The recent weakness in emerging market currencies, and implementation of the taper, are sure to be topics of discussion at the G-20 meetings in Australia. While the imminent retrenchment in quantitative/credit easing is responsible for some of the currency movements of late, I’m not sure this is the only way to look at recent events; nor do I think we need see a replay of previous episodes of currency crises in response to US monetary tightening.

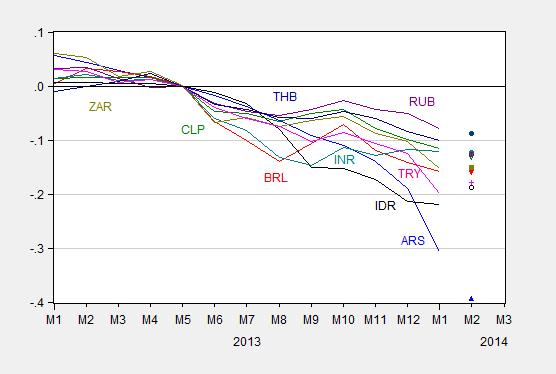

Figure 1: Log exchange rate against USD of Argentina Peso (ARS, blue), Brazilian Reals (BRL, red), Chilean Peso (CLP, green), Indonesia rupiah (IDR, black), Indian rupee (INR, teal), Russian ruble (RUB, purple), South African rand (ZAR, olive green), Thai baht (THB, dark blue), and Turkish lira (TRY, pink), all expressed against the USD, 2013M05=0. February observation pertains to 18 February. A decline indicates a weakening of the currency. Source: IMF International Financial Statistics, Federal Reserve Board via FRED, and Pacific Exchange Services, and author’s calculations.

Interpreting EM Currency Movements

For those of us who believed unconventional monetary policy (quantitative and credit easing, as well as forward guidance) had an impact on cross-border asset prices, including exchange rates (see this this post and this BIS discussion paper) it has been no surprise that exchange rates should move in response to talk of reducing the amount of monetary stimulus.

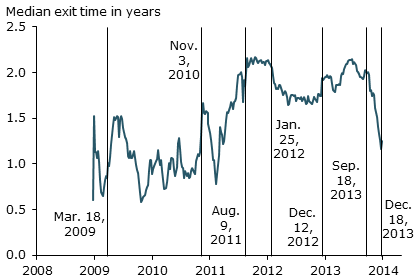

While forward guidance has been consistent in its phrasing, apparently recent discussion of more durable rapid growth in the US has meant a movement forward in the market-predicted raising of the Fed funds rate:

Notice the precipitous decline in the median time of exit from the ZLB between September and December of 2013. The recently released Fed minutes gives further weight to this view. [1]

Financial Stress and Idiosyncratic Factors

That being said, it’s clear from the heterogeneity in responses – Argentina has suffered far more than Thailand, for instance – that domestic factors are very important. (For the debate over the importance of local factors, see this presentation).

Nonetheless, thinking back to a previous episode of monetary tightening, in 1994, gives pause for thought.

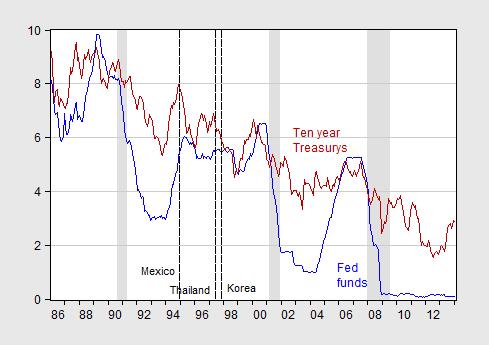

Figure 2: US Federal funds rate (blue), and ten year constant maturity yields (red). NBER recession dates shaded gray. Vertical dashed lines at dates of currency crises in Mexico, Thailand and Korea. Source: FRED and NBER.

