If (1) one is a concerned about budget deficits over the longer term, but (2) is concerned that a reversion to pre-2001 tax rates would hurt short term growth, then one should favor the partial extension of EGTTRA/JGTRRA for only those earning less the $250K ($200K for singles).

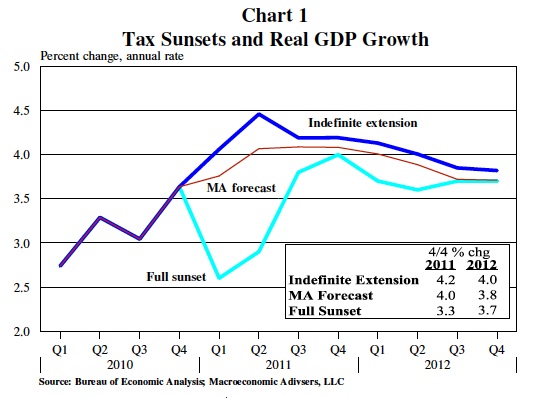

First, consider the impact of full extension versus only partial extension, according to Macro Advisers. Full extension has only minimal additional impact on GDP relative to partial extension.

Source: Macroeconomic Advisers (August 2010).

Clearly, the dark blue line is only slightly above the brown line.

At the same time, full extension is pretty expensive, in terms of its impact on the budget deficit, particularly in the out years.

Figure 1: Deficit as a share of GDP, actual (black), under CBO baseline (red), under President’s tax proposals for EGTRRA/JGTRRA and modification of AMT (blue) and extension of EGTRRA and JGTRRA and indexing AMT for inflation (green), by fiscal years. Shaded area is projected. Source: CBO, Budget and Economic Outlook: An Update (August 2010); CBO, An Analysis of the President’s Budgetary Proposals for Fiscal Year 2011 (March 2010), CBO Historical Statistics, and author’s calculations. [graph corrected 10/4/10]

These are not new points, but they bear repeating as the debate over the proper course for putting the Federal government’s finances, while maintaining support for the macroeconomy, heats up.

While I hear $700 billion associated with a full extension vs. partial extension, this difference surely must depend on what other things are lumped in with the extension. Working off figures in this post, comparing partial extension with AMT indexation against full extension with AMT indexation, I get a difference over FY2011-20 of about $1.6 trillion (including associated debt service). Just comparing the difference solely coming from full vs. partial extension, I get a figure something on the order of $500 billion (not including associated debt service).

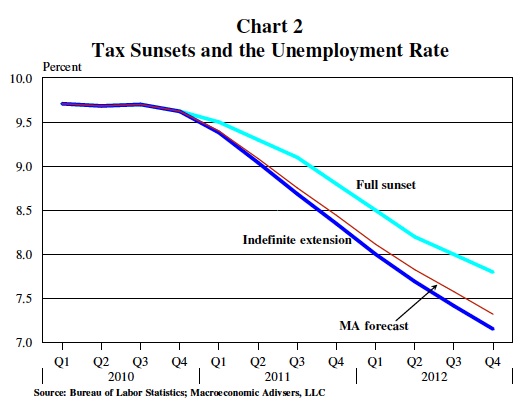

Just to add something new, here’s Macroeconomic Advisers’ take on the impact on unemployment.

Source: Macroeconomic Advisers (August 2010).

Obligatory caveat: If you don’t believe in neoclassical synthesis (short run price stickiness, Hicksian decomposition, long run classical AS curve), then the first and third figures are not for you.

Update and Extension: Thursday, 9/16, 2pm Pacific.

A knowledgeable Econbrowser reader sends the following:

Using the CBO “revenue” estimate of the President’s proposals regarding the 2001/2003 tax cuts omits significant “outlay” effects from refundable credits. See the JCT publication for the total revenue/outlay effect: http://www.jct.gov/publications.html?func=startdown&id=3665

This will give you a total cost of the President’s extension of $3.049 trillion vs full extension $3.893 ($850 billion difference excluding debt service). (Not exactly comparable because of different economic assumptions between March and August but closely comparable.) Note the outlay effects are combined in the main JCT table (which you want combined), but the outlays are also shown separately on the last page.

