The Heritage Foundation critiques the CEA assessment of the stimulus. In WebMemo #2799, Dr. Campbell writes:

The CEA’s method, in brief, compared a statistical forecast of the economy based on historical patterns (no stimulus) with the actual economic results in 2009. On this basis, it claims that there are 2 million more jobs in the economy than otherwise would have been the case. The CEA then concludes that this difference between this statistical forecast and the actual results were the effect of the stimulus.

…

Yet the CEA’s benchmarks for unemployment and GDP numbers were completely arbitrary. If the Administration had used other economic forecasts, the results would not have been as impressive–in fact, some would have shown that the economy lost more jobs after the stimulus package was implemented.

One way to see the inadequacy of the CEA’s method is to compare it with other economic forecasts made for 2009–before details of the stimulus plan were known. These forecasts were done by companies and agencies that have a direct interest in making the most accurate forecast possible so that businesses and governments can plan accordingly.

Well, I am confused on a number of counts.

- First, the author selects forecasts from well before the ARRA was passed — October 2008 for the Global Insight forecast and January 2009 for the CBO (although that forecast was finalized on December 19). But, as I pointed out in this post one has to condition for shocks that occur between the time of the forecast for a baseline, and the ex post event. Nobody disagrees (I hope) that the consensus forecast deteriorated substantially between December and February, when the ARRA was finally passed (see the deterioration in the WSJ mean forecast in this post).

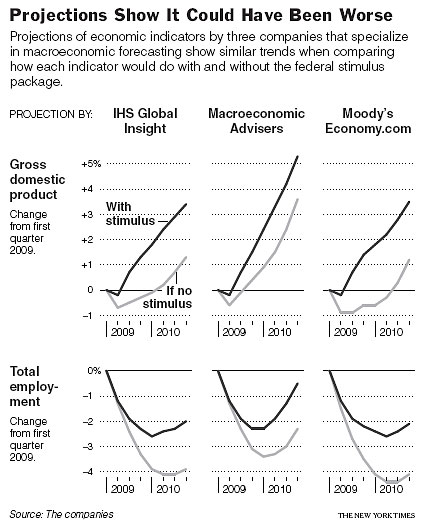

- Second, the CEA 2nd quarterly report clearly shows the estimated impacts on GDP growth rates from Global Insight, as well as other Macro Forecasters. These implied increments to growth rates do not jibe with the the inferences drawn by Dr. Campbell — that the impact on GDP is much smaller than CEA asserts when using forecasts from the other agencies and firms. In fact, the NYT compiled an interesting graph (reproduced here and below), showing the counterfactuals undertaken by the other firms.

Source: J. Calmes and M. Cooper, “New Consensus Sees Stimulus Package as Worthy Step,” NYT (Nov. 21, 2009).CEA summarized the estimates in their report — see Table 7, reproduced in this post, and below.

Table 7: from CEA, “The Economic Impact of the American Recovery and Reinvestment Act of 2009: Second Quarterly Report,” (January 13, 2009). - On a minor point, for the life of me, I cannot figure out how the numbers reported in this figure from the article were generated. I only discovered this by trying to replicate the various series, and discovering that they’re all nominal GDP figures. But the CEA reports did not provide nominal GDP figures, so I’m at a loss at figuring out how the graph was constructed.

Dr. Campbell continues:

The economic impact of the fiscal stimulus bill must be evaluated by projecting the economy without the stimulus bill and then introducing the fiscal stimulus to that same forecast. The CEA’s report constructs and then analyzes a forecast of a downward spiraling economy. It runs a “what if” scenario in the wrong direction. Rather than analyzing the economic impact of the fiscal stimulus on a benchmark forecast, the CEA constructs a forecast and benchmarks it to what actually occurred.

I think I must’ve read a different study than she did. CEA did run a counterfactual approach — it was a VAR approach. As I noted when I replicated CEA’s VAR approach in this post, it’s true the deviation from forecasted amalgamates fiscal and monetary policies and monetary and financial shocks, but that is a baseline one could use. But the resulting implied effect is consistent with the multiplier (or “model”) approach used elsewhere in the study, so I’m not certain what the criticism is.

