The increase in vertical specialization in Asia has implications for the strength of linkages between the region’s economies, and the tendency to manage intra-regional exchange rates.

From the paper:

First, the conventional means of measuring international competitiveness are going to be less and less adequate, as production becomes more fragmented. …

Second, the increasing role of intermediate inputs will likely drive down exchange rate pass through. This is true even if the increase is due to increasing arms-length transactions. …

Third, business cycle correlations are rising throughout the region. The more prominent increases are often associated with China, a finding consistent with China’s growing role in the global supply chain. Furthermore, the propagation of shocks throughout the East Asia system is consistent with China driving movements in output, at least in Korea and Taiwan.

Finally, there is evidence that the central banks of the region are paying more heed to the Chinese currency’s value. This is true at the high frequency (daily) and at lower frequency (monthly); it’s true with respect to rates of depreciation, as well as levels of exchange rates. Since these relationships are not structural, there is no guarantee that they will remain in place. At the same time, continued integration by way of production fragmentation should make central bankers pay extra heed to stabilizing currency values against each other.

The paper documents the increase in business cycle correlations over time, where the business cycles are estimated using both the HP filter, quadratic detrending, and differencing. Synchronization is interesting, but does not provide direct information on the origins of the correlations, and the propagation of shocks. VARs can help illuminate those relationships, although at the cost of imposing some assumptions about exogeneity and the set of relevant variables.

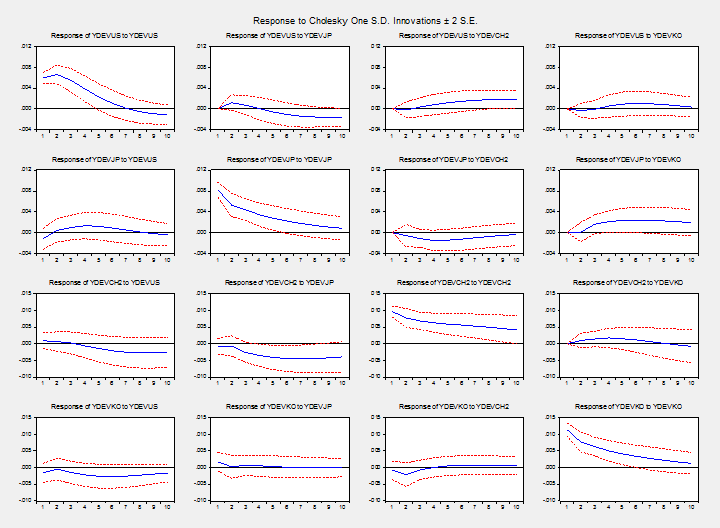

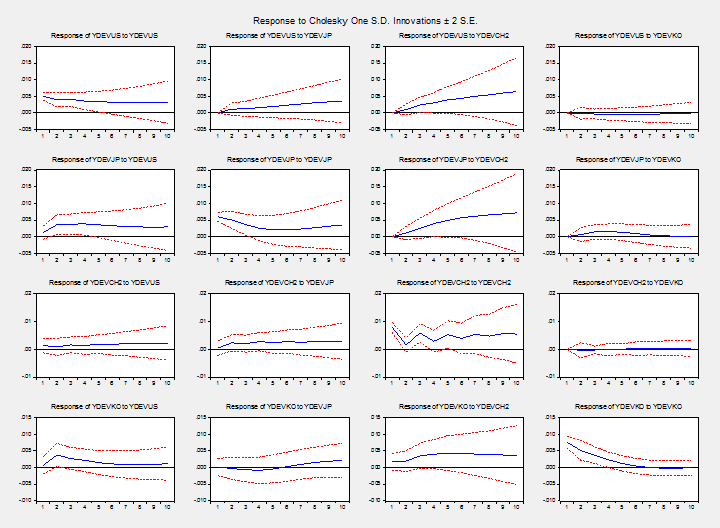

Here are the impulse response functions for a 2 lag VAR including the US, Japan, China and Korea, using the indicated ordering. This means that I assume that HP filter defined output gaps are endogenous, but the US business cycle is more exogenous than Japan’s, Japan’s is more exogenous than China’s, and China’s is more exogenous than the cycle of Korea. I show the IRFs for the early, pre-1998 period, and a post-1998 period, respectively.

Figure 1: Impulse response function for VAR ordered US, Japan, China, and Korea output gaps, 1981Q1-1997Q4. Output gaps estimated using HP filter.

Figure 2: Impulse response function for VAR ordered US, Japan, China, and Korea output gaps, 1981Q1-1997Q4. Output gaps estimated using HP filter.

The most relevant IRF is the fourth row of the third column in each block of graphs. There is little evidence of a spillover from China to Korea in the pre-1998 period, while there is a positive response in the latter period. The change is more pronounced in the case of Taiwan (also reported in the paper).

The paper is here.

Menzie It looks like a couple of the IRs in Figure 2 are not stationary; e.g., YDEVUS ==> YDEVHCH2 and YDEVJP ==> YDEVCH2. (I’m assuming they are not cumulative IRs). Am I misreading these?

Really interesting paper with a lot to think about.

As I think about it, the rise of China as a reserve currency would sensibly tie to regional inter-connection. We tend to think of the process as being driven from outside the region but that may be the wrong direction.

BTW, I love the graphs but, really, your labels suck big time. Without getting into the large panels of graphs, take the simpler Import or Export Pass Through. Why use the same shading for up and down? Why are all the letters the same size and all caps? (Which means they don’t actually line up with the columns.)

jonathan wrote:

“As I think about it, the rise of China as a reserve currency would sensibly tie to regional inter-connection.”

This is an interesting observation and I believe spot on. Robert Mundell suggested decades ago that there should (would?) be the rise of three currency areas: the dollar – the western hemisphere; the euro – Europe and the neighboring countries; the renminbi/yen – Asia. Then by extension, he suggested that one of these three currecy areas would then link to gold and by extension the other two would be linked to gold because of exchange rates. This would moving the world from the disastrous floating currency system to return to the world to a stable currency regime.

Not sure if you’re looking for value added price indexes (based on gross output less intermediate inputs) for an industry’s output or value added as the difference between a country’s exports and its imported intermediate inputs.

You should be able to use the OECD’s Trade in Value Added database to measure the nominal value of exports of product J from country A used to produce product K in country B. For the value added price index of export J from country A, if that’s what you want, you could assume that the overall industry VA price index for industry J in country A applies to industry J’s exports as well as to its domestic production. Country by industry VA price indexes are also available from the OECD.