Further, I don’t believe anyone is talking about permanent extension of the repeal of the estate tax which is assumed in the higher full extension number. I suspect omitting this cost will get the cost of the income extension into the $700 billion range (before debt service) in CBO’s numbers.

Treasury estimates $678 billion as the cost of the upper income provisions (See page 152 – http://www.treas.gov/offices/tax-policy/library/greenbk10.pdf).

I never thought I’d hear myself say this but, I think we have no choice but to let the Bush tax cuts expire in their entirety, and also do away with the medicare drug benefit. Damn the economy, and full steam ahead.

Honestly, it borders on arrogance to tell the reader in the first paragraph how to think. It is an especially cavelier assertion when the subsequent information does not even support the conclusion foisted upon the reader at the outset.

Am I to believe that concern for near term employment, and also medium term deficits, requires a tax cut only for those making under $200k? Not at all. The solution to near term weakness, and medium term deficits is to extend the Bush tax cut to ALL earners, but only temporarily. Extending the tax cut to earners over $200k in the near term is not just important, but MOST important, because that includes the small businesses who do a disproportionate amount of the hiring.

Beyond that, in the long term, repeal of all the Bush tax cuts will be necessary, but even that won’t be enough. Not even close. By chance, economics21 just posted an article on this. The level of taxation, long term, necessary to balance the budget is far beyond what the economy can handle w/o shedding more jobs. Therefore, substantial cuts to federal outlays will become unavoidable, and of course, the longer we wait, the harsher they will have to be. I am reminded of this quote: “The problem with socialism is sooner or later you run out of other people’s money.”

To further CT’s thought, “Damn the economy, and full steam ahead.” political win(s) over all!

Menzie wrote:

Clearly, the dark blue line is only slightly above the brown line.

Menzie,

This sentence below Chart 1 tells us volumes about your willful ignorance concerning growth and compounding. The US economy took over world dominance from the UK in the 19th Century with a growth rate about .1% higher. Just about the difference between the blue line and the brown line.

Also, you probably haven’t heard but we are in a very serious economic downturn and most people understand that our economy can no longer afford “slightly” more cost to production.

It is important to understand that the “rich” can simply put their income into hard assets this year and live off of a modest income next year knocking a huge hole in tax revenue. If taxes rates increase on the “rich” they simply stop having taxable income.

Where the choice to cut spending and leave tax rates as they are?

Or dare I say, cut spending, and then cut taxes, given a contstraint to bring the budget into balance within X years.

It would be really cool if right wing commenters would actually address the data, particularly when they propose doing the opposite of what the data suggest is most prudent.

What I wonder about most is how these right wing viewpoints are impenetrable by reality. We just spent eight years investigating the behavior of these beliefs in actual economies. The result was total disaster. And yet, to the right wing mind, this disaster does not exist, or if it does, could never be the result of the policies they supported and were implemented. In other words, the right wing mind has lost all sense of responsibility. No intellectual integrity remains. The only thing they know to do is repeat two words: “cut taxes”, ad infinitum.

Regarding tax cuts to stimulate the economy, what do you experts think about Harvard professor, Alberto Alesina’s 9-15-2010 WSJ opinion piece promoting government spending discipline and tax cuts as the way out of the current mess.

Russell,

Can you show me where the spending cuts were in the past few years? You have been brainwashed to the point where you accept no alternative to bigger government and higher taxes.

I am talking about spending cuts and tax cuts. Russell, you have fallen into the progressive trap, ie, take spending as given and determine the level of tax to cover it. Smaller government means less tax.

I just found the link to the NBER paper mentioned in today’s WSJ.

http://www.economics.harvard.edu/faculty/alesina/files/Large%2Bchanges%2Bin%2Bfiscal%2Bpolicy_October_2009.pdf

Ahh, a thread on the impact of tax cuts on economic growth. What I would like is for someone to explain how tax cuts always, always, always lead to growth. The goals of the entrepenuer to increase his income can be acheived by changing the distribution of the income pie as well as increasing the size of the pie. It seems a game theory approach using individuals with varying declining marginal utility of income would lead one to conclude that across the board tax cuts lead to income re-distribution toward those individuals with the greatest desire for more income. Simply put, the hoi-poi look at the tax cut as an increase in their income and the greedy take advantage of this to keep more of the productivity growth for themselves. I would venture that the cause of the recent disconnect between productivity growth and income is largely due to differing marginal utility of income being gamed through tax cuts.

tj,

Can you explain to me how the Bush tax cuts over the last ten years led to fiscal health and general prosperity? That is, please compare the general parameters of the economy in 2000 and then after eight years of your preferred governance, i.e. 2008. Then lets talk about who is brainwashed.

