These topics are the subject of two special issues, the first in IMF Staff Papers, and the second in the Review of International Economics.

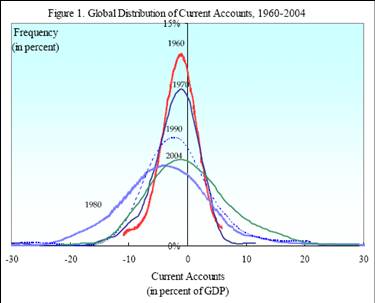

Figure 1 from Hamid Faruqee, Jaewoo Lee, “Global Dispersion of Current Accounts: Is the Universe Expanding?” (working paper version).

The IMF Staff Papers has published the proceedings from the current account sustainability conference Charles Engel and I convened in the Spring of 2008 (and discussed here). The papers included in this section, edited by Akito Matsumoto, are:

Special Section: Current Account Sustainability in Major Advanced Economies

- Introduction, Akito Matsumoto.

- Expected Consumption Growth from Cross-Country Surveys: Implications for Assessing International Capital Markets, Charles Engel and John H Rogers

- Global Dispersion of Current Accounts: Is the Universe Expanding?, Hamid Faruqee and Jaewoo Lee

- How Long Can the Unsustainable U.S. Current Account Deficit Be Sustained?, Carol C. Bertaut, Steven B. Kamin, and Charles P. Thomas

- Asset Prices and Current Account Fluctuations in G-7 Economies,

Marcel Fratzscher and Roland Straub - Global Imbalances, Productivity Differentials, and Financial Integration, by Suparna Chakraborty and Robert Dekle

Conference versions of the papers available here

Figure 9 from Joseph Gruber, Steven Kamin, “Do Differences in Financial Development Explain the Global Pattern of Current Account Imbalances?” working paper version.

The Review of International Economics special issue on “Global Liquidity” included the following papers:

- Understanding Global Liquidity in a Volatile World, by

Joshua Aizenman, Menzie Chinn, Michael Hutchison - Will Sub-Prime be a Twin Crisis for the United States?, by Michael P. Dooley, David Folkerts-Landau, Peter M. Garber

- Do Differences in Financial Development Explain the Global Pattern of Current Account Imbalances?, by Joseph Gruber, Steven Kamin

- Can International Productivity Differences Alone Account for the US Current Account Deficits?, by Suparna Chakraborty, Robert Dekle

- Global Imbalances: The Role of Emerging Asia, by Pietro Cova, Massimiliano Pisani, Alessandro Rebucci

- Capital Flows, Capitalization, and Openness in Emerging East Asian Economies, by Alex Mandilaras, Helen Popper

- Monetary and Financial Integration in the EMU: Push or Pull?, by

Mark M. Spiegel - Sterilization, Monetary Policy, and Global Financial Integration, by Joshua Aizenman, Reuven Glick

- A Macroeconomic Perspective on Reserve Accumulation, by

Avner Bar-Ilan, Nancy P. Marion - Hoarding of International Reserves: Mrs Machlup’s Wardrobe and the Joneses, by Yin-Wong Cheung, Xingwang Qian

- Option Pricing Approach to International Reserves, by Jaewoo Lee

- What is Driving Reserve Accumulation? A Dynamic Panel Data Approach by Diego Bastourre, Jorge Carrera, Javier Ibarlucia

The papers were originally presented at a Santa Cruz Institute for International Economics conference on Global Liquidity in April of 2008, organized by Joshua Aizenman and Michael Hutchison.

Nice pic! Baclet and I actually have a June 2008 Banque de France Occasional paper presenting a variety of distributions of international current account imbalances.

http://www.banque-france.fr/fr/publications/telechar/debats/distribution.pdf

THE DOLLAR AND THE US DEFICIT

Pleased by the prospect of the dollar declining? If foreign investors stop buying US bonds, that would be just great? The only mechanism for getting the trade deficit down is a lower dollar? It makes me sad to hear such views by prominent US economists.

Well, even Botswana can lower its deficit in this way. This is not an “accounting identity”, as Dean Baker called it. It is an accounting gimmick and a beggar-thy-neighbor policy. What if every nation was going to follow retaliatory competitive devaluations of their currency? According to the economics I know and have been teaching my students, this is a short-term “solution” which will backfire. Is it by accident that the world’s least competitive countries are the ones that are constantly devaluing their currencies? The trade deficit can only be reduced by increasing competitiveness and productivity, technological superiority, innovation, entrepreneurship etc. A constantly declining dollar will bring about inflation and higher interest rates for obvious reasons. US consumers’ purchasing power will drop. This will hurt manufacturing through a drop in consumption and demand for their products, and through an increase in their financing costs and imported raw material costs. They will become less competitive. This will increase the trade deficit. The decline of the dollar and its consequences will be exacerbated by the foreigners dumping the dollar and the dollar-denominated assets. I don’t know who will then finance the US debt. Americans will also try to protect their life’s dollar savings by converting them to stronger currencies, investing them in foreign-currency assets and perhaps moving them offshore. This capital exodus will further negatively impact the US current account deficit. Wall Street will plummet, and it will be very difficult for US companies to raise capital. A long-term Depression will hit the country. It’s a vicious circle. And gradually but surely the world will move to other reserve currencies. America’s economic and political standing in the world will erode.

