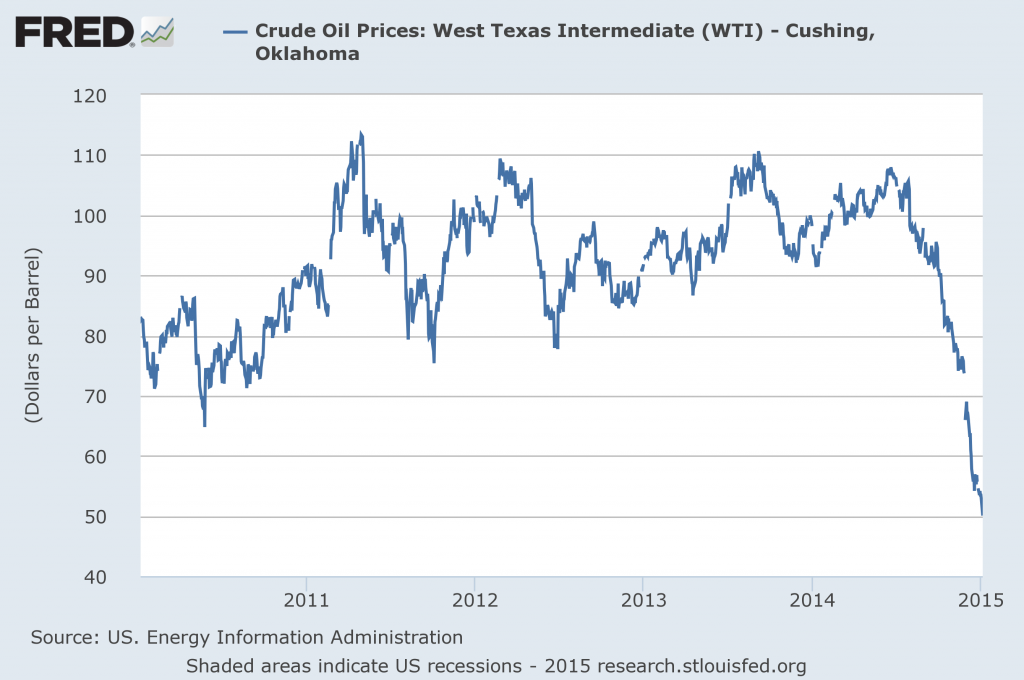

The price of oil passed another milestone last week, falling below $50 a barrel, a level that I had not expected to see again in my lifetime.

Price of crude oil (West Texas Intermediate, dollars per barrel). Source: FRED.

