Today, we’re fortunate to have Mark Copelovitch, Assistant Professor of Political Science and Public Affairs at the University of Wisconsin, as a Guest Contributor.

First off, let me thank Menzie for the opportunity to “pinch hit” here at Econbrowser. It’s a pleasure to be here. I am Menzie’s colleague in the La Follette School of Public Affairs here at Wisconsin, and my primary area of expertise is the politics of international finance.

Amidst rumors that Spain will be the next of the “PIGS” countries to seek a rescue package from the EU and IMF, the Bank for International Settlements has just published its Quarterly Review. The Review is always a must-read for those interested in understanding the current state of the global economy and international financial markets. I noticed two particular items of interest related to the ongoing eurozone problems.

The first is the detailed overview (Box 2, page 8) of the policy responses undertaken by the EU, IMF, and major G-20 central banks to restore financial market confidence in the eurozone. What is most striking is the speed and magnitude of the policy response. Indeed, what began as a $45 billion EU-IMF package for Greece on April 11, became a $750 billion effort by mid-May. This massive initiative included a substantially larger Greek rescue package ($110 billion) and the creation of a new $440 billion European Financial Stabilization Facility (EFSF), along with the extension of central bank swap lines between the major G-20 central banks and substantial ECB interventions to restore the depth and liquidity of European financial markets. Thus, despite the heated public opposition in Germany and elsewhere to a Greek bailout (and the initial dithering in March/April by EU leaders), European governments have quickly and forcefully moved to shore up Greece and the broader European financial system.

The second item, of perhaps even greater interest and relevance, is the release of the latest BIS data on bank exposure to the “PIGS” countries.

The data illustrate quite clearly how the PIGS’ problems could become a broader European (if not global) financial crisis (emphasis added):

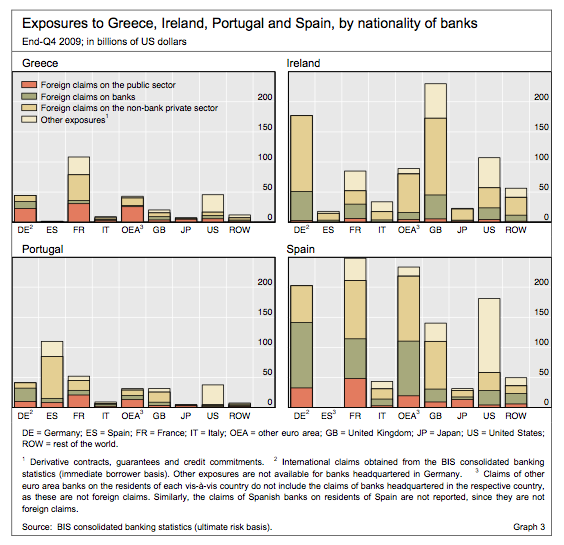

As of 31 December 2009, banks headquartered in the euro zone accounted for almost two thirds (62%) of all internationally active banks’ exposures to the residents of the euro area countries facing market pressures (Greece, Ireland, Portugal and Spain). Together, they had $727 billion of exposures to Spain, $402 billion to Ireland, $244 billion to Portugal and $206 billion to Greece (Graph 3).

French and German banks were particularly exposed to the residents of Greece, Ireland, Portugal and Spain. At the end of 2009, they had $958 billion of combined exposures ($493 billion and $465 billion, respectively) to the residents of these countries. This amounted to 61% of all reported euro area banks’ exposures to those economies. French and German banks were most exposed to residents of Spain ($248 billion and $202 billion, respectively), although the sectoral compositions of their claims differed substantially. French banks were particularly exposed to the Spanish non-bank private sector ($97 billion), while more than half of German banks’ foreign claims on the country were on Spanish banks ($109 billion). German banks also had large exposures to residents of Ireland ($177 billion), more than two thirds ($126 billion) of which were to the non-bank private sector.

