debt, auto loans, monthly bills ect will eventually force it as well.

3. Wouldn’t limiting the available homes actually help restablize the price of the ones on the market. By introducing a little scarcity?

Anyway this is a bad situation, because if you look at that simple Circular flow diagram you can remove the words funds and input “Blame” and you got a good start.

We (Consumers) don’t have the financial knowledge to understand how the financial system is set up, so we ‘hire’ the professionals and take their advice.

Just like if I am building my dream home I would hire a contractor. I don’t have the knowledge to know which plumbers do their work well, or if an electrician is actually wiring the house right. So we pay the contractor.

Then we pay the inspector to make sure that their work is actually right.

That is so much like the bank situation to me it is scary.

We lend the bank our money so they can safeguard it and give us a modest return by reinvesting wisely (because like the house we don’t have the knowledge to intelligently do it).

And we pay the government in taxes to make sure that they are looking out for our best interests (like the inspector does for us).

But the banks got greedy and started to feel that the money they were safeguarding was their own and got riskier and riskier in order to pull off more and more profit off the top. Similar to a dirty contractor that does shody work and hires the cheapest labor so he can make more money.

Paid the government officials to essentially look the other way with loosening a lot of the regulations, or just didn’t know what was going on.

Advertised their new mortgages and approved everyone with a pulse in order to gather as much before the collapse as possible.

I know this is slanderous, but if the people in the financial community actually know what they are doing, someone somewhere had to know this was inevitable.

And now we are forced as taxpayers to either:

Give the people directley responsible money so that the system does not collapse. But spread that cost over the entire tax paying population.

Or:

Have collapses in clusters. Having those homes forclosed on costs the population money as well. In the form of stocks, property values, jobs, and all the other costs that will have to rise as a result.

So which is better everyone suffer for the unrelenting greed, or have everyone suffer for our greed, but not kick as many people out of their homes they cannot afford without some help?

Any comment on the upcoming reset of option adjustable rates in 2010-2011? What is the impact of this? Any future problem for banks coming up?

Does this mean that by 2010 or 2011, houses will actually be affordable again?

Don:

The effect of this cycle’s moral hazard will be seen in the next credit cycle’s acceleration phase.

“Does this mean that by 2010 or 2011, houses will actually be affordable again?”

Yes. That is why bailing out people who can’t pay their mortgages is merely robbing prospective first-time buyers (young newlyweds, immigrants) or a better price.

There are always 1 million more new households created each year in America. To coax them out of renting and into buying, let prices correct naturally.

Robbing Peter to pay Paul is hardly stimulative.

Moral Hazard is happening right now. If my neighbor defaults and is relieved of his obligations, than maybe I will choose to default also. Bring back debtors prisons. We would not have a banking crisis if everyone fullfilled their obligations as contracted.

Menzie wrote:

“Hence, in considering whether to intervene to modify mortgages, it seems to me that one has to trade off concerns of moral hazard against the collateral damage on the financial sector,…”

Another trade off is more important IMO – namely, what is the best use of limited government resources? Should we try to prop up home prices and lenders, or to spend on increasing output directly to keep up employment? Frankly, I don’t think we can afford the cost of the former.

The moral hazard hasn’t even begun. What happens when millions of homeowners come to the realization that their homes are worth less than their mortgage? The average person moves every seven years. Millions upon millions of people won’t be able to sell their homes because they are underwater. Then comes the REAL wave of “walk-aways.” There’s no reason to pay the mortgage any more. It would be half as much to rent. I’ve considered it myself. The homes around me are selling for much less than I paid. I could rent for about 30% less. I ask myself why I’m paying my mortgage any more. The hit on my credit would probably be worth it. The only thing stopping me is my own moral standards. Believe me, there are tens of millions of people that wouldn’t think twice.

It’s just getting started.

Menzie wrote:

“Hence, in considering whether to intervene to modify mortgages, it seems to me that one has to trade off concerns of moral hazard against the collateral damage on the financial sector,…”

A more important trade off, IMHO, is the one between alternative uses of limited government resources. Is it better to prop up lenders and home prices, or to spend on projects to keep up employment?

I vote for the latter. Actaully, I don’t think we can even afford the former.

Moff:

Perhaps we have a different definition of moral hazard. I thought the definition was that an individual who was insulated from risk has an incentive to engage in risky behavior in the future.