A casual inspection of the timing of the interest rate hikes — at least in the 1990’s — and subsequent currency crises would suggest a pretty straight line cause-and-effect. However, casting a broader net over the data yields a slightly different story. From Hooper, Luzzetti, and Slok, “Fed taper and EM: Investors more selective,” Global Economic Perspectives (Deutsche Bank, 20 Feb 2014):

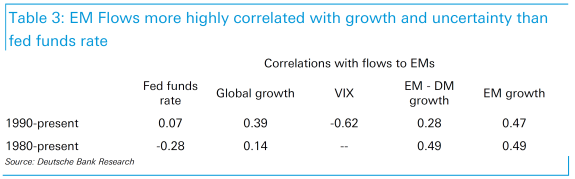

from an historical perspective, EM capital flows have not been highly correlated with shifts in Fed policy. For example, since 1990, the correlation between the fed funds rate and private capital flows to EM as a percent of EM GDP is slightly positive (7%) – the opposite sign from what would be expected (Chart 11). Looking further back to 1980, this correlation takes the correct sign, but remains relatively low (-28%). Instead, EM capital flows have been more highly correlated with uncertainty and growth prospects than with the fed funds rate (Table 3). In particular, since 1990, capital flows to EMs have been highly correlated with the VIX (-62%) and EM growth (47%).

Table 3 added 2/23:

Table 3 from Hooper, Luzzetti, and Slok, “Fed taper and EM: Investors more selective,” Global Economic Perspectives (Deutsche Bank, 20 Feb 2014).

This finding is reminiscent of recent findings by the IMF in its External Balance Assessment (EBA) approach; a volatility index similar to the VIX accounts for a component of current account balances (see discussion here and IMF Working Paper). [Disclaimer: I provided input into portions of this project]

These findings suggest to me that US monetary policy is only part of the story. Reduced pressure on EM currencies depends on minimizing financial stress in the core advanced economies, and the vagaries of individual EM country growth prospects.

That being said, EM policymakers will be confronted by difficult choices – whether to allow depreciation or use the interest rate defense to respond to capital outflows (caused by either higher foreign returns or financial stress). Which one is better depends on several factors, including how much foreign currency denominated debt has been accumulated as currencies have been stabilized (see the Economist’s take, using the Aizenman-Chinn-Ito exchange rate stability indices, here), versus the interest sensitivity of aggregate demand.

Vulnerabilities

What are the prospects emerging market economies as US financial markets and monetary policy normalize? The IMF has just released an assessment in anticipation of the G-20 meetings.

Global activity has picked up, largely on account of advanced economies. Growth firmed in 2013H2, driven largely by stronger outturns in advanced economies as final demand expanded broadly as expected. In many emerging markets, despite a boost to output from stronger exports, domestic demand has been weaker than expected, reflecting in part tighter financial conditions.

A new bout of financial volatility has affected emerging market economies as markets reassess their fundamentals. While the pressures were relatively broad-based, emerging economies with relatively high inflation and high current account deficits saw the largest asset price declines initially. Markets are showing signs of stabilizing recently, although they are still fragile, on the back of actions by key emerging economies to shore up confidence and strengthen their policy commitments. This episode, however, underscores vulnerabilities and the challenging environment for many emerging economies. The rapid jump in global risk aversion had also driven down advanced economy equity prices.

…

However, the recovery is still weak and significant downside risks remain. Capital outflows, higher interest rates, and sharp currency depreciation in emerging economies remain a key concern and a persistent tightening of financial conditions could undercut investment and growth in some countries given corporate vulnerabilities. A new risk stems from very low inflation in the euro area, where long-term inflation expectations might drift down, raising deflation risks in the event of a serious adverse shock to activity.

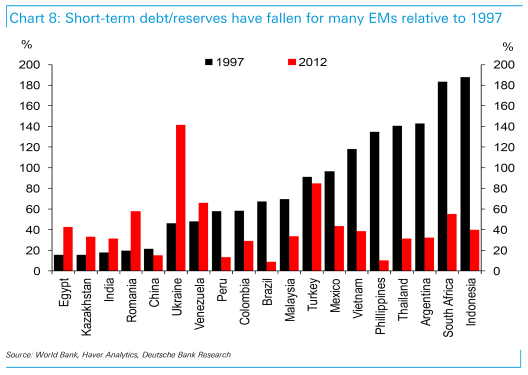

One bit of good news is that short term debt-to-reserves ratios is low for many EM countries.

Source: Hooper, Luzzetti, and Slok, “Fed taper and EM: Investors more selective,” Global Economic Perspectives (Deutsche Bank, 20 Feb 2014) [not online]

As discussed in this post, a higher reserves-to-short term debt means a greater resilience to a negative global economic environment. This bodes well for many countries, although several countries are in a more challenging situation than in 1997 – India and Ukraine for instance (Turkey experienced its currency crisis in 2000-01). (Recent developments in selected EM countries discussed in this post.)

