Last week we received positive readings for some key economic indicators. But I still see plenty to worry about.

|

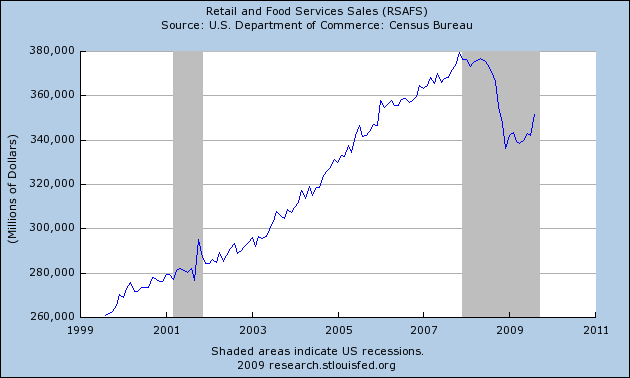

On Tuesday the Census Bureau announced that U.S. retail and food services sales in August were 2.7% higher than in July on a seasonally adjusted basis. True, 2/3 of the additional $9 billion in spending was attributed to motor vehicles and parts, and September car sales could be much worse than August. Another 1/6 of the new spending came from gasoline stations, and the higher average gasoline prices in August are hardly cause for celebration. But even excluding autos and gasoline, core retail sales were up 0.6% in August. Here’s the summary from Stephen Stanley of RBS:

after a string of contractions, these data suggest that consumer demand is, at a minimum, stabilizing. Core retail sales may even be starting to firm slightly (up in 2 of the past 3 months), but we will need to see another month or two of positive data to have confidence in that view.

|

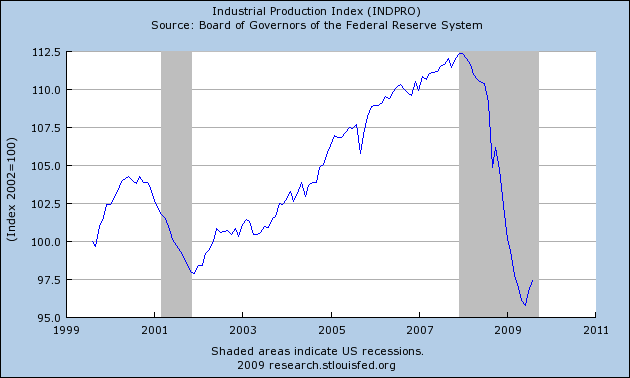

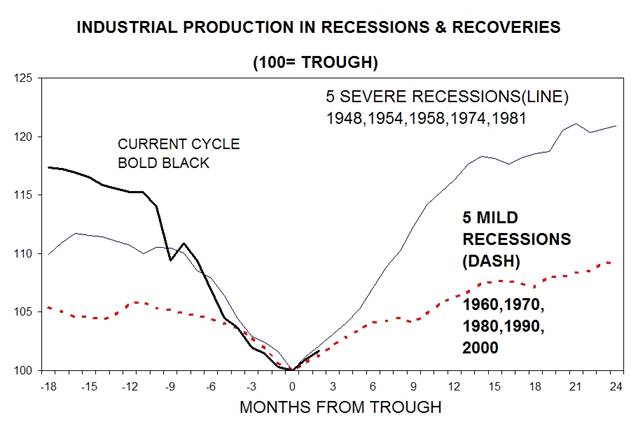

On Wednesday the Federal Reserve reported that its index of U.S. industrial production grew by 0.8% in August, adding to the 1% gain seen in July, and breaking the steady drop this indicator had been exhibiting since January 2008. Spencer of Angry Bear notes that the increase in industrial production over the last two months is typical for previous economic recoveries. If this does prove to be a typical recovery, given the sharpness of the downturn we would expect to see sharp growth from here.

|

These new readings for sales and production were enough to push the Aruoba-Diebold-Scotti Business Conditions Index back into positive territory for the first time since the recession began.

