John Fund, in National Review Online, writes of:

“…an ever-expanding government that chokes off economic opportunities for the middle class and those who aspire to it.

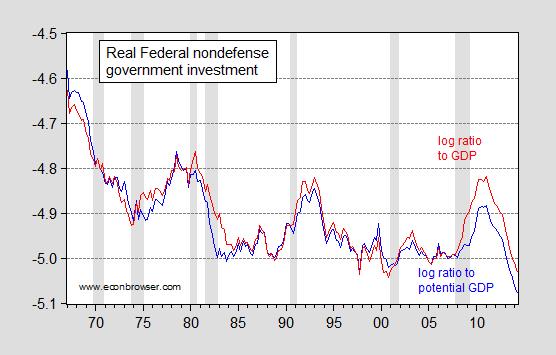

Time for some data. Figure 1 shows Federal government current expenditures normalized by the size of the economy.

Figure 1: Federal government current expenditures as a share of GDP (red) and as a share of potential GDP (blue). NBER recession dates shaded gray. Source: BEA, 2014Q2 advance release, CBO (February 2014), NBER and author’s calculations.

Federal government expenditures are now at 22.7% of GDP, far below the 25% recorded in 1982Q4 during the Reagan administration.

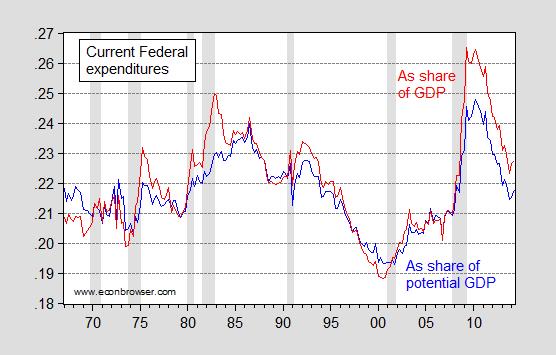

One point that all can agree on — even if there is no agreement on how to deal with the issue — is the deficient level of public investment. The American Society of Civil Engineers (ASCE) provided an assessment in 2013; their current estimated funding requirement through 2020 is $3.6 trillion. Figure 2 presents real investment as a log ratio to output.

Figure 2: Log ratio Federal real government investment expenditures to real GDP (red) and to real potential GDP (blue). NBER recession dates shaded gray. Source: BEA, 2014Q2 advance release, CBO (February 2014), NBER and author’s calculations.

Note plotted are real quantities for real government investment (which includes intellectual property products, such as software). This graph can be read as follows: the log ratio of investment to GDP rose from -4.99 in 2007Q4 to -4.82 in 2011Q1, which means that real government investment grew a cumulative 17% faster than real GDP. On an annual basis, over this 3.25 year period, investment was growing 5.2% faster.

Since 2011Q1, the log ratio has plunged to -5.03, which is a cumulative decline of 21% over a 3.25 year period. On an annual basis over this period, this is a 6.5% rate of decline.

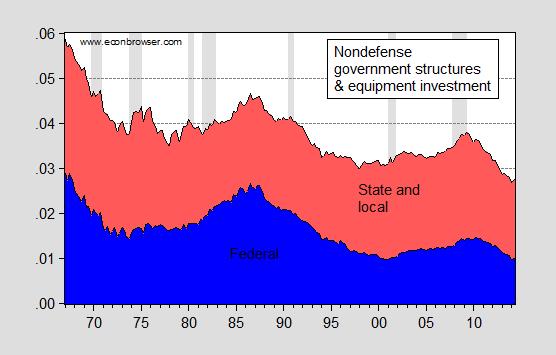

A lot of concern has focused on the decline in government investment in physical capital — bridges, roads, sewer systems, etc. That concern is focused not only on Federal investment but also state and local. I haven’t had time to generate the real investment ex-intellectual property products series, so I present in Figure 3 investment in structures and equipment as a share of nominal GDP.

Figure 3: Federal nondefense investment in structures and equipment (blue) and state and local investment in structures and equipment (red) as a share of nominal GDP. NBER defined recession dates shaded gray. Source: BEA 2014Q2 advance release, NBER and author’s calculations.

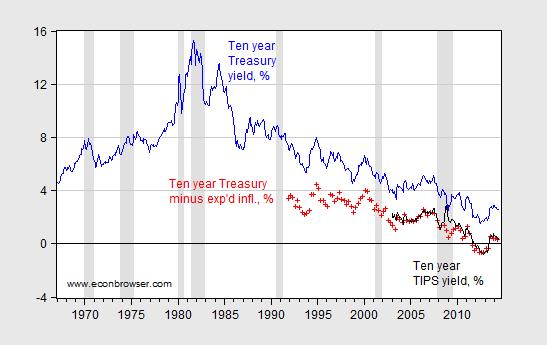

To me, the implications are clear. With borrowing costs extremely low, it makes sense to invest in infrastructure. Some disagree. Then, the question is, are you with Barry Eichengreen or Sarah Palin? By the way, despite talk of the taper, and incipient Fed tightening, borrowing costs for the government remain quite low; this is shown in Figure 4.

