From the latest issue of the Milken Institute Review, “Trends: Better Living Through Inflation” (co-authored with Jeffry Frieden):

If the aftermath of the Great Recession doesn’t feel like the recovery from a normal cyclical downturn, that’s because it wasn’t a normal cyclical downturn. We’re living through the consequences of a massive global debt crisis, and debt-driven crises produce an especially malign form of recession. …

The politics of debt is, if anything, more daunting than the economics. A debt crisis typically degenerates into bitter political conflict over who will bear the burden of the adjustment. Some of the conflict may be among countries, with creditor nations trying to force debtors to pay off in full and debtor nations rebelling against measures that could conceivably make that possible. Other political battles take place within countries, as taxpayers, bankers, government employees, pensioners and investors jockey to avoid being saddled with the costs of working off the accumulated debts.

If we simply choose to wait for the world to find acceptable formulas for sharing sacrifice, we may be in for nearly a decade of snail’s pace growth — a truly global lost decade. …

Our recommendation: Conditional inflation targeting now, by keeping the Fed funds rate near zero and supplemented with other quantitative measures as long as unemployment remained above 7 percent or inflation stayed below 3 percent:

When nominal interest rates are kept below the rate of general price increases, inflation reduces the real burden of debts denominated in local currency. To put it another way, as prices rise and wages follow, debtors (households, businesses and governments) find it easier to service their debts and can more readily resume regular economic behavior.

The idea may seem radical, but it’s hardly unprecedented. After World War II, the United States inflated away a portion of the debt that it had accumulated in the war years — and did so even though the economy wasn’t facing an actual debt crisis. An analysis by

Joshua Aizenman (University of California at Santa Cruz) and Nancy Marion (Dartmouth) points out that the federal government came out of the war with a debt equal to 109 percent of GDP, substantially more than the debt-to-GDP ratio the country faces today. But all it took to (nearly) halve the ratio between 1946 and 1955 was a mix of reasonable economic growth turbocharged by relatively mild (on average, 4 percent) inflation.

This is not a new observation. In Lost Decades (W.W. Norton), Jeffry Frieden and I wrote:

Government revenues keep up with inflation, but the debt doesn’t — and so its real weight declines. This is why countries with heavy foreign debts typically run inflation rates double those without. Many countries with foreign debts in their own currency reduce their real debt burden by allowing their currency to drop in value, so that foreigners get repaid in less-valuable currency. (p. 188)

The typical counter-argument is that any move toward a higher target inflation rate raises a possibility of a hyper-inflationary spiral. To place things in perspective, consider current inflation in the US and the Eurozone:

Figure 1: Annual inflation, measured by CPI for US (blue), for eurozone (red). Latter is HICP. Source: BLS via FRED, ECB, and author’s calculations.

Not only are current inflation rates quite muted in the US and the Eurozone; inflationary expectations are well-anchored [0], and can stay anchored if the target is conditioned. In his discussion of our article, Ben Casselman in the WSJ’s RTE blog noted:

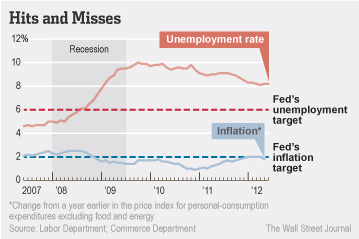

In a speech last fall, Chicago Fed President Charles Evans laid out the argument this way: The Fed’s implicit inflation target is 2%. The Fed doesn’t have a widely cited numerical target for unemployment, but a conservative estimate of the “natural,” or underlying, rate of unemployment is 6%.

“So, if 5% inflation would have our hair on fire,” Mr. Evans said in September, “so should 9% unemployment.”

Unemployment has come down some since last fall, but it’s still at 8.2%, nowhere close to the Fed’s “maximum employment” mandate. By Mr. Evans’s logic (which he explains more fully in his speech), the current rate of joblessness is equivalent to inflation running at 4.2% — more than double the Fed’s target rate.

Mr. Evans has argued the Fed should consider allowing inflation to run above its target until unemployment falls to some pre-determined — and pre-announced — level.