For more on recent developments in emerging markets, see here, here, World Bank via Econbrowser, Barry Eichengreen, Helmut Reisen, and WSJ RTE; Economist and Capital Ebbs and Flows on international macro cooperation.

The FED and Treasury are engaged in a bait-n’-switch. Of necessity their eyes are locked on the interest rate. All this talk of “tapering” is simply to get your eyes off of the real problem. We raised the debt ceiling because congress and the president are esentially old, obese men and women who want to feed themselves more and more, so they keep adjusting the scale setting.

It has been pointed out over and over that with natural interest rates the government budget would be bust. Just the interest on the debt would be the greatest expenditure in the budget. The more the spending the greater the debt ceiling and the greater the debt the more serious the problem.

It is clear to see and everyone, even Menzie, knows that it is true. If the FED and Treasury ever leave the ZLB the consequences will be devastating but ultimately they will have no choice. Economic laws are like any other law. They cannot be broken with impunity.

Is there an answer? Yes, but the window is closing quickly. The solution is real economic growth, not the illusion of growth via a real estate bubble or a stock market bubble financed by monetary expansion. That growth will only come when the government gets out of the way of producers. That day will come, but the question is will it be directed and orderly through the working of free markets, or will it be cataclysmic. Our ostrich government with its head in the sand is only making things worse. Our exponentially growing bureaucratic sector is also compounding the decline in growth. I do not envy my children and grandchildren.

I personally thought this was an interesting and worthwhile post. It’s more Wholesale, than Retail, so it hasn’t attracted as many comments. But I thought it the sort of thing I like to see. Less ideology, more education.

Ricardo –

To your point, the problem with the debt ceiling is that we live in a three ideology world, leading to a non-market failure regarding government debt. Cutting spending offends one group; raising taxes, another. But increasing debt is largely invisible. Therefore, in a world with multiple objective functions and a significant principal-agent problem around increasing debt, increasing debt will be the path of least resistance. We can see this clearly on the Republican side. They’re not crazy about raising the debt ceiling, but last time around the fight over the ceiling was a true horror. Now, they can see the Democrats on the ropes because of Obamacare, so they don’t want to rock the boat, and the path of least resistance is to raise the debt, because guys like Bill McBride and Jim Hamilton aren’t going to write bad things about them. But I have doubts about whether increasing an already high level of indebtedness serves the country’s long term interests.

In any event, the issue is not the weight or age of the people in Congress. It is the incentive system in which they function. We can assume that their motivations are Smithian: they act in their own self-interest. They’d like to do good, but they’d rather do well. (I’d love to see Jim write a post entitled, “Why I Expect Politicians to Behave Responsibly Even Though They’re Not Paid to Do So.”) Therefore, the key is to align the interests of the decision makers with those of the public, and if you’re a classical liberal, as I am, then that means politicians get paid for increasing GDP and reducing government debt. That’s what the FAA is all about.

ricardo,

i keep asking the same question but get no response from all these anti-fed types. if you are so sure the fed has the wrong rate, what is the correct rate? and how are you privy to this answer while the fed is not? further, you lament the low rates. what rate would you have us during the 2008-2011 time period in particular? i assume with a higher rate we would have had the explosive growth you dream about. and higher rates today would lead to greater growth than we have as well? you are living in an alternate universe!

“While the imminent retrenchment in quantitative/credit easing is responsible for some of the currency movements of late, I’m not sure this is the only way to look at recent events..”

I must agree. QE no doubt put extra pressure on the dollar, as foreign sovereign debt was chased by the Ms. Watanabe’s of the U.S. scene (probably some quants with little economics background on the trading floors of some of our TBTF’s). But I think the real issue is the stock adjustment story. Just as the yen carry trade waxed and then waned, so too will the current dollar carry trade. Early participants gained from the higher interest rates on foreign sovereign debt, as well as the falling dollar as others followed this trade. Eventually, though, the stock adjustment is finished, and new outflows just balance return inflows. Then pressures from trade (purchasing power parity) cause the currency to appreciate, which in turn discourages the carry trade. the process can snowball into a rather fierce snap-back of the currency. QE pushes the moment of stock adjustment to interest differentials into the future.

Steven,

In the case of my post the weight and age I intended mental condition not physical.

I do agree with your three ideologies but my assessment is a little different. I actually believe that the reactions to each group is for public consumption but the political class always wants to increase spending and raise taxes. It just depends on which side you want to build your campaign theme.