If an homeowner with a good credit rating who paid twenty percent down finds himself in a situation where his house is worthless, it may be sensible for him to simply walk away. This has nothing to do with whether he was encouraged to engage in risky behavior, or whether he might be more inclined to engage in risky behavior in the future.

If I am in a neighborhood in which a young couple purchased a $500000 home with nothing down is bailed out, I, as a responsible borrower may have a more cavilier attitude in the future. If, on the other hand, the economy fails, and I see the middle aged couple down the street who never took an unreasonable risk bailed out late in the slide, but the young couple flushed out early, then I will not be encouraged to emulate the young couple, although I will be thankful that those who were victims of the downturn who did nothing questionable would be saved.

This is my only point: as the economy tanks, the moral hazard created by a homeowner bailout declines. By how much is a statistical matter that I can’t answer.

People walking away from their houses because it is the reasonable thing to do is just an expected consequence of a housing collapse. Moral hazard isn’t involved.

Don and Moff

I think the main moral hazard issue is the effect of bailouts on the business models and behavior by lenders. The importance of the effect on individual buyers would seem to depend on the variance of results between individuals relative to the variance of results over the business cycle (which apparently has not been repealed).

I live in New Jersey, The houses around my neighbourhood is pretty much flat in the past 2 years, no 38% drop, I think there are only a few states are in the bad shape you mentioned.

NO System Risk!

gaius marius,

“..d4w, i don’t think we can even yet assume the former for most parties..”

more than inclined to agree, but did not wish to appear to be saying that the sky is falling despite Treasury’s money, stress tests, and further money. Thanks for calling me out on perhaps appearing Pollyana-ish though.

d4w, so far from pollyanna, there’s a real lack of the sufficient critical optimism to see through to the other side of the problems. i certainly don’t mean to squelch it.

on the topic of marks, there’s further this bit today from gillian tett — important analytical work emerging which indicates that CDOs are, even if marked to ‘markit’, are perhaps valued too optimistically vis-a-vis their real liquidation value.

From late 2005 to the middle of 2007, around $450bn of CDO of ABS were issued, of which about one third were created from risky mortgage-backed bonds (known as mezzanine CDO of ABS) and much of the rest from safer tranches (high grade CDO of ABS.)

Out of that pile, around $305bn of the CDOs are now in a formal state of default, with the CDOs underwritten by Merrill Lynch accounting for the biggest pile of defaulted assets, followed by UBS and Citi.

The real shocker, though, is what has happened after those defaults. JPMorgan estimates that $102bn of CDOs has already been liquidated. The average recovery rate for super-senior tranches of debt or the stuff that was supposed to be so ultra safe that it always carried a triple A tag has been 32 per cent for the high grade CDOs. With mezzanine CDOs, though, recovery rates on those AAA assets have been a mere 5 per cent.

gaius marius: How about providing some help for this naive observer. Abreviations: CDO = Credit Default Options? ABS = ? Some kind of mortgage I assume, but what? Alternative Bank Securities??? All But Shittt??? A rated Bond Securities ???

If CDO is a credit default option, how does it go into default? Isn’t it a form of insurance? But insurance contracts were supposed to be so profitable in the past because no insured needed to be made whole. How could so many CDO’s be in default?

I must be mistaken about the definition of CDO’s.

CDO : Collateralized Debt Obligations

a bunch of mrtgages are pooled and sold as shares, sort of like a mutual fund.

ABS: Asset Backed Securities, e.g. Real estate backed CDO’s

sorry rr —

CDO = collateralized debt obligation — that is, in its most common incarnation, a pile of low-quality tranches of asset-backed securities (ABS). investors then buy tranches of the pile (some significant fraction of which were rated AAA thanks to the structure) and are paid out of cash flows depending on their position in the structure.

ABS = asset backed securities — that is, a pile of receivables (assets, in this case mortgages). investors then buy tranches of the pile (called ABS) which are paid out of cash flows depending on their position in the structure.

one can think of a CDO as an ABS of ABS’s.

I am sick of this Moral Hazard vs. Common Good debate.

WHO ARE THE BONDHOLDERS OF THESE BANKS THAT ARE BEING PROTECTED AGAINST LOSS BY THE TAXPAYER?