The CBO recently released a document that places our current policy dilemma in context (Changes in CBO’s Baseline Projections Since January 2001, June 7, 2012).

The fiscal cliff refers to the end of several tax provisions and the implementation of the sequester which will amount to some 5% of GDP, and assuming plausible fiscal multipliers, will result in a recession in 2013. [1] The CBO prediction of a short, sharp recession is predicated on relatively rapid growth in the absence of the fiscal cliff. It is useful to recall why there is a conflict between stimulus, and fiscal constraint, at least in some people’s eyes. It has to do with the inherited deficit. Figure 1 shows the composition of changes in the budget balance, going from the January 2001 to January 2012 projections.

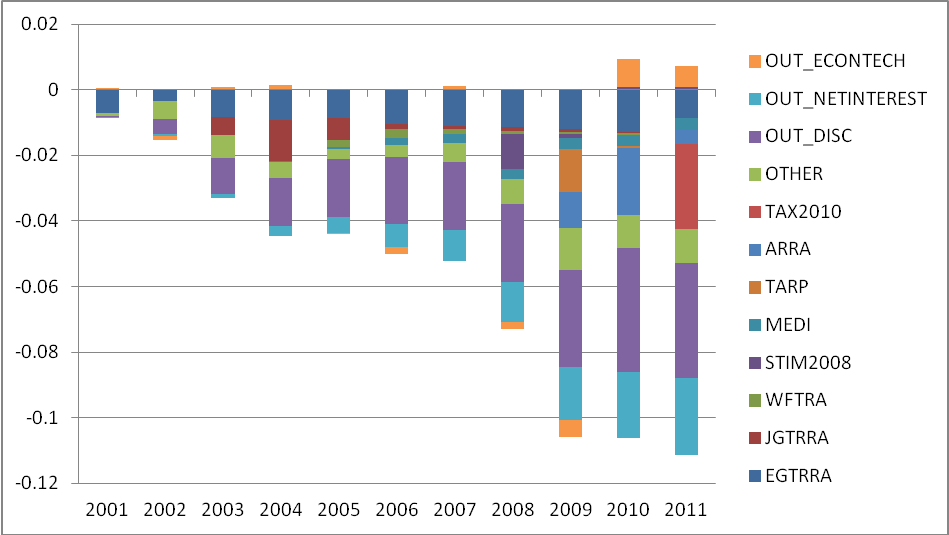

Figure 1: Changes in budget balance, in percentage points of GDP, from January 2001 to January 2012. EGTRRA is the 2001 tax cut, JGTRRA is the 2003 tax cut, WFTRA is the “Working Families Tax Relief Act”, STIM2008 is the 2008 stimulus package, MEDI is the Medicare Part D legislation, TARP is the Troubled Asset Relief Program, ARRA is the American Recovery and Relief Act, TAX2010 is the 2010 tax act, OTHER is other revenue and outlay measures, OUT_DISC is discretionary outlays, OUT_NETINTEREST is net interest, and OUT_ECONTECH is economic and technical changes. All divided by nominal GDP. Source: CBO, Changes in CBO’s Baseline Projections Since January 2001 (June 7, 2010), BEA, and author’s calculations.

The tax cuts accounted for a large share of the deficits through the 2000’s, and even in 2010, accounted for 1.3 percentage points increase in the deficit. In 2011, the extension of the EGTRRA meant that the Bush tax cuts lived on (in red, under TAX2010). Had the President’s proposal been implemented, the red block would have been about half the size shown (see Table 1-3 of CBO, An Analysis of the President’s Budgetary

Proposals for Fiscal Year 2011 (March 2010); the red block is $391 billion).

For FY2013, Deutsche Bank estimates the total extension of the Bush tax cuts would amount to approximately $250 billion; extending the tax cuts only to those with household income below $250K would cost only $100 billion (Source: DB, The US Fiscal Challenge, June 24, 2012).

Another major category is discretionary outlays (light purple). In 2007, slightly under half (47%) of this category was accounted by Iraq alone. [2] The cumulative cost of Iraq operations, ex.-debt service, through FY2012 is $807 billion, as shown in Figure 2.

Figure 2: Cumulative direct costs, in current dollars by fiscal year, in the Iraq theater of operations (“Operation Iraqi Freedom”). Does not include resulting debt service. Source: Amy Belasco, “The Cost of Iraq, Afghanistan, and Other

Global War on Terror Operations Since 9/11,” RL33110, Congressional Research Service, March 29, 2011, Table 3. Data for FY2011 is for continuing resolution, for 2012 is Administration FY2012 request.

As I observed in 2005, irresponsible tax cuts and wars of choice would constrain our future fiscal policy options should a serious downturn arise. [3] [4] And the dilemma posed by the fiscal cliff is the concrete manifestation of that prediction.

Concluding thought: Real Keynesians run structural budget surpluses when the output gap is positive. New style conservatives never run surpluses. [5]

At least you’re only blaming it on things that happened 36 quarters ago, not 120 like you normally do.

ITS ALL BUSHES FAULT! OBAMA’S 3.5 YEARS AREN’T ENUF!

That interest growth is super scary considering how low interest rates are.

Well, Sigh, there is the simple issue of whether Menzie’s point is true. The fact that Bush tax cuts were made a long time ago doesn’t make them less responsible for current deficits. They either are or are not a part of the problem. The math says they are a big part of the problem. The CBO says they are a big part of the problem. What is it about that simple logic that is giving you a problem?

The obsession with income taxes is ridiculous.

Keep the Bush tax cuts. Make the capital gains tax progressive.

Add in the fact that the Bush tax cuts did nothing to boost growth or job creation. There were more employed in the private sector in May 2001 than in June 2012.

You could put a similar red block in that diagram for any proposed tax increase that Congress chose not to pass.

You Keynesians are an odd bunch. You bemoan the the missed opporunity to impose a huge tax increase, while at the same time, you scratch your heads over an 80K monthly increase in employment.

“We must, therefore, take measures that there shall be no indebtedness of a nature to endanger the public safety. It is a menace that can be averted in many ways; but should a serious debt be incurred, we are not to allow the rich to lose their property, while the debtors profit by what is their neighbour’s. For there is nothing that upholds a government more powerfully than its credit; and it can have no credit, unless the payment of debts is enforced by law. Never were measures for the repudiation of debts more strenuously agitated than in my consulship.” Cicerone

A more subtile contemporary version is needed.