Also the debt limit fight in the fall ended up just as both sides wanted. The Republicans from the beginning were planning to capitulate and the Democrats knew it so all they had to do was nothing. There is no real courage on either side to do the right thing.

You are also correct about the incentives though I would not exactly say it is a Smithian thing but more of a Bernie Madoff thing. Both sides are playing us in a Ponzi game.

But how do you change the incentives so the market will turn us back toward freedom?

Ricardo –

In a situation in which borrowing has no political cost, there will tend to be a spending bias. I agree with that.

If you institute a program which pays bonuses for maximizing GDP growth and minimizing debt, then you’ll see frugality and efficiency at the Federal level. This is not hard to do, other than being completely alien to the mindset of virtually all economists.

However, such a system does not necessarily maximize individual freedom in every case. Remember, there are three ideologies, all with some level of justification, or more specifically, with situational legitimacy. Maximizing GDP growth may involve non-liberal measures, for example, mandatory pre-K. That’s not freedom, and it may not even mean low taxes in that respect. It does mean, however, that such a program will be continually put to a cost-benefit test. From my perspective, that’s what matters most.

Comments closed on Dr. Hamilton’s post WHO ANTICIPATED THE GREAT DEPRESSION? after I posted my response. My reason for posting is because I believe the brightest students of economics are hungry for truth and will not take the words of “teachers and experts” blindly. That the brightest will want to answer these questions for themselves.

Because I was struggling to find time to read the linked article and then write a response I never really had a chance to answer the question. There are a number of economists who claimed to have predicted the Great Depression and there have been articles (such as Irwin’s) and books written claiming that the theories of various economists forecasted the Great Depression. In truth there is only one economist who had a theory of economics that forecast the Great Depression, who was very specific in predicting the Great Depression, and then who specifically refused to take a very lucrative position at one of the world’s largest banks because of his understanding of the imminent crash in the world economy.

So was he one of the most popular economists of the time? Was he Keynes or Fisher? Both of them lost huge fortunes in the Great Depression. Was he Cassel? He spent decades writing about a fantasy gold shortage that never materialized even during Bretton Woods. What of Lionel Robbins head of the economics department at the London School of Economics that directly opposed Keynes? No, Robbins actually wrote a great book on the Great Depression but ultimately joined the Keynesians as a way of escaping obscurity and winning government employment. So was he one of the great Austrians, Hayek or Rothbard? No, they both were insecure of the truth before the Great Depression and then postulated theories afterward.

So who? In 1931 the great economist Fritz Machlup, wrote the following of his old teacher:

Many have been embarrassed that their champion did not have as clear a statement about the Great Depression and so a number of articles have been written arguing that this statement did not mean what it clearly says. But they must ignore the totality of his work, specifically his 1928 full analysis of Irving Fisher’s monetary views (and, according to Irwin’s paper, Gustav Cassel) promoting price indexes stating, “because of the imperfection of the index number, these calculations would necessarily lead in time to errors of very considerable proportions.”

So what is the unequivocal answer to who anticipated the Great Depression? Ludwig von Mises!

* The bankruptcy of the Kreditanstalt, or Creditanstalt, is considered by many as a more significant beginning of the Great Depression than the stock market crash of 1929. As stated in Wikipedia, “Creditanstalt had to declare bankruptcy on May 11, 1931. This event resulted in a global financial crisis and ultimately the bank failures of the Great Depression.” The DOW reached a peak of 381.17 on September 3, 1929, falling to a low of 198.60 on November 19, 1929, then recovering significantly to 294.07 by April 17, 1930. There is good evidence that if the Smoot-Hawley tariff had not been passed and signed the DOW would have totally recovered by the summer of 1930 so it is reasonable to question the crash of October 1929 as the beginniing of the Great Depression.

Menzie the opposite sign from what would be expected (Chart 11). Looking further back to 1980, this correlation takes the correct sign, but remains relatively low (-28%).

I’m not sure what the Deutsche Bank means by “relatively low.” If I’m understanding what they’re saying, the -28% correlation covering Jan1980 thru Dec 2013 would be 168 paired observations. Just a quick calculation of a simple correlation significance test gives me a t-dist statistic of 3.97, which is significantly different from zero correlation. So do they mean it’s statistically significant but small in policy effect?

2slugbaits: It was hard to tell from the text, so I have added Table 3 from the article; it’s a relative-to-other correlation coefficients comparison. Not ideal — would’ve preferred regression coefficients, but this is what they reported.