Quick links to a few items I found interesting.

Now-Casting.com reads current indicators as signaling an improving global economy. They project that real GDP will grow in the U.S. at a 3.4% annual rate, in the Eurozone at 0.8%, and in China at 8.3% for 2014:Q1.

Via Mark Perry,

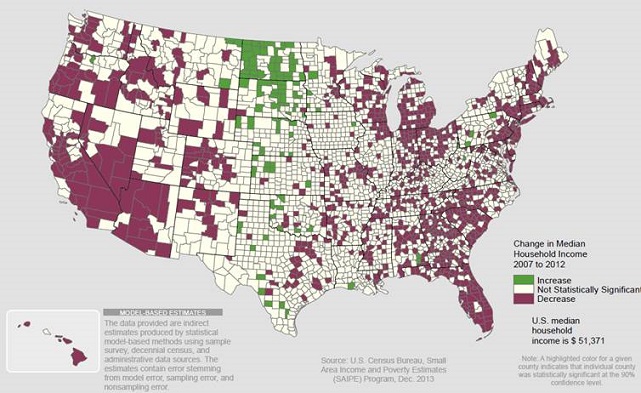

this map from the Census Bureau shows that the U.S. counties where median income has been growing are those where supply-side factors related to surging oil and natural gas production are driving the growth.

|

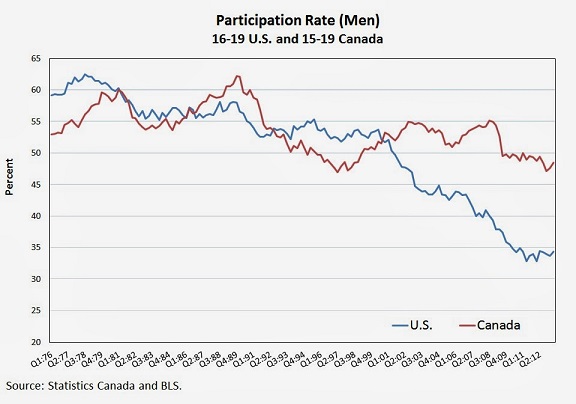

And David Andolfatto has some interesting graphs comparing recent trends in the labor force participation rate between the U.S. and Canada. For example, the teenage exit from the work force has strictly been a U.S. phenomenon.

|

The chart at the topic suggests that energy is the driving factor behind economic growth.

As for the labor chart, it appears we should blame it on Bush.

Professor Hamilton,

California, the Pacific coast and the Southwest look like a disaster zone on the map. Do you have any thoughts regarding what seems to be a dismal economic showing?

Professor Hamilton notes:

And David Andolfatto has some interesting graphs comparing recent trends in the labor force participation rate between the U.S. and Canada. For example, the teenage exit from the work force has strictly been a U.S. phenomenon.

Can you say “minimum wage?”

AS–

It’s called neo-liberalism and open borders.

Is Ricardo unable to look up the minimum wage in Canada? Every province has a higher minimum wage than the US. I think the lowest is about $10C. With currency conversion, the Canadian minimum wage is not quite $2US higher than in the US. And that’s the lowest. All provinces set their own, but $9.95C is the lowest.

To Steven’s point about oil and growth:

https://app.box.com/s/woucm592gcxcz9wzc797

https://app.box.com/s/6q23ylhjnfk591nrxrku

https://app.box.com/s/25angkfxm3yuh86hpmfq

What would US oil extraction and the associated growth look like without the growth of US and Japanese supranational firms’ boom in FDI to China for US and Japanese firms’ subsidiaries’ operations in China-Asia?

What happens to US oil extraction and exports when FDI to China-Asia further slows or contracts with the inevitable deceleration of growth of China’s economy, particularly fixed investment, production, and exports to the US, Japan, the EU, and intra-Asia?

What a gem David Andolfatto is. Fantastic international comparison charts.

I can’t believe I’d never visited his site before.

Jonathan,

Dig deeper!

In US states also set minimum wages (Washington State $9.19 and Washington DC $11.50). Canadian minimum wage for under 500 hours experience is $6C (Only one state has a Youth/Training lower than the federal $7.25).

There is another consideration. It is not so much the size of the minimum wage (though a complete analysis including taxes and cost-of-living will show the US and Canada compatible) it is more the change. When the minimum wage is increased every year as it was in the US at the start of the Great Recession you have serious dislocaiton of those workers at that level.

It is no secret that changes in the minimum wage reduce teenage employment.