Figure 4: Ten year constant maturity Treasury yields (blue), ten year constant maturity yields minus ten year (median) expected inflation (red +), and ten year constant maturity TIPS (black). NBER defined recession dates shaded gray. Source: Federal Reserve via FRED, Survey of Professional Forecasters, and author’s calculations.

For a discussion of transportation investment needs and potential impacts, see this NEC/CEA report.

For previous installments in the series on the myths regarding the ever-expanding government, see [1], [2], [3], [4], [5].

Update, 8PM Pacific: Transportation expert Cliff Winston has recommendations for more efficacious use of resources in transportation infrastructure — see the analysis here.

Yes, we need to spend more on “bridges, roads, sewer systems, etc.”

There are budget constraints and trade-offs.

Government has decided spending on the poor is more important.

It seems, the “War on Poverty” was successful putting a floor on poverty, to virtually eliminate “deep poverty.”

However, it also seemed to place a ceiling that trapped many in poverty.

For example, the poverty rate was falling sharply, until the “War on Poverty” was fully implemented and extended after 1964. Chart:

http://www.washingtonpost.com/blogs/ezra-klein/files/2012/07/poverty_time.jpg

PeakTrader, there are alternate measures of poverty that are considered much better now. The one you cite doesn’t include anti-poverty tax refunds, like the EITC. This is a good article on the problems with the poverty rate you are citing:

http://www.vox.com/2014/7/29/5946395/eitc-poverty-supplemental-measure-official-threshold

According to the Census Bureau:

“Individuals or families are “poor” if their annual pretax cash income falls below a dollar amount, or poverty threshold, that the Census Bureau determines using a federal measure of poverty that is recalculated each year.”

Chart:

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/shirakawa/Poverty%202009.jpg

Peak Trader: You should really try to get information from other places other than ZeroHedge. Here is some serious research: Thompson, Smeeding, “Inequality and Poverty in the United States: the Aftermath of the Great Recession,” FEDS Working Paper (Federal Reserve, 2013)..

There are many causes of poverty.

However, over the past few decades, there has been an explosion in spending on means-tested welfare programs (beyond Social Security and Unemployment insurance), reaching $1 trillion a year, e.g. “providing cash, food, housing, medical care, social services, training, and targeted education aid to poor and low-income Americans.”

And, people respond to incentives. For example:

“Rep. Gwen Moore (D-Wisconsin)—herself a former welfare recipient—acknowledged in her oral testimony: “I once had a job and begged my supervisor not to give me a 50-cents-an-hour raise lest I lose Title 20 day care.””

PolitiFact – Wisconsin

http://www.politifact.com/wisconsin/statements/2012/dec/30/paul-ryan/anti-poverty-spending-could-give-poor-22000-checks/

Peaktrader,

The problem with your argument is that if the government were to spend less on poverty, the rate of poverty would increase, not decrease.

At $7.25, a 40 hour working person would make about 15K a year, not enough to live off of in most areas (assistance programs help to keep people above poverty in these cases).

even a $0.50 increase per hour that you attribute to Gwen Moore refusing, would only take that person to 16K

Still not enough to live off in most areas.

As a result more people would go into deep poverty, and the extra money freed up would end up as useless (economically speaking) tax cuts for the rich, who tend to hoard money. This will merely create more social problems and a greater potential for social strife in coming years.

If you really want to end the need for spending on food stamps, and other poverty assistance programs, do 5 things:

Spend on fixing current infrastructure.

Invest in new infrastructure for the 21st Century (High speed internet, high speed transportation, clean renewable energy, etc.)

Raise Minimum wage to $11 Dollars then index to CPI, so it maintains its purchasing power going forward.

Make Higher education (Post HS Education) Free and forgive current Student Loan Debt

Invest heavily in R&D

axt113, how do you know the poverty rate will increase? Maybe, people will make different choices, and others will learn from the choices they make.

What if Gwen Moore’s supervisor needed her to work overtime? How will workers move up “the ladder” when they won’t take the first step?

And, what about the guy who worked through college and didn’t take out student loans, does he get money too?

The explosive growth in means tested welfare has been crowding-out government spending almost everywhere else.

So you assume that poverty is entirely choice based, sorry, but facts show that those born into poverty stay in poverty, its not choice, but environment that keeps people in poverty.

Also College is too expensive to work through it as minimum wage earnings in a year is less than the cost of one year of college

I stated above, there are many causes of poverty.