Casselman illustrates Evans’s point, assuming the Fed’s target unemployment rate equals the natural rate of unemployment:

Figure from Ben Casselman, “Number of the Week: Could Inflation Revive the Recovery?” WSJ RTE (July 21, 2012).

Note that our argument here focuses only on the balance sheet and government debt aspects. As discussed elsewhere, a higher general inflation rate facilitates the relative price adjustments which are of particular importance in the Eurozone [1] [2], and would also help revive the moribund housing sector in many countries.

One particular challenge in the Eurozone, where arguably the benefits of higher inflation would be the greatest, is that the definition of “price stability” would have to be altered.

Update, 7/24 noon Pacific: The repeated reference to (allegedly) already high inflation spurred me to refer readers to this post by Ed Dolan on the psychology of price perceptions.

Update, 7/25 11am Pacific: Additional coverage at LA Times by Michael Hiltzik:

Today, even among Democrats, economic policy is in the hands of deficit and inflation hawks. Their policies plainly benefit too narrow a segment of the population. The bond-holding class doesn’t have to sacrifice a penny of its wealth as long as the mantra of “shared sacrifice” applies solely to Americans who earn wages and pay mortgages. For the latter, a little taste of inflation may mean a lot. Without it, the whole economy may continue to just stagger along, and in the long term that’s not good for anybody.

Before the trolls arrive:

INFLATION BAD.

Menzie I hope your travels don’t take you to Texas. Gov. Rick Perry might put a Texas style whoop’n on ya’ for all that treasonous talk about wanting 3% inflation.

Bravo. Is there some way that Charlie Evans can ‘tag’ Bernanke and assume the mantle of Fed chief?

Clearly Professor Chinn is 100% correct IF you believe that the venal shuffling mess we call our government is capable of reliably turning off a considerably higher rate of inflation precisely as required.

What if a liberal or populist president appoints an inflation lover as chair of the Fed BEFORE the inflation is flawlessly turned off? Lots of people love a little inflation.

Remember that inflation can become imbedded. Remember the ineffable Jimmy Carter, Mike Blumenthal and William Miller fumbling around with accelerating inflation. And for you Democrats – remember the gas station lines. Not too helpful electorally were they?

Menzie,

3% BLS-calculated inflation, that’s all? We should really stop suggesting such sheepish half-measures. 3% is way too slow and unlikely to be that effective. After all, 2% have not resulted in economic miracle.

Anyway, who cares about inflation? Few people probably — and those are likely economically ignorant and have no political power to stop it — so they are not important.

What’s important is that Federal Reserve and its banks are able to print any amount of money — as much and as quickly as necessary to finally bail out all ailing financial institutions and provide unlimited financial support to all federal government’s worthy endeavors.

I’m all for punishing those nasty banks who lend people money at 4%. Force them to lend money at 8%. Why stop there? I’d like inflation to force the government to issue 7% treasury notes again.

That solves everything. Oh, except for the federal debt payments. I agree with you: screw the federal government… and screw the poor and screw the unemployed while we’re at it. Inflation solves everything.

Remember the ineffable Jimmy Carter, Mike Blumenthal and William Miller fumbling around with accelerating inflation. And for you Democrats – remember the gas station lines

Another conservative still stuck in a time warp. It’s forever 1979. I wonder if c thomson still wears open collared polyester shirts with gawdy gold chains. What traumatic event caused such arrested development?

The unemployment rate should be adjusted for the labor force participation rate. Actual unemployment is higher than 8.2%. Given the level of total debt (including that implied in our social welfare system), the US really only has two choices: inflate or default. In my view, it is only a matter of time until we see higher inflation.

It is inevitable that the politician who run the Fed & ECB will adopt this policy of inflating. Enjoy.

Slug, it is so much easier to denigrate C. Thomson than to present a counter argument to his observation that inflation can become imbedded, isn’t it?

I would love to see a rate of inflation that would encourage investment, but I question whether conditional targeting can achieve much, even with some unconventional easing attached. That target has to swim upstream against the world’s problems and the issues of the zero bound, which it has become obvious we don’t completely understand (which makes sense because it is rare).

