The paperback edition of Lost Decades (W.W. Norton) is to be officially released October 1st. This seems as appropriate a juncture as any to assess the predictions Jeffry Frieden and I wrote almost two years ago.

In the conclusion we wrote:

… Empty homes and unemployed workers testify to the past decade’s foolhardy experiment in excessive deregulation, excessive deficits, and excessive borrowing. Private and public interests are not the same, and their divergence has been demonstrated at great cost to America, and to the world.

Americans face serious economic challenges. They lost the first decade of the century to a boom that enriched the wealthiest, and a subsequent bust that impoverished the rest. Now they risk losing another decade to an incomplete recovery and economic stagnation. None of the changes necessary to avoid a repeat of this disaster will be easy. At every turn there are major political obstacles. Financial interests resist regulations that shift the burden of risky behavior back onto them and off of taxpayers. Beneficiaries of government programs fight against attempts to curb their benefits. Taxpayers refuse to pay the taxes needed to pay for the programs they want.

Partisan politicians block reasoned discussion, suggesting absurd pseudo-solutions instead of realistic alternatives. Ideologues and political opportunists encourage Americans to cling to the childish things that have served them so poorly in the past: a mindless belief that markets are perfect, that tax cuts solve every ill, that borrowing is to be encouraged. Despite the great trouble these policies have caused, their attractions continue to be touted and spouted by unprincipled pundits.

At the time we wrote those words in August 2010, we were hopeful that reasonable minds would prevail, despite the demagogic statements about “death panels” [0], demands that the government “get their hands off Medicaid” [1] and fears about hyperinflation [2] and/or crowding out [3]. But since then, we have seen a proliferation of frankly even crazier ideas sure to sabotage the nation’s future.

For instance, there is the belief that by cutting the level of government spending, magically the productive powers of entrepreneurs will be unleashed, such that the economy grows. In policy publications, this view was exemplified in the fantastical Joint Economic Committee-Republican study on the subject of expansionary fiscal contractions. Those views were propagated despite the fact that the evidence for expansionary fiscal contractions is almost nonexistent [4]. For those of us who believe that data can help inform public policy formulation, that lack of appeal to empirical evidence is perhaps the most profoundly depressing aspects of recent debates.

There are two ways to interpret these developments. The first is that there exist true believers. Expansionary fiscal contraction, extraordinarily high labor and capital supply elasticities, neoclassical financial markets, are all articles of faith. The second is that the promulgation of these ideas and accompanying policies are merely cynical ploys to achieve other aims: Demands to cut government spending in the name of “fiscal responsibility” are merely a cover for an agenda to shrink the size of government; else tax revenue increases would be a reasonable measure.

For my part, I am of the belief that most of the policymakers who make these claims actually know better. Many politicians espouse such views only because of short term expediency; pushing for tax cuts just to enrich oneself and one’s fellow clubmembers, at the cost of “others” at least makes sense from a rational-actor model. Specifically, the Romney tax plan, as described here, would shift the tax burden toward the lower incomes, to benefit most those with income in the top percentiles.

The fact that they know better is also highlighted by the following. Consider the commonplace belief in certain quarters that the ARRA (aka the stimulus package) failed to create jobs. One argument was that in order to spend, resources had to be taken away from some other activity. And yet, we now hear arguments that cuts to spending on defense goods will lead to job losses (e.g., Ryan [5]; see Bartlett’s discussion). The two arguments are logically inconsistent, but apparently this inconsistency little troubles these individuals.

The stakes are high. The impending fiscal cliff, the combination of expiration of tax cut provisions, and the implementation of the sequester provisions, constitutes a clear and present danger. The sequester was made necessary by the Republican intransigence regarding tax increases. Now the US economy faces the prospects of a renewed recession. With the eurozone in outright recession, and still skirting financial collapse, and China entering a period of uncertain but definitely slower growth prospects, it would not be exaggerating to say that political paralysis threatens to push the world economy into recession.

