Two years ago, Governor Brownback asserted:

Our new pro-growth tax policy will be like a shot of adrenaline into the heart of the Kansas economy.

The Facts

Newly released coincident indicators from the Philadelphia Fed (calibrated to match trends in real Gross State Product) indicate Kansas continues to lag the Nation. Leading indicators released by the Philadelphia Fed indicate continued lagging.

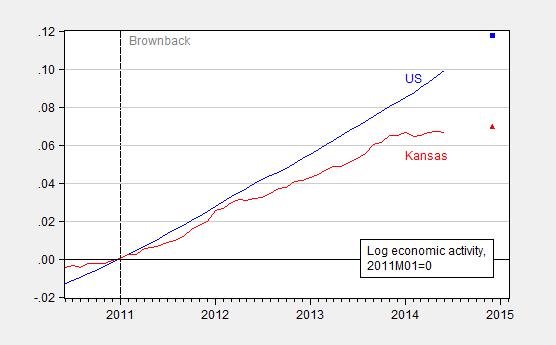

Figure 1: Log coincident indicators for US (blue), level implied by leading index (blue square), and for Kansas (red), level implied by leading index (red triangle), all normalized to 2011M01=0. Forecasts from July release. Dashed vertical line at 2011M01. Source: Philadelphia Fed, and author’s calculations.

Notice the complete stagnation of Kansas output since January 2014, and deceleration starting from January 2013.

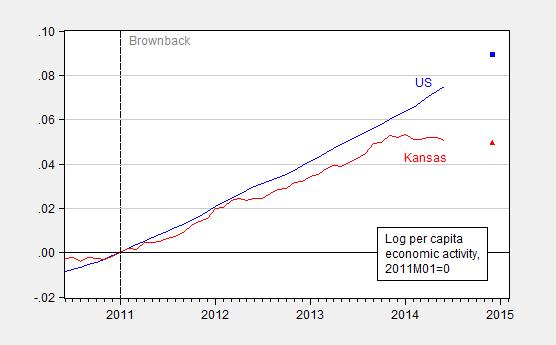

This pattern recurs, albeit with greater force, if one normalizes the coincident indices by estimates of population. I divide the Kansas index by quadratic-match interpolated population, and the US index by mid-month population (for 2014M06-2014M12, I use a dynamic forecast from an ARIMA(1,1,1) on log mid-month population.

Figure 2: Log coincident indicators for US (blue), level implied by leading index (blue square), and for Kansas (red), level implied by leading index (red triangle), all in per capita terms, normalized to 2011M01=0. Forecasts from July release. Dashed vertical line at 2011M01. Source: Philadelphia Fed, FRED, and author’s calculations.

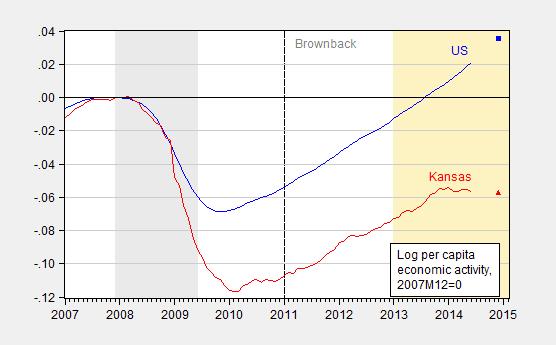

The forecasted trajectory for Kansas is fairly dismal. Some would say that this outcome is an artifact of the normalization date — that since Kansas fell less than the Nation, it should have bounced back more, or something like that. I’ve never found that “bounceback” argument particularly convincing, but be that as it may. In point of fact, Kansas fell more than the Nation, and has bounced back less.

Figure 3: Log coincident indicators for US (blue), level implied by leading index (blue square), and for Kansas (red), level implied by leading index (red triangle), all in per capita terms, normalized to 2011M01=0. Forecasts from July release. NBER defined recession dates shaded gray; tax cut regime shaded tan. Dashed vertical line at 2007M12. Source: Philadelphia Fed, FRED, NBER, and author’s calculations.

Interpretation

Why has Kansas output per capita stagnated, and in any case, declined relative to the Nation’s? One way of thinking about this is to take a supply-determined, or real business cycle, interpretation of output determination [1]:

Y = Φ F(K,N)

Where Φ is total factor productivity, K is the capital stock, and N is the labor force.

