From CBO:

…CBO estimates that extending the current EUC program and other related expiring provisions until the end of 2014 would increase inflation-adjusted GDP by 0.2 percent and increase full-time-equivalent employment by 0.2 million in the

fourth quarter of 2014. …

…Those figures represent CBO’s central estimates, which correspond to the assumption that key parameters of economic behavior (in particular, the extent to which higher federal spending boosts aggregate demand in the short term) equal the midpoints of the ranges that CBO uses. The full ranges that CBO uses for those parameters suggest that, in the fourth quarter of calendar year 2014, GDP could be increased very slightly or by as much as 0.3 percent, and employment could be increased very slightly or by as much as 0.3 million.

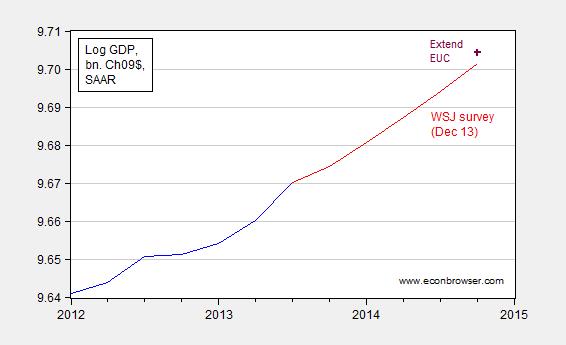

The high end impact (which would seem more relevant given the ZLB and amount of slack in the economy [1]) is shown below.

Figure 1: Log GDP (blue), and implied GDP from mean of WSJ survey from December 2013 (red), and counterfactual assuming extension of EUC (purple +). Source: BEA, 2013Q3 3rd release, WSJ (December 2013 survey), CBO and author’s calculations.

The calculations assume the forecasters in the WSJ survey assumed that the EUC would not be extended.

Talk about shooting yourself in the foot! The dough that goes to unemployment benefits, goes straight into the economy…100% pure fiscal stimulus. None of it is saved.

Congress is nuts!

The CBO is constrained by law as to how it scores the impact of policy changes so it reflects the political whims of congressmen rather than reality. Better would be to look at the results from President Bill Clinton’s Welfare Reform signed into law in 1996.

Below is a partial list of the results.

President Bill Clinton signed legislation overhauling part of the nation’s welfare system. The Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (P.L. 104-193, PRWORA) replaced the failed social program known as Aid to Families with Dependent Children (AFDC) with a new program called Temporary Assistance to Needy Families (TANF). The reform legislation had three goals: (1) to reduce welfare dependence and increase employment; (2) to reduce child poverty; and (3) to reduce illegitimacy and strengthen marriage.

At the time of its enactment, liberal groups passionately denounced the welfare reform legislation, predicting that it would result in substantial increases in poverty, hunger, and other social ills. Contrary to these alarming forecasts, welfare reform has been effective in meeting each of its goals.

■Child poverty has fallen. Although opponents of reform predicted it would increase child poverty, some 1.6 million fewer children live in poverty today than in 1995.

■Decreases in poverty have been greatest among black children. In the quarter century prior to welfare reform, the old welfare system failed to reduce poverty among black children. Since welfare reform, the poverty rate among black children has fallen at an unprecedented rate from 41.5 percent in 1995 to 32.9 percent in 2004.

■Unprecedented declines in poverty also occurred among children of single mothers. For a quarter-century before welfare reform, there was little net decline in poverty in this group. Povertywas only slightly lower in 1995 (50.3 percent) than it had been in 1971 (53.1 percent). After the enactment of welfare reform, the poverty rate for children of single mothers fell at a dramatic rate, from 50.3 percent in 1995 to 41.9 percent in 2004.

■Welfare caseloads were cut in half. The AFDC/TANF caseload dropped from 4.3 million families at the time PRWORA was enacted to 1.89 million today.

■Employment of single mothers has surged. The employment rate of the most disadvantaged single mothers increased from 50 percent to 100 percent.

■The explosive growth of out-of-wedlock childbearing has come to a near standstill. For thirty years prior to welfare reform, the percentage of births that were out-of-wedlock rose steadily by about one percentage point per year.The out-of-wedlock birthrate was 7.7 percent in 1965 when the War on Poverty started; by 1995 it had reached 32.2 percent.Following welfare reform, the long-term rapid growth in out-of-wedlock birth rate ended.Although the rate has continued to inch up slowly, the increase is far slower than in the pre-reform period.

