Paul Ryan in October 2009 writes:

“One of my key concerns is on the inflation front….”

“…We are already seeing some potentially dangerous developments in financial markets. Over the past six months alone, the dollar has declined nearly 15 percent against major currencies (Figure 4) . Due to extremely low interest rates in the U.S., some investors are using the dollar as a funding currency for a carry trade (borrowing and then selling dollars to buy higher-yielding foreign assets), which is further contributing to downward pressure. A falling dollar pushes up the cost of imported goods and commodities. Gold is at an all-time high above $1,000 per troy ounce (Figure 5) , silver and copper prices are on the rise, and oil prices have doubled over the past 8 months. These commodity price increases could be an early harbinger of future inflation.”

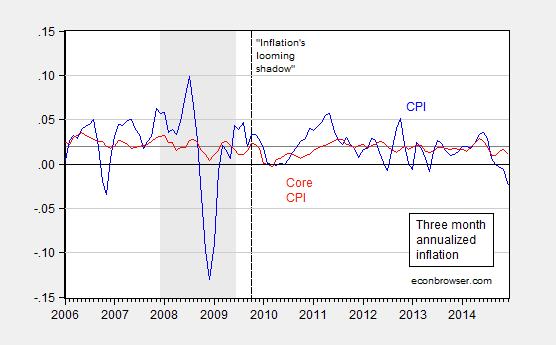

That’s from an op-ed in October 2009. Here are up to date statistics on inflation from today.

Figure 1: Three month annualized inflation using CPI-all (blue), Core CPI (red). NBER defined recession dates shaded gray. Source: BLS, NBER, author’s calculations.

from one of the leading conservative economic thinkers on the right!

Who you gonna believe? Ryan or Chinn’s lying graph?

Over at Delong’s there was a link that Brownback was proposing new taxes to cover his deficit. Unpossible!!

But Brownback is going to taxing the “moochers,” raising the sales tax, while cutting the income tax for the Koch brothers.

The core CPI for goods peaked in June 2012 and has been negative ever since.

According to conservatives, it is just a temporary hiatus, to be followed by a hockey stick of inflation growth.

Wait … what was it we talking about?

Obviously, Ryan was too optimistic about the Obama “recovery” in October 2009 🙂

‘hundred dollars here to stay’ James Hamilton, summer of 2014.

As long as we’re bringing up things people said that didn’t pan out…

of course prof hamilton is not in charge of the budge which defines the direction of policy this nation takes every year. but paul ryan has that responsibility. hence the reasons for his screw ups should be discussed publicly.

Because Mr. Ryan recognized how egregiously wrong he was about inflation, Obamacare, Medicare, the economic recovery, etc., he announced last week that he will not be a candidate for president in 2016. Instead, he will continue to serve his time in the dunce corner of Washington known as the House of Representatives, i.e., those who best represent the average voter and Fox News viewer.

Federal Reserve Bank of Chicago President Charles Evans repeated Wednesday his view that raising rates anytime soon would be a major blunder on the part of the central bank….

“We ought to get it up to 2% as quickly as feasible,” Mr. Evans said of inflation. And even with Fed efforts, inflation likely won’t hit that mark until sometime in 2018, he said. If inflation lags at 1.5% over a long period it would be a “remarkably negative hit” to the Fed’s credibility, he added.

http://blogs.wsj.com/economics/2014/10/08/feds-charles-evans-very-uncomfortable-with-calls-to-raise-rates/

The FED began deflating in the mid-1990s but it did not become manifest in their lagging indicators until about 5 years after it began. Once the FED realized the deflation was real they reacted in typical FED style; they began a massive monetary expansion. The aggregate indicators used by the FED did not show the impact of the monetary expansion because the fiscal policies of congress had channeled the expansion into specific sectors: health care (not yet Obamacare), education, and the most devastating, real estate. From 2000 the dollar began a slide in value. The decline picked up speed after the Obama administration came into office and the full weight of the government was put behind loose monetary policy. But every attempt to generate inflation failed. Every economist from Keynesian to monetarist believed in the QTM and so they expected increased “inflation,” but it was not happening. Why?

The monetary authorities did not realize something Milton Friedman finally realized at the end of his life. There is no transmission of money into the transactional economy unless there is collateral to allow the loan system to work. The real estate crash was the heart of the “credit” crash, but the credit crash has been created by loose monetary policy stripping away any collateral value in assets.

Yes, 5 years ago Paul Ryan was mislead just like all the other monetary authorities, but while Ryan saw loose monetary policy as a problem, the others saw it as “stimulus.” Paul Krugman was their leader first calling for a real estate ‘bubble” then calling for twice the monetary expansion that had caused the crash.

Sadly, the inflationists still do not understand that the monetary expansion has flowed into excess reserves and into the stock market as low interest rates and the economic crash have taken away any other return. Calls for 2% and 4% inflation (price increases) cannot be created with loose monetary policy. All loose monetary policy does is continue to destroy the usefulness of the monetary units of the world.

