Assessing the importance of direct government expenditures on goods and services [Edits to clear up ambiguity in terminology for readers Salim and Jeff — MDC 12/18].

One way to approach this issue is to examine the ratio of government spending on goods and services, [otherwise known as government consumption and investment], to GDP in nominal terms. [Hence, this measure excludes transfers]

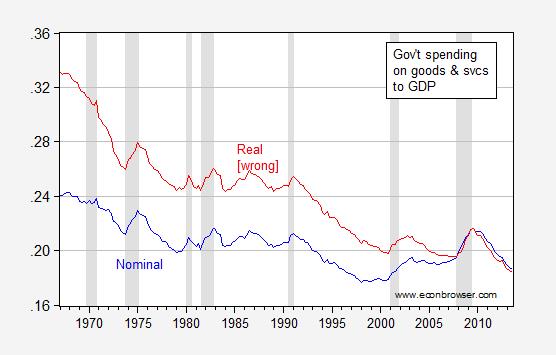

Figure 1: Ratio of spending on goods and services (all levels), aka government consumption and investment to GDP (blue), and ratio in Ch.09$ (red). NBER defined recession dates shaded gray. Source: BEA, 2013Q3 3rd release, NBER, and author’s calculations.

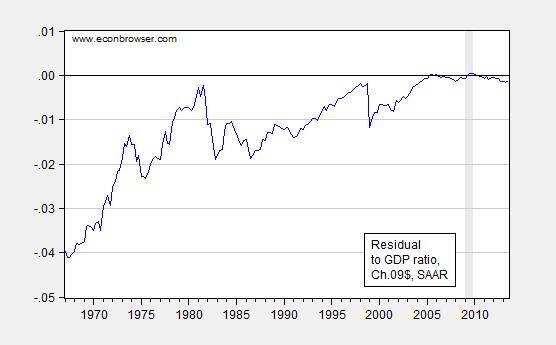

Notice that in nominal terms, the government consumption and investment spending, i.e., government spending on goods and services, and excluding transfers, ratio is declining. The decline is even more pronounced when expressed using Ch.09$. However, the calculated series is not meaningful as the sum of the components of GDP expressed in real Ch.09$ do not sum to actual GDP, as noted in this post. In this case the approximation to actual using the straight ratio is likely to be poor particularly in the late 1960’s to early 1970’s, as the residual approaches 4% of GDP.

Figure 2: Ratio of residual to GDP, in bn. Ch.09$, SAAR (red). Residual equals actual minus sum of components. Gray bar denotes the reference year. Source: BEA, 2013Q3 3rd release, and author’s calculations.

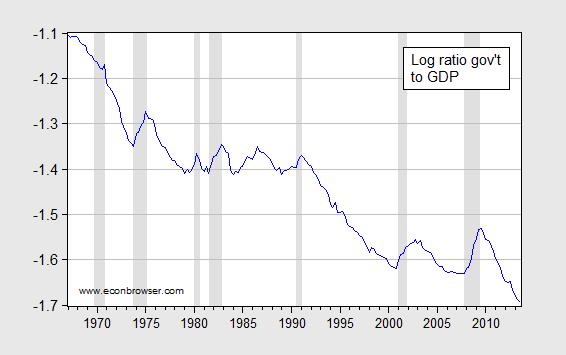

If the straight ratio of real magnitudes cannot be readily interpreted, given the failure of chain series components to sum up, then what can one do? An alternative is to plot the log ratio. The level of the series has no meaning, but the difference between any two points in series does.

Figure 3: Log ratio of spending on goods and services (all levels) aka government consumption and investment to GDP in Ch.09$ (blue). NBER defined recession dates shaded gray. Source: BEA, 2013Q3 3rd release, NBER, and author’s calculations.

For instance, the difference between the value in 1967Q1 of -1.105 and that in 2013Q3 of -1.695 is 0.59, representing a cumulative 59% change (in log terms). Given the roughly 46 years in the sample, this means that government consumption and investment spending (also known as government spending on goods and services) grew about 1.3% slower than GDP over this period.

Update, 12/18 3:25PM Pacific: Noah Smith speculates that Medicare expenditures are not in the government spending on goods and services series. That guess is correct. See this working paper, page 3. On the other hand, VA hospital expenditures and government health clinics would be included.

A semi-philosophical question: if you did this in 40 years, would you expect a similar aggregate ≠? I wonder. I expect it would. Which only buttresses your point about using log ratios.

Local, state, and federal gov’t spending to GDP:

http://research.stlouisfed.org/fredgraph.png?g=q5r

http://research.stlouisfed.org/fredgraph.png?g=q5s

http://research.stlouisfed.org/fredgraph.png?g=q5t

Total gov’t spending to GDP and private wages to GDP:

http://research.stlouisfed.org/fredgraph.png?g=q5u

The sum of rentier income (interest, dividends, and from assets) and total gov’t receipts as a share of GDP, sum of public and private wages to GDP, and private wages to GDP:

http://research.stlouisfed.org/fredgraph.png?g=q5v

Rentier income plus tax receipts far exceeds total and private wages.

Labor is inexpensive/productive/profitable compared to current rentier claims on wages, production, profits, and gov’t receipts, and gov’t claims on wages, production, and profits.

The private sector is screaming for investment in labor and production at sustainable 2-3% labor returns vs. unsustainable, non-productive rent seeking and assumed cost of growth of gov’t at 7-10% and 5-6% respectively.

But the TBTE banks, with the able assistance of the Fed, are promoting increasingly levered financial bubbles with assets concentrated to the top 0.01-0.1% to 1-10% at no velocity, which is like a giant vacuum sucking savings, investment, production, employment, wage gains, and purchasing power of labor from the economy.

Anyone? Does the below mean federal or all governmental unit’s budgets?

“government consumption and investment spending”

Hans: These figures are for Federal, state and local spending on goods and services.

This is GREAT news…despite the heartbreak for spend-like-drunken-sailors Dems (and Pubs under bush).

Here’s a trade question for you which I don’t quite know how to analyze.

Readers will recall that I stated that US oil consumption would fall at a 1.5% annual pace, and this indeed proved true from 2005 until April of this year.

Since then, it has leveled, and indeed is up in the last quarter.

Now, here’s the question. How much of the US’s incremental oil consumption does the US get to consume?

Over the last three years, the answer is ‘zero’. Oil consumption is lower than it was three years ago. Thus, all incremental shale oil production has been, in effect, import substitution. That is, more than 100% of increased US oil production in the last three years has gone for ‘export’, and it has been ‘exported’ to China and other emerging economies.

However, in the last year, US oil consumption is up by 600 kbpd. Thus, if I take the last year, the US has been able to consume 1/5th of its incremental production, equal to its global pro rata share of oil consumption (ie, the US consumes about 21% of the global oil supply).

On the other hand, the major oil producers have been able to increase oil consumption since 2005. Therefore, one would think that US oil consumption should increase by more than the US’s pro rata share of oil consumption.

Here are some other factors to consider:

– The estimated carrying capacity for the US economy for oil consumption is about $105 Brent (roughly 4.25% of GDP at Brent prices)

– The oil trade deficit, in dollar terms, is now back to where it was in 2005. Thus, major reductions in US oil consumption and spectacular increases in production have, in effect, just brought us back to where we where before the oil supply stalled. What are the implications of this for oil consumption in the US (or elsewhere, for that matter)?

