Today we are fortunate to have a guest contribution by Michael Weber, assistant professor at the University of Chicago’s Booth School of Business. This post is based upon a paper, co-authored with Francesco D’Acunto and Daniel Hoang.

Higher inflation expectations increase households’ propensity to purchase durable goods. This positive association is higher for more educated, working-age, high-income, and urban households. We exploit a natural experiment, the unexpected announcement of a VAT increase in Germany in 2005, to show that the effect of inflation expectations on readiness to spend is causal. Our results imply that monetary and fiscal policies that increase inflation expectations can spur aggregate consumption in the short run.

From the Great Recession to the present day, policy makers around the world have been debating as to which policies may increase aggregate demand and bring the economy back to its steady-state growth path. The major problem is that conventional policies, such as lowering nominal interest rates, are not in the policy toolbox, because rates have hit the zero lower bound (Bernanke, 2010; Blanchard, Dell’Ariccia, Mauro, 2010). Macroeconomic theory suggests that managing inflation expectations may be a useful policy measure: higher inflation expectations would lower the real interest rates in times of fixed nominal rates (Fisher equation), and lower real rates would stimulate consumption (Euler equation).

Surprisingly, there has been no evidence in micro data thus far that these intuitive channels may indeed spur the readiness of households to spend. If anything, the current literature suggests no effect of inflation expectations on readiness to consume (Bachmann, Berg, and Sims, 2015).

Inflation Expectations and Consumption Expenditure: Baseline and Heterogeneity

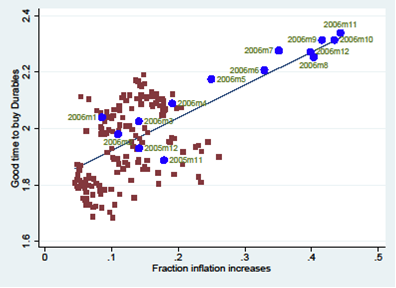

In a recent paper (D’Acunto, Hoang, and Weber, 2015), we use novel and unique German micro-level data from January 2000 until December 2013. We indeed find that inflation expectations are positively associated with the readiness to spend on durable goods. Figure 1 documents this result in a time series scatter plot. We use the confidential micro data underlying the GfK Consumer Climate MAXX survey. GfK asks a representative sample of 2,000 households every month whether it is a good time to purchase durable goods given the current economic conditions. Higher values correspond to better times. GfK also asks how consumer prices will evolve in the next twelve months compared to the previous twelve months. We create a dummy variable that equals 1 when a household expects inflation to increase. Figure 1 plots the average monthly readiness to purchase durables on the y-axis against the average monthly inflation expectations. Inflation expectations and readiness to spend on durables are strongly positively correlated. Temporarily higher inflation expectations indeed stimulate current consumption spending.

The GfK data also include a rich set of individual characteristics of respondents, including detailed demographics, expectations about household- and economy-wide future economic outlook, and perceptions about the evolution of economic outcomes in the past. In a multinomial logit specification that controls for household-level heterogeneity, we find that households that expect inflation to increase in the following twelve months are 8% more likely to be willing to buy durable goods, compared to households that expect inflation to be stable or decrease in the following twelve months.

Figure 1: Readiness to Spend on Durables and Inflation Expectations

The richness of the individual characteristics in the GfK data also allows us to study the heterogeneity of the effect of inflation expectations on the readiness to consume across several dimensions. We find that the effect is significantly stronger for the more educated household heads, for higher-income households, for households living in larger cities, and for working-age household heads.

The heterogeneity in the response of households to policy measures emphasizes a challenge for fiscal and monetary policy makers: the intended effects of their policies should be clearly stated, and the types of households that seem less responsive to these measures—that is, lower-income, lower-educated, and retired households, living in rural areas—should be targeted with specific communicative efforts so that the policy measures indeed deliver their full potential.

Inflation Expectations and Consumption Expenditure: A Causal Effect?

Observing detailed household- and economy-wide characteristics helps to control for the heterogeneity across households when estimating our effect. But the analysis thus far does not allow us to claim that the effect of inflation expectations on the readiness to consume is causal. Ideally, we would need a shock to inflation expectations which is exogenous to the characteristics of households, and which only affects a group of treated households. To get close to such an ideal experiment, we exploit a natural experiment. In November 2005, the newly-formed German government unexpectedly announced a three-percentage-point increase in the VAT effective January 2007. The narrative records show that the VAT increase was not legislated for reasons related to future economic conditions, but to consolidate the federal budget. The announcement of the VAT increase was an unexpected shock to German households’ inflation expectations, and should have resulted in higher consumption expenditure as long as nominal interest rates did not increase sufficiently to leave real rates constant, which is exactly what is suggested by the narrative records on the European Central Bank decision-making process.

