Estimates of monthly GDP indicate a rebound. So too do forecasts.

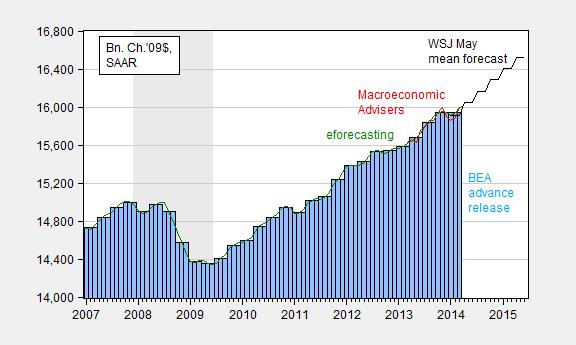

Figure 1 depicts GDP as reported in the BEA’s 2014Q1 advance release, the mean forecast from the WSJ May survey, and two monthly real time series.

Figure 1: GDP as released by BEA (light blue bars), WSJ May mean forecast (black), Macroeconomic Advisers monthly GDP (red), and eforecasting monthly GDP (green), all in billions Ch.2009$, SAAR. Forecasts assume 2014Q1 GDP growth is -0.7 ppts, SAAR. NBER defined recession dates shaded gray. Source: BEA 2014Q1 advance release, WSJ, Macroeconomic Advisers (May 14), eforecasting (May 13), NBER, and author’s calculations.

Note that eforecasting’s index for April is in line with the WSJ mean forecast for 2014Q2. Here is a more detailed look at the WSJ forecast, placed in the context of potential GDP.

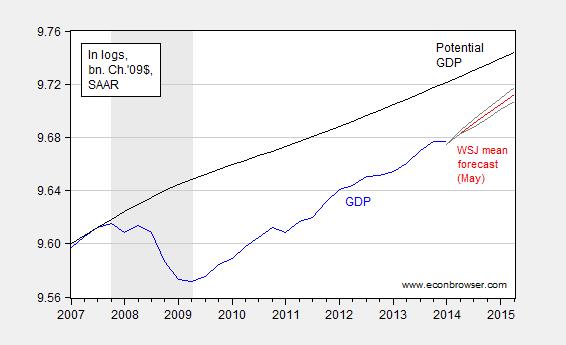

Figure 2: Log GDP (blue), WSJ May mean forecast (red) and 20% trimmed high and low forecasts (gray), and potential GDP (black). Forecasts assume 2014Q1 GDP growth is -0.7 ppts, SAAR. NBER defined recession dates shaded gray. Source: BEA 2014Q1 advance release, WSJ, CBO Budget and Economic Outlook (February 2014), NBER, and author’s calculations.

Note that the mean forecast indicates a -3.2 percent output gap as of 2015Q2; even with the trimmed high forecast, the gap would be -2.7 percent (both in log terms). This suggests that we are nowhere near a rapid surge in inflationary pressures.

Ten year expected inflation has been in a general decline, since the early 1980s. Chart:

http://www.clevelandfed.org/research/data/inflation_expectations/2014/March/image1.gif

Also, it’s likely, inflation has been overstated, because of new products and quality improvements, when the Information Revolution accelerated after the 1970s.

For example, how do we measure the improvements in cell phones over the past decade? Are they 10 times better – a 100 times better? It seems, prices of cell phones haven’t changed that much.

In the CPI they estimate that wireless telephone service has fallen from 100 in Dec 1997 to 57.8 in March 2014.

That is roughly a -2.5% average annual rate of decline.

Do you have any reason to think that estimate is massively wrong?

Goldman and JP Morgan revised their Q1 GDP more negative.

Ricardo: If you’d bother to read the notes to the graph, you would see that they already incorporate a -0.7% SAAR growth rate for Q1, in line with Macroeconomic Advisers’ assessment as of 5/14 (see black line in Figure 1, red line in Figure 2). I think you are a bit behind the curve; maybe you should get your news from places other than ZeroHedge.

Thou “doth protest too much, methinks.”

Ricardo: I don’t understand. To point out what is stated explicitly in the post hardly seems to be a disingenous denial. Please explain.

Ricardo,

You need to keep reputation in mind. Serving the Koch brothers at every turn may pay dividends – social or material, depending on you position in the echo chamber – but your reputation suffers. Experience teaches that, when you ignore or mis-characterize information, it is with purpose and not just an innocent error. So maybe this time, you just did a poor job of reading. Could be. But why would anyone familiar with your reputation assume you made an innocent error?

