Manufacturing output is returning to pre-recession levels, exports are continuing to grow,and the trade balance is shrinking.

Manufacturing output has risen more rapidly than output overall; to some degree this is unsurprising as manufacturing is highly procyclical.

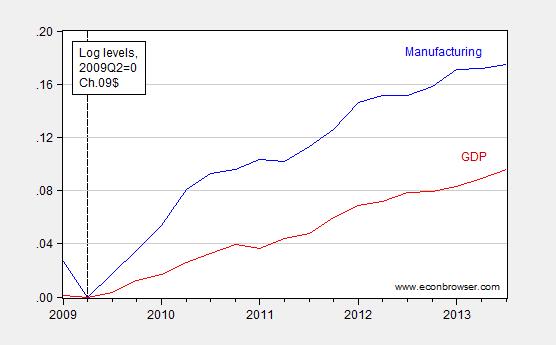

Figure 1: Log manufacturing output (blue) and GDP (red), in Ch.09$, rescaled to 2009Q2=0. Source: BEA, BLS via FRED, and author’s calculations.

This graph indicates that real output in manufacturing has grown 8.8% more rapidly (cumulatively, in log terms) than GDP as of 2013Q3. This is not dissimilar to that experienced in the last two recoveries.

However, exports have grown more rapidly than in the last recovery, which is notable given the general lackluster state of the world economy (Europe, China).

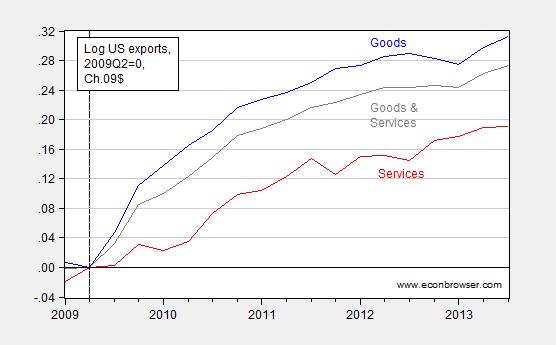

Figure 2: Log exports of goods (blue), exports of services (red), and goods and services (gray). Source: BEA, 2013Q3 3rd release, and author’s calculations.

Exports of goods is not quite the same as exports of value added, given vertical specialization (that is, exports incorporate imported inputs; see discussion here). However, the pattern is pretty clear.

On the other hand, as confirmed in November’s trade balance figures, US net exports as a share of GDP are increasing.

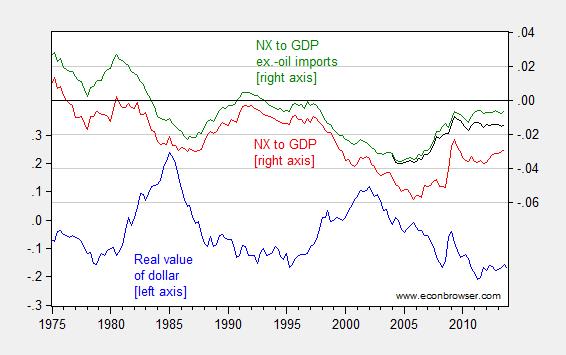

Figure 3: Log trade weighted (broad) real value of the dollar, 2010=0 (blue, left scale), and net exports to GDP (red, right scale), net exports ex-oil imports (green, right scale), and net exports ex.-oil (black, right scale). Source: Federal Reserve Board vis FRED, BEA 2013Q3 3rd release, BEA/Census trade releases, and author’s calculations.

Note that although net exports including petroleum imports and petroleum product exports are increasing markedly through 2013Q3, even excluding those items (the black line), we see a 2.2 ppts improvement relative to 2005Q4.

Irwin/Wonkblog argues that fracking is a big part of the reason for the improvement in the trade balance. That’s confirmed by Figure 3. But it’s useful to keep in mind that of the 2.9 ppts improvement, 2.2 ppts comes from non-oil and non-oil-product trade.

(Fracking might have helped US competitiveness by driving down energy-related production costs; I think the jury is still out on that issue, as discussed in this post).

Looking forward, continued progress depends on the value of the dollar (which might pop up if the taper proceeds rapidly, or if there is a new sovereign debt crisis overseas), and the extent to which growth in East Asia is consumption based.

Yeah, these type of posts all make me doubt secular stagnation. We are getting our groove back. Things are getting better across such a wide array of indicators, that I just don’t think something like secular stagnation is plausible. Give it a year or two, and we will be in a boom time, and not because it is a new bubble.

Plus add in health care costs decreasing, deficits lowering, a more educated workforce (perhaps the most underestimated outcome of the great recession is how many went back to school), stronger regulation of finance through Dodd-frank and CFPB, and so on. It really seems the opposite of what Summers is saying, this is looking like the best era in a long time.