To be clear about my first line, “inflation that would encourage investment”, if your money is becoming worth marginally less by sitting then you need to put it to work so you can earn more. But given the disgustingly low money supply figures and other indicators – like the negative interest rates on inflation protected bonds – I don’t see how we get that to happen.

Letting economists run the banking system is like letting 14 year old boys run the bomb disposal unit. An explosion, and a nasty one that kills a large number of innocent bystanders, is not just highly probable, it is inevitable.

Slugbaits: If you didn’t live through 1979, if you weren’t an active participant in the events of the time, you have no basis for being snippy. I was there, I was an active participant. It was every bit as scary as 2008. It is not something anyone who knows whereof he speaks would take lightly.

Does not intentional inflation shift some of the cost for the meltdown on to the backs of foreigners who hold dollar related assets?. If so, would this not be the nation that caused the meltdown dumping the cost on to other nations that are mostly innocent of any wrongdoing? And, if the answer to both questions is yes, what then happens to dollar-recycling gains. Then too, what damage is done to the credibility of the US?

“Many countries with foreign debts in their own currency reduce their real debt burden by allowing their currency to drop in value, so that foreigners get repaid in less-valuable currency.”

I suppose it is passe to mention it, is that not manifestly immoral?

Examples of similar activities which generate less enthusiasm would be short-changing customers, welching on bets, and “borrowing” money from your parents knowing you won’t pay them back.

At more or less three or four trillion USD difference with the estimates recorded in the paper dedicated to the Milken conference, the data of Fed St Louis confirm the US debt that is a Federal government debt 15,582,079 Millions of Dollars. One may take time to compute the accuracy of the Fed debt to GDP, but counting on the fingers it may be around 100%.It is a debt of 51000 USD per citizen, when the French debt per citizen is of 29000 Euros, Greece is not so far with 32000 Euros, a citizen of the Netherland would have a difficult arbitrage within Europe with a government debt per capita of 23000 Euros. The magic of the numbers is still intact, as one should include the private debt per capita. The illusion of the nominal debt is still the entertainment of the banking and financial universe real profits.

Federal Government Debt: Total Public Debt (GFDEBTN)

http://research.stlouisfed.org/fred2/series/GFDEBTN

Of course inflation is the solution, depreciating the dollar by 33% would reduce the debt of the US citizen to the level of the citizen of Greece. Such depreciation could improve the current account and boost the US export. Increasing the inflation by let us say at 4% a year would reduce the national debt by 54.4% in 20 years. A better course would be at a moderate inflation rate of 10% per year as it would reduce the real debt by 53.3% within 8 years. Since “nothing is lost nothing is created everything is transformed” the loss in the private and financial bonds portfolio could be among other,the fly in the ointment and more Qes would do.

The first post in this seies was the best. I’m reminded of the late Colin McEvedy’s description of how feckless European rulers dealt with debt in past centuries “by massacring the creditors (if they were Jews), fining them (if they were Italians) or, if absolutely cornered, selling off more of the royal estates and debasing the currency (again)”. While the less PC of these options may not be available today – although hard to say, with all the hate-the-banker gibberish in the media – the last means remains only too appealing. “Targetted inflation”, even were it possible (as it clearly isn’t), like “QE” and all the other cod-Keynesean kool-aid now on offer at your local central bank, simply rewards spendthrift individuals, corporations and countries at the expense of thrifty ones. It tells the next generation “max your credit cards! Go for that mortgage! The Fed or the Black Knight or someone will always come to the rescue!”. They won’t, you know.

@Gridlock

The late 70s and early 80s teach exactly the opposite lesson from the one that you appear to have learned. Inflation expectations became embedded(after roughly 40 years of Keynesian doctrine), then the fed increased rates, the economy slowed for a year or two and inflation expectations returned to normal.

It shows that the Fed can easily nip inflation in the bud, if willing. It would have been better if they had started earlier, but the inadequacy of their initial response shows that they can still stop inflation, even if wanting in competence and sense of timing. While reducing inflation required slowing growth somewhat, we’re already facing crappy growth, so a worst case scenario of mediocre economic performance isn’t really too worrisome.

But really, your worries of inability to prevent inflation sound hollow. We’re dying of thirst, and you’re fretting that if we’re lucky enough to find water we might fall in and drown.