Data so far for Q2 for mfg. IP, real earnings and hours, and real retail sales implies REAL FINAL SALES yoy of ~1.8% and 1.1% per capita, and annualized q-q of ~1.4% and ~0.7% per capita.

Annualized real final sales per capita of ~0.7% is the “new normal” for the era of Peak Oil-, demographics-, and debt-induced “secular stagnation”, which compares to the long-term rate per capita of ~2%.

And below are charts for Jeffrey and Steven (and anyone else interested, of course):

https://app.box.com/s/i5e769dr18htyqiln9a3

https://app.box.com/s/sh73qoy9uar2aoeoz7ur

The data are clear evidence of Peak Oil, “Dutch Disease”, and the US having fallen off the “Seneca Cliff” after 2008.

US industrial production ex mining and oil and gas extraction implies that the US entered cyclical recession again in Q4 2013 to date. That is to say, the net exergetic costs of extraction of costly tight and tar oil precludes growth of real final sales per capita.

At the trend rate of decline since Peak Oil in 2005-08, US industrial production ex mining and oil and gas extraction will contract 25-30% by 2016-19, which is equivalent to the contraction in 1929-33, only at a slow-motion rate over 9-12 years. Not surprisingly, the constant US$ price of oil is at or above the levels in the early 1980s and 2008-09, which coincided with the worst recessions since the Great Depression.

The evidence is clear that US (world) real final sales per capita cannot grow, let alone accelerate, with the constant US$ price of oil above $40-$50/bbl.

While we’re cheering the energy sector boom/bubble (and echo unreal estate and stock market bubbles), we conveniently avoid acknowledging the increasing cost to the rest of the US goods-producing sector and overall real final sales per capita, not to mention the mounting costs to the ecosystem.

What we have yet to recognize or publicly acknowledge so as to devise large-scale mitigation and contingencies, including conservation, rationing, etc., is that we are into the end game of systemic net exergetic decline since the onset of Peak Oil, which accelerates the longer the price of oil remains above constant US$ $40-$50, whereas the rate of decline for goods production ex mining will accelerate to the critical collapse phase by no later than 2016-19.

In the meantime, we will likely see ongoing precursor and ancillary effects increase and intensify around the world, as the weakest linkages give way within the global net exergetic system of flows, spreading eventually to urban/suburban/exurban US, UK, Europe, Canada, and Oz, resulting in the unraveling of the Anglo-American imperial trade regime, i.e., “globalization”, and a breakdown of trade and diplomatic relations between the US and China before the decade is out.

“BUT THE FORECASTS SHOW GROWTH!”, he screamed as the next recession started.

Anonymous aka Scott Walker, American Patriot and Freedom Fighter: Thank you for your comment. I gather that you believe a recession is imminent. Since you are commenting from a US Bancorp computer, I’d welcome any insights you might have that are constructive, and highlight why you believe a recession is imminent. Thank you in advance.

Menzie, you should put an asterisk on “Leave a Reply” saying that, if you think that something someone said is just to offend you, you would not just ignore the post, you would “denounce” where the commenter works. Shame on you.

marco, freedom of speech bites both ways. but it makes you wonder about the thought processes of some of the people working at the major banks….

Marco: I did not denounce, I merely noted where the comment was coming from. I have absolutely nothing against US Bancorp (and no relationship – no deposits, no loans). Anyway, there is no such thing a privacy on a blog.

Menzie,

Maybe this will help. I was not saying that the calcuations did not include the negatives. I was simply pointing out that the official government number was reported as positive, but Goldman and JP Morgan reported negative growth. Then Goldman and Morgan actually revised their reported numbers downward. Government statistics are self-serving. All calculations based on historical numbers that will be significantly revised are worse than an educated guess. No one knows what will happen tomorrow to change the numbers either up or down or if the numbers are even accurate..

Comrades! Stop the Kochs!

Ricardo,

That video is hilarious! Thank you.

Ditoes, Brian!

Thanks BC for underlining the obvious. I would also interject that its not only high gas and oil prices that depress commercial and industrial activity: its the Financial Repression that we will suffer for several decades as the impaired paper sucked-up by FED QE programs slowly goes to term…

In the long-run, civilization will benefit by a migration to a smaller population, renewable energy, recycled resources, and sane banking administration….