You really need to put up the data here in order for this conversation to proceed. Obfuscation and propaganda are not helpful.

JJ: Thank you for your comments.

You’re citing Economics21? Is this the Economics21 site that has such sage commentators as Keith Hennessey, who seems to have difficulties with trends and time sample selection?

I’m curious what the basis for your predictions are? Finger in the wind? After all, in your comment of 07/07/2009, you wrote:

So you’ll excuse me if I do rely on some actual numbers and historical correlations, instead of random, non-quantitative, criticisms.

Addendum: If given a choice to let EGTRRA/JGTRRA fully expire after a temporary partial extension, well, that seems reasonable to me [1] [2]. But why give a tax break to the +$250K group now?

Russell, please take a look at figure 1 in this article. You asked: “Can you explain to me how the Bush tax cuts over the last ten years led to fiscal health and general prosperity? That is, please compare the general parameters of the economy in 2000 and then after eight years of your preferred governance, i.e. 2008.”

I think you are asking the wrong question. We should be comparing 2000 with 2007 when we were starting into a recession. One party was able to stop and get us out of that 2001 recession within months. The other has yet to prove anything close to that for the 2007 recession.

Is that the kind of comparison you requested???

Or how about this one about policies? In 1999 and 2000 under Clinton stewardship we had a budget surplus. Coincidentally that was the same period when Bush established his economic policy.

Now, let’s make one little assumption, because of Clinton’s superior stewardship Bush did not have to contend with a brewing recession, and his initial tax cut was implemented to reduce that surplus to around the 0.0 base shown in Figure 1. Remember we are, at your request, comparing policies.

Care now to picture the Bush economy past 2001 upon that chart assuming the superior Clinton economic stewardship which prevented that 2001 recession and the implementation of the Bush tax cuts?

By Jove, it looks like Bush’s policies continued that ole budget surplus.

So, you see you have to assume that the 2001 recession was only Bush’s to make comments about comparing the policies within that decade. When you actually compare the two with an open mind you will see that they had similar results. Indeed compare the slope of the lines between the presidencies and they are nearly identical. If Bush had either not had the 2001 recession, days after his administration, or the later recession had been 12 months later, his budget numbers would have been as good if not better than Clinton’s.

Just another view to counter the constant misinformation. Those “what ifs” did not happen, but neither can we claim it was all Bush’s fault.

“If you don’t believe in neoclassical synthesis (short run price stickiness, Hicksian decomposition, long run classical AS curve), then the first and third figures are not for you.”

I can only believe in those things if graphs 1 &3 extend from 1990 to 2015 and demonstrate the full reversion to the 2000 tax rates ends up at the same points in 2011-14 as 1997-2000.

The middle chart seems to track effective tax rates, lower taxes:lower BuS/GDP.

CoRev:

Why was the budget surplus at the peak of a business cycle a problem, given the increase in Federal debt during the Clinton term in both real terms and as a share of GDP?

Wouldn’t the prudent fiscally conservative policy to be to continue the Clinton fiscal policies that:

1) led to steady growth and a long expansion

2) resulted in labor shortage

3) still increased the debt burden over the business cycle

4) looming future fiscal budget issues dictate reducing debt

If the tax cuts were planned in 1999-2000 based on the labor shortage economy, then:

a) tax cuts were designed to drive wage inflation by further increasing economic activity

b) tax cuts were designed to drive layoff to reduce wage inflation

One thing that those calling for less government spending never do is explain what they mean by less government spending, and connect that to how those cuts would lead to increased job creation.

For example, is the idea that cutting fire fighters will lead to more buildings burning down, thus more construction, higher fire insurance premiums, driving higher prices which require hiring more salesmen to maintain sales?

Cutting fire fighters which puts the competition out of business increasing demand at the surviving business will lead to more hiring at one business, but probably not enough to offset the losses at the burned out business.

