More from For a Few Dollars More: Reserve Accumulation in Times of Crisis, by Matthieu Bussiere (Banque de France), Menzie Chinn (UW), Gong Cheng (Sciences Po), Noemie Lisack (European University Institute) (also NBER Working Paper No. 19791):

…In the immediate aftermath of the crisis, countries that depleted foreign reserves during the crisis quickly rebuilt their stocks. This rapid rebuilding has, however, been followed by a deceleration in the pace of accumulation. The timing of this deceleration roughly coincides with the point when reserves reached their pre-crisis level and may be related to the fact that short-term debt accumulation has also decelerated in most countries over this period.

Note that the characterization applies to a ratio — specifically the log ratio of reserves to short-term debt, rather than reserves specifically.

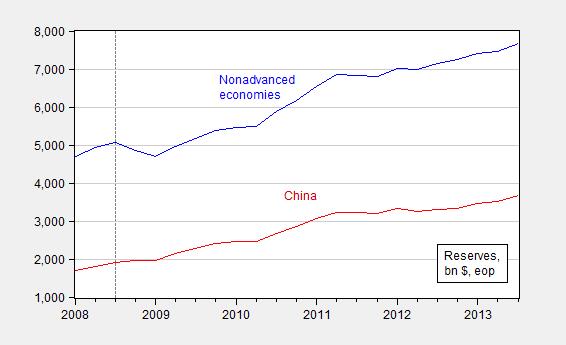

First consider the evolution of the level of reserves, for non-advanced economies as categorized by the IMF, and China:

Figure 1: Foreign exchange reserves of emerging market economies and less developed countries (blue), and international reserves ex.-gold for China (red). Dashed line at 2008Q3. Source: IMF COFER, and IMF IFS via FRED.

Second, as we argue in the paper, the (log) ratio of reserves-to-short term debt seems to be a key explanatory variable for growth during crisis the stabilization in terms of the log-ratio is even more pronounced.

A ‘flattening-out’ of foreign reserve accumulation is also noticeable in other countries when a more recent period is considered. This is the case for Indonesia, Malaysia and Thailand (figure 9) and many East European countries (figure 10) from the end of 2010. What drives this ‘flattening’ in foreign reserve accumulation? We come up with several possible explanations. First, it is possible that, once a country reached its pre-crisis level of reserves, it slows down the accumulation as foreign reserves are no free lunch and the opportunity cost and risks associated with valuation effects may be high. Second, the deceleration of foreign reserve accumulation may reflect a change of policy priority with regard to monetary autonomy, exchange rate stability and financial openness in the wake of the 2008-2009 financial crisis, as Aizenman et al. (2010) put forward. After all, reserve accumulation may be motivated by the need to reconcile the ‘Impossible Trinity’ (this is however an aspect of reserve accumulation that we do not consider in this paper). Last but not least, if foreign reserve accumulation tails off, it might be because of the stabilization of the underlying macroeconomic variable that foreign reserves are used to cover. In our paper, we argue that this macroeconomic variable is short-term debt. With the ‘flattening-out’ of short-term debt after the financial crisis (the reasons why short-term debt diminishes after the GFC are multiple, e.g. Great Retrenchment), the demand for foreign reserves must fall.

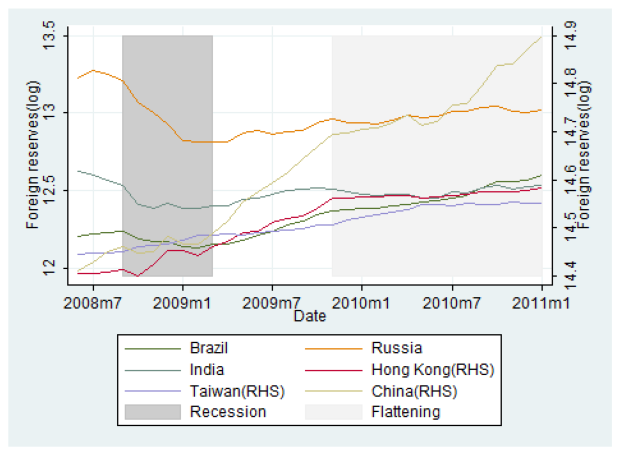

Figure 8 from the paper highlights the general pattern for the BRICs plus, at least in the sample examined (the sample ends earlier in the paper, matching the availability at time of writing of short term debt used to construct the ratio).

Figure 8 from Bussière, Cheng, Chinn and Lisack.

For these countries, the ratio has plateaued. China is one notable exception. (However, since the end of the graph’s sample, Chinese reserves level did stabilize, with a resumption of slower growth in 2013.)

Nice post and paper.

I realize that there is a large and growing literature claiming that the Great Reserve Accumulation is possibly about something other than manipulating currency values with imperfect capital controls, with all kinds of imaginative other explanations proliferating based on complex features of the data. But the basic evidence all seemingly points to the explanation favored by Mr. Obvious — that changes in reserves are all about stabilizing currency values. When the dollar is strong, reserve accumulation stops, when the dollar is weak, it begins again.

The question of reserves is interesting. Normally we think of reserves as savings to hedge against adverse conditions. John Allison in his book about the 2007-8 financial crisis notes that during good times banks would increase reserves and then drawdown reserves during bad times (even Keynes understood this concept). But he noted that bank auditors, who were usually not bankers but political appointees, were critical of banks who had higher reserves before the credit crisis and force reserves lower. Then when the crisis hit these same auditors invoked strict rules on reserves and prevented banks from drawing them down to cover for the decline.

The motivation of government regulators is just the opposite of good business practices. Regulators tend to look the other way during good times and so allow abuses of the system, but during bad times they are sensitive to criticism of their control and they impose draconian rules that only make the times worse.

When a business is looking for someone to run a segment of their business they look for experience and a positive track record of success. Then government is looking for someone to tell businesses how to run they look for someone with political power and influence usually with limited practical experience.

Government regulation and regulators are motivated by all the wrong influences and reasons. When we deal with government auditors we spend our first meetings educating them in the business before we ever begin to respond to questions and I doubt we are alone in this.

RicarDOH,

I didn’t read much, but it appears to me that the paper refers to central banks and you’re referring to commercial banks.

Economics is a fascinating “science”. With no theory at all, zillions of academics calculate correlations between all possible variables they can glean from available data ( government provides them with outmost honesty and clarity, of course) and then come up with most obvious links:)

How can a person find pleasure in explaining the correlations between 2D shadows in Plato’s cave and have no interest in peering out and finding out the 3D origin of those movements?

Fantastic “science”. Because it is social, you see, it has no ability to predict.. Of course, no one in Plato’s cave could predict anything about shadow movement if that moved of typical repeating pattern where You could call one shadow “cause” and the other ” effect”.

At the same time Roman Empire and Western Civilization follows exactly the same living in future ( on debt) and folowing currency devaluation pattern over almost 600 years.

At both Roman and Western Empires decline started when return on extra debt became negative.

That is of course a coincidence. But establishing causal relationships in a cave which break off after something changes in 3rd D after few years is of course a reputable and well paid occupation.

May be because it helps to keep people confused?

Anonymous,

Thanks. Yes, I know.