MarkS, indeed. The net flows to the financial sector exceed the yoy growth of nominal GDP, even without the net exergetic per capita drag from $100 oil on production and household and business net income after tax and debt service.

The more the central banks, on behalf of their TBTE bank benefactors, lever up asset prices to wages and GDP, the larger the net claim, i.e., “rentier taxes”, on future wages, profits, and gov’t receipts in perpetuity as you imply.

If the ECB next month takes over in response to the Fed’s “QEn+1 – taper”, it’s possible that the financial markets will further ramp asset prices and valuations to ridiculous levels, exacerbating the “rentier taxes” on the bottom 90-99%, increasing the drag effects on real final sales per capita from what is becoming unspeakably obscene Third World-like wealth and income concentration to the top 0.01-0.1% to 1%.

“The more the central banks, on behalf of their TBTE bank benefactors, lever up asset prices to wages and GDP, the larger the net claim, i.e., “rentier taxes”, on future wages, profits, and gov’t receipts in perpetuity.” This brilliant observation brings to the radar screen what I call the disconnect between the money economy and the physical economy. The two interact, and the greater the proportion of money to physical the greater the ongoing ultimate damage. The pernicious, damaging growth of the money economy for two centuries now has wreaked havoc beyond the pale on the physical economy, the real source of America’s wealth and standard of living. It began after the War of 1812. The truly viral stage was not reached until this past three decades. It took being nested in pure fiat, the case since 1971. The damage did not culminate in 2008 with the historically greatest bubble this nation has ever experienced – the credit-driven real estate bubble of the 2000s. It has not yet culminated! More fuel is being poured on by ZIRP and QE taking the disconnect to even greater heights. For a thoroughly researched eye-opening account, with a cast of scores including Adam Smith, the banker Ricardo, and Karl Marx, right up through Keynes and Friedman, read Michael Hudson’s The Bubble and Beyond: Fictitious Capital, Debt Deflation and Global Crisis (2012). Fictitious from the Latin ficticius — “artificial, counterfeit.”

A more appropriate word would be hard to find. For what is untethered fiat money and credit extended far in excess of physical assets to which pieces of paper are but claims? Other than counterfeit and artificial, the very antithesis of sound money and solid, tangibly-backed credit whose physical dimension does not permit of bubbles and their inevitable implosion. As this is the system in which we now live, none can isolate themselves from the calamities to come. Other than the uber-wealthy. And they along with many others including innocents risk the same fate as that of Marie Antoinette if, God forbid, this ever-higher tower of paper comes tumbling down taking a fair amount of the physical superstructure along with it.

Professor Chinn,

If I read the WSJ survey summary of 2nd Qtr. GDP growth, it says that the 2nd quarter GDP should increase at a SAAR of 3.3%. Do you agree with this forecast?

AS: Doesn’t seem like a bad guess, given the macro data we have.

Some of the comments posted here ought to pose a real concern for academic macro theorists. Modern macro always assumes some kind of rational household actors who can mentally work out the consequences of fiscal and monetary policy in the wake of some kind of demand or supply shock. So we end up with inertial Phillips curves, New Keynesian Phillips curves, sticky information Phillips curves, and so on. How do any of the assumptions behind these Phillips curves pass the laugh test after reading so many posts that link to Ludwig von Mises sites, Hayek interviews and zerohedge.com? I have an idea for some bright up-and-coming grad student looking to make his or her mark on macro. Work out a model that includes dim witted households who follow a Fox News Phillips curve (FNPC) to anticipate inflation and interest rates.

Ongoing falling Major World Currencies, DBV, and soon coming falling Emerging Market Currencies, CEW, means the crush of investment in Global Growth, DNL. While Econobrowser posts Estimates Of Monthly GDP Indicate A Rebound, So Too Do Forecasts, there are no profitable investment markets anymore. Ireland, EIRL, was the crown jewel of debt trade investing and currency carry trade investing, in the age of credit and the age of currencies; now with IRE, JHX, IR, CRH, RYAAY, XL, ACN, trading lower, it is one of the age of debt servitude loss leaders. The death of the wheels of economic activity, that is currencies, means economic deflation, and the dissolution of traditional governance. Fiat money will be replace by diktat money. And democratic governance will be replaced by regional fascism, as communicated in Bible Prophecy of Daniel 2:20-45 and Revelation 13:1-4

Hmmm. Well if that don’t beat all…

Most forecast are off the mark. So why the emphasis?