But you are free to live your illusions if you will only not force them on us.

The chart at the topic suggests that energy is the driving factor behind economic growth.

No, it really doesn’t. It simply suggests that when oil is expensive, owning mineral rights and producing oil will be very profitable.

I would agree that “extra-somatic” energy is pretty essential to industrial civilization, but so are metals, water, and many other things.

The driver of economic growth is the human ingenuity that makes use of resources, whether they are energy (wood, coal, oil, uranium, sun and wind) or other resources.

The idea that fossil fuel holds a privileged place in the pantheon of resources is simply a conceit fostered by fossil fuel companies in their pursuit of protection from proper accounting for external costs like pollution and geo-political security risks.

I looked up the dates on the county by county change.

It’s from previous Peak to essentially recession bottom (07 – 12)

It sort of make sense that the economically most active/successful counties would be hit worst by the Great Recession.

If, on the other hand, your county was economically lagging, or focused on agriculture or energy production, then you’d stand to gain from the growth in Chindia/BRIC.

Still true, but not so surprising, and it doesn’t hold too much policy value, i.e. Texas doesn’t seem to have benefited too much from the oil boom – most likely because it was already extracting a lot of oil. The true benefit comes from developing new economic activity where none existed before the recession.

That’s the same as saying: “You get richer by making more money”.

Perhaps I am from a younger generation who grew up on basic economics, after the supply-side school was thoroughly refuted.

While all economists believe that increasing LRAS will benefit society, I am failing to see how an energy boom is “supply-side” economics.

Long term growth depends upon:

(i) increases physical capital.

(ii) increases in human capital.

(iii) increases in technology.

While almost all economist agree with this view, there is substantial disagreement on what “supply-side economics” is.

Most people equate supply-side economics with slashing top marginal income tax rates and deregulation.

Perhaps, you are a correct, that this “supply-side” recovery is the result from deregulating energy.

However, as your map clearly shows, most of these gains are coming from North Dakota, where a California mall has more people shopping in it than the whole state of ND.

I am skeptical to believe that “supply-side” factors are responsible for this “growth”. If they are, it is strictly due to deregulation, and mostly selling off our natural assets, for private gains.

Anyways, I am interested to hear about the “supply-side” success story of ND, and how this successful story can be achieved on a national level, using the same basic economic principles.

Plus there’s like 650k people in all of North Dakota. Greater Los Angeles has, what, 11 million? So a booming energy sector has more impact.

Ricardo says “When the minimum wage is increased every year as it was in the US at the start of the Great Recession you have serious dislocaiton of those workers at that level.”

But the graph shows clearly that the youth participation rate has been dropping at an almost constant rate since 2000, although there were no increases in the minimum wage until the recession. In any case, after the recent spate of rises, the real value of the minimum wage is now about the same as it was in the mid-eighties, under Saint Ron.

There is a serious problem here, which cannot be dealt with by the simplistic approach of reducing wages and removing regulations.

Antiderivative: I made no mention of taxes or indeed any economic policy above. I was quite surprised by your response to a straightforward presentation of some simple facts.

My comments refer to the completely conventional and widely accepted macroeconomic distinction between determinants of aggregate supply and aggregate demand. I find the map relevant for those who claim that favorable developments on the supply side would actually be counterproductive in the current situation. For an introduction to that debate, see Krugman or my discussion of Wieland’s research.

Yes, it does, Nick G.

If everywhere in the country were growing, and the oil regions growing more, then oil would be just a plus. But the oil regions are growing, and much of the rest is declining. It’s a tale of two countries, consistent with both the surging oil production and declining oil consumption of the last three years.

More recently–in the last four weeks–gasoline consumption is up 4% yoy. That’s a big number–we’ve haven’t seen much like this since 2005 (although it was common before). It suggests something is up in the broader economy, ie, the purple areas.

Going into the great recession and the triple increase in the minimum wage over 90% of employed teenagers were paid more than the minimum wage.

AntiD may have stumbled upon a truth: “… If they are, it is strictly due to deregulation, and mostly selling off our natural assets, for private gains.” Reading between the lines and using “natural assets” (here I presume AntiD means resources) and “private gains” are economic negatives.

For those comparing ND to La, why did you stop there? We conservatives prefer to include these cities: http://www.businessinsider.com/cities-in-financial-trouble-2012-7?op=1 and let us not forget states: Illinois, California, etc Here’s a list: http://images.businessweek.com/ss/08/12/1218_shortfall_states/

If AntiD is correct it explains why Canada and several Scandinavian countries rich in resources. His conclusion(s)seem misplaced. I guess resources are to be used only in the source country, kinda makes trade difficult?

