From today’s FT:

ECB under pressure to tackle ‘crazy’ euro

Pressure is mounting on the European Central Bank to take action against a persistently strong euro with a leading industrialist calling on Frankfurt to tackle the “crazy” strength of the currency.

…

Fabrice Brégier, chief executive of Airbus’s passenger jet business, said the ECB should intervene to push the value of the euro against the dollar down by 10 per cent from an “excessive” $1.35 to between $1.20 and $1.25.

…

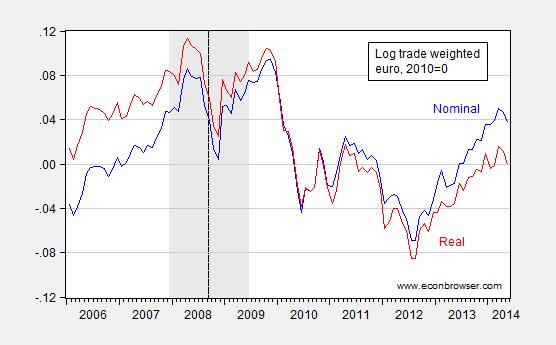

Following the euro over time, it’s clear that the euro is fairly strong, although not matching the levels in period just around the financial crisis. Remember, however, the dollar was particularly weak — and hence the euro particularly strong — just before the onset of the recession.

Figure 1: Log trade weighted value of the euro (broad), nominal (blue) and real (red), 2010=0. NBER defined US recession dates shaded gray. Dashed line at Lehman bankruptcy. Source: BIS.

Still, with euro area growth just barely creeping into the positive area, and with inflation far below target range, one could easily see how a weaker euro could help on both counts.

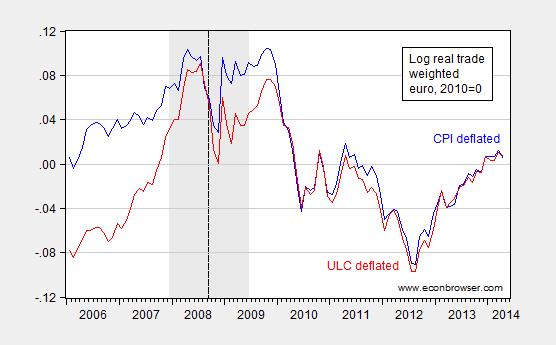

In terms of competitiveness, one would want to look to the unit labor cost deflated measures, rather than the CPI-deflated measure. Here, the same pattern emerges.

Figure 2: Log CPI-deflated trade weighted value of the euro (blue), and relative unit labor cost deflated (red), 2010=0. NBER defined US recession dates shaded gray. Dashed line at Lehman bankruptcy. Source: IMF IFS.

In the past, I (along with Jeff Frieden) have urged an increase in inflation. We didn’t post a mechanism for achieving that higher inflation, although the usual unconventional monetary policy measures — including credit easing– would have been in contention. However, increasing the ECB’s balance sheet faces some difficulties, ranging from legal to operational.

Nonetheless, today’s headline reminded me of Jeff Frankel’s proposal, made back in March.

The ECB should further ease monetary policy. Inflation at 0.8% across the Eurozone is below the target of ‘close to 2%’, and unemployment in most countries is still high. Under the current conditions, it is hard for the periphery countries to bring their costs the rest of the way back down to internationally competitive levels as they need to do. If inflation is below 1% Eurozone-wide, then the periphery countries have to suffer painful deflation.

The question is how the ECB can ease, since short-term interest rates are already close to zero.

…

What, then, should the ECB buy, if it is to expand the monetary base? It should not buy euro securities, but rather US treasury securities. In other words, it should go back to intervening in the foreign exchange market. Here are several reasons why.

First, it solves the problem of what to buy without raising legal obstacles. Operations in the foreign exchange market are well within the remit of the ECB.