It seems, you want to do nothing about the vicious cycle you talk about. I suspect, you want to keep feeding, and expanding, it.

Not every worker makes minimum wage.

And, I’m sure, many students worked, while in school, and either didn’t take out student loans or limited them.

I suspect, you want to keep feeding, and expanding, it.

Oh, my. You gotta stop reading those conservative websites – they’re full of odd ideas. Heck, who has more incentive to keep people poor than employers, who have more leverage when setting wages if their employees don’t have portable benefits (like health insurance), and if they’re terrified of falling into poverty due to losing a job?

So, your solution is to ignore the results and continue keeping generations in poverty.

We can promote work, and even careers, with labor standards and safety nets.

As a matter of fact, without work, we couldn’t afford labor standards and safety nets.

Your statements, including prior statements, are political rather than economic.

Peak,

I’m not sure who you’re talking to, or what argument you’re making. My argument above: it’s silly to suggest that “safety nets” keep people in poverty.

It’s helpful to keep in mind that our economy is designed to perpetuate poverty. Unemployment is built-in: if it declines below a certain point, the Fed has to raise interest rates to prevent inflation. So, *someone* will always be unemployed, though we can hope that the people in that role will change.

Any given investment in infrastructure is subject to its own discreet cost/benefit analysis. Union wages will go a long way to driving a wedge between cost and benefit, as they have the effect of increasing the net hurdle rate compared to market wages. That is, a project will have to have a higher rate of return to cover higher union costs.

I personally do not find infrastructure deficient in New Jersey, or most of the east coast. A key exception is New York City, which was dreadful 50 years ago and is dreadful today. Unions and general New York City (read Port Authority) incompetence have much to do with that.

http://www.vox.com/2014/8/4/5966769/john-oliver-perfectly-describes-the-fresh-hell-that-is-the-port

The other key exception is the Connecticut Turnpike (I-95), which has literally third world levels of government engagement. It is short three lanes of capacity each side through New Haven, and one lane each side to the Rhode Island border. I have earlier estimated the annual social returns to expansion at 25-33%, that is, levels of returns we might expect on early stage biotech investments. That, on infrastructure. If that were a matter of money, well, that’s a problem we could solve.

Whoa, who said data was allowed in this argument???

Clifford Winston pours a lot of cold water on infrastructure spending, here: http://www.brookings.edu/research/opinions/2014/04/13-bridge-to-nowhere-winston

His arguments underscore the need for an FAA. If Senators and Congressmen were paid for performance, I could assure you we’d have six lanes each side running north from New York on I-95.

Spending on infrastructure will always and unavoidably involve spending money on inefficient projects. If we had insisted on pure efficiency outcomes for infrastructure since WWII, we would be driving on highways like those Kerouac saw in “On the Road”, and the way from Chicago’s sole airport, Midway, to the Loop would be an impassible Congress Blvd. In the place of inefficient infrastructure spending, WInston recommends the politically-impossible direct employment subsidies to industries, which should the millennium come and be passed by Congress, would quickly dissolve into feather-bedding, ghost-employment, and similar fraud scandals (gee Mr. WInston, what could possibly go wrong offering billions to employers to hire new employees–think about it for a second?).

If you want spending that absolutely fails on efficiency concerns let’s subject military spending to Mr. WInston’s analytical framework, looks pretty bad. However, military spending seemed to do the trick in 1939 and on, to certainly spark economic growth.

So if you insist on total economic efficiency you will get legislation that will not pass, which I guess is what Mr. WInston is actually after. Besides, how can you write this: “Moreover, infrastructure costs are inflated by inefficient investments and burdensome regulations. For example, if roads were built with thicker pavement to better withstand the damage inflicted by heavy trucks, both highway authorities and motorists could save billions of dollars annually on maintenance and repair costs.” How would you get thicker pavement–make wishes? cross your fingers? leave hints for the highway designers in fortune cookies? How about mandating it through–(cue the scary music)–regulation? My real question is how does Mr. WInston actually end up getting paid for doing this kind of work?

“Spending on infrastructure will always and unavoidably involve spending money on inefficient projects. If we had insisted on pure efficiency outcomes for infrastructure since WWII, we would be driving on highways like those Kerouac saw in “On the Road”, and the way from Chicago’s sole airport, Midway, to the Loop would be an impassible Congress Blvd.”

I am perplexed by this statement. Most, if not all, interstates would pass the social ROI test, I would think. I would agree there’s some need to think far ahead, as it’s impractical to re-work a highway every ten years. So, as a practical matter, you have to be thinking in 30-40 year windows, particularly in built-up areas.