Steven,

No, it really doesn’t.

First of all, the theory of energy as an elixir for economic growth is based on it’s value in manufacturing and transportation. That’s not why Texas and N. Dakota are doing well. They’re doing well because they’re getting royalties or producing something that they can sell to others. In fact, those royalties, which can range from 1/8 to 3/8 of the revenue, are a classic example of economic rent: land owners are doing nothing productive to add value, they’re simply cashing in.

2nd, as you’ve pointed out elsewhere, this production isn’t changing prices or increasing oil consumption in the US (because prices are set by the international market, and underpinned by OPEC), they’re simply reducing crude oil imports. That means that oil exporting countries are getting less “rent”, and Texas and N. Dakota are getting more (as well as additional oil production employment).

This is a zero sum game, in which income and wealth are being transferred. The transfer from the US to OPEC is falling, and the transfer from oil producing areas of the country to oil consuming portions is rising.

The only sensible solution: get out of the game. Use CNG/LNG in your long distance truck. Dump propane, and get NG, or an air-based heat pump. Buy a hybrid, EREV or EV. If you can’t afford a new one, buy a used one (very affordable used Priuses are out there).

Nick G.: Note the map plots the change in median income. I don’t believe the median resident in the indicated counties is receiving royalty payments.

You can lead Seattle’s political horticulture, but you can’t make them think;

http://www.seattlepi.com/news/article/Seattle-s-new-mayor-makes-move-toward-15-wage-5079142.php

‘City Council Member Nick Licata expressed confidence the city will raise its minimum wage to $15 an hour.

‘”We’re a strong caring city. Generally we do what needs to be done,” Licata said. “We got Elvis Presley to come here…I think we can get to a $15 minimum wage.”‘

I suspect low skilled labor will be searching as successfully as the Elvis watchers.

I don’t believe the median resident in the indicated counties is receiving royalty payments.

They are in Texas: many of those mineral leases are on small pieces of property (some surprisingly urban/suburban). In N. Dakota, it’s mostly farmers receiving that income. On the other hand, many farmers have surprisingly low net incomes: that’s why they’re so excited to get rents from oil leases or wind turbines: it changes their lives entirely.

In any case, lease-holders are spending much of their new-found income locally: they’re buying new trucks from the local dealer, they’re renovating the family farm with local help, and they’re replacing the old combine at the local John Deere.

In both locations, much of the money is going to production-related employment. That’s nice for the local workers, but that’s a cost (an input, rather than a valued output), not a benefit to the overall economy. It helps bring income their way (transferred from oil consumers), but doesn’t directly add value to the economy.

In fact, in an odd way shale oil destroys value: it replaces OPEC oil which is mostly pretty cheap to produce with domestic oil which is pretty expensive to produce. It’s nice for the US to reduce the wealth transfer to OPEC, but the world is poorer: more people are working to produce the same output of oil.

After 50-70 years of growth of oil extraction of 4-5%/year, the US has became afflicted with “Dutch Disease” since 1970-85, after which oil extraction per capita has fallen 50% along with the onset of deindustrialization, financialization, and feminization of the economy.

Canada and Australia are also experiencing the condition.

Additionally, the US has fallen off the so-called Seneca cliff since 2008, extracting at a doubling time of 5-6 years about one-third of total proven reserves. Regress that rate of extraction to consumption, exports (to consumption and extraction), and proven reserves, and we are (1) exporting future net energy consumption and associated real GDP per capita growth at an alarming rate and scale to growth of reserves; and (2) our financialized, debt- and asset bubble-based economy and society is in BIG trouble by no later than 2016-17.

The unprecedented debt/asset bubble to GDP and wages, and US economy and society being inflated by the Fed/TBTE banks, cannot be supported by the underlying structural decline in net liquid fossil fuel energy per capita.

The energy sector’s gain is a net zero-sum cost to the rest of the US economy. Now the profit gains to the energy players are no longer available to sustain further scale of growth of investment and extraction.

Most of us are seemingly unaware that we are in a Red Queen race off the Seneca cliff of net energy and real GDP per capita.

Nick G: Median means 50% of the population.

JDH,

Yes, and if a large portion of the leaseholders had an income below the median, then additional income to them will raise the median level.

