In December I provided some simple calculations of the extent to which a slowdown in the growth of global oil demand may have contributed to the spectacular drop in oil prices since last summer, and I updated those estimates two weeks ago. Some of you have suggested that as conditions keep changing, perhaps I should update those calculations every week. Thanks to the always-helpful Ironman at Political Calculations, I can now go that a step better, and provide eager Econbrowser readers a quick tool they can use to update these calculations on their own on a daily basis, if your heart so desires.

The basic idea behind my calculations is the observation that at the same time that oil price has been declining, we’ve also observed big drops in the price of other commodities like copper, the yield on 10-year U.S. Treasuries, and the value of other currencies relative to the dollar. My assumption is that the success of oil producers in Texas has little to do with the latter three developments.

I used a regression estimated using weekly data from April 2007 to June 2014 to summarize the historical correlation between changes in the price of oil and changes in the other three factors. I used the coefficients from that regression to calculate how much of the change in the price of oil in each week since July could have been predicted statistically on the basis solely of changes in copper prices, bond yields, and the value of the dollar, interpreting those predicted values as the fraction of the oil price change that might be reflecting broader weakness of the global economy as opposed to any specific development in oil markets in particular.

Ironman has put together a little tool you can use to calculate how much of the change in the price of oil between any two dates would be attributed to demand factors with this method. Just input the four prices at your chosen starting date and ending date and press calculate. It’s set up with default values (if you just press “calculate” yourself without entering any numbers) to analyze the change in the price of oil between July 4 and January 15. If you try it you’ll see the answer is that oil prices would have been expected to fall to $75 a barrel based on changes in demand factors alone since last summer, accounting for a little more than half of the observed decline in the price of oil.

I’ve also provided little self-updating widgets below that should always display the very latest values of these indicators. So you could come back to this page any time in the future, enter the values you see displayed below in the “current values” boxes and see how any new developments may have changed the calculations.

Commodities are powered by Investing.com

And I also provide below a table with the historical weekly values for the variables since every date this summer, if you are interested in how much of the change since a given date might be attributed to demand factors. For example, if you input starting values as of December 12, you’ll see that 68.8% of the change between December 12 and January 15 appears related to developments affecting global markets generally and not just oil.

In other words, increases in oil supply have been very important, but many analysts seem to be overlooking a critical part of the story.

Thanks again to Ironman for letting us use his neat tool.

| Date | Oil | 10-yr Treas | Dollar | Copper |

|---|---|---|---|---|

| 7/4/2014 | 104.76 | 2.65 | 75.9606 | 3.269 |

| 7/11/2014 | 101.48 | 2.53 | 76.0685 | 3.259 |

| 7/18/2014 | 103.83 | 2.5 | 76.3295 | 3.174 |

| 7/25/2014 | 105.23 | 2.48 | 76.7712 | 3.227 |

| 8/1/2014 | 97.86 | 2.52 | 77.1377 | 3.207 |

| 8/8/2014 | 97.61 | 2.44 | 77.2883 | 3.166 |

| 8/15/2014 | 97.3 | 2.34 | 77.2246 | 3.097 |

| 8/22/2014 | 93.61 | 2.4 | 77.9607 | 3.223 |

| 8/29/2014 | 97.86 | 2.35 | 77.9769 | 3.16 |

| 9/5/2014 | 93.32 | 2.46 | 78.7604 | 3.17 |

| 9/12/2014 | 92.18 | 2.62 | 79.5593 | 3.107 |

| 9/19/2014 | 92.43 | 2.59 | 79.8452 | 3.091 |

| 9/26/2014 | 95.55 | 2.54 | 80.787 | 3.035 |

| 10/3/2014 | 89.76 | 2.45 | 81.638 | 2.998 |

| 10/10/2014 | 85.87 | 2.31 | 80.8575 | 3.035 |

| 10/17/2014 | 82.8 | 2.22 | 80.5261 | 3.003 |

| 10/24/2014 | 81.27 | 2.29 | 80.8143 | 3.041 |

| 10/31/2014 | 80.53 | 2.35 | 81.8865 | 3.047 |

| 11/7/2014 | 78.71 | 2.32 | 82.7915 | 3.038 |

| 11/14/2014 | 75.91 | 2.32 | 82.6899 | 3.046 |

| 11/21/2014 | 76.52 | 2.31 | 83.0093 | 3.029 |

| 11/28/2014 | 65.94 | 2.18 | 83.4545 | 2.846 |

| 12/5/2014 | 65.89 | 2.31 | 84.2232 | 2.902 |

| 12/12/2014 | 57.81 | 2.1 | 83.5603 | 2.934 |

| 12/19/2014 | 56.91 | 2.17 | 84.7477 | 2.885 |

| 12/26/2014 | 54.59 | 2.25 | 85.0187 | 2.814 |

| 1/2/2015 | 52.72 | 2.12 | 85.8219 | 2.817 |

| 1/9/2015 | 48.35 | 1.98 | 86.5842 | 2.755 |

| 1/16/2015 | 48.49 | 1.83 | 87.0009 | 2.617 |

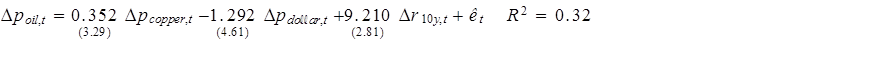

Updated 1/27/2015: Reader Rick Stryker found I made an error in the way my original regression was treating missing observations. The correct regression coefficients (with 5-lag Newey-West t-statistics in parentheses) are given below:

I’ve updated the tool above to reflect the new coefficients. This does not change any of the results reported above. I apologize to readers and users of the tool for any inconvenience.