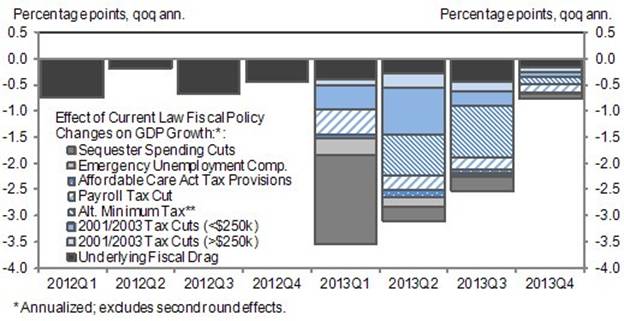

The impact of diving off the fiscal cliff is illustrated in Figure 1.

Figure 1: from Alec Phillips, “The Fiscal Cliff Moves to Center Stage,” Goldman Sachs US Economics Analyst 14 Sep 2012.

The extent of the hit to growth would depend on the number of provisions extended. For additional discussion, Bloomberg Brief, Goldman Sachs, and Citi. The CBO analysis and baseline forecast is covered in Box 2-1 in the August Update.

Current informed commentary holds that after the election, sane minds will prevail; if something more than a temporary extension is achieved — such as a plan of medium term fiscal consolidation incorporating both tax increases and spending decreases, combined with continued short term stimulus — we then might yet see our optimism of two years ago validated:

… A skeptic might conclude that nothing can change for the better, that neither the interest groups nor the taxpayers nor the policymakers have any reason to act differently. We prefer to think that there are times when citizens, voters, interest groups, and policymakers are able to rise above their own self-interested concerns. We hope that now is one of those times, and that Americans learn from this painful episode to avoid another lost decade.

More on the Lost Decades here.

I am of the belief that most of the policymakers who make these claims actually know better.

I used to think that, but with the latest crop of Tea Party dunces in Congress I’m not so sure anymore. I’ve always found that smart congress critters hire smart aides; and stupid congress critters hire stupid aides. Today there are simply way too many clueless aides chock full of ideology and devoid of the kind of technical expertise those of us in the Executive Branch are normally used to dealing with. This is a shockingly bad crop of congressional aides.

I agree that anyone advocating cutting the level of government spending at this point in the business cycle is misguided. The rational approach is to cut the rate of growth in entitlements.

I would like to see the CBO scoring of how Obama’s plan(?) does this without raising taxes on the middle class and without broadening the tax base.

According to PEW Research, in the last decade, incomes for the top 5% have been falling faster than for any other group except the bottom quintile.

http://marginalrevolution.com/marginalrevolution/2012/08/a-look-at-u-s-income-growth.html

Except for the “excessive deregulation” part, Menzie’s quote from his book is really not too bad. But this small phrase misses the primary problem that the past 100 years or so has been a time of massive over-regulation not deregulation.

This is easy to prove. All you have to do is ask an expert in any field what the government regulations require of that field. For example could Menzie do a tax return and get the same answer as 10 tax accountants doing the same return? Would the 10 tax accountants get the same answer? The answer of an expert to your question about government regulation will be a blank stare. No one knows all the government regulations in the Congressional Record much less each of the government departments and sub-departments.

James Madison wrote in Federalist No. 62: “It will be of little avail to the people that the laws are made by men of their own choice if the laws be so voluminous that they cannot be read, [thank you Nancy Pelosi] or so incoherent that they cannot be understood; if they be repealed or revised [thank you Barak Obama with waivers to Obamacare] before they are promulgated, or undergo such incessant changes that no man, who knows what the law is today, can guess what it will be tomorrow. Law is defined to be a rule of action, but how can that be a rule, which is little known, and less fixed?”

Menzie wrote:

…there is the belief that by cutting the level of government spending, magically the productive powers of entrepreneurs will be unleashed…,/i>

This is actually not magical belief such as the magical belief that increasing the money supply is the modern version of the horn of plenty. This is actually logical.

Government spending is not driven by demand but by politics. One of Keynes’ errors was to argue that spending would create its own demand (the bastardization of Say’s Law). Keynes shifted the focus from satisfying demand defined as wants and needs, to pretending that government spending on pet political projects was equal to satisfying actual needs. Essentially this was the modern version of saying of the starving masses to “let them eat cake.”

Entrepreneurs satisfy wants and needs; government satisfies politicians lust to buy votes.

“Taxpayers refuse to pay the taxes needed to pay for the programs they want.”

No, taxpayers refuse to pay the taxes needed to pay for the programs VOTERS want. THIS is why we have a deficit.

“mindless belief that markets are perfect”

Nobody belives this. Many people, however, believe the market is better allocator of resources than a beaurocrat. Evidence of this is supported by the recent book “Wisdom of Crowds.”