For GDP purposes, it’s OK that exports are not on a value added basis. GDP includes gross exports and subtracts gross imports. So either way the imported inputs come out.

Value added trade is more important for bilateral comparisons because it adjusts for the fact that gross imports from Country A may contain intermediate inputs from Country B.

I looked at the trade figures in a different way (all rounded in billions).

On a YTD basis exports rose 31B and imports lowered 9B. The biggest moves can be seen oil and gas.

Add up oil, fuel oil, petr. prod., nat gas and gas nat. and YTD exports increased 13B while imports decreased 42B.

55B change in all kinds of oil and gas trades is 11B higher than the YTD change in the trade of goods.

Other big individual moves can be seen in civilian aircrafts, parts and engines, in cell phones and automotives.

Also keeping an eye on excavators, agri machinery, … while wondering how Jim Chanos’ Caterpillar short will do.

You relate, Fracking might have helped US competitiveness by driving down energy-related production costs; I think the jury is still out on that issue, as discussed in this post) ……..

I believe fracking is a very big economic event, as is pipeline distribution to refiners, especially in the Gulf Coast, to boost manufacturing and export both …….. A case in point is that the stock value of US Refiner, Valero, VLO, has risen quite strongly in the last six months on exports to the Eurozone where the Euro, FXE, has risen very strongly …….. I focus on the title of your article, it communicates to me that the economic policies of central bank stimulus, such as POMO, and credit easing, such as QETernity, have been to revive manufacturing ……..Dispensation economics theory presents the concept that central bank interventionism has been primarily investor centric, and that economic growth measured by GDP and other metrics such as employment are only exogenous metrics not goals …….. The point being that the manufacturing activity presented in this article is at a peak, that is at a zenith, and is going to take a real tumble as investors derisk out of stocks.

Still unclear exactly how QE eases conditions: Fed’s Dudley

Okay, everyone who is surprised by Dudley’s revelation raise your right hand – no Slug I said your right hand.

The only thing Dudley left out is that the FED does not even know if QE eases conditions or makes them worse. Fundamentally the FED is pretty ignorant of what its policies do. Since the Hoover administration the government has been experimenting with the economy to the detrement of the citizens. Let’s all just shout a collective, “PLEASE STOP!”

Agree with XO.

US product supplied is up 3.3% 4 wk ma compared to the same period a year ago. Gasoline consumption is up 3.5% on the same basis.

If we allow the economy can achieve 1.2% oil efficiency gains even absent significant oil price pressure, then the US has sufficient scope to grow GDP at 4.5-4.7% in the coming year. (I doubt we’ll see the efficiency gains, but in principle they’re available.)

Thus, for the time being, oil does not appear to be a constraint on US GDP growth. Given that the trade deficit is also in pretty good shape, and that deleveraging is coming to an end, the economy would seem to have room to grow at a good clip, leaving aside considerations of fiscal or monetary policy.

Irwin, in the linked blog, states:

“It might be better for American workers if this correction of trade deficit and financial imbalances was being fueled more by rising exports — particularly from labor-intensive sectors– than by falling energy imports…”

This is incorrect. US oil production has risen by 3.18 mbpd since 2009, while US oil consumption has risen by 0.1 mbpd (full year monthly data, STEO).

Thus, virtually all of increased US oil production has been “exported” to date, that is, it is pure import substitution. Therefore, falling oil imports in this sense are a sign of economic health, not economic distress. Irwin, although correct in an accounting sense, is wrong in substance.

This impact is quite dramatic. The effect of increased oil production on the US trade deficit in 2013 compared to 2009, is $124 bn on an annual basis, $10.3 bn every month.

My Washington contacts inform me that the Administration is looking to make Arctic drilling much harder from a regulatory point of view. This has been apparently a priority for John Podesta, who recently joined the Administration as ‘counselor’.

Is it really the intention of the Administration to destroy the economy of Alaska? Ninety percent of state revenues come from the oil business. Without offshore drilling, the Trans-Alaska Pipeline will lose its viability sometime between 2020 and 2030, and the Alaskan economy will collapse. That’s what Podesta would like to see.

Ricardo Okay, everyone who is surprised by Dudley’s revelation raise your right hand – no Slug I said your right hand.

If I were an economist I could always invoke the spirit of Harry Truman by asking which right hand.

…and the Alaskan economy will collapse…

Population of Alaska is around 732,000, just a tad larger than Detroit.

To be simply, honestly, pragmatic, in a present and future tense of complex demands, crises, promises and catastrophes, both nationally and globally, Alaska matters how, exactly?