You’d be surprised: many of the producing parcels are small (thus their owners not especially high income), and many of them belong to properties that don’t produce a lot of *net* income. Many, many farmers have 2nd jobs, for instance, to make it economically.

And, of course, even where the farmer/rancher is high income, much of the income is immediately respent locally. And, even where the parcel is owned in Manhattan, much of the TX and ND oil revenue will go to local production employment.

Now, it’s worth noting that many farmers have benefited from high oil prices indirectly, because it has raised corn prices through diversion of corn to ethanol. I’m not sure how much overlap there is with the present case.

Bruce,

Yes, marginal oil production costs are rising sharply. As long as the economy is structurally dependent on oil, that’s a big problem.

Fortunately, there exist better and cheaper alternatives for most of the uses for oil. We just have to implement accounting that will incentivize the transition, and put in place the proper public policies. Sadly, the FF industry has been very successful at delaying th transition.

It’s time to think outside the Fossil Fuel box, and kick our oil addiction.

JDH,

Perhaps I’m missing something related to median vs mean.

My sense is that a lot of the new income will be going to below-median-income people (either lease-holders, local suppliers to lease-holders, or local production workers (and their suppliers-housing, food, etc)), thus raising the median.

Further, median and mean are usually pretty close, unless there’s something unusual that skews things.

Am I missing something here?

Anti-d –

For any given factor endowment of land, labor, capital and energy, growth will be determined by i) the existence of sound property rights, and ii) human ingenuity. Put another way, we will tend to become more efficient at using our factors over time.

If one or more factors is declining, then the growth rate will be determined by how fast human ingenuity can displace the declining factor.

Or put another way, if our oil consumption is declining, then the GDP growth rate (if oil is a binding constraint) will be a function of how fast the economy can adjust to using less oil. I have written about this any number of times.

By the way, we can judge if oil is a binding constraint and other factors are not.

To wit:

– Is unemployment high or low? It’s high, so labor is not a binding constraint.

– Are interest rates high or low? Low, so capital is not a binding constraint.

– Is real estate priced very high? It’s declined and is somewhere in the middle. So land doesn’t seem to be a binding constraint.

By contrast:

– Is the price of oil high or low? High.

– Are wages in the oil sector high or low? High.

– Is productivity in the sector high or low? Low (as measured by declining output per dollar of capex).

– Are there signs that some countries are being bid out of oil markets? Yes.

– Are the dollar amounts material? Yes.

– Does the commodity have ready substitutes? No.

– Is it an essential enabling commodity (ie, is it crucial for transportation)? Yes.

In other words, we have ample reason to believe that other constraints are not binding and oil is a binding constraint.

the U.S. counties where median income has been growing are those where supply-side factors related to surging oil and natural gas production are driving the growth.

Surging oil & gas production does not increase oil & gas supply in those counties, nor does it reduce local fuel prices. Oil & gas are transported elsewhere for refining and other conversions. Diesel is a form of supply, and local oil production doesn’t increase diesel supplies. In fact, it makes diesel less avialable, as fracking-water and oil trucks consume the local supply.

Oil & gas production help these economies through a transfer of income from oil consumers to mineral-lease-holders and production workers (income that otherwise would have been transferred from oil consumers to oil exporting countries, so in effect this is a transfer from OPEC to Texas).

The rise in oil prices over the last 8 years has naturally pulled more income & wealth out of oil consuming areas and transferred it to oil producers.

Steven,

The obvious question is: if oil is a binding factor, why aren’t inflation rates higher?

I’m not sure I’d describe a teenager who has decided to socialize by social media rather than “cruising” as having been outbid for oil. Similarly, I wouldn’t describe a tax driver replacing a Crown Vic with a Camry Hybrid as being “out-bid”: his overall cost has gone down sharply, and the ride is nicer.

And, yes, a hybrid is a ready substitute for 60% of a driver’s fuel consumption, and an EREV (e.g., Volt) is a ready substitute for 90%.

Nick G: I don’t know why you want to label oil production as an “income transfer.” An income transfer is a redistribution of income without an exchange of goods or services. The sale of oil & gas is not an income transfer because it includes the exchange of a good (oil & gas). Moreover, it is universally accepted that oil is an important input in the production of other goods and services. Higher oil and gas production means a greater ability to produce those goods and services. That is all JDH means when he says an increased production of oil & gas is a positive supply-side factor. Note this is not “supply-side economics.” You can argue that increased oil production has significant environmental costs or is unsustainable but you can’t argue that oil production is just an income transfer or is not a positive supply-side factor. The later are true by definition.