If there were an FAA, there would be another tunnel to Manhattan at Columbus Circle, the tolls on the GW Bridge would be fully automated, and there would be a complete by-pass system from the NJ TWP to the CT TWP running across a parallel Verrazano Narrows Bridge. And let me add, that someone would have figured out how to increase the Amtrak speed limits to Boston, so that the train from New York is not pathetically slower than driving. Hell, we’d have an overpass here in Princeton at Rt. 1 and Washington Road (the road leading directly to the University and the heart of town), which they’ve been discussing for twenty years and can’t see to get around to actually fixing.

It’s not a question of funding; it’s a question of incentives.

You’re missing the point. Infrastructure spending will occur when there is the political will to make it happen, not ROI. What is the ROI on the H-1, H-2, and H-3 Interstate? They don’t even connect with another Interstate (which is pretty funny when you think about it). What is the ROI for most of the highways west of the Mississippi and East of the Pacific Coast? The reasons the Interstate System came into being were: to connect for military purposes, to employ construction workers, to enrich contractors, to buy rural votes, and to buy urban votes; it was not “hey this has a great ROI let’s go do this”. As such it had the military/industrial complex, unions, contractor associations, rural legislators at the federal and state levels, and urban legislators at the federal and state level backing it. It could not help but come to fruition. ROIs, which were calculated, and were influenced by political considerations, were a cover story.

Best I can tell, the H-1, 2 and 3 interstates are in Hawaii. There might be a reason they don’t interconnect with the rest of the network.

Otherwise, there are a limited number of east-west interstates:

I-10, linking Houston, San Antonio. El Paso and Tucson

I-40, linking Nashville, Memphis, Little Rock, Oklahoma City, and Albuquerque

I-70, linking Kansas City, Denver and Las Vegas

I-80. linking Omaha and Salt Lake City (I’ll grant you, there must be some empty stretches on that one)

I-90, linking Minneapolis, Sioux Falls, Rapid City, Billings and Bozeman (ditto)

I-94, linking Minneapolis, Bismarck, and back to Billings (very ditto)

OK, every state gets an interstate. I do get that. But if you live in North Dakota, you don’t want to be entirely isolated, particularly because distances are great. It’s a six hour drive east-west through South Dakota. I would not care to do that on secondary roads. These are not ‘roads to nowhere’; they are the only high speed road links connecting those small state populations with the rest of the country.

What do you mean by FAA?

Fiscal Accountability Act. I’ve written on it many times.

The author you cite argues that by imposing tolls, you will achieve the correct level of demand for infrastructure, this of course assumes that people will have perfect information of how much infrastructure is needed, what kinds of infrastructure is needed, that they will view tolls as equal to taxes (even if the amount of money they spend is the same), etc.

If on the other hand, people aren’t aware of the repairs needed, and view tolls as worse than taxes, you’ll have less creation of infrastructure than is optimal, and you’ll have less utilization of infrastructure than is optimal (people will choose to sit in traffic rather than spend money on tolls, even if the cost of gas use and opportunity cost of time lost sitting there is greater than the toll)

The NRO has some imperatives. One is to stay in business. To do that it has to sell ads. To do that it has to keep building imaginary bridges over imaginary rivers.

infrastructure spending would be a great way to immediately stimulate the economy along with providing long term usable assets (as opposed to military spending on say a nuke or a missile). unfortunately our budgetary process is not operated in a way to produce efficient infrastructure projects and ongoing maintenance. we are not only under budget in the area of civil infrastructure (who isn’t under budget in their own little operating world), but we are under budget to a level that is chronic in nature. lack of maintenance, mostly due to budget constraints, forces us into costly replacement rather than lifetime extension. this is due to the fact we let the degradation proceed to a point where repair is no longer possible and a replacement is required. just a very inefficient use of funds and resources. i don’t think the government leaders and voters fully recognize the size of this problem-you see this in the “how many road workers does it take to….” jokes still in circulation. ideology aside, wouldn’t it be nice to stimulate the economy at low interest rates and obtain long term beneficial assets at the same time?

I wonder what would have resulted if the “infrastructure” spending in Iraq and Afghanistan had been spent in the U.S. Since our present administration has effectively demolished any gains that might have resulted from such spending in those countries, the ROI there is, effectively, zero.

bruce, many would say spending on that “infrastructure” should not have occurred at all-you know, the nation building experiment.

Steven Kopits I personally do not find infrastructure deficient in New Jersey, or most of the east coast.

Really? Ever been to Newark Liberty Airport? Or as I like to call it, the Giant Men’s Room Along a Concourse. And this is a strange comment given that Hurricane Sandy was less than 2 years ago. You don’t see any need for seawalls as sea levels rise?

Menzie I want to thank you for reading John Fund at NRO so that the rest of us don’t have to. That’s called taking one for the team.