Dr. Campbell concludes:

The CEA claims that the stimulus bill created jobs in 2009, but this claim is based on its newly constructed “it would have been worse” forecast for 2009. When trillions of dollars are being spent, the American people deserve to have a true economic analysis done and should not waste money on meaningless reports.

I guess “true economic analysis” is in the eye of the beholder.

[Update, 4:35 Pacific]

Dr. Campbell has posted a response and comments (below). Here is my rejoinder to her comments.

Let me thank Dr. Karen Campbell for her response. Let me address several points in turn.

First, if the conclusion is that any agency that uses the “model” approach used by CEA, then we should close down the CBO. In particular, see this report. I think this puts the criticism is its proper context.

Second, to drive home this point, we should also put in the category of agencies and individuals doing “bad economics” people like Stanford Professor of Economics John Taylor (and former Undersecretary of the Treasury under G.W. Bush), and the modelers cited in this blogpost. See my take on his point here.

Third, to the substance of the matter, regarding baselines. I agree, it would be best to use a forecast just before the policy change is implemented, then compare outcomes to pre-shock forecast. For institutional reasons, agencies are not able to report such results typically because official forecasts are not made on a constant basis. Rather, two official forecasts are conducted each year, and are the product of a consultative process by the Troika (Treasury, CEA, OMB).

Now, there very well might be internal forecasts, but because of the aforementioned institutional constraints, those cannot (in my understanding) be reported in an official US Government document. I presume (but do not know) that CBO has a similar stricture. (Full disclosure: I was on CEA staff 2000-01 in Clinton/Bush Administrations; I was visiting scholar at CBO Macroeconomic Analysis Division in 2005).

When I was in the government, the Macroeconomic Advisers macro model was used as a workhorse model for evaluating, in-house, various policy scenarios. If this is still true (and I have not asked my contacts in the USG if it is), then one can guess that the baseline should look very similar to whatever no-stimulus baseline Macroeconomic Advisers has, with accounting for whatever other assumptions are relevant (including rest-of-world GDP, price of oil, etc.).

In the end, I would say in an ideal world, we should hope to do something like what you propose. In the real world, confronted with data inadequacies and (for the government agencies), constraints on what can or cannot be reported, what is undertaken by CEA and CBO seem quite appropriate. (So, I think CBO should not be closed down.).

By the way, since you were gracious enough to respond to my post, I would welcome elucidation on how the series in the Figure in your article were constructed/obtained.

I stopped paying attention to the Heritage Foundation after reading a few of there things about Global Warming. It was so blatantly bias i just don’t trust anything from them.

Heritage does not even attempt to make well reasoned arguments anymore. I saw one about airline deregulation that compared the number of crashes in the period after WWII until deregulation with the period after deregulation. They compared simple annual averages over those periods to claim that deregulation had, essentially, saved lives. What they ignored was that the number of crashes had dropped to approximately its current level several years prior to the steps toward deregulation due to improvements in airplane technology. Hence, the averages were skewed. This was a lousy analysis, but they published it anyway.

The fact that they would put together such a shoddy analysis here should not be particularly surprising. Frankly, this was only slightly better informed than a rant by Glenn Beck on the same subject.

Menzie, why is it that you rarely if ever seem to be so confused by left-wing “analysis”?

The problem is that it’s all guesswork and can’t be substantiated by fact or checked against anything at all. The real and truthful answer is that we don’t know how much of an effect the stimulus had if any and we can’t know.

The number of jobs “saved” or created is just about as accurate as the projected default numbers the banks used to estimate their risk exposure. Anyone can make a model, anyone can make a model that has no semblance to reality. But when these models are given weight and real world decisions are based upon them, then the people who make these ridiculous claims have to be called out. Get the point?