Nick G., Steven (and Jeffrey Brown, should you be lurking), et al., see below:

https://app.box.com/s/15wrz6ao6pa2bz4lqv0e

https://app.box.com/s/w38zpmjwll4rfc4k50e0

https://app.box.com/s/qedkncs4uiqya0jetksm

https://app.box.com/s/uqmlp8laqdjjidsk17p4

https://app.box.com/s/hdjasm1a0x541hxejbqg

https://app.box.com/s/mi2gni3puh7yt21daxnc

https://app.box.com/s/nhyellg6uvb91y7m58dh

The primary inference is that the US (and EU and Japan) predictably fell off the so-called Seneca cliff in 2008-09 following Peak Oil in 2004-05, coinciding with the cumulative order of exponential order of differential rate of growth of private debt to wages and GDP.

We are exporting at an accelerating rate future consumption of net energy per capita and the capacity to sustain real GDP per capita, as well as to provide the necessary net energy per capita to build out renewable infrastructure AND simultaneously maintain the existing liquid fossil fuel infrastructure.

Establishment economists either don’t know this or are not permitted to say, whereas economists, physicists, geologists, env’t scientists, and ecologists do not talk to one another, i.e., cannot speak one another’s language, let alone collaborate.

Snowden and Assange’s disclosures are relatively inconsequential compared to the national security threat to the US (and “globalization” by extension) posed by the implications from the data at the links above.

Put another way, the owners of US, Canadian, and Australian supranational firms are exporting to China-Asia to such an extent that we are creating an economic and political rival in the form of China that will compete for scarce resources per capita worldwide, not unlike what the UK and US did with respect to Japan before Pearl Harbor and Britain did with South America and the South Africa in the late 19th century, China in the mid-19th century, and the colonies and France in the late 18th century to early 19th century.

The logic of Anglo-American oil empire is global war in a last-man-standing competition for the remaining resources of the planet at Peak Oil, falling net energy per capita, and population overshoot.

NickG gives us this absurdity: “And, yes, a hybrid is a ready substitute for 60% of a driver’s fuel consumption, and an EREV (e.g., Volt) is a ready substitute for 90%.” Why did he forget the caveat: substitutes for as long as the battery can discharge?

Hybrds might be candidates for taxis and take advantage of their fuel efficiencies on short and infrequent trips. Otherwise they are just another smaller and heavier vehicle on the roads.

As far as I know, Sherman County, Oregon doesn’t have any oil or gas production.

I think it is important to note that there are important differentiating characteristics of counties which are not limited to oil windfalls.

Nick –

Re: oil and inflation. For a given budget constraint, a real increase in price will cause a decrease in budget available for other goods. It’s not necessarily inflationary. If you add matters of debt and monetary policy, it could be inflationary. Ask Scott Sumner.

If you use a supply-constrained model, then the oil price rises to the carrying capacity level. This price, by construct, will be higher than the OECD carrying capacity price and lower than the non-OECD carrying capacity price. In other words, if there’s not enough oil to go around, the fast growing economies will bid it away from the slow growing economies.

In such a world, we can see both falling prices and falling OECD consumption, which is what we’ve seen for the last two years or so (excepting US from Q2 2013).

Thus, the damage to the economy is inflicted not by oil prices, but by declining volumes. The corollary of this notion is that OECD demand will be price elastic during these periods. Thus, the OECD economies will readily concede consumption without a price spike.

This is something the Fed doesn’t understand. The Fed primarily monitors the effect of oil through prices. However, I’ve argued above that 80-90% of the adjustment to recent oil prices has come through reduced mobility, not efficiency gains. Thus, recent oil consumption declines are affecting mobility, which we have good reason to believe will also affect GDP. But the Fed does not see this–they don’t have an analytical framework to do so.

In any event, I don’t see oil price pressures as necessarily inflationary, although they could be.

Nick –

Driving and youth employment:

Michael Sivak, UMTRI, “The Reasons for the Recent Decline of Young Driver Licensing in the U.S.” See the top chart, p. 17

http://deepblue.lib.umich.edu/bitstream/handle/2027.42/99124/102951.pdf?sequence=1

Only 18.8% of survey respondents aged 18-39 without a driver’s license held a full time job. Astounding statistic.

From the Highway Loss Data Institute (insurers’ group): “Drop in teen driving tracks with teen unemployment”, http://www.iihs.org/iihs/news/desktopnews/drop-in-teen-driving-tracks-with-teen-unemployment-hldi-study-finds

Mobility is employment.