|

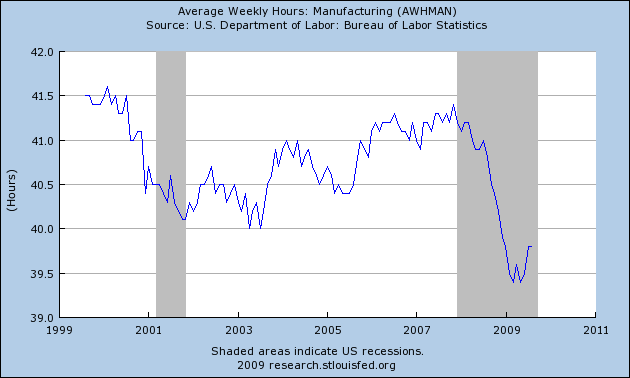

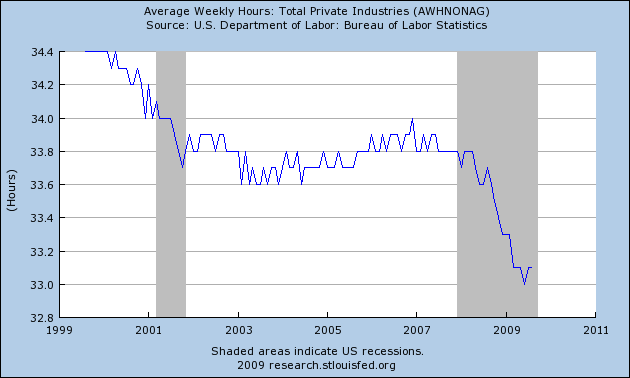

What’s not to like? My key worry about the U.S. economy remains the employment picture. The Conference Board includes initial claims for unemployment insurance and average weekly manufacturing hours in its index of leading economic indicators, the number of workers employed on nonfarm payrolls in its index of coincident economic indicators, and average duration of unemployment in its index of lagging economic indicators. Manufacturing hours have indeed rebounded off their lows.

|

But for total private industry jobs, we’ve been stuck at 33.1 hours/week since March, unless you want to claim victory on the basis of the brief nadir of 33.0 hours/week touched in June.

|

New claims for unemployment insurance did fall this spring. But the 4-week average reported Thursday is actually worse than the numbers we were seeing at the end of July.

|

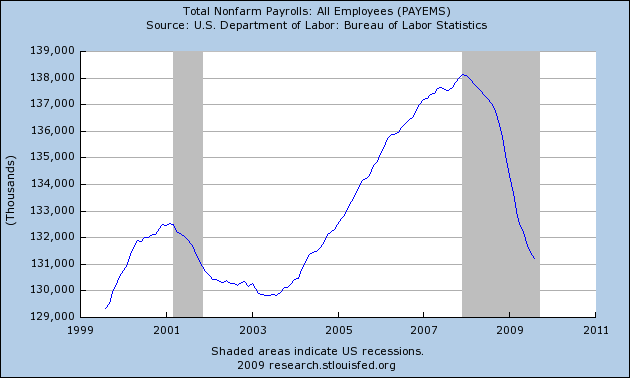

Bill McBride believes that as long as the number of new claims remains above 400,000 per week, the total number of Americans working is going to continue to fall. With the latest 4-week average for new claims at 563,000, we’ve got a long way to go before the employment situation is actually improving.

|

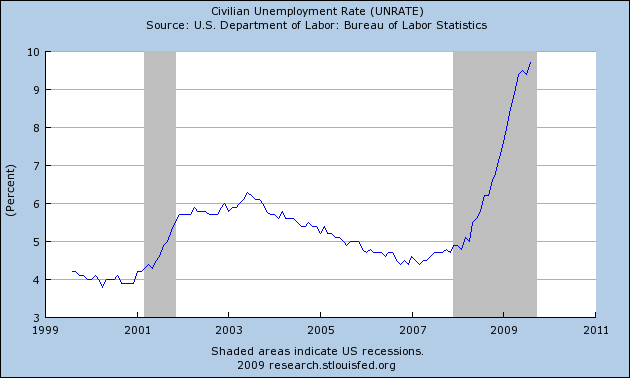

And even once the number of Americans working starts to grow, unless it grows faster than the number looking for work as a consequence of population growth, the unemployment rate will continue to climb.