I’m not sure inflation targeting is the answer. Boosting nominal GDP via direct injections of new money is much more likely to create non-inflationary growth in any economy with major capacity. Governments should spend new money (not debt) directly

into the economy via infrastructure investment and at the same time limit new bank credit, so the money supply remains stable.

I call this Monetary Dialysis.

http://sustento.org.nz/wp-content/uploads/2012/07/NZ-Investor-Piece-Monetary-Dialysis.pdf

Inflating away the debt is morally the same as default. You are not paying back what you borrowed.

In fact, it is sheer gangsterism: the man with the gun ordering others to accept the default on basis of his superior might.

Then there’s government debt: in the context of Japan, inflation has only a modest ability to relieve the government of its burden. First, some liabilities are very short-term and some are inflation-indexed. For example, in present value pensions and healthcare for retirees are a major component of government liabilities and to date no democracy has been willing to use pestilence and famine to lessen the burden of population aging. Older individuals tend to vote.

The other component on the liability side is that debt maturities aren’t long enough. That’s relevant because (third) we don’t find countries going from low to high inflation overnight [an Argentina with a currency peg that fails is not a story that carries over to the run-of-the-mill large OECD economy], while nominal interest rates tend to build in inflation expectations.

You can’t halve debt that way, my playing with numbers suggests at best a low double-digit reduction.

[One way to read this: in this instance, inflation really doesn’t matter, pun intended.]

A ceiling of 3%?

If inflation reached 3.4% and unemployment was 7.5%, would you then advise the Fed to tighten?

(BTW, saying, “that would never happen” is not a valid answer.)

Many refer back to the Jimmy Carter era when discussing Menzie’s (and Professor Hamilton, BTW) crys for more inflation. This call is much closer to the calls or Richard Nixon than of Jimmy Carter.

Nixon was facing a declining economy, increasing unemployment, a rapid depletion of US gold reserves, increasing debt from both Johnson’s Great Society programs and the “Great Society Plus” programs of Nixon himself. Seeing this and facing a reelection campaign Nixon had the “independent” Arthur Burns turn on the presses as Nixon severed the dollar link with gold.

This is where we are and the Menzie/Nixon formula is front and center.

But there is an interesting difference. Nixon was not living in the bust phase of the Austrian Business Cycle. The was still a path dollars could follow to enter the productive economy. Nixon actually did increase inflation, as did Gerald Ford, as did Jimmy Carter.

Now since we have this record of following Menzie’s formula for recovery do we have a measure of the results? Double digit inflation, double digit unemployment, and double digit interest rates.

So can we expect the same today. Probably not. The FED had been almost desperate in its attempts to generate inflation but the transmission mechanism is broken (ABCT) and the monetary pumping simply pumps up excess bank reserves. The deleveraging that is necessary to allow the money to flow back into the economy simply has not taken place and the government is doing all that it can to prevent the deleveraging.

The lesson from Japan is very instructive. The Japanese have proven that demand side economic policy can sustain a declining economy for 20 even 30 years. Contrary to popular belief we are not in a recovery but are being dragged along the bottom as we drown.

Until we accept the fact proven by the Nixon inflation that inflation does not bring down unemployment, inflation does not lower interest rates, and inflation does not help an economy to recover can we begin to make productive decisions. Monetary solutions to fiscal problems are like white wash on a rotting house.

Criticism is easy but workable solutions are hard. Recovery is very easy economically, but almost impossible politically.

1. Stabilize the currency – neither inflation nor deflation.

2. Remove barriers to production and business creation.

3. Stop the increased spending on crony capitalism and new government projects.

4. Streamline business creation and expansion to generate employment.

5. Allow the market to control the deleveraging process especially the allocation of bank credit.

6. Get the government out of the way.

If we were to close the federal government down totally for one year, the economy would return to full recovery almost over-night.