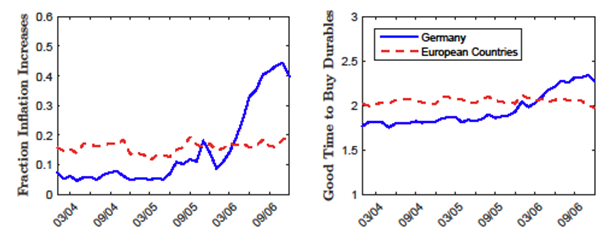

Of course, German households alone do not allow for a causal test, because all Germans were exposed to the VAT shock. To construct a viable counterfactual for German households, we look at households in other countries of the European Union. We obtained access to the confidential micro-data for three countries (France, Sweden, and the United Kingdom) through national statistical offices and GfK subsidiaries. A concern is whether these households represent a plausible counterfactual for the behavior of German households had the VAT shock not happened. Figure 2 provides evidence that indeed foreign households may represent a viable control group.

Figure 2 Inflation Expectations and Readiness to Spend on Durables: Germany vs. Foreign

Figure 2 shows that the trends of both average inflation expectations and average readiness to spend on durables were similar for German and foreign households before November 2005, which is 14 months before the start of the VAT increase. We construct a difference-in-differences identification strategy. We compare the outcomes of German households to those of foreign households, both before and after the VAT tax increase shock. To run the analysis at the household level, we match German households with similar foreign households before the announcement of the VAT increase in November 2005. The matching is based on the propensity score to be treated with the shock, estimated with a set of observables that are homogenously elicited across households in various countries through the harmonized questionnaire from the Directorate General for Economic and Financial Affairs. We test formally that, after the matching, German and foreign households are indistinguishable across the matched observables.

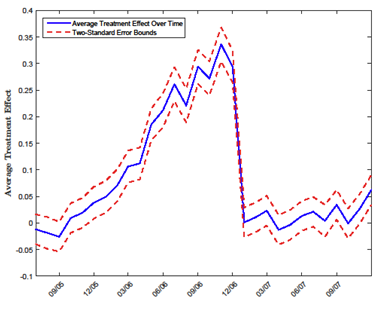

In January 2006, that is, twelve months before the announced VAT tax increase, German households are 3.8 percentage points (s.e. 1.5 percentage points) more likely to declare that it is a good time to purchase durable goods after the announcement compared to before, and compared to the matched foreign households. Interestingly, we find that the effect builds up over time in 2006. Figure 3 reports the size of the monthly estimated effect over time.

Figure 3: Change in the Readiness to Spend on Durables: German vs. foreign households

The effect increases in magnitude throughout 2006 and peaks at 34 percentage points in November 2006. The average treatment effect drops to zero in January 2007 once VAT actually increases and higher inflation materializes. Interestingly, we do not detect any reversal of the positive effect of the VAT shock on the willingness to purchase durable goods after January 2007. German households behave similarly in their purchasing propensities to matched foreign households not exposed to the shock before the announcement of the VAT increase but also after the actual increase.

Discretionary fiscal policy?

Discretionary fiscal policy is often rejected as a tool for business cycle stabilization. Implementation lags, larger permanent deficits resulting in higher long-term interest rates and distortionary future taxes, or higher marginal propensities to save out of a temporary tax cut (i.e., lower (old) Keynesian multipliers), make it a less desirable policy tool compared to conventional monetary policy. At the same time, a growing literature stresses the use of fiscal policy to stimulate demand in times when conventional monetary policy is less effective. Farhi and Werning (2013) show theoretically that fiscal multipliers are large and above 1 during a liquidity trap. The central mechanism in their paper is that government purchases lead to higher inflation, lower real interest rates, and, therefore, more consumption today. Feldstein (2003) already stressed earlier that discretionary fiscal policy does not have to rely on questionable income effects, but could fully operate through an inter-temporal substitution channel by increasing private incentives to spend: higher inflation expectations lead to more consumer spending today. The use of unconventional fiscal policy can therefore be expansionary and, at the same time, does not lead to higher budget deficits (Farhi, Correira, Nicolini, Teles, 2013).