History and humankind are full of resources in the penultimate time of total of financial collapse. Vespasien Roman emperor meeting with a penury of financial resources and high debts enacted a tax on the urine, when Titus his son full of reproach on the matter was challenging the tax, his father reminded him that money does not smell. Constantin expanded the tax under the name of “chrysagyre”.

One may assume debts have to be repaid and budgets to be balanced, the expenditures side of the ledgers deserve a thorough reappraisal.

Menzie wrote:

Concluding thought: Real Keynesians run structural budget surpluses when the output gap is positive. New style conservatives never run surpluses.

Menzie,

This is a great quote!

Keynesians are hoarders. In good times they fear economic overheating and so they do what they can to restrict growth and then they fear the future bad times so they over-tax and hoard resources hiding them away as useless as money buried in the garden.

But those who believe in free markets do not hoard as do Keynesians. If the government begins to run a surplus free market economists see this as a waste of resources and a loss of investment and production. Those of us who believe in the free market understand that we must get those resources out of the dust bins of govenment lock boxes and into useful production to increase prosperity and employment.

It is the free use of capital and resources that brings the fresh air of freedom and prosperity not the dank, dark money boxes of paranoid misers.

Thanks Menzie. A very perceptive comment!!

I might modify the statement to read “social conservatives rarely run surpluses.” I am not sure I’d use “never”, but I wouldn’t shy away from “rarely”. This sad situation is one reason for the rise of the Tea Party.

But deficits also characterize egalitarians, by and large. Indeed, the mis- (or rather non-) alignment of incentives of politicians insure that all of them have an incentive to make off balance sheet or deferred commitments. Local government pensions obligations are only one example. Democracies, in the last thirty years at least, have tended to run deficits in good times and bad, regardless of party in power.

If you want to change the behavior, change the incentives. If you’re not willing to do that, then all you’re doing is griping, not problem solving.

The real answer is move up corporate tax rates. They are half of what they were back in the 70’s and have resulted only in corporations continuing to move jobs overseas. Here’s the deal, raise the corporate tax rate to 45%. Provide a small tax credit for corporations that increase the number of U.S. based jobs. This will do two things. It will force corporations to expand job opportunities in the U.S. and it will get them to spend the cash hoard they are sitting on.

July STEO Update

As is my habit, here’s a summary of the July Short Term Energy Outlook from the EIA.

From March to May, the oil supply outstripped demand–by more than 2 mbpd in April and May–culminating in recent price weakness. For June, however, demand exceeded supply, suggesting some price recovery moving forward.

At the year horizon (June 2013), the EIA is projecting global supply up 1 mbpd, but I think this will prove too low. The EIA has raised its North American outlook to almost +800 kbpd, which is a very good performance indeed. In addition, Iraq is likely up +500 kbpd over the next year, and Brazil could well add +200 kpbd, with Russia and Kazahkstan adding another 200 kbpd as well. The EIA sees production recovery in Sudan and Syria over the period. I have my doubts. But I think Libya could easily over-produce and put another 250 kbpd into play. To make the EIA numbers, Saudi would have to reduce production by some 1.6 mbpd, to just above 8 mbpd. I’m not sure I see that happening. I think the Saudis will be closer to 9 mbpd.

Net-net, I think supply could be up closer to 2 mbpd.

Now, those who follow my comments will recall that I estimate structual demand growth at 2.4 mbpd / year. So 2.0 mbpd is pretty good, but not quite enough. Except that currently the global economy is looking at weak demand for the coming period. The US consumer is looking to buy more fuel efficient cars; Europe’s a mess; and China is facing a soft spot. So there’s not a lot of incremental demand out there just now. This would argue for relatively soft prices for the next year or so, maybe in the $85-95 range Brent.

If this is true, the global economy will get the first breathing room its had on oil prices for a while, and that should allow greater GDP expansion. From the oil perspective, the global economy might just get a break here. The near term may be brighter than we think.

Of course, for the Administration, timing is everything. A month here or there could matter.

I suspect that Conservatives fail to make one very important distinction. Keynesian “hoarders” are advocating the use of tax revenues from existing wealth to ‘save for a rainy day’; while… any productive investment can be created from ex-nihilo funding. The ex-nihilo funds are growth neutral eventually, as with any lending, but there is residual interest which remains as growth. This growth though comes with no risk so long as the loans are paid off. And this growth is no better or worse than growth from existing wealth, it is simply a difference of risking something that already exists, as opposed to risking debt that will be due at some point in the future. But the ex-nihilo loans expand the money supply by the amount in question, while the existing wealth simply changes hands.

There is then a type of hoarding but not at the expense of growth. This would be akin to a farmer storing seed while using imaginary seed that actually produces crops without putting his seed stores at risk. This farmer thereby is prepared for a ‘rainy day’ in both the literal, and in the figurative sense.

The question that is germane to our times though, is whether a type of stimulus will help or hinder any economy subjected to excess liquidity as it relates to incomes/wages.

Interesting that the war cost chart is Iraq only. Why not Iraq + Afganistan? Would the shape be different over the last 4 years?

Yes, following the link we see that the actual slope of the cumulative war cost chart would continue at almost exactly the same upward slope until projected data replaces actual data, if we counted both wars.

Why would one choose to show half the story, where things get better in 2008, instead of the whole story, where they don’t? I have no idea what the motive could be.

Steven Kopits Democracies, in the last thirty years at least, have tended to run deficits in good times and bad, regardless of party in power.

This just isn’t true. The US ran rather large surpluses in the 1960s and in the 1990s. Spain ran surpluses prior to their collapse. Ireland ran surpluses. The UK ran surpluses in the late 90s and early 2000s. Japan ran surpluses up until the early 90s. Germany runs surpluses. Lots of democratic countries run surpluses. But you’re right about the Tea Party. No country can run a surplus if they pray to Grover Norquist.

Ricardo I don’t think you understand a lick about Keynesian economics. Keynesians simply point out that in the real world free markets sometimes fail because actual demand does not match planned demand. Sometimes there are output gaps, and those gaps can be positive or negative. I believe in free markets just as much as you do. The difference is that I believe in real world free markets that sometimes fail and need correcting. You believe in fantasy free markets that are fun to dream about but don’t actually track with anything real. Just because you can imagine an Easter Bunny doesn’t make it real.

You Keynesians are an odd bunch. You bemoan the the missed opporunity to impose a huge tax increase, while at the same time, you scratch your heads over an 80K monthly increase in employment.