It reminds me of the work done by Wall Street analysts.

Interesting read, especially for economic professors and their staff.

http://www.newyorker.com/online/blogs/johncassidy/2014/05/rebellious-economics-students-have-a-point.html

BC, without the Fed, there wouldn’t have been any growth at all over the past few years.

Lower interest rates and higher asset prices induce people to spend and borrow, and reduce saving, a lower cost of capital spurs production, refinancing at lower rates increases discretionary income, lower mortgage rates makes buying a home more affordable, 401(k)s and IRAs increase in value, etc. There are massive multiplier effects throughout the economy.

You can praise the Fed later.

Peak, I can not agree. The Central Bank has failed completely to improve economic growth

and all of this after five years of the recession..They are only producing the mis-allocation

of money and capex spending…They are part and parcel in reducing the living standard of the

middle class…They are afraid of deflation and another recession.

The economy should have boomed after one of the worst recession in America, rather than

just limp along…We have major structural problems which the Reserve can not address.

Federal Reserve policies have failed…Governmental unit spending, has also failed to stimulate

economic growth.

Only the market place can make the economy grow but it is being kilt with level after level of

taxes and very costly regulations.

Unless there is an overhaul, the rot will continue.

hans,

how can you say the fed has failed to improve economic growth. what does your crystal ball say the economy would have done if the fed had simply sat on the sidelines and watched the depression worsen?

“they are afraid of deflation” of course they are afraid of deflation. modern economies have a very difficult time reversing course in a deflationary environment, as opposed to an inflationary environment. there are very few positives in a deflationary environment-primarily no growth. and don’t confuse deflation with efficiency-price drops due to efficiency are good, price drops do to deflation are bad. on top of all of this, debt burdens simply rise in a deflationary environment. so of course the fed is afraid of deflation. it would take an economic nincompoop to think deflation was a good thing!

finally, not sure why we should expect an economic boom following a fiscal crisis led recession. this is not a typical business cycle recession. different animal altogether compared to the 80’s style recessions.

Your Baffingship:

“how can you say the fed has failed to improve economic growth.” The growth rate since

the “recovery” has been substandard…The YOY GNP increase of less than 2%…Record food

stamp recipients and over 93 million workers unable to find employment..Where is BO! This

is job inequality…A housing sector which is still in a state of depression and is only producing

marginal numbers due to the construction of new flats.

” what does your crystal ball say the economy would have done if the fed had simply sat on the sidelines and watched the depression worsen?’

Perhaps four bad quarters (a box of butter minus a stick or two) and then a robust recovery for the short term.

I suspect, that Bank Bernank, knew that our banking sector; our shadow banking and several large GSE were

on the verge of collapse..They lost their nerves and started the second shift for printing…

I agree that if possible both deflation and inflation should be avoided…I would also add, that inflation

has destroyed more economics than the former…Correct me if I am wong.

http://philosophicaleconomics.wordpress.com/2014/05/17/why-a-66-crash-would-be-better-than-a-200-melt-up/

“modern economies have a very difficult time reversing course in a deflationary environment, as opposed to an inflationary environment.” Why, if there is a means for solving inflation issues, then why not for deflation?

The aggregate are effect by inflation, whereas deflation is primary a debtor’s issue.

“Though deflation was devastating in the Depression and became a serious problem in Japan in the 1990s, Pack says the threat to the U.S. and other developed economies has diminished because manufacturing and agriculture have smaller roles in the economy than they once did. “Manufacturing accounts for a relatively small percentage of expenditures in the U.S. now,” he says. Instead, the economy is dominated by service industries, and wages constitute their biggest expense, he adds, arguing it is harder for employers to cut wages than for manufacturers to cut prices.

Blume adds that one cause of the Depression was mismanagement of the Gold standard, which governed currency values. The gold standard was abandoned long ago. Other experts say government stimulus efforts should keep deflation at bay.”

http://www.bloombergview.com/articles/2014-04-23/the-economic-monster-called-deflation

http://www.ata.boun.edu.tr/ehes/Istanbul%20Conference%20Papers-%20May%202005/Growth_despite_deflation%5B1%5B1%5D.1%5D.pdf

“finally, not sure why we should expect an economic boom following a fiscal crisis led recession.”