If you view inflation as a tax on consumption, a regressive one at that, then this policy is consistent with all the other tax increases that Obama has pushed through Congress. Taxing our way to prosperity —

Taxes that took effect in 2010:

1. Excise Tax on Charitable Hospitals (Min$/immediate): rules set by HHS. Bill: PPACA; Page: 1,961-1,971

2. Codification of the “economic substance doctrine” Bill: Reconciliation Act; Page: 108-113

3. “Black liquor” tax hike Bill: Reconciliation Act; Page: 105

4. Tax on Innovator Drug Companies Bill: PPACA; Page: 1,971-1,980

5. Blue Cross/Blue Shield Tax Hike Bill: PPACA; Page: 2,004

6. Tax on Indoor Tanning Services. Bill: PPACA; Page: 2,397-2,399

Taxes that took effect in 2011:

7. Medicine Cabinet Tax. Bill: PPACA; Page: 1,957-1,959

8. HSA Withdrawal Tax Hike. Bill: PPACA; Page: 1,959

Tax that took effect in 2012:

9. Employer Reporting of Insurance on W-2 Bill: PPACA; Page: 1,957

Taxes that take effect in 2013:

10. Surtax on Investment Income: Bill: Reconciliation Act; Page: 87-93

11. Hike in Medicare Payroll Tax Bill: PPACA, Reconciliation Act; Page: 2000-2003; 87-93

12. Tax on Medical Device Manufacturers. Bill: PPACA; Page: 1,980-1,986

13. High Medical Bills Tax. Bill: PPACA; Page: 1,994-1,995

14. Flexible Spending Account Cap – aka “Special Needs Kids Tax”. Bill: PPACA; Page: 2,388-2,389

15. Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D Bill: PPACA; Page: 1,994

16. $500,000 Annual Executive Compensation Limit for Health Insurance Executives Bill: PPACA; Page: 1,995-2,000

Taxes that take effect in 2014:

17. Individual Mandate Excise Tax.Bill: PPACA; Page: 317-337

18. Employer Mandate Tax.Bill: PPACA; Page: 345-346

19. Tax on Health Insurers Bill: PPACA; Page: 1,986-1,993

Taxes that take effect in 2018:

20. Excise Tax on Comprehensive Health Insurance Bill: PPACA; Page: 1,941-1,956

I take it that none of you have 50 cents in your savings account. I am unclear why you are all so eager to tax savers so heavily. Depleting savings moves you toward poverty, not prosperity. You might enjoy consuming the seed corn, but next winter will be grim.

PCM: You said that debt is “51000 USD per citizen”, and “Greece is … 32000 Euros”, and “depreciating the dollar by 33% would reduce the debt of the US citizen to the level of the citizen of Greece”.

That is not correct. Reducing $51,000 by 33% gives you $34,000, but you stated the Greek Debt in Euros not UD$. In $ @ 1.21, it is $38,720. Furthermore, the debt should be contextualized in terms of GDP per capita, national income per capita, etc.

Anybody who thinks that morality has anything to do with international finance is a cretin (of both the moral and intellectual varieties.) But I’ll tell you what’s actually immoral- blighting the lifetime prospects of an entire generation by doing nothing to reignite the economy because some wealthy investors might become a bit less wealthy.

Steve,

Evidently, you are not fully informed about our “exorbitant privilege” so… considering that, along with my experiences regarding people who are quick to use terms such as “cretin”, I’ll assume that you are merely a child, or a teenager perhaps.

The US is able to consume far more than what it produces while almost magically still maintaining a high standard of living (trading paper for goods), and allowed to borrow cheap while lending less-cheap, and to basically make up the rules as needed (IMF, WTO,), and when things still go wrong… the US is allowed to tell the ROW that currency manipulations (see Plaza Accords) are necessary because the global economy will suffer if the US economy is less than robust. These and many other such advantages are what are at risk.

For those who have forgotten the ‘Currency Wars’ already, the Brazilians, with widespread support in the developing world, suggested that QE2 would be countered with a flood of currencies in the Forex. That did not happen but our Treasury Secretary did travel immediately thereafter to Brazil and presumably make some sort of assurances. The US economy does not operate in isolation anymore.

Looks like we got deflation in the heartland. CAT seeks to flatten wages for manufacturing workers for 6 years. They state it is to bring their employees in line with “market reference ranges.” Source NYT.