This analysis is important for a number of reasons. First, if US oil consumption is falling, then refining capacity will either fall idle (60%) or be repurposed for exports (40%). If US oil consumption will continue to fall, then it makes sense to export the excess shale oils rather than build refineries. On the other hand, if US consumption will rise and exports are prohibited, then it makes sense to invest in new downstream capacity.

The simple interpretation is that the oil price will remain above US carrying capacity and US oil consumption will continue to fall. In this scenario, it makes sense to export excess shale oil production, to my mind.

However, given the volume of US incremental production, I think the US has scope to increase domestic consumption. But I don’t know how much, or really even how to think about the analysis.

Any thoughts?

State and local accounts for more than half of total government spending in most years. S&L’s share of GDP (nominal) actually increased during the 1990s when the total gov’t share sharply declined. Federal’s share of 6.1 percent in 2000 was its lowest since 1937.

Just squinting and looking sideways at this statement: “Given the roughly 46 years in the sample, this means that government consumption and investment spending grew about 1.3% slower than GDP over this period.”, one could think, though of course this would be wrong, that the government got good value for its money.

Properly: “How much of the US’s incremental oil production does the US get to consume?”

Menzie –

I replicated your last graph using both real and real index data (the latter is a vertical shift of 1.5406). Then, using the index data, which has longer series for the components of spending, I looked at Defense, Federal Nondefense, and State & Local.

There’s a huge drop in defense spending from the 60s to the present, with predictable political cycles around the trend. There’s also a drop, more modest and less cyclic, in State & Local purchases.

Federal non-defense purchases have hardly budged over 50 years. Its log ratio to the GDP index is about the same in 2013q3 as it was in 2008q4, 1989q4, 1983q4, and 1962q2. It was at its lowest points during the Clinton and Kennedy presidencies.

Transfers and total gov’t expenditures are not, of course, included in NIPA. Just doing a quick-and-dirty nominal ratio tells the story we all know: transfers have become a much more important part of government expenditure over the last generation. That will grow a great deal more as the baby boomers retire.

The nominal ratios (net nominal transfers over general govt expenditure, FWIW):

1963: 20%

1973: 27%

1983: 30%

1993: 33%

2003: 35%

2013: 41%

At the Federal level, those shares would be even higher. The government’s role has shifted massively from public goods (especially defense) toward pensions and redistribution. As Oh & Reis argued recently, this is true in Europe as well.

I don’t think progressives would be particularly happy to go back to 1963 or 73, when the government purchased a lot more military goods and transferred a lot less income to households. Nor do I think it’s logical to think that states & localities should spend the same share of GDP on education (their biggest expense) when children make up 24% of the population (2010) as when children made up 34% of population (1970).

The debate over government expenditures today is largely on the transfer side. If one’s goal is to promote a precise and well-measured discussion, I think one should be careful to use the labels “Government Purchases” and “Government Expenditure” rather than the ambiguous “Government Spending”.

Thank you, Salim, you confirmed what I suspected.

Who cares what government spends on goods and services when entitlements are not included? Entitlements, especially elderly entitlements, are where the money is. Medicare especially.

I know I’m shocked that wealth transfers are crowding out spending on goods and services. Who could have seen this coming?

Thanks, Salim, nailed it.

salim,

“The government’s role has shifted massively from public goods (especially defense) toward pensions and redistribution.”

if you think about it, this is logical. social security is a function of population, which is growing. but defense spending, for instance, does not necessarily grow with the population. last time I checked, the land area to defend has not increased during the past 50 years, but the population has. so one should expect a change in this ratio over time.

also, does one really consider social security and medicare as a pension and redistribution package? considering there is a max cap on SS and medicare tax, my guess is plenty of wealthy extract more out of medicare than they put into the system? I guess you could call that redistribution as well?

Steven, US oil exports are primarily to US supranational firms’ foreign subsidiaries and contract producers/suppliers, given the nature of the Anglo-American imperial trade regime.

Two-thirds of US oil exports go to Canada, Mexico, and Central and South Americas, including for US subsidiaries’ goods production and transport, and for imperial military consumption.

https://app.box.com/s/bw8sqno4fcdai2gvn5h1

https://app.box.com/s/txig5u69mz0pbgsj3qn5

Growth of US oil exports peaked with the business cycle in 2012 and has been decelerating with recession-like world real GDP per capita since, along with the US imperial military drawdown in Iraq and Afghanistan.

http://news.xinhuanet.com/english/china/2013-11/19/c_132900621.htm

http://www.tradingeconomics.com/china/foreign-direct-investment

Growth of FDI to China appears to have reached a secular peak with world real GDP per capita (and Peak Oil), debt/GDP, and demographics.

Thus, growth of US oil production and exports is likely peaking (has peaked) with the peak in growth of world real GDP per capita (and “trade”), including decelerating growth of same for China-Asia hereafter.

Steven,

I’m puzzled by the unstated premise that oil consumption is necessary a beneficial thing.

If consumers are finding cheaper substitutes, which allow US oil production to find better uses abroad and reduce the trade deficit, what’s not to like?

If consumers move from a gas guzzler to a gas sipper, they reduce their costs while not (necessarily) giving up any utility.

For instance, if someone moves from a Porsche to a Tesla, they can reduce their oil consumption and overall costs while improving their comfort, handling and acceleration…

So, isn’t moving away from oil pretty much good for everyone??

Bruce,

I’m puzzled. The US is a large oil importer. In fact, oil exports are prohibited by law.

Now, you may be thinking of oil *products*, which are indeed being exported. Of course, if the US can import oil, refine it, and export the value-added product, what’s not to like?

And, of course, US crude oil production is growing quite quickly, and shows no sign of a near-term (3rd!) peak. Take a look at N. Dakota and Texas, in particular.

Nick G: Your example is a sample that does not represent the population.

Try that with F-Series trucks… the highest sales volume vehicles. Can you replace a 6-cyl. F-150 with an all-electric F-150 [or Silverado, or Titan, or Tundra] and have comparable utility and costs?

Steven,

Let me take a stab at your closing question.

The proper framework, in my opinion, is not the “value” of oil, but it’s substitutes. At $100/bbl, oil is rather more expensive than it’s substitutes for the majority of consumption.

So, the real question is: will the pace of economic growth, which naturally raises the volume of transportation etc, outpace the rate of substitution?

Will hybrids, PHEVs, and EVs improve their cost, performance and consumer education/acceptance faster than the economy grows? I’d suggest that substitution will grow over time. As an student of the “exponential function” can tell you, exponential growth means a deceptively slow pace at the beginnning, and a faster and faster pace with time.

So, economic recovery might overwhelm substitution in the short term, but it’s very likely to lose the race in 5-15 years, as ICEs become more efficient, batteries become cheaper, aerodynamics improve, and people learn to love the performance advantage that electric drivetrains provide.

Bruce,

Yes, it certainly can. The Tesla is an example, intended to help you see the possibilities.

We’re in the middle of a transition, which is starting with small vehicles. Big vehicles can certainly be electrified. Consider the example of the diesel submarine, which accounts for most subs in the world: it’s an EREV design, just like the Chevy Volt.

Salim: Well, I thought I was pretty clear when in the first paragraph, I indicate spending on goods and services, and there is a big label in Figures 1 and 3 indicating that what is graphed is spending on goods and services, and the legends for Figures 1 and 3 repeat that fact, and the paragraph under Figure 1 cites “government consumption and investment” and I repeat that point in the last paragraph. But I acknowledge perhaps greater disclosure might have been necessary for the ADHD set.