Our findings offer direct empirical support for those theoretical papers and provide important implications for policy makers, especially for those coordinating the fiscal and monetary policies of countries that are still struggling to exit the Great Recession, such as Italy and Greece (e.g., Handelsblatt, 2015). A series of pre-announced VAT increases and a simultaneous reduction in income tax rates would result in a predictable increase in inflation without inducing additional uncertainty, would increase consumer spending today, and would not lead to higher budget deficits, all while keeping the total tax burden of households the same.

References

Bachmann, R., T. O. Berg, and E. Sims (2015). Inflation Expectations and Readiness to Spend: Cross-sectional Evidence. American Economic Journal: Economic Policy 7 (1), 1-35.

Bernanke, B., 2010. Monetary Policy Objectives and Tools in a Low-inflation Environment. In Speech at a conference on Revisiting Monetary Policy in a Low-Inflation Environment, Federal Reserve Bank of Boston, October, Volume 15.

Blanchard, O., G. Dell’Ariccia, and P. Mauro (2010). Rethinking Macroeconomic Policy. Journal of Money, Credit and Banking 42 (6), 199-215.

D’Acunto, F., D Hoang, and M. Weber. 2015. “Inflation Expectations and Consumption Expenditure.”

Fahri, E., Correira, I., Nicolini, J. P., and P. Teles (2013). Unconventional Fiscal Policy at the Zero Bound. American Economic Review 103(4), 1172-1211.

Fahri, E. and I. Werning (2015). Fiscal Multipliers. Liquidity Traps and Currency Unions. In preparation for Handbook of Macroconomics Volume 2

Feldstein, M. (2003). A Role for Discretionary Fiscal Policy in a Low Interest Rate Environment. In: 2002 Federal Reserve Bank of Kansas City Annual Conference volume, Rethinking Stabilization Policy.

Handelsblatt, 2015. “Das Geld ist nicht da”

This post written by Michael Weber.

Given that most consumers make their judgements about inflation based on very few components (mostly the price of gasoline), is there evidence that sudden changes in the prices of gas (at times when overall inflation is uneventful) encourage or discourage durable goods purchases?

Groan. :-\

An increase in VAT is not inflation. It is a real price increase.

Steven,

SPOT On! I noticed the same thing, but I just let it lie because it was just one of many logical errors.

It may also work for some U.S. states, to have some effect in spurring demand, for durable goods, with (lowering) state income tax rates and (announcing raising) sales tax rates, particularly for states, or states in a megalopolis, with many highly educated and affluent workers.

However, there may be a net increase in state taxes for lower income workers, given progressive state income taxes and regressive state sales taxes.

You lost me at “From the Great Recession to the present day, policy makers around the world have been debating as to which policies may increase aggregate demand and bring the economy back to its steady-state growth path.

Why is conspicuous consumption a good thing? Why is massive credit expansion to over-purchase consumer goods a good thing? Why is adding to the disposable economy a good thing? When is more consumption, enough consumption? It appears that the answer to this question is the John D. Rockefeller answer, “Just a little bit more.” The only difference is Rockefeller was talking about income from production while economists talk about consumption from consumers already burdened with excessive debt. Duh?

“When is more consumption, enough consumption?”

When the creation of goods and services to feed that consumption is enough to employ everyone at a livable wage. Quite simple.

So Redwood, it is production not consumption that will tell us when enough is enough. I think you are closer than the average Keynesian. You are closer than the idea of more and more consumption ad infinitum.

Keynesians aren’t into consumption, but investment. Neo-liberals are into consumption because they drive rent seeking and wealth upwards. Austrians are into consumption of the wealthy as well. A dirty secret they will never tell you. When they are talking about “savings”, they mean wealthy backers who save to invest without debt. The problem is, the amount of savings required to run a free enterprise system pretty much means to enslave the non-property/capital owning classes which creates strife. Essentially that was what happened in the early 30’s when the system was trying to liquidate, but after years of debt based growth. So either you don’t have the growth and have strife or it crashes down and you have strife. Strife is strife.

A better system is to abolish all usury in banking and allow a regional fiat based system for the states to handle without interest fees to the banks. If you don’t support abolishing usury, you don’t really want to reform the system.

I think, it is not the best idea to relay on GFK microcensus data, since this data only describes the subjective “readiness to consume” and is notoriously uncorrelated to actual consumption!! If you look at actual retail sales, they are quit flat in the relevant period: http://de.statista.com/statistik/daten/studie/70190/umfrage/umsatz-im-deutschen-einzelhandel-zeitreihe/

Did you notice that they talk about durables?