More Nick –

“Similarly, I wouldn’t describe a taxi driver replacing a Crown Vic with a Camry Hybrid as being “out-bid”: his overall cost has gone down sharply, and the ride is nicer.”

The taxi driver who originally purchased the Crown Vic did so for a reason. He had the chance to purchase the Camry and didn’t, so presumably the taxi driver made a Pareto optimal decision the first time around, either due to cost of the vehicle or features the vehicle offered. Thus, the Camry represents some loss of welfare–it’s a second best choice. (I prefer the Camry, too, by the way.)

“And, yes, a hybrid is a ready substitute for 60% of a driver’s fuel consumption, and an EREV (e.g., Volt) is a ready substitute for 90%.”

If the capital and operating cost of a hybrid is lower than a gasoline-alone engine, then that solution will win out. Let it compete without subsidies, and let the dust settle.

All electrics are not cost competitive.

To sum: There are two issues here:

1. Are there superior solutions to gasoline/diesel engines? The answer so far is, not really. Hybrids are somewhat competitive, but most people are still buying standard engines.

Nat gas could be competitive if the regs were written right. At present, they don’t seem to be, and natural gas engines are too expensive. Pity, I think.

But keep in mind, the US produces only 11 mboepd of natural gas. We are using (last week) 21 mbpd of oil products. So at best we would hope to displace about 2 mbpd with natural gas products–which is occurring, by the way, in the refinery, just not for transportation fuel.

Second, I fail to see why “addiction” to natural gas is somehow superior to “addiction” to oil. They’re both fossil fuels.

2. How fast can society adjust?

Even if there is a superior solution, it takes quite a while to swap out a new asset base for an old one. The rate of adaptation matters.

Finally, the costs of adjustment during this recession don’t appear to be assumed be everyone pro rata. Instead, it’s seem to have been disproportionately an insider/outsider recession, with the brunt of the adjustment coming from people losing their jobs, rather than everyone consuming less. I don’t know why this is so, but I think it merits closer examination.

In any event, this may explain in part why fuel efficiency seems to have improved so slowly. Those people with jobs and SUVs got to keep their SUVs and keep driving. Those who lost their jobs lost their mobility in its entirety. Thus, the savings did not occur on a per-mile basis, they occurred by excluding a whole class of people from driving.

That interpretation is consistent with a lot of the data, but I don’t know why things have turned out this way.

It’s too bad JDH can only see North Dakota from his view of a Census Bureau map on the computer screen from the comfort of his office in San Diego. In reality it is a hellish landscape with thousands of natural gas flares you can see from outer space. The criminally reckless oil companies are so eager to get at the more valuable oil that they flare the natural gas to the atmosphere in complete disregard for the environmental consequences as seen here. You can overlay this view on the Census Bureau map of pretty green squares.

http://www.ceres.org/industry-initiatives/oil-and-gas/gas-flares-from-space

We have a long history in the west of the destruction caused by these extractive mining booms. You can find the crumbling results from the past century and a half in small towns across Idaho, Montana, Wyoming and North Dakota. An influx of thousands of get-rich-quick “gold diggers” leave behind a wasteland of crumbling infrastructure and pollution.

The rush of outsiders brings with it prostitution, drugs and crime. The money flood corrupts state and local governments as the out-of-state billionaires quite literally buy the legislatures, which come quite cheap in these low population states. Housing shortages quickly price out the locals as tin towns of trailers spring up rented out for thousands of dollars a month. The local Chambers of Commerce jump aboard, firing up expensive new school, road, water and sewer projects.

It’s like feeding a child a breakfast bowl full of sugar. Everything looks rosy until the inevitable collapse of the boom and the towns are left with half-finished infrastructure projects they can’t afford and a mountain of debt they can’t pay. All of the money flows out of state to New York and Texas, leaving behind impoverished communities and polluted super-fund sites when the boom is over. The mining moguls treat these states as third world countries ripe for the picking and quickly discarded like yesterday’s trash.

Jeff,

hmmm. I must not have written clearly. I’ll try again.

Oil production in N. Dakota doesn’t increase the supply of fuel in N. Dakota. Nobody in N. Dakota uses crude oil: they use diesel, gasoline, etc. The crude oil goes to refineries in Indiana, Louisiana, even Europe. The refined products go into an international market (with some local variation based on pollution regulations).