French and German banks were not the only ones with large exposures to residents of euro area countries facing market pressures. Banks headquartered in the United Kingdom had larger exposures to Ireland ($230 billion) than did banks based in any other country. More than half of those ($128 billion) were to the non-bank private sector. UK banks also had sizeable exposures to residents of Spain ($140 billion), mostly to the non-bank private sector ($79 billion). Meanwhile, Spanish banks were the ones with the highest level of exposure to residents of Portugal ($110 billion). Almost two thirds of that exposure ($70 billion) was to the non-bank private sector.

Two patterns are particularly interesting here. First, the banking sectors of the “core” eurozone countries — especially France and Germany — are even more heavily exposed to Spain than to Greece. Second, there is substantial heterogeneity in exposure to the PIGS countries: British banks are particularly exposed to Ireland, Spanish banks to Portugal, etc. Similarly, beyond the eurozone, US bank exposure is substantially higher to Spain and Ireland than to Greece or Portugal, while Japanese banks are far less exposed to all of the PIGS countries than their US and European counterparts.

So, what might all of this mean if the rumors are true and the remaining PIGS also turn to the EU/IMF for financial assistance? David Cottle, in his Wall Street Journal blog yesterday, hit on the key point:

These data are particularly interesting and well timed. Leaders in Europe’s relatively prudent ‘core’ are conducting their own heated internal debates over the extent to which the profligate periphery ought to be bailed out with their voters’ hard-earned funds and reputations. The idea of blank checks to Greece, Spain and all isn’t one that resonates much with the German people by all accounts; it’s hard to imagine the French are any more keen […] But, alas, the BIS’ numbers blur the over-used distinction between ‘periphery’ and ‘core’ almost to the point of invisibility. For the latter, it may well be a case of ‘bail out the debtors; the banks you save may be your own.’

As Cottle highlights, the key dilemma facing France, Germany, and the other “core” eurozone countries is that any EU/IMF rescue package has two simultaneous (and inseparable) effects. On the one hand, these packages are taxpayer-funded bailouts for the “profligate periphery.” On the other, they are also bailouts for heavily-exposed German and French banks, and they may be necessary to ensure domestic financial stability in the “core” countries. As Cottle correctly emphasizes, you can’t have one without the other.

I raise a similar point in my newly-published book, The International Monetary Fund in the Global Economy: Banks, Bonds, and Bailouts, in which I argue that the domestic financial interests of the IMF’s largest shareholders have been a critical determinant of variation in IMF lending policies over the last three decades. As the Fund’s largest quota contributors, the “G-5” countries (the US, Germany, Japan, UK, and France) exercise de facto control over IMF lending decisions. At the same time, the G-5 countries are also home to the largest private creditors in global markets, including the world’s largest commercial banks. Consequently, G-5 bank exposure heavily influences these governments’ preferences over IMF lending policies. In particular, I find that IMF loan size and conditionality vary widely based on the intensity and heterogeneity of G-5 governments’ domestic financial ties to a particular borrower country. When private lenders throughout the G-5 countries are highly exposed to a borrower country, G-5 governments collectively have intense preferences and are more likely to approve larger IMF loans with relatively limited conditionality. In contrast, when G-5 private creditors’ exposure to a country is smaller or more unevenly distributed, G-5 governments’ interests are weaker and less cohesive, and the Fund approves smaller loans with more extensive conditionality. I find strong evidence that these patterns hold both within countries over time (I focus on IMF lending to Korea and Mexico from 1983-1997 in the book), as well as more systematically over time and across cases for the universe of IMF loans from 1984-2003.

So, what are the implications for a future EU/IMF bailout of Spain (or Portugal, or Ireland)? Despite the heated rhetoric by Angela Merkel, Nicolas Sarkozy, and others about the need for the PIGS to put their own house in order by imposing staunch austerity measures, we are quite likely to see even stronger support for Spain (and Ireland), given its importance for the profitability and solvency of French and German banks. Portugal, in contrast, is likely to fare worse than Greece, given its limited importance for the major eurozone (and G-5) banking sectors. At the same time, we are also likely to see tensions within the IMF over the size and terms of any contribution to future PIGS rescue packages, given that American and Japanese views about the importance of eurozone bailouts are colored by their own, less extensive, financial interests in these countries. Ultimately, whether the “core” countries in the EU and the IMF view a rescue package as a “bailout” or a worthy endeavor depends not only on whether the borrower in question has been “profligate,” but also on their own domestic financial interests and the vulnerability of their own commercial banks to a potential financial crisis.