My guess is that approximately 5% to 10% of global Crude + Condensate (C+C) production is currently being produced at a loss, after operating costs (not counting drilling and completion costs).

And note that if we exclude high decline rate US production, there was no increase in global C+C production from 2005 to 2013, as annual Brent crude oil prices increased from $55 in 2005 to an average of $110 for 2011 to 2013 inclusive (and the pattern continued in 2014, as Brent averaged very slightly less than $100).

If we subtract out plausible estimates for global condensate production, it’s quite likely that total global crude oil production (45 and lower API gravity crude oil) has not increased since 2005, even counting the US. In other words, it’s quite likely that actual global crude oil production effectively peaked in 2005, while global natural gas production and associated liquids, condensate and natural gas liquids, have so far continued to increase.

Given the above, the outlook for global supply doesn’t look too good, especially when we consider the underlying decline rate. The gross decline rate is the decline rate with no contributions from new wells, recompletions, workovers, etc. For example, this would be the decline in US oil production from 2015 to 2016 if no new wells were completed in 2016. The net decline rate would an observed decline in production, after new wells were added.

The observed 2005 to 2013 6.6%/year net decline rate (net being the rate of change after new wells were added) in C+C production from the North Slope of Alaska would seem to support for the IEA’s estimate* that the gross decline rate from existing oil wells worldwide is on the order of 9%/year:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=manfpak1&f=a

In order to simply maintain current global oil production for 11 years** at a gross decline rate of 9%/year, the global industry has to replace the productive equivalent of every currently producing oil well in the world over the next 11 years–from the Americas to the North Sea, to Russia to Africa to the Middle East.

*Source:

COLUMN-Breakeven and shut-in prices for oil wells: Kemp

http://www.reuters.com/article/2015/01/13/oil-shale-prices-kemp-idUSL6N0US2GE20150113

**At a 9%/year decline rate, existing production would be down to 37% of current production in 11 years, since we would be declining against a falling production level, but I am stipulating a “steady state” production scenario.

Global vehicle sales, which I believe hit a new record high in 2014, are puzzling, given the collapse in oil prices. Note that during the previous oil price decline, global vehicle sales fell from 2007 to 2008 (when oil price started falling) and of course fell further in 2009.

An interesting stat about US car sales, bit with a rather disquieting historical parallel:

Pricing: The extra icing on the cake in a great year (for car sales)

http://www.autonews.com/article/20150105/BLOG06/301069998/1448

So, this calculation tells me that 52% of the drop of the price in oil is due to demand factors.

This is not easy to find in the EIA data.

If we consider full year consumption growth, it was 0.9 mbpd in 2014 (1.0%) compared to 1.34 mbpd (1.5%) in 2013. Well, that’s a big difference, except almost all of it is attributable to weak US demand. But consumption in the US was up 710 kbpd in December, so whatever annual weakness there existed was more than erased in December. Not a convincing explanation, therefore, of the price weakness we see now.

Well, what about Q4 on Q4? Consumption was up 1.24 mbpd in Q4 2014 on Q4 2013. By comparison, consumption was up 0.95 mbpd Q4 13 on Q4 12. So, not a very convincing explanation there either. Nothing very weak about 1.24 mbpd demand growth.

Well, what about December? Up 2.0% in 2014 vs 0.9% in Dec. 2013. Not convincing either.

Is weakness coming from China? Doesn’t really show in the data.

Maybe the data’s bad, and we conclude that we don’t like EIA data anymore, but we certainly liked them six months ago.

I don’t know. I cannot find the weakness on the demand side, certainly not in EIA data.

Steve: The market is forward-looking, responding to anticipated demand. Whether that perception is justified or not remains to be seen. But it is showing up in a set of related indicators, namely, copper, bond yields, and value of dollar.

There are two possible interpretations of oil price as regards expectations. One of these is that current inventory conditions drive current oil prices. The IEA and OPEC data refute this notion for Q4 2014; one is essentially forced to an expectations model to explain the price collapse in Q4 if IEA or OPEC data are to be believed. The inventory build is simply not large enough to explain oil price movements. On the other hand, current inventory conditions in Q4 could explain the price collapse if we believe EIA data. (I can’t tell you how much I hate it when we can’t agree what the actual facts are.) If you have not read my article on this, you should. I have a few graphs on this.

http://www.prienga.com/blog/2015/1/20/supply-minus-demand-explained

I can accept the notion that expectations drive prices, but your model is not an expectations model. Unless I misunderstand it, all the variables are contemporaneous. It’s not copper futures to spot oil, right? Now, you can argue that these models all incorporate future expectations, but so does the oil futures curve. Why wouldn’t I just stay with that if I believe that the future drives the present?

Now, some of these variables clearly matter. About 1/3 of the drop in oil prices can be attributed to the strength of the dollar.

Copper is also a peaky commodity, but oil does not track copper very well since 2011. Both oil and copper measure the strength of the Chinese economy, as both are secondary (I think, secondary) development phase commodities, ie, both are related to house building and automobiles, as opposed to commodities like iron and cement, which are more first phase commodities linked to things like roads, rail, and airports, for example. So a correlation makes sense, but we’re really measuring the health of the Chinese economy with both of them. Do we think China’s going to tank? Don’t know. I don’t have a good model of China, not one that I believe.

As for exchange rates: If we take the view that the US current account deficit has settled into a “comfort zone” where decreased in oil imports are offset by increasing non-oil imports, then that’s suggestive. It suggests that the current account deficit may be driven by the capital account, that is, by the need for foreign countries to access ‘risk-free’ US securities (a Gortonian view), and being willing to therefore depreciate their currencies to gain access to US debt by creating a US current account deficit. That would also drive US interest rates lower. Or perhaps the logic is less tortured. A decreasing current account, faster GDP growth and improving terms of trade allow the dollar to appreciate against other currencies. I don’t know. I think the “comfort zone” thesis is likely to prove correct; as for the rest, I leave it to the macro economists to make sense of the data.