Hey, Heritage claims the strong growth in the 90s was the result of tax cuts, not the tax hikes at the beginning of the 90s (Bush and Clinton):

March 4, 2008

Tax Cuts, Not the Clinton Tax Hike, Produced the 1990s Boom

by J.D. Foster, Ph.D.

WebMemo #1835

But writing from 2008, you might think it obvious to point to the even greater growth in the 00s thanks to the 2001, 2002, 2003, and 2004 tax cuts. Oops, mentioning the 00s and tax cuts producing growth in jobs and economy serves only to disprove ones tax cut dogma.

And by the way, the stimulus they are attacking is one-third direct tax cuts, and about one-third indirect tax cuts in avoided state and local tax hikes plus energy related tax incentives.

And one might ask why no one is criticizing the 2008 stimulus which had zero “spending” just tax cuts and aid to the states – how many jobs did that one save in 2008?

I’ve come to expect low grade nonsense from the Heritage Foundation too. I had a go at one of their articles on my blog:

http://ralphanomics.blogspot.com/2009/12/nonsense-from-heritage-foundation.html

Time for calling spades spades. When Heritage authors write incoherent but authoritative-sounding stuff, it is meant as push-back against evidence not favorable to the Heritage position. Pardon me – I have been a bit oblique. Heritage is lying. VAR this and forecast that, but the goal is to allow those who want to doubt the effectiveness of stimulus spending, but who have a fondness for something more elevated that Hannity. So VAR this and forecast that, and Heritage has made a few more people wrong-headed. Heritage is a wrong-headedness factor, with fancy-sounding lies the means of production.

Menzie wrote:

I’m not certain what the criticism is.

Maybe I can help. Heritage is saying that analysis comparing “what ifs” with “what ifs” and then claiming it as reality is absurd. Using this logic you can make the analysis say what you want it to say, but then that shouldn’t surprise anyone who knows how government numbers are “means tested” against political agendas.

Ricardo,

When dealing with counterfactuals, there is no choice but to deal with “what if”. That’s what a counterfactual is. That cannot be the sum and substance of a legitimate critique of a counterfactual analysis. If that is what you have gotten from the Heritage critique, then thank you for helping to show that the Heritage critique is bogus.

It was clear from the careful weaving together of dishonest elements, as our host points out, that the Heritage critique was bogus. But it is nice of you to provide another angle from which to view the bogusness of it all.

Menzie & Jim–

Just to let you know, I am not going to read this political claptrap passing as economic analysis anymore. The economic “reasoning” going on in this blog is as irrational and biased as that of the Heritage and other right-wing groups. It is not worth my time to continue reading it.

I think I am going to go with the Heritage Foundation on this issue. The ‘analysis’ of the effects of the stimulus package is just political narrative that is built on a foundation of arbitrary assumptions that have no basis in reality. The simple fact is that the economy is now doing worse than Obama claimed that it would in the absence of the money used to bail out the AIG counterparties and the banking system. While the massive spending in support of Wall Street did a lot to keep the reckless financial companies afloat for a while, it did not do anything positive for the real economy. Jobs are disappearing even faster than Obama said they would if the government did noting and the only think keeping GDP from collapsing is an inventory cycle and liquidity injections that are keeping the economy from correcting before it can start growing again. Obviously, the readers of this blog tend to be followers of the discredited Kaynesian view of economics. Personally, I prefer the Austrian view.

http://www.youtube.com/watch?v=d0nERTFo-Sk&feature=player_embedded

Terry: Speaking for myself, I’m sorry to hear of your departure. But at least you’ll still have Shadowstats to get your information from (your 8/12/09 post).

Let me agree with Terry. I don’t shop for economic analysis at Heritage; I do it at Econbrowser, and I don’t particularly find the good guy-bad guy perspective useful.

I’d like to see a little more thinking behind the numbers. For example, I’d welcome on piece entitled, “The Stimulus: What Worked, What Didn’t, and Was it Worth It?”