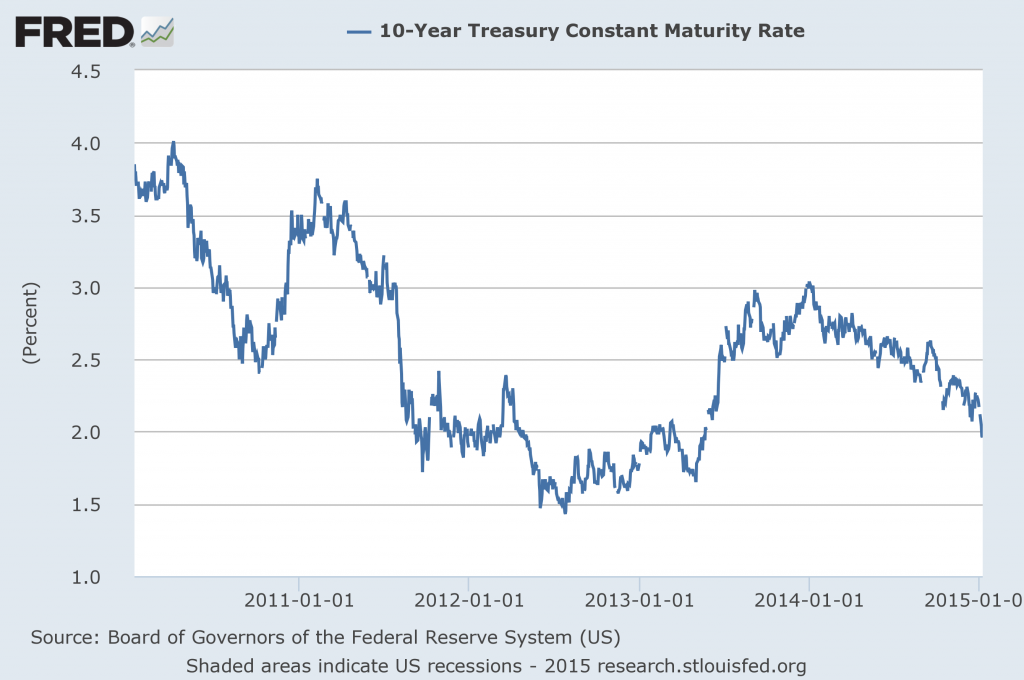

It’s interesting that we crossed another milestone last week, with the yield on 10-year Treasury bonds falling below 2%. That, too, is something I had not expected to see.

Nominal interest rate on 10-year Treasury bonds. Source: FRED.

And these two striking developments are surely related. I attribute sinking yields to ongoing weakening of the global economy, particularly Europe. And slower growth of world GDP means slower growth in the demand for oil. Other indicators of an economic slowdown outside the United States are falling prices of other commodities and a strengthening dollar.

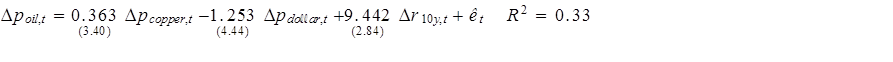

A month ago I provided some simple analysis of the connection between these developments in the form of a regression of the weekly change in the natural logarithm of the price of WTI on the weekly log changes in dollar price of copper and trade-weighted value of the dollar along with the weekly change in the yield on 10-year Treasuries. Here again are the results of that regression when estimated from April 2007 to June 2014 with heteroskedasticity- and autocorrelation-consistent t-statistics in parentheses:

Last month I used that regression to ask how much of the decline in oil prices between July 1 and December 12 of last year could be predicted statistically by the changes in copper prices, bond yields and value of the dollar. I found that the regression would predict a $20 decline in the price of oil over that period. Since it seems reasonable to assume that changes in copper prices, bond yields, and the exchange rate reflect primarily global demand factors rather than anything going on specific to the oil market, I concluded that about $20 of the $47 drop in the price of oil between July 4 and December 12 could be attributed to demand factors.

The price of oil has fallen another $8/barrel since then, prompting me to update those calculations. Since December 12, copper has slid an additional 6.15%, the dollar gained an additional 2.67%, and the 10-year yield fell another 13 basis points. On the basis of the above regression, that would have led to us predict an additional oil price decline since December 12 of almost another $4/barrel.

That is, of the $55 drop in the price of oil since the start of July, about $24, or 44%, seems attributable to broader demand factors rather than anything specific happening to the oil market. That’s almost the same percentage as when I performed the calculation using data that we had available a month ago.

So what’s been happening on the supply side of oil markets is important. But so is what’s been happening on the demand side.

I had a conversation about these and other topics with Jeremy Martin of UCSD’s Institute of the Americas that you can listen in on if you’d like.

Professor Hamilton,

Should there be an understandable relationship between the price of Brent and the monthly deficit or surplus of world supply compared to demand for petroleum?

The demand drop is not evident in the EIA data. Just not there. Maybe a revision in the upcoming STEO will say otherwise, but it ain’t there now.

US oil consumption is up 820 kbpd in December; Europe is on track for 4% demand growth in mid year.

The country who’s under-performing? China. There’s a decent argument to be made the Xi is reversing the policies which have defined China since Deng, ie, moving to an inward-looking, more authoritarian policy, rather than an outward facing, commercial approach. This is exactly the change which overtook Hungary after 1990 and why I’m writing from Princeton and not Budapest.

That would be a tragedy for China, but Chinese governance is historically more marked by a closed, backward-looking attitude than one of engagement. It is the last thirty year period which is anomalous, not the sort of authoritarian steps we’re seeing now.

Steven, every 60 years (Long Wave progression) or so since the late 18th century, e.g., White Lotus Rebellion, Opium Wars, Boxer Rebellion, and Mao’s revolution, the Chinese elites faced a fallout from engagement with the West that resulted in economic crises and social unrest, prompting a state reaction and eventually turning inward and disengaging from the rest of the world. Global, regional, and internal events are converging to suggest that history will rhyme yet again in the years ahead.