Steve: You seem to be completely discounting the recent revisions in IEA demand forecasts.

I think it comes down to whether the model purports to make a statement about current conditions, or expected conditions.

The model does not reflect current conditions, in terms of demand (although it does in terms of supply and overall balance).

The model could reflect expected conditions, ie, a possible downturn in the market. None of the incoming data is supportive of such a view. Just the opposite.

Steve: Oil markets are absolutely forward-looking. I take it as given that any coherent account of the current price is going to be based on market expectations of what’s coming next, and that is certainly how I interpret the simple regression I ran. On the forward-looking nature of oil markets, see for example Section 3.1 in this paper.

I appreciate that. But the market only cares about balances, not whether they come from supply or demand.

The question here is, does more than half of the fall in oil price come from weakness in demand? And that answer to that, as of today, is no.

The model is therefore arguing that there is some anticipated weakness in demand, along the lines of the IEA forecast. I appreciate that, and there could be. But there is precious little confirmatory data to support that assertion in the last sixty days.

Now, you can argue that we’re going to have some sort of global meltdown outside the US if you’re saying that more than half of the weakness comes from demand that we are yet to experience. That’s a lot!

So where does the weakness come from? Not the US. Europe? But European oil consumption is rising, not falling. But maybe Greece precipitates some event, maybe Russia. OK. That could happen in theory.

Otherwise, we’re left with China. You tell me. All I have for China is a booming Shanghai stock market and 6% oil demand growth in December.

On the other hand, if low oil prices are the result of the huge supply additions which are readily visible in the data (as opposed to the fall in demand, which is not), then you’re looking at a boom, not a bust. A collapse in oil prices should be hugely helpful to the global economy, other than the oil exporting nations.

Very, very different interpretation of events.

Copper v Oil is here: http://www.prienga.com/blog/2015/1/25/copper-vs-oil

After 2011, you can see the difference between a supply-constrained and an unconstrained commodity. When oil is no longer constrained, it falls hard, much worse than copper.

I think oil production has had a material impact on exchange rates through the current account and its impact on growth (and possibly through that, to expectations for interest rates). See my post here: http://www.prienga.com/blog/2014/12/6/oil-and-the-trade-deficit

Steve: You raise a valid point about possible causation running from oil prices to the exchange rate. I can definitely see this as a factor in the value of the Canadian dollar, which has a weight of 16% in the index. It is less clear to me why a decrease in oil prices should cause a depreciation of the euro (weight = 19%) and the yen (weight = 10%) relative to the dollar. To me the more natural explanation is weakness in the world economy.

Is it weakness in the Euro or strength in the dollar? We added a hell of lot more oil production than the Canadians and completely refashioned our current account balance. Did you look at my analysis of the trade deficit? You should, it really speaks to dollar strength. http://www.prienga.com/blog/2014/12/6/oil-and-the-trade-deficit

In any event, I haven’t checked extensively, but I have interpreted recent developments as strength in the dollar. Brazilian real, Korean won have also depreciated against the dollar. UK has depreciated against dollar, too. See if you can find a currency not pegged to the dollar that has depreciated against it in the last six months.

And, oh, boy, the interpretation is vastly different if the thinking it’s non-dollar weakness instead of dollar strength.

If you take an oil-based view of recent developments, you would expect a ripping global economy in the next six months. And we see that in the US data. As of yesterday, in at least some of the Chinese data.

Steven writes : “So, this calculation tells me that 52% of the drop of the price in oil is due to demand factors.

This is not easy to find in the EIA data.”

Ha, ha, that’s funny. Steven, do you want to embarrass James ?

But the calculator is nice, thanks James. There is a clear correlation between trading liquidity for copper and oil, resulting in higher prices at the pump and for copper, too. That’s no surprise, when we had the money at our trading desk we put it into earths resources, may it be copper or oil, making average Joe paying a higher price at the pump. Did anyone say oil demand (or even supply) played a role ?

Jim is reflecting a view that I hear elsewhere. It is the same view taken by the IEA and OPEC, as well as PIRA and Energy Aspects, among others. I take it seriously, but I just can’t find it in the EIA data. If it is demand, then it would be signaling the impending collapse of China. Not impossible, but the Credit Suisse data from last night are not supportive of such a view.

This from Credit Suisse Hong Kong, last night:

“December apparent oil demand saw 6% YoY growth, rising from 4% growth seen in November. This brought 2014 total oil demand to 1.6% growth, the slowest growth pace since 2000. December crude imports saw 13% YoY growth amid sharply lower oil price, bringing 2014 total import to +10%.”

I read that as surging Chinese demand. And guess what, I think it’s going higher, if I assume China’s not going into recession.

Ain’t no weakness in demand there; at least not on paper.

So, we have gasoline demand in the US up 800 kbpd and China’s oil demand up nearly 700 kbpd in the last month or two. Where’s the weakness in demand?

Hi Steve Kopits,

Your thesis seems to be no weakness in demand for oil. Do you also think there has been no change in the supply of oil? The EIA shows a 1.5 mbpd increase in C+C output in the trailing 12 month average YOY. Does the EIA have World demand data for 2014? I only see OECD for 2014 and Q2 is the last quarterly data point the OECD demand was down 800 kb/d from Q2 2013 to Q2 2014. So I guess it depends upon which EIA data one looks at. On a quarterly basis World liquids supply was up by 1.4 mbpd from Q2 2013 to Q2 2014, and for the Q3 comparison it is a 1.1 mbpd increase from 2013 to 2014. The demand side is not clear from EIA data. The EIA’s short term energy outlook estimates that it is excess supply that is the problem, demand grew by about 0.9 mbpd in 2014 while supply grew by 2 mbpd.

