How tight is the labor market? A recent article summarizes the argument that wage pressures are building. From K. Madigan in WSJ Real Time Economics:

Economists now are debating whether the Fed has set its Nairu sights too low. And they point to two reports out Tuesday as proof.

The first report was the small business survey done by the National Federation of Independent Business.

The May survey showed optimism among business owners is the highest since before the Great Recession and a few labor-market indicators have also left the recession behind. A cycle-high percentage of business owners report having problems filling certain job openings. The share saying they cannot find qualified candidates was the highest since October 2007.

…

Another sign that the U.S. is closer to full employment came from the Job Openings and Labor Turnover survey from the Labor Department.

The Jolts report showed a large gain in job openings in April. …

Since mid-2009, the Beveridge curve has shifted to the right. At every level of openings, the jobless rate is now higher–a possible sign of skills mismatch between the unemployed and the workers companies seek.

It also suggests the labor markets are tighter than implied by the jobless rate.

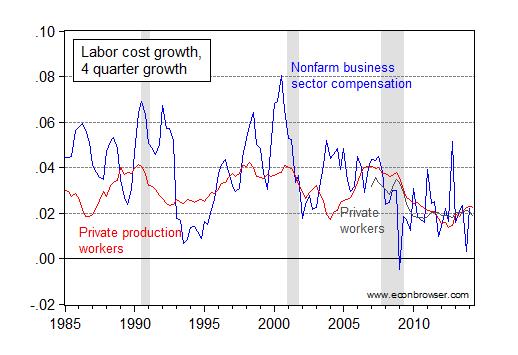

It may very well be that the labor market is signalling higher wage growth. However, those signals have not yet shown up in price indicators. Figure 1 depicts the costs from the productivity and costs release, as well as from the employment release.

Figure 1: Four quarter growth rates in nonfarm business sector compensation costs (blue), nonfarm private production and nonsupervisory employee wages (red), and nonfarm private employee wages (dark gray), all seasonally adjusted. 2014Q2 observations are for the first two months of the quarter. NBER defined recession dates shaded gray. Source: BLS.

We have certainly seen higher wage inflation in the past.

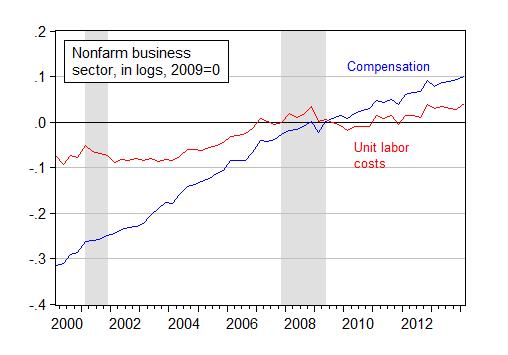

In addition to muted compensation growth thus far, it’s interesting to observe that the level of unit labor costs, an important indicator of production costs (and hence price level trends) is only 1% (log terms) higher than they were half a decade ago.

Figure 2: Log nonfarm business sector compensation costs (blue), and unit labor costs (red), seasonally adjusted, 2009=0. NBER defined recession dates shaded gray. Source: BLS.

Obviously, one wants to be careful about extrapolating these trends. The deceleration in productivity growth has clear implications for unit labor costs, so one might see a jump in unit labor costs. However, as John Fernald has observed, the deceleration has already occurred, so there is no a priori reason to expect a further deceleration.

Hence, from my perspective, the case for an imminent surge in compensation costs has yet to be made.

Madigan cites increased job openings as per May JOLTS; which showed job openings in retail rose from 488,000 to 553,000 and job openings in restaurants and bars rose from 563,000 to 625,000, while job openings in construction fell from 116,000 in March to 94,000 in April…not exactly the jobs the kids need to pay off their student loans…

And job openings for professional and business services went from 787,000 to 853,000, about the same as the increase in retail job openings that you mentioned.

Investormill: Job Openings: Professional and Business Services

there’s no job-type breakout in that large JOLTS category, but we know from the unemployment reports that around a third have been temporary help services; the rest could be anything from janitors to accountants..

I had a very good friend, Sam, who was mentally challenged. Five days each week he would ride his bicycle to a local McDonalds where he would clean tables. He would interact with customers bringing them napkins, and condiments, and his smile made everyone who visited leave with a smile. Did the McDonalds need his services? Not really. It could be argued that he brought in enough return customers to pay he wage, but it could not be proven. Most of those customers would have come in anyway but Sam’s presence made their visit more enjoyable.

The McDonalds faced a decline in business and ultimately the manager, in tears, let Sam go. Sam went on public assistance.

