From the conclusion to a provocative paper by David Autor, David Dorn, and Gordon Hanson, entitled The China Syndrome: Local Labor Market Effects of Import Competition in the United States:

our study suggests that the rapid increase in U.S. imports of Chinese goods during the

past two decades has had a substantial impact on employment and household incomes, benefits

program enrollments, and transfer payments in local labor markets exposed to increased import

competition. These effects extend far outside the manufacturing sector, and they imply substantial

changes in worker and household welfare.

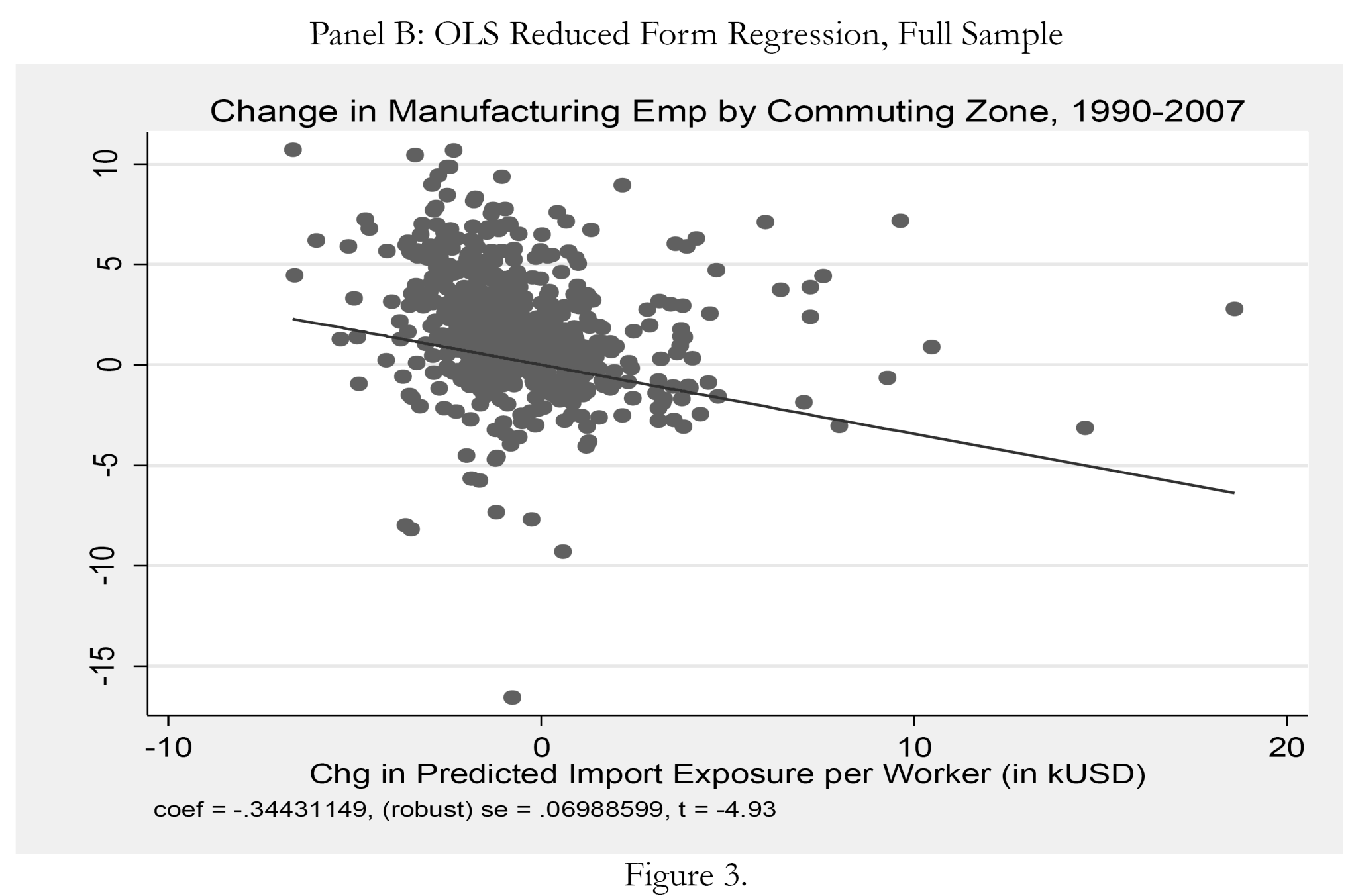

The authors reach these conclusions using an interesting instrumental variables approach, where the instruments for import growth into US commuting zones using Chinese import growth into other income countries. The relationship between employment and (instrumented) import exposure is illustrated in Panel B of Figure 3.

Figure from Autor, Dorn, and Gordon (2011).

While there are losses along several dimensions (employment, wages, deadweight losses associated with transfers), there are also gains. Putting these together, the authors conclude:

Our results suggest that the strong focus of previous literature on wages misses important

aspects of labor-market adjustment to trade. We find that increased exposure to low-income-

country imports is associated with rising unemployment, decreased labor-force participation, and

increased use of disability and other bene ts, as well as with lower wages. Comparing two CZ’s over

the period of 2000 through 2007, one at the 25th percentile and the other at the 75th percentile of

exposure to Chinese import growth, the CZ at the 75th percentile would be expected to experience

a differential 4.1 percent fall in the number of manufacturing employees, a 0.8 percentage point fall

in the employment to population rate, a 0.8 percent fall in mean log weekly earnings, and increases

in per capita unemployment, disability, and income assistance transfer benefits on the order of

2 to 3 percent. Hence, federally funded transfer programs, such as Social Security Disability

Insurance (SSDI), implicitly insure U.S. workers against trade-related employment shocks. Import

exposure also predicts a large but imprecisely measured increase in benefits from Trade Adjustment

Assistance (TAA), which is the primary federal program that provides nancial support to workers who lose their jobs as a result of foreign trade. However, TAA grants are temporary, whereas most