The EIA provides global supply and demand in detail on a monthly basis in their Short Term Energy Outlook (STEO). You can find it here:

http://www.eia.gov/forecasts/steo/

I did not say their was no weakness in demand for oil. I have detailed that number in the comments above. I don’t believe there is any weakness in demand currently, based on EIA weekly data and Credit Suisse’s report on China.

In my estimation, there was a macro regime change in July/August 2014. If you step back and take a high level view, lots of factors/variables hit a major inflection point simultaneously in July/August and have remained on trend ever since: Oil prices started going down, copper and most other important industrial commodities also started declining, interest rates started coming down and inflation expectations fell as well, and the dollar began rallying steadily.

I think that there’s a large, as yet misunderestimated change taking place that just isn’t apparent. I wish I knew what it was . . . . . . . if I had to pick one thing, it would be China, but I don’t think it’s a coincidence that QE in the US was fairly close to tapering down to nothing in July/August, either.

Meanwhile, on the supply side, here’s what we see, for the week of Jan. 16, compared to the same week last year:

US oil supply: +1.7 mbpd (!)

of which,

crude: +1.13 mbpd

NGLS; +0.45 mbpd

biofuels: +0.09 mbpd

That’s a whole lotta supply growth.

http://www.eia.gov/petroleum/supply/weekly/

One small clarification, for the benefit of readers: When the EIA refers to “Crude oil,” they are talking about Crude + Condensate, but as I have frequently pointed out, when one asks for the price of crude oil, one gets the price of 45 or lower API gravity crude oil. The dividing line between crude oil and condensate is most commonly defined as 45 API gravity (although some sources put it as high as 50, and some use a lower number). In any case, the following graph shows the precipitous decline in distillate yield, just going from 39 AP gravity crude to 42 API gravity crude (labeled as condensate on the chart):

http://i1095.photobucket.com/albums/i475/westexas/Refineryyields_zps4ad928eb.png

And note that the following chart showing API gravities of global crude oils versus sulphur content tops out at an API gravity of 40:

http://i1095.photobucket.com/albums/i475/westexas/APGravityVsSulfurContentforCrudeOils_zpsc28e149c.gif

Condensate and natural gas liquids are byproducts of natural gas production, and as noted above, if we subtract out some plausible estimates for global condensate production, it’s quite likely that we have not seen a material increase in actual global crude oil production (45 and lower API gravity crude oil) since 2005, even as annual Brent crude oil prices averaged $110 per barrel for 2011 to 2013 (and about $100 for 2014). And of course the question is, if four years of approximately $100 or greater oil prices only kept us on an “Undulating plateau” in actual crude oil production, after trillions of dollars were spent on upstream capex, what happens to global crude oil production given the current price collapse and resulting (ongoing) decline in upstream capex? (Of course, Steven addressed this issue some time ago.)

In any case, this does not take away from Steven’s point that we have seen a huge increase in US liquids production, and I wonder if the third quarter (2014) decline in US net imports (total liquids basis) provided a lot of the missing declining demand that we have been discussing (which in effect is what Steven was pointing out). Based on four week running average data, US overall net imports fell from 6.2 mbpd in the week ending 6/13 to 4.7 mbpd in the week ending 11/07, a decline of 1.5 mbpd in the US demand for net imports of oil.

What I define as Global Net Exports of oil (GNE*) fell from 46 mbpd in 2005 to 43 mbpd in 2013 (2014 data won’t be available until around September). And what I define as Available Net Exports (ANE, or GNE less Chindia’s Net Imports, CNI) fell from 41 mbpd in 2005 to 34 mbpd in 2013.

It seems to me that in effect we saw a 1.5 mbpd decline in demand for ANE in the third quarter of 2014, just due to the decline in US net imports. However, US net imports have recently rebounded, hitting 5.9 mbpd in early January, and most recently we were at 5.6 mbpd in the week ending 11/16 (all four week running average data).

Correction:

It seems to me that in effect we saw a 1.5 mbpd decline in demand for ANE in the third quarter of 2014, just due to the decline in US net imports. However, US net imports have recently rebounded, hitting 5.9 mbpd in early January, and most recently we were at 5.6 mbpd in the week ending 1/16 (all four week running average data).

*GNE = Combined net exports from top 33 net exporters in 2005, total petroleum liquids + other liquids, EIA data

In the battle between Steven Kopits and Professor Hamilton I side with the Professor.

Steve, I think you somewhat mischaracterize the Professor’s point. Professor Hamilton wrote: “The basic idea behind my calculations is the observation that at the same time that oil price has been declining, we’ve also observed big drops in the price of other commodities like copper, the yield on 10-year U.S. Treasuries, and the value of other currencies relative to the dollar. My assumption is that the success of oil producers in Texas has little to do with the latter three developments.”

These three parameters are due to the appreciation in the oil price unit, the USdollar. This does not imply that all of the other factors can be boiled down to a reduced demand from China and the US. The part of the oil price decline that is not caused by the USdollar appreciation also includes world crisis conditions and the economic slow-down in Europe.

Steve, are you saying you believe the appreciating dollar is having a greater impact on oil price declines than demand figures? If that is your point then I might agree.

I am saying that US shale oil production is revolutionizing the global economy.