Why not, even after the Fed Lead Depression we had a recovery.

Baff, I have more to add, however, time is fleeting and will add more in two days.

Baff, is not the decline in income among several classes a

possible concern for deflation?

Hans,

your response is typical of the fantasy land which conservatives have lived the past years. you are sooooo sure the recovery is a failure, but it is impossible to know if a better outcome could have occurred if you had let obama present a true recovery act of proper magnitude, or even if a conservative plan would have produced a better outcome. you just take it on faith that a better outcome could have occurred for propaganda.

when you consider we have had 2 significant depression level events (1930’s and 2010’s) which each have occurred over long duration, it is foolish to think these are run of the mill events which are easily fixed. if we cannot agree on the magnitude of the financial event the country suffered through, there is no point even continuing with a discussion on solutions.

“Why, if there is a means for solving inflation issues, then why not for deflation?”

We have tools to resolve inflation, primarily by raising interest rates. We have had many inflationary events to search for a solution, and we have found one that does work. However, we have had fewer deflationary events in the modern world to examine effective tools. Monetary policy has been shown to have limits for deflation. While i can raise interest rates as high as needed to deal with inflation, i have a lower zero bound which limits my ability to drop interest rates in response to deflation. we have an asymmetric monetary policy tool at this point in time. perhaps if we suffer through another 5 deflationary events, we will stumble upon a better tool, but i would hope we simply avoid deflationary environments rather than try to work our way out of them.

“I agree that if possible both deflation and inflation should be avoided…I would also add, that inflation

has destroyed more economics than the former…Correct me if I am wong.”

i would disagree. the great depression and great recession were both far more harmful economically than any of the inflation events which cropped up through the years. which would you rather have as a repeat, the inflation of the 1970’s or another repeat of the great depression of the 1930’s or great recession of the 2010’s?

Hans, it’s not the Fed’s fault one foot has been on the accelerator and the other foot has been on the brake.

Without the Fed, this expensive recoverless recovery would be even worse.

Economists should control fiscal policy and all major economic policies in the macroeconomy rather than politicians.

Peak, we need a new brakeman for this expensive recoveryless recovery.

Peak, real final sales per capita are no higher than at the peak in 2007-08

IP per capita ex mining and gas and oil extraction is at the level of 1995 and contracting at a rate of 2.5-3% yoy. The boom/bubble in the energy sector is another bit of handiwork by the Fed/TBTE banks, as well as Fortune 25-100 firms’ massive FDI in China-Asia that is now faltering and set to contract with China’s production and exports (and a trade deficit from energy and food in the years ahead) and the deflating of China’s largest fixed investment and credit bubble to GDP in world history.

Full-time private employment per capita is at the level of 30-35 years ago.

Real non-residential investment less private employment is not growing, which correlates highly with IP mfg. per capita and real final sales per capita, implying a marked deceleration for IP mfg. hereafter.

Real retail sales per capita yoy are at near 0% as of Apr, and real retail sales ex autos per capita yoy are negative.

Real average hourly earnings are negative yoy.

Auto inventories have surged vs. sales, implying a deceleration of growth of auto mfg., which follows the implication for a slowdown of IP mfg. hereafter.

The real median house price again rose above real wages per capita in 2012-13, which occurred during the peaks of previous Kuznets cycle housing bubbles preceding 5- to 7-year busts. The real estate echo bubble appears to be deflating as 2014 unfolds. Another housing recession is ahead, lasting perhaps into the end of the decade, this time for high-end buy-up properities.

The cyclical rate of one-unit housing and auto sales per capita peaked in 2012-13, and the former is contracting, and the latter is heading there. Housing and auto sales will no longer contribute to growth of real retail sales per capita and thus to real final sales per capita going forward.

Real disposable personal income less transfers, debt service, and “health care” spending is in deep recessionary contraction. Discretionary spending is set to weaken significantly hereafter.

Total net flows to the financial sector exceed yoy growth of nominal GDP. The Fed/TBTE bank-induced asset bubbles and resulting disproportionate rentier flows are masking the underlying cyclical and secular weakness of the economy. The more financial assets bubble up, the larger the net rentier claims on the rest of the economy, and the slower trend real final sales per capita.