By the way, the information regarding total spending was recounted in this post, as well as this post. And here. As well as here for a shorter sample.

@Nick G.: “Now, you may be thinking of oil *products*, which are indeed being exported. Of course, if the US can import oil, refine it, and export the value-added product, what’s not to like?”

Given the nature of the Anglo-American imperial trade regime (the successor to the British Empire’s version from the 1870s to WW I), we’re “exporting” oil “products” to ourselves abroad, including to supply the imperial military to secure markets and shipping lanes.

Note that ADM (with the help of Monsanto, Cargill, Dow, etc.) acquires vast tracts of land and tropical forests to be cleared to grow corn and soybeans in Mexico and Central and South America (displacing sustainable subsistence practices that have existed for centuries) to “export” to the rest of the world so that Frito-Lay (PepsiCo) and competing firms can produce processed grain-based oils, corn syrup, and other assorted junk “food” to sell in the EU and Asia to promote “globesity” worldwide.

On the basis of this success, US pharmaceutical and biomedical firms can profit from the increase in metabolic, cardiovascular, autoimmune, and DNA-mutating (cancer) diseases resulting from the consumption of the junk “food” produced with carcinogenic petrochemical oil “products” we “export”.

Moreover, given that the production of this “food” requires vast billions of gallons of water from glacial run-off and ancient aquifers, it is necessary for US supranational firms to “acquire” the “property rights” to exploit the freshwater resources to produce the “food” to sell to the top 10% of foreign populations to which pharmaceutical and biomedical firms can sell drugs and other treatments so that they, too, can “be like us” and spend 18% of GDP on “health care”.

Once US firms have a monopoly on water resources and secure local and national paramilitaries to defend their “property”, they can bottle it and sell it to the co-opted elites within the foreign populations who can afford it, whereas the bottom 99.9% will have to spend 50-60%+ of their incomes (assuming they can find paid employment after being displaced from the land) for food, water, and cooking oil.

Salim I’m not sure why we should particularly care that transfers are becoming a larger share of government spending. Those transfers represent transactions between two parties and there is no a priori reason why both parties should be private sector agents. A transfer is a transfer is a transfer. Let’s look at pensions. Back in the old days there was less of a need for government funded pension support because private sector employers provided the transfer between generations. Those days are long gone (unless you’re a very rich CEO with a golden parachute and a stunning record of management incompetence). But for the average worker pensions are a thing of the past. But the key point is that private sector pensions are identical in every important respect with public sector provided pensions. The identity of the pension provider is economically irrelevant. Now what does matter is how much money goes towards the maintenance of pensions, irrespective of whether those pensions are funded by businesses, the government or personal 401k plans. The basic economic rules are the same. There must be the same amount of national saving. Now it is true that if pensions become very large relative to GDP, then those pensioners will crowd out the consumption of current workers. But that’s true whether those pensions are funded by FICA taxes or funded by the dissaving (selling bonds and equities) of private individuals or supported out of the overall wage bill for corporations. Even as big of an opponent of Social Security as Marty Feldstein concedes that much. If you want to argue that the growth of publicly funded transfers is a problem you must first show that it distorts supply side incentives and leads to deadweight losses. Now you might be able to make such a case, but I think I could also make an equally compelling case that the security of publicly funded pensions increases risk tolerance and incentives workers to shift into jobs that offer a higher marginal value. The same is likely true publicly funded healthcare that untethers workers from low productivity jobs.

Notice that I am not saying increasing government consumption and investment in the NIPA tables might not be something to worry about if it were in fact true. Government consumption in the NIPA tables represents real goods and services that were consumed by government and those have real economic consequences. But worrying about the growth in transfer programs is a shadow game. Ultimately it’s just about the top 0.01% wanting to keep an ever growing share of GDI.

Nick –

In general, in a market economy, more is better. That includes oil.

However, if we have to reduce oil consumption, how could that be achieved? As you note, adaptation can occur in different ways. These include conservation, efficiency, substitution and reduced economic activity. At issue is the rate and scope of potential adaptation.

We can calculate the proportion taken by efficiency gains and reduced economic activity, respectively.

US Gasoline and diesel use since 2005 are down 3.2% (STEO data), and vehicle miles traveled are down 1.4% since that time (and 3.0% below the 2007 peak (US DOT HMVT)). Thus, the fuel efficiency gain, at least by these measures, is a pretty modest 1.6% over an eight year period. (This is a strange finding, and someone might want to check this independently.)

By contrast, vehicle miles traveled are about 9% off trend, from 2005 and allowing for the impacts of the recession.

Thus, since 2005, about 80-90% of the adjustment has come through reduced mobility, and only 10-20% through increased fuel efficiency.

However, this is not the whole story. US oil consumption as a whole is down about 9% from its peak in 2005.

As a result, we would conclude that sectors other than road transportation took the brunt of adjustment of reduced oil consumption. This makes sense. Consumers substituted where they could more easily, for example, in home heating oil use, which is more readily swapped out for natural gas.

But people clung to their cars as critical tools in their daily lives, and at least based on the statistics I could dig up, the mileage of this fleet is not a whole lot better than it was eight years ago.

So, Nick, the statistics do not tell a story of Porsches versus Teslas. They speak of 6 people in 100 (on average) who have been forced from their cars, with the remainder struggling to hold on, and not really wanting or able to improve their fuel economy by very much. That’s what the statistics seem to be saying, at least if I interpreted them correctly.

Menzie: I don’t think Salim’s point was that your post lacked enough labels, but rather the labels used were ambiguous. I for one think it’s obvious that simply repeating an ambiguous phrase does not render it unambiguous but I acknowledge that stating this might be necessary for the hubristic set.

Slug wrote:

Salim I’m not sure why we should particularly care that transfers are becoming a larger share of government spending.

Spoken like a true progressive – no closer to a true communist seeking to take wealth from producers and give it to the political class.

It seems people are choosing more efficient vehicles.

New car sales:

2005 total auto MPG = 30.3

2012 total auto MPG = 35.6

2005 total light truck MPG = 22.1

2012 total light truck MPG = 25.0

I chose 2005 because SK chose 2005 but also because that was around the peak year of light truck sales vs car sales (about 55%/45%. Since then the ratio has returned to about 42% to 58% – where it was in 1996 or so (the graph I have is a bit hard to read so these numbers might be off).

This doesn’t really contradict what SK says above, just that I think he underestimates how people have moved to more fuel efficient vehicles in addition to driving less. I imagine this trend will continue. I am looking for a new car to replace my 10 year old Chevy and I am insisting on at least 40 mpg highway. But I am cheap, so I might keep the Chevy who knows.

Regards.

kopits,

it is probably a combination of less use and greater efficiency vehicles accounting for the decrease in consumption, as you mentioned. while you are right, the fleet as a whole may be slowly revamping into higher efficiency vehicles, that does not mean use of such vehicles is the same. for instance, many people chug big suv’s around town, but when they travel greater distances they often have another car in the family which is far more efficient-and they use that for the trip. we do that in our family. these are trends which may be hard to pick up in the data, but I would guess this type of behavior is rather common.

Salim and Jeff: I have attempted to remove any ambiguity in this post. I hope this addresses your concerns.

From the soapbox.