So how does the belief that prices are inflated by unsustainable policy factor in?

High marginal Income taxes on the wealthy spur inflation because of how the tax code operates. The result to lower effective taxes is to invest more and that creates situations of accelerating employment due to the investment. This is what happened in 2013 when a chunk of the Bush tax cuts were abolished.

Consumption is a off shoot, not a leader in this regard. Targeting it is a waste of time, but that is how policy works nowadays.

The US is now in a condition of NET CAPITAL CONSUMPTION and thus that of growth of prospective labor product from production in perpetuity, implying that the current capital formation/accumulation to GDP being at the level of 20-25 years ago and all net value-added output being pledged to the financial sector and its top 0.001-1% owners will preclude an acceleration of the post-2007 trend of real final sales per capita above ~0% indefinitely hereafter.

Hyper-financialization via QEternity, QEverywhere, ZIRP, NIRP, and the central banks acting on behalf of the TBTE banks perpetuating unprecedented financial bubbles as a share of wages and GDP absolutely everywhere exacerbates the conditions, ensuring a net rentier claim on wages, profits, and gov’t receipts and thus a drag on growth of the non-financialized sectors in perpetuity.

Keynesian and neo-Keynesian eCONomists have no remedy for these debilitating once-in-history conditions resulting from Peak Oil, population overshoot, resource depletion per capita, climate change, peak Boomer demographic drag effects, extreme inequality, and Gilded Age-like politics; and neither do Austrians, neo-liberals, supply siders, monetarists, communists, socialists, state-capitalists, or imperial corporate-statists.

Quite the conundrum, one might say.

BC: Keynesians have a remedy. But it is 180 degrees upside-down. Their remedy entails cutting savings. Duh. Austrians have a remedy. It is for the government and private-corporation Federal Reserve to take their hands off and let the free market equilibrate. Which means cleaning the Aegean stables of malinvestment and vampire banks and corporations to free up resources congealed therein. Neo-liberals, who are they? Might you mean those espousing 1980 Reagan-like policies as in his 4-plank program of cutting money growth, tax rates, regulation, and government spending (modified appropriately for current conditions)? Supply siders miss the demand side. Monetarists are Keynesians. Communists, socialists, state-capitalists, and imperial corporate-statists are of the same ilk – not about better standard of living for the average man, but about central planning and power and wealth for themselves.

Which leads to a point of great interest. What policies should be employed? Those that do the least damage. Those that turn aggregates toward optimal away from currently distorted paths. The key being debt, the flip side of which is savings. The economy will indeed grow feebly, into perpetuity as you like to say, unless and until the debt ratio is brought down. The sins of poor policy since at least the mid-80s will take a generation to ameliorate, even with optimal policy . Political corruption, and the mainstream economics paradigm that feeds it, will not at this time permit switching from today’s bankrupt policies to tomorrow’s optimal, desirable ones. For things to change, some wise, courageous politician is going to have to put together a simple program and sell it to voters. 3-plank as that’s all the average voter can digest. The rule of law has been eviscerated, and at the highest level corruption abounds. One plank must address this. No society ever survived without putting aside a surplus to fund investment, with the emphasis on physical saving meaning abstaining from consumption including housing until the flow of saving is once again adequate. This is plank 2. Plank 3 is eliminating usury which can be accomplished by government-created fiat money, or by tangibly-backed money like gold. These three planks – I do not claim they are perfect, though they come easily to mind – go against the grain of current culture and run smack dab into vested interests. The expectation must be, then, that America’s decline will continue. When the next financial crisis strikes, the Great Depression of the 30s will have to be renamed. In the wake of that event, it remains to be seen if the public will wise up and revolt. Chances are the fear generated will produce clamor for even bigger government. Then all will be lost. For what other nation of size on this planet can be expected to hold out a beacon to the rest of the world as ours did upon its founding?

As for the point of the paper itself – let’s get some inflation going to stimulate consumer spending that will increase household debt – sheer lunacy!

JBH, I could not have said it better. Thanks.

The causality is established in this case, but the question is broader. How does a disparate group of people and institutions respond to inflation expectations when the central bank targets an inflation rate? How do debtors and creditors respond to inflation expectations when the central bank targets an inflation rate? Is the outcome an effect or a cause?

Not sure the authors understand the difference between inflation and a one-time price increase.