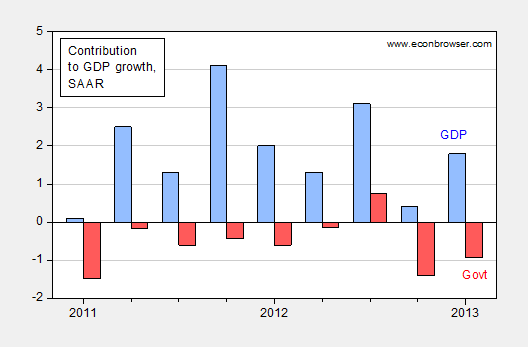

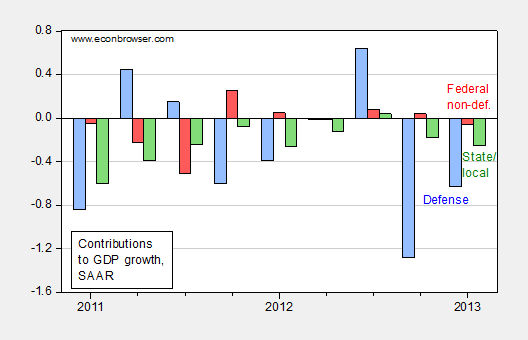

The third release of 2013Q1 GDP suggests even more tepid growth than originally thought. Government spending at all levels, state/local, and both Federal defense and nondefense, is deducting from growth (in contrast to the previous two recoveries).

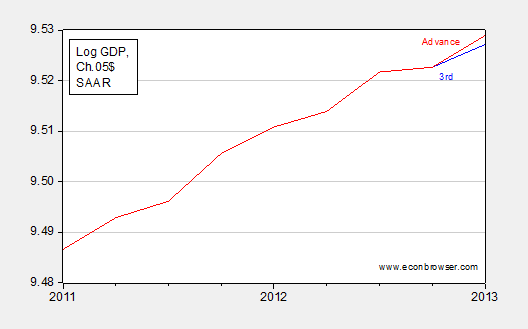

Figure 1: Log real GDP, Ch.2005$, SAAR, Advance release (red), third release (blue). Source: BEA.

Figure 2: Real GDP growth (blue bar) and contribution of government spending on goods and services (red bar), SAAR, in ppts. Source: BEA.

Figure 3: Contribution of Federal defense spending on goods and services (blue bar), Federal nondefense (red bar) and state and local (green bar), SAAR in ppts. Source: BEA.

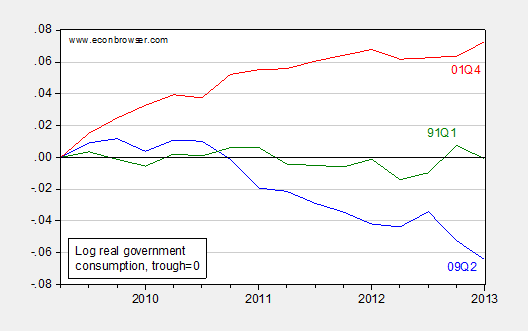

These graphs suggest that faster growth could be achieved if we were not cutting government spending so rapidly. A comparison of government spending in this recovery against the preceding two is below (employment is compared in this post).

Figure 4: Log government consumption versus 2009Q2 trough (blue), versus 2001Q4 trough (red) and versus 1991Q1 trough; trough = 0. Source: BEA, NBER, and author’s calculations.

“Cutting government spending” is a real stretch.

Yes, we’re spending less than the enormous 10% GDP deficits including TARP and Porkulus. What, you want those one-off items to become the new spending baseline?

We’ve run the numbers – government spending cuts ($24.2 billion) are contributing about 8% of the total fiscal drag activing upon the U.S. economy (using data from the BEA’s 3rd estimate). The combined tax increases ($56.3 billion) for Social Security, Obamacare and on the incomes and investments of high income earners is responsible for the other 92%. The total drag is $183.4 billion, or about 1.1% of the nation’s $15,984.1 billion GDP in 2013-Q1.

So, to put it mildly, government spending cuts have had an almost trivial effect upon the fiscal drag acting upon the U.S. economy.

Coincidentally, that outcome mostly agrees with what the Federal Reserve predicted would be the case….

it’s even worse than you think, menzie…

were it not for increase in winter farm inventories, most of which appears to have mostly been a seasonally adjusted reversal of the drought’s effects, which devastated summer farm inventories by $19.2 billion and fall inventories by 15.2 billion, 1st quarter GDP would have increased by less than a 1.0% annual rate…

The economy is actually near the LRAS curve with low utilization rates of labor and capital. The result is declining profit rates with little pressure to raise wages and boost demand inflation.

When we reach the LRAS curve in this way, you get a limbo type of stagnation. Yeppers… we are in stagnation mode.

Varones,

Words mean what they mean. Government spending fell at a 4.8% annualized pace in Q1 after falling at a 7.0% annualized pace in Q4. Those are cuts in spending. There have been cuts in government spending in 4 of the past 5 quarters. That is simply, unambiguously true. And since it’s true, then it is not a stretch to say so, and what you have written is simply, unambiguously false. Is that because you don’t understand the topic, or have you intentionally written something that’s not true.

