Before 2008, U.S. monetary policy was primarily conducted in terms of a target set by the Federal Reserve for the fed funds rate, which is the interest rate a bank pays to borrow funds overnight from other banks. A large academic literature used the fed funds rate as a summary of monetary policy, looking at its correlations in dynamic regressions with other variables of macroeconomic interest. But the fed funds rate has been stuck near zero for the last 5 years, and will likely be replaced by an alternative policy focus even once we exit the zero lower bound. Economic researchers face not just the difficulty of summarizing what the Fed has been doing in the current and future environment, but also the practical challenge of how to update their historical regressions to try to describe the full set of historical data along with the new experience in a coherent way. Here I describe a new research paper that suggests one solution to these problems.

One approach that some researchers have been using to model the dynamics of interest rates when the short end of the yield curve is stuck near zero is based on the shadow rate model first proposed by Black (1995). This hypothesizes the existence of a “shadow” short-term interest rate that might in some circumstances be quite negative. In normal times (when the observed short-term interest rate is sufficiently high), this shadow rate is positive and coincides with the observed short rate, and the dynamic relations among interest rates of various maturities are described using familiar tools. The hypothesis is that when the shadow rate falls below some bound, we could continue to calculate an implied negative shadow rate as if it followed the usual historical dynamics as well as calculate forecasts for that shadow rate. To predict the actual short rate at any future horizon, we just compute the expectation of the maximum of the future shadow rate and the lower bound. We can then get predicted values for all other yields from the assumption that risk gets priced in a consistent way across assets.

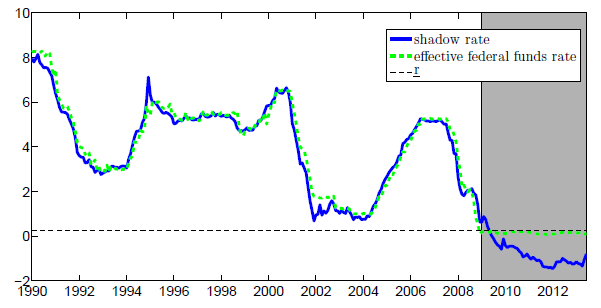

A recent paper by Dora Xia, a UCSD graduate student who expects to complete her Ph.D. this spring, and Cynthia Wu, a former UCSD student who is now an assistant professor at the University of Chicago, makes several contributions to this literature. First, most previous applications of the shadow rate model have involved arduous numerical simulations to calculate its full predictions. By contrast, Wu and Xia develop a very simple closed-form expression that gives a very good approximation to the predictions of the model for the yield of any maturity. Here is a graph showing the estimate of the shadow rate that comes out of their approach. Up until 2009, this basically coincides with the observed fed funds rate, but since then, the implied shadow rate has been quite negative.

|

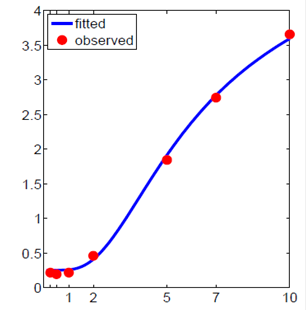

Their model tracks the recent behavior of the yields on Treasury securities of various maturities quite closely. For example, the red dots in the graph below describe the average one-month forward rates in 2012 associated with 3-month, 6-month, 1-year, 2-year, 5-year, 7-year, and 10-year Treasury securities, while the blue curve gives the model’s predictions for what those rates should have been. It appears to be an approach that is quite accurate and easy to use.

|

Of particular interest is Wu and Xia’s observation that their series for the shadow rate exhibits similar correlations with other macro variables since 2009 as the fed funds rate did in data up until the end of 2007. Wu and Xia took a popular model that had been estimated before the Great Recession in which the fed funds rate was used as the summary of monetary policy, and just replaced the fed funds rate with the Wu-Xia shadow rate to get a data set that continues after 2009. Although this device could not fully account for all that happened to interest rates and unemployment during the Great Recession over 2007-2009, Wu and Xia found the evidence to be consistent with the hypothesis that data since 2009 could be described using the spliced series as the monetary policy indicator and using the same model that described pre-2007 data. In other words, the shadow rate displays the same sort of correlation with lagged macro variables since 2009 as the fed funds rate did in earlier data, and likewise the value of macro variables that one would predict using the new shadow rate series is close to the value one would have predicted in earlier data using the fed funds rate instead.