I will not be surprised to see the new generation of PLA generals assert more political power during a period of worsening internal conditions ahead.

Mr. Kopits,

Your comment is very interesting, however, please note that US petroleum demand peaked in 2005: see BP’s Statistical Review for the evidence. I’d argue that the current decline (this is of course with 20/20 hindsight) has been building for a while, in that with US petroleum demand falling off longer term, China needed to pick up the slack. If they are no longer doing that, the reaction should be expected to be pretty sharp.

Paul –

I am well aware of US oil market trends. At the link below, just for you, is my US oil consumption forecast through 2018, product by product. This is an unconstrained forecast, which assumes oil below, say, $70 barrel on a Brent basis.

http://www.prienga.com/blog/2015/1/11/us-oil-consumption-forecast

I think the other commodities are a similar story to oil, with a fair amount of new supply coming on and not finding enough demand growth.

In advanced economies, I think this is mainly a case of well established structural downshifts in demand growth once again refusing to bow to perennially optimistic expectations of a rebound. That has especially been the case in Europe and Japan, but even the US for all the booyahs over noisy quarterly numbers has only mildly accelerated to about 2.5% a year.

In China and some other EMs, I think this is a cyclical pullback from unsustainable credit expansion. At the same time, in China, authoritarian economic policy is exhausting its ability to identify obvious catch-up investments. So I see this as a permanent growth slow-down, which could but hasn’t yet turned into a serious cyclical slowdown. Moreover Asian EM cities are getting about as smogged and gridlocked up as they can get, and there’s a growing recognition that fuel subsidies are stupid and the money needs to be redirected into mass transit. The oil price drop is giving governments an easy way to do that without having to increase petrol prices. So on top of the permanent growth slowdown in China I see a permanent downshift developing in oil consumption growth relative to overall growth across EM Asia.

I follow the IEA data, and what it has been showing is some slowdown in oil consumption growth and a sharp reduction in 2015 consumption forecasts since June. Through September that mainly reflected the disappointed expectations of turnaround in Europe and Japan and the slowdown in China. Since then the forecast cuts have been coming mainly from the former Soviet space and other oil producers. And there has been very little demand projection increase, mainly because so many EMs and oil producers, which had been the main drivers of demand growth, are not fully passing on the price drop to their consumers. That represents a very important decision being made by EMs to use the oil price drop to shift resources into other things besides more rapid oil consumption growth.

But the price decline seems to have stalled out this past week around $47-48 per barrel. This might be the bottom. Why? Back in Novemeber the Saudis were reported to have planned their fiscal policy based on an oil price between $45 and $50 per barrel. We are there, and there are rumors they have made interventions in the market. Perhaps they cannot keep it from falling further, but maybe they can and already have.

See my article in at the Barrel, Barkley.

http://blogs.platts.com/2015/01/02/opec-call-price-collapse/

I think the Saudis have complete discretion in setting the price up to $80 Brent without too much difficulty. It’s just a matter of how much production they want to cut.

And of course, there’s room for an intermediate cut if the Saudis so choose. As long as the price remains below marginal cost, the Saudis can cut production to raise the price and and retain the opportunity to re-inject those quantities later. The question is really, what is marginal cost? There’s no point in cutting production until we have better data on that. But figure, within 100 days, cutting will be on the table seriously. If prices remain around $50 Brent in March, I would expect the Saudis to cut then with plenty of advance notice (ie, they will have an incentive to talk up the price even without cutting).

I should have a piece on this in the UAE’s National in a couple of weeks: “The Al-Naimi Doctrine”

Your rumor may be questionable given that the Saudis don’t ‘intervene’ when they want to prop up the price, they back away and refuse to sell.

There’s no doubt they could move the price upward by cutting their output. It’s a question of whether that would be sustainable, or if it would just inspire too much production, a new glut and another decision for the Saudis between cutting their output even further or letting the price fall.

So, here are the supply / demand revisions in the last five days:

– US demand up 800 kbpd; that’s as much as IEA 2015 total global oil demand growth

– Currie at GS notes that, at a 30% capex cut, US output would fall 400 kbpd in 2015. (See my post: http://www.prienga.com/blog/2014/12/16/its-more-than-1-trillion) Just last week, the consultancies, IEA, EIA were all agreed that US production would rise 500-700 kbpd.