workers who take-up disability receive SSDI benefits until retirement or death (Autor and Duggan,

2006). For regions affected by Chinese imports, the estimated dollar increase in per capita SSDI

payments is more than forty times as large as the estimated dollar increase in TAA payments.

I have a few observations.

I think it’s important to remember, when comparing costs and benefits, that this is the welfare levels with China under (relatively) free trade against the welfare levels without China, and not against autarky.

Further, as the authors note, over time some of the costs (transfers and associated dead weight losses) disappear, so the benefits eventually outweigh the gains.

Finally, as I observed at the conference where some of these results were mentioned [1], it is unclear whether the trends (and hence impacts) that held over the 1990-2007 period would persist into the future. Chinese wage rates are rising (as noted here and here), and US exports to China might accelerate.

Figure 1: U.S. goods exports to China, in millions of 1982$, n.s.a. Nominal values deflated by PPI for finished goods. Source: FREDII, and author’s calculations.

Even when the benefits outweigh the costs, the tabulation of gains and losses by groups highlights the facts that international trade has distributional consequences. That realization should not induce policymakers to hinder trade via protectionist measures. Rather it reminds us that transfers from gainers to losers is a prerequisite for trade to be Pareto improving.

Update, 10:45am Pacific, 4/5/2011: I neglected to mention earlier coverage of this paper by Konczal. Also, RA/Free Exchange cites a different take (by BeyondBRICs on the rise in wages in China.

We already have selective protectionism in the U.S, just not for working class professions. The paper assumes otherwise, or not, hard to say.

But merely looking at the results of trade ignores the inputs, which are not neutral.

Presuming that we usally want policies to be pareto improving, why is it a given that policymaekers should not protect those losing from trade?

In my view what one has to do is the evaluate whether trade or government intervention, e.g. subsidies to loosers, are most distorting. I cant see why the outcome will always favor free trade.

Now what is required to bring home, so to speak, the distributional aspects of the Anglo-American imperial trade regime’s effects on US wage rates and benefits is for the work of economists, such as Mssrs. Chinn and Hamilton, with all due respect, to be outsourced to Chindia.