Steven Kopits the Trans-Alaska Pipeline will lose its viability sometime between 2020 and 2030

This has to be one of the worst reasons ever given for expanding oil exploration in Alaska. Perverting public policy in order to line the pockets of the pipeline’s owners is bad public policy and godawful economics. This is also one of the reasons some of us are very leery about the Keystone pipeline; once it’s built there will be all kinds of political pressures to organize public policy around keeping the pipeline profitable for its owners.

As you know, Alaska effectively taxes oil and distributes much of the revenue to every Alaskan. In other words, Alaska is the land of welfare queens if ever there was such a place. It’s strange to hear so many conservatives blather on about how unemployment insurance and other welfare arrangements discourage initiative and effort for those living in the lower 48, but somehow curtailing welfare for Alaskans will wreck their economy. Very strange argument.

BTW, according to the CDC Alaska has the highest marijuana use and the third highest cocaine use.

http://www.businessinsider.com/what-states-are-most-abusive-of-alcohol-and-illegal-drugs-2011-8#

If they’re worried about losing all that oil revenue, then maybe Alaska should follow Colorado’s lead by legalizing and taxing recreational drugs. Can it be any worse than continued oil addiction?

Alaska is a strange place. My friend who lives there calls it an open air insane asylum. At one point I thought it would be cool to live there because it was good times when I visited. Then the medication started working.

But yeah, free stuff. What’s not to like? Even their dullard former half-term governor understood that.

XO you are delusional

Link to health care costs decreasing? Every single long term trend points to lower growth. We can not escape our demographics.

Second –

I think you’re attitude summarizes broader feelings. Who cares what happens in Alaska? Or Nebraska? Or in Wisconsin, for that matter. Well, I care.

Right now, the oil business is providing revenues to the state government totaling $50,000 for a family of four per year. Take that away and the economy collapses. Perhaps you’re a fan of hardship–certainly for other people. I’m not.

Shell anticipates, by the way, that its projects in the Alaskan Outer Continental Shelf (OCS) will produce 1.8 mbpd at peak. Today, the US Gulf of Mexico is producing around 1.3 mbpd. So the OCS is very important project, particularly in the post-shale age (ie, after 2020), representing as much as 10% of US consumption today.

It’s a very big deal. Nationally, it is the single largest economic initiative, representing an up-front investment of about $50 bn, and a total investment on the order of $150 bn. For the citizens of Alaska, it’s literally a choice between two very different economic realities.

Slugs –

If you think Alaska will be a better place if the average family’s effective income is reduced by $50,000 per year, make your case.

As for idleness in Alaska, the state’s unemployment rate was 6.5% in 2013, below the national average.

As for pot, I am reasonably liberal on the matter. I am very curious how things play out in Colorado–it’s really a test lab for public policy. Personally, I am horrified at the number of people in jail for non-violent drug offenses. I am also worried about drug abuse, but this comes down to public policy choices. Colorado is giving us an opportunity to see how that works in action. Let’s let it play out.

Finally, on Trans-Alaska Pipeline (TAPS) economics:

I am agnostic about pipelines as such. (We have a pipeline service here in New York, by the way.)

The TAPS is important because it’s the only way to cost-effectively transport oil from Alaska. It is an engineering marvel. Lose the pipeline, and Alaska’s oil resources are stranded. That’s my interest. I am concerned about TAPS’ viability, not its profitability.

Steven Kopits I never said Alaskans were lazy and wouldn’t work. Hey, Alaska’s employment-to-population ratio is significantly greater than the national average. My point was that many conservatives are very inconsistent regarding the employment incentives of welfare grants. When it comes to welfare queens, Alaskans are in a class by themselves, but yet they still work.

I’m not sure I understand the distinction between economic “viability” and “profitability.” Seems like a distinction without a difference. If there are good economic reasons for bringing down Arctic oil, then the pipeline will be viable. But we should not use the pipeline as a reason for drilling in the Arctic. That’s a sunk cost argument in disguise.

As to Alaskans being made worse off without the pipeline revenues, I’m sure that’s true. But it’s also true that local medieval warlords were made worse off when royal agents were able to break the stranglehold that those warlords had over river traffic. And everyone except those warlords was better off for it. It’s basically the same thing with Alaska. I don’t see the compelling argument for making the rest of us pay more at the pump so that Alaskans can have more money.

There are a lot of serious issues regarding oil exploration in the Arctic. It’s not clear how much oil is actually there. It’s not clear who actually owns the oil…Russia has some claims as well. After the BP spill in the Gulf do we really trust that oil companies have the capability to clean-up in the Arctic? I do know that my friends over in the US Navy will tell you they are not aware of any technology or logistics solution that will work year round. [BTW…this was a Military Operations Research Society Symposium topic a couple years ago.] And if we still need Arctic oil in 2030, then we will be looking at much bigger problems than unemployment in Alaska.