|

I see this as more than the conventional hand-wringing about a “jobless recovery.” That phrase might suggest that we’re just talking about a replay of the anemic recovery that followed the 2001 recession. In the first 6 months of 2002, nonfarm payrolls fell by 350,000, or 58,000 per month. In July and August of 2009, payrolls fell by 492,000. If the recession really ended in June, as some claim, this is a much more serious problem than we saw in 2002-2003.

And it is a more serious problem not just because of the ongoing human cost. It also undermines the prospects for continued improvement in the other indicators. As long as large numbers of people are still losing their jobs, that can set in motion a number of undesirable feedbacks such as increasing loan delinquencies that could bring about a replay of some of the concerns many of us had hoped were behind us. Federal Reserve Bank of San Francisco President Janet Yellen was right on target:

The financial system has improved but is not yet back to normal. It still holds hazards that could derail a fragile recovery….

And the likelihood of continuing losses by financial institutions will add new fuel to the credit crunch. In particular, small and medium-size banks could experience damaging losses on commercial real estate loans. Thus far, the largest losses have been on loans for construction and land development. Going forward, however, rising loan losses on other commercial real estate lending is likely because property values are falling, office vacancy rates are rising, and credit remains tight or nonexistent for those many property owners that will need to refinance mortgages over the next few years. Financial contagion from this sector is one of the most important threats to recovery.

So yes, it was a good week for some key economic indicators. But serious concerns remain.

Jim,

Interesting post, and an especially good point about the employment situation now vs 2001-02.

One thing I haven’t seen discussed much about the retail sales data is that Aug-Sept is back-to-school season. Texas had its annual tax-free weekend from 8/21-23 (IIRC), and I’m sure it was similar in other places. Especially since some of the stronger categories were books, apparel, etc., I wouldn’t be at all surprised to see a couple of weaker months coming up.

PS

Professor,

It appears that a significant number of the “unemployed” will be losing their elegibility for unemployment compensation. I know that unemployment numbers are adjusted downward for those who no longer file for unemployment. Will this loss of elegibility distort the unemployment numbers since these people would like to file but cannot?

Professor,

John Mauldin (not at all one of my favorite analysts) shares a repost by Institutional Risk Analytics noting 25 banks failed in 2008 while todate 92 banks have failed in 2009. But they estimate that 2,256 banks have an “F” rating. With an estimated failure rate of 50% in the near future over 1,000 banks will fail.

Many do not worry about this because deposits are insured by the FDIC, But………

The estimate is that these bank failures could cost the FDIC $400-500 billion. FDIC reserves are currently only $10 billion and you may recall that the FDIC was given a recent injection. To put this into perspective the FDIC only borrowed $15 billion (and we are still paying on this 30-year loan) to cover the S&L crisis.

If the FDIC borrows the money to cover the losses it will have to increase its charges to member banks, but remember 2,256 are already rated “F.”

And all of this is even before we take into account the expected crash of commercial real estate. An anecdote, just this weekend I drove through one of our upscale strip-malls noting vacant storefronts. Half were empty. If you want to get away from the graphs and equations and see the real world I suggest you take one of these little jaunts and count the empty storefronts in your neighborhood.

No, we are not out of the woods and I would suggest that, though the government continues to pretend that we are coming out of the woods, it leads us in deeper and deeper.

We have not even seen the depths of the woods yet, and note I am not even considering unemployment in this assessment.

The thing I wonder is during the boom years we had 15 million illegal immigrants(not all working of course) and a few million more H1b visas.

This is what the Fed calls “running the economy at potential”.

I have no idea whether legal and/or illegal immigrants get picked up in employment data. They do surveys to collect the data (establishment and household surveys), so maybe anyone who answers the phone is a data point.

How do we know how many Americans are working or not? And just who are we concerned about keeping employed in the USA?