The US slowed its monetary easing in late 2010. Only a few months later the economy began to recover. The FED has continued to wind down its QE and other monetary easing programs. The result has been an appreciation in the dollar and a decline in commodities. This haas allowed a slow recovery but actions by government attempting to counter price declines and congressional mandates to increase business costs (Dodd-Frank, expanded Sarbanes-Oxley, Obamacare) has continued to hinder the recovery.

It is amusing that the misunderstanding of Paul Ryan is now used in an attempt to justify a continuation of the policies that created the Great Recession.

“The FED has continued to wind down its QE and other monetary easing programs. The result has been an appreciation in the dollar and a decline in commodities. ”

or the other currencies, such as the euro, have had increased monetary policy and a deflationary environment, making our performance positive in comparison?

richard, what is strange about your argument is you appear to be against inflation. hence you have no problem with deflation-this is what the fed was trying to avoid. so the question to you is, five plus years after the beginning of the financial crisis, if we had simply let deflation run its course without fed intervention, you believe the world would be in a better position today? really?

SPENCER,

Great observation! CPI decline came as a result of the decline in monetary expansion.

Where are the usual suspects to tell us that a falling commodity (oil) price is not deflation? That’s the first take-away I see from looking at the CPI: a drop in consumer prices due to the drop in oil price.

We would probably call that “benign” deflation though.

The US is following Japan (and the EZ), as is predictable given the implied characteristics of a debt-deflationary regime of the Long Wave Trough (as in the 1830s-40s, 1890s, and 1930s-40s), i.e., “secular stagnation” or a Schumpeterian “slow-motion depression”:

5- and 10-year trend of real GDP/final sales per capita.

5- and 10-year trend of CPI and PCE deflator.

Long gov’t note/bond yield.

Public and private debt to GDP.

Growth of central bank balance sheet and monetary base circulating primarily between the gov’t, largest financial institutions, and the central bank.

Peak demographic drag effects on housing, spending, household formations, growth of business formations, etc.

Declining labor force participation reducing the reported U rate.

Deteriorating job, income, and purchasing power prospects for those age ~16-35.

What is “different this time”, and between the US and Japan, is that the US has (1) ample reserves of costlier, lower-quality crude oil substitutes to extract (but the bubble is bursting now); (2) the US as become hyper-financialized (net annual flows to the financial sector now equaling annual growth of GDP), which Japan is not, which allows the US to sustain (so far) Third World-like wealth and income inequality and its effect on money velocity, labor’s share of GDP, marginal labor productivity, and overall growth; and (3) the US can spend 5-6% of GDP on never-ending imperial war, which Japan cannot.

However, US debt to wages and GDP, record low for labor’s share of GDP, decelerating productivity, little or no growth of the labor force, net flows to the financial sector, and overvalued assets and wealth and income inequality will continue to drag on the decelerating secular trend rate of real GDP/final sales per capita indefinitely. The bursting of the shale oil, echo housing, student loan, and subprime auto loan bubbles hereafter will further reduce the secular trend rate of real GDP/final sales.

Lets remember, the big reason Greenspan got rid of M3, wasn’t for inflation, but for deflation. M3 is still lower than it was in 2008 lol.

I think the economy has done amazing for the lack of money in it. We are using everything we got, efficiently as we got.

Richard Fox and BC. Profoundly correct analyses. High-powered base money does not translate into spendable money unless there is sufficient bank equity to support the increase in loan assets the creation of spendable money entails. What asset is not now in a bubble because of the upside-down economic theory the Fed and other central banks follow? All bubbles burst. One already has.

As global growth grinds lower, policymakers here and abroad know only one thing – expand money, credit, and fiscal stimulus. All these paths lead straight to more debt. Yet since global debt is at a record relative to the means of supporting it, the situation will only get worse. Debt is as Reinhart Rogoff said. The burden of debt is so heavy it now casts a deflationary pall across the globe. The pressure on prices is palpable. The deflationary pressure perforce constricts nominal growth all the more. So it becomes ever-harder for banks to raise equity and for indebted households, corporations, and governments to service their debt, let alone get out of underneath it.

In the interim, not only was the economic system not cleansed of the malinvestment that had built up before the crisis. Fed policy added an additional 6-year sedimentary layer of malinvestment on top. The first sign of this malinvestment is surfacing in the oil patch. The potential “economic energy” stored up in too high crude oil prices was like a sealed oxygen canister on a leaking spacecraft. It bought some time in the form of a one-time freeing up of discretionary income. But it cannot patch the structural damage. Now that canister, too, is exhausted. There is no ammo left – monetary, fiscal, or otherwise. Nonetheless, central bankers will continue to create money out of nothing to buy new sovereign debt backed by nothing – that is, they will enlarge the debt even more. Which will only darken the deflationary pall, which will press down even more on the highly-leveraged financial structure that has become increasingly untethered from the real physical economy until all snaps and buckles.