Keynes discredited? I was not aware that had taken place. I am aware that a lot of weaker minds and partisan cheering sections have been instilled with that view, but discrediting takes more than stamping one’s feet and saying “no, you’re wrong!” One of the popular econ blogs carried a sort of ad hoc survey of professional economists to see how many take Austrian thought seriously. The answer was pretty close to “none”. So if it is an Austrian argument that Vangel is relying on for the notion of Keynes being discredited, well, there ya go.

And Vangel, you want to learn how to spell “Keynes” if you want to be taken seriously when trashing him.

Sometimes when you read propaganda pieces like Dr. Campbell’s they are well crafted examples of slippery logic that reveal more by what they leave out that what they leave in. This piece however was clumsily written and made me immediately look into who the author is (more on that later).

1) The Chart

The supposed CBO GDP figures are nowhere to be found in their January 2009 projection. The figures are too high for real GDP and too low for nominal. They do indeed appear to have been completely pulled out of thin air.

The IHS/Global Insight figures are from a projection published in October 2008 over four months before ARRA was enacted into law, during a time when the economy was in a free fall. Needless to say IHS/Global Insight has analyzed the effects of the discretionary fiscal stimulus repeatedly since then and its estimates are very close to the CEA’s as well as the other major private forecasters.

The CEA’s estimates are from a report published in January 2010 over a year after their initial estimates of the effects of a hypothetical fiscal stimulus.

2) Macroeconomic Projection Techniques

Dr. Campbell seems to be unfamiliar with how the various projections have been constructed. She says for example:

“Although the assumptions for 2009 were similar, CBO and GI used different forecasting methodologies that led to fairly different results although all predicted a small expansion by the fourth quarter of 2009. The CEA, in constructing its statistical forecast, used yet another methodology.”

Actually the CBO, GI and the CEA all use very similar methodology, as do Goldman Sachs, J.P. Morgan Chase, Macroeconomic Advisers and Moody’s economy.com. That’s probably why their projections and estimates of the effects of the stimulus are also very similar, not different. (In fact probably a better argument against their estimates might be made on their methodological uniformity, not their differences.)

She also wrote:

“The economic impact of the fiscal stimulus bill must be evaluated by projecting the economy without the stimulus bill and then introducing the fiscal stimulus to that same forecast. The CEA’s report constructs and then analyzes a forecast of a downward spiraling economy. It runs a “what if” scenario in the wrong direction. Rather than analyzing the economic impact of the fiscal stimulus on a benchmark forecast, the CEA constructs a forecast and benchmarks it to what actually occurred.”

This particular criticism is extremely odd because this is precisely how estimates of the effect of the discretionary fiscal stimulus have been constructed by all of the major macroeconomic models, not just the CEA’s. This implies that she is unfamiliar with current macroeconomic projection methodology.

3) Who is Karen Campbell, and is she competent to be arguing with Christina Romer?

Karen Campbell is a “policy analyst in macroeconomics” at The Heritage Foundation’s Center for Data Analysis. Campbell is designing and maintaining the center’s several computer models of the US economy. (I didn’t know the Heritage Foundation had any computer models of the US economy, and if this is an example of her expertise, I’m not totally inspired with confidence.)

Campbell received her doctorate degree in economics in 2008 from Temple, where apparently her work developing a theory of entrepreneurship received an award for an outstanding dissertation. She also earned a 2004 master’s degree in economics from Temple and a 2000 bachelor’s degree in accounting from Houghton College in New York.

Despite her doctorate in economics, her chief expertise appears to be in accounting. She is a certified management accountant and financial manager through the Institute of Management Accountants. Prior to catching a ride on the wingnut gravy train writing propoganda pieces for Heritage, Campbell was chief financial officer of the ABC Lid Machine Co., and ABC Seamer Technologies Inc., where she developed the canning equipment manufacturing and co-packaging firm’s accounting system and prepared financial statements. (Which suggests to me she is detail oriented, so where did those CBO figures come from?)

The question is, what makes a stimulus a stimulus?

Is fiscal stimulus a merely a “bridge” that keeps AD up as private demand falls? In this case, stimulus was clearly successful.