So let’s see: We’ re pretty much already there on the demand side, and we just lost 1.1 mbpd of supply–all in one week–and all just from the US. Keep in mind that the US is the engine of global oil supply growth–and now that’s supposed to fall outright. What happens in the rest of the world?

Just wait a week or two. See the graph: http://www.prienga.com/blog/2015/1/9/supply-minus-demand

Steven, once the shale sector bust is well underway and the effects pass through to the ancillary sectors, including energy-related transportation, US oil consumption is likely to fall significantly in proportion to the decline in US shale production and transport.

The increase in subprime auto loan delinquencies and defaults began a year ago and is accelerating into year end 2014, which will eventually hit vehicle sales for the cycle.

We should begin to see the effects of the energy and subprime auto credit busts on shale production, housing, autos, and goods orders, IP, and real GDP by the tougher comparisons beginning in Q2, including CPI decelerating below 1% to perhaps negative at some point hereafter. The TBTE banks are also on the hook for lots of C&I loans to the energy sector this time around.

The cyclical low for jobless claims to payrolls suggests that employment is peaking and the U rate bottoming, which further suggests that the layoffs now beginning in the energy and related sectors will contribute to the peak in employment and bottoming of claims and the U rate in 2015.

Let me put it to you this way, BC.

Vietnam, doing nothing but enjoying oil prices will fall, will see GDP rise by 3 percentage points. That is, oil imports for 2015 fall from 8.8% of GDP to 5.8% of GDP. That’s huge, absolutely huge.

For China, that number is 1% of GDP, by the way.

By the way, for India, that number is about 2.4% of GDP. The Modi miracle. We are talking some big numbers here.

Whose “the supply / demand revisions” are these, yours?

I looked at the EIA’s latest forecast, and they still had a very mild consumption increase of 1.4% / 260kbpd in 2015 vs 2014, and a fairly strong US output increase of 600kbpd (by annual averages). That’s already a month old, but they were already assuming a $49 WTI average for the first half of 2015. I didn’t look at how the latest forecast compared to previous forecasts.

I need to add a correction. GS said a slowdown to +400 kbpd. Mea culpa.

John Kemp, however, forecasts an outright decline. http://www.reuters.com/article/2015/01/07/shale-drilling-prices-kemp-idUSL6N0UM21320150107

this can only be done academics. embarassing

What is happening to the price of natural gas? Coal? Uranium?

Ed

Yeah, I think you’re right. I live in Taiwan, and right around the time that QE ended and the commodity prices started dropping, I noticed all the neon lights missing half their bulbs. All the lights are going out here. Even the public healthcare signs. There’s your demand drop. Get ready for Asia to crash. I’ve been expecting this, simply because they’re the ones that haven’t yet joined the Great Recession.

Jason, the pullback in FDI by US (and Japanese other other) supranational firms in China-Asia and elsewhere was predictable and telling, as global trade is decelerating to a crawl and now capital, credit, and trade flows have reached parity with GDP PPP between the three major trading blocs. This implies that the major fiat currencies will trend in the long run to around par with one another (and trade-weighted US$ Broad Index around par +/-).

Asia’s growth since the 1990s has been driven by massive amounts of investment from US supranational firms (and associated intra-Asian “trade”), not from sustainable organic growth. Now that FDI is slowing or contracting and trade growth is largely over, China-Asia will be increasingly vulnerable to credit and liquidity crises, debt, asset, and price deflation, and a dramatic deceleration of growth of real GDP per capita. In China’s case, a marked deceleration of real GDP per capita from 6% to 2-3% is quite likely in the years ahead, owing largely from a collapse in exports, investment, and production, and an increase in energy and food imports.

Professor,

By using copper, interest rates, and a rising dollar you are actually using the same parameters in different forms. I have calculated that the impact of just the rising dollar accounts for about $30 of the $55 dollar decline or about 54%. The huge fall in the price of gold indicates a very large rise in the value of the dollar.