I say all that to remind everyone that higher wages come from prosperity not mandated minimum wages and definitely not from unemployment insurance. The problem with the tight labor market is a skill problem. The high unemployment we are facing today is worse than most realize becuase it is not across the board. Those with skills do not have a serious problem finding jobs. Entry level and non-skilled labor is simply not being employed. For evidence of this all you have to do is look at the unemployment rate of blacks and teenagers. Our government has made decisions that are disastrous to the poor and disadvantaged as they skim the cream off the top of major corporations for their Las Vegas junkets and gifts to their Dominican mistresses.

ricardo, every business man can increase profits by cutting costs. layoffs are an easy way to show paper profit. so every business lays off 10% of its workforce and provides zero percent raises. how does that affect aggregate demand and profits for the individual company in the coming year? another round of layoffs? we lack people in the business world who can see the bigger picture.

“The problem with the tight labor market is a skill problem.” not true. the problem is we have a disconnect between what management will pay and what labor will work for. the tech field is a prime example-and a showcase for manipulation of a labor market. this has occurred through manipulation of the visa program, cartel like behavior amongst large tech companies in recruitment, abuse of noncompetition employment clauses, etc.

That’s a lot of hogwash in one small McDonald’s wrapper.

Sam went on public assistance.

You might want to find out more about this story (is this an urban myth-type story, from a political email?). I’m not familiar with any “public assistance” program that would give cash benefits to an adult able bodied male like Sam just because they were unemployed.

While you are looking at ULC it should be noted that much of the recent weakness is due to weak compensation — at near record lows — as good productivity.

Moreover, it looks like 2nd quarter hours worked are rising at a 3% – 4% rate so do not expect strong productivity in the second quarter unless growth is much stronger than expected.

The small business survey you cite as been trending higher for five years, yet during that period neither employment growth or wages accelerated.

How much should credit should we give to a measure that has been wrong for five years?

Slow growth of business revenues and private investment to employment, and after-tax profits contracting yoy, suggest that growth of employment is set to decelerate as cyclical effective demand constraints bear down from peak Boomer demographic drag effects on housing and consumption and high prices of oil and gasoline to wages and GDP.

John Fernald’s projection that overall productivity will grow in the long-term by only 1.6% per year is bad news.

Do you have any thoughts about that projection?

@Nick G: “John Fernald’s projection that overall productivity will grow in the long-term by only 1.6% per year is bad news.

Do you have any thoughts about that projection?”

The aggregate of labor force and labor productivity growth has decelerated to 1.45-1.65% from 3.4% in 2000 and 2.4% in 2007. The aggregate per capita is now 0.7-0.95% vs. 2%+ long term.

Historically, real labor productivity per capita is a factor of population growth and capitalization of labor (tools, skills, available net energy per capita, etc.), which has been ~1% for the advanced countries, including the US, UK, and Germany. The aggregate of population/labor force growth and labor productivity over the long run has been ~2% real.

However, since the 1970s-80s, a large share of aggregate US real final sales was a result of increasing debt to wages and GDP coincident with deindustrialization (offshoring and labor arbitrage and the resulting decapitalization of labor), financialization (increasing share of wages and GDP flowing to the financial sector), and feminization (women becoming about half the labor force but up to 80-85% in medical services and education, two of the fastest-growing sectors since the 1980s).

Yet, today and hereafter population growth will slow from 1%+ for the last 50-100 years before 2000 to 0.6%, debt to wages and GDP reached the jubilee limit bond and won’ grow hereafter, and Boomer demographic drag effects imply that the labor force will not grow, or only a little, as peak Millennials make up just 33-50% the size of the peak Boomers as a share of population and labor force when entering en masse at similar age.

Moreover, the emergent Schumpeterian techno-economic S-curve (biotech, nanotech, genomics, bioinformatics, biometrics, nanoeletronic sensors, quantum and molecular computing, Big Data, the cloud, etc.) is causing the accelerating of automation of service sector paid employment today and hereafter with high fixed costs of infrastructure, including energy, medical costs, and gov’t, will result in further deskilling of labor, which in turn will cause structural unemployment/underemployment and widespread loss of purchasing power (and payroll tax receipts) from paid employment. Theoretically, labor productivity per the existing workforce will soar, but labor’s return as a share of final sales/GDP will further decline, if not plunge, causing real final sales per capita to fail to grow indefinitely, if not eventually contract inexorably.

Further increases in the bubbly value of financial assets as a share of wages and GDP from central bank reserve expansion and encouraging rentier speculation only exacerbates the debilitating effects of inequality from increasing net flows to the largely non-productive (parasitic) financial sector (worse in the UK), ensuring low, no, or negative real total returns to financial assets for many years to come.

Summary

High fixed costs per capita for the existing built infrastructure in need of replenishing along with record levels of private and public debt to wages and GDP, high energy costs to wages and GDP, slowing population and little growth, or contraction, of the labor force, and accelerating automation and elimination without net replacement of paid employment will reduce further labor’s share of real final sales, causing no growth of real final sales per capita, and thus no growth of capital formation, investment, employment, and gov’t receipts.