Bruce Hall The effective ROI was always going to be zero. Before taking over as Kerry’s Asst Secy of State, by brother-in-law was the State Dept’s #2 in Afghanistan. He had a lot of experience in hellholes and basket case countries from his earlier time with USAID. When he first arrived in Afghanistan he had high and naïve hopes about building schools and highways and all that. Reality soon settled in. It has nothing to do with this Administration. The aid was always going to be money down a rat hole.

I’ll bet the people along Lake Erie are thinking that maybe a little infrastructure spending might be a good idea. We tend to think of infrastructure investment only in terms of adding to the capital stock. But pollution and other negative externalities subtract from the capital stock. Instead of worrying about gross domestic product we should be worrying about net domestic product after correcting for the consumption of natural resources like lakes and rivers. And aquifers.

2slug, I agree. Both Bush and Obama’s attempts to export democracy or whatever were a gross misapplication of our armed forces and money. It’s good to see that such budgets are being cut back drastically. Being the world’s policeman doesn’t also entail being the world’s social worker.

Government is needed when the immediate market-driven building and maintaining of our infrastructure fails. That said, one could argue that privately operated toll highways are superior to many government efforts at low-bid building and non-maintained freeways. Still, local roads are probably best built and maintained at the local government level. Here’s an interest snippet from a 1955 Time Magazine article: http://content.time.com/time/magazine/article/0,9171,861259,00.html The arguments still go on. http://www.chron.com/news/houston-texas/article/Private-toll-roads-gathering-speed-1494829.php

Anything government does, can and will be done by private enterprise if 1) government doesn’t prohibit it and 2) there is a sufficient business proposition. Bridges to nowhere will not be built. Some “infrastructure” is just nice to have; e.g., parks. Disney will build entertainment parks, but the local green gathering place for families won’t happen unless they are part of larger developments. It’s all a matter of money. Those with money will pay for the “infrastructure” costs; those without the money will let government pay for those costs with the money received from those who will or can pay.

That doesn’t mean government should stay out of infrastructure development and maintenance. Even privately owned infrastructure can be regulated and standards set. It just seems that we take for granted that government should have more-or-less exclusivity for infrastructure control. That may not be the best choice in all circumstances. Private efforts will take ROI into consideration; governments probably will not.

While it’s true that the government shouldn’t have exclusive rights to building infrastructure, it often has some important advantages over the private sector. For one thing, the government uses a much longer time horizon than private enterprises because the latter never know if they will still exist ten years from now. Since infrastructure spending can often have long-term effects, this is important. Another reason is positive exogenous effects. Yes, toll roads can cover some of the cost but they are often very unpopular with people (maximizing GDP isn’t the only thing that counts, maximizing human welfare must surely be an important goal). Secondly, because private firms operating toll roads can never come close to perfect price discrimination they are unable to gain the full exogenous benefit from building a road which means some infrastructure that has a positive societal net value will not get built without the help of the government.

Also please stop putting Obama and Bush in the same box. The only american intervention begun under Obama has been Libya and that was in order to prevent a massacre, not a case of nation building (the intervention resulted in civilian deaths numbering in thousands rather than hundreds of thousands). I don’t know if he did the right thing in staying out of the war in Syria but that decision makes it hard to accuse him of trying to export democracy through military means.

bruce,

one problem with the privatization of public infrastructure is business always has the option of failing-by choice or by necessity. i mean this in the since, from a business perspective, if a division of a company is no longer seen as profitable going forward, then the correct business decision is to close shop-meaning fail. but what happens when a business running an infrastructure project decides they want to spend their resources elsewhere? now you have a problem-a public good is at the whims of a profit decision. are you really willing to let the market forces play out in this situation? it is the same problem with education. you can privatize public education if you desire, but what happens when the private business makes a conscious decision to close shop? public citizens pay the price rather than private investors. it is difficult to embed public services into the private sector-the incentives usually do not align well.

Newark Airport is Port Authority, Slugs.

Having said that, I find Newark reasonably efficient. Parking is quick, if not cheap. The layout is reasonably linear. They don’t confiscate my toiletries as often as they do in Philadelphia. I’ve never had trouble with traffic in our out, at the sacrifice of my car’s suspension in the last mile before the airport. And if you’re a psychic, you can find your way back to the NJ Turnpike without trouble. If you’re not a psychic, it can be accomplished with some trial and error.

I’m trying to think whether I have any airports that I really like. Providence, maybe. Barajas Airport in Madrid is magnificent. They have two stunning terminals, each perhaps a mile long. They’re cavernous, ceilings 80 ft high, glass all around–absolutely the most energy efficient construct one could imagine the sweltering Spanish summer. They manage to handle, with 100 gates, about the same volume as Newark does in Terminal A, with perhaps 17 low rent gates. And Barajas has the advantage of requiring 40 minutes to get from one gate to another.