In the US, shale has led to

1. GDP growth in excess of the rest of the OECD

2. a rebalanced current account, which has now settled in a ‘comfort zone’, thereby

3. leading to a stronger dollar, which will

4. make the US the key importer, driving export-led growth in other countries, and

5. collapsing the price of oil, leading to

6. an immediate cost savings in imports to European countries and China on the order of 1-1.8% of GDP with no other multiplier effects included and

7. a boost of 2 to 3 percentage points of GDP growth to developing countries like India, Vietnam, and Indonesia, purely from import cost savings, and all this will lead to

8. improving global GDP growth, particularly as multiplier effects come into play and

9 surging oil consumption, very much along the lines of 1986, which we are already beginning to see in the data

Professor Hamilton,

If you used EViews for your modeling, would you mind posting your EViews work file as a learning tool?

Thanks

AS: I used RATS; data and code here.

And by the way, the Greeks appear to be in a position to walk on the Euro.

Look at the data. http://www.prienga.com/blog/2015/1/1/greeces-economic-outlook

To me, it says these guys can opt out and walk away from the debt, and they are going to do just that, because they have no realistic means of repaying the full amount. If I were the Troika, I’d slap an FAA on the Greeks so fast their heads would spin, because that’s the only realistic chance the IMF, ECB and ESM have to get their money back. Or put another way, an FAA will provide the incentive for the Greeks to maximize the amount of the repayment.

As it is, for the IMF this looks to be a major disaster, a huge blow to the prestige of the institution. And I wouldn’t want to be at the ECB, either. “Recriminations” is the word I’m looking for, I believe.

some people may feel the greeks created this situation with poor governance-and i would not argue against this view. but over the past few years, the continued spiral down was driven by the austerity measures of the troika, with leadership provided by the germans. they punished the kid by beating him black and blue-austerity rules. they cratered the economy to the point i do not believe it is feasible for the greeks to overcome their debt. if the troika does not offer principal reduction, i am not sure what benefit greece gains by remaining in the euro. they have shown it cannot be done with austerity and structural reform. they need bankruptcy reorganization.

Believe it or not, Baffs, I am largely in agreement with you.

But what’s the prize here? It’s good governance. How do you get good governance from Greeks? (Not easy!)

You pay them for it. This is an ideal opportunity to implement a Fiscal Accountability Act, to make sure the incentives of Greek politicians are aligned with maximum sustainable growth. And sustainable growth is the best guarantee of the Troika salvaging as much as it can of its very bad loan portfolio in Greece.

steven, the real question is can you convince the greeks to accept another package from the troika? this will be quite difficult, considering thus far the greeks have obtained nothing but a beating each time they accepted something from the troika. it could end up that the troika could offer a reasonable plan but it will be rejected outright based upon past experiences (i.e. past beatings). spain and portugal are watching this very closely for sure. if the new government does not reject the current terms of aid, things inside of greece, at least politically, will get mean.

When I run the regression using weekly data from 4/20/2007 to 6/27/2014 from JDH’s data set, I get very close to JDH’s numbers, but not exactly.

I’m using R to do the regression. For those who may be familiar with R, here is the list of commands:

——————————————————————————–

library(sandwich)

library(lmtest)

d1 <- read.csv("oil1.csv") // load data from 4/20/2007 to 6/27/2014 from csv file

m |z|) JDH estimates

tb10 9.20958 3.27341 2.8134 0.004901 ** 9.442

dollar -1.29248 0.28045 -4.6086 4.053e-06 *** -1.253

copper 0.35250 0.10726 3.2864 0.001015 ** 0.363

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

——————————————————————————————–

That’s just a little different from the regression output that JDH reported. If I estimate the parameters in excel, I get the same parameter estimates as R. Appreciate any ideas as to why I am not reproducing JDH’s output exactly.

For some reason, the R commands got garbled when I posted them. Let me try again:

library(sandwich)

library(lmtest)

d1 <- read.csv("oil1.csv")

m <- lm(oil~tb10+dollar+copper+0,d1)

coeftest(m,df=Inf,vcov = NeweyWest(m, lag = 5, prewhite=FALSE))

The output got garbled as well. Let me try that again:

z test of coefficients:

Estimate Std. Error z value Pr(>|z|) JDH estimates

tb10 9.20958 3.27341 2.8134 0.004901 ** 9.442

dollar -1.29248 0.28045 -4.6086 4.053e-06 *** -1.253

copper 0.35250 0.10726 3.2864 0.001015 ** 0.363

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

That’s still a bit hard to read. The estimated coefficient from R on tb10 is 9.20958 with a Newey-West corrected standard error of 3.27341. jdh reported a coefficient estimate of 9.442 using what I think is the same data.

You want to give us that in English, Mr. Stryker?

Hi Steven,

When I saw jdh’s regression, I decided to reproduce it to understand it better. To do so, I used R, which is a free, open source statistical package. However, I did not get the same results as jdh. Close, but not the same and I was puzzled about that.

Rick Stryker: Sounds like you must have used a slightly different data set or sample period than I used. My data, code, and output can all be found here.

Thanks JDH. If I take the data set from your spreadsheet and just estimate OLS using the Excel regression tool, I get the same estimates I got in R. That is, I take the data from 2007:4:20 to 2014:6:27, inclusive, with oil as the dependent variable and regress against tb10, dollar, and copper from the spreadsheet.

I’ve not used Rats but I would assume the regression you are running in Rats is just modifying the covariance matrix but not the OLS estimates. If so, I don’t know where the discrepancy is coming from.

Rick Stryker: Yes, you’re correct. The RATS code I was using turned out not to be treating missing Friday observations in the way I was intending. I’ll try to put up a corrected version of the tool later today. It doesn’t look like it changes any of the calculations, however.