So, crude oil production in N. Dakota doesn’t increase local fuel supply. In fact, it reduces it, because drilling and fracking wells consumes quite a bit of fuel.

N. Dakota counties are doing better because of increased income: royalties and production work salaries.

And, finally, as Steven Kopits discussed recently, much of US production is simply import substitution: we’re reducing our trade deficit with oil exporting countries, but not reducing prices (at least if OPEC can manage to prevent it).

Does that help?

Corev,

Hybrids don’t need charging. Extended Range EVs eliminate liquid fuel consumption for about 85% of miles (the percentage of vehicle miles travelled under about 40 miles), and higher than average fuel efficiency reduces that final 15% by another 1/3, getting us to a 90% net reduction.

That’s good enough for the moment: the perfect is the enemy of the good.

Sherman County, Oregon is green but has no gas and oil production. What it does have are a small population (~1732), and a new large wind farm(450MW). Per capita it has ~108X as much wind gen as the state with the highest per capita wind generation. Obviously this is not scalable, anymore than per capita oil production 66X national per capita production in North Dakota is scalable. Incidentally, the state with the highest wind generation per capita is North Dakota, and the boom in wind generation has occurred during the 2007 to 2012 timeframe. Economic confidence by the local government in Sherman County has allowed government spending to increase rather than decrease, as in North Dakota, where spending per pupil on schools has increased 27% over the subject timeframe, instead of the marked contraction in most states. Prior to the resource boom, the county had a declining population, meaning that a housing boom and bust which affected the economy of the rest of the country largely passed it by. Thus the substantial contraction in construction activity seen in the organically growing parts of the country did not occur, requiring smaller growth to overcome the downturn and show net positive growth. Again, this is very similar to North Dakota. Finally, a substantial fraction of county economic activity is agricultural, and economic policies (ethanol among others) which have rewarded ag commodity producers have also rewarded this county. Again this is similar to North Dakota, which has seen the largest per capita increase in agricultural land wealth of any state in the country during this latest ag commodity boom.

NickG claims: “Hybrids don’t need charging.” and from that I think he must also believe in unicorns and pixies. Nick, I know what you are trying to say they don’t require external charging, but they are not perpetual motion machines. Being self contained charging systems, they still do not get the E-miles of your extended range EVs.

Corev,

Sure. I’m not sure what your objection is to hybrids, then. I agree, they don’t get the same reductions of EREVs.

They taxi industry is switching over to them. I interviewed a driver a couple of days ago. He feels like all of his colleagues do: he loves his hybrid: better drive, lower costs. His company only switched lately because they’re cautious, and wanted to make sure they were reliable. They’re now delighted with the maintenance costs, especially brake life.

Steven,

There are a number of interesting details here to discuss. For instance, have you looked at the 1st derivative of the US VMT numbers, for the last 10 years? Do a linear regression, and you’ll see that growth has been declining since well before the Great Recession. Oddly enough, drivers just aren’t that sensitive to gas prices, and much of the decline in consumption has been outside of personal transportation.

But there’s something more important: bad accounting, and external costs which are gumming up our free-market system and improperly allocating resources.

You’ve spent quite a bit of effort detailing the harm that our structural dependency on oil is doing: unemployment, reduced economic growth, etc., etc.,

Climate Change, multiple oil shock recessions, oil wars.

Wouldn’t you agree that a simple pigovian fuel/carbon tax (rebated back, to avoid the tax increase stigma) would improve resource allocation, improve economic efficiency, and accelerate the transition away from oil?

Nick –

VMT turned in 2005, when the oil supply stalled. (See the link.) It turned at the same time in Great Britain, for example. That’s the whole point of the peak oil debate and supply-constrained forecasting, which contends that, if the oil supply does not grow fast enough to meet everyone’s needs, then the fast growing countries will bid away the oil consumption of the slow growing countries. That’s what the graph shows.

http://www.advisorperspectives.com/dshort/charts/indicators/miles-driven.html?miles-driven-CNP16OV-adjusted.gif

Oil is bad in the way that air is bad. No air, no life. No oil, no job.

A carbon tax will reduce employment.

I am all for transitioning to superior forms of transportation, including CNG and self-driving EVs. I’ve written about both topics.

For both CNG and SDEV’s, we need some enabling legislation. I written some about those, too.

VMT turned in 2005, when the oil supply stalled.