Perhaps not funding courts as is being done in NH, results in slower civil action leading to firm hiring goons with guns to settle civil claims?

Or, letting bridges fall down will increase the hiring as more miles are driven to detour around the bridge government won’t spend money on to replace? Was Gov Pawlenty a good fiscal conservative in his handling of bridges and especially the I-35W Mississippi bridge in Minneapolis in 2005-8?

Those calling for fixing the economy by cutting taxes an cutting government without defending these as solutions with specifics with the economic impacts of the specifics modeled or justified in theory are demanding a free lunch.

Anyone who talks tax cuts is always promising free lunches, because they never layout the costs.

I have a more cynical view of policy. I think that ever since George The First lost re-election to Willie “It’s the economy, Stupid” Clinton, the R’s went back to the drawing board and concluded they needed a way to make the business cycle last 8 years.

So they decided Keynes was wrong about counter-cyclical fiscal policy, Greenspan had to turn over a new leaf and become a monetary dove, Johnson was right when he decided to have a war and a Great Society at the same time (Cialis for Seniors and mucho bucks for rich people), add one more war for good measure, and turn the regulatory branches of government into walking zombies.

So they ending up tweaking the business cycle to 7 years. Close enough for government work, and we got 8 years of George the Second. 1 year too short for McCain-Palin, however. Oops.

Clinton got lucky with the PC, telecom, Internet, corporate IT modernization and general tech boom aiding the economy. We even thought old industry leaving the country was a “natural” event.

Does anyone here actually believe that the US private sector can grow fast enough in the next 10-20 years with the Boomer demographic drag and the structural effects of Peak Oil to even come close to servicing the existing or any new private debt, let alone fund and refund the implied tens of trillions of dollars of federal gov’t obligations?

Does anyone here realize that gov’t wages and transfers plus rentier income now exceed an equivalent of 50% of private GDP and surpass private wages after taxes?

Do you know that gov’t wages exceed proprietors’ income, even with corporate profits/GDP at or near record highs?

How can the private sector grow with gov’t and public and private debt service surpassing half of the output of the private sector, and growing at around twice the rate?

Does anyone realize that this is the path historically taken by banana republics and empires in collapse? Argentina, please cry for us!!!

If one has not thoroughly examined these critical structural factors, a debate about this marginal policy tweak or that is embarrassing, and worse than irrelevant.

“I think you are asking the wrong question. We should be comparing 2000 with 2007 when we were starting into a recession. One party was able to stop and get us out of that 2001 recession within months. The other has yet to prove anything close to that for the 2007 recession.”

This is quite hilarious. What did I say? Oh right:

“And yet, to the right wing mind, this disaster does not exist, or if it does, could never be the result of the policies they supported and were implemented. In other words, the right wing mind has lost all sense of responsibility. No intellectual integrity remains. The only thing they know to do is repeat two words: “cut taxes”, ad infinitum.”

Well said! Thank you, CoRev, for making my point crystal clear. I knew you would.

Russ,

For the record, I said cut spending first, or at least with the constraint that a combination of spending cuts and tax cuts puts us on trajectory toward budget balance. The evidence you seek is in the link I provided above.

The authors are well respected, at least in terms of their publication record in respected journals.

Here is a portion of the abstract-

We examine the evidence on episodes of large stances in fiscal policy, both in cases of fiscal stimuli and in that of fiscal adjustments in OECD

countries from 1970 to 2007. Fiscal stimuli based upon tax cuts are more likely to increase growth than those based upon spending increases. As for fiscal adjustments those based upon spending cuts and no tax increases are more likely to reduce deficits and debt over GDP ratios than those based upon tax increases. In addition, adjustments on the spending side rather than on the tax side are less likely to create recessions.

Ok. Econbrowser’s commenting apparatus is a bit hard to deal with if you assume interactivity.

So. I despise political arguments. I had to keep things short in the previous posts so that the more ideological could follow but this is what I think:

1. Recessions are the responsibility of the people who were responsible for the implemented economics in the half decade, or maybe, just maybe, a little less time frame than that before the recession gets announced, whether by JDH, or somebody/organization less reputable.