I wish to highlight a very important statement made by Slug.

“Those transfers represent transactions between two parties and there is no a priori reason why both parties should be private sector agents. A transfer is a transfer is a transfer.”

This statement is a concise explanation of the current popularity of of modern Keynesian economic theory.

It needs to be noted that there is no distinction of voluntary transactions and involuntary transactions from command. In addition, incentives of the parties of the transaction do not matter.

Modern Keynesian theory is popular because it best describes the actions and consequences of a command economy. And we are in a era of rising popularity and power of authoritarian governments. Call it what you may, the Bureaucratic State, Unlimited Government, Socialist Democracy, Oligarchy, Monarchy, the Modern Way, or simply Tyranny. Whatever called, it is the normal state of human existence.

Several of the readers and contributors recognize this. But I suspect that several here are confused. They recognize the obvious intelligence and education of Professor Chinn as well as the knowledge of the use of Keynesian economics by of those contributors such as Slug. I ask that they keep in mind why Modern Keynesian theory is promoted in so many institutions above Classical, or Mises, or Hayek, or Friedman among others.

Modern Keynesian Economics works for the system of the governments mentioned above. The question remains is there better systems without such domination of command.

Menzie – Thanks. I certainly didn’t intend to imply that you’d misrepresented anything, but the ways that these labels get used is generally pretty sloppy outside academia.

2slugbaits – the reason I thought it was worth pointing out the compositional change within government consumption & investment, and the broader compositional change from G toward transfers is because these are pretty active policy debates right now. People who are arguing for higher unemployment insurance, for example, should know they’re talking about transfers, not G. Likewise, clarity helps to ease conversations between left and right. Can Chris Edwards (http://www.cato.org/publications/congressional-testimony/damaging-rise-federal-spending-debt) and Menzie both be telling the truth? Yes – but a noneconomist observer would be forgiven for thinking one of them was lying if the two of them don’t make a genuine effort to define their terms.

More substantively, 2slugbaits wrote:

The key is not the sector of the parties, it’s their willingness to transact. There is no assumption in economics that transactions involving an unwilling party are socially (let alone mutually) beneficial. Liberals typically care a lot about protecting people from asymmetric information, monopolists, and other market imperfections. Coercive transactions are pretty significant imperfections!

In order to protect human freedom, government has a duty to strive to make its intrusions as small and as beneficial as possible. Formally, among government’s goals is to make coercion a binding constraint rarely. (It has other goals, too, and thus tradeoffs).

Modern democratic governments do a decent job of non-coercion on the spending side: we have an all-volunteer military, jury duty is the only required civic action, etc. But taxation is always coercive, and I’ve been forced to buy a very large bundle of goods with my taxes, including an Iraq war, the No Child Left Behind subsidies, weird earmarks, and union rents on highway construction. There are plenty of things in the bundle from which I get consumer surplus, such as bike lanes and police protection.

So yes, transfers matter: they represent massive transactions in which one or both of the parties is not given a choice in the matter. The benefits they offer have to be traded off against their impinging on human freedom.

Menzie: Yes that does help with the exposition. Now maybe you’ll have time to address the substantive issues?

Random, Baffs –

You can see new car fuel efficiency here, from the indispensable Michael Sivak: http://www.umich.edu/~umtriswt/EDI_values.html

This UMTRI data would suggest greater efficiency gains than those calculated using road fuel consumption and vehicle miles traveled.

So would a supply-constrained oil model.

Something is not quite right here. Perhaps I’m looking at the wrong data, or in the wrong way.

Salim – Incredibly articulate comments.

Salim People who are arguing for higher unemployment insurance, for example, should know they’re talking about transfers, not G.

Okay, fair enough. Frankly, it never occurred to me that most educated readers of this blog would have confused the two, but you may well be right about that.

As to coercive transactions, in the real world there are very, very, very few cases when at least one of the parties isn’t coerced in one way or another. Non-coercive transactions are wonderful and if business and labor unions both eagerly want to expand private pension benefits, then I don’t think anyone is going to argue against that. But 99% of the time that’s not how the world works. T.H. Green showed us more than 150 years ago that we can do better than negative freedoms.

So yes, transfers matter: they represent massive transactions in which one or both of the parties is not given a choice in the matter. The benefits they offer have to be traded off against their impinging on human freedom.

Just to be clear, I was not saying that the size or motives or targets of transfers do not matter. My point was that there is nothing inherently special about transfers in which both parties are private actors and transfers in which one of the parties is the government. I don’t have to think too hard on the matter to come up with plenty of coercive transfers between two private parties.

Ed Hanson Modern Keynesian theory is popular because it best describes the actions and consequences of a command economy.

This is quite possibly one of the stupidest and ignorant comments I’ve read on this blog in quite awhile. Keynesian economics is agnostic about government transfers. Keynesian economics is about using fiscal and monetary tools to stabilize output due to fluctuations in aggregate demand. Keynesian economics has a lot to say about how much we spend on government consumption and services (i.e., the stuff in the NIPA tables), and nothing to say about transfer programs. Many Keynesian economists also like transfer programs, but for reasons that are completely unrelated to their Keynesian views. And vice versa. For example, Martin Feldstein is a very conservative economist who works in the Keynesian tradition and yet he is very opposed to Social Security. Part of the problem might be that you might be one of those folks that Salim worried about who did not understand the difference between “G” and government transfers. So I guess this is evidence that Salim had a point there.

And oh by the way, Milton Friedman also worked within the Keynesian tradition…he just focused on the old “LM” curve rather than the “IS” curve.

Steven, thanks. The driving index was interesting I had never seen it before. I guess it is taking a while for the efficiencies in new cars and trucks to be reflected in the index. It seems kind of stuck.

When two private parties trade they do so based on value. Value is subjective, in the mind of the beholder. Value lies at the core of economics. This issue was settled well over a century ago. If one party wants a good or service, and the other wants to exchange it, the transaction that takes place is not coercion. Similarly with the exchange of labor for a wage. Anyone can choose to not work. Of course there would be consequences in not working. But the choice is there. Other than for criminal acts, and externalities, coercion is a trivial residual in the private sector. Coercion emanates almost wholly from government.

The question is how much. That depends on the individual. If an individual perceives that the government spends too much (does not give enough value), that person is being coerced. The coercion takes place when tax dollars are taken out of that person’s income. When deficit spending that accrues to debt puts the individual on the hook for some future liability, that also is a tacit form of coercion.

As the informational costs to any individual of calculating and knowing their pro rata share of each and every item of government are beyond the pale, no individual knows exactly how much they are being coerced (or not). As a practical matter, the whole thing goes into the political arena. If government were of an optimal size, and grew in some fixed proportion to the growing economy, making exception for necessary wars and the like, the feeling of coercion would in that case be limited to that small segment of the population who wanted still smaller government than that of “optimal.”

Ninety-two percent of Republicans and 56% of Democrats believe government is too big. Overall 72% of the public believe “big government” is the gravest threat to their future (Gallup). This is a measure of coercion. I have no way of knowing what the optimal amount of coercion is. I suspect the theoretical optimal amount is zero. And that zero could be asymptotically approached in theory, though with great difficulty in practice. But we do not have to know. Government merely needs be cut back iteratively to a level where it is no longer problematic in the eyes of the public.