Hello Professor Copelovitch,

As a European and an economist, I have been following these events quite closely myself. I share the broad lines of your analysis. However, I think you mis-read the significance of the European Financial Stability Facility. Indeed, you write above: “European governments have quickly and forcefully moved to shore up Greece and the broader European financial system.” However, in my view, the EFSF is, up to now, no more than a public relations scheme, in which the euro governments pledge to lend to fellow euro sovereigns who face borrowing rates so high that they are effectively shut out of financial markets. The use of a SPV is an accounting trick, meant to keep these contingent liabilities off government balance sheets if ever the SPV had to borrow in financial markets. The members of the European Council would have to approve each and every loan; these loans are contingent on fiscal austerity plans being negociated with the EU Commission, the ECB and the IMF. The loans made with the money that the SPV would borrow would have to be collateralised by funds coming from euro countries that currently face grave financial stress, i.e. such countries as Greece, Ireland, Spain, Portugal and Belgium would all have to fund the bailouts upfront. Finally, the loans from the IMF would in part be funds made available from euro countries’ IMF quotas. All this would weaken the already fragile fiscal positions of the funding countries. Furthermore, are the US, Japan, China and other non-euro countries on the IMF’s board ready to provide cheap (sub-market) loans to “advanced” European countries? In short, I don’t see how this can be qualified as a quick and forceful move. Rather, a media-oriented “Shock & Awe” show, while kicking the can down the road, hoping that things will somehow work out by themselves.

Patrick VB—Although you are probably right that “the use of a SPV is an accounting trick” and that “The members of the European Council would have to approve each and every loan.” The fact is, the ECB has already created a funding stream and holds overnight deposits of over $360 euros. Once Trichet starts to purchases sovereign bonds without sterilizing, then there will be no need to access the SPV which is basically a public relations scam anyway.

The ECB is quickly becoming an EU-Fed, operating autonomously. Germany will howl and there could be some unpleasantness in the upcoming elections. But the German establishment will defend its banks whatever the costs.

Patrick VB, what you say cetainly has the ring of truth.

My view: It is not a matter of having the money to bail out the debtors – the money has already been lent. The problem is, the debts can’t be simply forgiven without harming the financial system. But to make creditors whole on the backs of taxpayers is impossible.

The solution is to set up a system now to quickly force equity holders and bond holders of existing assets to recognize their losses instead of transferring them to taxpayers (as is still being done in the U.S. – forget the TARP, look at GSE debt and Fed purchases).

The system has to allow new loans going forward to worthy borrowers without having to make whole the holders of the bad legacy loans. But nothing will be done until crisis hits and bailout is the only alternative.

Nothing has been done in the U.S. in the unrealistic hopes that property values will rise and alleviate the legacy loan problem. (Hence the failure to MTM the old mortgage debt). Meantime, the game is extend and pretend, deny and delay.

The game will be up when lenders come to realize that governments of ‘developed’ countries can fail, too.

Thank you for posting the knot of lending relations (and therefore pain tolerance) of the core toward the periphery. It seems quite likely that the core/periphery paradigm is based on a distinction without a difference (except for Portugal.) Do you think Portugal will be tempted to go Argentinian, and force creditors to accept a substantial loss?

Don, are you sure that recognizing the cost of the ponzi units isn’t best absorbed over an extended period? I agree it does frustrate the “normal” workings of a market, in that the vultures find the pickens slim, but the colateral damage is considerably reduced. Given the current interest rate enviroment, the carrying cost of delaying seems likely to be much less than the cost of a hasty mtm at the bottom of the business cycle. I would venture that immediately recognizing the loss on the ponzi units is pro-cyclical.