I read posts like Pkpetro and I must confess to becoming very confused. We have seen significant productivity growth over the last 15 years, well above what was considered to be sustainable, and yet the trade deficits have grown significantly.

As someone on the front lines of globalization, I must say that posts like this seem disconnected from reality. There is no way the US can compete with the labor rates in other countries in a wide range of industries.

There is also no way the trade deficit is in any way sustainable.

This sentence “The trade deficit can only be reduced by increasing competitiveness and productivity, technological superiority, innovation, entrepreneurship etc.” frankly seems silly. For it conveniently fails to indicate HOW this will be accomplished.

Of course there is another way the trade deficit will be reduced: by lowering American wages. Absent a lower dollar everyone knows this is how the trade deficit is going to be reduced, but no one has the guts to put that on the table.

Fladem, in many ways we HAVE a lower dollar. Remember when the dollar bought 224 yen in ’84? It’s in the 90’s today.

The Euro has been all over the place since its conception, as low as 89 cents, as high as a buck fifty. We’re near the top of the range.

Yet that trade deficit grows and grows and grows.

Menzie’s contention in the past is that the trade deficit is a function of the federal budget deficit. A higher federal deficit drives the trade deficit higher. I sympathize with that view (you can’t help but notice that the TD really started to explode concurrently with the Reagan deficits), but I didn’t see any great decrease in the TD with the Clinton surpluses. If anything, the Asian financial crisis exacerbated that deficit.

Are these TDs unsustainable? We’ve had massive and growing deficits for going on 30 years now. If they’re unsustainable, the dollar crisis is taking its sweet time getting here!

I don’t know what the answers are, but it seems to me that we’re in uncharted territory, trying to integrate literally billions of people into the global economy in a very short time. Maybe 50 years from now, when China and India have wage rates on the order of Eastern Europe or Mexico, things will settle down a bit and the trade deficit will work itself out naturally and painlessly.

BTW, what if those productivity statistics are a mirage? What if the data is skewed because of all the multinationals that make so much of their production in China? After all, what is the proper accounting of an iPod that is made in China? What portion of the price should be accounted to China and what portion to the US?

Maybe the trade deficit is an illusion?!?

30 years of a trade deficit for the U.S. has produced, from international trade economists, recommendations to fiddle with temporary conditions, such as the value of the dollar.

The value of the trade-adjusted, real dollar is about where it was in the late 197 0’s today.

Economists can’t conceive of a U.S. policy aimed to reduce the U.S. trade deficit, despite the knowledge that other countries have explicit policies and pracitices to create a trade surplus.

Escape from this reality requires adoption of the goal of equal trade (no trade deficits) for all nations AND implementation of U.S. policy aimed at showing other nations how to get there.

Five nations are long-time surplus traders with the U.S., accounting for 60% of the U.S. trade deficit.

This nation needs a law which says import tariffs will be gradually increased (at four months intervals) on all imports into the U.S. that are manufactured in each of the five countries producing 60% of the U.S. trade deficit.

By concentrting on five nations, the point will be made without reducing trade with the rest of the world.

That is a tariff proposal that will not start a trade war.

Obama’s imposition of tariffs on a specific product is stupid. Everyone knows that tariffs on specific products invite retaliation. Tariffs limited to specific nations is a horse of a different color.

These learned discourses seem to me quite hollow, despite the prestigious journal (although they are a conference issue and presumably not refereed). They appear to be blind to some obvious stuff – namely, the export-led growth strategies pursued in Asia.

In the last paper, how were the ratios of reserves to GDP measured? By real (PPP-adjusted) values, or simply nominal values? Were the observations weighted by size of GDP, or was each ratio taken with equal weight? Was Japan included among the floating rate countries? Based on behavior in which period (before or after 2004)? Their reserve stock was built up over a period that included both types of behavior.

I still have trouble grasping the view that truly massive currency interventions by countries with capital controls do not influence borrowing by deficit countries. Nor am I convinced that Japan’s policies (explicit interventions up to 2004 and implicit support for the yen carry trade after that) were completely ineffective in the global allocation of debt.

Pkpetro, you are teaching your students exasctly the right thing.

However, we have to reverse the direction of trade. We have piled up so much debt that our children will have to build GM cars at the national car plants. The cars will sell briskly for a handful of francs.

WalMart will be a luxury goods store, and we will have to do without their Chinese work boots, and for that matter, bananas from South America.

Unemployment will be zero as the world scrambles to employ Americans for 10 yen a week.

The mortgage payments will be a problem until all the banks go out of business, and then we are home free.

don: Both sets of papers were peer reviewed.

The reality documented from a group of nations may not apply to the U.S. We are an outlyier.

What interests me is the conditions under which the U.S. has sustained a very large trade deficit for 30 years, a deficit that is not matched in size and duration by any other nation. We cannot understand our predicament by studying the experience of other nations.

We can see a way out of our predicament by become as selfish as our trading partners who have created the bulk of our trade deficit.

Ugh. Makes me feel even worse. No one seems to be worried about what appear to me to be serious imbalances being created by currency policies. Sort of like the feeling I had when reading arguments of fresh water economists that the U.S. economy was not building dangerous imbalances in 2005. Even Bernanke’s work (on the ‘savings glut’) was too shallow in explaining its causes. Is there a ‘correct think’ movement to prevent criticism of these policies (perhaps a fear that the masses would take up and misuse the criticisms)?