Well, no, look more closely. That’s a graph of total VMT. Look at the derivative: the change of VMT from year over year. You’ll see a steadily descending line: the rate of growth has been declining for some years. The peak you see in that chart is simply the point where that change in the growth rate meant that the rate hit zero.

if the oil supply does not grow fast enough to meet everyone’s needs, then the fast growing countries will bid away the oil consumption

hhmm, not really. That’s a way too static point of view. This is a beef and pork kind of situation: when beef gets too expensive, people will eat pork. DOes that mean that beef has been “bid away”? perhaps. But, little harm has been done.

Oil is bad in the way that air is bad. No air, no life. No oil, no job.

I was afraid of that. No, oil is bad in the way that obsolete things are, like kerosene in the age of electric lighting.

A carbon tax will reduce employment.

How? If you rebate the tax, then aggregate demand won’t fall.

Yes, people might drive less, but are you really suggesting that we *subsidize* oil prices in order to encourage driving? That’s what you’re doing when you don’t include all of the costs of oil in the sale price. That leads to economic distortions, and sub-optimal allocation of resources, right?

superior forms of transportation, including CNG and self-driving EVs

Why the heck do we need EVs to be self-driving?? That seems like a huge red herring: why wait until then?

Again, you’ve spent quite a bit of effort detailing the harm that our structural dependency on oil is doing: unemployment, reduced economic growth, etc., etc.: Climate Change, multiple oil shock recessions, oil wars.

Wouldn’t you agree that a simple pigovian fuel/carbon tax (rebated back, to avoid the tax increase stigma) would improve resource allocation, improve economic efficiency, and accelerate the transition away from oil?

Now, let’s be clear: people could respond to a pigovian fuel tax by shopping online, combining shopping trips, commuting less, etc.

Or, they could switch to hybrids, PHEVs, EREVs, EVs, CNG vehicles, etc. The existing fleet in the US gets about 22 MPG. Hybrids can easily double that, so the average fuel price could double, and people could still drive for the same cost per mile by switching to hybrids.

We really don’t need oil. It’s expensive, dirty, and dangerous (to our soldiers, anyway).

Let’s kick the habit, ASAP.

Nick –

Kerosene is obsolete? What does your aircraft use?

Show me an electric car that can compete without subsidies.

Beef and pork. What’s the alternate fuel for your car? Pork?

I’ve done a great deal detailing the impact of lack of oil.

Steven,

I’m puzzled – you’re not really making a serious argument.

For instance, when I referred to “kerosene in the age of electric lighting” it should be perfectly clear that I was talking about the use of kerosene for illumination. Electricity successfully replaced oil in the late 1800’s for lighting – the Edison bulb was superior in every way to kerosene. If gasoline for automobiles hadn’t come along, the oil industry would have been in real trouble.

Now it’s time for electricity to do the same for transportation. Electric motors are superior in every way to infernal combustion engines. Now that oil is no longer dirt cheap, and batteries are finally good enough to power hybrids and plug-ins, the transition is under way.

show me an electric car that can compete without subsidies.

Sure, the Tesla. And, pure EVs are a red herring: hybrids and EREVs are the sensible alternatives right now, during this transition.

And, of course, hybrids get no subsidy, and oil is currently getting much larger subsidies than any EV.

I’ve done a great deal detailing the impact of lack of oil.

No, actually, you’ve presented arguments showing that oil is unreliable, and that unreliability is very, very costly. We’ve had a number of oil shocks, and they’re very expensive.

————————-

You haven’t addressed perhaps the most important issue: external costs. Oil has appeared very cheap, when in fact it was never cheap. Climate Change is very expensive. Oil wars are very expensive (estimates range from many 100’s of billions to the trillions). Heck, Professor Hamilton attributes much of the Great Recession to Peak Oil. Well, the GR vaporized what, 6 trillion in capital? If Peak Oil is responsible for 50% of that, that’s a cost of $3 trillion, or about $10 for every barrel consumed in the last 10 years! If we fully load oil with all it’s costs, we’ll find that it’s not nearly as cheap as we thought.

Nick,

It is hard to argue with folks on change, when that change would be detrimental to their livelihood. We have many folks entrenched in the world of oil, and will be resistant to a change from oil because it will impact their jobs, security, etc. similar thing with electric vehicles-the change from gas power to electric is scary because some folks have spent a lifetime understanding the old auto industry and are afraid of the electric world-with new power players and agendas for the future. And then you still have some folks who believe oil reduction and electric vehicles indicate the environmentals have won-a political battle many will fight to the death! But a changing of the guard is occurring nevertheless.