If output is completely supply determined, then one has to think about the fact that the change in output must be attributable to either the change in total factor productivity, TFP (Φ), the capital stock (K), or the labor stock (N). That is (after taking logs, and assuming a Cobb-Douglas production function):

Δy = Δφ + σ Δ k + (1- σ) Δ n

Where σ (1-σ) is capital (labor) share of income. Now as best as I can determine, population has continued to increase through 2013 (the 2014 figures are an extrapolation based on lagged population growth). There has been no war in Kansas that might have destroyed the extant capital stock, so it seems unlikely K has declined. This suggests that (with increasing population and likely increasing capital stock) there must have been technological regress — that is Φ must have declined. How? Perhaps some amount of Kansas technology has been destroyed. Another interpretation consistent with a supply determined view is that the first equation omits human capital, and somehow human capital has disappeared — and increasingly so, over the past year and a half.

Some New Classical interpretations would, strictly speaking, append an error term to output, to represent the fact that expectational shocks could drive output away from full employment of resources. However, to make the deviations serially correlated, either the expectational shocks must be serially correlated themselves, or there are real impediments to adjustment, such as capital adjustment costs or sticky prices (But going down that route would lead to a New Keynesian model, so let’s dispense with that).

Another possibility is that tax policy has changed the labor leisure tradeoff (the tan shaded area denotes the period in which the new tax regime was in place). Perhaps the wedge between pre-tax and after-tax returns to labor or capital have increased thus reducing the optimal levels of capital and labor employed. However, the entire point of the tax cuts implemented by Governor Brownback was to reduce the burden on households (particularly higher income households) and firms. In essence, there is a puzzle.

A Reconciliation of Facts and Theory

Or maybe output is demand-determined in the short to medium run…

Page 13 of the Kansas State FY2014 Comparison Report indicates that for FY 2014 (which just ended) is 3.1% lower than FY2013; FY2015 will be 0.6% lower than FY2013. What about the trend in real spending? Since the CPI-Midwest rose 1.7% (y/y through June), then real spending fell 4.8%. Even more telling is that nominal economic activity probably rose about 3.3% through June (change in Philadelphia Fed coincident index plus change in CPI-Midwest). So that is a drastic fall in spending, when considered as a share of nominal GSP.

More on ALEC, Laffer, Wisconsin and Kansas, here.

Update, 6PM Pacific: In a panagyric to Brownback, the WSJ has detached itself further from reality (if that is possible), in Why Liberals Hate Kansas: Sam Brownback’s tax cuts must be discredited before they succeed.:

By liberal accounts Kansas is experiencing a major fiscal and economic meltdown like well, you know, Illinois. The truth is that it’s too soon to draw grand conclusions about the tax cuts, which have been in effect for all of 19 months. But some early economic indicators suggest they may be producing modest positive effects. The danger is that a coalition of Democrats and big-spending Republicans will pull out the rug before the benefits fully materialize.

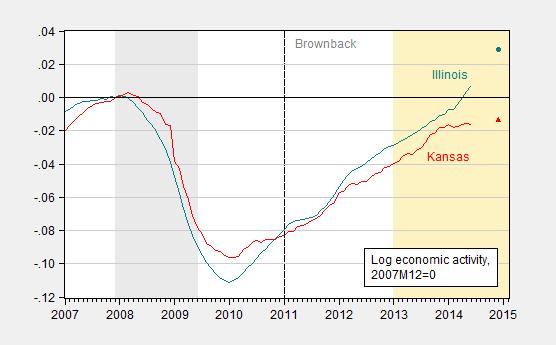

I found interesting the characterization of Illinois economic performance. The comparison of Kansas to Illinois is not flattering. Since I have read this comparison in the comments section in the past, here without further ado is the relevant comparison:

Figure 4: Log coincident indicators for Illinois (teal), level implied by leading index (teal circle), and for Kansas (red), level implied by leading index (red triangle), normalized to 2011M01=0. Forecasts from July release. NBER defined recession dates shaded gray; tax cut regime shaded tan. Dashed vertical line at 2007M12. Source: Philadelphia Fed, FRED, NBER, and author’s calculations.

Professor Chinn,

I notice that Oklahoma seems to track the US coincident indicator nicely. What is Oklahoma doing that Kansas is not? As a learning question, how are you converting the “level implied” from the leading indicators? Also, what source do you use for the population needed to calculate the per capita series.

