An Analysis of Indian Non-Financial Sector Firms

Today we are fortunate to have a guest contribution by Yin-Wong Cheung (HK City University) and Rajeswari Sengupta (Indira Gandhi Institute of Development Research). This post is based on their paper.

In the last quarter century, the global economy has witnessed not just a rapid expansion in international trade but also the growing prominence of dynamic emerging economies on the global trade landscape. Despite steady growth in global trade, however, there have been recurring concerns about the impact of exchange-rate movements on trade – rekindled more recently by the 1997 Asian financial crisis and the 2008 global financial crisis. India provides an interesting case study in how exchange-rate fluctuations impact exports. In 1991, India implemented a series of globalization and liberalization measures primarily targeting the foreign-exchange market and tradable sectors. Undeniably, India’s economy has become increasingly integrated with rest of the world and now has a considerable presence as an exporter in the global economy.

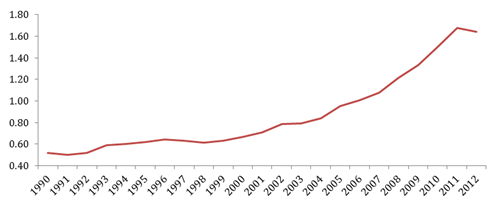

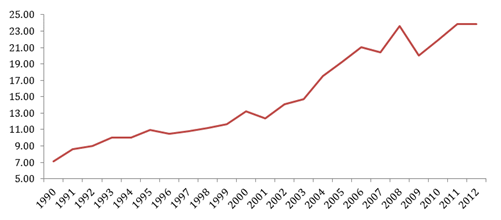

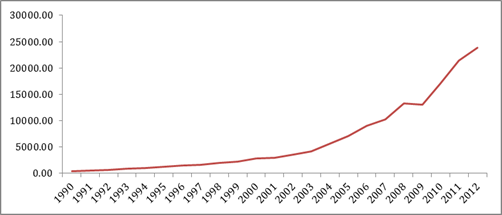

The annual growth rate of India’s exports of goods and services increased from 16% in 1999−2000 to around 33% in 2010-11. The contribution of exports to GDP went up from 6% in 1990 to 12% in 2000 and 23% in 2010. Simultaneously, India’s overall share of total world trade (which includes trade in both goods and services) increased from 0.5% in 1990 to about 1.4% in 2010. The remarkable increase in India’s exports can be seen from Figures 1-3. India also adopted a more market-oriented exchange rate regime in the first half of 1990s. Since deregulation, the rupee’s exchange rate has mostly been in a managed floating regime.

Figure 1: Ratio of India’s Exports to World Exports (In percentage). Data source: IMF, International Financial Statistics (IFS).

Figure 2: Ratio of India’s Exports to India’s GDP (In percentage). Data source: IMF, International Financial Statistics (IFS).

Figure 3: India’s Exports of Goods and Services (In billions of local currency units). Data source: IMF, International Financial Statistics (IFS).

In our recent paper, Cheung and Sengupta (2013), we asked how have fluctuations in the exchange rate affected decisions of Indian exporting firms and investigated whether the data suggests a weakening of the link between the real effective exchange rate (REER) and exports. Using a rich firm-level data set some of the questions we investigated are:

- What is the impact of exchange-rate depreciation (appreciation) on exports of Indian manufacturing firms?

- Does the textbook prediction that exchange-rate depreciation (appreciation) boosts (deters) exports hold for Indian firms or is there no significant association?

- What are the firm-specific features that influence their export responses to exchange rate changes?

- What are the macro features of the economy as a whole that impact firm level export responses to exchange rate movements?