The suggestion is that we then might use the shadow rate series as a way of summarizing what the Fed has been doing with its unconventional policy measures such as large-scale asset purchases and forward guidance. If the Wu-Xia framework is correct, these unconventional policies can all be summarized in terms of what effect they had on the shadow short rate. By comparing the shadow rate with the value that traditional models would have predicted for the fed funds rate, Wu and Xia get a measure of the shocks to monetary policy. Wu and Xia find that monetary policy has recently been a bit more expansionary than usual (pushing the shadow rate about 0.6% more negative over 2011-2013 than the traditional monetary policy rule would imply), as a result of which their estimates imply that the current unemployment rate is 0.23% lower than it otherwise would have been.

The Wu-Xia series for the shadow rate is available online. I recommend this as a practical patch for researchers who want to update analysis that made use of historical data on the fed funds rate.

And while I’m on the topic of useful new research coming out of UCSD, let me also call attention to another paper from Dora’s Ph.D. dissertation, which develops a practical way to get term-structure models that actually generate decent forecasts.

Amazing work. Xia absolutely killed it.

James,

Jim Bullard has talked about this too (based on the work of Leo Krippner); see here:

http://research.stlouisfed.org/econ/bullard/pdf/Bullard_CFAR_StLouis8Nov2012final.pdf

FedZero, another failed FBR monetary policy…

Eight years of this in the past 13 years and the lowest GNP growth in modern times..

More proof that this institution has little use other than a shrine for bankers to worship..

This is interesting work. Also glad to see Jim Bullard’s talk above (via David Andolfatto).

The one missing piece from both pre-crisis and post-crisis measures is a real time estimate of the short-run natural interest rate. One really can’t say whether monetary policy is tight or loose unless one gauges the target interest rate or shadow rate against the natural rate. Comparing it to the Taylor Rule does not cut it either. It is not a structural equation.

Although some of the enthusiasm for bitcoin is driven by a distrust of state-issued currency, it is hard to imagine a world where the main currency is based on an extremely complex code understood by only a few and controlled by even fewer, without accountability, arbitration, or recourse.h/t Peter Klein

Is it really that hard? Could there be a better description of modern Federal Reserve Policy?!!

JDH

Those are intersting results and I bet you are very proud of your current and former students.

Another important issue is the transmission mechanism.

Does the traditional transmission mechanism of FED policy to real changes in employment and output remain unchanged under the new policy regime?

Does the overhang of excess reserves alter the traditional transmission mechanism?

It seems the FED targeted bank balance sheets, which is distinct from inflation and growth. If the FED wasn’t targeting bank balance sheets, then their would be no purchase of MBS’s. I’m not arguing that it was a mistake, just wondering what the impact is of these changes in policy goals and tools.

Bullard’s powerpoint is interesting. However, he frames the period from early 2009 – 2011 differently than he frames the current period:

“According to these estimates, the shadow policy rate is currently more than 300 basis points lower than the rate recommended by the Taylor (1999) rule.”

“In 2009, policy may have been too tight relative to the recommended Taylor (1999) rate.”

The difference in 2009 between the ‘shadow rate’ and the ‘Taylor prescription’ was 8%. The current delta is 3%. Why the ‘is’ versus ‘may have been’? To present the data objectively one would say:”According to these estimates, the shadow policy rate was more than 800 basis points higher than the rate recommended.”

The difference in 2009 was more damaging than today’s difference, not just because it was larger in magnitude, but because the economy was in a more vulnerable position. There is a significant degree of politics involved in monetary and fiscal policy – see Europe as a striking example. How analysis is framed makes a huge difference as to how it is used by policy makers.

It should also be seen that, from Bullard’s presentation, even in 2006, the shadow rate was 3% lower than ‘prescription’.

Bullard’s chart is interesting. Suggests that Fed rates prior to late 2008 were too low (relative to the Taylor rule). I don’t know how else to interpret other than to say that Fed policy was a direct contributor to the 2007 recession and 2008 financial crisis.

Measurement is fun. One variable that is hard to measure is business sector and investor confidence. Accommodative monetary policy is supposed to restore confidence but clearly in recent years, that has not always been the case. Based on the working hypothesis that accommodative monetary policy can actually reduce confidence/increase pessimism, perhaps there is a latent index of confidence lurking in all the shelved capital?

“as a result of which their estimates imply that the current unemployment rate is 0.23% lower than it otherwise would have been.”

So QE1 and QE2 reduced unemployment by .23%?

OH WHAT A FED POLICY!