Jim –

How does that model allocate between supply and demand factors?

Professor Hamilton,

I must also have a mistake. I imported your change data into EViews and find the following:

change in price of oil = 0.342 change in copper -1.338 change in dollar + 9.547 change in tb10 R^2 = 0.31 (per input data, all log percentages except t10 rate change)

Using Newey West corrections with 5 lags, t= 4.23, -5.99 and 2.55 respectively.

AS,

Yes, I got those coefficient estimates in R using the entire data set as well.

For people interested in greece (besides oil), here is the blog of the new greek economics minister.

http://blogs.valvesoftware.com/economics

Yanis Varoufakis. Hear, hear James, he is visiting Professor at the Lyndon B. Johnson Graduate School of Public Affairs at the University of Texas at Austin.

Yanis Varoufakis is an academic economist, an author, and a prominent contributor to the debates on the recent economic crises in Europe and the United States. Born in Athens, 1961, he moved to England to read Mathematics and Statistics and holds a PhD in Economics from the University of Essex. He is currently Professor of Economic Theory at the University of Athens and Visiting Professor at the Lyndon B. Johnson Graduate School of Public Affairs at the University of Texas at Austin. His previous academic appointments include the Universities of Essex, East Anglia, Cambridge, Sydney and Glasgow. His books include:

The Global Minotaur: The True Origins of the Financial Crisis and the Future of the World Economy, London and New York: Zed Books

Modern Political Economics: Making sense of the post-2008 world, London and New York: Routledge, (with J. Halevi and N. Theocarakis) 2010

Game Theory: A Critical Text, London and New York: Routledge, (with S. Hargreaves-Heap), 2004

Foundations of Economics: A beginner’s companion, London and New York: Routledge, 1998

Rational Conflict, Oxford: Blackwell Publishers, 1991

* Guys, make no mistake, the time of austerity in greece has ended. Krugman’s take here :

http://www.nytimes.com/2015/01/26/opinion/paul-krugman-ending-greeces-nightmare.html

The real question is : Weimar reloaded ? The answer will be in Spain …

The proportional aggregate of 65-70% of world real GDP per capita has decelerated to an historical recession-like rate in 2014 and at the slowest 9- and 10-year rates since the early 1980s and the Great Depression. The 5- and 10-year rates of growth of trade are likewise at the rates during the Great Depression.

The strengthening US$ is a result of slowing or contracting US FDI to China-Asia and elsewhere coinciding with global recession-like conditions and slowing growth of trade, with firms repatriating dollars, as well as the obvious interest rate differentials.

The increase in US oil consumption in the past 12-36 months or more is attributable to the super-exponential, i.e., log-periodic bubble, growth of US oil production to the fastest 5-year rate since 1927 and 1937. During the period, it required consuming 65-80% of US oil production to achieve the unsustainable super-exponential acceleration of oil production and the net production of an average of just 500Kbd.

That is, the soaring energy cost of energy extraction at $75-$100 resulted in US oil production being uneconomical and thus unsustainable given the underlying trend of US demand outside the energy and energy-related transport sectors.

Therefore, regressing demand, production, price, and net differential energy cost of production, and given the rate of decline of shale wells, US oil production is set to crash in a characteristic “anti-bubble” trajectory back to the levels of 2011-12, with a proportional decline in oil consumption. Given the nature of “anti-bubble” trajectories, the crash could resolve as soon as summer-fall 2016 to winter-spring 2017.

If so, the decline will exceed that of 2009-12 and match the decline in 1979-85, risking a Texas-sized bust in the energy and energy-related transport and goods-producing sectors.

The energy sector bubble has contributed overwhelmingly disproportionately to incremental growth of US industrial production (IP), and the bust in the energy sector is likely to surprise most economists by how quickly growth of orders and production decelerates early this year and perhaps contract YoY in H1.

The collapse in the prices of oil and gasoline is recessionary. With the exception of 1986 going back to the Civil War, each time the price of oil has fallen by today’s YoY rate, the US experienced a recession and an equity bear market averaging a 34% decline. Therefore, the fallout to orders, investment, IP, housing, vehicle sales, and employment from the energy sector bust will more than offset the benefit from falling energy prices for consumers.

With non-financial US corporate debt at a record to GDP going back to 1927-30, the increasing risk of energy junk debt and bank energy C&I loan defaults resulting from the energy sector bust, the Fed will again be required to bail out banks at a scale similar to the real estate bust in 2007-10.

Therefore, the Fed will NOT raise rates in 2015 but more likely resume QEternity to fund yet another round of bank bailouts and the increasing fiscal deficit.

Get ready for a Texas-sized energy bust and fallout for the rest of the economy, y’all.

Intteresting stuff, Jim.

Of course, the price continues to stay pretty much wthin the $45-$50 per barrel band it has been for about three weeks now, with both WTI and Brent within that margin mostly, the band that the Saudis declared in November was what they were doiing their budgetary planning on. Curiously, this has held through the transition from one Saudi king to another despite some predictions by some commentators that it might surge upwards, or by more commentators, downwards.

Your call’s good so far, Barkley.

Here you go, on the role of the US for export led growth elsewhere:

http://money.cnn.com/2015/01/27/investing/europe-cheap-travel-euro-11-year-low/index.html?iid=HP_LN

And this gem, from the article:

The best deals are likely to be found in Spain and Greece where the economies are even more depressed.

the currency change is certainly making me consider a european trip. not sure about greece. but france, spain, and italy at a nice discount is becoming very tempting.