At the end of the 1990s the dollar climbed around 20% and the price of oil fell to the production cost. Marginal producers went out of business and in the 2000s when production recovered there was a huge oil shortage causing the price of oil to shoot up rapidly as oil producers struggled to keep up with demand. The situation with oil is much tighter than in the 1990s. If we elect a supply side president in 2016 there is a good chance that the recovery will be even stronger than in the 2000’s, closer to Reagan’s 1980s. That will mean a huge increase in the price of oil very rapidly.

I agree with Steve Kopits earlier analysis about $100/bbl oil in 2016 but for different reasons. Oil today is a great buy if you can hold it 5 years (probably less).

My perception is that the world is experiencing OPEC (Saudi) predatory pricing with the intention of crippling U.S. shale oil producers. Once mission is accomplished, watch the price of oil rebound. This is all an effort to keep the “peak oil” fiction intact. Kill competition and you don’t have “peak oil”, you have “oligopoly oil”… an “oiligopoly?” Then, high prices can be maintained regardless of demand because all of that alternative supply will be continuously impeded by producers who can afford to destabilize prices whenever they want to maintain “market share” knowing temporary lost profits are just the price of keeping out competition.

I know, I know… this is just a case of the “low cost producer” responding to the market.

bruce,

why is saudi behavior “predatory pricing”? they are simply selling at the market price. now if your argument is really that saudi is not cutting back production, why should they?

That is correct. But the political connection of the Saudis and the US Government, plus military bases, you have not mentioned.

I’ve long used the real oil imports in the monthly trade data published by Census as a measure of the marginal demand for oil.

It is responsible for the big swings in the demand for oil from OPECs perspective.

But with refined product exports soaring over the past few years maybe you should watch the total real US balance or trade in POL — crude & refined oil.

Since 2006 it has been falling at around a 15% annual rate.

From a world demand for oil perspective this is clearly the variable to watch, not US production.

Price today has fallen into the $46 range. Goldman Sachs is forecasting it will go to about $40, and statements out of KSA that price will “never” be above $100 again are reporedly driving the price down. But it is still above $45.

Marginal cost of production in KSA according to Jim’s recent very informative graph are below $40, so they can increase production and make money at $40, but reportedly would prefer to see above $45. But a temporary drop to $40 might really be useful for clearing out the peripheral producers around the world.

I have spent serious time in KSA, and anybody who says what they do or do not do does not know what he is talking about.

I shall attempt to pots the link to my post on this at Econospeak. http://www.econospeak.blogspot.com/2015/01/has-oil-price-drop-come-to-end.html .

Does not seem to be working, but that it easily found at Econospeak.

Of course, I have violated my own dictum about saying what the Saudis will do or not do, although my statements about their oil price expectations for their budgeting process are based on public statements from them. They do seem to have the range of $45-$50 per barrel in mind, whether or not they can manage to keep it in that range for any period of time by any actions of theirs. It may well be that even they have little influence or control over the price, certainly in the near term.

Ricardo: “I have calculated that the impact of just the rising dollar accounts for about $30 of the $55 dollar decline or about 54%.

Uh, oh. Danger alert. Ricardo is attempting to do math again. Curiously, the price of oil fell in dollars and euros and yen and yuan all at the same time. It seems, according to Ricardo, that all currencies increased with respect to each other simultaneously. Perhaps Ricardo has discovered some new paradox of Einstein’s relativity.

“falling below $50 a barrel, a level that I had not expected to see again in my lifetime.”

But Jim, you weren’t thinking about long run revolutionary technology. Certainly, in the long run (not that long), there’s going to be amazing solar, linked to really good, computer driven and coordinated, electric cars (and/or very largely electric hybrids). There’s going to be much better fission, and it’s looking likely fusion. And this will eventually completely collapse oil prices.

Maybe, that’s what the Saudi prince meant:

Saudi Prince: Oil will never return to $100

January 12, 2015:

“Saudi Prince Alwaleed…we’re “never” going to see $100-a-barrel oil prices again.

“There’s less demand, and there’s oversupply.”

The comments from the prince mirror ones by Ali al-Naimi, the Saudi oil minister who said $100 oil may be a thing of the past in December.

Alwaleed concedes a rebound may happen eventually. He just doesn’t think it’ll carry oil all the way back to $100.”