Professor Hamilton,

It seems rather obvious to a layman that this is a crisis that was caused by, or at least aggravated by, relatively high debt levels and poor underwriting. Are current debt levels a factor in recovery?

For instance, in the five severe recessions in the graph above that show the very strong recoveries, household debt as a percent of GDP was less than half what is now, and nonfinancial business debt about 45% less.

Won’t continuing deleveraging, and the decreased ability to take on new debt, factor into the speed and magnitude of the recovery?

And if not, why not?

DickF: To be counted as unemployed for purposes of the series graphed, what matters is whether you have taken an active step to try to find work within the last 4 weeks, not whether or not you are collecting unemployment compensation.

Cedric Regula: Of course it’s hard to know for sure, but I believe that the official statistics do include large numbers of undocumented immigrants.

Bob in MA: Yes indeed, the debt issue is the primary reason that I share the skepticism held by others as to the prospects for a V recovery.

Well, this will be a continuing point of speculation and discussion, but my belief is past performance of recessions and recoveries are not indicative of future performance…to quote a typical financial disclosure statement.

We don’t need to worry about rich people that much, they will be ok, but I think we have a bifurcated middle class. Those in trouble due to very high debt and/or unemployment, and those that are doing ok. We may wipe out a lot of debt thru foreclosure and bankruptcy, but then the failed banks will taken over by the FDIC.

I like reading Mauldin’s stuff, and the FDIC does have a big problem still. And the Fed is closely watching the commercial real estate situation. You can be sure Ben is cooking up some contingency plans. We will have shopping malls on the Fed balance sheet, you can bet on it.

So the FDIC may need up to an estimated $500B for smaller banks over the next year or two. Remember much of the $700B in TARP funds could be repaid by the big 9 banks. That funding could be made available to the FDIC. The USG will not let depositors lose money, so the FDIC really is backed by the USG.

But I did catch wind of how that may really happen. Citi has been making Adam Smith noises lately and pounding on their chests that they want to repay TARP and “Get the government OFF THEIR BACKS!”.

But in order to raise the cash, they are doing some sort of borrowing(I forgot what they call the debt instrument”), but it comes with a FDIC guarantee! At least that is what I heard on CNBC.

That is a little disturbing, because now we have the Treasury financing a fiscal deficit, the Fed buying everything in sight and expanding its balance sheet, and now the FDIC is making loan guarantees. I guess I should mention Fannie, Freddie and the FHA, and maybe then I’ve completely “ring fenced” all the players expanding liabilities to the taxpayer.

But if it makes the economy better…cool!

Here’s a recent TARP scorecard. Eight large banks paid it all back, with profit. The largest recipients, Citi and BA have not yet.

I read elsewhere that the original TARP program included a provision that banks are allowed to issue private debt backed by a FDIC guarantee and use the proceeds to re-pay TARP. I also heard Geithner say he believes he still has authority to re-use the repaid TARP funds again without congressional approval.

So we have advanced the art of expanding taxpayer liability, without resorting to voting up the national debt ceiling. I think this is considered bad if you are enron or aig, but this is the USG, so it’s ok!

http://www.dailymarkets.com/stocks/2009/09/01/us-turning-profit-on-tarp-but-big-loans-remain-in-citigroup-bank-of-america/

Thank you for the answer, professor.

I don’t have the confidence in my opinion (that debt levels are key to the type of recovery we’ll have) to assume a robust recovery is impossible.

But I feel none of those making the sanguine forecasts can have much credibility until they can explain either why the extreme debt levels don’t matter, or how they can be easily overcome. The issue just doesn’t seem to exist to them.

Even Jim Grant’s piece, “From Bear to Bull”, in yesterday’s WSJ makes no mention of debt levels and the influence they will have on recovery. He actually compares this recovery to 1957-8, a classic business cycle recession from a time when homeowner equity was 75%, while credit cards and the junk bond market were virtually nonexistent.

I don’t have the confidence in my opinion (that debt levels are key to the type of recovery we’ll have) to assume a robust recovery is impossible.