Also, I can’t believe you can even look yourself in the mirror when you say our markets have been “deregulated.” We have more regulations now than ever in the history of the planet across any country. Don’t you think you have a higher duty to truly inspect the facts given that you are a respected Professor of Economics at a fine institution before you spew such an egregious lie as “excessive deregulation.”

How many new regulations were put into place under Bush? How many were eliminated? What was the net effect? Thank you and good day.

It may be worth visiting the site of the FDIC and numbering the banks that failed since October 2000;

It is worth stressing that failed banks when significant are absorbed by larger banks with the effect of producing bigger volume banks. It is worth noting that the banks size enable them to take larger positions on capital markets that have been proved to be unmanageable, for the banks, operating staffs, board members and Ceos .

It is worth noting that very few investments banks only have survived through the age, and the mutation has always gone through consolidation with commercial banks transferring the volatility on incomes and revenues on more stable resources and revenues.

http://www.fdic.gov/bank/individual/failed/banklist.html

This list is most likely not exhaustive and most likely, failed only those that could be afforded by tax payers funds.

D Weelock Fed Saint Louis published a comprehensive paper on Banks consolidations in the USA.

Banking consolidation and market structures: Impact of the financial crisis and recession.

Only one gap the paper addresses Banks through the prism of consolidation in the deposits and savings, the liabilities, the leverage incurred through current commercial activities, capital markets and equities markets are left open.

The number of US banks has been brought down from 14000 in 1984 to less than 8000 banks in 2010,having for effect a concentration of the deposits and savings among fewer operators (P3 Fig 1).

When knowing that the price of a commercial Bank is more enhanced by the deposits and savings collected than the book value of its assets, we are left debating the goodwill value. Competition for resources as there are no banks without resources but one has to address the uses of funds, Banks do not fail through their excess deposits but through their uses of funds and contingent liabilities.

In essence there is no need to confuse risk diversification and regulations both have to converge towards the same goal that is a risk minimization for the society without upholding the risk maximization for the shareholders.

The rest is rhetorical when knowing that we have seen the largest banks failure in the history, and yet as of today the losses in the banking industry are even not fully divulgated.

Bluntly it is tiring to see failures,being over represented. The 99 % of the society does not care if the banking industry is posting +5/10 % more or less profits,it cares when it is called to pay for 99% of the losses.

If you’re going to make a regulatory and deficit case, then you must make it across the OECD. This crisis is not limited to the United States. Further, you must make a case as to why it did not affect the non-OCED countries. This is a counter-intuitive result and requires some explanation.

I think it also necessary that, at a minimum, you dismiss the role of oil. We have been unable to increase airline capacity and VMT in the last several years, and oil prices are at such a level that US oil consumption will continue to fall. (Here are the related analytics: http://www.epmag.com/Production-Drilling/Oil-price-America-afford_41209)

You must make the case that traditional GDP growth rates (eg, 3%) can be maintained when US oil consumption is in secular decline, that is, that employment can be increased when incremental employees can neither drive additional miles or fly anywhere. Intuitively, that would seem to be a hard case to make.

While I don’t disagree with the notion of regulatory failures, I think the story is really more Blame it on Beijing and an oil shock. The Fed failed to compensate for excessively loose money (in real terms), leading to a housing bubble. The Fed persists in this policy today, trying to sustain a housing market still trying to clear.

The oil shock part is straight-forward. Jim has written about it; so have I, although I would note that we are speaking of a demand, not supply, shock. The following article, for example, I think qualifies as a foundation piece in understanding oil supply and demand dynamics. It’s predictions from more than three years ago are still spot on.

http://www.douglas-westwood.com/files/files/474-PeakOilEconomics.pdf

What was less apparent at the time (at least to me), was that oil demand can toggle between inelastic and elastic modes, which leads to this article:

http://www.europeanenergyreview.eu/site/pagina.php?id=3761#artikel_3761

The article argues the price inelastic demand can lead to endogenous oil shocks. Prices overshoot because consumers fail to reduce demand fast enough in the face of a positive demand shock. The piece also provides a mechanism to explain Jim’s “innoculation theory” of price shocks, notably that prices returning to previously attained highs will not lead to the dislocations associated with new highs. This is precisely the “toggling” noted above. By this line of thinking, inelasticity and elasticity are characterized by hope and fear, respectively, leading to different behavioral responses.