By removing a significant portion of the friction, or stickiness, from the labor market for US, Canadian, Aussie, Kiwi, and UK e-CON-omists, I suspect that the western economies could be much “more competitive”, eliminating the costs of having so many seemingly bright people waste their vital intellectual energy studying and promulgating “economics” (and uneconomic growth) and producing harmful political propaganda to rationalize the power and privilege (wittingly or otherwise) of the rentier-oligarch overlords on Wall St.

On a related note, I had a chance to testify yesterday to the House Energy and Power Subcommittee in Washington–on China’s oil and gas outlook. It was great fun; definitely a highlight of my year. For those interested, you can find a copy of the testimony on our website: http://www.dw-1.com

Dr. Chinn,

We have ben trying these trade deals for decades and been subjected to this “compensate the losers and everything will be fine” drivel the whole time. It never happens. It is time to admit that a policy that depends for its success on a compensation program that will not happen to work is a mistake and change course.

Thanks, Steven. Good work, as usual.

As you appear to know well, the scale of structural effects of Peak Oil (and falling net energy) and population/ecological overshoot, as well as the three major global trading blocs having reached parity WRT oil consumption and GDP PPP, suggests that we have reached the end of real private per capita GDP growth; therefore, we risk a last-man-standing contest between the West and China for the remaining oil supplies and natural resource stocks of the planet.

Chindia’s growth since the ’80s-’90s has been a direct effect of the desperate attempts by US supranational firms to expand globally to keep revenues, profits, and capital accumulation growing, i.e., perpetual drive to avoid the dreaded Marxian falling rate of profits crisis.

Thus, the Anglo-American imperial corporate-state’s encircling of the planet and consuming resources well beyond a sustainable rate ensures that per capita net energy returns will at some point collapse along with corporate revenues, ROI, and capital accumulation, marking the end of capitalism (and all other “isms” that rely upon capitalist surplus).

The Anglo-American imperial military has become largely and increasingly a force deployed at the behest of private corporate interests to secure natural resources around the globe, including oil fields, ports, and vital shipping lanes. It does not take a leap of fancy to envisage a point at which the US gov’t acting on behalf of its corporate-statist owners will invade and occupy most of the countries with oil fields, or at least prevent China from doing so via sanctions, blockades, embargoes, and the like against Chinese state-sponsored firms seeking to secure oil in Africa, the Middle East, and the western hemisphere.

But the Almighty cannot print enough money to increase liquid fossil fuel production/extraction/destruction, arable land, and water, let alone Bubble Benny and the Inkjets do it; but that will not dissuade Bubble Benny and his bankster and imperial corporate-statist benefactors from trying.

This, as we say in court, assumes facts not in evidence:

“That realization should not induce policymakers to hinder trade via protectionist measures. Rather it reminds us that transfers from gainers to losers is a prerequisite for trade to be Pareto improving.”

I see little evidence that the transfers referred to will actually occur. In fact, the evidence suggests the opposite conclusion – that in fact such transfers are unlikely to take place (see the actual tax policy in the states and being debated in Congress)

Which in turn raises the real world question of the costs and benefits of trade when transfers DO NOT take place.

The question that the author has chosen to answer is in fact rather immaterial to the real world choices we face.

Rather it reminds us that the existence of Santa Claus is a prerequisite for trade to be Pareto improving.

It is hard for a trained economist to agree that even in the long run, we may be better off with impediments to trade. But to consider an extreme case, suppose income from Saudi oil exports were poorly distributed among the populace, so that you get very rich overlords, with just enough distributed to the underclass to render it uncompetitive in any venture in which it must compete with foreign labor. Is the populace better off than one with lower overall income, but for the most part gainfully employed (such as, say, Chile? A popular uprising in the Saudi Kingdom may imply that they are not.

What might this have to do with the U.S.? Well, it is not too hard to envision a future in which U.S. agricultural exports come to play a role similar to Saudi oil exports. The authors’ findings predict an outcome very like what I would expect to see, only become much more obvious.