Second, they also do not pose moral hazard issues (unless one thinks of the long-term moral hazard that the ‘exorbitant privilege’ of printing the world’s international currency creates for US fiscal policy).

Third, ECB purchases of dollars would help push the foreign exchange value of the euro down against the dollar.

…

Frankel discusses some of the challenges to this measure. Certainly, there is some question of how other policymakers would react to such a policy measure; however, given current conditions — particularly the pace of inflation in the euro area — this approach should be given serious consideration.

Cute – but political poison inside the Euro zone.

Why do anything? Keep the pressure on for internal change in France, Italy, etc. The Germans can live with the Euro at these levels.

My impression is the Euro has strengthened because the ECB took the essential step of making a broad guarantee. It’s hard to figure how they could weaken the Euro without also weakening that guarantee – unless you believe their policies are somehow insulated from each other by an invisible wall. The real problem then, IMHO, is that weakening the Euro raises the existential problems that broad guaranteeing statements were meant to solve. If you believe the Euro is fine, that this is just a monetary policy issue, you might feel differently, but I can’t help but think the entire Euro system remains at risk.

Not sure weakening the euro by intervention would weaken the currency’s viability. After the initial euro depreciation, though, I think the currency would face further appreciation pressures as U.S. traders would find peripheral debt even more attractive and take up the dollar carry trade with a vengeance. I agree wholeheartedly with your statement that the euro system remains at risk, but I think a big source of the problem is U.S. monetary policy, with attendant depreciation of Asian currencies that engage in currency intervention.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Fbb

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Fbc

The euro’s current value reflects US-EZ interest rate differentials and the net trade-weighted flows between the US and the EZ (and the US flows to China-Asia of which Germany and Japan capture some of the net flows). The euro is possibly ~10% “overvalued” against the trade-weighted Broad US$ Index. However, a 9-10% decline in the euro would mean next to nothing in improving trade-weighted euro-denominated exports, as Germany is the exporter of the EZ, with half the exports going to EZ neighbors and a non-trivial share of “exports” going to North American Daimler, BMW, VW, and Audi auto production.

http://www.forbes.com/sites/deanpopplewell/2014/07/08/dollar-dips-worrying-german-trade-data-emerges/

http://www.reuters.com/article/2014/06/17/us-china-economy-fdi-idUSKBN0ES0BC20140617

But all of this is trivial in the context of total global trade and capital flows, as the long-term trend for all of the major fiat digital debt-money currencies is to trend towards par with one another as GDP PPP and trade and capital flows trend towards parity at slow or no growth of “trade” and real final sales per capita.

The global economy is now effectively integrated with parity of GDP and trade and capital flows between the three major regional trading blocs.

http://www.forextell.com/fx-volumes-declining-major-interbank-platforms/

Currency volatility will continue to be low and forex trading even more boring and unprofitable hereafter.

there is some question of how other policymakers would react to such a policy measure

I don’t think Britain would be any too thrilled.

I doubt the E.U. can export its way to prosperity.

Why would Americans build factories in Europe?

Wages, regulations, and taxes may be too high to make a profit.

The Europeans aren’t strong competitors in the Information and Biotech Revolutions, where the U.S. not only leads the world, it leads the rest of the world combined (in both revenue and profit).

And, Asia is a better place to invest in Industrial Revolution products.

Of course, a weaker Euro will boost E.U. exports, including tourism, and attract some foreign investment, e.g. in high-quality manufacturing.

However, the Euro may not depreciate enough to have much of an effect on output and employment.

During last week’s press conference, Draghi recalled that the exchange rate is not a policy variable, and that the ECB does not target an exchange rate. He also indicated that an active exchange rate policy would bring reactions from other major central banks (or Treasuries) around the world, and would thus potentially generate unneeded conflicts.

Though the euro area would benefit somewhat from greater exchange rate competitiveness (the euro area as a whole is a large, not very open economy, quite like the US), the main issue at this point is generating more internal demand. This goes much further than aiming to depreciate the euro.