By the way, just for the sake of clarity, the final revision to Q1 showed a somewhat smaller drag on GDP from government than did the first revision. That is not clear from Menzie’s comment.

kharris,

I was referring to Menzie’s quote which he illustrated with Figure 4, indexed to 2009.

As for the bipartisan sequester that Obama signed, I think we can all agree that the very modest spending cuts have failed to live up to the apocalyptic rhetoric of the left.

Menzie wrote:

The third release of 2013Q1 GDP suggests even more tepid growth than originally thought.

By whom?

Menzie wrote:

The third release of 2013Q1 GDP suggests even more tepid growth than originally thought. Government spending at all levels, state/local, and both Federal defense and nondefense, is deducting from growth (in contrast to the previous two recoveries).

These graphs suggest that faster growth could be achieved if we were not cutting government spending so rapidly. A comparison of government spending in this recovery against the preceding two is below (employment is compared in this post).

Menzie,

This is an instructive post. Some time ago I pointed out from one of your graphs on GDP that periods where we had a war GDP increased and I also pointed out that this was evidence that GDP does not actually measure the output of the economy but is more a measurement of government spending. War does not increase wealth but destroys it.

Once again here you clearly demonstrate that GDP does not measure actual production but in large part only measures increased government spending.

Ever since it was first conceived GCP has been controversial with thinking economists, but sadly the demand side economists have won the war of propaganda. The myth of GDP as a measurement of growth is generally accepted.

Thanks for the post Menzie.

Professor Chinn,

Did you do a Real GDP forecast for the 1st quarter? If so, what was your forecast? Also, if you made a forecast what model did you use?

Thanks

That fiscal “drag” is weighing down on GDP should come as no surprise – it was forecast by the CBP to detract 1-1.5% from growth in real GDP quite some time ago. Current monetary policy at the ZLB, including QE, is probably having little or no effect on the “real” economy. For all the recently declared Fed focus on the unemployment rate, a much more meaningful measure of employment is the employment-to-population ratio (L/N), as this is a direct input into many production functions. This measure has flatlined at its trough since the onset of the 2008-9 recession, indicating no improvement to labor-market conditions.

Iron Man, please give it up. Obamacare lol…..what a waste.

BEA doesn’t know what growth was in the 1st quarter of 2013 and won’t know for 10 years. GDP “reports” should be abolished in the near quarter and only released yearly(which would still contain revisions).

WYN wrong wrong and more wrong. You look at population entrances vs. exits. The EPR is indeed telling that the labor market has improved because it isn’t falling and has inclined slighty.

A “no improvement” market would be a slow continuing decline in the EPR.

Mark J. Perry :

Environmentalists, liberals and former economist Krugman routinely hurt poor people.

Mark J. Perry is an economics professor of considerably higher stature than Menzie Chinn.

Darren: You keep on saying this, and it may very well be true that Dr. Perry has a higher stature. I believe in the use of data. One assessment, based on metrics, is here. It might be useful for you to consult the page in order to obtain a quantitative view, and also to place in context where Dr. Krugman stands.

Darren: Menzie, as usual, is being polite. You don’t seem to know much about evaluating “stature.” There are few people with better economic credentials than a full professor at a top economics school. When you are A.B. magna cum laude from Harvard and a Berkeley PhD that also speaks volumes. Menzie also has a long record of other prestigious affiliations and publications, which you would know if you did a little checking.

I’m not going to do a comparison to Mark Perry, with whom I have spent some friendly meals and hours. I just don’t like the attack on the source because you have a political disagreement.

Now let us all take Menzie’s wise suggestion and stick to the facts.

“Some time ago I pointed out from one of your graphs on GDP that periods where we had a war GDP increased and I also pointed out that this was evidence that GDP does not actually measure the output of the economy but is more a measurement of government spending. War does not increase wealth but destroys it.”

THIS.

If Govt spending was the magic bullet, why not have a stimulus package of 50 trillion? We’d all be zillionaires after the multiplier.

Good nasty fun! I love it.

‘My model is better than your model. His PhD tops your guy’s. You suck.’

All meaningless…

i think that Professor Chin has made the blog many orders of magnitude more partisan that it was years ago before his affiliation. He made a cottage industry of attacking the Tea Party and its attempt to rectify the the consequences of a bloated public sector in Wisconsin.So one should expect to receive as you give.

john jansen: Question of clarification: the blog starts in June 2005; I join in October 2005. So, in your counting, does 4 months = “years”? Just curious what sort of accounting system you are using. Base 4?

The validity or lack thereof of the right’s contention that the sequester has had little negative impact is best understood by their persistent attempts to blame this result of Republican intransigence on Obama.

Menzie: to be fair to “mr” jansen, though I don’t know why one would wish to be given that last comment, his use of “years ago” can be fairly read as describing the time since your affiliation, rather than the time before your affiliation. I would agree that his implication about the 4% of the time during which the blog existed without you differs from his actual statement.

benamery: It is utterly conceivable that john jansen is unable to express himself in a grammatically correct manner, so your point is well taken.

Nice cover, Varones. You meant one thing, but wrote another. Then when called on it, you tried “hey, look over there”. The subject at hand is that you wrote something utterly false, not whether your favorite bogey-man said something false.

Oh, and by the way, love the “think we can all agree”. High on my list of all-time favorite cheap rhetorical devices, asserting that “we all agree” with your position. Seriously, dude, get honest.