Three interesting figures on fuel consumption, job creation, and prospective interest rates.

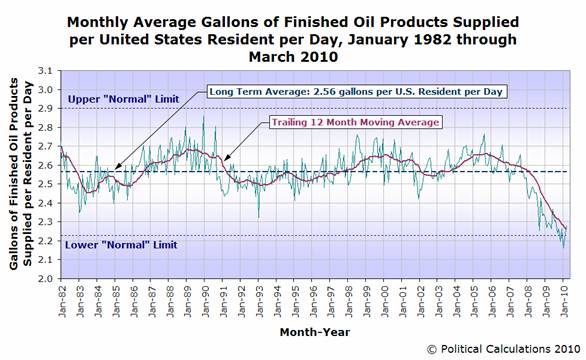

Political Calculations notes the remarkable drop in U.S. per-capita fuel consumption:

|

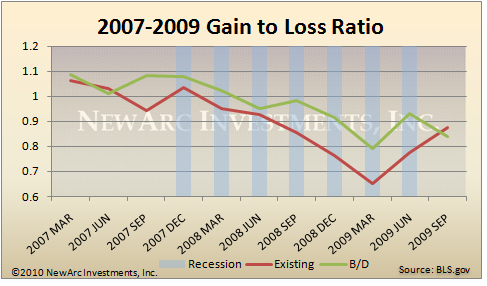

Jeff Miller looks at the ratio of jobs created to jobs lost for (a) continuing establishments (in red) and (b) establishments either newly created or going out of business (in green), and concludes something changed after the most recent recession ended. There’s either less job creation from new businesses or more job losses from liquidated firms than we’d usually expect.

|

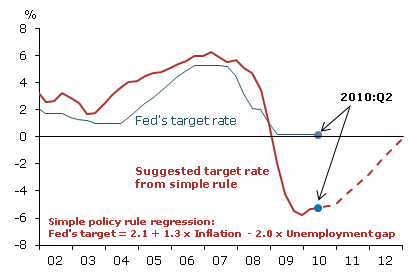

And, via Calculated Risk and Economist’s View, Federal Reserve Bank of San Francisco economist Glenn Rudebusch notes that, according to a traditional Taylor Rule, the Fed might not raise interest rates until well into 2012:

|

Interesting equation for fed funds. But historically the fed does not give unemployment a greater weight than inflation. This is especially true since the 1970s when the Fed apparently gave the two factors roughly equal weight.

To the extent that banks seem to be borrowing from the fed at around zero percent and lending to the treasury at around two percent with an average term around four years – inflation above two percent would be a big problem for the banks in the near term.

JDH: A nit to pick. You might want to correct the labels on the horizontal axis. Feel free to blame it on Microsoft Excel.

spencer: You said “….the fed does not give unemployment a greater…” I take it that you meant the unemployment gap and not unemployment??? Of course, in the 1970s the Fed didn’t follow a Taylor rule, so maybe you did mean “unemployment”.

JDH: Oops. My mistake. Jim Miller’s chart goes back to 1992, but I see that you were only recreating a portion of his chart.

Actually I have tested a Taylor Rule that gives unemployment and inflation equal weight that goes back to the late 1950s.

From 1960 to 1980 it does a great job of explaining fed funds. Yes they were not formally following a Taylor Rule in the 1970s, but for all practical purposes a Taylor Rule fully explains their actions.

The same rule giving inflation and unemployment an equal weight also does a good job of explaining fed funds under Greenspan.

Under Volcker the fed clearly gave inflation a greater weight.

So when did the fed actually give unemployment a greater weight than inflation?

2slugbaits: The figure is reproduced exactly from further down in Jeff Miller’s original article.

Rudebusch:

“The risk of such financial side effects could shorten the appropriate length of a near-zero funds rate. However, the linkage between the level of short-term interest rates and the extent of financial imbalances is quite erratic and poorly understood.”

You see, the risk ‘poorly understood’, so let’s ignore it!

David P,

I understand the urge to be snide is sometimes overwhelming, but Rudebusch is not ignoring the financial side effects – as is clear from your own quote. The logic of making decisions based on things that are poorly understood is pretty week, so it does make sense to base policy mostly on relationships that are well understood.

So I think Rudebusch’s statement is unobjectionable. We do need to realize that, in a poorly understood relationship, the financial effects to extend the appropriate length of near-zero funds rate.