Do you recall the PIIG? Because these countries could not white-wash away the errors of their government by currency debasement each was forced to deal with their problems before the countries fell into utter destruction. Ireland is once again on the road to recovery as they ended their destructive policies. Span has implemented serious tax cuts to recover. Greece has gone through a very serious government austerity forced on them by their previous government’s mistakes and vote buying with government largess. All the while the euro actually stood as an anchor to each econoomy forcing the governments to do what they would not do because of political pressure.

The problems in Europe are much more broadly based now. France has almost taken the place of the PIIG in economic trouble with its socialist government.

To pretend that Germany will allow the serious debasement of the euro is a pipedream. Germany is strong because it has not gone the way of other expanionist countries in their demand side/massive government spending foolishness.

Rather than blame the euro, Europe should be praising the strength the euro demonstrated for dodging disaster by making European countries reform. This is just a small example of the strength of a currency that is beyond the reach of government. Politicians all over the world lack discipline. Only a sound currency forces politicians to end flawed economic policy.

ricardo,

you really want to tout ireland, spain and greece as examples of expansionary austerity? i think you need to take another look at their performance since the financial crisis. i feel very sorry for the many folks living in those countries over the past few years-what a miserable existence.

and giving germany props is rather disingenuous. you blame the peripheral countries for practicing poor economics, but this was only accomplished by allowing the germans to export to the southern europeans who then were allowed to debt finance imports at low rates. policy was set up to allow this to happen, to the benefit of the germans. years ago the euro central bank should have raised rates-before the crisis-to slow down the overheating southern economies. but germany would have cried foul because they would have been hurt by such a raise in rates. slowing down german exports and south europe imports would have been helpful in avoiding the debt problems-but it did not happen. a single currency with a single central bank, but no transfer payment mechanism, inherently will create large distortions across the diverse economic bloc.

Wrong, my friend… their Debt to GDP is much worse, and deteriorating, despite the fiscal efforts:

http://www.voxeu.org/article/revisiting-pain-spain

Although I agree with some of your positions, let’s get the facts straight….

A leaked document shows just how much the EU wants a piece of America’s fracking boom

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/07/08/could-a-trade-deal-lift-the-u-s-longstanding-ban-on-crude-oil-exports-europe-thinks-so/

My comments:

I didn’t see any mention in the above article regarding US net crude oil imports. Based on most recent EIA data*, the US is reliant on crude oil imports for 45% of the crude oil processed daily in US refineries. If we were to export one mbpd (million barrels per day) of crude oil to Europe, we would have to boost our imports of crude oil by one mbpd (at current production and consumption levels).

Globally, since 2005 we have seen a decline in what I define as Global Net Exports of oil (GNE), with the developing countries, led by China, so far consuming an increasing share of a post-2005 declining volume of GNE. The Chindia region’s (China + India’s) net imports of oil (CNI) have been rising so fast that based on the 2005 to 2012 rate of decline in the GNE/CNI ratio, in only 16 years China and India alone would theoretically consume 100% of GNE, leaving no net oil exports available to about 155 net oil importing countries. For more info, you can search for: Export Capacity Index.

*For EIA data, search for: EIA Weekly Supply Estimates

Jeffrey, interesting. Thanks.

BTW, US oil consumption to final sales/GDP is again at the historically recessionary level. With the trend of real final sales per capita at ~1% since 2009-10 and 0% since 2007-08, the current price of oil and acceleration of the price YTD, yoy, and q-q annualized implies a sizable drag from real net exports and real investment and consumer spending for Q2, suggesting perhaps as much as 0.7-0.9% reduction in annualized Q2 real GDP.

When real GDP per capita is growing at 2-2.5% and the price of oil below $30-$40, the economy can withstand an increase in the price of oil and the acceleration of price from a low level. However, with real GDP per capita at 0-1%, the economy is significantly more vulnerable to an oil price shock and consecutive or periodic q-q annualized contraction of real final sales/GDP.