This is all an interesting stress test for the EU. I’m curious to see once this crisis is over, as they all are at some point, what sort of commitment the Germans and other less proliferate spenders will have to the EU. So far, in for a pound, in for a kilogram, seems to be the decision. If nothing else to buy more time to let the crisis pass. But if Spain goes Grecian, this won’t be pretty and the EU will surely end sooner.

@Copelovitch: Very nice point, and this does help to see whether the IMF may actually contribute.

@Patrick VB and responders: Yes, it is fairly clear that the SPV would be difficult to actually use. In that regard, there is another interesting point in the BIS Quarterly Review.

The BIS assure us that the exposure of German, Belgian and French banks to the sovereign debt of Portugal, Greece and Spain is a small portion of their capital. However most of the exposure is to the private sector, and they avoid discussion of that. This doesn’t seem like an oversight, because elsewhere they discuss the full exposure. It seems more they are trying to keep investors calm by discussing capital in a very limited context. That doesn’t seem too reassuring!

Details at http://www.clearonmoney.com/dw/doku.php?id=investment:commentary:2010:06:14-bis_discussion_of_bank_risk_re_peripheral_europe_is_incomplete

Ah, and now we are beginning to see that the whole thing is a global house of cards.

The only way out is to devalue the debt by debasing the currencies.

Varones,

“Debasing the currencies”? You mean, putting less gold into the coins or silver threads into the paper money??? BTW, Saudi paper money actually does have silver threads in it as certain fundamentalist Muslims are bullionists, which is part of how the Hunt brothers were able to talk then Prince, now King, Abdullah to invest large sums into the silver bubble, which then crashed hard. Thought the world was going to go on a silver standard. How silly. Obviously it is on the verge of going on a gold standard, but one that will be “debased,” shucks.

@Raskolnikov: As I see it, the aim of the EFSF is, first, to calm the markets and, second, to put in place a “bailout fund”, hoping that the mere existence of the fund will allow highly indebted Sovereigns to continue to borrow from the markets at rates compatible with deficit and debt reduction.

The ECB’s decision to buy sovereign debts on the secondary markets (the Securities Market Programme, or SMP) is meant mainly to allow Euro banks to offload the now risky Sovereign bonds they hold with only a minor writedown (haircut). Note that technically, the ECB’s sovereign debt purchases are not really sterilised; the ECB uses 1-week fixed-term deposits to absorb SMP liquidity but as these deposits can still be posted as collateral for regular open market operations (OMO), the SMP sterilisation is in effect neutralised. But this is of secondary importance in the ECB’s overall management of liquidity. The main point is the following: the ECB decided to once again relinquish control over the monetary base by re-establishing full-allotment fixed-rate tenders in May 2010. As long as this type of OMO remains in place, the ECB will continue to be in effect in “full QE mode”. Once again, this is meant to underpin directly the euro banking sector, and only indirectly the sovereign borrowers.

Barkley,

Kind of hard to debase something that has no base in the first place, isn’t it?

This isn’t about going back on the gold standard. Leave gold aside.

The fact is that the system as a whole is insolvent because of the chain of debt holdings. Example: Greece defaults, so big French and German banks go bankrupt, their creditors get wiped out, and it ripples through the whole economy causing a deflationary depression.

Closer to home: the housing market takes another leg down, causing millions more people to walk away from underwater mortgages, causing property values to fall further. The US government takes the hit this time because Fannie, Freddie, and FHA are guaranteeing virtually the entire mortgage market. But the housing depression spills over into the general economy and depresses activity so much that tax revenues fall off a cliff and social safety net costs climb leaving the US government completely unable to cover its current operations, much less debt service.

This is why central banks will keep printing to keep asset values inflated and prevent this scenario. If you let any country, large institution, or large class of businesses or people default, the losses take the whole system down.

Will all this printing have its own disastrous effects? Undoubtedly. But that won’t stop Zimbabwe Ben and his colleagues from cranking up the presses.