But I feel none of those making the sanguine forecasts can have much credibility until they can explain either why the extreme debt levels don’t matter, or how they can be easily overcome. The issue just doesn’t seem to exist to them.

Bob_in_MA makes good points. How many of those recessions depicted in figure 1 were propagated by a finance sector meltdown?

Should we not be looking at the experiences of economies outside the USA for an indication of the US economy may recover?

Once a student I was reading Mundell theory of equilibrium,that is a BOP equilibrium,full employment, supply for and demand for money set at a given equilibrium and the same for the investment savings curve. The interest rates,fiscal policy,exchange rates policies would come to salvage three out of four cases of imbalances.

Once a grown up I have to cope with retails sales only. Did I miss some new major economics theories in between?

Cedric,

The illegal immigrant issue is much ado about nothing. We should protect our borders from intrusion by those who would do us harm but those coming to work pay their own way. Immigration is a good thing. It is the best “poll” of which countries are the strongest economically.

JDH: “My key worry about the U.S. economy remains the employment picture.”

Awhile back you also mentioned longer term structural adjustments, i.e. retraining people to do things that will eventually result in products or services that will be demanded in whatever recovered economy exists in the future (i.e. NOT financial services). Are you still concerned about this?

The August retail sales were lower than August 2005 sales. The monthly retail figures have been below 2006 values all year. The July sales were at least above the 2005 July sales. Maybe this is good news – lots of pent-up demand somewhere!

In addition to the higher and I expect much longer burden of unemployment now than in the turn of the century recession(s), the huge leverage consumers/workers–unemployed or not–now hold challenges not only growth in sales, but the strength of the financial sector.

Of course, then, the banks are aren’t lending these days, merely securitizing—and we know how well that’s gone!

Nice review, Professor.

Yes, things are improved, due to the massive government intervention. But, as seen by early looks at Sep. auto sales, the bloom is off that rose, now.

The move back down is now underway.

Off topic: in case you have not taken a peek, I recommend that you peruse Dr. Keen’s thoughts:

http://www.debtdeflation.com/blogs/

I find his line of argument convincing.

If you’re looking for serious concerns, try this. The President’s web site (http://www.whitehouse.gov/issues/fiscal/) said he will: “Cut the deficit in half by the end of the Presidents first term.”

If he succeeds, we absolutely, positively will fall into another recession or worse. A growing economy requires the money supply growth to exceed inflation, population growth and the current account deficit, plus the desired GDP growth.

For charts and evidence, see: http://rodgermmitchell.wordpress.com/2009/09/16/203/

and

http://rodgermmitchell.wordpress.com/2009/09/07/introduction/

There’s some evidence that nonfarm payrolls do not capture at least some of the illegal immigrants. Calculated Risk some time ago noted that housing starts started their decline well before residential construction employment started to collapse. Some of that may have been a switch from residential work to nonresidential, but much of it was likely the drop in off-the-book workers.

I think that on the surface your headline is correct, but it depends on how you define “improves.” I personally do not see what has happened as an improvement. The govt has had to step in to prop up pretty much every single financial market, and in doing so has further mortgaged our future generation and further destroyed the purchasing power of our currency. This type of govt intervention, at least based on historical trends and common sense, is clearly not sustainable. That is why as an investor I continue to feel that gold will outperform most other areas going forward. Over the weekend I read some interesting articles about gold and the markets at http://www.goldalert.com

that discussed this week’s upcoming economic events, such as the Fed meeting and G20, as well as other recent noteworthy events such as the IMF sales and Chinese purchases of gold, all of which I think can provide investors with important information and analysis on the current macro environment impacting the gold price.

I have a question. When will the real, or at least nominal, income of the lower 90% of wage earners begin raising?

I agree with Cedric Regula. And I’m more than a little incensed at the government’s actions. So much for the hope that taxpayers would not be on the hook for even more of the (so far unrecognized) legacy loan losses, in favor of private lenders and equity holders.