So, by all means, infrastructure. But as I sat in my chair in Barajas, waiting for my flight and looking down the endless length of terminal, quite as the tomb, all I could think was, “You know, you could get into a debt crisis, with a terminal like this.”

http://commons.wikimedia.org/wiki/File:Terminal_4_del_aeropuerto_de_Madrid-Barajas,_Espa%C3%B1a,_2013-01-09,_DD_14.jpg

Steven,

Yes, I do agree that Newark is pretty good. It’s definitely better than Philadelphia and I prefer it to JFK, Dulles, and O’hare.

Personally, I like the Barcelona El Prat in Spain. I think Malpensa Airport in Milan is an impressive airport too. And I like the Hong Kong airport.

I’m not wild about the LA area airports–too congested. Narita is ok but it’s a hassle to get into Tokyo.

You don’t really need a lot of glitz to get the job done. The airport in Liberia Costa Rica as well as Kona airport on the Big Island are both pretty minimalist. But they work efficiently.

America’s infrastructure problem is in reality a selfishness problem…. People and corporations that make the income in the economy would much rather spend their coin on private wells, septage systems and gentrified trucks, than public roads, sewers, and water distribution systems…. Hell, we can’t even raise the gas tax in most states and the federal government to cover natural inflation in the cost of maintaining the existing road system. The tax rate on fuel per gallon has been static for decades.

America is rapidly disintegrating into a classic Latin American gated community. The rot will continue until the deserving and needy baby boomers are safely tucked into their final resting places.

In Washington State a certain political party seems to be telling us that if a bridge falls into the water it is inconclusive evidence that there is a problem.

Saw that bridge last week. Seems like they just plucked it out of the water and are putting it back the way it was? I found that strange.

I just got back from a trip to Colombia and on the plane I read the new book JAMES MADISON. After reading of the Founders motivation based on liberty and freedom, Menzie’s misreading of John Fund’s editorial is even more stark. Tory thought is still alive.

The entire quote from the Fund paragraph is, “That kind of bipartisan cooperation is what’s gotten us into our current economic mess, as special interests co-opt both political parties, blur the ideological differences between the two, and create an ever-expanding government that chokes off economic opportunities for the middle class and those who aspire to it.” Fund is not talking about increased government employment but about eliminating the EX-IM Bank. There are very few people I know that do not see the EX-IM Bank as corporate welfare and crony fascism of the worst kind, yet this is what Menzie chooses to support.

The EX-IM is classical Keynesian theory so I am not surprised at Menzie’s support of corporate welfare. Taking from successful taxpayers and giving it to mega-corporation is actually basic Keynes and why the Chamber of Commerce, through the Republican establishment, is so strongly supporting crony fascism. Many might be surprised that Menzie and the Chamber of Commerce would be on the same side, but if you understand the mercantilist foundation of Keynes and big business it is no surprise at all.

So what does Menzie do? He takes the results of austerity caused by our economic decline (reduced government employment) and uses the decline to justify giving more power to the central government that created the decline. I encouage you to read the entire Fund article not just the sound bite provided by Menzie in his quote.

Here are more important quotes.

“Despite Ex-Im’s protestations that it has programs to help women, minorities, and small businesses, the bank is essentially a form of corporate welfare for giant multinationals.”

“By a “fair value” accounting approach, meanwhile, the system recommended by the Congressional Budget Office (but not used by Congress), Ex-Im will cost billions over the next ten years.

“Morton Blackwell, a member of the Republican National Committee for Virginia, says that the drive to dismantle the Ex-Im Bank should be a no-brainer for congressional Republicans — who have trouble retaining the enthusiasm of their voting base. “In an election year, to actually have a chance to zero out a special-interest welfare program and show taxpayers they can mean what they say is a no-brainer,” Blackwell told me. That said, he acknowledged that congressional Republicans might yet again ignore the opportunity and proceed with the business-as-usual approach that has helped keep their approval ratings in the polling basement.”

Talk about overheated rhetoric.

Quotes from Robert J Samuelson, hardly a communofascist.

“The CRS gives examples of transactions in 2013: a $155 million loan to Ghana for a hospital expansion supported by U.S. engineering and construction firms; a $1.1 billion loan guarantee to an Indonesian airline to buy Boeing jets; and a $694 million loan to an Australian company for U.S. mining and rail equipment from Caterpillar and General Electric. ”

Hardly sounds like the worst sort of fascism.

But hell, France and Germany can now provide those loans so Garuda can buy planes from Airbus and Australia can buy equipment from Siemens.

Then there’s this.

“It has about 400 employees. In 2013, its operating budget — its overhead — totaled $90 million, according to a report from the Congressional Research Service (CRS). But these expenses were fully paid by fees and interest from Ex-Im’s private customers. There was no direct drain on taxpayers. Indeed, the bank turned a profit in 2013 and paid $1.1 billion to the Treasury. If it were eliminated, future deficits would probably increase, albeit by small amounts.”

