Impacts, Transmission and Recovery.

This was the topic of a conference I recently attended, sponsored by the Korean Development Institute and the East-West Center, organized by Maurice Obstfeld, Dongchul Cho, Andrew Mason and Sang Hyop Lee. It was a great opportunity to hear diverse views on the progress of the world economy. The papers are here.

Rather than discussing all the papers, I want to highlight a few papers that had particular salience for me. First was Barry Eichengreen‘s assessment of the progress we have made in dealing with the underlying sources of the crisis. From Macroeconomic and Financial Policies Before and After the Crisis:

First, while this crisis, like all crises, had multiple causes, at its center were problems of lax supervision and regulation. It is appropriate therefore that post-crisis efforts, both in the United States and at the level of the G20, should focus on regulatory reform. Unfortunately, accomplishments here are less than meet the eye. In the U.S., nothing has been done to downsize big banks.25 The role of the credit rating agencies in regulatory decision making has not been eliminated. It will still be possible for the banks to trade bespoke credit default swaps over the counter. Other than abolishing the Office of Thrift Supervision, nothing has been done to consolidate the fragmented process of supervisory oversight. Macro-prudential supervision will be by committee, which sounds suspiciously like no macro-prudential supervision at all. The new financial consumer protection agency is in limbo: in the Fed but not of the Fed.

At the level of the G20, there is still no agreement on what should be the priority: a bank tax, an executive compensation tax, new restrictions on hedge funds and private equity funds, or a ban on short selling. While there has been much discussion of further reforms of the Basel II framework, there has been no progress in implementation. The crisis in Europe hardly creates confidence that there will be early progress; the weak condition of their banks has caused Germany and France to suggest waiting as long as ten years before fully putting the new rules into effect. Efforts at constructing a proper resolution regime for systemically significant financial firms at the global level have barely begun. This may be too negative an assessment at progress in strengthening supervision and regulation. But it is hard to contain one’s disappointment that more was not done in the wake of the most serious global financial crisis in 80 years.

Second, the crisis is a reminder of the value of keeping one’s fiscal powder dry. Too many of the advanced countries entered the crisis with large budget deficits and elevated debts. An unprecedented crisis may have justified an unprecedented fiscal response, but against a backdrop of fiscal profligacy it also created unprecedented problems of debt sustainability. Emerging markets learned from the crises of the 1990s the importance of running budget surpluses and keeping fiscal capacity in reserve. One can only hope that the advanced countries, including the United States, draw the same lesson from recent events.

Third, the crisis reminds us that mechanisms for international policy coordination remain inadequate. It would have been better in 2008-9 if countries with unused fiscal capacity had done more to support global demand, enabling those will less unused capacity to do less. More recently, at the June 2010 G20 meeting in Busan, U.S. Treasury Secretary Geithner urged Germany, China and other countries with unused fiscal capacity not to cut policies of fiscal support willy-nilly, enabling other, mainly European, countries with pressing budgetary problems to get on with the task of fiscal consolidation and preventing the reemergence of global imbalances. Once again, the sentiment was admirable, but the response was non-existent.

Fourth, the response to the crisis is a reminder of the importance of coordinating monetary and fiscal policies. In this instance, the coordination deficit is especially glaring in Europe. First the reluctance of the European Central Bank to engage in quantitative easing pushed governments into doing more – often more than they were capable of doing safely. Then the inability of governments to agree on a concerted response to the second phase of the crisis in 2010 forced the ECB to abruptly reverse its position on direct bond purchases, something that did nothing to enhance the credibility of the policy makers concerned.

I was considerably less upbeat on the prospects for the world economy after the paper was presented than before (and my views were already pretty gloomy). But I think Professor Eichengreen has the outlook right.