As this is mostly about money (society’s scarce resources), growing the pie is of first order priority. That will not happen with government at its present size. If the public were aware of this, there would be changes at the voting booth. Possibly even a constitutional convention, if the political system is as corrupt as I believe it is. One thing for certain, the masses are going to have to become informed. It would be easy enough for the media to do this. If the mainstream media would cover the pertinent points, and tell the truth. Neither of these conditions obtain in this first decade of the 21st century. So getting the public informed would appear to be the first order of business.

As it is, the public is lied to constantly by the media and politicians on both sides of the aisle. The truth gets spun into half-truths and worse. The public gets kept in the dark. The culture morphs away from ethics and morality, away from the Judeo-Christian heritage, the ancient legal roots of the Anglosphere, and the exceptionalism of this nation. All too many are unaware there is no such thing as a free lunch. Personal responsibility and accountability are going by the wayside. It is “ask what my country can do for me”; and the end justifies the means, nearly any means. All this affects the economic sphere and degrades growth. Keynesian economics, other than its value as a short-run palliative, is on the dead wrong side of this. Keynesian economics, by enabling growth of government, is part of the problem. Keynesian economics is in this sense coercive.

What is the difference between gov’t spending on goods and services and gov’t budget? Here’s my calc showing the U.S. federal government currently manages about 23% of the U.S. economy, slightly below the peak in 1983. What am I missing?

http://supportingevidence.com/Government/fed_budget_as_percent_GDP_over_time.html

Ed Hanson: I should like to answer the question you ended your interesting post with. Peripherally, before I do, I’d like to punctuate your observation about tyranny as the “normal state of human existence”. You may not realize how right you are. We can look back 7000 years and see some 25 civilizations having fallen. The end state of the polity was always tyranny. In 1776, one of the brightest, most educated, most farseeing group of men in all of history gave this nation a form of government the world had never seen. Ancient Athens being the closest contender. It was a step function advance all mankind could look to to improve its lot. Above all else our forefathers did their best to insure that tyranny would be held in check. The Constitution which followed a decade later had one objective. To ensure individual Liberty, the greatest threat against which is the tyranny of government. They sagaciously left a note for all future generations that this was the sacred thing that needed careful tending and nurturing. Even at the cost of blood, so sacred is it.

Now for the proper economics. The proper economics requires a proper moral, ethical, and legal structure undergirding it. I shall assume that. The proper economics’ essence starts with sound money. Gold is the quintessential money. It cannot be debauched. Fiat money with a fractional reserve system is at the opposite end of the spectrum. Economics must put the national surplus first. Keynesian economics does the exact opposite. It matters not that consumption is the end desire. Savings is the starting point. And, real savings (abstinence from consuming scare resources) must be set aside before any investment can take place. Savings goes to investment, which builds the capital stock, which is the only thing that makes workers more productive. Productivity, of course, is the essence of real growth and rising standard of living.

The business cycle should be dampened to its natural level. The cycle has been artificially amplified by credit and the financial system. The cycle should be dampened, not done away with. Since like the poor, the business cycle shall always be with us. But dampened down to natural so that the swings are not so devastating to long-run potential. These swings come from excess credit buildups. And from unnecessary inflation cycles. This goes straight back to sound money. If you don’t grasp sound money, you won’t get the rest.

Free markets. The price system is a marvelous thing. Since markets are less free in proportion to the size of government, this means limiting the size of government. The government should be limited to optimal size. Optimal size includes space for defense, legal system, diplomatic relations with the rest of the world, and elements of industrial and trade policy. The proper economics recognizes that most though not all other functions are best devolved to or left with lower levels of government that are closer to the people who are on the scene. If you don’t like living in Wisconsin because there are people like Menzie – it’s a joke Menzie; your adherence to an ideology gone a bridge too far notwithstanding, this excellent blog is sufficient in itself to make you a valuable asset to WI – you can move to Texas. A one-size-fits-all big national government, which is what this nation has turned to, is the antithesis of proper economics. This is so because big government degrades potential growth. Not right-size government, but overly big government. And it is so because entrepreneurial spirit is a fragile, highly idiosyncratic thing. Homogenization and bureaucratic diktat is its enemy. Whenever you take choice away from people (by excessive regulation, taxes, and so forth), you cut away at the core of what it is to be human. Nothing is more sacred to an individual than free will.

The proper economics must have an appreciation of time. That is, the short-run must be given its due, and the long-run its. This Keynesian economics definitely does not do. Following directly, this means that the federal government’s budget must be prudently managed. It must be in balance already by the medium-term, and definitely in the longer-term. Going back to the beginning with (truly) sound money, you will find that the business cycle will be far tamer this way. The problems caused by excess credit and excess bank lending and leverage, without the real resources saved to back the credit up, will not arise. The credit-interest-leverage cycles of the past 100 years need not have been so onerous. Prophylactically, as a consequence, the need for Keynesian stimulus would have been mostly a moot point. Automatic stabilizers and not much more are enough. The “much more” would be called on only in the event of exogenous shocks. The Federal Reserve has been the most ill-conceived, pernicious institution this country ever created. It is not even a part of government, so voters have virtually no say. The Fed gave us the Great Depression, the Great Stagflation, and the Great Recession … and exacerbated nearly all the smaller cycles in between. Potential growth has been sheared like a sheep this past 100 years in the process.

One more thing the proper economics must do. And that is to lay out the rationale and theory for US trade vis-à-vis the rest of the world. The assumptions that underlay the conventional Ricardian theory of comparative advantage are not met in the real world. Ross Perot was right about NAFTA. “Free trade” as cheered for by the reigning economics paradigm has devastated this country. There must as much as possible be free markets domestically . But the US – from the standpoint of the welfare of the average American – must never take an unexamined free trade stance. The rest of the world does not; and even if the rest of the world did. Manufacturing is the sine qua non of potential growth. The manufacturing sector must be allowed to brew its state-of-the-art leading edge technological innovation in an unbounded creative cauldron. And that leading edge must be protected, not offshored. It will fly like the wind otherwise. And much of the well-intentioned and costly US government R&D will be captured in a heartbeat by the rest of the world. Domestically domiciled global corporations could care less. They have no allegiance.

In summary, a modified Austrian economics is the proper economics. Modified to bring gold-backed dollar, short-term Keynesian remedy, the common sense ancient wisdom of prudent budget balance, and a truly proper dynamic, long-term-oriented trade theory all under one roof. It is apparent to all but those blinded by ideological cataracts that the present paradigm – Neoclassical Keynesianism – is not working. Their solution is to do what is not working in even greater dosages. A proper economics would not countenance that. The points where the cries are the loudest are precisely those most in need of change.

Scott, I looked at your graph. Maybe you need glasses! Or I do.

It looks more like 21.x% not 23. And it doesn’t look like 1983 was the peak – 2009 appears to be the peak (The Great Recession?) and it looks like a steady decline since then and is currently lower than the decade from 1980 to 1990 – the Golden Era of St. Ronnie. So besides the worst financial crisis since the Great Depression, all within range?

To me the word “manage” implies some kind of control. And I grant that collecting FICA taxes (for example) from employers and employees and then turning around and sending them out in the form of Social Security checks to seniors is a huge administrative task, but the seniors themselves decide how to spend the money be it on slot machines, cat food, or bus tours to Dollywood. Presumably private businesses profit from these transactions as they would if you bought some bottles of wine and a new Lexus.

