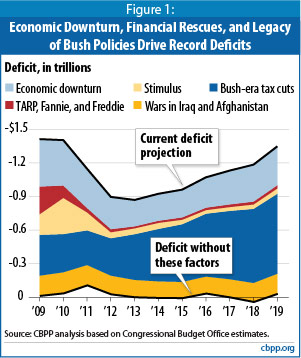

Or, what would happen if we “Let Bush Be Bush”. Recall the 2001 and 2003 tax cuts were written to expire, for the most part, in FY2011. The impact of extending those cuts (along with some others) is strikingly depicted in this Figure from the Center for Budget and Policy Priorities (h/t Brad Delong).

Figure 1 from Ruffing and Horney, CBPP, Dec. 16, 2009.

Ruffing and Horney describe the method of calculation of the “Bush-era tax cuts” portion thus:

Through 2011, the estimated impacts come from adding up past estimates of all changes in tax laws — chiefly the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), the Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA), the 2008 stimulus package, and a series of annual AMT patches — enacted since 2001. Those estimates were based on the economic and technical assumptions used when CBO and the Joint Committee on Taxation (JCT) originally “scored” the legislation, but the numbers would not change materially using up-to-date assumptions. Most of the Bush tax cuts expire after December 2010 (partway through fiscal 2011). We added the cost of extending them, along with continuing AMT relief, from estimates prepared by CBO and JCT.[14] We did not assume extension of the temporary tax provisions enacted in ARRA. Together, the tax cuts account for $3.4 trillion of the deficits over the 2009-2019 period. Finally, we added the extra debt-service costs caused by the Bush-era tax cuts, amounting to $1.9 trillion over the period and an astonishing $350 billion in 2019 alone.

The CBPP article amalgamates several sets of tax provisions. Seeing the impact of extending individual provisions can be seen in this excerpt from Table 1-5 of the CBO’s recent Budget and Economic Outlook (Jan. 26, 2010).

Excerpt of Table 1-5 from CBO’s recent Budget and Economic Outlook (Jan. 26, 2010).

One can also see these numbers graphically in a nifty little interactive facility the CBO has put up here. Below, I’ve shown a snapshot of the CBO baseline deficit (black) and what happens when EGTRRA and JGTRRA are extended.

Snapshot of Interactive Graph, with CBO baseline (black) and EGTRRA and JGTRRA extended (purple).

Note that the President’s Budget does propose allowing the tax cuts on upper income households to lapse; the estimated increase in revenues shown in Table S-8 (page 164) of the Budget. The addition of revenues is estimated at $41.4 billion in FY2011, and $137.4 billion in FY2020.

Given that Obama is president, he is the one who has the power to push deficit-widening tax relief measures, and he is pushing them, it might be more relevant to estimate the potential impacts of “letting Obama be Obama”.

CRISES NOW AND THEN:

WHAT LESSONS FROM THE LAST ERA OF FINANCIAL GLOBALIZATION?

Barry Eichengreen

Michael D. Bordo

The capital flows of the 1990s, like those of the 1890s, were directed toward the private sector, Goodhart argues, in contrast to the period centered on the 1970s, when the public sector was on the borrowing end. Hence, late-19th century crises, like their late-20th century counterparts, were not typically preceded by chronic government budget deficits. Rather, problems originated in the private sector, generally in poorly-managed, poorly-regulated banking systems and in the boom- and bust-prone real estate and property markets.

The 21st century is born with a global banking crisis,a currency crisis and global cumulative chronic budgets deficits

In the same

Wirth (1893), p.227. The tendency for low interest rates to inflate a financial bubble is

also clear in this episode. In the words of The Economist (2 August 1890, p.984), .Reckless

borrowing and lavish expenditure have been the order of the day both within the Governments

and with the people, and the readiness with which European investors have responded to the

never-ending appeals for new loans has done little to credit their intelligence. But the speculative

bubble has now been pricked….

Menzie,

Christina Romer has done studies that show that any tax increase actually reduces revenue. Since eliminating a tax cut is effectively increasing taxes, have you seen or done any study demonstrating how much revenue will be lost by this effective tax increase?

could you give us a source for that Romer claim?

RicardoZ: I’m afraid I don’t know of any paper of hers that says that any tax increase reduces revenues. Indeed, that literally can’t be true since her study (with Romer) discussed different types of tax cuts, some endogenous, some exogenous. However, despite the fact that I suspect I am more familiar with her papers than you are, I remain open to being educated — if you can provide a specific source/page number/URL, I would be much obliged.

Menzie, RicardoZ read it on the Wall Street Journal editorial page and heard it on Fox News. Therefore it must be TRUE, as an article of faith. At least according to Professor Gerard Alexander writing in the Washington Post, we liberals are condescending when we question the factual assertions of conservatives and libertarians.

Bush and Cheney and the Wall Street Journal editorial page also said that these tax cuts would produce huge growth and surpluses, as we could all see existed right up to the day of Obama’s inauguration on 20 January 2009, right RicardoZ?

Somehow the right-wing interpretation of the Romer paper has changed from saying that she said that tax cuts increase economic growth to saying that she said that tax cuts increase revenue generation. The first proposition was questionable enough with regards to comparing it to other forms of stimulus. The second proposition has been entirely fabricated.

February of 2010 and we’re still being treated to very thinly-veiled “But Bush!”

Romer did obscurely state that a shift occurred circa 1980 so that tax hikes to reduce the deficit didn’t hurt growth, as opposed to tax hikes to increase the deficit, I suppose.

My view was Romer went to great lengths to show tax cuts are a free lunch as economic dogma requires. I can’t imagine the methodology extended through 2009 would conclude tax cuts provide the positive benefits implied by the paper.