WAPO http://www.washingtonpost.com/opinions/robert-samuelson-the-misleading-debate-on-the-export-import-bank/2014/07/01/91bb7208-0138-11e4-8572-4b1b969b6322_story.html

Not sure why you revising this topic, but this has been true for years.

Even Hamilton, who hates Krugman and basic macroeconomics, recognizes this.

randomworker,

You just don’t connect the dots. When the EX-IM provides the money to other countries to buy our products the other country is not buying the products, the American taxpayer is. Think deeper than mercantilist delusion.

If I understand correctly, they don’t provide funds, they guarantee loans. That’s not quite the same.

I’m not sure if the Ex-Im bank is a good idea, but it certainly seems to have a competitive justification if other exporting countries are providing the same terms.

Eliminating it seems like a badly considered campaign gimmick. It would be better to go after much larger and more harmful corporate subsidies. Just one small example of many: sugar price supports, which help Florida sugar cane growers but which drive candy manufacturers out of the US and create an artificial market for high-fructose corn syrup.

Ricardo,

I think you have misunderstood what the Export-Import band does: They provide loan guarantees – from their web site: “Ex-Im Bank provides working capital guarantees (pre-export financing); export credit insurance; and loan guarantees and direct loans (buyer financing).”

Ex-Im runs a profit, since they charge a fee for their services.

I’m not sure that this is good or bad, but it’s important to know the facts, and not make up straw men.

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Hfd

Total local, state, and federal public debt is now 6 times total receipts ex federal social insurance receipts, up from 2 times in the 1970s-80s and 3 times in the early 2000s. Debt to receipts reached the critical order of exponential magnitude in 2008-09 from 1982. Debt to receipts can no longer increase without increasing taxes, which will reduce growth of private (un)economic activity.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Hfg

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=Hfl

Total local, state, and federal debt to GDP is at 120% (and 156% to GDP less gov’t spending ex transfers), again, having reached an order of exponential magnitude of growth since the early 1980s. With the trend rate of GDP since 2007-08 of 2.5%, total debt cannot grow faster than $500 billion/year.

This implies that there will be little or no net incremental “stimulus” for infrastructure “investment” during the next recession; rather, most incremental federal deficit spending will be for no-multiplier income support and other transfers for food stamps, unemployment payments, Medicaid, SSI, Obummercares, etc., as well as the next inevitable bailout of the banking/financial system.

At a trend nominal GDP of 2.5%, and 1.8% per capita, the US economy cannot sustain an increase in prices beyond a rate of 1.5-2% without a q-q annualized contraction of real final sales per capita. The YTD CPI rate is 2.6% and 3.5% q-q annualized.

At the trend rates of wages, wages to GDP, and labor productivity, wages cannot grow faster than ~3.25-3.5% before labor costs constrain profits with slow labor productivity and no growth of the labor force.

Any acceleration of labor productivity from accelerating investment in automation, especially in the services sector, will reduce the rate of growth of employment and constrain wage growth and thus the rate of real final sales per capita.

Thus, at the current rates of CPI and wages, as well as debt to receipts and to GDP, the trend real final sales per capita is less than 1% to near 0%, i.e., the debt-deflationary regime’s “new normal” for the “slow-motion depression”.

Too much public and private debt to wages, GDP, and receipts, Peak Oil and the price of oil above $40-$50, and peak Boomer demographic drag effects will constrain the post-2007 trend rate of real final sales per capita to around 0% indefinitely hereafter.

The assumed growth gap is much smaller than most economists perceive, suggesting that the US, EZ, and Japanese economies are at a cyclical demand constraint and no faster than stall speed.

To answer the question of big government we need a counter-factual, or some data on a similar economy with small government.

Interestingly, we have just that case if you look at the US economy from 19850 to 1950. By 1850 virtually all of the institutions needed to support modern, large corporation, industrial capitalism were in place.

From 1850 to 1950 the trend long term growth of US per-capita GDP was 1.5%. Moreover, the depression does not distort this conclusion . One, if you calculate the growth rate from 1850 to 1935–before the great recession– you get the same long term growth rate and by the end of WWII per-capita real GDP was well above the long run trend of 1.5%.

So what happens after 1950 when we added big government to the economy. The trend long run real per-capita GDP rose to 2.1%, or almost a 150% of the pre-WW II trend.

OK,I have data contradicting the statement that big government made thing worse

What is your data supporting your statement that big government hurt growth?

–

Spencer,

Menzie provided a wonderful link to a GDP calculater some time ago.