The .23% drop in unemployment translates into 360,000 jobs. By Okun’s Law, this raised the level of GDP by $80 billion at most. For this, the 43 million retirees over age 65 who are 75 years of age on average have lost far more than $80 billion. Including the effects of both ZIRP and QE, over the past 5 years retirees who do have savings cumulatively lost $280 billion of interest income because of rate suppression. This went and is still predominately going to bail out too-big-to-fail US and European banks. Like the con man at the carnival with the pea hidden under the walnut shell, slight-of-hand has kept the full story from the public’s eye. Those who have any or all of their life savings parked in fixed-income are intimately aware of their own personal loss. Never in their working lives did they imagine this happening. And there is anger. But what they have yet to even vaguely grasp is the magnitude of the hit on them as a voting block. Were they to organize around this issue, the political landscape at district, state, and national level could surely change in 2014 and 2016.

Anonymous,

You optimism is infectious. Just consider that over the 3 year period about $1 trillion per year in QE reduced unemployment by .23% based on Phillips Curve analysis. So just think, all we have to do is increase QE to $94 trillion per year and we could get rid of unemployment in another 3 years.

Has Yellen done this calculation?

anonymous,

first, this is an estimate based on a model not in use-yet. the fed already said this was not a great solution-better fiscal policy would have been the path to take.

second, have you got a better solution for the fed? easy to criticize, much harder to produce a credible alternative solution. or you suggest raising interest rates in a depressive environment as a means to reduce unemployment?

jbh,

“Including the effects of both ZIRP and QE, over the past 5 years retirees who do have savings cumulatively lost $280 billion of interest income because of rate suppression.”

you argue of rate suppression. but we have been in a depression like environment-what kind of rates did you expect? they should be ultra low even without the fed. and perhaps folks should be more diversified. i am guilty, with way too much in savings type instruments. but that is the price to pay for staying liquid. you should not expect to be paid interest in a low growth environment!

You cannot complain about lost interest income without considering the increase in value of long-term bonds, and the huge run-up in stocks. What is $280 Bln in interest income compared to the increased value of stocks and bonds? Tell anyone, no matter their beliefs, that QE has had no impact on the stock or bond markets and see how hard they laugh.

second, have you got a better solution for the fed? easy to criticize, much harder to produce a credible alternative solution. or you suggest raising interest rates in a depressive environment as a means to reduce unemployment?

Posted by: baffling at November 13, 2013 09:39 AM

The thing that drives me crazy with folks of your ilk is that you think you can direct the economy past bad investments. We have at least 40 years of foolish policy based on the NOW NOW SCREW the future, and you think that manipulating rates will somehow avoid the inevitable pain that will come.

The best cure for withdrawl is time and sobriety. Having another drink is only going to make the withdrawl worse in the future. You can not avoid it.

The best thing for the US would be for the govt to gut spending, and the fed to raise rates to something close to their historical mean. It would be incredibly painful for a few years, but it would be sustainable, and we would recover. Our current policy is desperatly trying to fight off the next recession, but the longer we try to fight it, the harder it will be to fight it.

PS recessions are not the disease. They are a symptom.

anonymous,

first, this is an estimate based on a model not in use-yet. the fed already said this was not a great solution-better fiscal policy would have been the path to take.

Posted by: baffling at November 13, 2013 09:39 AM

Do you know anything about the models that suggest fiscal policy stimulation works?

Old Keynesian model was based on the idea that people don’t think about the future. This has been so completely discredited by at least 4 nobel prize winners that it’s absurd it is still parroted by the media.

New Keynesian model basically says govt spending should increase inflation forcing people to spend now. We have no inflation. How big do you want to juice up our deficits to create New Keynesian inflation?

The short answer is both of these models are wrong. We don’t become more wealthy as a country unless we produce more, period, end of story.

JBH The Wu and Xia chart shows that the shadow rate has been negative for quite some time. How (exactly) has there been “rate suppression”? Sounds to me like anyone earning a non-negative return on a safe asset is getting more than the market “wants” to offer.

And WRT a previous post, baffling is right. If employers cut employer provided healthcare, then this should increase the money wage that workers receive because healthcare is part of the overall wage bill. It would also make the labor market more efficient because untethering healthcare from employment makes labor more mobile and elastic.

Wow. I completely agree with 2sb’s comment.

And of course, as other commenters have pointed out, the increase in the price of bonds makes up for the decrease in interest income. All people need to do is sell some bonds (either take more out, or transfer to a different fund).

slugs

If employers cut employer provided healthcare, then this should increase the money wage that workers receive because healthcare is part of the overall wage bill.

Don’t forget to subtract the $2000 to $3000 annual fine per full time employee for not providing coverage and the administrative headaches for firms that continue to provide coverage. It’s doubtful Obamacare will cause a significant increase in wage growth.

However, I agree, untethering health care from employment is a good thing. Tax deductions for individuals who buy their own insurance in the private market would be a good place to start.

I also recall your claims that business owners would be stupid to cut their workforce in response to Obamacare. I also recall the study Menzie cited that showed no impact on part-time/full-time status and hours worked. That study was flawed because it didn’t control for firm size.