Your posts are becoming increasingly bizarre. Who said anything about wanting a tax increase in the current environment? What Menzie was talking about was all the unnecessary fiscal stimulus that we saw during much of the Bush years when the economy was operating at something like full employment. Menzie’s point is that by running very large structural deficits during full employment Bush didn’t give us much fiscal space when we really needed it. In other words, Bush’s policies effectively ate our seedcorn. Or to use another analogy, Bush spent the rainy day fund when the sun was shining.

The solution here is a no brainer. The tax cuts for those at the very high end generate almost zero stimulus but have a very bad effect on the debt. Allowing the tax cuts for those at the very top to expire while extending the tax cuts for those in the lower brackets would avoid a contractionary effect without doing too much harm to the long run debt problem. Almost every economist knows that’s the right answer. This really isn’t controversial. The problem is with those on the whacko right who are in perpetual denial…and in my experience they almost never actually took even so much as an intermediate macro course, but yet they’re just sure the problem is too much government spending alongside record high tax rates!

Steven Kopits You didn’t mention the apparent relaxation of tensions with Iran. I’m not the mideast diplomat in the family, but my sense is that just about every country except Israel is coming to accept the reality of an Iranian “almost bomb.” The latest issue of Foreign Affairs even argues that a near-nuclear Iran would be a good thing. And this coming from one of the foremost scholars on the “realist” side. Big navies stationed in the Gulf seem to have a way of concentrating the mind on both sides. So maybe increased Iranian oil production isn’t too far off either.

Thanks for the comments on the Keynesian propensity to hoard.

Consider that in a Keynesian world the object is to smooth out the tops and the bottoms. You take from the good times to give during the bad.

This sounds good if you say it fast and turn off you brain, but the problem is that such a policy prevents real dynamic growth from ever happening. Just as an economy begins to grow and recover from the bad times Keynesians suck out all the fuel. When the times are bad they pour it back in but the economy can’t handle it so it floods into reserves or inflation or commodities.

The world of the left whether Keynesian or socialist is a world of mediocrity. The intent is to make everyone the same and the result is to dumb down society. What the left doesn’t understand is that while you can make the brilliant dull by hindering its luster you cannot make the dull brilliant. You can keep an intelligent person from succeeding but you cannot make an unintelligent person successful. You can destroy a growing vibrant economy but you cannot create production when the economy is in decline.

The result of the rush to medeoricity is actually the path to decline, the dumbing down of society.

Any government running a surplus must reduce taxes or create lost production that can never be recovered.

“Letting tax cuts expire”, that’s grand. Can we agree that after ~10 years we should refer to these for what they are, tax increases.

What about all these tax increases? Why are we ignoring these?

*Impose a minimum effective tax rate of up to 30% on taxpayers with annual income exceeding $1 million.

*Increase the tax rate on capital gains by one-third, to 20% from 15%. He proposes to raise dividend taxes to 39.6% from 15%.

*Phase out exemptions and lower-bracket tax rates for higher-income taxpayers. This will raise marginal tax rates for those individuals even higher than 39.6%.

*Limit certain tax deductions for individuals with incomes over $200,000.

Within Obamacare:

*There will be an additional 0.9% Medicare tax on wages over $200,000 ($250,000 for joint filers).

*HR 4872 modifies the health care act to impose the expanded 3.8% Medicare tax on investment income for people with income over $200,000 (or $250,000 for joint filers).

*Flexible spending arrangements for health care expenses will be reduced to $2,500 maximum starting in the year 2013.

*The current 10% penalty is doubled to 20% for any withdrawal or distribution that made for non-medical expenses.

*Currently, out-of-pocket medical expenses are tax-deductible to the extent the expenses exceed 7.5% of a person’s adjusted gross income. Starting in 2013, only medical expenses that exceed 10% of AGI will be tax-deductible.

*Obamacare will impose a 2.3% excise tax on gross receipts in excess of $5 million for domestically-sold medical devices

*Starting January 1, 2013, Obamacare will impose a 2.3% excise tax on gross receipts in excess of $5 million for domestically-sold medical devices

*An added 2.3 percent tax on medical device makers.

http://online.wsj.com/article/SB10001424052702303513404577356413669520718.html?KEYWORDS=Obama+list+of+tax+increases

http://taxes.about.com/b/2010/03/30/tax-provisions-in-the-health-care-reform-law.htm

KevinM: Iraq was a war of choice. I count it as truly “discretionary”. If you look back at all my posts, you will see that I am consistent on focusing on Iraq; the first of these posts is here, where I noted that Larry Lindsey’s $100-200 bn estimate was more likely to be right than Administration (read Mitch Daniels’) estimate of $50 billion.

Ricardo,

I was in Nicaragua just after the Sandinista takeover and there were make-shift schools being built all across the country. But you say: “The intent is to make everyone the same and the result is to dumb down society.” Yet when the ‘business friendly’ Samosa regime was in power there were no schools for “everyone”. And this is of course a common problem across the world, the business friendly folks see “everyone” as part of the ‘demographic dividend’ but… as you said:”you cannot make the dull brilliant”. So it seems that your comment has an inherent hypocrisy. You are accusing the Left of causing a dullness that, when it comes to “everyone”, cannot be made brilliant in the first place.

I am also tempted to respond to your third paragraph but it consists of nothing more than unsupported claims. For example this: “Just as an economy begins to grow and recover…”, when might you be speaking of?

The essence of the problem is that both Bush and Obama were/are profligate spenders.

The discretionary wars they both have prosecuted are horrible, wasteful tragedies. (Indeed, it is remarkable how similar Bush & Obama are in so many ACTIONS: wars, drones, GITMO, civil liberty infringements, bail-out, subsidies, same tax rates…)

The tax cuts should have been matched with spending cuts.

Menzie,

Despite embarrassed Democratic denials, Iraq was a bipartisan war with substantial support from both Democrats and Republicans. Over Bush’s term in office, the war in Iraq and Afghanistan cost about $750 billion. From 09 through 2012 projected, the war in both countries will cost about $620 billion. Obama promised to end the war immediately but he didn’t. He also promised to close Guantanamo, but he didn’t. He didn’t because both are bi-partisan policies although his side can’t admit it for political reasons.

The premise of your post is that Obama is trying to pursue responsible policy but is hamstrung by the mistakes of the past. But that is a hopelessly naive view. Obama knows perfectly well that his tax proposal has no chance on either side of the aisle. His focus group research has convinced him that he can score points on Romney with the rich guy attack but he’s been having trouble making that stick with the Bain ads. Obama’s campaign hopes to change the subject from the economy and wants to bait Romney into a class warfare battle that Obama thinks he can win.