P.S. The whole debt chain reaction problem is due to too much leverage by all players in the system.

If French and German banks had less leverage (more capital, better balance sheets), they’d be able to take the hit from a Greek default and the problem would end there. If the banks’ bondholders had less leverage, they’d be able to survive a loss on their bonds. If U.S. homedebtors had less leverage (higher down payments), they’d be able to survive a drop in housing prices.

Most of the big players in Western economies are far too leveraged: households, banks, and governments.

This could be a point that differentiates us from Japan. At least the households had and have good balance sheets in Japan.

OT:

For those interested in the causes of the BP oil spill, I might suggest reading the letter from Waxman and Stupak to Hayward. Fascinating reading.

http://energycommerce.house.gov/documents/20100614/Hayward.BP.2010.6.14.pdf

Thank you Patrick VB for the clarification although I’m a bit sketchy on what you mean when you say: “The main point is the following: the ECB decided to once again relinquish control over the monetary base by re-establishing full-allotment fixed-rate tenders in May 2010. As long as this type of OMO remains in place, the ECB will continue to be in effect in “full QE mode”. Once again, this is meant to underpin directly the euro banking sector, and only indirectly the sovereign borrowers.”

I expect the euro will survive this crisis somehow, although I cannot figure out exactly how. What’s troubling is that if the ECB’s overnight deposits are nearly $400B and ECB lending is nearly $800B, then the EU shadow banking system must be slowly freezing up. Euribor is up again today and even stabilization of the euro hasn’t relieved credit conditions.

I don’t expect a Lehman Bros, but all this talk about austerity will not help matters at all. The whole thing looks like a slow motion train wreck.

So, gosh, maybe they will break down and restructure some of this debt. Is that the end of the known universe? Not.

Implicit is that those guilty of making & taking profligate loans are being bailout by the innocent. That is, at the expense of those who enjoyed none of the profits or spending.

The justification that the house of cards built on fiat money & gov’t-cartel banking will collapse is real but misguided. The collapse of the financial system would destroy no real capital. The means of production would flow into more prudent hands. Justice & economic efficiency would occur if markets weren’t distorted by the politically well-connected.

The present system that Copelovitch accurately describes is corrupt. As there is no free lunch, the ultimate reckoning will be massive default via inflation.

The BIS data for Ireland includes loans made by foreign banks to their own units in Dublin’s offshore financial centre.

So Ireland’s real exposure is much less than it seems.

Hi Raskolnikov, regarding the ECB’s monetary policy and general provision of liquidity, it is important to understand how the policy framework is implemented. Normally, ie pre-crisis, the ECB provides liquidity through open market operations (OMOs) that are based on variable rate Repo tenders; in effect this is a competitive bidding process with a minimum bid rate. The ECB then chooses what bids they alot or accept. Since October 2008, the ECB moved to a fixed rate tender system. At that time, the rate was 3.75%; hence, the ECB accepted all Repos that were bid, without limit to the amounts! (full allotment), at 3.75%. The fixed rates for Repos then fell to 1% in May 2009, where they have been since then. In May this year, the ECB was thinking about returning to variable rate tenders and scrapping the full allotments, thus limiting lending to what it wished instead of what banks desired. The renewed uncertainties in the euro area then led the ECB to backtrack and pledge to keep the fixed rate full allotment tenders for Repos in place without specifying any timeframe for ending this procedure. This is, in effect, the brunt of the “Quantitative Easing” going on in the Euro Area.

Bryce,

I agree. I’m not defending the bailouts.

I’ve railed against the bailouts for years.

But when you see a crooked game with an obvious end result that you can’t change, all you can do is position yourself appropriately.

WC Varones: Exactly. Still the corruptness of it shouldn’t be ignored. We are a million miles away from a free market…to wit, free & just societies.

Thanks very much for the explanation anonymous.