But this is the same all over. Our average rated performers have received virtually zero increases in 3 of the past 4 years while their share of health care costs has increased by double digits.

So how is this supposed to end? Mr. Walter will still collect his coupon, but is that the main consideration here?

4% average inflation since 1972 has done wonders for our debt, and greatly affected income inequality, since the wealthy are more able to hedge against inflation, increasing real estate holdings and so forth, and benefiting from equity returns, which are certainly helped by inflation, as prices outpace wages.

TJ:

Your list of “tax hikes.” Oh my. I’ll just take one of them.

“Black liquor” tax hike. Actually, it was the elimination of a tax credit. And not to worry, a Republican representative has managed to earmark the tax credit back onto the books.

So how are we going to balance the budget again? Eliminate Defense completely and half of medicare? Got it.

Here is the link for that list. I forgot to include it in the original post.

http://www.atr.org/full-list-obamacare-tax-hikes-a6996

tj: Ah, Americans for Tax Reform. And for hydrofracking!!!. Who knew the two necessarily went together.

Walter Sobchak: “I take it that none of you have 50 cents in your savings account. I am unclear why you are all so eager to tax savers so heavily. Depleting savings moves you toward poverty, not prosperity.”

As a young married person with a brand new mortgage, and a lot of student loan debt, I’d like to point out that for some of us who aren’t geezers, inflation isn’t a tax.

What a surprise to find that a librel would find Obamacare good and fracking bad? Lessee, this is the same week that we learned Canadians were better off than Americans, and that parts of the world allowing drilling have better weathered this recession. Oh wait! I think I just repeated my self. Canadians, drilling and reduced impacts from the recession? Wonder if there are examples in out own little country? /sarc off

CoRev: You are projecting. I didn’t say anything about the positives or negatives of hydrofracking. I just thought it strange that a site on tax reform should tout hydrofracking.

Menzie, I am surprised an economist would even question: “Who knew the two necessarily went together.” the need for added fundamental raw resources by a tax reform group.

You do realize that energy raw resources are fundamental to nearly every economic activity? I think there may be some law of supply and (of what’s that other part) at work here. 😉

Certainly not a new idea. See William Jennings Bryan and Free Silver.

I agree wit the premise. Critics here talk about the wealth destroying penalty to savers, however most americans are not savers, but debtors.

If we want to call the wealthy “job creators”, then they have the means available to protect themselves.

The US looks set up to default on its real debt to me. Today’s record low 10Y interest says investors are willing to settle for a nominal payout.

On the political Obama/Bush arguments I find myself berating the host for all-opinion pieces. On these economic pieces I’d like more opinion. It is presented as someone else’s work. What does the Professor think of it?

My take is that sure, this is one way to resolve the debt crisis, but like all the rest it will only work if net USG deficit spending trends sharply down.

Nick, like I said.

If inflation is a tax, shouldn’t it be passed by congress, rather than being imposed by an unelected semi-private body?

Steve: I will take that as a personal insult, and a demonstration that you have lost the argument.

Menzie I’m really curious. Way, way back when I was in college I don’t recall any econ students beyond the freshman level who shared many of the crazy crypto-Austrian-Tea-Party nonsense that seems all too common on economics blogs today. We certainly read other economic traditions (e.g., physiocrats, classical labor theory of value, Marx, the Austrians, etc.) in intellectual history classes along with secondary sources like Mark Blaug, but it seemed to me that everyone just took it all in as little more than mildly interesting background stuff written by a bunch of long dead white guys. So I’m curious if students today are different and really do come to contemporary economics with a Tea Party view. A few days ago Noah Smith (over at Noahopinion) wrote that he was pretty shocked by some of the stuff he read while visiting several economics blogs. I’m wondering if these heterodox views (and here I’m being very polite) are peculiar to a blog demographic or if you see the same kind of “out there” views in the classroom regarding the imminence of Zimbabwe inflation, gold bugs, austerity and big government hovering over your house in black helicopters.

2slugbaits: The Austrian theory of business cycles was fringe when I was in graduate school (1985-91), and to my knowledge remains so in academic circles. At the undergraduate teaching level, that approach certainly holds little sway, as evidenced by the textbooks that are published, and sell. There have been, and remain, certain strongholds. But I do not see their influence growing in academia.