Here we are with an apparent slowdown in the economy with a looming fiscal cliff and rather than propose something that can garner bipartisan support, Obama prefers to play chicken in attempt to score political points. Is that presidential? Or is it more proof that he is the “amateur” that Klein claims?

And you are defending this political chicanery by dredging up Bush. As I’ve pointed out many times in my comments, Bush is no longer president and hasn’t been for a while now. The current President and what he is doing to solve our problems is the issue.

It is strange that the equation used to calculate deficits is:

tax revenue – tax cuts = deficits

I would think a better equation would be:

tax revenue – spending = deficit/surplus

Somehow, Keynesians seem to believe that government spending is a given and increased government spending is a corollary. Now history would tend to support that thesis, but that’s simply because the more food you put in the trough, the more the pigs will demand.

Gridlock, actually you want to do the exact opposite.

It’s better to get rid of the corporate tax and increase (and make progressive) the tax on capital gains.

This will bring in dollars overseas.

Bryce, I think the Iraq war was a good idea. The spending was what was wrong.

Ricardo, in the actual real world, the only place unfortunately where economic macro theories can be tested, the greatest period of U.S. prosperity, investment, and income growth was the period from 1946-1969, the period when Keynsian economics had its greatest influence on policy makers. And it all started going bad when LBJ started a foreign war (Vietnam), and like George W., decided to start paying for it on a credit card rather than listen to his Keynsian advisors call for a tax increase. He later partially gave into advice from Walter Heller, Arthur Okun, and Paul Samuelson to impose a temporary income tax surcharge to pay for the war and restrain inflationary spending. But by then the inflation genie was out of the bottle, and Nixon firehosed it with gasoline to help his reelecton in 1972.

Regarding your comment about the dull “mediocrity” of a mixed economy guided by Keynsian priniciples, one can say many things about the 1960s, but “dull” and “uncreative” are not words that come to mind, at least in this boomer’s recollection.

Can you give an example of your Galtian paradise in the real world? Are Enron and AGI examples of Galtian supermen/women’s creativity? The current LIBOR scandal? I have read your word salads called posts a couple of times, and besides the snark and pushing of various memes lifted from John Galt’s speech, I find them senseless.

aaron, if we could have minded our own business, Al Queda would have attacked the secular Saddam, who in turn was a counter-weight to Iran.

Thousands are dead. We have tons of wounded veterans for whom we must care, tons more debt, and more enemies than before.

Ray Lapan-Love,

If Somosa is your example of a free market capitalist you are in serious trouble. Why not Hitler or Mussolini? I have a better path for you. How about Hayek and Schumpeter?

sherparick,

After WWII the Keynesians attempted to continue massive government spending on the theory that there would be a serious depression when the government stopped spending and the unemployed stopped being cannon fodder and came home. Schumpeter was almost alone in predicting an economic boom after WWII.

Congress passed a tax cut right after the war but Truman vetoed it. The voters rewarded him by voting in a veto proof congress and a tax cut was passed into law. Surprise! Prosperity followed.

Then you might want to check out a President named John Kennedy who created a plan to lower taxes. He was killed but his tax plan survived and created one of the greatest booms in US history.

Slugs –

You’re right on Iran. The EIA says that Iran is -800 kbpd compared to early 2011. So a material easing of tensions could see that supply come back on the market in relatively short order.

As for surpluses: For the 34 countries which the IMF groups as “advanced”, on annual basis, from 1980 to 2011, the IMF WEO shows they ran a deficit 70% of the time (573 of 820 observations).

I would consider that a deficit tendency.

Ricardo: “Consider that in a Keynesian world the object is to smooth out the tops and the bottoms. You take from the good times to give during the bad.

The world of the left whether Keynesian or socialist is a world of mediocrity. The intent is to make everyone the same and the result is to dumb down society.”

Ricardo is doing a great service in explaining the mysteries of the workings of the conservative mind. Conservatives equate smoothing out the destructive effects of boom and bust cycles with mediocrity, making everyone the same and dumbing down society.

I am continually astonished at these revelations.

Ricardo Consider that in a Keynesian world the object is to smooth out the tops and the bottoms. You take from the good times to give during the bad.

Well, yes. And Friedman believed that too. Ever hear of the Permanent Income Hyposthesis? And any modern day macro course will establish intertemporal consumption constraints to pin things down. Ever take a course in optimal control theory? I’m guessing not.

The world of the left whether Keynesian or socialist is a world of mediocrity

At least you seem to recognize that Keynesians and socialists are two very different kinds of economists. That’s progress and you’re ahead of some on this blog. But what Keynesians oppose is unnecessary economic punishment. We’re not masochists who feel the need to whip and purge ourselves in order to put the economic body in good humor. All that’s needed are intelligent policymakers and a Congress that is not economically illiterate.

Rick Stryker Iraq was a bipartisan war with substantial support from both Democrats and Republicans. Sad, but true. Still, a lot more Republicans supported it than Democrats, so it had a definite GOP bias.

Obama promised to end the war immediately but he didn’t

No, he actually didn’t. Obama promised to get out of Iraq but he wanted to be as careful in getting out as we were careless in getting in. I believe that is almost an exact quote. And candidate Obama never promised to pull out of Afghanistan. He wanted to redeploy troops from Iraq and to Afghanistan. That may not have been a smart policy choice, but that was his position. So you’ve misunderstood and mischaracterized Obama’s position.

Obama knows perfectly well that his tax proposal has no chance on either side of the aisle.

This may not be as true as you think. Last night there was a story about how several Republicans have quietly floated the idea of allowing the fiscal cliff crisis to happen on 1 January, but then reinstate cuts for the four lowest marginal rate groups and restore much of the spending. This could be done after the election but before the new Congress sits in early January. This is something being proposed by some Republicans, not Democrats.

Bush is no longer president and hasn’t been for a while now.

True, but his policies are still in place. It’s called ruling from the grave. Bush may not still be in office, but his dead hand is still at the till. And I just loved your comment about Obama playing chicken!!! What a hoot. Obama learned from his past mistakes that you have to play hardball with the Tea Party nuts.

Bryce The tax cuts should have been matched with spending cuts.

If you’re referring to when the economy was operating at something like full employment (i.e., ~2006/2007), then yes. I would agree. Better yet. Tax increases and spending cuts. But just because that might have been a good policy 5 or 6 years ago does not mean it would be a good policy today. Policy choices must be conditioned on where the economy is in the business cycle.

Ricardo,

Had Hayek or Schumpeter had the option of providing education to the poor in Nicaragua, as compared to those who did provide such, they would have been worthy of mention. As it turns out though, Samosa was an actual ‘business friendly’ despot who was in fact the only person who fits in the example given.