JDH, you would make a good Chief Operating Officer. You cover all the operating items well, except you neglected to mention that Federal stimulus for operating activities has about peaked. But check with your CFO about the balance sheet. Home mortgages had record defaults last month. Commercial real estate loans are increasing their default rates. Credit card debt increased its rate of decline last month (to a record) meaning that more personal income was saved and not spent, and its trend seems unchanged, as yet. Since this recession was triggered by balance sheet events – too much debt and phony assets – it would be worth your review of the original problems. You may change your mind on the outlook.

If the ADS business conditions index is above zero at present, that is supposed to mean that business conditions are above average, which does not seem realistic.

At the same time, another fact about the ADS index that I found strange is that, during the 2001-07 economic expansion that drove the unemployment rate down to 4.4 percent, business conditions were above average less than half of the time, and the average includes all of the recessions in the sample.

Bob_in_MA says he doesn’t have confidence in his opinion (that debt levels are key to the type of recovery we’ll have) to assume a robust recovery is impossible.

I think a sustained recovery is doubtful. It is not so much the debt levels per se as it is the trade deficits that under lie so much of the debt out there. In the General Theory, Keynes wrote,

“[A] favorable balance, provided it is not too large, will prove extremely stimulating; whilst an unfavorable balance may soon produce a state of persistent depression.”

William White, a former chief economist at the Bank for International Settlements, predicts the Great Recession won’t end because the world’s governments are not addressing the trade imbalances, which caused it. We lack the manufacturing capability to export enough to dig out, assuming we had enough of a declining dollar.

Finally, Richard Duncan sees the result of so much debt and its expected augmentation over the next several years as leading to an inability to manage it except by having the Fed monetize it with the result being serious inflation, in the context of a continuing recession/depression, that could lead to “a fall of Rome scenario” in the United States.

Some of us do not think there is a ready way out. The flow variable of GDP is by no means the whole or even an important part of this picture. Keynesians are too accustomed to looking only at flow variables and in the short term. The real issue here is stock variables, like debt and deficit totals, in the longer term. I think we have some real problems that are not being well addressed.

Let us get very Keynesian, because many professed Keynesians are not and our government is not doing too well at it in several regards.

As a young man, Keynes favored open free trade. However, from studying the real world, he came to realize that countries can gain an edge by adopting strategies designed to develop trade surpluses, that is adopt a policy known as mercantilism. The problem with mercantilism is that countries that trade with such surplus countries themselves wind up running serious trade deficits.

If and as those deficits continue, according to Keynes, they can result in a persistent depression in the deficit countries. Aggregate demand is reduced and eventually financial crises ensue which are caused by too much borrowing from abroad, according to Keynes. Sound familiar. If so, why did not the Keynesians see it?

In volume 25 of Keynes collected writings are his plans for the institution that would regulate the world economy after World War II. His plan for what became the Bretton Woods system. Both the IMF and the WTO were founded based upon Keynes advice, but not all of Keynes advice was heeded. The omission was crucial.

The institution Keynes sought would have prevented mercantilism. It would have had very different requirements for trade surplus and trade deficit countries, not the one size fits all policies that are expounded by the IMF and WTO.

Specifically, Keynes proposed institution would require that trade surplus countries take down their trade barriers, while it would let trade deficit countries use export subsidies and tariff barriers to bring trade into balance. (Perhaps this is the course the USA should now follow anyway, regardless of the political consequences and international law.)

The mistake has come home to roost and roost big time in America. That is bad enough, but here is an even more disturbing thought. Just maybe the Chinese have played the omission.

Could it be that there are some really smart Chinese Keynesians who have figured out how to have China rise to the top of the economic heap and have America sink into the sea economically, all without ever firing a shot? What do we need here, a book for American policy makers called Keynesianism for Dummies?

Kimball,

Yes, well, I happen to think that if we are not careful, the Chinese will buy the Pentagon, and our standing army will become tax collectors.

At the rate we and China are doing us in, China won’t need their own army, much less ours, but tax collectors! Now that’s a group they’ll need.