Steven, the US has had the principal role in “export-led growth elsewhere” for 25-30 years via Fortune 25-100 supranational firms’ FDI in China-Asia and to a lesser extent elsewhere. There would not have been the “Asian Tigers” and the “China Miracle” without literally trillions of dollars’ worth of FDI and “trade” (“exports”) from US and Japanese firms in China-Asia since the 1980s-90s, which not coincidentally occurred with US deindustrialization, financialization, “offshoring”, “outsourcing”, and labor’s share of GDP falling to a record low last experienced during the Great Depression and the 1890s.

However, now Peak Oil, population overshoot, resource depletion per capita, excessive debt to wages and GDP, demographic drag effects, fiscal constraints, record-low labor share of GDP, and obscene and worsening wealth and income inequality are resulting in global GDP per capita trending YoY at a recession-like rate and the slowest 9- and 10-year rates since the early 1980s, the Great Depression, and 1890s, as well as the growth of “trade” decelerating to the slowest 6- and 9-year trend rates since the Great Depression.

Moreover, look at US exports, exports to GDP, and the change rate. US “exports” (primarily US firms’ shipments of capital goods, ag products, armaments, technology transfer and intellectual property, etc., to their subsidiaries abroad) are not growing, and not coincidentally neither is US FDI to China-Asia, which is a primary factor in the slowing of global real GDP and trade. The US is NOT going to drive global “export”-led growth. We’ve already done that for over 30 years, and the secular growth regime since the 1980s (labor arbitrage, “globalization”, cross-border, intra-Asian “trade”, etc.) is over (see the IMF paper).

Now that capital, investment, hot money, and trade flows have achieved effective parity between the three major global trading blocs, “trade” and real GDP per capita are poised to decelerate to zero or contraction (owing to Peak Oil and net energy costs of energy extraction per GDP and per capita), with the major fiat digital debt-money currencies trending towards, and around (+/-), parity with one another hereafter indefinitely.

http://research.stlouisfed.org/fred2/series/MYAGM1CNM189N

China M1. Y/Y. Slow.

” But the market only cares about balances, not whether they come from supply or demand.”

Strikes me that there is some confusion over exactly what ‘supply’ and ‘demand’ mean. They are not strictly speaking synonyms for production and consumption.

US factory orders ex defense and aircraft are at a -12% annualized rate for Q4, -7.7% since Q2, and -1.5% since Q1. (Orders for the oil and gas sector likely plunged in Dec and will continue to do so hereafter.) The correlation to IP mfg. and real final sales implies a marked deceleration for the 4-qtr. rate of real final sales hereafter to as slow as stall speed or worse.

This is similar to the deceleration in late 2007 to summer 2008 and late 2000 through summer 2001, including rapidly decelerating and then contracting corporate earnings. The stock market was oblivious to the business cycle deceleration then as it is now. (The stock market became a lagging indicator during the 1990s Dotcom bubble.)

The Fed will NOT raise the funds rate but rather much more likely resume QEternity by as soon as Q2-Q3.

In fact, TBTE banks have been busy accumulating Treasuries since early 2014 to front run the Fed in anticipation of selling to the Fed at a premium when QE is resumed to bail out banks’ C&I loans to the energy sector and to fund the increasing fiscal deficit.

Thanks to JDH for the effort and the generous sharing. Thanks to Rick Stryker for digging deeper and suggesting stat program R.

With respect to the US dollar and asset values in general, ZIRP and similar policies elsewhere appear to be creating greater asset price volatility and now, competitive currency devaluations.

It all makes ‘sense’ if you believe that ZIRP and glorious battles against the deflation demon are part of a parcel of reasons that explain slower than expected global economic growth.

It is also ironic that global economic uncertainty, much of which has its roots in US public policy, conspires to create the US as the ‘safe haven’ investment destination.

I just plugged in the numbers from the widgets and now the model suggests that 57% of the decline in oil prices is due to insufficient demand.

Just musing here, but it seems that in light of the recent trend of declining per capita oil usage in rich developed countries, that in order for benchmark oil prices to reverse course, investment capital has to start flowing out of the USA into the rest of the world, particularly the emerging economies.

That would simultaneously reduce the value of the US dollar and spur oil demand as private investment in emerging economies ramps up.

The “lmtest” package in R is great if you want to batch process 10,000 regressions, but it kind of sucks if you only want to do a single regression. The input procedure can be a little fussy. If you’re looking for a free open source and “Econometrica blessed” software package, I’d recommend GRETL. It’s a lot like EViews, and just like EViews you have the option of using either commands or point-and-click from the drop down menu. FWIW, back at the office I have an older version of LIMDEP that sometimes gives OLS outputs that are slightly different from what I get using other packages. I mainly use LIMDEP for stochastic frontier analysis studies, so it’s not a big deal. Something to watch out for.

A word of caution about Excel. It is well known that Excel can give erroneous R-squared values if you run the regression without a constant. I haven’t yet tested it with Excel 2013, but I know it was a problem in Excel 2003, Excel 2007 and Excel 2010. When I first encountered the problem I thought I had just discovered something new. Far from it. It’s been a known problem for a long time.

http://support.microsoft.com/kb/829249

Yes, I think if you are a more casual user gretl is a great free package that includes almost all the standard functionality.

The advantage of R is that you can do the simple things too but you also have a full statistical programming language of incredible power. So, if you want to get more deeply into statistics or econometrics, R is the way to go in my view.

For example, if you want to do time series econometrics, R packages have better coverage of methods and tests. With R, you can get into machine learning, statistical learning theory, big data, and Bayesian econometrics. RSTAN is an R interface into STAN that allows you to do Bayesian econometrics such as Markov Chain Monte Carlo, the Gibbs sampler, etc. You can interface with Hadoop. You can read from noSQL and SQL databases, call R from c++, or call c++ from R. You can also backtest trading strategies with the Quantstrat package.