Therefore, I suspect that we will discover hereafter that the US/world economy decelerated to stall speed in Q3-Q4 2013 and that the Q1 q-q annualized contraction was not entirely attributable to weather effects. Or, alternatively, the so-called “weather effects” were a consequence of the much slower secular “speed limit” for growth of US final sales/GDP per capita (“effective demand” per capita), resulting in the increasing fragility of the US economy to oil shocks, “weather effects”, and what will likely be a growing list of potential “exogenous shocks” hereafter.

the ECB is constituted independent and has an inflation only target.

The endless attempts of french criminals to break treaties are despicable.

Time for a few beheadings : – )

just 2 links to the oil topic, which now seems to wash up in nearly every thread here,

http://www.marketwatch.com/story/iraq-syria-forced-to-turn-to-sea-for-drinking-water-2014-07-09?siteid=YAHOOB

http://news.yahoo.com/how-the-u-s–is-letting-russia-beat-them-to-the-punch-on-military-aid-to-iraq-203343350.html

water and air power seem to reconfigure the fertile crescent in the moment as well

Re Frankel’s proposal: It sounds good at first blush – take a page out of China’s currency manipulating book. But on closer review, it seems very flawed. If the ECB decides to intervene and yet not engage in QE, it will have to sterilize the effects of the currency purchases on the monetary base. I don’t see how this would help anything – without capital controls, sterilized intervention should have minimal effect. Also, it would have to sell some of its other assets, but which ones? I thought they were already hitting constraints from exchanging debt of the strong members for that of the weaker members. In short, if the ECB is unwilling to engage in QE, I see little prospect (or benefit) to them from buying U.S. Treasuries.

Spain Continues Recovery with Tax Cuts in New Year

But those of you who struggle to prove the PIIGs are still suffering are missing the point. They were prevented from going the way of Zimbabwe because of the restraint of the euro. They are dealing with their problem now not by folloiwng the foolish recommendations of so many inflationsits, whining for them to white-wash their problems by creating their own currency and inflating the sadness away. It is the illusion of the alcoholic who sees his next drink as the one that will make his world wonderful.

ricardo

“They were prevented from going the way of Zimbabwe because of the restraint of the euro.”

i have to laugh every time i hear a fool make the zimbabwe claim. it makes clear you have no idea what happened in zimbabwe-and why it does not make sense to compare europe to zimbabwe. your arguments should apply to iceland-but it did not turn into a zimbabwe! you need to rethink your economic models and your ideology.

Yeah, not quite true… don’t know if the link will open correctly:

http://www.imf.org/external/pubs/ft/weo/2014/01/weodata/weorept.aspx?sy=2012&ey=2019&scsm=1&ssd=1&sort=country&ds=.&br=1&pr1.x=32&pr1.y=14&c=132%2C184&s=GGXWDN_NGDP&grp=0&a=

We have here the IMF Debt / GDP forecasts for France and Spain. France is going down, Spain is going up. But hey, let’s ignore the data, right?

well said, Ricardo !

Currency manipulation like this French manager and the english FT propose, is certainly not the job of the ECB. There is totally no justification for that, with even ex-Germany EU running a Currency Account surplus, just not stupid socialist France and the UK. Please take a look at the appropriate pages at “The Economist” or whereever you look up this kind of data.

To suggest that I, as a German tax payer, give cheap credit to the US government via ECB buying US bonds is obvious completely nuts.

This is the brain child of some Ashoka Mody, a well known anti-Euro crime propagator. He was fired from the IMF for that. One of his earlier victims, in the US, missed with his shot on him.

How long do American economics departments want to give aid and comfort to anti-Euro crime propagators like Princeton to Mody and Krugman, the Boston’s MIT/Harvard to Orphanides and Rogoff?