Thanks

Increased natural gas production in Oklahoma versus substantial decline in production in Kansas? Oklahoma has a noticeable oil-and-gas boom going on, although not on the same scale as ND.

AS: Re: your first question, not sure why the acceleration.

The leading indicators are the 6 month nonannualized growth rate; I can add that to the most recent coincident indicator to get the implied 6 month ahead level.

Population for the states are available on an annual basis. I extrapolated for 2014, then used a quadratic match interpolation. For the US as a whole, I can take the POPTHM series from FRED and use an ARIMA(1,1,1) on the log levels to forecast.

Professor Chinn,

Thanks!

“The danger is that a coalition of Democrats and big-spending Republicans will pull out the rug before the benefits fully materialize.”

Tax cuts cannot fail, they can only be failed.

What? Log? Why Log? Why not just “economic activity”, whatever that is?

Why all the babbling bs? ARIMA(1,1,1)? You believe that holds any meaning in relation to Kansas’ “economic activity”? Why?

Further, apparently, you believe Kansas is insular, but, at the same time, not unique. Why?

Was there an expectation of huge growth in Kansas in response to the tax cuts? No. But, our unemployment is decidedly below the national average. You know, that’s like more people working and earning, and stuff. But, better, ….. well, worse in your point-of-view, people get to actually keep more of what they earned. This is an end, in and of itself. Kansas is fine. And, it will be more fine, because people get to keep what they earned, and are not forced by a government to give what they earned to people they don’t wish to give it to. In America, we call this “freedom”. It’s a strange concept, look it up.

Kansas would be more fine without interference from other less worthy people wishing to suckle off of the teat of Kansas. So, the people who help feed the world get to keep some of what they earned …. boo hoo.

Rather than celebrate this fact, the author wishes to convince people Kansas is economically declining. He does this by using a meaningless method …. to whit ….“Log coincident indicators for US (blue), level implied by leading index (blue square), and for Kansas (red), level implied by leading index (red triangle), all normalized to 2011M01=0.”

Yeh, the old “log coincident indicators” …. well, I’m a believer!!!! 😀

James Sexton: Thank you for your tightly reasoned comment.

Regarding logs, please see James Hamilton’s post on logs, here. I am hopeful you will understand the concepts of exponentiation, or at least multiplication and division.

Regarding state unemployment rates, see Wolfers. The concept of “fixed effects” might also be germane to interpreting the impact of the Brownback program.

Regarding “economic activity”, the Philadelphia Fed’s coincident indices has been used in this blog in many instances without being dismissed out of hand. If you believe the coincident indices are faulty, it would be helpful for you to identify the exact source of your disquiet, and perhaps take your concerns to the Philadelphia Fed.

Now, please feel free to return to burning books.

Yes, his comment was straight from the good book of the Church of the Wholly Ignorant, but…I appreciated it for its poetic elements.

Minzie, thanks for the response, and the links.

I don’t understand how it happened, in spite of my comment starting with 7 questions about your post, you seemed to perceive my comments as dismissing “out of hand” the thoughts posited in this post.

What I was dismissing was the post, in and of itself. Without even the most rudimentary explanations as to why one should lend any credence to the information you presented, then the post holds no meaning to most people.

Still, you seemed to miss, or at least didn’t respond to the most germane part of my comment. To whit, tax cuts are an end in and of itself. Whether or not there’s increased economic activity, or even decreased because government is wasting less, is only secondary to allowing people to keep more of what they, themselves, had earned.

I would say the person who is burning books is the one least familiar with the concepts and precepts of individual liberty and freedom. Which, is appalling assuming it is an American writing the post.

james

“Whether or not there’s increased economic activity, or even decreased because government is wasting less, is only secondary to allowing people to keep more of what they, themselves, had earned.”

i guess that depends upon whether or not you want to live in a civilized society with shared costs for the betterment of all.

some of those “other less worthy people wishing to suckle off of the teat of Kansas” may not feel the state should spend money on an airport that they cannot afford to fly on. or highways when they do not have a car. i suppose a police force is not really that important when you have few belongings. farming subsidies? funny how it is socialism when it applies to other people, but not when it applies to issues you would deem important. at least that is how your post come across to the reader of a blog.

What do you mean there was no expectation of huge growth? What in the world does a “shot of adrenaline to the heart” mean?