Here is a study that controls for firm size and suggests that Obamacare is increasing costs for firms, forcing employers to cut hours and move employees to part-time status.

Obamacare is a huge policy change. Why do you refuse to accept the fact that this major change in policy is going to have a major impact on many firms?

*Some 31 percent of franchise businesses and 12 percent of non-franchise businesses say they have already reduced worker hours because of the law.

*About 27 percent of franchise businesses and 12 percent of non-franchise businesses have already replaced full-time workers with part-time employees because of the law.

*Some 41 percent of the non-franchise firms say they already see health-care costs rising because of the law.

*As the franchise firms look toward the future, 28 percent of them say they’ll stop offering health coverage in 2015 because of the law. One-third of franchise businesses already do not offer health insurance

http://www.csmonitor.com/USA/Politics/2013/1113/Businesses-cut-full-time-workers-to-meet-Obamacare-mandate-study-says-video

tj,

noboby refuses to believe obamacare is a big change in policy-that statement is needed for strawman arguments.

if a company is offering adequate health insurance, they will not be affected one bit by obamacare. their insurance policy meets the minimum standards and life goes on. this is the VAST majority of companies and employees.

this will affect companies which do not offer health insurance or offer inferior policies. and those folks will have to deal with some issues. they can choose to offer a minimum policy, or pay the fine and not offer the policy. but now they will need to deal with a labor market with more options. i can take and/or keep a job with a company that does not respect my health, or i now have the ability to move to a company who values my health a bit more. health insurance will not keep me tethered to a poor employer. this is a HUGE change in dynamics that the pro-business people hate and the pro-worker people love.

so yes, obamacare will have major impacts. but in ways you do not quite seem to understand unless you look from the workers perspective.

Our company just notified us of another layoff. That makes 20% in the past 5 years. And our bloated government goes into absolute shock when 18% get paid vacations for a couple of weeks. Our company provides goods and services for real people and we pay taxes. The government provides heartache for people and sucks up tax revenue. Things are so out of proportion!!

ricardo,

i guess you don’t drive on a road to work, cross a bridge, drink water and dispose of sewer with a water treatment plant. somebody defends your country with a military? you have safe food to eat? the mri and ct scan used to detect unhealthy tumors were developed by who? even the internet you use to bash the government was based on government work.

wake up and quit crying like a 3rd grader slapped on the wrist! maybe your company is laying people off because it produces things the world does not need or want!

https://app.box.com/s/m98htpmebgfwadb30s6y

https://app.box.com/s/63apk9x7g83ls01m2kb9

https://app.box.com/s/acjof0mfytg9vy3aqiuf

https://app.box.com/s/mtstr48n9q4qobidc1ha

Yet more evidence of an incipient US recession. The ACA will be a nail in the coffin of the private US business cycle this time around.

But economists and stock speculators don’t see the recession (at least not publicly), of course, but neither did they before 9/11 and the AIG and Lehman takedown.

https://app.box.com/s/6ais4da2oloayeyyrkwe

https://app.box.com/s/q4538hkpx6np1wrlil83

Moreover, Yellen says there’s no stock market bubble, thus she’s affirming the further inflation of the largest global debt and asset bubble in world history. Someone should ask her if it were a bubble, would she see it? Does she know what a bubble looks like? Would she tell us if she ever were to see a bubble? That it is the largest bubble in history that she claims not to see renders her credibility next to zero.

All bubbles burst. The bigger the bubble, the worse the dislocation resulting from the subsequent crash. The Fed on behalf of the TBTE banks has enabled the largest global bubble in history, yet the Fed Chairperson cannot publicly admit it and is charged with inflating the bubble to even more bubblier extremes.

Tragic.

I like the paper and the application – I provided positive comments to the authors on an earlier draft. However, people should be aware of two very important issues regarding shadow short rates (SSRs).

First, the empirical issue is that SSRs are sensitive to the model specification, the data used to used to estimate them, and even the estimation technique; see Bauer and Rudebusch (2013), Christensen and Rudebusch (2013), and Krippner(2013):

http://www.rbnz.govt.nz/research_and_publications/discussion_papers/2013/dp13_02.pdf.

Second, the theoretical issue is that SSRs are not an actual rate faced by economic agents (e.g. people don’t get paid for borrowing!!).

I’m working on a paper that I think resolves these issues; i.e. using the shadow/ZLB term structure model to create a measure that is robust to different modelling choices and that is consistent and comparable between conventional and unconventional monetary policy periods. If people are interested, I’ll see if I can get the RBNZ to upload the draft when it is done next week. Would be great to get any comments on the idea.