Today Germany expelled the alien spy ring leader, the CIA station head in Berlin

http://online.wsj.com/articles/germany-asks-top-u-s-embassy-intelligence-official-to-leave-country-1404999919

Such treatment is usually reserved for Axis-of-Evil states, like North Korea, which shares other characteristics like the death penalty with the US.

As somebody, who has lived in the US for many years, always considered the US as our brothers in arms, in good and in bad times, I say:

Impeach Obama now !

Before he turns every loyal ally into an enemy.

genaur,

i suppose it was all right to keep interest rates low during the runup of the periphery debt, directly due to the benefit of export for german goods to the periphery. as long as monetary policy benefits the germans, it must be the proper policy. and rather than the periphery having their own currency to accommodate this imbalance, the problem was just worsened. and since a monetary policy change now would be detrimental to german exports, let the periphery suffer with internal contraction and deflation with wage cuts. yeah the ECB and euro is really nice if you are german, not so nice elsewhere. so your view is, what is good for germany must be good for the euro zone in general-and if not let the others suffer!

It does not seem to bother you for one minute, that the demand of the french manager is criminal.

Joining the Euro was voluntary, Danmark and Sweden stayed out. The rules were clearly spelled out: no bail out, no money printing, debt target 60% of GDP, and enshrined in the treaty. They are not subject to constant re-discussion.

The ECB is targeting inflation for the whole area, and made its decisions accordingly.

The constant invention of mercurial stories of how something benefitted Germany in particular, in order to justify breaking the rules, is just annoying.

Italian Renzi will also learn that he has to play by the rules, and UK Cameron did just learn with the 26:2 vote on the EU Commission head, that the rest of Europe is sick and tired of his rule breaking threats.

We Germans have the law and the majorities on our side.

genaur

“The ECB is targeting inflation for the whole area, and made its decisions accordingly.”

this is where you fail to grasp the situation. the inflation target was for germany. there was an entire periphery which required a different inflation target-but this was ignored. so the benefit goes to germans and the northern countries. it is a flaw in the euro system. the burning question is not what was done-we know the answer to that-but was the decision correct? if they had raised rates to tame peripheral inflation, and germany had gone into a recession, would you still stand behind your rule of law argument? because that course of action would still have been legal and within the mandate of the ECB.

Marco,

Thanks for the data. France is in real trouble trying to follow the demand economic model. Spain is proving once again the supply model works. Spain was forced into government austerity by the euro and now they have made the positive change to tax cuts that are to be implemented in 2015. If they do not lose heart they should see a real supply side effect as their growth continues.

Did you see that France debt is going down, and Spain is going up, despite the austerity?

please don’t bother ricardo with the facts, it interferes with his ideology!

If the ECB wants a weaker EUR it needs to lower ex ante real yields relative to those of the US. Alternatively, but equivalently, it needs to steepen the euroarea yield curve relative to the US curve. As Krugman and Woodford’s modelling shows monetary base quantities are irrelevant per se. What matters is that whatever action the ECB takes delivers a credible pledge to raise inflation on a permanent basis. Its this bit that they just struggle to be willing to do…

baffling,

I do not only believe it, but know it. When Germany did go into recession begin of 2000 and we hit the 3% deficit criteria the first time begin of 2003, 6 weeks later a social democrat chancellor stood in front of the German people and declared : personal responsibility must be strenghtened, sacrifice have to be made, … basta.

Pensions were cut by 10%, public wages frozen, higher levels of public employees had to work 42 hours per week, of course without additional compensation, and we tightened the screws on the unemployed, forcing 1-Euro-jobs.

The endless attempts to argue that some other inflation target would be somehow better is just a thinly veiled assault on inflation targeting, trying to destroy a hard Euro.

The Euro rate setting in the early naughties was just determined by the weak exchange rate of our startup currency to the Dollar and the rate setting there.

Today we have more independence and it will increase with every year.