But let me ask a follow up question: If the ECB continues to “keep the fixed rate full allotment tenders for Repos” doesn’t that keep the value of the (bank) collateral artificially high? In other words, isn’t the ECB issuing loans using some other standard than “market pricing” and thus, allowing the banks to avoid painful writedowns?

Hi Raskolnikov, Sorry, I omitted to sign my previous response (Anonymous, June 19, 3:00 AM). You are right that the system of non-competitive bidding (full allotment) now used by the ECB allows banks to finance themselves more cheaply than if they had to compete with one another for limited allotments of repos. This is all the more so that the ECB has also lowered the quality limit of eligible collateral for repos. It can be viewed as a direct subsidy to banks. As such, it helps banks to remain afloat as inter-bank liquidity becomes harder to come by and more costly. So is this an optimal response? I don’t know… The ECB probably has access to privileged information on which to base its policy actions. Anyways, it provides banks with some “breathing space”, time to deal with their impaired or toxic assets, and raise capital ratios. Are banks doing this and to what extent? At this stage, I can only guess… What is the alternative? A full blown systemic banking crisis in Europe, maybe? The ECB and European governments are clearly risk-averse: by helping out the banks, they remain in known territory (at least for a while longer); if they don’t, they don’t know what could happen, and they seem to fear the worse. Being risk-averse, they opt for the first option. Kicking the can down the road…

More components should be included :

As economists

Are they any benefit to be expected from a return to former domestic currencies for countries trespassing a threshhold of say 80% public debt/GDP for Greece,Spain,Italy,Portugal..?

Debt interest rate will be higher ( Please see Hellenic debt bulletin)

http://www.mof-glk.gr/en/publications/debt/bull_21_eng.pdf

Beggar thy neighbour on what? on which products?

As banker

Loans contracts from wholesale lenders must stipulate enough cross defaults,forces majeures for trigerring at least a bankers meeting of 30 banks.A good receipt for having no outcome on whatever issues,more autopsies than resolutions.

Depreciation of the banks liabilities?

They will never offset the loans and credits default to be triggered by an uprise of the debts interest rates.

Are banks equal in pain?

Of course no,whosalers suffer from risks concentration,currencies depreciation,higher interest rates on their debtors driving more defaults whilst retailers have their risks more spread out through available liquidities resources,customers deposits,local FASB,mark to hopes,theoretical values.

They are more usage of 105 liquidity ratios for domestic networks than for offshore lenders.

Getting back to the subject is Spain a subject of bigger concern?

Yes not for the public debts,not for the 450 billion euros real estates loans but for its banking industry which carries European systemic risks size.

As an IMF lender

Is the money allocated to the bail out of the European countries a depletion of resources that could impair other rescues. How much would be needed to bail out

USA

UK

Japan

Has the IMF enough resources to meet with these challenges with or without the mediteranean countries of Europe?

The best cure was the prevention

Frank G.:

I doubt the delay will prove worth the cost to taxpayers of the transfer to private wealth holders – and it certainly will not be if sovereign default becomes an issue. As for “hasty MTM at the bottom of the business cycle,” I doubt housing prices are at the bottom. In fact, the delay may well prove not to have helped, merely moving the problem into a future time when economic conditions will be no better than they are now. We have had time to set in place a system for orderly destruction of defunct lenders, instead of burdening taxpayers (including potential losses being taken up on our behalf by the Fed in supporting Fannie and Freddie) and other misguided atempt to maintain asset prices (such as the homebuyers tax credit – CR is exactly right about the efficacy of that policy). That we have not I think is more a result of political forces than of following he best economic policy.

All this is not to say policy makers necessarily aren’t doing the best they can given political constraints, but there is certainlt room for doubt.

Are bailouts and debt restructuring “corruptness”? Please. This goes on all the time. Hyperventilating going on here by people who want to have a Really Big Crash to justify their gold buggery.

Legal debt restructuring is fine. Who said it wasn’t? Restructuring, bankruptcies, etc. between the unwise lenders & bad borrowers is exactly what would happen in a market economy.