As an individual that has recently inherited farmland in Kansas, I have done a bit of research into agriculture in the state. I do not pretend to be an expert, but my understanding is that the largest economic activity in the state is agriculture. Does your analysis address the fact that Kansas, and specifically the western third that is almost entirely farmland, has been in a severe drought for the last three years? For example, wheat production on non-irrigated “dryland” averages around 60 bushels an acre usually, but during this drought yields in western Kansas have been commonly reported in the 10-15 bushels per acre range. This is a dramatic drop in production that could impact economic activity. I unfortunately do not have the links available to me at the moment, but I have read news stories about this issue in Kansas that have put a significant portion of the blame on for this flat economic activity on the drought. Your thoughts?

Trying to understand what is going on in Kansas from aggregate data using simplistic economic models is as silly as considering a relatively small overall change in taxes as a “shot of adrenaline”. I’m an aerospace engineer in Wichita, KS, and am fairly tired of people with no real understanding of the economic situation here using it to grind their political ax. Wichita’s 50 largest employers have had a net jobs loss of 6.8% over the past year. We manufacture Beechcraft, Cessna, and Learjet here. The light jet and general aviation market has not recovered from the recession. This is a problem that goes far beyond tax cuts, we sell to the world.

The wheat crop this year was impacted by drought and then by poorly timed rain that caused issues with the harvest. There have been layoffs and reductions in compensation at local hospitals. The Mississippi Lime play isn’t quite developing the way people thought. The list goes on and has nothing to do with the tax cuts.

There’s more to the economy in Kansas than tax cuts and state spending. Viewing the aggregate data as only a function of government action is total nonsense.

http://www.bizjournals.com/wichita/print-edition/2014/07/25/where-are-wichitas-job.html?page=all

thomas

“We manufacture Beechcraft, Cessna, and Learjet here. The light jet and general aviation market has not recovered from the recession. This is a problem that goes far beyond tax cuts, we sell to the world.”

this appears to be an aggregate demand problem for kansas. and tax breaks to enhance local supply side economics helps you to sell more aircraft throughout the world how?

What’s baffling is that you seem to be implying that my post defends the tax cuts. It doesn’t, I never expected them to have the impact that was advertised. The point of my post is that too much is being attributed to them on both sides to score political points when the economic reality is largely a result of other factors.

thomas,

of course kansas has problems, and the sources are diverse. but one problem you have is aggregate demand slump. now cutting taxes may not be the worst move, but the state justifies tax cuts with spending cuts. and spending cuts do not help an aggregate demand problem. this is the result of extremely faulty policy. so it is perfectly justifiable to illustrate how poor policy is a contributor to the poor performance of the state of kansas.

“The point of my post is that too much is being attributed to them on both sides to score political points when the economic reality is largely a result of other factors.”

if the economy was booming in light of the austerity policy in place, would you also argue that the growth was not a result of conservative economic policies?

I would have considered it a lucky coincidence if the Kansas economy had improved, not a direct or primary consequence of the tax cuts or “austerity”. That’s self-serving testimony for your counter-factual, though, so take it for what it’s worth.

thomas,

i guess we differ on our perspective. i believe that government policy can have a rather significant effect on an economy, noting a lack of government response is a government policy itself. you feel government policy has little to do with how an economy performs.

Thomas M. Hermann: I applaud you for posting under your own name.

First, I agree other things are happening at the same time. However, the article you cite clearly brings up the issue of whether demand side or supply side factors are of key concern. Tax cuts that reduce costs might be helpful to an individual firm; however, if low aggregate demand (including export demand) is the problem, then cutting spending and taxes, with tax cuts aimed at low marginal propensity to consume households, and spending cuts aimed at high propensity to consume households, seems the essence of what we in the business call pro-cyclical fiscal policy. Since there is no offsetting monetary policy, Kansas having no independent currency, this seems like a particularly ill advised course.

Second, if in fact there is a commodity-related supply shock (re: your point about drought), then once again a tax-based, pro-cyclical fiscal policy seems at the minimum irrelevant, and at the worst, counterproductive. Again. However, as noted in other instances, value added in agriculture accounts for some 4% of Kansas gross state product, small relative to other sectors, so I am not sure that is decisive.

Third, the Kansas City Fed notes that of the three largest reductions in employment, Federal and state government along with manufacturing account for the most. Hmmm, negative shock to aggregate demand via reduction in demand for small aircraft, what to do, what to do, let’s cut spending on teachers! So, I’m not asking for an elimination of downturns, merely leaning against downturns, as opposed to exacerbating, which is exactly what the Brownback program has accomplished.