Robert Gordon has foreseen this phenomenon; however, most economists are trained and paid to dismiss his thesis, therefore, they are 20-30 years behind the techno-economic S-curve, if you will.

The bottom 90% American working class cannot compete with automation AND foreign slave labor. Without a structural increase in paid employment and labor’s share of GDP and/or an alternative to paid employment for subsistence purchasing power for the bottom 90%+, e.g., Basic Income Guarantee, Social Dividend, etc., the country will be at increasing risk of a collapse of the mass-consumer economy, austerity and increasing economic insecurity for the majority of Americans, and social instability and a durable loss of faith in institutions. Already the overwhelming majority of the US population perceive the country to be on the wrong track and federal elected representatives as tools of Wall St. and the CEO caste and their top 0.01-0.1% benefactors, whose interests are increasingly divergent from the masses, if not by definition in opposition in a zero-sum, winner-take-all system in which the vast majority of us are losers. The Fed’s actions over time only further facilitate and reinforce the inequality and indifference and disengagement from the productive economy by the top 0.01-0.1% to 1%.

Where is today’s Smith, Ricardo, Mills, Marx, George, Veblen, Kondratiev, Schumpeter, Kuznets, Juglar, Kitchin, Mises, Hayek, and Keynes? Who is standing on the shoulders of giants to see the way forward to avoid a zombie apocalypse?

Simple question. When wages increase, is it always considered ‘inflation?’

Mr Herbert, no, especially if you have productivity gains.

And as even the WSJ has noted, price increases seem mostly to be the with the goal of making more profit, not cost driven.

https://app.box.com/s/8o9nq5m2robjymg6l8xa

https://app.box.com/s/5mn3uxfovpbevonufq59

https://app.box.com/s/07jsyuk64zc738quwtje

https://app.box.com/s/5dcle1n37nf6jqqjsktr

The regression of the data ensemble used by the NBER to determine business cycle dates for data through May implies a further deceleration of the 4-quarter real final sales per capita rates. After-tax real incomes and spending continue to be weak with no indication of acceleration. Industrial production is so far being skewed higher by oil and gas extraction that has likely peaked and has begun to decelerate.

Stall speed occurred in Q3-Q4 2013. Recession likely began in Q1, weather notwithstanding.

Because of the post-2007-08 cyclical trend rate of ~0% for real final sales per capita, coincident diffusion indices will be unlikely to detect stall speed and deceleration into recession before a recession is already underway. Thus, the US economy is much more vulnerable to even modest shocks that result in contraction than is generally assumed.

The widespread consensus is that there is no risk of recession or a bear market until the Fed begins restraining or reducing bank reserves, raises the reserve rate, and the yield curve thereafter inverts; however, this does not occur ahead of recessions during debt-deflationary regimes of the Long Wave, which began in the US and EZ in 2008 and has been underway in Japan since 1998.

The probability is effectively 0% that the Fed will begin raising rates and the yield curve inverts to presage a recession.

I don’t understand how wages for anyone in the bottom 90% could ever go up.

1. Move production to third world.

2. Automate all the skill out of job…replace 20 good jobs with 1 great job and 15 minimum wage ones.

3. If those two thing do not affect the mkt for a particular skill, simply send your lobbists to DC, claim you “can’t find anyone with the skill” and then get free reign to import indentured servant with the desired skills at well under the prevailing wage rate in the US.

4. Slash government payrolls.

All of these dynamics put a hit on aggregate demand…putting further pressure on wages.

gman, a monument should be built in DC and your post engraved on it.

But eCONomists, lawyers, politicians, lobbyists, mutual, pension, and hedge fund managers, CEOs, and TBTE banksters are the architects, enablers, facilitators, and primary beneficiaries of what you describe, yet they have yet to be outsourced or automated out of existence, even though there is little organic demand for what they (don’t) produce (destroy?); curious, that, but one can hope for such progress.

Dear Dr. Chinn,

I wanted to pass along this article in the Washington Post, “Tax cuts in Kansas have cost the state money and jobs,.” The article contains additional links to editorial in the WSJ and an article on the same subject in the NY Times. Very interesting in light of the tracking you have been doing of the economies in Wisconsin and Kansas.

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/06/27/tax-cuts-in-kansas-have-cost-the-state-money-and-jobs/

Best regards,

Samuel

Also, I have been reviewing some of the latest information from the Wisconsin Dept. of Workforce Development on Local and City Level Employment. It seems to me, as a causal reader, that employment in Wisconsin has stagnated. Could it be that some of the economic policies implemented recently led to stagnant growth?

Thank you.

And Wisconsin is also following in Kansas’ footsteps by having a budget shortfall after taxes were cut. We’re likely looking at a $1 billion deficit for their next General Fund budget , and another $1 billion in Transportation Fund deficits.