Jeff Apparently you did not read the Simon Wren-Lewis link because he gave several reasons why you might want to pursue both fiscal and monetary policy. They have different effects. Also, a couple years ago Menzie posted some slides from his undergraduate IS-LM lectures that showed how fiscal and monetary policies had different volatilities depending upon the relative slopes of the curves. You might want to review his lecture slides.

You seem awfully damn sure that monetary policy is all that’s needed. I don’t share your faith. For one thing, we know that conventional monetary policy won’t work because we’re at the ZLB. If folks are talking about monetary policy, then they are talking about unconventional monetary policy. And even the Fed admits that they are not entirely sure about QE or how to unwind from it. I’ve been a supporter of an aggressive QE program, but I’ve never said it wasn’t without risk. Greater use of fiscal policy means we would not have to lean so heavily on one unproven tool. Besides, using monetary policy always comes down to increasing inflationary expectations…and I’ve read enough of your posts to know that you would be the first…okay Ricardo would be the first…you would be the second person here to wave the bloody shirt and talk about Helicopter Janet debasing the currency. So it’s a little hard to take your new found faith in monetary policy all that seriously.

Slugs –

Viability is an operational concept. Profitability is a financial one. The major Alaskan operators own the pipeline, so it’s really all-in economics that count, rather than stand-alone pipeline numbers.

I can assure you that Shell is not spending billions drilling in the OCS to preserve the viability of the pipeline. But Shell needs the pipeline to make its OCS project viable. No pipeline, no OCS.

Increasing the oil supply will not make you pay more at the pump. Jim has written about the link of gasoline prices to Brent. You know that.

There is debate on how much oil is in the Arctic. The EIA is showing no increase in Alaska production to 2040. I asked them why. “It’s all gas,” said a senior EIA administrator. Clearly, Shell doesn’t believe that. They wouldn’t have spent $2 bn on leases if they did. But they have half a hole into the Chukchi so far–that’s not enough to prove there’s recoverable resource.

Spills are, of course, a key concern. However, oil seeps along the Alaskan coast are nothing new. Like the Gulf of Mexico, people found oil by following the slick. Notwithstanding, the Arctic seems to be able to handle it. Indeed, the Macondo spill was broken down at water temperatures very similar to that of the Alaskan OCS. (Or as Dean Martin might sing, “Baby, it’s cold down there.”)

Finally, the reservoirs in the OCS are low pressure (3 kpsi) in shallow water (140 ft). Macondo was probably above 15 kpsi in 5,000 ft of water. It very basic from a drilling point of view. Are the environmental riks zero? No. Are they manageable? Yes.

The logistics, however, are formidable.

And, yes, we’ll still need the oil in 2030. Indeed, that’s why Alaska is so important. There are very, very few resources left where an additional 1.8 mbpd can be brought into play, at least from conventional resources. Alaska may be unique in that way–it’s one of the few potentially big catches left in the world.

Whokebe:

It is growing slower, but yes, you are correct that it is still growing. More precisely, I would have said “slowdown in health care cost inflation”. That is what I meant, which is good news compared to health care cost inflation projections, say five years ago.

Financial repression is growing in the US. One of its characteristics is a growth in exports. It is not the same type of financial repression in China though.

The subject of financial repression will grow through year.

Slug – LOL!

We can keep making excuses or we can make changes in the direction of our government. No amount of rationalization will change the facts.

China surpasses US as world’s largest trading nation

Ricardo,

I’m puzzled. China has 3 times the population of the US. Why shouldn’t it be growing towards a per-capita level of GDP and trade roughly comparable to the US, and if so, why shouldn’t it’s level of trade be substantially larger than that of the US??

Let me put it another way: the US was a developing nation in the 19th century, and had levels of growth around 5%. That has declined gradually to around 3% currently. China is at 8%, and is catching up. How are “changes in the direction of our government” going to increase US growth to 8%?

Nick,

When one of the most centrally controlled communist economic system in the world passes the US in economic health it is a definite sign that the US is headed in the wrong direction. China has always had a population greater than the US. Why is it only today that China’s economy is blowing right by the US. (Let me give you a hint: Robert Mundell!)

For most of human history, China has had the world’s largest economy. This only changed around 1600, during the recent aberration of European economic domination. Things are now returning to normal.

Are you familiar with US historical economic growth rates? Is it realistic to expect US growth rates above 3-4%??

kopits, why should we continue to invest in the Alaskan pipeline and encourage our dependence on a finite resource with many secondary costs (environmental, war, etc)? would a better investment be in renewable resources such as wind and solar? the pipeline served a purpose, for sure, but its time is passing. I would rather invest in future long term solutions rather than more finite short term patches. we need to prioritize towards more sustainable energy sources.