@Gian:

“Inflating away the debt is morally the same as default.”

So what? No one is forced to loan money. The lender accepts both the risk of default and the risk of inflation when they decide to loan money in return for a premium. Since most lenders before the crisis actually planned on a higher rate of inflation than the current rate when negotiating the interest rates on loans, these lenders are receiving an unearned windfall. Thus, ethically, asking for a return to the previous trend level of monetary value is simply asking that lenders not receive an implicit subsidy due to inept government policy.

Did it ever occur to policymakers on the FOMC that focusing on an inflation measure heavily influenced by import prices basically holds down prices at the expense of unemployment and is a defacto gold standard. I recall back in the day, these economists named Bernanke and Gertler wrote that most of the recessionary impact of high oil prices was due to monetary policy response. Thank god the FOMC held rates at 2% in sept 2008 – they were all worried about inflation due to high oil prices and all that, despite deteriorating business conditions right after Lehman collapsed. So whats that fella Bernanke doing these days anyway?

Patrick,

The Chinese and other surplus nations feel that they are being “forced” into buying dollar related assets.

It was not so long ago too, that Washington Consensus policy was advocated by the IMF, and poor nations were encouraged to hold t-bills so as to improve their credit status. This is no longer the case but QE is widely seen as causing ‘splill-over’ and the resulting carry trades are pushing up exchange rates.

most americans are debtors is a red herring….the question is not debt but its duration. If most americans have short term, credit card debt, as I suspect, then inflation ain’t gonna do much for them. You have to have long term debt to have inflation help you out. That’s why the optimal treasury/fed policy with idiot investors like us is to increase the U.S. debt duration and then inflate like mad. This would do *wonders for banks*, see, e.g., late 70s, where banks got caught on the wrong side. Of course, with the established policy of private gains and socialized losses, which folks like Krugman think is deregulated markets, it doesn’t matter, banks are simply quasi governmental institutions. So since they are off the hook, just poor little old investors holding the bag. go ahead, crank it up. worked for zimbabwe.

@Ray:

The excess rate of savings in China is a serious problem, but it is not a problem for the US or the Eurozone to solve. The way that this problem is solved is entirely within the power of the government of China. China just needs to let their currency appreciate against the dollar and euro instead of forcing an implicit peg. They’d prefer not to do this because pegging their currency is a way to subsidize their manufacturing industry.

In other words, we should hardly be concerned with maintaining low inflation so that it is easier for China to manipulate their currency, subsidize their manufacturing, and undermine manufacturing in the US and the EZ.

Patrick,

You didn’t read my comments carefully enough. I am not taking sides with China and other surplus nations here. My point is that there are surplus nations, which hold dollar related assets, that take the position on ‘exorbitant privilege’ which will lead to retaliation. And to assume that this is not worthy of consideration suggests that some Americans are too reliant on American MSM.

And, whether the concerns of other nations are warranted or not, is beside the point. There are however nearly endless examples of WTO trade violations which the US is guilty of as well. Do you realize for example that ag subsidies not only aid farmers but also Wall St? Then too, for any nation wanting to undermine the privilege of our reserve currency status, the fact that dollars are being recycled which provide comparatively low interests rates to a population that consumes too much already, with so many other nations in need of those surplus dollars, do you really think that the ROW takes the Chinese currency manipulating seriously. If you do, consider where the global economy would be now if the infamous foreign inflows, those recycled dollars that Bernanke cited as integral to the cause of the recent asset bubbles, would have been invested in the developing nations instead of in our asset markets. Try to imagine just how many ROW Fin Mins have said: ‘I told you so’ when the subject of the US unemployment rate arises and when the need to increase ‘exports’ is mentioned. Imagine if you will, them saying something like: “gee, I wonder how many more global consumers there might be, if those vanishing trillions would have been invested where they were needed”?

Just one little problem with this whole argument –

the assumption that wages will rise with inflation

@Ray

Pretty much everyone has broken some rules with respect to free trade. So what? Seems like you’re just trying to muddy the waters. Definitely not clear why previous bad actions means we shouldn’t pursue a policy of inflation, which will help rectify one of those past bad actions. Specifically: the current account deficit being run with China.