I give the Fed/TBTE banks credit for creating yet another massive, unsustainable financial bubble to wages and GDP, and this one the biggest in history. All bubbles burst, and the largest bubbles burst spectacularly. The next deflating real estate and stock market bubble will be global, including China-Asia. The last time a simultaneous global asset bubble and debt-deflationary regime occurred was in the late 19th century, i.e., Panic of 1893 and the Second Great Depression lasting into 1897-98, prior to the imperial wars: Spanish-American War, Boer War, and Russo-Japanese War.

Only this time the global debt-deflationary regime will occur with Peak Oil and population overshoot on a planet with more than four times more people than in the 1890s, and more than three times more than in the 1930s.

Most excellent, BC…What is rarely spoken about is the massive

worldwide expansion in debt, over the past twenty years.

BC,

You haven’t addressed the basic question: why do you think that coal, NG, wind and solar have low E-ROI? Or that they aren’t scalable? You’ve mentioned Jeffrey Brown and Steven Kopits, but neither of them addresses those two questions: they suggest in general terms that Peak Oil will be the End of The World As We Know It, but they don’t provide evidence.

So, have you looked at E-ROI numbers? The scalability of these resources, especially coal and NG over the last 40 years, and wind and solar going forward?

BC, a bubble is needed in a depression.

When the economy recovers, a bubble won’t be needed.

You can thank the Fed now and later.

Slug,

Hayek points out that Keynes did not know the economic literature before he wrote his mercantilist GENERAL THEORY. What is important is that even in this day those who follow Keynes still have not addressed the economic literature. It is like Mises devastating critique of socialist calculation. Socialist simply gave up on their futile attemps to refute him and now simply ignore him. Most Keynesians choose illusion to serious economics. Ignoring truth does not make it go away.

Ricardo So Hayek said that Keynes wasn’t familiar with the economic literature. Well, okay. This is an easily testable claim. Let’s look at the General Theory. On page 176 he references Bohm-Bawerk in the footnotes and then again on the footnotes to pages 183 and 214. On pages 76 and 239 he discusses the Austrian School. On pages 80, 352 and 353 he discusses Bentham. Hume’s essay on Money is referenced in a footnote to page 343. Irving Fisher is mentioned too many times to count. Jevons shows up on pages 329-332. J.S. Mill makes an appearance on pages 18-20 and then again in the footnotes to page 364. Alfred Marshall, Ludwig von Mises, Karl Marx, William Petty, Thomas Malthus, David Ricardo, Adam Smith….all of them are discussed or referenced. And oh by the way, so is Hayek. So instead of calling Hayek a liar, I’ll be generous and just attribute his comments to the failing memory of an old man who said some pretty stupid things. Hayek in his bathrobe telling those neighbor kids to get off the lawn.

The old man seems to have forgotten another interesting piece of history; his bet with Kaldor. Hayek’s theory clearly predicted one thing and Kaldor claimed Keynesian economics predicted something else. They had a bet. History moved forward to reveal the bet. Hayek lost and Kaldor’s prediction came true.

Look, Austrian mumbo-jumbo is economics for dummies. It’s for people who like to imagine great cycles and unquantifiable relationships. Austrian economics is forever predicting doom and malinvestment. We’re always on the cusp of economic collapse. But Austrian economics has no explanation for recovery except the witch doctor’s chant of “Liquidation! Liquidation! Purge the Rottenness!” About as useful as some medieval doctor talking about bodily humours. You’ve been predicting hyperinflation for years. It still hasn’t happened. Do you ever stop and re-evaluate? No. Instead you just consult Shadowstats. I’m sure you believe all of your economic predictions have been spot on, but like Hayek it’s not a good idea for senior citizens to trust their memories. Scroll through some of your old predictions here.

Finally, Keynes was not a socialist by any standard use of the term. Keynes did not argue for government ownership of the means of production. Keynes was not a mercantilist by any use of the term. Classical mercantilists believed in the accumulation of specie (or was that fecie? See Norman O. Brown’s discussion of Martin Luther and filthy lucre). No one would ever accuse Keynes of being a gold bug. The other sense of the term mercantilist refers to people who want the government to set up cozy partnership agreements with powerful business interests. Examples would be Dick Cheney, Scott Walker and Haley Barbour. The WSJ op-ed page is the intellectual mouthpiece of that brand of mercantilism. One of the biggest mercantilists is Steven Moore of the Club for Growth. He’s pretty much the penultimate mercantilist. Isn’t he your hero as well?