Some attribute these positive trends to the strong economy in the late 1990s. Although a strong economy contributed to some of these trends, most of the positive changes greatly exceed similar trends that occurred in prior economic expansions. The difference this time is welfare reform.

I differ slightly with the last paragraph in that it is clear that the strong economy did not contribute to the positive changes, rather welfare reform contributed significantly to the strong economy. Welfare Reform reduced costly spending on unproductive citizens while transitioning them into productive tax paying citizens. Rather than a drain on tax revenue, Welfare Reform created contributing producers. There is no reason to expect a reduction in unemployment payments to do any less.

Raskolnikov,

If an unemployed worker is living off of savings, and EUI allows them to avoid that, then most of it will be saved.

How do you assume that none of it is saved?

The CBO numbers show that it’s pretty much a wash, with a slight bias toward keeping unemployment as the less costly option. The political problem is this takes overall growth plus some tax revenue from that and compares it to spending from the government. On a financial basis – not a human, moral basis – I am of mixed minds about this. On a moral basis, I’m in favor of continuing UI and I see your post as an attempt to show the overall economy benefits or, given uncertainty, at least breaks even from that choice.

It seems like 6 months of unemployment benefits may slightly short, but 2 years of unemployment is WAY WAY too long. If you are unemployed for two years than your pre-unemployment standard of living was probably too high, and you need to quickly adjust your spending habits to compensate for what your skills actually contribute to today’s economy, which is most likely much less than before you were unemployed (in other words, get used to a lower salary!). Just because you get paid $15 an hour one year, does not entitle you to make that much money for the rest of your life.

Anon,

That logic may have been true before the depression, even if it sounds more like an unexplored truism than an empirical fact, but given the incredible labor bust the entire world has seen recently, 2 years of unemployment sounds like it could be lived through even with intensive, and significantly self-deprecating, job hunting.

And today we have Scott Walker berating the lazy unemployed for not taking the jobs he promised to create but failed to.

Ricardo comments about “unproductive citizens.” This from someone who is either retired and living off productive workers or he has to be the world’s least productive worker cheating his boss while posting 24/7.

Anonymous If what you said about wages being permanently lower is true, then you are also saying that the economy is permanently less productive and we should all downscale our expectations. But the problem with your post is that it confuses cyclical unemployment and structural unemployment. The point of extending unemployment insurance is to combat cyclical effects with increased aggregate demand and to keep the long term unemployed attached to the labor force. Not extending unemployment insurance is a great way to ensure cyclical unemployment becomes structural unemployment, making us all permanently poorer.

The only way I can see someone using AD reasons to justify UI policies is if they think monetary policy is ineffective. And that’s an untenable position at this point.

Jeff Let’s be clear, the argument isn’t so much that extending unemployment benefits will further stimulate aggregate demand so much as it’s the concern that allowing those benefits to lapse will be contractionary. Remember, extended benefits were the status quo ante until last week, so we shouldn’t expect a further extension to provide additional stimulus.

You’re also wrong about there being no need for fiscal policies in light of monetary policy effectiveness. I think most people would agree that monetary policy should be the instrument of first choice during normal economic times. But when you’re at the zero lower bound and inflation is well below target, then there’s a strong case for fiscal policy as well. Besides, no rational person puts all their eggs in one basket in a time like this. Monetary and fiscal policies can and should complement one another when the economy as at the zero lower bound.

Also, this post from Simon Wren-Lewis makes the point better than I ever could:

http://mainlymacro.blogspot.com/2014/01/monetary-versus-fiscal-odd-debate.html

In terms of the old IS-LM debates, the argument was always about the relative slopes of the IS and LM curves.

Slugs I’m laughing at how you proudly make the unimportant distinction between adding more AD or not subtracting AD, either of which is an “AD reason,” and then follow with “you’re also wrong…”

Secondly, the idea that fiscal and monetary policies are complements, so why not try a little of this or a little of that, is wrong. You either think monetary policy is effective or its not. If you think its effective then you must accept the fact that monetary policy is steering the ship. Whatever effect extending UI has on AD will be incorporated into monetary policy, so its AD effect will be neutralized. Now you may say, well we don’t know for sure if monetary policy is effective, or not. Well, that brings me back to my original comment. There isn’t any evidence to suggest monetary policy isn’t effective.