Thank you for the response, it was useful and the KC Fed Note is a great starting point. In absolute terms, the largest decrease was in Manufacturing, State Government, and Leisure & Hospitality. Manufacturing combined with Leisure & Hospitality lost twice as many jobs, in absolute terms, as State Government. This doesn’t account for differences in wages, but presumably these are all high propensity to consume households. Also note that the increase in Local Government jobs have more than offset the loss in State Government jobs. So I’m still left with the question of whether or not the cuts in State Government are too much, too little, or just right.

Back to my original point, this is the type of detail that gets lost in aggregate. It is the level of data that should be driving the discussion and the policy.

Menzie,

Well I see that the “Fair Play for Kansas” trolls have found your comments, and the usual suspects are being paraded. “Oh, it’s the drought”, “Oh it’s aircraft assembly” all of which are versions of the usual red herring explanations favored by conservatives when their policies so abjectly FAIL. First, let’s examine the role of the drought–agriculture, while using an enormous amount of land, does not represent a great deal of Kansas’ GDP. According to the Kansas DoL 2013 Economic Review (https://klic.dol.ks.gov/admin/gsipub/htmlarea/uploads/Economic%20Report%202013.pdf) Natural resources & mining (which includes agriculture) IN TOTAL represents only 6% of total Kansas GDP. Sorry, the drought will have a material impact only if it wiped completely out all plant life in Kansas. (Manufacturing by contrast is three times as large as a contributor as agriculture). Which brings us to aircraft assembly; while it the state’s most important export, still is only part of manufacturing. Exports of Transportation Equipment are around $3-billion out of a $20.5-billion dollar manufacturing sector.

So if one of the Kansas trolls can tell me that all plant life ceased to exist in Kansas and that there was a total halt to all aircraft and transportation manufacturing I might actually believe their all-too-obvious obfuscations.

Otherwise, let’s get back to the base question: Brownback promised a pinky swear promise that the Tax Cuts would “unleash the entrepreneurs”, “give a shot of adrenaline straight to the heart” and would cause of “wave of job creation and economic growth”. NONE (repeat–N-O-N-E) of that happened in the past nearly two years. So now the conservatives just want everyone to move along and not mind the school funding cuts, the service cuts, the benefits cuts, because well, because.

Next up from the Right Wing Noise Machine: “the tax cuts didn’t succeed because they weren’t large enough”.

I’m not defending the tax cuts, never believed that they would accomplish what was advertised. Conversely, I don’t blame the economic ills in the state on them. The point of my post is that the state economy is not some simple function of taxes and state government spending. It was silly to make the claims about the benefits of the tax cuts and equally silly to blame all of the ills on them.

It’s surprising that you’re so blinded by your partisanship that you label any view that doesn’t fit within your party line as the product of a “troll”. Then you try to frame the discussion in the binary terms of the usual partisan positions. The real world is much more interesting, diverse, and complicated than the binary view that politics tries to impose on us.

You again miss the point. Brownback sold these tax cuts, heavily weighted towards the rich (and also providing a means by which anyone, and I do mean anyone, with a sharp tax attorney and some judicious business entity creation, can avoid all Kansas personal income taxes) on the rationale that they would create jobs, bring economic growth, stop teenage acne, and otherwise usher in a new millennium for the Sunflower State.

But they have failed.

You can’t now come and say, “well we knew they we’re going to work anyway, shucks”. You can’t come back and say “well it was the national economy”. It is in the nature of an investment promise; “give me your money and I’ll double it by the end of the year”. In such a context, when you posit a predictive outcome and it doesn’t happen, people are entitled to say “you are a fraud”, and the you’ll deserve the penalties you receive.

Yeah, I completely missed the point that you’re arguing with Brownback instead of reading what I wrote, despite the fact that I’m the one posting using my real name so there shouldn’t be any confusion. Anyway, I’ll step aside so you can continue your argument, good luck getting a response from him.

Great piece on Kansas Menzie. I also noticed that the coincident indicators have shown a welcome pick-up in activity in Wisconsin. The Badger State has been growing more quickly relative to Minnesota and the rest of the country for the better part of the last year. What do you make of the relative improvement? I wonder if it has to do with less fiscal drag at the state and local level. Thoughts?