Your time frame

Nominal GDP for 1850 to 1950 was 4.87%

Real GDP for 1850 to 1950 was 3.78%

From 1950 on the Bretton Woods gold standard when the US (when the US debased the dollar on the back of Europe) until Nixon took us off of gold in 1971

Nominal GDP from 1950 to 1971 was 6.68%

Real GDP from 1950 to 1971 was 3.90%

Under a floating dollar until current

Nominal GDP from 1971 to 2013 was 6.55%

Real GDP from 1971 to 2013 was 2.83%

The effects of a debased dollar are easy to see after 1950.

The awful effects of debasement on growth are even worse after the supply effects of Reagan through Clinton (the Japan effect).

Nominal GDP from 2000 to 2013 3.84%

Real GDP from 2000 to 2013 1.76%

Real GDP from 1950 to 1971 was 3.90%.

Real GDP from 1971 to 2013 was 2.83%.

The effects of a debased dollar are easy to see after 1950.

Hey. Peak US oil was 1971. I’d argue that this shows that dependence on oil is very bad for our economy.

Note that in the 1850-1950 period population growth was much stronger than in the post 1950 era.

Real GDP is essentially productivity plus population and population made a much bigger contribution to growth in the earlier period.

That is why I use per-capita GDP to remove the impact of difference in population growth from the analysis.

Ricardo

Funding for the EX-IM bank isn’t something that most people would fall on the sword over. Killing it off is probably no big deal one way or the other. But even if you think it might be a good idea on balance to defund it, this is probably the worst possible time to do it.

So what we know about you:

(a) Get your economics from Ludwig von Mises sites

(b) Get your statistical data from shadowstats.com

(c) Refer to zerohedge.com for financial advice

(d) Take your history from books written by Lynn Cheney

My oh my. Isn’t there some line in the Bible about putting away childish things?

Steven Kopits I agree that the Philly airport is much worse than Newark. But that’s not saying much. In any event, you seem to agree that there are other airports that you regard as being much worse than Newark. Shouldn’t those be candidates for infrastructure spending? And speaking of Philly…how about that godawful subway system. You also skipped past the part about Hurricane Sandy infrastructure spending. Just thought I’d point that out.

Did I say Philly was worse than Newark? I use both airports, and probably consider Philly my home airport. I’m not thrilled by either. They both work.

But let’s consider where the two real inefficiency costs are in an airport. from my perspective. The first is security and the TSA. I have to budget about 20 min for that. That’s a material cost for me. It is not primarily a function of infrastructure, but policy and capacity.

The second is chronic delays, particularly late in the day. These are primarily a function of air control systems and practices. Again, you could probably get a decent bang for the buck with better systems. But more runways might also help. Now, what’s the constraint on runways? Is it funding, or the NIMBY-ism of the neighbors? At Heathrow, my recollection is that it was the latter.

And here’s the rub. Let’s assume we built a brand new airport in Philly. How many years would pass until it looks like the current one? Three? Five? Infrastructure is not a panacea replacing good operations.

As for hurricanes. These hit the east coast from time to time. For New York, the critical issue is to make sure the subway and road tunnels can be adequately sealed. This doesn’t take a billion dollars, but it does take organization. Otherwise, sea levels are rising at about 3 mm per year. Defenses should be adjusted accordingly over time.

But do I think the shore should be sealed from Cape May, NJ to Rockaway, Long Island? That’s not practical.

The first is security and the TSA. I have to budget about 20 min for that. That’s a material cost for me. It is not primarily a function of infrastructure, but policy and capacity.

And that cost is one of many imposed by our dependence on oil. If we weren’t dependent on oil, we wouldn’t be invading countries in the M.E. and placing soldiers in places like KSA and Iraq. 9/11 wouldn’t have happened, and neither would the TSA.

Slug,

You are kidding with your Saul Alinsky post, aren’t you? Alinsky always says don’t debate issues attack your opponent. In the end those who ignore issues become ignor-ant.

Just for the record:

a) False. I get my economics from Mises but not the Mises (Rothbard) site.

b) False. I have seldom ever even looked at Shadowstats. You have me confused with someone else. Of course what I do know about them is they have a more consistent and non-political (honest?) record than the federal government.

c) False. I sometimes read Zerohedge if an article is referenced, but it is not one of my regular stops.

d) TRUE!!! I love Lynn Cheney!!!

Yes there is a line in the Bible about putting away childish things, but I will still play your games at times hoping against hope that you will grow into reason and debate..

Nick G wrote:

“Hey. Peak US oil was 1971. I’d argue that this shows that dependence on oil is very bad for our economy.”

Nick,

You have the cart before the horse. Dollar debasement and tax policy significantly drove US oil produciton off shore. That has continued until today and has expanded to other industries.

Dollar debasement and tax policy significantly drove US oil produciton off shore

As best I can tell, rising US oil imports sent a lot of money to Arabs who liked the idea of gold better than cash, regardless of the price. They showed up and wanted a lot more gold than the US had.

Could you expand on the idea that oil production was driven offshore? Provide sources, or links?