Joseph,

I know you are still learning so I will be king when I point out that oil is primarily quoted and traded in dollars. Keep studying. You’ll get there.

“falling below $50 a barrel, a level that I had not expected to see again in my lifetime.”

Hmmm! I seem to remember Michele Bachmann being savaged by the elite “experts” for saying that if she were president she would get the government got out of they way and gasoline would fall below $2/gal. I filled up this weekend for $1.98/gal. just imagine how low the price would be if the government was not hampering production!!

The moral to the story: Get the experts and government out of the way and we will have a robust recovery and people might even stop leaving the workforce.

Seems that there are another possible “moral(s) of this story”:

You didn’t need Bachmann to bring down oil prices (or alternatively: Obama wasn’t so bad after all)

The President doesn’t really influence oil prices in a significant way

Government and regulations don’t seem to constrain recovery (or alternatively: Obama’s government has not imposed onerous regulations)

Seems that political agendas can be made to fit any events and “facts”

baffling wrote:

bruce,

why is saudi behavior “predatory pricing”? they are simply selling at the market price. now if your argument is really that saudi is not cutting back production, why should they?

I am feeling sick. For the first time I agree with baffling.

ricardo, keep taking my medicine and eventually you will feel better 🙂

It has the effect of predatory pricing by creating an oversupply situation which drives prices down so that competition (U.S. fracking) has to operate at a lost. I didn’t think it necessary to go “step 1” “step 2” “step 3”.

bruce, why must the saudi’s cut back on production? why can’t the frackers in the usa cut back production so the price rises? in essence, why should the saudi’s pay a price so the shales can stay in business? its not like it was the saudi’s who increased production, it was the shales.

The Saudis won’t cut back production and the U.S. producers will and the prices should and will go back up. Net effect: supply restriction and the elimination of supply sources that can meet demand in the future. In the future, investors will be unwilling to back any producer with costs higher than the Saudis knowing that the Saudis can drive down prices anytime they want to by maintaining production higher than demand warrants if they feel threatened by new competition.

Is that not the description of an oligopoly? Is that not the effect of predatory pricing?

Now if that happened solely within the U.S., there would be action taken to dismantle the oligopoly and prevent such market manipulation. But on a global basis, there is little that can be done to prevent price whiplashing in the future. Consequently, we can look forward to more “peak oil” nonsense and higher cost oil without viable alternative sources.

bruce, the saudi’s continue to pump oil as they have for years. a new source of shale oil comes online and produces a supply of oil that exceeds the demands, and now saudi should be part of the cut created by an oversupply generated by new shales? it is simply baffling that somebody could blame the saudi’s for excesses created by us shale producers! how much protectionism do you desire? is “drill baby drill” still your mantra?

by the way, if you are concerned about uncontrolled oil costs created at the discretion of foreign entities, then perhaps you should better support domestic alternative energy approaches which minimize oil’s effects on the us economy.

JDH: Interesting reflections–you are far from alone in being caught offside by the severity of the oil price slump or the weak longer bond yields. That was a terrific interview too. Very accessible, well explained.

I doubt the public wants to hear about trigger strategies in a non-cooperative game theoretic Cournot model. Saudi and OPEC techno-bureaucrats should be well versed in that language.

At the rate oil prices are dropping, now at US$45/bbl, you could re-do that estimation every few days. Humour aside, it would be interesting if you re-did the estimation every $10/bbl lower.

I see the WTI discount to Brent has almost disappeared and naturally wonder why. Are shut-down thresholds being reached faster in North America? Is the high US dollar a factor already a significant factor for US production? Is European economic weakness more directly impacting Brent prices?

So, for about 8 hours the price of oil fell below $45 within the last 24, hitting a low of about $44, but is now back up to $47. Will it stay there above $45? Well, I am not going to make any further predictions about the near term movement of the price, but it is on the record that the Saudis would like it to stay there. Were they responsible for today’s price bounce? I have no idea.

Barkley Rosser: Volatility should be expected given the uncertainty.

If, and I reiterate if the Paris attacks on Charlie Hebdo and others increase the western country fear premium, then that could conceivably negatively impact expectations of global aggregate demand growth.

Bellanson,

XL Pipeline! Enough said.

Price still holding above $45 today.