The article also begins to examine the relationship of oil consumption to GDP through efficiency gains. And this brings us to the state of the art today. To argue that oil doesn’t matter requires that the economy be able to adjust flexibily and quickly to a lack of oil. No one has convincingly made such a case, either pro or contra, to my mind.

That’s one topic I am working on.

China Oil Demand Falls 1.5% in August (Platts)

http://platts.com/PressReleases/2012/092412

Falls of this sort coming off an inelastic stretch would ordinarily be accompanied by a recession.

Menzie wrote:

“…With the eurozone in outright recession, and still skirting financial collapse, and China entering a period of uncertain but definitely slower growth prospects, it would not be exaggerating to say that political paralysis threatens to push the world economy into recession.”

…A skeptic might conclude that nothing can change for the better…”

I am one of Menzie’s skeptics.

The “Fiscal Cliff” will happen in January 2013. Sen. Harry Reid has already said that he will bring none of the Republican House initiatives to the Senate floor. The House has addressed the problem and a bill is languishing waiting for Senate action. Reid and Obama do not want action on the provisions that will bring us the fiscal cliff before the election. They want our country facing a huge economic crisis because it works with their political narrative.

The New York Times put it this way: ”Mr. Obama was scheduled to attend a reception for world leaders at the United Nations on Monday night. But a campaign adviser acknowledged privately that in this election year, campaigning trumped meetings with world leaders. “Look, if he met with one leader, he would have to meet with 10,” the aide said, speaking on the condition of anonymity.

If, as his campaign adviser states, Obama believes campaigning trumps meeting with world leaders, it is certainly not a stretch to understand that campaigning certainly would trump a little thing like a worldwide recession.

So realistically, we will fall over the fiscal cliff whether Obama or Romney is elected. But consider what will happen after the November election. President Obama has made it clear that he wants the Bush tax cuts to expire so the tax portion of the fiscal cliff will give him what he wants concerning tax policy without him having to do anything. He actually can allow the tax disaster to happen and blame Republicans for it. So what of sequestration and the spending cuts? Again this is exactly what President Obama wants. He has attempted to cut the military budget ever since he was elected. Once again he has what he wants and he doesn’t have to lift a finger to get it. The fiscal cliff, that even Menzie recognizes, is exactly the policies that President Obama has been working toward.

I do appreciate Menzie’s comments on this issue because obviously he understands the disaster that we face and the only solution will come after the November election. While we will fall off of the fiscal cliff in January 2013 the only way we can minimize the disaster is to elect Mitt Romney in November because he is the only one who will reverse the disaster, though after the fact. I have to admit that I have mixed emotions welcoming Menzie to the Romney camp!!

Ricardo: You truly believe that President Obama wants sequestration to proceed, with half of the cuts applying to defense, and half to discretionary nondefense? That is, you believe he wants Head Start and extended unemployment insurance to be cut (along with NOAA)? Those are objectives and desires more in line with your friends. Get real.

Menzie,

No where in the legislation does it state that Head start and extended unemployment insurance will be cut. It only says that half of the cuts will be “discretionary nondefense” as you state. Obama gets to pick and choose what nondefense he will cut, just as he can choose what defense he will cut. This is taylor-made for Obama. So in answer to your question, yes, I believe that sequestration is exactly what Obama wants. With the stimulus he got to reward his buddies with crony capitalism. Now with sequestration he gets to punish his enemies. Welcome to Chicago politics.

Can someone explain the various presidential polling demographics to me?

For example, today’s NYTimes/CBS/Quinnipiac poll found 8-10 pt leads for Obama. But when you examine the demographics you find the polls have oversampled Obama’s key constituiencies. Here’s Florida for the poll above:

PARTY IDENTIFICATION

Republican 27% 344

Democrat 36 417

Independent 33 387

Other/DK/NA 4 48

Women are also oversampled with 54% registered women and 54% sampled, although I can’t find a breakdown for the last elections,

Menzie,

I need to correct one thing on my response to your question. My belief is in what Obama has actually said and is no just my personal belief. He has specifically said that he wants the Bush tax cuts to expire and he wants the massive cuts in defense. Bottom line is that he is more interested in his agenda than he is in a worldwide recession.