Hmm, guess taking money out of the middle class and giving breaks to the rich and corporate didn’t really work did it. File that under “DUHHHH!”

Maybe some of you guys should try actually reading an economics textbook some time. Like these two guys from LSE:

http://www.voxeu.org/article/uk-productivity-and-job-puzzle

‘[In the UK] the combination of slower trend growth in wages, associated with extremely poor productivity performance, with increased downward pressure from unemployment, means that the economic pain in this recession is felt in terms of falling real wages rather than fewer jobs. Part of the explanation may lie in the fact that the loss of income from unemployment has risen over time, as unemployment benefits – which in the UK are not linked to previous salaries, as they are in most countries – have risen more slowly than wages.

‘Meanwhile, administrative pressure on benefit claimants to take low-waged work rather than hold out for a better paid job has steadily increased. This means that workers may be more likely to trade lower wages to keep their jobs now, compared to previous recessions. Moreover, trade unions are far weaker and less prevalent than they were in previous recessions when they were more able to keep wages rising even in the face of low demand. Firms are then using plentiful and relatively cheap workers to meet demand (rather than investing in new machinery etc.), producing the outcomes of falling real wages, poor productivity, and modest increases in unemployment.’

Let’s put on our thinking caps, and ask ourselves what would happen if there was a minimum wage law that mandated unskilled labor be paid more than their productivity. Class?

Here is more ammo for your theme of governors over promising employment growth via tax cuts.

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/06/27/tax-cuts-in-kansas-have-cost-the-state-money-and-jobs/

Best

Keep up the good work

dilbert

I think both sides of this debate are missing the issue.

Yes, employers of skilled labor are having trouble filling positions, but that’s been true for years, and largely reflects unwillingness to invest in training. That is, there are upward wage pressures in parts of the labor market, but they are not very strong or new. Short-term jolts movements are unlikely to mean much.

Yes, unemployed low-skilled labor is still plentiful with few localized exceptions. That will continue to weigh on the average and somewhat reduce skilled bargaining power.

So, yes, there’s little reason to expect much change in wage growth trends. The turnaround in inflation is quite minor and mostly to do with international commodity markets and the domestic credit cycle.

That however doesn’t mean that loose monetary policy will help at all. Not only is monetary policy the wrong tool for a competitiveness problem, its power is close to exhausted.

If skills are that much in demand..where are the massive wage increases and in what professions?

Monetary policy won’t help competitiveness? Oh really..monetary policy can’t lower the currency?

Having asked that I have to admit something else may be going on. Wages here in things like manufacturing are already low by 1st world standards. Regulations are low by first world standards..yet we run a trade deficit? Many a sacred cow may need to be gored.

Nick G,

My story is a first hand account. Sam is a personal friend. As I said in the story he is developmentally challenged. When Sam lost his job at McDonalds he was forced to take public money to support himself. The point is not so much Sam as it is the fact that wages are dependent on economic conditions not dictates of the government. The government can set all the wage floors they want to but they will not change reality. It is the typical delusion of statists that government dictate can somehow change scarcity and the laws of economics.

ricardo,

in your “story” of sam, perhaps instead of blaming the government one should blame the manager of the store. perhaps sam really did pay bring in more for the store than he cost, but the manager and his business partners were unable to quantify this accurately. letting him go then would be a dubious decision. in “stories” like this there is the implied assumption that management always makes the correct decision. i would challenge that assumption to the fullest. my experience has been a large number of managers and their decisions are shown to be flawed in hindsight. now you can argue that hindsight is 20/20, which is true, but it still does not change whether a decision is good or bad. every time you challenge the wisdom of government, you should do the same for the private sector.

Even while working at McDonalds “Sam” was probably taking public money to support himself.

Ricardo,

There’s a basic problem here: in a classical market, the price for marginal supply will be equal to the marginal cost of production. So, that means in a labor market labor compensation will be equal to the cost of subsistence and minimum training, no more.

So, in the absence of intervention, in the form of unions or wage laws, labor will always be paid the minimum. Low skill workers will be truly poor. Educated workers will paid the additional cost of their education – these days, educated workers will be paid subsistence wages plus the cost of their student loans, and no more.

We’ve forgotten this because of the existence of unions, minimum wage laws and anti-trust laws, and because labor markets haven’t been very efficient.

Wages have stagnated for the last 40 years because unions are becoming weaker, real minimum wages are falling, anti-trust laws are no longer enforced, and labor markets are becoming more efficient, with international arbitrage, online hiring systems, etc.

It may be efficient to pay workers the absolute minimum, but it’s not humane. Corporate CEO’s know that: that’s why CEO pay isn’t an efficient market, and CEO pay continues to rise without being anchored either in performance or ratios to other levels of employee pay.