We found that a one-percentage point appreciation of the REER reduces the average firm’s export share by 6.3%. In the presence of certain control variables, this exchange-rate effect can exceed 10%. Our findings in general are also suggestive of a negative volatility effect on the export shares of firms. A one standard deviation rise in REER volatility on average dampens an Indian firm’s export share by as much as 26%. This negative volatility effect lends support to the reasoning that a high level of uncertainty represented by a high level of volatility has an adverse effect on trade. Notable among the impact of other control variables is the finding that both real and nominal wage increases have a negative effect on exports. This result is quite intuitive; a rise in wages increases operation costs that then reduce the firm’s competitiveness in the global market. Labor costs are also found to amplify the exchange- rate effects on trade. We further find that exports of Indian firms co-move with world exports. Global trade patterns point to the general behavior of Indian exporting firms, but do not overshadow the exchange-rate effect.

To deepen our investigation, we conducted a few additional analyses and considered asymmetric exchange-rate change effects. We found that appreciation is associated with a stronger exchange-rate change and a stronger volatility effect on trade than depreciation. Furthermore the adverse exchange-rate effect seems to be stronger for firms with a small export share than with a large one. Our estimated results indicate that a one-percentage point REER appreciation reduces the export share by around 11% for firms with below the median export shares, and by 5% for firms with export shares above the median level. Firms that export relatively less are apparently more adversely affected by appreciation.

On the volatility side, firms with below-median export shares react negatively to REER volatility, while somewhat curiously, firms with larger export shares react positively to a rise in exchange-rate volatility. Arguably, firms that have a large export share could have the incentive and, possibly, the means to benefit from exchange-rate volatility through hedging or re-directing their exports to alternative markets. We were also interested in exploring whether the exchange rate has differential impacts on goods and services export categories and within services, across information technology (IT) and non-IT sectors, given that India’s export sector has been dominated by commercial services especially IT services, over the last decade. In our analysis, exports appear less sensitive to the negative exchange rate effect than services exports. Non-IT services are the only type of services exports that seem to be significantly impacted by exchange-rate change.

These results have several important policy implications. Reducing currency volatility seems likely to enhance export performance. In addition to improved hedging instruments, policies could be devised to alleviate volatility. Moreover, exchange-rate policy seems to have a stronger impact on some firms than others. Thus, a simple policy of managing the rate of appreciation to promote exports may have the unintended consequences by creating imbalances between different types of firms.

A finer classification of firms and exchange-rate movements suggests that the exchange-rate effects on exports of firms are more complex than simple textbook prescriptions. A discussion that focuses exclusively on exchange rates runs the risk of overlooking other factors that may hinder India’s exports. For instance, our results are suggestive of some kind of cross-market interaction such as higher labor costs potentially magnifying negative exchange rate effects. Thus, policymakers should not focus exclusively on an exchange rate policy to promote India’s export activity. India’s export performance can likely benefit from a host of catalytic factors such as investments in infrastructure including highways and ports, liberalization of the labor market, and a concerted policy to promote manufacturing industries.

This post written by Yin-Wong Cheung and Rajeswari Sengupta.

Thanks for posting this Menzie.

The Governor of the Indian central bank, Raghuram Rajan, has received a report from a panel he set up to review India’s monetary policy especially its high inflation rate. The panel recommends monetary policy address inflation rather than other targets such as the exchange rate. Rajan understands that the stability of the currency is more critical in monetary policy than financial stability, growth, or international exhange. If the Indian citizen can rely on the Indian Rupee to hold its value then production and exports will take care of themselves and the quality of life for the Indial citizen will improve.

Below are excerpts from a Reuters article concerning the report.

The central bank had been widely expected to keep its policy repo rate unchanged at 7.75 percent at its next policy review on January 28, following a decline in wholesale price inflation.

The reforms would mark the most dramatic change implemented by the 50-year-old Rajan….

In its 130-page report, the panel recommends that managing inflation take precedence over the central bank’s two other current main objectives of economic growth and financial stability.

If adopted, the RBI would use consumer price index inflation, which now stands at 9.87 percent, as the benchmark for targeting inflation.

It would aim to pare CPI inflation to 8 percent over the next 12 months and 6 percent in the next 24 months. Its eventual target level would be 4 percent, plus or minus 2 percent.