One particularly convenient package is quantmod, which allows you to load data from yahoo finance, FRED, and other sources. For example, to load the SP500 series from yahoo and chart it, you merely do

library(quantmod)

getSymbols(“^GSPC”)

chartSeries(GSPC,theme = “white”)

You can also load, chart, and otherwise run statistical analysis on any of the series from the FRED website automatically using quantmod. You can automatically load the 3 FRED variables from jdh’s regression and chart them from R. For example, the oil series can be downloaded from FRED and charted with

getSymbols(‘DCOILWTICO’,src=’FRED’)

chartSeries(DCOILWTICO,theme=”white”)

Yep, I agree. I’m not familiar with some of the packages you mentioned. You did mention machine learning. I like the “e1071” package for support vector machine/support vector regressions (SVM/SVR). It beats the hell out of using the LIBSVM module in MATLAB…and a lot cheaper. Did I mention that I hate MATLAB? I’ve been doing a lot of work with the Canadian Defence Ministry testing out SVRs. At first I was a skeptic, but I’m starting to become a believer. R also has a lot of tests that you don’t ordinarily find in most COTS packages. For example, when testing ammunition lots we like to use a Hotelling distribution because there are so many variables. That one is kind of hard to find and it’s a pain if you have to make a large number runs, but R makes it easy peasy. I use the queueing package quite a bit as well. Another one that can make your life easier is the “forecast” package. If you have 50,000 time series and you have to generate 50,000 different ARIMA models based on Box-Jenkins rules, then R is the way to go. Again, a lot easier and lot cheaper than using something like SAS’s Forecast Studio. That said, I’m not a big fan of the VAR and SVAR packages in R.

Professor Hamilton,

What entry do you make for data input when there is no trade on a day? Do you use the previous day’s value or just not have a matching data set? I believe that EViews will handle leaving a cell empty when there is no trade if that is the desired input.

AS: Personally I find RATS most convenient for time-series analysis, but discovered through this exercise a feature of the program with which I had been unfamiliar. I had originally constructed the weekly data set (the one that you originally downloaded) by using the last available observation for a week– Thursday, for example, if Friday was a holiday. That spreadsheet contained one observation each week, with each row labeled with the appropriate day on which the observation pertained (usually Friday, sometimes Thursday). I then read that spreadsheet into RATS as a weekly time series. What RATS did that I didn’t realize was, if an observation for a given week was indicated as coming on a Thursday, it skipped the observation and used the following week’s observation instead, and then repeated that observation for the following week. So RATS was skipping a few observations and counting a few twice, which made a small difference for the reported estimates but essentially no difference for the percentage contributions that I had reported in the original post.

Professor Hamilton,

Thanks. I have downloaded the source data and am searching for the missing data, so as to replicate your output model (as an amateur’s learning experience). How many missing data points did you find and in which series, if I may courteously ask? I also want to see If EViews will automatically find the Newey-West lags. I can’t remember if you provided a rule of thumb in the past related to summing cross-sections and computing a range of Newey-West factors, with the low being 0.75 times the count^(1/3) and the high being 1.4 times the count^(1/3).

Thanks

AS: Since you downloaded the original spreadsheet, you can see immediately from it by checking for those dates that aren’t a Friday. In the new version of the spreadsheet, I just replaced non-Friday dates with Fridays (even though the observations were still Thursday data) in order to trick RATS into reading the data as I intended. I didn’t make a note of how many such dates there were, but just made the original adjustments with global excel commands.

AS,

Two common rules of thumb for setting the lags in Newey West are 0.75T^(1/3), which you mentioned, and 4(T/100)^(2/9), where T = 400 observations. For both these rules, you’d take the integer part and they’d both therefore suggest 5 lags.

Blowout numbers for initial unemployment claims: 265k.

“This is the lowest level for initial claims since April 15, 2000 when it was 259,000…[The DOL reports] there were no special factors impacting this week’s initial claims.”

Given that the oil patch is suffering a round of layoffs, these numbers are simply astounding. We’ll have to see if there were any one-offs that pop up, but on the face of it, this is an incredible initial claims number. It speaks to a red-hot economy, notwithstanding some of the negative news that’s come out in the last few days.

Meanwhile, US oil consumption remains at the +800 kbpd level based on most recent weeklies, and I think the data speaks to this level sustaining, as I noted in the Financial Times:

“Steven Kopits of Princeton Energy Advisors, who thinks there could be a strong pick-up in global oil demand this year, says such a reaction was only to be expected. He believes other forecasters, including the International Energy Agency, the think-tank backed by rich countries’ governments, have underestimated the scale of the possible demand response.”

http://www.prienga.com/blog/2015/1/16/quoted-in-the-financial-times

It is amazing to me how much I have come to count on Bill McBride to provide me essential insight into the macro world. http://www.calculatedriskblog.com/2015/01/weekly-initial-unemployment-claims_29.html

I had exactly the same reaction.

Interesting, and surprising, admission from Saudi Aramco CEO:

Reuters: Saudi Aramco to renegotiate some contracts on low oil price -CEO

http://www.reuters.com/article/2015/01/27/saudi-oil-aramco-idUSL6N0V60Z320150127

2005 to 2012 data for Saudi Arabia:

http://i1095.photobucket.com/albums/i475/westexas/Slide21_zps74c9ebac.jpg

2013 Data, as a percentage of 2005 values (there were some minor revisions to prior years):

Production: 104%

Net Exports: 95%

ECI Ratio (Ratio of production to consumption): 70%

Est. Remaining Post-2005 CNE: 60%