Regarding XL pipeline, Jim had a good post on this quite some time ago. But, bottom line is that even bringing it up in the context of this discussion is s joke. It is the most overpoliticized nothing out there, with btth sides wildly exaggerating its significance for anything, both the supposed economic gains from it and the supposed environmental losses from it. The whole debate is an embarrassing farce, but its impact on the price of oil is most asuredly epsilon approaching zero..

ricardo, if your goal is to increase supply and bring down the cost of oil, great. but keystone pipeline does not fit into that equation. oil sands will not be explored and extracted at sub $50 barrel oil. from an economics perspective, a pipeline that serves high extraction cost oils probably will not have much success. be careful what you wish for. if keystone fails economically, it will be even harder to get approval for other types of transport systems. just saying…

“Slowing economy”?… When China’s growth “goes down” from 7.2% to 7.0% it means the 2nd derivative is negative – PERCENTAGE-WISE (!!!).

Economists don’t understand the data-projection called “percentage”. Sometimes the percentage view distorts the underlying data.

Example

China will grow 7% over the prior year. Now, the 7% rise in 2015 is GREATER than the 7.2% rise in 2014 in ABSOLUTE terms, due to a higher basis… So the real-original GDP data is in fact SPEEDING, not SLOWING. In fact the 2015’s 7% is equal to 7.5% in 2014’s terms (!!!). And now the TV/IMF experts are scratching their heads…

So, the term “slowing” is misleading the ignorant, which includes most “experts” we see on TV, incl some famous professors with very weak understanding of statistics/numbers.

Where there is a real demand fall, is gas-millage. If a Prius drinks half of the Corolla it replaced, there is a demand difference. And with new cars having significant better gas millage, and car-rotation at it’s historical highest levels, we have a demand issue which has nothing to do with “slowing economy”. The global economy is projected to grow by 3% (projected by clueless economic-politicians, who spend too much time under tanning machines), that means 3% more energy consumption, and there is NOTHING “slowing” about this.

Sorry to ruin the party…

Barkley Rosser: No disagreement on XL from a US perspective but would simply point out that the Keystone XL delay has huge significance for Canada and the global environmental movement.

For a massive welfare state like that of the USA, a few billion here and a few billion there does not matter. For smaller Canada, the deep discounts faced by western Canadian oil producers due to insufficient infrastructure are significant. The search for alternative outlets continues and could eventually see dil-bit pipelined to Atlantic Canada — something I would have thought several years ago was not cost effective.

In the background, Americans continue to pay the lowest excise taxes on dirty fuels among the rich OECD countries which suggests that the cheap energy entitlement is alive and well in the USA. My impression is that many anti-oil pipeline activists also want cheap energy. Holding up pipelines allows these activists to have their cake and eat it too. They feel good about helping Mother Earth and continue to personally benefit from low excise taxes.

The pipeline hold up reduces the pressure for US excise taxes to be increased.

Success in holding up Keystone has likely encouraged Canadian activists to hold up Northern Gateway pipeline and the Transmountain pipeline expansion in British Columbia. Oil sector proponents have complained long and hard about the amount of US money funding local opposition.

Oren wrote: Economists don’t understand the data-projection called “percentage”. Sometimes the percentage view distorts the underlying data.

On the contrary, economists tend to understand logarithmic transformations and percentage calculations better than anybody else. Some of them even understand growth theory and may even view China as the tail that is wagged rather than the tail that wags the dog.

This comment is a bit late, but maybe useful for future speculation: http://www.bbc.com/news/business-30913321

It somewhat reinforces what I commented earlier:

“The Saudis won’t cut back production and the U.S. producers will and the prices should and will go back up. Net effect: supply restriction and the elimination of supply sources that can meet demand in the future. In the future, investors will be unwilling to back any producer with costs higher than the Saudis knowing that the Saudis can drive down prices anytime they want to by maintaining production higher than demand warrants if they feel threatened by new competition.

Is that not the description of an oligopoly? Is that not the effect of predatory pricing?

Now if that happened solely within the U.S., there would be action taken to dismantle the oligopoly and prevent such market manipulation. But on a global basis, there is little that can be done to prevent price whiplashing in the future. Consequently, we can look forward to more “peak oil” nonsense and higher cost oil without viable alternative sources.”