We are past the point of no return.

‘Gold is at an all-time high above $1,000 per troy ounce ….’

Easy to see Ryan’s reasoning as gold (traditional indicator of inflation) had steadily risen from about $400 in 2005. It continued to increase to almost $1,900 in 2011. It’s still higher today, at about $1,200 than it was when Ryan spoke in 2009.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

if patrick was wrong about canada, and still will not admit being incorrect, i suppose it is fair to question if anything he has to say has merit. patrick there is nothing wrong with admitting your mistake. denying you even made a mistake is, however, a foolish proposition. do not fall victim to this conservative ideology!

You mean like Menzie has fallen victim to the Red Herring Fallacy, by changing the subject away from the one under discussion?

Or you, to the fallacy that because someone is wrong about one thing, they must be wrong about everything?

Yes, ’tis a pity some are so bad at logic, baffling.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

patrick

“Or you, to the fallacy that because someone is wrong about one thing, they must be wrong about everything?”

incorrect. you are allowed a mistake, just own up to that mistake. if you don’t do that, then i have to question anything else you say. why? because you have shown you either were 1. unknowingly making an incorrect statement to begin with and continuing to pursue that item after being corrected or 2. knowingly making an incorrect statement to achieve your argument. under those conditions, one should doubt anything else you say.

baffling, the test of a logical argument is, traditionally, the syllogism. Which you seem to not have mastered.

(Hint: ‘Menzie says Patrick made a mistake’ doesn’t work as a Major Premise)

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

patrick, do you claim to be correct or do you admit to being wrong?

General Question for anyone: How much of an effect is the velocity of M2 having on inflation or the lack thereof?

http://research.stlouisfed.org/fred2/series/M2V

“The monetary authorities did not realize something Milton Friedman finally realized at the end of his life. There is no transmission of money into the transactional economy unless there is collateral to allow the loan system to work. The real estate crash was the heart of the “credit” crash, but the credit crash has been created by loose monetary policy stripping away any collateral value in assets.”

I think this is an interesting point. It’s a kind of R&R argument, ie, that an over-indebted economy has no ability to borrow more, ie, there is a lack of collateral. This was not true in the 1970s, by the way. That was a straight oil shock, not a hybrid oil-financial shock. By this line of argumentation, we had stagflation in the 1970s, because easy money, combined with the availability of collateral, created a transmission mechanism of inflation into the economy. That was missing this time around, so we saw stagnation without inflation, even in the presence of ostensibly easy money.

Interestingly, this suggests that once collateral values are restored, so is the transmission mechanism of inflation into the economy. If that’s the case, we may come to see the Volcker period in reverse.

This also reinforces the notion that the Fed should have helped “Main Street” rather than Wall Street. The focus of intervention should have been on reducing principal, not interest rates. The Treasury should have sent unsterilized checks to households until inflation appeared. A little to radical for Bernanke et al, but that’s where I think the plain vanilla analysis takes you.

steven

“The focus of intervention should have been on reducing principal, not interest rates. ”

but this would have manifest itself in deflation (lower values of principal) which is what we tried to avoid to begin with, correct? the concern was with all the ramifications deflation brings to the table-most are not good.

No, Baffs. This is the classic helicopter drop. More money chasing the same amount of goods. Now, you could argue that people would pay down their debt with the money, which is the point. The remainder would be saved or spent. What’s our savings rate? 4%? Something like that? So 90%+ of the funds would either pay down the debt or stimulate consumption. And that’s what we want.

But this is hardcore, unadulterated debasing of the currency. I doubt it would ever get much political support. It has significant distributional implications. I am just saying that it seems to be the policy which should work under the circumstances, ie, it has a clear transmission mechanism.

Menzie wrote:

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression.

Menzie,

Your pettiness is outrageous.

Speaking of pettiness, do you still believe there should be no cap on food stamps, that all citizens should have food stamps?

Wow, what brilliant economic insights!

Actually Ricardo, it’s not his pettiness so much as his obtuseness–his continual resort to one of the crudest logical fallacies. Though, like all good con men, he does seem to know that there are suckers born every minute.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Ricardo/Dick/DickF/RicardoZ/Richard Fox: I give the benefit of a doubt to Patrick R. Sullivan that he has some link to reality, and can realize when he has made an error of fact, even when he will not admit it. I long ago gave up that assessment of you, probably when you asserted that Iraqi possession of WMD’s justified the invasion, long after everyone else, including President Bush, acknowledged that this was not the fact. In other words, no use asking you to admit an error since I know you have no contact with reality.

Menzie,

Your heartburn with Patrick is over interpretation of data. Your insistence that everyone should be receiving food stamps is a logical absurdity, the socialist delusion at its strangest.