With respect to retaliation, there isn’t much that China can do about it. If we inflate, we have them over a barrel. Their ability to peg to our currency is not unlimited. As we inflate, we push that limit and they can’t maintain their peg. But it isn’t like cutting trade is an option for them. It would cause the same consequences that losing the peg would, namely, they would lose access to foreign markets to dump manufactured goods.

Please state clearly. What is our downside? Economic disequilibrium exists->US inflation restores equilibrium.

Useful to know that the Chinese will just suck it up if we play economic games with them. Hillary should be told.

Useful to know that the Chinese will just suck it up if we play economic games with them. Hillary should be told.

Patrick,

Had you read my comments, you would already know ‘my’ “downside”.

Menzie: The Austrian theory of business cycles was fringe when I was in graduate school.

Sorta like Keynesian economics today with its no-theory IS-LM silliness. Thank goodness some good policy makers like Paul Ryan studied at a second-tier school in Florida and not one of those Ivy League or Ivy-League Lite schools that breed elitist snobs like the 2-bit clown slugger….

Robert: I was asked whether Austrian economics has a strong foothold in academia; I responded with an honest assessment, as opposed to a snide non sequiter. Austrian business cycle may hold sway in lots of places (perhaps in your own mind), but believe me when I tell you, for better or for worse, it was — and remains — fringe in academia.

Robert Paul Ryan studied at a second-tier school in Florida

Wrong Miami. He studied at Miami of Ohio.

Ivy-League Lite schools that breed elitist snobs like the 2-bit clown slugger….

I actually went to one of the high temples of freshwater economics. I went over to the Keynesian dark side a long time ago. But then again I’ve always been comfortable with an eclectic background. When I took advanced economics in high school my teacher got his Ph.D. from the Univ of Chicago but we used Samuelson’s textbook. Go figure. Also, you should clarify your 2-bit comment. I assume you mean 25 cents, but youngsters might think in terms of 32-bit, 64-bit, etc.

Sorta like Keynesian economics today with its no-theory IS-LM silliness.

The old IS-LM workhorse certainly has its problems, but like all models part of the art is knowing which model is appropriate for which situation. That’s just a fact of life since we don’t have perfect, complete and unified models in economics…or much else for that matter. And as it happens the IS-LM model tells you most of what you need to know policywise when the economy is in a deep economic slump with interest rates hovering around the zero bound for almost four years.

I see several deep problems with Austrian economics. First, it’s almost exclusively a theory of economic collapse. Even recoveries are merely temporary events waiting for the next bust cycle. Austrian economics is all about collapse and moving away from some equilibrium position. Keynesian economics has a very different view about equilibrium. Second, my experience is that very few people who claim to be Austrians have ever actually read Austrian economics. What attracts them to Austrian “economics” isn’t the economics, but the libertarian philosophy that goes along with it. These are political ideologues looking for an economic system rather than people who are really interested in actual economics. Third, at some point you have to call a debate done and over with. For me the deciding point was Kaldor’s meticulous dismantling of Hayek’s argument. They had a prediction and a bet. Hayek lost rather decisively. Finally, I’ve never seen much written about this, but I always thought Austrian economics was always at war with itself. Austrian economics likes to stress how the destructive impulses of capitalism are necessary for the creative side. Capitalism without destruction is a dead economic system. Fine. But then they simultaneously argue that if it weren’t for government the markets would get everything right. They blame the government for the boom and bust cycles of capitalism. Well, you can’t have it both ways. If the destructive side of the booms is a necessary condition for the creative side of capitalism, and if government is the source of booms and busts, then isn’t this an argument for government being the driving force behind Austrian creative destruction? If you’re an Austrian you have to ask yourself if a world without government interference in the market wouldn’t also be a static economy without creativity and growth.

@Ray:

You may find your comments perfectly clear, but try to imagine a world where other people don’t understand what you mean as well as you understand what you mean. I asked for clarification because after I read your comments your point wasn’t obvious to me. You can either clarify or lapse into solipsism. Up to you.