Baits, a very distinguished post.

“Look, Austrian mumbo-jumbo is economics for dummies. It’s for people who like to imagine great cycles and unquantifiable relationships. Austrian economics is forever predicting doom and malinvestment. We’re always on the cusp of economic collapse. But Austrian economics has no explanation for recovery except the witch doctor’s chant of “Liquidation! Liquidation! Purge the Rottenness!” ”

So, Baits, do you believe in business cycles? Is there such things as malinvestments? What is your cure

for recoveries? I operate a very small business and last year I experienced my own mal-investment,

which resulted in no profits in one of our divisions…It happens all the time, as no one can foresee future

course of events…And those that commit to many market follies are soon removed from the scene.

In fact, the market place is always in a state of flux, relegating many enterprises as obsolete and

requiring others to reinvent themselves…Surely, you must comprehend this, irrespective of one’s

economic ideology.

hans, what is good for an individual business is not always appropriate for the economy overall. as a single business, when you hit financial trouble you cut back your spending. but if all businesses cut back during a macro event, you get contraction and no growth. so all businesses cut back even more in response to the first order contraction, and so on in a vicious cycle. now eventually you will get the economy to contract enough that is must stop shrinking and begin to grow again. but this is after an inordinate amount of suffering by the people of the economy. while this may offer a solution, it is far far far from the optimal solution with respect to employment, wealth, stability, etc. when i cut back my spending, you end up with reduced income. not good for an economy as a whole.

A contraction are the nature of things, Baffing, and completely

unavoidable…ALL ENTITIES must prepare for such eventuality..

I wish either Professor Hamilton or Chinn would do a thread

on the implication of deflation on economies..It would be a

most interesting exercise.

I have learned a little of it, do to your postings, Baff…I plan to

read more about the Nippon experience with it…Just lack the

time at this moment.

hans,

you need to separate the concept of contraction with deflation. contraction in an individual sector help eliminate inefficiencies in that sector, and maybe not. but other sectors are not affected so the economy as a whole does not contract. deflation, on the other hand, is not sector specific. it is a contraction of the entire economy, if you will. this is bad, no, it is terrible.

“A contraction are the nature of things, Baffing, and completely unavoidable”

I am not sure how you can justify such a statement.

“Hayek points out that Keynes did not know the economic literature before he wrote his mercantilist GENERAL THEORY.

Ricardo, that maybe not a bad thing.

Menzie,

Unless you’re trying to crush any dissent by outing people’s locations who usually disagree with you, I’d prefer if you deleted the post where you out a network location I happen to occasionally post from.

If not, if you could please post a spreadsheet of all non-public information you have on the networks your posters post from, to show you’re a just and fair person.

Anonymous: I guess you don’t have the courage of your convictions, then. You can comment at will — just be willing to stand by your comments. That hardly counts as “crush[ing] any dissent”.

By the way, I don’t count 138 comments from this location as “occasionally”.

I’m happy to stand by my points, but you revealing non-public specific networks I post from to the public in order to shame me or threaten my job is not relevant. That is how you crush dissent and if you refuse to remove it I will stop visiting your blog. Congrats, you won, enjoy your echo chamber.

Anonymous: If there is any shaming, it is in your own mind. You should be proud of your job and employer, and proud of your views.

Thank you again for your comments.

anonymous, i think you fail to realize the internet is not anonymous-and it should not be anonymous. you should take responsibility for your statements. and menzie did not out you in any sense of the word. thousands of people work at your bank-nobody has an inkling of who you are. that you become very concerned about your comments being “outed” indicates perhaps you are making irresponsible statements online-and are aware those statements are irresponsible.

So the brave anonymous is upset that we might have a clue he/she is one of 20000 potential employees who snark on a blog.

And some say Americans have spurned the brave convictions of their Tea Party ancestors. I say, Not!

Slug,

Mentioning someone’s name does not mean you know their writing. Keynes was in an economics school so I am sure he had heard many names, but he was too interested in politics to bother himself with serious economics. Hayek says he took Keynes first major work seriously and spent a lot of time criticising it. Then as Keynes released his “General Theory” he told Hayek he had changed his mind. Hayek never criticised the General Theory for two reasons. First, Keynes would just change his mind again and second, it was so mercantilist, Keynes even dedicated a whole chapter to mercantilism, that Hayek never thought anyone would take it seriously. This was probably the greatest mistake he ever made. Hayek underestimated the power of Keynes influence on the political class justifying government crony socialism and monetary debasement.