Your mind is playing tricks on you.

Variations in the Earth’s orbit have 4 times the impact on climate than anthropogenic CO2.

Menzie should face up to the facts, and stop treating global warming like the religious doctrine he is treating it as.

Darren: You’re getting your science from Instapundit? And what does this have to do with the fiscal cliff?

The claim is that the 10 year (2010-2019) cost of Obamacare is $1.4 trillion, and is conveniently and approximately balanced by additional revenue and savings. However, new estimates show Obamacare costs ^2.6 Trillion over the 10 year period 2014-2023. So, if we extend the analysis above out to 2023, we would see Obamacare adding an average of ~ (2.6T-1.4T)/10Yrs = $120 Billion per year in deficit spending. Now we know why Obama had to use 10 years of revenue but only showed 6 years of costs when he sold this to America.

http://www.npr.org/2012/07/12/156659733/weekly-standard-obamacare-cost-estimates-rise

Ray Lapan-Love,

Your problem is you confuse crony capitalism with free market capitalism. President Obama is probably the most business friendly president in the history of our country. You will not find any president who has given so much tax revenue (both currency and future by the way) to the business community. I am not sure there is anyone who would call President Obama a free market capitalist.

Slug wrote:

But what Keynesians oppose is unnecessary economic punishment. We’re not masochists who feel the need to whip and purge ourselves in order to put the economic body in good humor. All that’s needed are intelligent policymakers and a Congress that is not economically illiterate.

Slug,

I love this comment – “Unnecessary economic punishment.” I assume that you are refering to austerity, but that only comes when bad central planning creates an economic crash, so on that issue we agree. Now the need to “whip and purge” is interesting because once again that requires some form of intervention which is absolutely contrary to free market principles, so I guess we agree once again.

Where we disagree is that all we need is “intelligent policymakers and a Congress that is not economically illiterate.” This very statement is a fantasy, better an oxymoron. Hayek was very perceptive to point out the problem of a lack of knowledge in central planning. It is simply impossible for any person or small group of people to have sufficient knowledge to compare to the market place. Check out Leonard Read’s I PENCIL for a great story illustrating Hayek’s insight.

So I guess we agree on two out of three – not too bad.

Menzie,

Here is a reverse spin on the same CBO numbers:

Portman: CBO Tears Down Yet Another Of President Obama’s Straw Men

B Turnbull

Thanks for the link. I don’t know if you saw this one, too.

Ricardo:

“Your problem is you confuse crony capitalism with free market capitalism.” No, my problem, where you are concerned, is this: You claim the Left wants to dumb everyone down. Then, I counter with what I have seen with my own eyes, that being, about the Sandinistas building schools where there had been none. This then being an example of the Left doing everything possible to facilitate education in the very same environment where the Right had done nothing.

But of course you sidestepped the premise of my example and tried to make the argument about Samosa’s credentials as if your vast generalizations (“everyone”, the “left” and etc.) are excusable, while my use of Samosa to represent the stereotypical right-wing despot, with the Sandinista regime being typical of the left-wing, are not up to your standards.

And you think I am confused??? YOUR premise established that we are simply comparing the ‘right’ and the ‘left’, it is therefore ludicrous to suggest that the Samosa regime is not a valid contrast to the Sandinistas.

I didn’t realize that Glenn Reynolds did tree-ring analysis. I also didn’t realize that earth’s orbit affected government finance.

B Turnbull: Gee, I wonder how much of that category “net interest” is attributable to the added debt associated with EGTRRA/JGTRRA. I agree that wholesale extension of these cuts 2010-12 is another big share of current deficits. That was I’ll-advised.

tj Once again you are confused. This is an old story and several months ago Krugman did a masterful job of showing why it’s only a story for those who cannot do arithmetic. Look at the time horizons for the two cost estimates. The first 10 year time horizon included several years in which the new healthcare laws did not go into effect, so obviously the direct costs were less than the second time horizon which effectively included more years. Duh! And CBO did not say that Obamacare was a NET cost of $2.6T over 10 years. You also have to evaluate the savings, not just the cost. On balance Obamacare very slightly reduces healthcare costs by about 0.25% of GDP. Not exactly earth shaking, but a savings nonetheless.

You need to give up your ridiculous slams at Obamacare. The only thing we’re learning is that you simply do not understand the issues.

Ricardo It is simply impossible for any person or small group of people to have sufficient knowledge to compare to the market place.

Even if true, that does not mean the market never fails. The fact is that the market does fail regardless of what you and Hayek may want to believe. So when the market fails and we’re left with gobs of idle capacity and millions of unemployed workers someone has to figure out what to do. If no one is smarter than the market, then no one is entitled to claim that the market is always self-correcting. And if it’s not always self-correcting, then you have two choices. The first choice is to deny that there’s a problem and just pretend workers have spontaneously adopted new labor/leisure trade-offs. The second choice is to look around at past policies that worked. We know that it is possible to restore aggregate demand using monetary and fiscal policies. Policymakers might not hit the target in the exact sweet spot, but all that I ask is that they make the situaton better, not worse. And we know how to do that.

BTW, even Hayek outgrew some of his early silly beliefs.

B. Turnbull I hope Rob Portman can do better if he wants to be Romney’s Veep. There are some rather obvious problems with the analysis. First, for much of that 10 year period the economy was in recovery, so cyclical deficits were not a factor. That means what deficits did accrue under Bush were primarily structural, not cyclical. And this leads to the second point, which is that during the middle part of the decade we shouldn’t have been running ANY deficit at all. We should have been running surpluses. That was Menzie’s point when he said, “Concluding thought: Real Keynesians run structural budget surpluses when the output gap is positive. New style conservatives never run surpluses.” Third, it’s important to break out the on-budget deficit from the off-budget surplus. The CBO numbers reflected the unified budget, and that’s fine if you want to talk about the macroeconomic effect of deficits. But if you want to dissect contributions to the deficit, then you need to separate the on-budget from off-budget sides. The off-budget side was running huge surpluses in the 2000s that masked the huge deficits on the on-budget side. And those on-budget deficits were due to Bush’s wars and to the tax cuts. Finally, one reason the rich are paying a bigger share of income taxes is because they are gaining a bigger share of income. But that doesn’t mean the bottom half isn’t paying taxes. It was those huge FICA tax surpluses that helped pay for the tax cuts at the top.

Slugs,

Your comments are impressive.

Ray Lapan-Love,

In your demand that I accept Samosa as an example of free market capitalism, are you prepared to accept Hitler as the example of Keynesianims? After all, Keynes did say in the German version of the General Theory that his system would work better in a totalitarian state.