Note the tax cuts generate more revenue is easily proved by cherry picking the interval from the pump and dump inducing capital gain tax cuts to the bubble bursting as asset prices inflate on tax revenue asset churn hits its peak. But to argue that selling the same assets for progressively higher prices until the bubble pops is productive economic growth or even activity would be absurd. But taxes are due on the way up, and getting the benefits of tax losses is very hard and slow.

Thus to get sustained growth in revenue from tax cuts, monetary policy needs to support inflating all prices to prevent the bubble popping. Otherwise the higher revenue from tax cuts costs trillions in losses in asset prices and lost jobs as the asset price collapse signals the need for job cuts. Eg 1929, 1987, 1999, 2008.

Since the default outcome is that the tax cuts expire, and the Republicans in congress have shown themselves to be the defenders of the status quo at all costs, perhaps this is an opportunity for the Democrats to package a bill extending the tax cuts along with something more controversial? Then see if the Republicans heads explode when forced to choose between obstructing the Democratic agenda or being put in the position of effectively voting for a tax increase.

Has anyone modeled what happens if we close the deficit by cutting spending while holding tax rates constant? Or is just too radical to consider ever cutting spending?

“Has anyone modeled what happens if we close the deficit by cutting spending while holding tax rates constant? Or is just too radical to consider ever cutting spending?”

Who do you have in mind to throw out into the street?

Seriously, list the spending cuts and size and when you would have them occur, within the next 18 months, of course.

You do have specific spending cuts in mind, and are confident you can justify throwing them into the street, don’t you?

Agree somewhat with J.C. The analysis is more political than economic. The title of the graph is particularly telling. How about the deficit without entitlements? Wouldn’t that show that entitlements were driving the future deficits? Other than that, I find the implied economic forecast to be too rosy.

Joe C.,

If you’ve followed the issue, you are aware that a number of efforts along the lines that you suggest have been made. There is very little in the way of spending change and tax change that has not been considered. We know as well as we are likely to what the results would be, and the fact is our estimates aren’t very good.

What we do know is that at current tax rates, there is not strong evidence that modest tax increases reduce output much. Taxes distort more and change business decisions more at higher than at lower rates, and our rates are not so high that changes make profound differences.

mulp is right. When appealing to spending cuts, you need to identify cuts. When identifying cuts, you need to do two things. One is justify them outside of their political feasibility, the other to determine whether they are politically feasible.

Relative to other advanced democracies, a look at our budget shows that we spend less on income transfers and health, more on the military than is the norm. That seems to me a reasonable thing to keep in mind in figuring out where to spend. You may disagree. For now, though, our political culture seems utterly incapable to spending on the military in anything like a rational way, merely in deciding how to spend the money we have. I cannot imagine engineering another “peace dividend” after squandering the first one. So when it comes to drawing up a rational spending plan that is also feasible, I see trouble. Knowing that current tax rates don’t reduce economic growth much, and that changing spending in a rational way looks very hard, the fiscal conservative in me says we need to let the disappearing Bush tax cuts disappear. Down well below the $250k that Obama has in mind as a lower limit.

Mulp: Really? There isn’t any waste in government spending such that any spending cuts require throwing someone out in the street? I’m sorry but that isn’t even remotely serious.

kharris and mulp: Specific spending cuts. Well, I haven’t actually been through the budget line by line but I find it hard to believe that the tiny cuts found by the Obama administration are the best we can do. How about farm subsidies? Is there a serious economist of any political persuasion that supports them? How about ethanol subsidies if you don’t include those in the other farm subsidies? How about military spending? How about cutting federal spending on education and pushing those decisions back to the local and state level? How about actually doing something about medicare fraud (I happen to live in Miami, the medicare fraud capital of the world)? How about eliminating the mortgage deduction and stop susidizing housing? How about raising the retirement age for Social Security and Medicare? How about selling off some excess federal real estate? How about any number of corporate welfare programs? How about eliminating duplicative programs? How about eliminating an energy department that accomplishes exactly doodlysquat? How about shifting taxation from income and capital to consumption so we don’t kill the economy while we satisfy your big government spending plans? How about eliminating corporate income taxes, which I’m sure you both know are very distortionary, and replacing them with a VAT which is more efficient and won’t send our multinationals offshore? How about shifting taxation in general from capital and income (things we need and want to grow) to consumption?

kharris, you are right that increasing taxes at this level is not very damaging but economics is about what happens at the margin, so since mulp put it in these terms, whose job are you willing to sacrifice at the margin to fund the government you want? Who are you willing to throw out in the street?

I am tired of these debates with non serious people. You say the cuts have to be politically feasible but of course then nothing is poltically feasible because if you cut spending you will be goring someone’s ox. We can either start doing these things ourselves or eventually the market will force them on us. We can continue to raise the national debt for a while but I seriously doubt the market will allow us to run deficits as the Obama budget envisions. Cutting spending and changing our tax code are difficult things, but they have to be done eventually. Why not at least have a serious discussion about how to do it?

menzie: we actually do not have to guess whether tax cuts increases or dercreases revenue. The fed govt revenues during the Bush tax cuts: 03 1.782T, 04 1.88T, 05 2.154T, 06 2.4T, 07 2.568T.

Is there really any question that tax cuts raise revenues?

tim kemper: I highly recommend to you the concept of “multiple regression”. In other words, the world is not bivariate. How about the tax revenue increases after the Clinton tax rate increase?

I’m sorry you are going off script here. Everything is Bush’s fault. Please report to re-education camp.

Menzie

Not arguing if tax increases increase revenue. I am just saying the contrary: that tax decreases don’t necessarily mean decrease in revenue. That is a fact you can’t argue so static modeling by your former employer of CEA is misleading. Come clean now that you have left. As an econ professor, you can teach that tax reductions actually can increase revenues. No?