Or is fiscal stimulus a “spark” that ignites the fuel of private demand, leading to a self-reinforcing recovery dynamic? In this case, the stimulus is increasingly looking like a failure.

On of the reasons the “spark” objective is the important one has to do with long term deficits. A “bridge” approach just results in massive debt increases and structural deficits — witness Japan. If the economy double dips or stagnates here, what will our (U.S.) long term deficit projections look like? What impact will that have on Treasury rates? Would the Fed step in to monetize structural deficits? We can debate the answers, but the questions themselves point out that the cost of ineffective “bridge” stimulus is great indeed.

kharris wrote:

It was clear from the careful weaving together of dishonest elements, as our host points out, that the Heritage critique was bogus. But it is nice of you to provide another angle from which to view the bogusness of it all.

kharris,

If, as it appears, you have come to understand that most government analysis is bogus then this exercise was well worth it.

Terry,

I would encourage you to stay. Too many people run from opposition rather than deal with it. What are your arguments against what Menzie has written? It may have a political bias but then so does life. Make your case don’t put your tail between you legs and sulk away.

I will note (although this will just annoy the foot stompers) that of the three main “right” (labels here are tricky and important) think tanks in Washington, Heritage seems to be the one that is the most mindlessly partisan. The Cato Insitute has a libertarian orientation, which makes it independent from the Republican Party, and during the Bush administration it criticized that administration on many points. While it is probably less independent than Cato, the American Enterprise Institute is more to the moderate end of things on domestic policy (but a den of neocons on foreign policy, quite the opposite of anti-war Cato), and likes to joint projects with the center-left Brookings Institution. It maintains a patina of non or bi-partisanship, even if it clearly tends to support Republicans.

Heritage, however, is just a pure partisan propaganda shop. There are some smart people there, but they keep their heads down whenever they come up with anything that does not agree with the current Right-End of the Party Line. So, this pretty incompetent article by Campbell is not all that surprising.

Menzie – this is presumably a stupid question, but forgive me. It seems obvious that one needs to use a baseline to make these sorts of comparisons, and there appears to be little reason to question the baselines used by these different analyses. Did the situation materially deteriorate again after February? Is this why the White House was so off initially in terms of projected jobs impact/unemployment rate? If there was a further material deterioration after February, how does this complicate the analysis in your view?

You provide a succinct summary of my critique of CEAs Economic Impact of the Stimulus report when you write, these implied increments to growth rates do not jibe with the inferences drawn by Dr. Campbell — that the impact on GDP is much smaller than CEA asserts when using forecasts from the other agencies and firms.

My critique was that the CEAs method for estimating the economic impact of the American Recovery and Reinvestment Act (ARRA) cannot be used to make a meaningful inference about the economic impact of ARRA quantitatively (or qualitatively).

The CEA admits, as do you, that numerous other events and actions were taking place that could explain the difference between the forecast and actual data. The economic analysis undertaken by the CEA either needed to use econometric tools to separate out and isolate the ARRA effect in the difference between the forecast and actual or they needed to run an impulse response of ARRA on their VAR model (a counterfactual analysis). That is, if they were going to use a VAR approach to study the impact of ARRA they needed to establish the baseline and then introduce ARRA to that same VAR model. For example, Christine Romer and David Romer used such an approach in their paper The Macroeconomic Effects Of Tax Changes: Estimates Based On A New Measure Of Fiscal Shocks (http://www.nber.org/tmp/3985-w13264.pdf).

My point is that the Administration approach did not, in fact, estimate the impact of ARRA. The CEA just subtracted actual quarterly results for 2009 from the forecasted quarterly results. Thats a bad analytical move for at least two reasons: (1) Any number of things could explain the difference between a forecast and actual results. It is the job of the economist to separate out these effects in a statistically meaningful way. (2) The fact that using different forecasts provides different quantitative results shows that this methodology is inadequate for estimating the impact of ARRA.