Professor, with all due respect, you’re on the wrong side of this and it’s going to come back and bite you in the ass.

Sorry, I said it, but that’s what it is.

The purpose of the free trade was to recycle the earnibgs and saving of the working class to the richer, outsourcing the factories and increasing dramatically the benefits, because the cost are much lower but the prices have not decreased in similar amounts

The bi companies have an effective control of the market prices, so the can increase, in this way, the profits

But this policy (anti-Fordism) is not sustainable in the long run, and now you can see the real effect

We will see people in developed countries more and more aproaching to the living conditions of the chinese workers more than the opposite, and this “shinization” of the westeners may be is “Pareto efficient” but it will have dramatic consequences in the future of our societies, as the social conditions at the end of the XIX century were quite “Pareto efficients” but create huge social problems

I found a lot of things in this paper unconvincing. Their lack of a credible explanation of the way they handle population shifts is hard to swallow. Most of their observations are in the southeast, which is experiencing positive population growth. And transfer payments in the Bible Belt are not exactly generous. I suspect people are moving from the north to Dixie for reasons other than robust job opportunities. There’s also a fair amount of ad hoc stuff in the paper. The use of a time dummy for 2000-2007 seems ad hoc. They want to talk about the effect of shocks, but it looks to me like they have implicitly assumed an ad hoc and contemporaneous exogenous/dependent variable relationship. And by chance I see where Krugman just had something that separated TPF for manufacturing products versus immediate consumption goods. Many of the goods that they used in their study would be immediate consumption goods, which have a low TPF. Should we be surprised that wages are low in that sector. Another problem I have with the paper is that they brush past the fact that much of the value added component of Chinese imports actually accrues to US workers; e.g., distribution & sales.

Insisting upon Pareto efficient outcomes is a pretty steep hill for any public policy, including a protectionist one. In the real world I’ll settle for a Rawlsian outcome in which welfare for the very bottom of the income ladder is improved even if income for the next to bottom of the income ladder goes down. And if you’re worried about economic justice, then sooner or later you have to ask yourself why justice for American workers is all that counts. Doesn’t it matter that free trade improves the lives of Chinese workers? Does that carry zero moral weight?

What we need are full employment policies. Free trade is welfare enhancing, but free trade also assumes that all resources are fully employed. Instead of bashing Chinese workers, I prefer to bash stupid GOP politicians that won’t support countercyclial policies.

2slugbaits: I overwhelmingly agree with your general political arguments, but:

1) A lot depends on what “protectionist” measures are proposed. Currency realignment would without question stand accused of being protectionist, but would very likely be welfare enhancing for Chinese workers (while improving the wage and employment circumstances for US workers most exposed to import competition). Warren Buffett’s cap and trade for trade proposal would likely have a similar effect.

2) While you’re surely right that counter cyclical policies should be the order of the day, the fact is that neither fiscal nor monetary policy is currently directed by people who share this view. In contrast, exchange rate policy is essentially set by the administration unilaterally: even if technically Congress can intervene, the administration has great latitude in imposing sanctions for currency manipulation and in directly intervening in the for ex markets. So, to the degree that a dollar devaluation is expansionary, its the only form of counter cyclical policy that does not require support from either GOP elected officials or GOP bank apparachtiks (the Fed).

3) Strictly politically, trade tends to split the GOP electoral coalition (GOP voters are pretty anti-trade, GOP funders are very pro-trade) much more so than it does the Democratic coalition (whose business supporters are in industries that are export oriented, and would be helped by dollar devaluation/currency realignment).

So an effort to address the economic downsides of expanded trade with china could very easily

*improve the well being of Chinese and US workers

*provide a much needed expansionary impulse to the economy, while

*driving a wedge into the GOP political coalition

Those, I think, are the key points to keep in mind.

I don’t think improvement of chinese workers lives carries zero weight but I cannot understand why destroying american workers lives does.

Rich C Those are all fair points. Yes, many people would consider currency realignment as a protectionist measure, although I wouldn’t. I usually reserve protectionist measures to particular microeconomic issues; e.g., tariffs to protect textile workers in North Carolina, or import restrictions on cane sugar, Brazilian ethanol, Chilean beef, etc. I usually lump currency realignment in the macroeconomic category. Still, I see your point. And I would support currency realignments.