Ricardo That is not Obama’s postion. Obama said that he supports ending the Bush tax cuts for those making more than $250K. There is zilch evidence that raising taxes on that group would have a contractionary effect.

He does want significant (but not “massive”) cuts in defense spending. So do I. So do most people. In fact, even most top generals, admirals and civilian officials at the Pentagon want to see cuts in defense spending. Are you an outlier? Do you think we should not cut back defense spending? Now you could make a good case that cutting back operations & maintenance funding would be a bad thing in a recession, and I think there’s a lot to that argument. But most of the cuts that the Pentagon is talking about are in the procurement appropriation accounts and those have a three year obligation life, so they shouldn’t have much effect on the recession. A cut in procurement appropriation dollars for FY2013 doesn’t actually start to bite until FY2016 because FY2012, FY2011 and FY2010 obligation authority carries over in those accounts. And the ship construction and military housing accounts carry over for 5 years.

Obama has modified his position for his campaign but he has fought against all of the Bush tax cuts since he was in the Senate. His “tax the rich” compromise was simply a political ploy. It has no foundation in fact. According to the CBO his tax increase on the rich ploy would not even budge the deficit, but it would devastate S-Corps that employee about 80% of all manufacturing.

Concerning Obama’s defense cuts even his Defense Secretary has said his spending cuts would harm out ability to defend ourselves.

If Obama is reelected he will have no incentive at all to make any changes to try to reverse the impact of the fiscal cliff after January 2013. If he is not talking about it now during an election what makes you think he would after the election when he is “more flexible?”

Ricardo You are simply way off base. Obama wasn’t even a senator when Bush’s tax cuts were enacted. And you have badly misunderstood the S-Corps argument. It would affect well less than 1%.

And again, you’re wrong about what the SECDEF said. What the SECDEF said was that the sequestration cuts would be devastating; the SECDEF did not say that Obama’s proposed cuts would be devastating. In fact, that would be a bit bizarre since the SECDEF was the one who proposed those planned Defense cuts!!!

And your grasp of post-election politics is lame. If (when) Obama is re-elected he will hold the strong hand. He will be in a position to negotiate continued tax cuts for the bottom four brackets and allow the top rates to revert back to the Clinton rates.

Now over the longer term and once the economy has recovered, then it will be necessary to remove the middle class tax cuts as well as the upper bracket tax cuts. We will also need a small ad valorem tax. We’ll need lots of new tax revenues. That’s just a reality. But you don’t do those kinds of things when unemployment is over 8% and the economy is growing at less than 2%.

Ricardo

Have you seen any analysis of the effects of Obama’s middle class tax increases? There is no way he can accomplish his spending goals without raising taxes on the middle class and corporations. As you correctly point out, the ‘tax the rich’ blather is nothing more than ear-candy.

@2slugbaits

“Now over the longer term and once the economy has recovered, then it will be necessary to remove the middle class tax cuts as well as the upper bracket tax cuts. We will also need a small ad valorem tax. We’ll need lots of new tax revenues. That’s just a reality. But you don’t do those kinds of things when unemployment is over 8% and the economy is growing at less than 2%. ”

And if the economy never “recovers” and we have 22T in debt in 2016?

Ricardo: “According to the CBO his tax increase on the rich ploy would not even budge the deficit, but it would devastate S-Corps that employee about 80% of all manufacturing.”

Do you even think for a minute before posting nutty stuff? “S-Corps employ about 80% of all manufacturing.” That doesn’t even pass the smell test.

If you are interested in real numbers you can look here for data from S-corp.org which certainly doesn’t have a liberal bias:

http://www.s-corp.org/wp-content/uploads/2011/04/Flow-Through-Report-Final-2011-04-08.pdf

S-corps employ only 25% of all workers. Even if you add in sole proprietorships and partnerships as flow-through businesses you only get up to 54% of workers.

Further, S-corps and other flow-throughs mostly employ service workers. Only 7% of S-corp workers are in manufacturing compared to 15% for C-corps. So it works out, even if you use the most generous definition of S-corp to include sole proprietorships and partnerships, they employ less than one-third of manufacturing employees.

What you may be referring to is that about 80% of flow-through businesses do manufacturing. However that is quite different from saying that 80% of manufacturing workers are in S-corps since the majority of S-corps have fewer than 20 employees.