The criticism of picking forecasts before the stimulus was enacted is moot since I am not trying to show the impact of ARRA but rather the inadequacy of simply producing a forecast and subtracting the difference. However, the choice of forecast was intentional. And if the forecast was not made before the stimulus bill passed, then the forecast would have included the impact of the stimulus and thus could not be used as a counterfactual of what would have happened without the stimulus.

I have great respect for Christina Romer and do not want to argue with her. My hope is that my critique is somewhat constructive so that the arguments can be improved so we can all gain a better understanding of the effectiveness of spending billions of dollars.

Kinda quiet in here……Menzie? Hello? Any response? Hmmmm…..

Joe: I apologize for the delay — I was engaged in my “day job” when this item was posted. Specifically, I was teaching intermediate macroeconomics. Hence, I was not able to respond with the immediacy you desired.

Let me thank Dr. Karen Campbell for her response. Let me address several points in turn.

First, if the conclusion is that any agency that uses the “model” approach used by CEA, then we should close down the CBO. In particular, see this report. I think this puts the criticism is its proper context.

Second, to drive home this point, we should also put in the category of agencies and individuals doing “bad economics” people like Stanford Professor of Economics John Taylor (and former Undersecretary of the Treasury under G.W. Bush), and the modelers cited in this blogpost. See my take on his point here.

Third, to the substance of the matter, regarding baselines. I agree, it would be best to use a forecast just before the policy change is implemented, then compare outcomes to pre-shock forecast. For institutional reasons, agencies are not able to report such results typically because official forecasts are not made on a constant basis. Rather, two official forecasts are conducted each year, and are the product of a consultative process by the Troika (Treasury, CEA, OMB).

Now, there very well might be internal forecasts, but because of the aforementioned institutional constraints, those cannot (in my understanding) be reported in an official US Government document. I presume (but do not know) that CBO has a similar stricture. (Full disclosure: I was on CEA staff 2000-01 in Clinton/Bush Administrations; I was visiting scholar at CBO Macroeconomic Analysis Division in 2005).

When I was in the government, the Macroeconomic Advisers macro model was used as a workhorse model for evaluating, in-house, various policy scenarios. If this is still true (and I have not asked my contacts in the USG if it is), then one can guess that the baseline should look very similar to whatever no-stimulus baseline Macroeconomic Advisers has, with accounting for whatever other assumptions are relevant (including rest-of-world GDP, price of oil, etc.).

In the end, I would say in an ideal world, we should hope to do something like what you propose. In the real world, confronted with data inadequacies and (for the government agencies), constraints on what can or cannot be reported, what is undertaken by CEA and CBO seem quite appropriate. (So, I think CBO should not be closed down.).

By the way, since you were gracious enough to respond to my post, I would welcome elucidation on how the series in the Figure in your article were constructed/obtained.

Help me understand how the models in question avoid the following problem.

Take a look at employment for the period Jan 2007 through the present. Notice the steep downward trajectory during 2008 and the first quarter of 2009. Other series follow a similar pattern. If I use that time period to establish the parameters for my forecasting model then my forecast is going to be biased toward a continuation of that steep downward trajectory. We all know that hours and employment were cut to the bone and a continuation of any trend established in 2008 was simply not feasible. Can anyone explain how a model can disentangle the ARRA effect from a natural bottoming when the model establishes its forecasting parameters during the period of time when the data is experiencing its steepest descent? If I use those ‘biased’ parameters and remove some spending then the forecasted descent gets even steeper and makes the ARRA effect appear large even though the true effect may be insignificant.

Menzie: Thanks for your update. It was interesting.

As a practical matter I am curious to know a little more about projecting the baseline forward versus modeling the effect of changes in policy.

I would think that for the baseline, it’s a matter of fitting an existing VAR (or whatever) specification to the latest data, then using a forecasting technique (e.g. any of those in Jim’s book) to come out with a forecast based on parameters from the fitting.

However a change in policy may imply anything from a simple restatement of project inputs (e.g. government spending, tax rates), to rejiggering some paramters (maybe adjusting priors), to a remodeling of the actual specification of the equations of the VAR. The latter doesn’t seem at all far-fetched given the actions of the Fed, which have by no means confined to simple Taylor rule type manipulations.