Just for the record if I have ever called Keynes a socialist I was wrong and retract it. I do not recall ever making such a comment. But Keynes was a proud mercantilist and a promoter of the benefits of crony socialism. The General Theory more than any other theory promotes government abuse of power through confiscation and redistribution of economic resources. Keynesianism justifies materialism by promoting consumption at all costs and crony socialism by promoting government spending at all costs.

Slug,

To put meat to my post above I hope readers will consider the truth in this short excerpt of comments by George Gilder to understand why our economy is gasping for air.

“This administration is much more hostile to free enterprise than the Chinese communists,” he said.

“The Chinese have got free zones [free-market-oriented special economic zones] all over the place. The Chinese communists have 40% lower government spending as a share of GDP than the U.S,” he added, noting that even Russia’s economic trajectory is set to achieve lower spending to GDP in the coming years.

But despite this trend he decries, Gilder’s indefatigable optimism could not be suppressed.

“The economy of the mind can change as fast as markets can,” he said, noting that after World War II, everyone was predicting another economic depression. “But in 1946 a new Congress came in and achieved a 61% drop in government spending; 150,000 regulations were laid off. Tax rates were, effectively, cut in half. That set the stage for the golden age that followed.”

Professor Chinn could also reveal my location and hopefully followed-up

with a personal visit, wherein, a limousine would be waiting to whisk

him away for a delightful dinner at Morton Steak House.

I may be in the bottom of his class but on the top when it comes

to hospitality.

About Anonymous and posting from a corporate location. If Anonymous is a Registered Rep, a Principal, or an officer of the company he may be prohibited from posting his views using US Bank owned equipment or on work time. That is why randomworker no longer posts from work! Our policy is that posting on private message boards on company time needs to be pre-approved by our compliance department. So that workers are not undermining the corporate message. The corporate message from USB in this case is…

“The U.S. economy likely will see average growth of 3 percent, while Japan and Europe likely will improve to 2 percent and 1 percent, respectively. ” In other words, no recession in the forecast!

Regards.

Slug,

I have had time to access my copy of the General Theory. Here is the quote where Keynes lays out the mercantilist theory that his theory memics.

“…the methods of the early pioneers of economic thinking in the sixteenth and seventeenth centuries may have attained to fragments of practical wisdom which the unrealistic abstractions of Ricardo first forgot and then obliterated. There was wisdom in their intense preoccupation with keeping down the rate of interest by means of usury laws (to which we will return later in this chapter), by maintaining the domestic stock of money and by discouraging rises in the wage-unit; and in their readiness in the last resort to restore the stock of money by devaluation, if it had become plainly deficient through an unavoidable foreign drain, a rise in the wage-unit[5], or any other cause.” [my emphasis]

Keynes proudly admits that his theory is based on “the early pioneers of economic thinking in the sixteenth an seventheenth centuries.”

Your BaffingShip:

I found this in my files..It is from the Brilliant Mr Pater Tenebrarum of the Acting-Man.com.

“There are 65 episodes of deflation without depression and 21 of depression without

deflation…Thus, 65 of 73 deflation episodes had no depression, and 8 of 29 depression

episodes had no deflation…What is striking is that nearly 90% of the episodes with

deflation did not have depression…In a broad historical context, beyond the Great Depression,

the notion that deflation and depression are linked virtually disappears.”

So let’s stop the fear-mongering from those that suggest that deflation will lead

to a depression…Also, for those whom over-leverage their finance let deflation be

a warning and punishment for their lack of monetary stewardship.

hans, the two most significant financial episodes of the past 100 years were the great depression and the great recession. both of these events had major deflationary components-lets be clear without the actions of the fed this past event would have resulted in significant deflationary data. you need to explain why deflation did not impact the severity of these events. a random quote from a biased blog does not count as a valid argument. there is nothing positive out of a general deflationary environment, and furthermore, we really have no policy ideas on how to effectively recover from such events. your support for deflation is baffling.

Buff, I posted a reply with two links, however, for whatever

reason it was not posted..

I spent quite some time to form the post and will waste no

more.