Salim, unemployment insurance in my state is just that…insurance. Employers are required (coerced!) into paying the premiums for it on my behalf. If I should become unemployed I can draw on that account. More like a medical savings account, really. We can agree that extended benefits in some cases is a transfer. Maybe I am wrong, but it always sounds to me like you guys want to go back to the boom and bust cycles of the late 1800’s.

Regards.

Slug

My comment is neither stupid nor ignorant. Perhaps you did not understand it or maybe the case is you did understand it and caused you to use slurs as a mode of attack. Either way, since you are not yet ready to see Modern Keynesian theory in such stark terms, I am quite willing to make the effort of meeting half way to promote understanding. Please feel free to think in terms of MKT giving cover for a command economy, as you yourself alluded to.

I note that you did not return to “A transfer is a transfer is a transfer.” It is true that it is an important part of Keynesian theory, but so sadly untrue in the real world.

So be it, lets move on to your latest post. For brevity, let’s work with;

“Keynesian economics is agnostic about government transfers. Keynesian economics is about using fiscal and monetary tools to stabilize output due to fluctuations in aggregate demand. Keynesian economics has a lot to say about how much we spend on government consumption and services (i.e., the stuff in the NIPA tables), and nothing to say about transfer programs.”

On its face, stabilization means command from the few from above to modify individual decisions of the many. Yes, it is somewhat capable of that stabilization, but as history demonstrates, at the cost of long periods of low growth and stagnation. You may be satisfied with such results but, I am not. For one thing, the cost of power granted to the few is too high. No, Keynesian economics is not agnostic about government transfers, but for argument sake, let’s work with that premise. This means that Keynesian theory has no room in theory for private property. It can not see that the evolution of private property for the many as a major engine for the miracle of great prosperity that has been the result.

Let’s now move to Milton Friedman, and correct the record. Friedman was trained and spent his early career with Keynesian theory. In addition, he acknowledged that the vocabulary of Keynes became the vocabulary of economics. But that does not mean the same as he “worked within the Keynesian tradition.” But feel free to think that it does. I would gladly trade that point, for you to embrace Milton’s belief that all government spending (yes, that includes transfers) should be reduced to less than 10% GDP.

Go rent “Free to Choose” and watch again and again, it could only help you but I suspect you are too sophisticated for it.

Random –

Fuel economy gains have slowed this year. Ceteris paribus, people prefer bigger, more powerful cars.

It is perplexing, however, that nameplate fuel economy improvements do not appear to have shown up in measured efficiency data. I think they should have, as more efficient vehicles cascade year after year into the US vehicle fleet.

Jim has written about the topic some time ago. Perhaps we could prevail on him again during the holidays to take a fresh look at the matter.

JBH: Just curious. When you write:

Do you mean that anything not of the Judeo-Christian heritage is therefore not worthy of being the basis for ethics and morality?

Menzie

In partial answer to your curiosity toward JBH.

The Abolition of Man by C.S. Lewis

Perhaps you will be surprised at the use of the Chinese word Tao by one of the best Christian thinkers.

I checked, the U of W Library has it.

Some thoughts on target audience. I am clearly for an ever bigger one.

But we can weight target audience by the comments above, put into five categories: Critical, Supportive, Response to Critical (Supportive), Neutral, and Other Topic.

Of 40 responses, excluding this one:

Critical: 13

Response to Critical (Supportive): 5

Supportive: 3

Neutral: 5

Other topic: 14

If we exclude “Other Topic” as irrelevant for target audience purposes, then 69% of responses were either “Critical” (50%) or “Response to Critical (Supportive)” (19%). By contrast, 31% were Supportive or Neutral.

Based on the sample of comments to this one post, Menzie, your target audience appears to be principally your critics and those prepared to engage them.

This matters, because of course you could censor critical comments, just as Reddit has elected to do. (http://dailycaller.com/2013/12/18/reddit-bans-comments-from-global-warming-skeptics/) In principle, that would drop on-topic comments by up to 70%, it would seem.

Your target audience, it would appear (at least from the commenters’ perspective) are those coming to debate.

JBH

Thank-you for your post, I will try to be brief but there is a lot of grist to what you wrote.

As for tyranny, yes, I tried to be historical, but I always question as best I can how right I am.

I could not say it better about the need for a “proper moral, ethical, and legal structure undergirding” economics. As for that, all culture in general. Supply must come before demand, however economy came before money. There are trade offs that come with a gold standard, which change depending on the details of the system. As there are trade offs with fiat money. And a fractional reserve banking system. And a Central bank. Saving, investment, and especially the allowance for human capital – the human mind are most important. Too often brushed aside by Keynesian theory.

I do not have an answer to the business cycle. The Austrian business cycle model has much to say. I believe in sound money. I do not believe in debasement is a good thing, but I suspect we would disagree with how to define sound money.

Free markets.. Sometime the world may have it, but I doubt it. But as you write, it is an ideal to strive for.

The US Central Bank has a overall terrible record. No disagreement. I still expect a central bank of more limited power could be positive in trade off, but I do not hold my breath to see it. However, I do understand some of its problems. For example, remaining with the discussion of modern Keynesian theory, the additional employment mandate given the Fed an impossible task. This Phillips Curve type of mandate is impossible for it, but as a law abiding entity of this country, it is obligated to try.

I am a strong supporter of free trade. I am not a supporter of over reaching global treaties that created the WTO. The trade offs gained are greatly countered by the bureacracy, power politics, and just plain slowness in response. I have less problems with NAFTA, it is close enough to by lateral free trade agreements that I think are simpler. Yes, there is manipulation of all nations under the guise of free trade, such is life. Free trade or Freer trade creates wealth.

I have great respect for Austrian Economics, depending on which variation it is. But all varieties understand that the best economies are emergent, not top down command types. Where you mix some Austrian with short term Keynesian, and other aspects, my combination is Supply-side, Friedman freedom and limited government.

2slugbaits wrote: “in the real world there are very, very, very few cases when at least one of the parties isn’t coerced in one way or another”

Really? I imagine that you can easily find some example of coercion and some example of non-coercion. But if you actually believe that “very, very, very few” (maybe

jbh, your lengthy anti-Keynesian rant cracks me up!

your fixation on gold is baffling. you really want the nation’s and the worlds economy to be held hostage by those who control the gold trade? not very democratic!

I think you do not fully understand Keynesian theory-and I will admit to being a novice in this area. but my understanding is Keynesian analysis illustrates the effects of drop in aggregate demand in particular, and the need to support this aggregate demand drop. in reality, this should be done by the private sector. but they become selfish in this regard, and cut rather than support the economy. the hope is somebody else out there will sacrifice for the sake of demand-very selfish behavior. in this case, the only other option is for government to step in and boost demand. Keynesian theory does not directly say open the government spigot. it simply says open a spigot! when the rest of the economy fails, government must stand in at last resort.

as you say “The culture morphs away from ethics and morality, away from the Judeo-Christian heritage, the ancient legal roots of the Anglosphere, and the exceptionalism of this nation.” this is what happens when the private sector fails to do its job and leaves the economy vulnerable.

Steven,

Shouldn’t we be celebrating an example of Hayek’s creative destruction of obsolete industries? Isn’t it clear that fossil fuels have massive real external costs (pollution, security costs, etc) whose recognition would greatly accelerate the inevitable transition away from fossil fuels?

Okay, let’s examine specific arguments:

In general, in a market economy, more is better. That includes oil.