Slug,

This time your post is so bad it will take much to respond. Line by line.

Even if true, that does not mean the market never fails. The fact is that the market does fail regardless of what you and Hayek may want to believe.

Keynesians never define failure. This is a weasel-word. Normal people define failure as preventing individuals from reaching their potential. That means that by definition a free market is always successful because individuals are free to reach whatever potential they have. On the other hand central planning always fails because by definition it takes from one group to give to another preventing one group from reaching their potential.

So when the market fails and we’re left with gobs of idle capacity and millions of unemployed workers someone has to figure out what to do.

Idle capacity comes from central planners trying to figure out what to do. In a free market, capacity is always maximized. While over production in a centrally planned economy is by design, over-production in a market economy is penalized then put to its most economic use (here is a curse word to you, JB Say, and no he never said “supply creates its own demand”).

If no one is smarter than the market, then no one is entitled to claim that the market is always self-correcting.

There is no if; no one is smarter than the market, period. Any one with a brain should understand that you are not smart enough to know all of the desires and needs of your neighbor. It is hubristic fantasy and price to pretend that you do.

And if it’s not always self-correcting, then you have two choices.

What is being corrected? A free market is about choices either good or bad. A free market rewards good choices while it penalizes bad. Only in a centrally planned economy are bad choices perpetuates with a need for “correction.”

The first choice is to deny that there’s a problem and just pretend workers have spontaneously adopted new labor/leisure trade-offs.

As I think about it, this comment is largly true. Freedom to choose does allow bad choices but the market will not allow them to continue and compound. Central planning often not only allows bad choices to continue but often creates them, then rewards them allowing them to compound.

The second choice is to look around at past policies that worked.

Excellent!! Free markets work; Central planning fails. Here we agree.

We know that it is possible to restore aggregate demand using monetary and fiscal policies.

Not at all, it is just the opposite. It is obvious and right in front of our faces. The FED and congress has tried to “restore aggregate demand using monetary and fiscal policies” since 2006 and the result has been economic disaster: the Great Recession. Prior to that we saw the same with the Great Depression and the Great Inflation as well as a host of lesser declines.

Policymakers might not hit the target in the exact sweet spot, but all that I ask is that they make the situaton better, not worse. And we know how to do that.

No you don’t!!! That is arrogance and hubris beyond reason. You don’t even know what your neighbor wants, yet you have the gaul to say you know what the entire economy needs? Give me a break! Policymakers do not hit the target because they do not know what the target is. That answer from the Sudoku players is as varied as the players themselves. All you want is to make the situation better?! Is that to line your pockets at the expense of your neighbor or to lift all boats? Economic growth comes from economic freedom and economic growth lifts all boats. Central planning by design lifts some boats at the expense of a host of others. Central planning is just dressing up the pig, crony capitalism.

2slugs

Can you provide a link to the CBO analysis for the years 2014-2023? I’d like to see their analysis that shows $2.6 Trillion in revenue and savings. Thanks.

Regarding taxes – How much do we need to increase taxes the “rich” to solve our on/off budget problems? After your proposed tax increase, what is the share of total personal taxes the “rich” would be paying?

Ricardo,

Your claim that I disputed is as follows:

“The world of the left whether Keynesian or socialist is a world of mediocrity. The intent is to make everyone the same and the result is to dumb down society. What the left doesn’t understand is that while you can make the brilliant dull by hindering its luster you cannot make the dull brilliant. You can keep an intelligent person from succeeding but you cannot make an unintelligent person successful. You can destroy a growing vibrant economy but you cannot create production when the economy is in decline.”

I thereafter disputed your litany of unsupported claims with this:

“I was in Nicaragua just after the Sandinista takeover and there were make-shift schools being built all across the country. But you say: “The intent is to make everyone the same and the result is to dumb down society.” Yet when the ‘business friendly’ Samosa regime was in power there were no schools for “everyone”. And this is of course a common problem across the world, the business friendly folks see “everyone” as part of the ‘demographic dividend’ but… as you said:”you cannot make the dull brilliant”. So it seems that your comment has an inherent hypocrisy. You are accusing the Left of causing a dullness that, when it comes to “everyone”, cannot be made brilliant in the first place.”

So… how could “free market capitalism”, or “Hitler”, or ” the German version of the General Theory”, have any thing to do with my use of the Sandinistas as an example which represents the “left” as contrasted against the Samosa regime?

A rebuttal in support of your initial foolishness would need to be something along the lines of an example of something to the contrary of my response. You set the standard with your generalizations. Now you need to provide an example of a right-wing government that has done something to eliminate “mediocrity”. And since you so much want to make a distinction about the wonders of the “free market”, maybe you could use Somalia or some such nation as an example.

In any case, I think of the Left as more dedicated to education than the Right. So… convince me otherwise. But that will take more than cliches and unsupported claims that are backed up with evasions. In the meantime, I remain convinced that your critical thinking skills need improvements.

tj: “Can you provide a link to the CBO analysis for the years 2014-2023? I’d like to see their analysis that shows $2.6 Trillion in revenue and savings. Thanks.

Wait, you are the one claiming that there is a $2.6 trillion increase in Obamacare costs. How about you first provide the CBO analysis that shows that increase. Thanks.

Menzie,

Catherine Rampell at NY Times Economix has a good, simple post on the fiscal cliff.

The upper tax cut expiration will put a .24% drag on the economy. That’s a 6% smaller economy one generation out.

The thing to me about the tax cut expiration is I doesn’t really do what it sold to. It isn’t very significant. I doesn’t make things more equal and it creates a drag on the economy.

This is just a side show. To really affect inequality and revenue, they should be talking about making the capital gains tax rate progressive.

Ray Lapan-Love,

Let me cut to the chase. I do not wish to have anything to do with either right-wing or left-wing fanatics in Nicaragua or the US. I believe in free market economics. If you want an example Calvin Coolidge. If you need a Democrat Grover Cleveland.

Ray Lapan-Love:

“Free education for all children in public schools.”

It comes as item 10 of the Communist Manifesto.

Of course, communists love free and COMPULSORY education for all children. It is a powerful political tool:

In fact, not just Communists, but early American Progressives and even Puritans demanded it. It is quite a popular item as political tool to shape and influence population.

Yes, you are impressed with “the Left as more dedicated to education”; however, you must also choose to ignore or discount the Left’s history of mass murders, squashed liberties and generally meager existence that ordinarily accompany such regimes.