I agree that trade tends to split the GOP, but it also splits the left. There are plenty of liberals (many of whom post here) that are not exactly big fans of free trade, down on WTO, opposed NAFTA, etc. That’s where I tend to part company with many of my liberal brethren. Free trade is not always and everywhere an unmixed blessing, but over the long run it expands potential global GDP. The problem for governments is to make sure global aggregate demand keeps pace with expanding potential GDP.

“Currency realignment would without question stand accused of being protectionist,”

A strange statement, and one with which I strongly disagree. From statements in his blog, it would certainly appear that Paul Krugman also disagrees.

How can a move toward free-trade equilibrium exchange rates be called “protectionist”?

I am sure all the outsourcing policy of the big companies is, in fact, only an humanitarian policy, to avoid the “zero moral weight”

Why not allowed 30 or 40 millions new inmigrants form the 3º world to come to US?, I think, as some suggest for the public employees, this could increase the supply side in the job market, decrease the wage and makes our economy much more competitive in the future

The real problem is the destruction of the real base for the economy, a mean “real” as the manufacturing base, because, at the end, what make people work for are material things (at least in our model of society), money, in the long term, has no meaning.

The R+D is and will follow the same trend that the manufacturing, because needs to be in contact with it to apply the results in the right way

At the end all the educational an research effort made by public investment, will be outsourced as well, and then the techonological base, that really make the wealth sustainable, will go away for the same mechanism

The strategical approach of Deng Xiaoping was very clever, because in fact the techonology = power

Don remarks “It is hard for a trained economist to agree that even in the long run, we may be better off with impediments to trade.”

On the contrary, it is easy: David Ricardo’s arguments about the benefits of free trade only apply as long as the essential factors in product remain immobile. But today, all factors (other than land, which only applies in agricultural production) have become entirely mobile. Therefore Ricardo’s arguments in favor of free trade collapse.

The Sonnenschein Mantel Debreu theorem shows us that there exists not one market equilibrium, but many, and most will be enormously suboptimal. As DFC points out, we’re now hung on a massively suboptimal equilibrium with China (and other third world countries) in which all our high-wage high-skill work is getting offshored and/or automated out of existence in the United States. The result is a future in which America becomes a country of dog groomers and xerox clerks and elder care workers, and you can’t sustain a first world economy on that kind of low-age low-income tax base.

mclaren

We seem to agree.

“And if you’re worried about economic justice, then sooner or later you have to ask yourself why justice for American workers is all that counts. Doesn’t it matter that free trade improves the lives of Chinese workers? Does that carry zero moral weight?”

I think it is useful that you are honest that a lack of concern with the nation state and borders and ones fellow citizens is inherent in the standard model of free trade. Thank you for your candor.

I am wondering how economists feel about the rights and privileges we possess as citizens. Do they devalue these? Would they embrace living in a country a more ‘free’ economy which had terrible ongoing pollution? No franchise? Political corruption and inadequate rule of law? Political prisoners? Torture of same? Etc. You get my drift. This could describe China, of course. But also it could be a list describing much worse states – where the degraded political condition is not captured by any economic theory.

I think someone should do a poll to find out how entirely theoretical is economists’ embrace of free trade, as associated with rejection of the nation state and rights of citizenship. I want to know if there is hypocrisy – would you reject the democratic nation state and its legal and civil protections for yourself and your family? Or do you only choose to deprive American workers further down the the ladder from the protections of borders.

It is important to adjust ones theories to reality. If economics truly does ignore the existence and function of the nation state, with its capabilities for granting rights, insuring the rule of law, franchise and the like, it is hard to take seriously. How can economists even weigh in on immigration or protectionism if they don’t believe in the validity of the nation state as an actor? If they don’t believe in rights of citizenship?

Nation states exist, they are part of reality. If economics as a discipline cannot cope with that, something is seriously awry.