Just back from England and a couple of presentations, one at the CCBS on the Trilemma and monetary policy spillovers. Here are three graphs, related to the presentation, which illustrate how policymakers in different emerging market countries are responding to the stresses their economies are undergoing.

I limit the examination to the BRICs (Brazil, Russia, India, and China) as well as other countries, some of which are included in the “Fragile 5”; the additional countries are South Africa, Indonesia, Mexico, and Turkey. I proxy US monetary policy with the Wu-Xia shadow Fed funds rate, first discussed by Jim in this post.

Recall, in a Mundell-Fleming framework under a quasi-fixed exchange rate, and imperfect capital mobility (notes here), policymakers can respond either by allowing currency depreciation, raising policy rates, or depleting foreign exchange reserves.

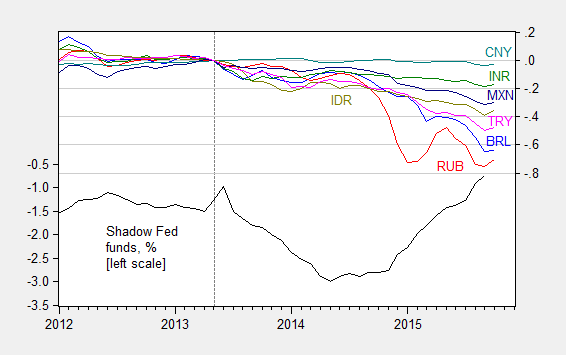

Figure 1: Shadow Fed funds rate, in % (black, left scale), log exchange rate against USD, where down is depreciation, for Brazil (blue), Russia (red), India (green), China (teal), South Africa (purple), Indonesia (chartreuse), Mexico (dark blue), and Turkey (pink), all normalized to 2013M05=0, right scale. October data is through October 14th. Source: FRED, Wu-Xia, Pacific Exchange Services and author’s calculations.

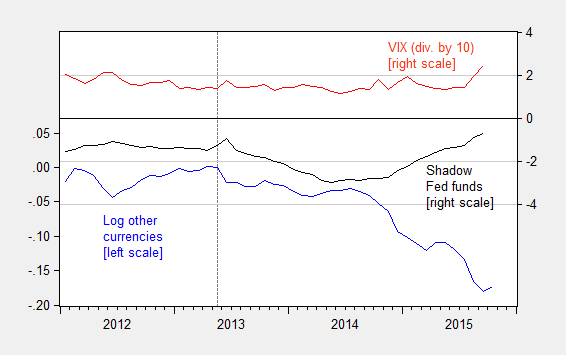

It’s interesting to note the wide divergence in depreciations (although one should recall these are rates expressed against the USD, which has appreciated strongly over the last fourteen months). Also, the anticipation of monetary tightening in the US, as measured by the shadow Fed funds rate, is not the only factor stressing emerging markets. The VIX, a key determinant of emerging market exchange rates and current account balances [1] [2] [3], has been slightly elevated as well in the last couple of months.

Figure 2: Shadow Fed funds (black, right scale), VIX divided by 10 (red, right scale), and log other important US trading partners currencies index (Federal Reserve) normalized to 2013M05=0 (blue, left scale). Source: FRED, Wu-Xia and author’s calculations.

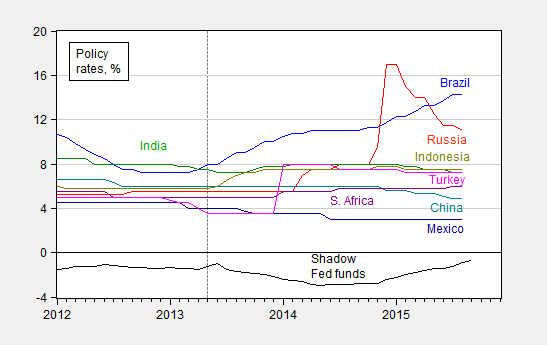

As shown in Figure 3, some countries have opted for an interest rate defense; the Russian Federation early on embarked upon a vigorous defense, with rates still elevated (by the way, I think the book still is to be written on the parsing out the efficacy of financial sanctions vs. the weakness of oil prices in pressuring the Russian economy.) Brazil is clearly the most obvious case of an interest rate defense.

Figure 3: Shadow Fed funds rate (black), policy rates for Brazil (blue), Russia (red), India (green), China (teal), South Africa (purple), Indonesia (chartreuse), Mexico (dark blue), and Turkey (pink). October data is through October 14th. Source: FRED, Wu-Xia, Pacific Exchange Services and author’s calculations.