As far as your distinction/definition of Left and Right, Nazi Germany and Fascist Italy would appear to be on the right for you; however, by no means these were free market economies.

B Turnbull,

Your point seems to be that education is a bad thing?

Or, are you suggesting that “free market economies” are devoid of “propaganda, mass murders, squashed liberties and generally meager existence that ordinarily accompany such regimes.”

How about the 100+ nations around the world where more than 90% of their populations live in dire poverty while adhering to free market principles?

Or, if we are ‘cherry picking’ our way through history, how about I pick antebellum US history as a counter to “prepare more productive future slave work force”, how does actual slavery in a Christian/free market society measure up?

Anyway, your argument is almost as foolish as Ricardo’s use of Calvin Coolidge as a champion of free market-ism (his term ended March 4, 1929 just 7 months before the onset of the Great Depression). The thing is… there are people with good intentions on both sides, and there are evil people on both sides, and endless examples of each.

B Turnbull: Gee, item 10 also included abolition of factory child labor. Should we re-institute that?

Ray Lapan-Love:

Cherry picking through history? I don’t think so. Lenin, Stalin, Mao, Pol Pot, etc. — tens if not hundred of millions murdered, and the rest of population reduced to position of slightly more than slaves.

What is your example of good Marxist regime? Sandinistas in Nicaragua, because they were commited to free education for children?

Actually, most of these Marxist regimes eventually failed, free education or not. And some that are still around, like North Korea, have people who are almost starving; in contrast, South Korea has per capita GDP of $31,700 (2011 est. from cia.gov), and is one of the richest countries in the world. If you want an example of central planning vs free market, take a look at South vs North Korea; surely, South Korea is not pure free market economy, but it does have a lot more of it than the North.

Anyway, for your example of Sandinista to be effective argument against original statement, you need to provide examples of brilliance coming out of Sandinista ruled Nicaragua. I am sure North Korea has free and compulsory education too, but South still whips them in brilliance as exemplified by Samsung, Hyundai, etc., as well as general economic performance of the country.

P.S. The previous comment, posted at July 13, 2012 05:17 PM, should say B Turnbull not Anonymous.

You’re getting your science from Instapundit?

er… the link contained therein is not Instapundit, but from the Daily Mail (UK).

http://www.dailymail.co.uk/sciencetech/article-2171973/Tree-ring-study-proves-climate-WARMER-Roman-Medieval-times-modern-industrial-age.html

Plus, Instapundit is far more free of bias than you are, as you, Menzie, are the one who believes in something that science has disproven again and again.

I notice you can’t really rebut anything, Menzie, but just dodge while doubling down on your blind belief in the fiction of global warming.

Anonymous & Co.,

You win, “the left” only aspires to dumbing “everyone” down to a lowly state of “mediocrity”.

And yes, your mentioning of North Korea and Stalin and etc. proves that free-market-ism does not hinder brilliance while also knowing which children not to waste resources on because: “you cannot make the dull brilliant”.

Thanks for helping me to understand.

Anon I provided to a link to my source that extended the CBO analysis. All I got in return was hand-waving and vacuous claims.

tj: All you provided is a link to a Weekly Standard (!?) picture with six made-up numbers on it. Where is the analysis that supports these imaginary numbers? Otherwise we just have to assume that it is fictitious.

One clue to the phoniness is that the caption says these are nominal, not real, dollars. For future projections one can assume any desired inflation rate that will arbitrarily generate whatever number you like in nominal dollars even if real spending doesn’t change at all.

In all fairness to the effort made by the Sandinistas, I feel compelled to add this:

“Prior to the Sandinista Revolution in 1979 the majority of the rural population of Nicaragua was illiterate, with estimates as high as 75%-90%. The total population had an estimated illiteracy rate of 50%. Planning for the literacy campaign began approximately four months after the Sandinista Revolution which overthrew the Somoza political dynasty.[2][3] Nearly 60,000 youths (high school and college age) and 30,000 adults of varying backgrounds were trained in two weeks for the five-month campaign. Citizen groups, workers’ associations, youth organizations, and public institutions provided organizational support for the campaign.[4] The goals of the literacy campaign were of a social-political, strategic and educational nature:[5]”

“The fact that every class, race, gender and age was involved, brought about a new perspective towards the distribution of power and wealth. Women also played a major role in the literacy campaign. Like the Cuban example, about 60% of the brigadistas were female and such a title made the women feel a sense of belonging and equalization in the revolutionary process of their country. Lastly, due to the great success of the campaign, Nicaragua made a substantial contribution in finding solutions for the eradication of illiteracy worldwide. In September 1980, UNESCO awarded Nicaragua with the Nadezhda K. Krupskaya award for its successful literacy campaign. This was followed by the literacy campaigns of 1982, 1986, 1987, 1995 and 2000, all of which were also awarded by UNESCO.[1]” Wiki

I fear that some of the readers here lack a full spectrum of news and analysis, so in response to this: “Actually, most of these Marxist regimes eventually failed, free education or not. And some that are still around, like North Korea, have people who are almost starving; in contrast,…”

I hence respond with this:

“By 1998, when Hugo Chávez was first elected President in Venezuela, US domination of the continent meant over 40% of the population of Latin America – more than 200 million people – were living in poverty and the continent was going backwards. As US economist Mark Weisbrot has explained, Latin America was experiencing a sharp slowdown in economic growth. The neo-liberal shock therapy – first tried and tested in Chile following the US-backed military coup against its elected left government in 1973 – had been extended throughout the continent. As a result, from 1980 to 2000, Latin America per capita growth was only 9% compared to 82% during the preceding 20 years. To find a growth performance of Latin America that is even close to that level of failure, one has to go back more than a century, and choose a 25-year period that includes both World War I and the start of the Great Depression.”

“Left shifts”

“This period of economic stagnation ended around the year 2000 as a series of countries broke from the IMF and World Bank imposed neo-liberal policies that primarily served the economic interests of the United States. This has led to big improvements in living standards over the past decade, with the greatest improvements being in the countries most prepared to resist imperialism’s demands – Venezuela and Cuba.”

“In Venezuela the defeat of the 2002 US-inspired coup against Hugo Chávez gave new momentum to the Venezuelan revolution in decisively smashing the forces of the old regime. This allowed the revolution to concentrate on delivering spectacular gains for the population – extensive health care and education and other social support, in particular. This has been accompanied by a strong anti-imperialist stand both in relation to defending its own sovereignty and in standing up internationally against imperialism’s efforts to impose its will on other semi-colonial countries.”