A different, statistical/historical, retrospective perspective was provided by Michael D. Bordo and John S. Landon-Lane, in The Global Financial Crisis: Is It Unprecedented?. From the concluding Discussion :

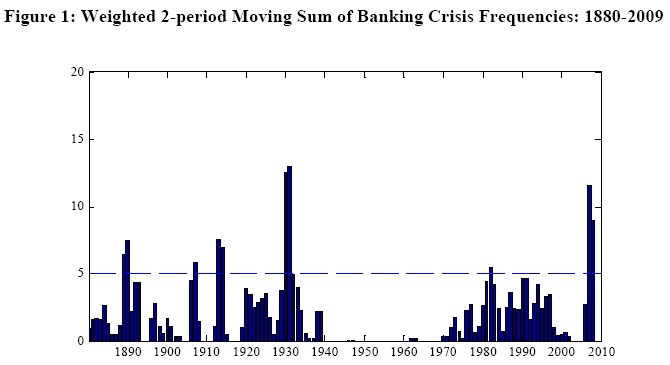

… since 1880 the world has witnessed 6 global financial (banking) crises. This result is based on our aggregation of several chronologies of banking crises where we calculate a moving sum of the weighted counts by country size and condition on crisis incidence across continents. When we add in currency crises and search for global twin crises we only find one in the 1930s. When we add debt crises to the total we find that no triple global crises occurred. In terms of incidence weighted by country size the 1930s was the worst global crisis by far, followed by the recent crisis. Although the number of countries affected by crises was lower than some of the historic crises, the presence of the US and other major countries makes the recent crisis important in terms of the number and size of countries involved.

We also measured the output losses in global crises. We used a business cycle dating algorithm to date classical business cycles and for each recession we computed the accumulated percentage loss as our measure of the severity of a recession. We found that the distribution of recessions associated with crises was highly skewed with a fat left tail and that the mean accumulated percentage loss was higher for recessions associated with crises than those that were not associated with crises. We also found that recessions associated with banking crises were worse than those associated with currency crises and we found that banking crises appeared to affect all countries more than currency crises. The losses during recessions associated with currency crises were larger for those countries having a currency crisis than those that did not.

We then compared the 6 global banking crises that we identified and found that the recessions associated with the most recent crisis was quite similar in average loss to the crises of 1906-07 and 1982-83 but not as large as in the 1890-91 and the 1913-14 crises. The other important finding is that the most recent crisis is not associated with a highly skewed loss distribution. Unlike all other banking crises there are no really large negative losses. This result is unprecedented.

Bordo and Lane provide an interesting plot of banking crises over time:

Figure 1 from Bordo and Lane (2010).

The authors conclude with a series of policy implications, the last one of which reads:

Finally, the fact that this crisis was one of the least costly of the global financial crises suggests that perhaps policy makers in the countries affected learned some of the lessons from the past global financial crises. They followed aggressive expansionary monetary and fiscal policies. This was certainly not the case before World War II.

Another paper of interest was International Financial Markets and Transmission of the Crisis: Determinants of Exchange Market Pressure and Absorption by International Reserves, by Joshua Aizenman and Michael Hutchison. From the abstract:

This paper evaluates how the global financial crisis emanating from the U.S. was

transmitted globally. Our focus in on the extent that the crisis caused external pressures

(exchange market pressure), measured by a combination of exchange rate depreciation and loss

of international reserves, across different regions of the world, across countries with different

income levels, and differing levels of restrictions on international capital flows. We investigate

in greater detail how emerging markets responded to the crisis, both in terms of total exchange

market pressure and whether the response or absorb of the shock was mainly through exchange

rate depreciation or the loss of international reserves. We correlate exchange market pressure

with various real and financial indicators and find that higher-income emerging markets that

were more integrated in the world financial system, and countries with higher total foreign

liabilities/GDP, were more vulnerable to the financial crisis. Countries with large balance sheet

exposure — high external portfolio liabilities exceeding international reserves — responded to

the global shock by allowing greater exchange rate depreciation and comparatively less reserve

loss. Despite the remarkable buildup of international reserves by emerging markets during the

period prior to the financial crisis, countries relied primarily on exchange rate depreciation rather

than reserve loss to absorb most of the exchange market pressure shock. This could reflect a

deliberate choice, possibly to gain competitiveness at times of collapsing export demand, or

market actions that moved quickly and strongly to adjust to changing circumstances, especially

in emerging markets with open capital markets. The financial market crisis was followed by a

global recession, suggesting that exchange rate depreciations attempting to improve international

competitiveness can be part of the adjustment of small economies but can’t resolve global

collapsing demands.