No, it really doesn’t Oil is an input, not a valuable output. We value transportation, status, and finished goods, not oil.

Ceterus paribus, wouldn’t we choose a high mileage vehicle over a low MPG vehicle, and minimize oil consumption??

It’s true that oil consumption has correlated with GDP, but lots of things can move people and goods, and a Tesla is just as good as a Porsche for status.

However, if we have to reduce oil consumption…

Again, we see an unstated assumption that oil consumption is good. In fact, the faster we reduce oil consumption, the faster we can reduce pollution, trade deficits and become a trusted party to ME peace negotiations, rather than the supporter of midieval royalty.

As long as you approach this subject with the assumption that oil is good, and that the transition away from it will necessarily be bad, you’ll find yourself misled.

At issue is the rate and scope of potential adaptation.

Not really. We could adapt far more quickly than we are, with better public policy. At issue is the rate and scope of *current* adaptation.

We can calculate the proportion taken by efficiency gains and reduced economic activity, respectively.

Actually, we can’t, at least not with this approach. That’s because we’re in the middle of a generational, historic shift away from a car culture. If you look carefully at the VMT numbers, you’ll see that the annual rate of growth started declining well before the 2004 increase in oil prices.

Young people own fewer vehicles, and drive fewer Vehicle Miles Traveled (VMT) out of choice, not necessity. This is in part because of alternatives for socialization (smartphones, Facebook, etc), and in part due to a recognition of the external costs of ICE vehicles, especially climate change.

We see this shift equally in employed and unemployed young people, and across income levels.

…this is not the whole story. US oil consumption as a whole is down about 9% from its peak in 2005. As a result, we would conclude that sectors other than road transportation took the brunt of adjustment of reduced oil consumption.

Much of the reduction in consumption happened outside of households: businesses are more sensitive to costs, have better access to alternatives, and perhaps most importantly, have much better economies of scale (e.g., fleet managers can research costs far more efficiently than housespouses).

Menzie: I did not mean “anything not of the Judeo-Christian heritage is therefore not worthy of being the basis for ethics and morality.” China’s traditions of Confucianism, Taoism, and Buddhism evolved in step with Chinese morals, ethics, and culture. This worked for China. Quite different in the West. As Western Civilization arose out Greek and Roman Classical Civilization, Judeo-Christian traditions informed morals, ethics, and culture in the West. This worked for the European continent, Great Britain, and other English-speaking countries including the US. The protestant work ethic was a powerful force in the ascent of the British Empire and the American Empire that followed. Around the time of Roger Bacon, modernity with its emphasis on scientific and rational reasoning arrived on the scene. But the mores were already inculcated and were kept alive by the religions of the West. Science and religion were able to coexist. And this mixture supported the greatest takeoff in economic growth in history. I brook no ill feelings toward any religion. Nor toward people who have thought their way to atheism or agnosticism. Likely the world would be a better place if religions were more inclusive rather than exclusive. But postmodernism, with its hallmark characteristics of relativism and disdain for tradition, is an errant path I do not like to see this nation go down.

salim, I believe 2slugbaits implies that most transactions are not fully transparent and thus an element of “coercion” does exist. this is typical of the asymmetry of information available to the parties of a transaction. withholding pertinent information is seen by some as simply maximizing information for gain. but if that information were available to both parties and resulted in a different outcome, then one party would certainly feel coerced into that transaction. coercion can take many forms and disguises.

Salim As I hinted with my earlier reference to T. H. Green, coercion can come about due to the absence of negative liberties or due to the absence of positive liberties. Negative liberty without the means to actualize that liberty is an illusion at best and can be coercive at worst. Just to take your trivial supermarket example, having the legal right to shop at a supermarket without the practical means of being able to do so effectively means people are coerced into buying cheap hi-fat, hi-carb foods at the corner Kwikee-Mart. There are such things as food deserts in many of our largest cities. Having the “freedom to choose” without having meaningful opportunities to choose is a cruel joke. It’s a joke that very few middle-class folks have to experience, but not everyone is middle-class. Endowments matter. The freedom to starve is not meaningful. Ever hear of the prison industry cycle in the south? You also asked if I’ve ever been hired. Well, as it happens I do work for the government, and while my position puts many restrictions on what I can do (e.g., I am not allowed to quit or retire without the government’s concurrence), those were at least conditions that I understood when I was hired. So in that sense I don’t think those terms were coercive. But before I worked for the government I worked for a communications company that retroactively imposed post-employment restrictions on what I could do even though none of those restrictions were part of my original hiring. And the big business friendly courts have allowed those kinds of things for reasons we don’t need to go into here. Going back to pension plans, the courts have allowed private sector raiders to steal pension funds, leaving pensioners with no recourse. How is that not coercion? During the recent mortgage crisis private sector agents used plenty of coercive techniques against people with little ability to defend themselves. Seizing homes without even bothering to go through the untidy business of due process. Even wrongly seizing homes that were owned outright by the homeowner who didn’t even have a mortgage! Stuff like that.

On balance most of the kinds of transfer payments in the federal budget go towards helping the old, the weak and the unfortunate. I don’t think the top 0.01% should complain too much about having to pay higher taxes to support those transfer payments since that same top 0.01% also uses that same government to enforce (read “coerce”) extractive policies against the weak.

I’m not sure I understand your comment about me supposedly rejecting non-Marxist economics. Quite the contrary. I have little patience with Marxist economics. But I also have little patience with much of the naïve freshwater view of the world that simply sweeps hard but inconvenient realities under the rug. As I said, endowments matter, frequent misinterpretations of Coase notwithstanding. The fact that many people have become resigned with coercion to the point that they don’t even recognize it as such says a lot. So maybe I’ll agree with Marx’s “false consciousness” thing, but not his labor theory of value economics.

JBH After reading your post I think you half expect there are hundreds of millions of radical sans-culottes Jacobins running the country, ready to put down any simple businessman who wants to get ahead. A takers-and-makers version of history. Here’s a clue: the rich are doing just fine. There’s really very little risk that the government will seriously threaten their liberty. A more likely story is that the rich control the levers of power and coerce the poor far more than the other way around. And if you’ve ever read any game theory stuff on the economics of predation (and I’m pretty sure you haven’t), then you would know that increasing transfer payments to the poor is an optimal strategy.

Ed Hanson So Friedman’s “Freedom to Choose” is your idea of a book on economics? Sorry, but that was high school reading material. Friedman was not an Austrian. You sound like a lot of people I know who claim to follow Austrian economics but have never actually read any Austrian economics. Instead, they usually read political tracts written by people who also happened to be Austrian economists. I seriously doubt that you have ever read what they actually say about economics beyond the claptrap stuff about freedom, malinvestment cycles, blah, blah, blah.

On a personal note, I get a little annoyed when people talk about Friedman’s book “Freedom to Choose” as some kind of libertarian anthem. And Friedman should have been at least a little more sensitive because many decades ago one of his graduate students offed himself. I grew up in Chicago and he was a friend of mine, living right across the street. A few months after he got his Ph.D. he took that freedom to choose stuff to heart and committed suicide. A recently minted University of Chicago Ph.D in economics who was having a very hard time reconciling what he learned in graduate school with the real world just outside Hyde Park. While Friedman knew he died, I don’t think Friedman ever knew that it was by suicide because the official report showed accidental overdose. But then again, the medical examiner never saw the note either.