Moreover, you can’t reason, what’s wrong with trying some fiscal policy to error on the side of caution? Worst case scenario is that it had zero effect? Right? The problem with that reasoning is that you start to evaluate programs on some phantom AD instead of their own merits. And in this case these phantom AD effects are even used to minimize very real AS effects. The program should be justified on its own merits, to do otherwise only confuses the issue.

Ricardo,

you have your facts wrong (in order to buttress your opinions?). Here’s just one example. You stated: “After the enactment of welfare reform, the poverty rate for children of single mothers fell at a dramatic rate, from 50.3 percent in 1995 to 41.9 percent in 2004.”

Simply not true. according to the census here are the data (from: http://www.census.gov/hhes/www/poverty/data/historical/families.html)

poverty rate in 1995, All races, single mothers, with children under 18: 41.5%

In 2004, that rate was 35.9%.

But more importantly, the poverty rate fell throughout the Clinton administration, before and after the enactment, to reach a bottom in 2000 @ 33%, whereupon it *immediately* rose under Bush (and Obama) to reach 40.9% in 2010, where it has stayed till the end of the data (2012).

I know you don’t like helping the poor, but you can’t make up facts to justify this opinion.

bellanson,

Those were not my facts. They were from a 2002 report on the results of the Clinton Welfare Reform.

Here is something newer that you might get your teeth into.

What happens when jobless benefits are cut? North Carolina may offer clues

Excerpt:

Last summer, North Carolina slashed the amount of cash it gave to people after they lost their jobs and the state also reduced the number of weeks they could receive benefits. Within several months, the unemployment rate fell a few ticks and by November it fell to a five-year low.

I just don’t understand why people who are perfectly sane in other areas seem to lose their minds when it comes to simple economics. As Thomas Sowell says if you want more of something you subsidize it. If you want more unemployment subsidize it.

The North Carolina example is not rocket science. People suddenly found that they had no alternative but to get a job so they did. The state turned the unemployed from a drain on the budget to contributing tax payers and producers. Only a Progressive economist has trouble understanding this simple concept.

bellanson,

A little more for you on the specifics of the quote. It was from testimony given to the House Ways and Means Committee by Robert Rector on July 16, 2006. Rector was on the committee that designed the Clinton Welfare Reform package and he continued to do extensive research on the results after the legislation was passed. Something Progressives never do.

I would encourage you to read the definition of the statistics from Rector compared to your statistics. Rector is analyzing “the poverty rate for children” your statistics are “All races, single mothers, with children 18.”

If you dig deeper into the census data and look at other poverty levels you will find statistics that approximate Rector’s numbers.

I realize you were digging for numbers to discredit my post but I would encourage you to try to use open-minded reason rather than statistics to support a prejudice.

“then you are also saying that the economy is permanently less productive and we should all downscale our expectations”

It is less productive. Imagine what the economy would look like if we hadn’t run 13 trillion in deficits over the last 30 years. If interest rates hadn’t been held artificially low for 20 years. Our entire economy is a bubble.

Ricardo,

There is nothing wrong with conservative views, but making up statistic is wrong! .

First you say: “they were from a 2002 report..”, then you say it’s “It was from testimony given to the House Ways and Means Committee by Robert Rector on July 16, 2006”.

Can you provide a link?

You, yourself stated: “…, the poverty rate for children of single mothers…” – well that’s exactly what I provided the data for: “single mothers with children”.

But the most important part you totally missed: Poverty rate fell before the law change, and started to rise when the dot com bubble collapsed.

Poverty rate tracks the economy, not the welfare reform changes!

Now, 15+ years after the reform, the poverty rate is back up to where is was in 1995! The “benefits” of the reform are all gone!

I suggest that you take your own advice about using “open-minded reason rather than statistics to support a prejudice”

I would phrase it differently: Let the facts guide your opinions not the other way around!

ricardo,

“The North Carolina example is not rocket science. People suddenly found that they had no alternative but to get a job so they did.”

the North Carolina topic was recently touched on by Krugman, you should give it a read on his blog.

you are elated over the elimination of unemployment insurance, since you claim this is the cause of the drop in unemployment. however, both the article and Krugman both identify the fact that unemployment could have dropped by people leaving the workforce-not people gaining jobs. and to further emphasize this point, the federal unemployment rate has fallen significantly in the past couple of years. if you give north carolina credit, then you need to give Obama credit for his policies which have also dropped the unemployment rate. are you willing to do so?