Barkley Rosser, you aren’t fully engaging your mind. Politically arranged bailout [which I term corrupt] & legal debt restructuring [which I didn’t] are opposites. Further more, in what way is 2 or 3 simple statements of fact “hyperventilating”?

Thanks for the answer Patrick VB. I’m having a tough time wrapping my brain around some of this stuff.

Here’s my concern; The ECB is lending on collateral for which it will never get a full return. (mostly sovereign debt from club Med countries and some real estate) In as much as it’s possible, the ECB should be forcing haircuts now and helping to resolve underwater banks.

Why is this important? Just look at this earlier post by Prof James Hamilton “Follow the Money”:

“If you buy a mortgage-backed security (or collateralized debt obligation constructed from assorted MBS), you could then issue commercial paper against it to get most of your money back, essentially making the purchase self-financing.

This was the idea behind the notorious off-balance sheet structured investment vehicles or conduits, which basically used money borrowed on the commercial paper market to buy various pieces of the mortgage securities created by the loan aggregators. The dollar value of outstanding asset-backed commercial paper nearly doubled between 2004 and 2007.

Yale Professor Gary Gorton has also emphasized the importance of repo operations involving mortgage-related securities. If I buy a security, I can then pledge it as collateral to obtain a repo loan, again getting most of my money back and allowing the purchase to be mostly self-financing as long as I keep rolling over repos. Although I have not been able to find numbers on the volume of such transactions, it appears to have been quite substantial.” (“Follow The Money”, James Hamilton, Econbrowser)

So, it’s not just the underlying collateral that is shaky, but the massive leverage stacked atop dodgy collateral. And, who knows how much that may be?

The repo market is being used to maximize leverage regardless of the systemic instability that it creates. By propping up asset values (through its lending operations) the ECB is just making a bad problem worse.

This is how crazy it’s gotten–This is from today’s WSJ:

“..the ECB is currently offering effectively unlimited liquidity to the banking sector through its regular refinancing tenders….

This has increased sharply in recent weeks, peaking last week at a record high of EUR384.26 billion owing to two separate factors.

The ECB’s role as an intermediator of credit has increased as banks have turned more shy of the risks in the money market. As such, both the amount banks borrow from the ECB and the amount that they deposit with it have risen.

(Note: If the ECB is covering more of the “lending and borrowing” what do we need banks for?)

WSJ: “In addition, the overall level of uncertainty has risen about liquidity provision after July 1, when the ECB’s EUR442 billion 12-month refinancing tender from last year expires.”

(Note: Want to guess what the ECB does about the $442 billion?)

The ECB has basically repealed the “free market” as a reliable pricing mechanism. We are living in a post-capitalism twilight zone.

Raskolnikov, I think you are correct, the ECB is now playing a dangerous game, putting its own balance on the line by buying financial assets without imposing a haircut based on market values or hold to maturity values. It could find itself undercapitalised, with its Sovereign underwriters unwilling or unable to recapitalise it. The only way out could then be monetisation and inflation to reduce the real value of the liabilities side of its balance sheet. But here again, a problem pops up. Printing mony is inflationary only if it is not accompanied by a corresponding decline in the velocity of money. In a depressed economy, inflation could be tougher to create that commonly thought.

Patrick VB said: “In a depressed economy, inflation could be tougher to create that commonly thought.”

Yes, and I expect that this deflationary period could last much longer than people anticipate. Household balance sheets are underwater and unemployment will remain high, which means that consumer borrowing will be slow. So, the red ink on the fed’s balance sheet won’t be much of a problem (as far as inflation) nor will the losses on fannie and freddies books. Still, by moving assets and non performing loans onto the Fed’s balance sheet, Bernanke has effectively engineered a massive transfer of wealth to bankers and other shadow players.

Meanwhile, the rest of us are still trying to dig out.

Raskolnikov,

Yes, these deflationary periods are really annoying. They cause gold prices to go up, just like inflationary ones do also. No matter what happens, the price of gold will go up. Just keep that in mind and buy some. You can’t lose.