Steven Kopits: The commenters are not representative of the target audience (or even audience). I know this because I can see IP addresses coming in; there are about 1000 distinct visitors per day. There are certainly not 1000 comments per day. In addition, I talk to people in the USG and other policy institutions who read this blog, but do not comment. So, your poll is neither here nor there.

Salim,

You write quite well and express your opinions in a compelling manner, but when you say (I paraphrase): Government transfers/transactions are coercive but private ones are not, then I don’t think that you’ve fully thought it through:

Your argument is based on the assumption that in private transactions you can opt out:

” Even private “package deals” (say, a non-drinker who pays full price for an alcohol-included cruise) aren’t coercive, since the teetotaler could have opted out of the cruise altogether.”

This kind of “opt out” is available to you when it comes to government transactions too: you don’t have to pay taxes, you can opt out by not having a job.

That statement is true about work too: I don’t have to work to make a living: I could choose to live under a bridge and beg (or perhaps choose to be born independently wealthy?)

It’s technically true, but it really is a practical un-truth.

So, IMHO, there really is little difference between government transfers and private party transfers.

To illustrate the point consider my health-care insurance situation: I’m covered by my wife’s insurance, and rejected the coverage by my employer. I don’t get to pocket the savings that my employer makes by not having to cover me. So insurance (transaction) by the (private) employer and me (the individual), is coerced, exactly the same as if I was using Obama care. No Difference at all! I must accept the cut in my salary that would have been spent on insurance premiums.

(Yes there might be differences in price and in coverage, but your statement was that private transactions are not coerced, while government transactions are – Not accurate.

I give you 1/2 a point if you modify your statement to: Government (mandated)transactions have the weakness that they are tempting to manipulate for profit and political influence, and thus should be carefully scrutinized and perhaps be minimized.

If that is what you are trying to say, then I fully agree.

“…people are coerced into buying cheap hi-fat, hi-carb foods at the corner Kwikee-Mart.”

Oh, please.

So you think management at Kwikee-Mart says, “Gee, our customers would rather have vegetables, but let’s sell them Twinkies instead.” Shelf space is at a premium, guy. Inventory turns are critical. They sell what people want to buy.

Slug

Take a breath, you seem to be losing it.

Salim’s definition of coercion seems clear to me. He is saying that if you have two choices A and B that are available to you and you would have chosen A, coercion occurs when some third party provides an incentive to choose B instead. That incentive is the threat to do something that you will not like–with imprisonment, death, torture, assault, violence, etc. The threat does not have to involve bodily harm. If someone threatened to expose some embarrassing detail unless you choose B, that would also constitute coercion. On the other hand, if someone offered to give you a gift if you choose B rather than A, that would not be coercion.

Commenters are attempting to define coercion in a completely different way. They are saying that choices B and C are available but you’d really rather choose A, but A isn’t an available choice. That’s not coercion in the sense that Salim is using the term.

Are they somehow equivalent? No. Every transfer always has an underlying decision to tax or borrow behind it. Taxes are coercive in the sense that Salim is using the term. And, while borrowing is not coercive, ultimately it involves coercion since taxes must be raised in the future to finance the borrowing.

Taxes and borrowing are important to focus on since they have economic consequences. As students of economics know, the deadweight loss from taxation is proportional to the tax rate squared. Thus, as taxes double, deadweight losses go up four times. Taxes also have negative incentive effects.

There is also a moral element. The coercion behind taxes is inconsistent with personal freedom. Although we may have reasons to support some level of taxes, we have to remember the costs to liberty too.

Thus, transfers are important to worry about since they have economic consequences and they are inconsistent with personal freedom. This is not to say the the level of transfers or taxes should be zero but rather to say that we may legitimately question the current and projected level of taxes, borrowing, and transfer payments.

Nick –

Creative destruction is the replacement of an existing product or service with one which is superior, with superior defined as better or cheaper. Right now, we have no better or cheaper ready alternative to oil.

Right now, we have no better or cheaper ready alternative to oil.

Yes, we really do, although the reality is much more complex than that comment suggests. There are a number of unstated premises hidden in that comment.

First, it doesn’t make sense to talk about a single alternative. There are a number of uses for oil, and each is different. There are some for which there are obviously better and cheaper alternatives, but which still use oil in surprising quantities, including: electrical generation; space heating; industrial process heat; petrochemicals, etc.

Most of the rest of the uses can be broken into many niches, each of which needs different solutions and which have different cost/benefits: taxis are very different from commuter cars; commuting is very different from recreation travel; local delivery is different from long haul trucking; ferries are very different from long-distance container vehicles.

A few uses will be challenging, like aviation and long-distance water shipping – they account for a relatively small percentage of overall consumption. Others, like taxis, will be pretty easy.

The history of oil is a long line of applications which have been replaced by better and cheaper alternatives: the first 30 years of oil was basically kerosene for illumination, which was replaced by electric light; Edison’s first electric generation plants were oil-fired, and 20% of US generation was oil-fired in 1979; space heating was big for a long time;, etc.

2nd, there’s no reason that alternatives have to be liquid fuels: there was a notorious study several years ago (Robert Hirsch) which concluded that mitigating Peak Oil would be expensive and slow, which completely excluded from the analysis hybrids and EVs!

3rd, Many cost benefit analyses are very incomplete: hybrids are a partial alternative, and are already the cheapest form of car. Pure EVs are cheaper than their ICE counterparts. But, that’s only the case over their lifetime: if you stop the analysis at 5 years, alternatives with greater capital cost are penalized. Similarly, the lower maintenance costs for EVs need to be included.

4th, learning effects and economies of scale have to be included: the Chevy Volt has a small battery and a generator: that configuration is inherently inexpensive, but GM is still paying off the costs of development and ramping up production. Eventually, extended Range EVs (EREVs) like the Chevy Volt will be an obviously better and cheaper alternative, with 10% of the fuel consumption.

Keep in mind that oil was dirt cheap for more than a century, and has only been moderately expensive for about 8 years: that’s not long enough for many industries and people to switch from short term elasticity to long-term elasticity mode.

5th, and perhaps most importantly, we have to take into account external costs. Oil has appeared very cheap, when in fact it was never cheap. Climate Change is very expensive. Oil wars are very expensive (estimates range from many 100’s of billions to the trillions). Heck, Professor Hamilton attributes much of the Great Recession to Peak Oil. Well, the GR vaporized what, 6 trillion in capital? If Peak Oil is responsible for 50% of that, that’s a cost of $3 trillion, or about $10 for every barrel consumed in the last 10 years!

If we fully load oil with all it’s costs, we’ll find that it’s not nearly as cheap or wonderful as we thought!

On Dec. 17 baffling wrote “…there is a max cap on SS and medicare tax…”

That is incorrect. There is no cap on Medicare tax on wages.

(In addition the ACA added the Medicare tax on all income, including dividends and capital gains, on all joint income over $250k.)

Furthermore the social security benefit is highly “progressive” with respect to lifetime contributions. You receive less benefit relative to contributions the more you contributed.

Higher income retires also must pay income tax on benefits. They also must pay more towards Medicare expenses.

tew,

social security taxes are “progressive”. so what? they should be, and the benefits should be taxed at higher levels for higher earners. that is how you keep the system sustainable. it is NOT a pension plan.

same thing with medicare. but nevertheless the older wealthy do benefit from medicare-immensely. you think a 75 year old could buy an affordable health care policy in the private sector? good luck with that!