Finally, The Great Trade Collapse and Contraction of Exports in Korea during the Global Crisis, written by Hangyu Lee, noted that the incidence of the trade drop during the 2008Q4-09Q1 period was strongly related to the share of durable goods in total exports. This correlation is shown in Figure 3 from the paper.

Figure 3 from Lee (2010).

This result is highly suggestive of the composition effect in driving the trade collapse, although as I noted in my discussion, the correlation does not necessarily rule out the possibility that credit factors were important.

All ten papers and the accompanying comments/discussions can be seen here.

The proximate causes of the global economic crisis are inherent to the capitalist system, i.e., the Kondratiev or Long Wave, and are coincident with the end of an era of unsustainable compounding private debt and debt service as a share of incomes, production and capital accumulation, and private GDP; global peak production of oil and net energy; and emergent demographic drag effects for at least 65-70% of the global economy.

If one does not start with these underlying structural causal factors, then one will be woefully misled to think that the solution is more of the same that led us to this point: more public and private debt-money at compounding interest atop a pile of private debt-money obligations of which perhaps 40-50% must be forgiven, defaulted upon, etc.

The overwhelming majority of mainstream e-CON-omists are taught, socialized, coerced, and brainwashed to dismiss the Long Wave, debt-money excesses, resource constraints, and structural demographic factors as too “deterministic”, as they imply hard super-structural limit bounds on growth, gov’t intervention, policy tweaking, and increasingly complex interactions leading to diminishing returns to more debt and intervention.

Moreover, virtually all e-CON-omists operate on the deeply internalized theoretical basis that the natural world is a sub-set of the economic system rather than the glaringly self-evident converse.

If e-CON-omists dismiss the very underlying structural factors which determine the nature and trajectory of economic activity, then their basis for understanding the economy, and thus recommending policies, is flawed and their analysis and advice likewise.

The institutionalization of the flawed models and the associated professorships, endowed department chairs, corporate and gov’t grant money for “research” and a stable of grad students, socioeconomic and occupational status competition, affirmative action to fill quotas to perpetuate the system, and the like preclude anything more than token critiques and shallow self-examination of the theoretical basis for the prevailing belief system, rendering a growing share of e-CON-omists’ work as irrelevant, and even dangerous.

“a bank tax, an executive compensation tax, new restrictions on hedge funds and private equity funds, or a ban on short selling.”

These are solutions? The problem is over-extended borrowers. Weak lending controls were only a facilitating factor. But a driving force in creating the problem was excess desired savings, including savings artificially spurred by governments (mainly by currency interventions in Asia). China is still forcing its savings on the ROW to the tune currently of about $20 billion per month. If the private financial sector had been more robust, how much longer would the global imbalances have grown and how much worse would the problem have become before the inevitable correction?

A ban on short selling? How about strict controls on manipulation of markets. A ban on short selling just makes it easier to deny and delay.

A bank tax on TBTF’s to force them to pay for the implicit insurance they receive would be good. So would aequate capital requirements. Too bad the lenders have too much political power. Too bad the debate among policy makers is so uninformed and subject to manipulation by interested parties.

So, the last graph just points out that over-extension of borrowers never reached the level of 1930 until very recently.

Shorter Nemesis — Menzie should have stood in bed.

Menzie,

Thanks a lot for posting these papers. They are very interesting especially the ones you excerpt.

“First, while this crisis, like all crises, had multiple causes, at its center were problems of lax supervision and regulation.”

Barry should read the recent paper by Krugman and Wells. Neither financial market fragility nor loose monetary policies were the ‘central’ cause of the housing bubble – it was the global savings glut, greatly exacerbated by official currency interventions. Unless Barry is making the perfectly useless point that the bubble would not have collapsed as quickly as it did with better regulation …

David Stockman prescribes the bitter medicine of debt deflation and austerity.

Hold your nose and open wide.