Or, at least the G-20 at your fingertips.

Eswar Prasad (Cornell and Brookings) and Karim Foda have put together a new website, “TIGER: Tracking Indexes for the Global Economic Recovery”.

In collaboration with the Financial Times (FT), Eswar Prasad and Karim Foda of Brookings have developed a set of composite indexes which track the global economic recovery. The Financial Times has produced the Tracking Indexes for the Global Economic Recovery (TIGER) interactive map, which appears on the FT Web site.

For anybody who has struggled to access the relevant macro statistics for countries like China, on a timely basis, this website is very useful. The actual figures aren’t available, but at least one can see time series plots of the data.

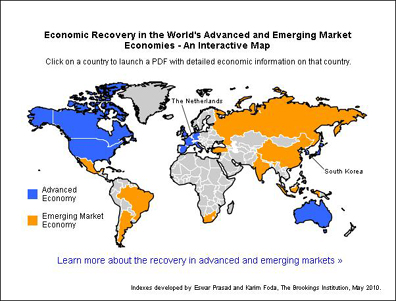

Country coverage is summarized below:

The data for China is here.

Based on their readings of the current indices, Eswar and Karim Foda arrive at these conclusions:

The composite indices reveal five dominant themes.

First, the global economy turned the corner by mid-2009, but there is a long way to go before the recovery is entrenched and on track toward robust growth. Growth rates of many indicators have rebounded strongly after plunging into negative territory during 2008. These high growth rates are off a lower base of course and there is still a lot of ground to be made up before the levels of these indicators are back at their pre-crisis levels. For instance, growth rates of industrial production in many G-20 economies are now higher than before the crisis but, because growth rates fell sharply during 2008, the levels of industrial production are still below pre-crisis levels.

Second, the recovery has been uneven. Growth rates of industrial production and trade volumes have recovered strongly, while the recovery in GDP and employment has been modest at best.

Third, the recovery in world financial markets has outpaced that in key macro variables. In the last two months, however, financial market performance has leveled off. This indicates greater uncertainty about the trajectory of the recovery but could also mean that financial markets realized they had gotten ahead of themselves.

Fourth, confidence measures have regained some of the ground they lost during the worst of the crisis but business and consumer confidence still remain weak and could stall the recovery.

And finally, emerging markets felt the effects of the global crisis later than the advanced economies and have also recovered more sharply. Among the major emerging markets, the recoveries in China and India have been particularly strong.

What does the future hold? We should not discount the fundamental resilience of market economies and there are certainly signs of a continued recovery among the G-20 economies, especially the major emerging markets. But there are many risks in the period ahead.

So in summary our current situation would have been considered and extreme crisis condition for most of world history, but because it is up from an even worse period “don’t worry, be happy.”

Wow, the TIGER is a great resource to really delve into the details of the economic recovery of this global crisis. While things seem to be looking up, it’s hard to be at ease because you never know what the future may hold.

Boy, it sure looks to me as thuogh the financial index leads the real economic indexes and indicates we may be headed down again.

One story: The old paradigm – U.S. and other debtor nations provided needed AD for global growth, but the pattern of indebtedness was unsustainable, both increased indebtedness of the private and public sectors in the debtor nations. Private indebtedness collapsed first, exacerbating public debt problems. Now, public debt problems are endangering the financial sector anew. Also, the financial sector was basically lying about its profitability, by overly discounting its bad debts.

Yes, the big question is can we be bankrupt and recovered all at the same time.

I’ll flip a coin here to decide, but I’m keeping the result secret.