“Linked to this forward momentum in Venezuela was the victory for Evo Morales’ Movement Towards Socialism in Bolivia, re-affirmed in subsequent elections and in the defeat of a number of pro-imperialist, right-wing mobilisations and attempted civil conflicts. In South America’s poorest nation, revolutionary forces led by Morales draw their support primarily from the two-thirds of the population who are indigenous. A small white elite had previously enriched itself and foreign companies through control of Bolivia’s vast gas wealth – the second largest in Latin America – whilst the indigenous majority lived in deep poverty, denied basic education and medical services. Morales has nationalised natural resources and, with Bolivia’s economic growth in the last four years higher than at any time in the last 30 years, Morales has used this to initiate social programmes for the poor, including free medical care, social security for new mothers and the elderly and a massive programme for literacy that includes payments to low-income families to make sure their children can attend school.”

By Stephen MacAvoy – Socialist Action, June 28th 2011

———–

For those who have not followed Latin American politics of late, there are several nations moving to the left with varying degrees of intensity.

Ray Lapan-Love,

“This period of economic stagnation ended around the year 2000 as a series of countries broke from the IMF and World Bank imposed neo-liberal policies that primarily served the economic interests of the United States.”

Ray,

I totally agree with this quote from your post. The IMF and World Bank had specific responsibilities when they were created and their need is now gone. They had to find some way to justify their existence so that began to pretend to be able to engage in central planning and help distressed countries. Their policy perscriptions were total poison: 1) cut government spending 2) raise taxes (preventing the private sector from replacing the government spending cuts) then 3) destroy the currency through devaluation and inflation.

Could anyone name even one country the the IMF and World Bank has actually brought out of a recession? The truth is that when a country refused to follow the IMF and World Bank is when their recovery began.

But to then say “the greatest improvements being in the countries most prepared to resist imperialism’s demands – Venezuela and Cuba” borders on the insane.

Venezuela was the richest country in South America in the 1970s and early 1980s. Their top tax rate was 25%. They were producing so much food that they were feeding much of the rest of South America. Chavez took control and instituted his Fascist (not socialist) policies and now Venezuela cannot even feed its own people. The government has to import coffee from Brazil and government imported foods are left to rot in warehouses by government incompetence. Where before Colombians were moving to Venezuela to work in the 1970s and 80s today Venezualan are moving to Colombia.

Cuba is has been a basket case for decades. Without foreign aid especially from Russia the country would have disappeared long ago. Raul Castro has just appealed once again to Putin to increase aid to Cuba.

You really must differentiate political propaganda from reality. You remind me of the economists under Stalin. You had to lie and make up statistics or you ended up in Siberia or dead, or ultimately both (Nikolai Kondratieff).

GK: Then look at the odd trend line in the graph, which omits the upsurge in temperatures at the end of the sample. I.e., use your brain, instead of pickig coclusions that fit your priors.

tj I never said that Obamacare would save $2.6T. Reread my post. You’re the one who said that it would be a net loser of $2.6T. And just to clarify, your link was not to the CBO report. Your link was to something that the Weekly Standard cobbled together based on something that the Senate Republicans (not CBO) cobbled together as their interpretation of what Obamacare would do. I have actually read the CBO report and the Senate Republicans have grossly misrepresented what CBO said. It is true that CBO said there would be an increase, but CBO clearly explained that the increase over their original report was entirely due to the fact that the projection effectively included more years (10 years versus 6 years) and the last two years included an older demographic. CBO recognized that this was unclear to many mathematically challenged Republicans, so CBO issued a clarification:

Our projections made last February (our most recent ones for all the provisions of the law) extended the original ones by two years, but again changed little, on net, from the original projections for each given year.

http://www.cbo.gov/publication/43104

And here is the latest CBO update on Obamacare from March 2012. This is the report that the Senate Republicans were misusing. Sorry, but CBO’s analysis does not support your claims and unmasks the Senate Republicans as liars hoping that their supporters wouldn’t actually bother to check the facts.

Ricardo,

This: “You really must differentiate political propaganda from reality” is difficult to accept considering that I have actually spent extended periods in Latin America, and not as a tourist but as a participant in the struggle, and you… are presumably using second-hand “propaganda”.

To begin with, Caracas was the most crime ridden and dangerous city in all of Latin America throughout the late 70s and the 80s, much the same as Havana was in the 50s. And the majority of the population in each of these places lived in extreme poverty. So what does it matter that “Venezuela was the richest country in South America in the 1970s and early 1980s”. If Bill Gates were to move to Haiti it would probably have the highest average income in Latin America too, but so what?

Anyway, to suggest that Venezuela went from being the land of plenty to a nation that “cannot even feed its own people”, is a bit much. You could truthfully say though that Chavez has paid off the IMF and is now lending money to other nations so that they can do the same.

Dear righties,

Here are a couple of other ways to measure progress:

“Executive Summary

This paper looks at some of the most important economic and social indicators during the 10 years of the Chávez administration in Venezuela, as well as the current economic expansion. It also looks at the current situation and challenges.

Among the highlights:

The following may help explain away some of the confusion, for some readers(?):

By Mark Weisbrot

Venezuela has seen a remarkable reduction in poverty since the first quarter of 2003. In the ensuing four years, from 2003 to 2007, the poverty rate was cut in half, from 54 percent of households to 27.5 percent. (See Table 1). This is measured from the first half of 2003 to the first half of 2007. As can be seen in the table, the poverty rate rose very slightly by one percentage point in the second half of 2007, most likely due to rising food prices. Extreme poverty fell even more, by 70 percent – from 25.1 percent of households to 7.6 percent.

These poverty rates measure only cash income; as will be discussed below, they do not include non-cash benefits to the poor such as access to health care or education.

If Venezuela were almost any other country, such a large reduction of poverty in a relatively short time would be noticed as a significant achievement. However, since the Venezuelan government, and especially its president, Hugo Chavez Frias, are consistently disparaged in major media, government, and most policy and intellectual circles, this has not happened. Instead, the reduction in poverty was for quite some time denied. Until the Center for Economic and Policy Research published a paper correcting the record in May 2006, (“Poverty Rates in Venezuela: Getting the Numbers Right”) publications such as Foreign Affairs, Foreign Policy, the Washington Post, the New York Times, the Financial Times, the Miami Herald, and many others all published articles falsely asserting that poverty had increased under the Chavez government. A few of these publications eventually ran corrections. While poverty did in fact rise sharply in 2002-2003 (see Table 1), the publications cited above all printed false statements about the poverty rate after it had dropped back down and the new data were publicly available.