Rich people can pay for private schools and security within gated communities. They live in the world of “FREEDOM.” Hence the troll about paying for the moochers in the middle and working classes who want to send their kids to public schools, good roads to drive on, and fire and police are their to provide public safety. Once the rich seem to enjoy partaking in the same commonly provided services, but no more. Than have been revealed to be God’s chosen, and they are made even more aware of how SPECIAL and FREE they are by watching non-rich people suffer and lose freedom because THEY AREN”T RICH.

It would make a good study to determine what has stalled Kansas so much (I suspect that continuing austerity and decline in employment and real wages in Kansas State and local governments has reduced demand and that there was no corresponding private investment boom to offset the public sector employment and investment decline).

“If those companies were excluded from the 2013 WBJ employers list, the city would have actually posted a 6.1 percent increase in the number of full-time employees in 2014.”

Those companies being the top 50.

“And there’s been a small increase in jobs statewide. A June report from the Kansas Department of Labor shows 16,700 jobs were added statewide for a year-over year increase of 1.2 percent. About 8,600 private-sector jobs were added in Kansas between May and June, the Labor Department data show.”

Again, there is more going on here than tax cuts and state government.

http://www.bizjournals.com/wichita/print-edition/2014/07/25/where-are-wichitas-job.html?page=all

If the agricultural and aircraft industries are in deep depressions, from drought and weak national & global demand, that affects other parts of the economy, e.g. consumer goods & services and supply chains, through a multiplier effect.

If you think of Kansas as its own little country and realize that the economic health of the State is basically the net of funds in versus funds out (Trade Balance) then the importance of agriculture and aviation becomes clearer. These are export industries which send goods out of the State and bring money into it. There are certainly other sources of “foreign” trade (as in trade with other States and countries) and other forms of inflows. This is one of the States that declined to participate in Medicaid expansion. Compared to 23 other States, Kansas left millions of dollars on the table which would have flowed into the State and added to the State’s economy.

I mention Medicaid only as an example of the variety of ways a State can attract inflows. Insufficient inflows will cause the State’s economy to deflate. Viewed in this manner tax cuts, except for the issues of propensity to spend and tax breaks to out-of-state corporations (both outflows) , may move money from one hand to another within a State but does not add to the total level of wealth unless it proves to be a successful attraction tool.

In fact, counter-intuitively, I found (in working with small businesses as a lender for several decades) that small businesses are likely to be less aggressive, expansionist and focused on profit and productivity if they are comfortably profitable after tax than if they are not.

The Amazon.com business model, of fast growing revenue and huge losses, doesn’t work for every business.

Menzie, is it possible to look at spending per income group at the state level? As I look at the Kansas “story”, it’s not only spending cuts but tax cuts skewed almost entirely to the top. I’ve seen graphs of this – sorry, don’t remember if you’ve covered this aspect – which show a tax increase for the bottom 20% and almost no change for anyone below the top 20%. I’d think the pattern of spending and skewed tax cuts could depress economic activity.

jonathan: If it’s possible, I’m afraid I don’t know the answer. Seems pretty hard; administrative micro data must exist for taxes, but I doubt an equivalent exists for spending.

The government reconsidered in the 1980s and 1990s and chose to ape the pre-1970s dollar policy for twenty years, causing dislocations of another variety, out of hedges back into the real economy. Economic growth was much higher. Somehow in the 21st century, government fell in love with the 1970s again.

It is quaint—and sad—to see all this argumentation about the inflation rate, about the government’s ludicrous statistic, the consumer price index. Academics and progressives are saying if there’s no movement in the CPI, as there has not been lately, dollar policy is just fine. Wrong. The harm of the fiat dollar comes primarily, if not wholly, in the goosing it gives to the misallocation of capital into non-real investments. And this effect is massive.

Kansas must deal with a federal government that takes from the productive and gives to the speculator. It is the hedge fund and the bureaucrat who are currently making the money. But all of this will in time come to an end and then a Kansas that is based on a firm foundation of low taxes and a healthy productive base will prosper as the artificual boom turns to bust. This is difficult to see with a myopic mercantilist view of economics.

ricardo,

kansas must deal with the fact it introduced some very stupid “pro growth” policies which have not led to enhanced growth, and which are not conducive to its long term prosperity. kansas was the experiment, and it failed. quit trying to create excuses for the outcomes their policies created. look back and reassess why those policies failed-then quit repeating the same mistake!