2. Clinton, but actually, “Rubinomics”, was responsible for the 2001 recession. How could that not be?

3. Cutting government spending is problematical as a means of addressing a technologically advancing society with increasing population, productivity, and GDP. But increasing productivity can help here a lot, think your about your state DMV.

4. Keynesian economics works, and is uncontroversial in those economists who dwell in the less ideologically calcified regions of their faith. As proof I give you our hosts. Distinctions remain, but the general idea remains broadly accepted.

5. Government spending could surely regularly be cut across the board, if only as an exercise in cutting deadwood. Mainly those ideas that have turned into obscure “branches”. But this would only be practical if new, hopefully more efficient initiatives were funded that addressed the realities of point #3.

6. We need to get realistic about military spending. Here is a good place to start, that cuts 1 trillion dollars (yes, that’s right) without degrading whatever level of safety is required for a well functioning society:

http://www.comw.org/pda/

7. We need to raise taxes on a marginally advancing scale so that “the rich”, defined as those making above $1,000,000 per year today, indexed to inflation, pay 50% of their taxes to the damn state.

That’s what I think, and it’s probably, given historical evidence, a whole lot healthier for a well-functioning American society than the driving down to as stupid as possible mantra of “tax cut tax cut tax cut…”.

Cedric, I tend to agree that the over all policies resulted in the great moderation. More importantly, unless we can get a concise list of Clinton policies and their impacts and interactions, we have to admit the Clinton was just luckier than most other presidents.

Menzie, now that’s worth a dissertation and a book.

Mulp, you start with a question: “Why was the budget surplus at the peak of a business cycle a problem, given the increase in Federal debt during the Clinton term in both real terms and as a share of GDP?”

Answer is simple, politics. We had a Republican Prez who believed that the money was best left in the taxpayer’s hands. Then wham, we had a recession and 9/11 to contend with. Just not as lucky as Clinton, I guess.

This question has always baffled me. “Wouldn’t the prudent fiscally conservative policy to be to continue the Clinton fiscal policies that:…” Asking that question assumes there is a policy baseline with which to compare. If you define the full policy baseline then we can begin to discuss. Otherwise there is no common ground to begin discussions.

Russell, if you can not argue the points then ridicule and attack the person. Yup! Now that’s a successful technique. You lost! The discussion is over.

I’m afraid that any thoughts of tax cuts or even keeping taxes the same is like debating how many angels can dance on the head of a pin. There aren’t angels and even if there were, they certainly wouldn’t dance on the head of a pin.

We’ve played that trick for too long. Maybe the Fed will try more QE and run the Fed balance sheet up to 5 trillion, but one of these days or years, hard to tell which, private investors including foreign CBs and SWFs will decide the Fed is trying to corner the market for treasuries and dollars and hand the Fed all of them.

If the Fed does no new QE, the Treasury still is projected to run the national debt up to 20 trillion by the end of the decade, and the latest OMB projections go hyperbolic after 2020. Of course we never get there….

What if I don’t care about utilitarianism, but do care about individual rights, including one’s right to life, liberty, and pursuit of property?

If the government could generate an additional 1% gdp growth by manufacturing Soylent Green, would you support it? I’m already handing over roughly 50% of my income to federal, national, and local taxes. These taxes are basically legalized cannibalism. I can give you other schools of economic thought that will demonstrate a correlation between individual rights and economic freedom and positive utilitarian outcomes, but I don’t care to argue that point. I’m just going to say – it’s immoral and evil to plunder the lives of others.

By the way, Cato has a full page ad in today’s WSJ with several ideas for reducing the size of government. Several have merit, but a few simply shift the burden onto the states and locals. (see cato.org) That shift will be difficult in a few states where pension liabilities have gutted the state piggy bank.

assumptions, added up, lead to a wildly optimistic conclusion, and suggest we could let sunset?

1) the 2Q 2010 GDP is wrong. the 3-4Q estimate and jumpoff over 3% is real optimistic. as is 4-5% growth in early 2011

2) elmendorf CBO in april published that rate sunset, no AMT patch, and Stim spending unwinding could generate 2.5% fiscal drag in 2011.

3) so gridlock, which i have favored in the past, would quite likely generate a recession next year with growth as high as 2% going in. Instead we will require congress to immediately do the right things?