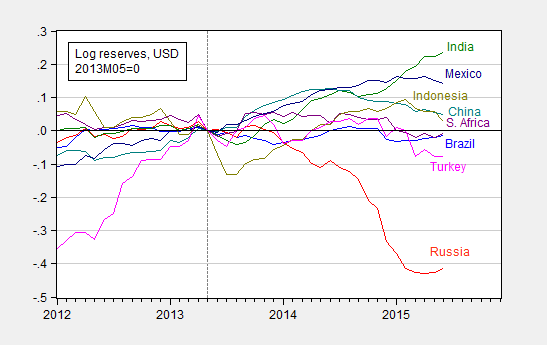

While Russia has relented on policy rate increases, it’s interesting to note that reserve decumulation (Figure 4) has — in percentage terms — been much more marked for that country. In log terms, reserves are now some 40% down relative to 2013M05; most of the other reserve decumulations pale in comparison.

Figure 4: Shadow Fed funds rate (black), and log international reserves ex.-gold for Brazil (blue), Russia (red), India (green), China (teal), South Africa (purple), Indonesia (chartreuse), Mexico (dark blue), and Turkey (pink), all normalized to 2013M05=0. Source: FRED, Wu-Xia, and author’s calculations.

That being said, the Chinese international reserves ex.-gold in June 2015 are 7.8% down from the June 2014 peak (while September 2015 foreign exchange reserves are down 12.8% relative to June 2014 [4], in log terms).

In Aizenman, Chinn and Ito (2015), we investigate what determines the amount of stress — as measured by exchange market pressure indices — experienced by different economies, as a function of exchange rate stability, capital account openness, trade and financial linkages and a variety of other macro indicators; further discussion is in this post.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2f8L

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2f8X

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2f8R

“The market” has been “tightening money” before the Fed has been able to begin to increase the cost of reserves.

The acceleration of the velocity of “money” in the US has plunged to the deepest level since 2008, 2001, and the early 1980s since the end of 2014 and early this year, i.e., when the current recession began, along with the crash in the price of oil/commodities and the likely onset of a bear market for the broader equity market.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2ke8

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2ke2

TBTE banks have been increasing their holdings of Treasuries and MBS as a share of assets for a year or more in anticipation of recession, an equity bear market, the next phase of QEternity, and selling to the Fed at a premium.

Just as in summer-fall 2001 and fall 2008, the stock market and eCONomists are 2-3 quarters behind the cycle.

More QEternity, please, and with a double side of liquidity trap, deflationary panic, and NIRP this time. Hold the forward giddiness.

http://blog.gavekalcapital.com/the-smart-money-has-never-been-this-long-the-long-bond/

http://www.bloomberg.com/markets/rates-bonds/government-bonds/japan

Ready for more QEternity, another global deflationary recession, a big bear market, another real estate bust (high-end, buy-up properties this time), the 10-year yield below 1%, and the 30-year below 2%?

I would note that the brazilian central bank has been selling its reserves in a “creative” way. Instead of selling dollars on the spot market, it sell dollars swaps and then keeps rolling these swaps. The public sector exposure to USD diminishes, BUT the amount of reserves is unchanged. I hope I was clear enough.

Rafael: Very clear. Observe that China also has begun acting in the forward exchange market in a big way. If you know of a recent good paper on this specific subject, I’d be grateful for the reference. For an EM, the act of selling dollar reserves shrinks the EM’s monetary base and is contractionary on its economy. Not selling reserves, in this environment where the US carry trade is unwinding, risks an excessive devaluation of the EM currency or its outright collapse.

I’m not sure if selling the reserves actually shrinks the monetary base in every EM. Well, at least in Brazil it would not, since the reserves are “sterilized”. This means that the Central Bank has REPOs in the same size as the reserves in order to make them neutral in regard to the monetary base. If the Central Bank decided to sell the reserves, it would also undo the repos.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2kWh

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2kWg

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2kWr

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2kWs

Among the many reasons that the Fed won’t raise rates, has maintained ZIRP, and will eventually do NIRP under deflationary conditions with wide risk spreads.

But the Fedsters can’t say this, or reveal it to the mass-media money honey chatterers, or risk causing bedlam in Belgium.

It is a weird approach to discuss the Russian currency, interest rate and reserve developments under the heading ‘Response to US tightening’. In the first couple of months after the first tapering signals, Russian data moved in line with EM peers. There was no “early response” from the Russians to US monetary policy, it came much later. Only in 2014 (Ukraine crisis) and in 2H14 (drop in crude prices) Russia took a different course. On oil vs. sanctions no book is needed because there is already proper empirical evidence: https://ideas.repec.org/p/diw/diwwpp/dp1488.html

MC wrote: ” (by the way, I think the book still is to be written on the parsing out the efficacy of financial sanctions vs. the weakness of oil prices in pressuring the Russian economy.) ”

That would be an interesting exercise. So far it would appears that financial sanctions ==> Russian Ruble to collapse ==> cushions negative oil price shock.

I forecast that the Cold War warriors will be disappointed with the sanctions campaign against Russia.