Hoping you might shed some light on this?

Ricardo,

If, as it appears, you think I what I wrote about Heritage analysis was meant to refer to government analysis, then I must correct you. Reread what I wrote.

If, alternatively, and as it also appears, you have intentionally ducked away from responding to any of the substance of what I wrote, and rather chose to try a cutsie misdirection, then I must chastise you. Cowardice in debate gets you nothing. Address the substance or stand aside.

Dear friends,

I am sorry to learn of your confusion.

Perhaps one of these measures may give you some comfort:

1. Choose another line of work — say, community organizing, which might suit you; or

2. Learn from this column published sequentially to your confused piece seemingly to help resolve your puzzlement:

February 10, 2010 — 4:20 p.m. EST

United We Fall

Is President Obama embracing divided government?

By JAMES TARANTO

“How could such smart people do so many stupid things?” asks Michael Barone. The “smart people” are President Obama and his men:

The same people who directed the campaign that defeated Hillary Clinton and routed John McCain, a campaign that raised far more money and attracted far more volunteers than any before it, have within a year come up with a legislative program that is crashing in ruins and that, to judge from recent polls, has left the Democratic party weaker than I have seen it in almost 50 years of closely following politics.

Barone considers, and finds inadequate, Jonathan Rauch’s explanation: “The problem is one-party government. Presidents lead better, he argues, when they are constrained by the need to get bipartisan support.” Barone argues that “the problem is more basic”:

Obama was faced with a fundamental choice. He could either chart a bipartisan course in response to the economic emergency, or he could try to expand government to Western European magnitude as Democratic congressional leaders, elected for years in monopartisan districts, had long wished to do.

[edited by JDH to reduce length]

The assertion that there is anything worth learning in the writings of the chief propagandist for the WSJ comics page is stunning to read. And really, really funny. BasiclyBenighted starts out sounding smug in his assertion, so we have to take him at his word – he really doesn’t know the difference between reality and what he reads in the back of the WSJ front section.

Let me help. A “false dichotomy” is a form of logical error in which one thing, say “chart a bipartisan course” is posed as the only alternative to some other thing, for instance “expand government to Western European magnitude”. The lovely thing about this particular false dichotomy is that the two choices presented are each false, as well. It is a favorite GOP trick these days to demand that the smallest congressional minority in decades be given the right to dictate legislative outcomes over the heads of the largest congressional majority in decades. In fact, Obama has left room in the legislative process for GOP priorities, such as a bid dose of tax cuts in both stimulus plans, the lack of anything like a true public option in health care proposals. That sort of thing. So the “bipartisan” choice is dishonest, in that it assumes Obama has not tried to give the GOP a legislative voice, when in fact he has.

The other choice is false in its framing. There is no “Western European” magnitude of government. Western European countries vary greatly in the share of GDP represenhted by government. This is really just a WSJ comics page bugbear. “Oh, no — Western Europe!!!!”

So, BasiclyBaffled, I hope this has helped broaden your understanding of how the world works outside the fevered minds of the WSJ editorial team.

Oh, I neglected to mention — BasiclyBefuddled is quoting a WSJ editorial board spinner who is quoting a guy on the pay of Faux News/AIE. Barone may be a fine source in his Almanac – dry and factural, I hope? – but in deciding to trust or not, we should feel free to ask who butters his bread, just as we must with Taranto.

I am a proponent of the model approach and use them extensively, particularly dynamic modeling. I find both econometric models and simulation models to be valuable tools for economic analysis. But like any tool, they must be used correctly to get good results. The problem with the CEA report is that they did not use the model approach. They used half a model approach. They gave a form of economic analysis without the substance.

They used a VAR model to estimate the economy without stimulus but they did not then use the same model to estimate where they economy would be with the stimulus. It is this predicted value of the economy with stimulus that could then be compared with actual data. (There could still be quibbles with robustness and inference testing between the simulated data and real data but at least the methodology would be consistent.)

The numbers we used for the graph were real 2005 numbers. I will send you the table via email that we used to generate the graph so you can check them. Please let me know if you find a mistake in a calculation so we can get it corrected.

Thanks again for taking the time to read and respond to my webmemo. As iron sharpens iron…

kharris,

Sorry that I assumed that you had been disabused of your faith in politically motivated government statistics.

Thanks for your helpful understanding, Mr. Harris. Pretty much cleared everything up.

Take a deep breath and an overdose of tranquilizers. Things will get better.

Here in Hockessin, Delaware we had 27″ of snow on 2/5-2/6 and another 13″ of snow on 2/9-2/10. This was in a state where even 3″ leads to utter paralysis. Needless to say I was without power, heat, internet and running water for approximately 40 hours. It’s interesting to see the exchange that took place between Drs Chinn and Campbell in the meantime.

A few observations:

1) I’m gratified to learn that Dr. Campbell is a proponent of the model approach. My first impression from her article was that she was not. (And this raised the question of what is the nature of the Heritage Foundation’s computer models. Evidently they are consistent with current practice.)

2) Much thanks to Dr. Campbell for clarifying her central point. It does appear that the CEA has used “half a model approach.” (This is evident in not only the latest ARRA assessment but also the preceding one.) This is in fact different from what the CBO and the various major private forecasters have been doing. However it is worth mentioning that, despite this (significant) methodical shortcoming, the CEA “projection approach” has yielded estimates of the stimulus’ effect that fall near the middle of the estimates produced by the major private forecasters.

3) Now for some major nitpicking. If the CBO series contained in the graph represent real GDP (2005 dollars) as Dr. Campbell states then they are way out of the ballpark. The CBO report she referenced did not contain explicit real GDP estimates and did not contain any quarterly projections at all. The report projected 2009 nominal GDP to be $14.241 trillion. Since they were projecting the 2009 GDP deflator to increase by 1.8% this means they were projecting the GDP price index to be about 110.4 (2005=100). Thus they were forecasting 2009 real GDP to be only about $12.9 trillion. The graph included with her article indicates an estimated real 2009 GDP of about $14.06 trillion, about 9% greater than their actual January 2009 forecast. The CBO’s actual forecast was in fact slightly lower than GI’s more pessimistic October 2008 forecast.

It’s hard for me to believe that such a error could have escaped Dr. Campbell’s attention. Anyone who spends their time forming and analysing macroeconomic projections should have noticed this huge glaring discrepancy.

Thanks to Dr. Chinn and Mark Sadowski for flagging the error in the CBO numbers. We realized that we picked up the potential GDP number instead of the GDP forecast number. We are in the process of correcting the graph and posting the revised graph.

My aim was simply to illustrate why comparing a difference between a forecasted (simulated number) and real/actual data is not a valid method for concluding a causal effect of a policy. Unfortunately, my illustration caused more confusion rather than illumination. I really appreciate Dr. Chinn for blogging about it and checking our numbers. I am thankful for the chance to clarify the issue here as well as improve our work at Heritage.

To Karen Campbell, while I poked hard at the Heritage Foundation (and have not altered my general view stated above here), I did note that there are capable people there. I appreciate that you appear to be trying to correct the problems in your study that led to the confusion that Menzie Chinn pointed out. All the best with that effort.

Dr. Campbell taught my first semester Microecon course at Temple. That was way before I became interested in Economics though (I study Finance). She gave me an A-, but if I had known she had such… interesting… political and economic views, I probably would have been motivated to get an A in that class. It certainly would have made the class more interesting. Nevertheless, she gets plenty of great reviews on Rate My Professors.

With all due respect for the degrees and years of study involved in attaining those achievements, let us get to the real world. Economic forecasting is akin to weather forecasting. When a weather person tells you it snowed 6″ overnight, but only 3″ is on the ground, the average person will only believe 3″ fell. I am not a fan of Keynes, but some of the models do work. I believe we would have lost 1 to 2 million additional jobs without stimulus.